| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Fat Free Yogurt Market Size 2024 |

USD 1354.81 Million |

| China Fat Free Yogurt Market, CAGR |

12.09% |

| China Fat Free Yogurt MarketSize 2032 |

USD 3375.36 Million |

Market Overview

China Fat Free Yogurt Market size was valued at USD 1354.81 million in 2024 and is anticipated to reach USD 3375.36 million by 2032, at a CAGR of 12.09% during the forecast period (2024-2032).

The China Fat-Free Yogurt market is experiencing significant growth, driven by rising health consciousness, increasing lactose intolerance cases, and shifting consumer preferences toward low-fat dairy alternatives. Consumers are actively seeking nutritious options, fueling demand for fat-free yogurt enriched with probiotics, high protein, and natural ingredients. Additionally, the rapid expansion of e-commerce and modern retail channels enhances product accessibility, boosting market penetration. Manufacturers are introducing innovative flavors, plant-based alternatives, and fortified variants to cater to evolving dietary preferences. Government initiatives promoting healthier lifestyles further support market growth. The trend toward premium and functional yogurt products, such as those with added vitamins and gut-health benefits, is gaining traction. Moreover, sustainability-focused packaging and clean-label products are becoming key differentiators in the competitive landscape. As urbanization and disposable incomes rise, the market is poised for continued expansion, with technological advancements in dairy processing further enhancing product quality and variety.

The China Fat-Free Yogurt Market is witnessing significant growth across key regions such as Beijing, Shanghai, Guangzhou, and Shenzhen, driven by a rising health-conscious population and growing demand for functional dairy products. These regions benefit from advanced retail networks, increasing disposable income, and a strong presence of health-focused consumers. Key players in the market, including Nestle, Danone S.A., Yoplait by General Mills Inc., Chobani, LLC, and Arla Foods amba, are leading the charge by offering a variety of fat-free yogurt options, such as organic, probiotic-rich, and plant-based variants. Regional brands also play an important role by catering to local tastes and preferences, while international brands leverage their global reputation to expand their market presence. The growing trend towards e-commerce platforms and the shift in consumer preference towards sustainable packaging further enhance market dynamics, enabling brands to strengthen their position across various regions in China.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The China Fat-Free Yogurt Market was valued at USD 1,354.81 million in 2024 and is expected to reach USD 3,375.36 million by 2032, growing at a CAGR of 12.09% during the forecast period.

- Increasing health awareness and preference for low-fat, high-protein dairy products are major market drivers.

- Rising consumer demand for organic, plant-based, and probiotic-rich yogurt is shaping the market’s evolution.

- Popular flavors like peach, strawberry, and blueberry are witnessing higher consumer engagement, especially among younger demographics.

- Intense competition from both domestic and international brands creates pricing pressures, but also drives innovation.

- Supply chain challenges and high production costs remain market restraints, limiting the reach of premium-priced fat-free yogurt products.

- Regions like Beijing, Shanghai, Guangzhou, and Shenzhen are key markets, driven by high disposable incomes and strong health trends.

Report Scope

This report segments the China Fat Free Yogurt Market as follows:

Market Drivers

Rising Health Consciousness and Dietary Shifts

The growing awareness of health and wellness among Chinese consumers is a primary driver of the China Fat-Free Yogurt Market. With increasing concerns about obesity, heart disease, and digestive health, individuals are actively seeking healthier food choices. For instance, the National Health Commission of China has launched initiatives to combat obesity, emphasizing the importance of balanced diets and low-fat options, which aligns with the demand for fat-free yogurt. Fat-free yogurt, rich in probiotics, proteins, and essential nutrients, aligns well with the demand for functional foods. Additionally, the rise in lactose intolerance cases in China is pushing consumers toward dairy alternatives that support gut health without causing digestive discomfort. The shift toward healthier lifestyles, coupled with government initiatives promoting balanced diets, has further accelerated the market’s expansion. Health-conscious millennials and urban populations are particularly inclined toward low-fat, high-nutrition options, reinforcing the demand for fat-free yogurt across various demographics.

Product Innovation and Premium Offerings

Manufacturers are continuously innovating to meet evolving consumer preferences, contributing to the market’s robust growth. The introduction of new flavors, fortified formulations, plant-based alternatives, and functional ingredients enhances the appeal of fat-free yogurt. Premium offerings with added probiotics, vitamins, and high-protein content are becoming increasingly popular among health-conscious consumers. Additionally, the demand for clean-label and organic yogurt is on the rise, as buyers prioritize transparency and quality over conventional products. The use of natural sweeteners, innovative textures, and non-dairy fat-free options further diversifies the market. Leading brands are also focusing on sustainable and eco-friendly packaging, which not only attracts environmentally conscious buyers but also aligns with China’s push for greener food production practices.

Expanding E-Commerce and Retail Presence

The rapid expansion of e-commerce platforms and modern retail chains is significantly driving the market. Online grocery shopping has surged in China, with consumers preferring the convenience of purchasing fat-free yogurt through digital channels. Major e-commerce giants like Alibaba’s Tmall, JD.com, and Pinduoduo are offering a wide range of dairy products, allowing brands to reach a broader audience. Additionally, retail giants and supermarket chains are expanding their dairy sections, increasing accessibility to fat-free yogurt in both urban and semi-urban regions. Subscription-based delivery services and direct-to-consumer (DTC) models are also gaining traction, ensuring consistent supply and personalized consumer experiences. The growing online presence of domestic and international brands further accelerates market penetration, offering customers diverse options and competitive pricing.

Government Support and Changing Consumer Lifestyles

The Chinese government’s focus on promoting healthier food choices and dietary awareness campaigns is a crucial factor boosting the fat-free yogurt market. Policies encouraging the consumption of nutritious, low-fat dairy products are positively impacting consumer behavior. Furthermore, changing lifestyles, particularly in urban areas, are influencing dietary habits. Busy professionals and younger generations prefer on-the-go, ready-to-eat dairy options, making single-serve fat-free yogurt a popular choice. As disposable incomes rise, consumers are willing to spend more on premium and health-focused food products, further fueling market demand. Additionally, growing Western influences on dietary patterns and increased exposure to global food trends are making fat-free yogurt an essential part of daily nutrition for many consumers in China.

Market Trends

Growing Demand for Functional and Fortified Yogurt

Consumers in China are increasingly seeking functional foods that offer enhanced health benefits, driving the demand for fortified fat-free yogurt. Products enriched with probiotics, prebiotics, vitamins, and minerals are gaining popularity due to their ability to support gut health, boost immunity, and aid digestion. For instance, the Chinese government’s initiatives under the Healthy China 2030 Plan have emphasized the importance of probiotics in maintaining gut health, further fueling demand for probiotic-enriched yogurt products. Additionally, high-protein variants are appealing to fitness-conscious individuals looking for nutrient-dense, low-fat dairy options. The rising prevalence of lifestyle-related diseases, such as obesity and cardiovascular issues, has further reinforced the trend toward health-focused yogurt consumption. Manufacturers are responding by developing innovative formulations that combine nutritional value with great taste, ensuring sustained market growth.

Rise of E-Commerce and Direct-to-Consumer Models

The increasing digitalization of grocery shopping is reshaping the distribution landscape for fat-free yogurt in China. Consumers are increasingly purchasing yogurt online through platforms such as Alibaba’s Tmall, JD.com, and Pinduoduo, benefiting from wider product choices, competitive pricing, and home delivery convenience. For instance, the rapid growth of e-commerce in China has been driven by urbanization and rising disposable incomes, making online platforms essential for reaching a broader audience. Additionally, the direct-to-consumer (DTC) model is gaining traction, allowing brands to establish direct connections with customers through personalized marketing and subscription-based delivery services. This shift is enabling smaller brands and startups to enter the market and compete with established players, driving further innovation and variety in the fat-free yogurt segment.

Expansion of Plant-Based and Dairy-Free Alternatives

The shift toward plant-based nutrition is significantly impacting the fat-free yogurt market in China. Consumers who are lactose intolerant, vegan, or environmentally conscious are actively exploring dairy-free yogurt alternatives made from soy, almond, coconut, and oat milk. These products offer similar probiotic and protein benefits while catering to individuals avoiding animal-derived ingredients. Additionally, clean-label and organic options are gaining traction as consumers prefer products free from artificial additives, preservatives, and added sugars. As a result, domestic and international brands are expanding their plant-based product lines, creating a more diverse and inclusive yogurt market in China.

Premiumization and Sustainability Initiatives

Chinese consumers are demonstrating a strong preference for premium yogurt products that offer superior taste, texture, and nutritional benefits. Brands are introducing artisanal, organic, and small-batch yogurts with unique flavors and ingredients, such as exotic fruits, superfoods, and traditional Chinese medicinal herbs. Additionally, sustainability is emerging as a key trend, with manufacturers investing in eco-friendly packaging, biodegradable containers, and sustainable sourcing practices. These initiatives not only reduce environmental impact but also appeal to environmentally conscious consumers who prioritize ethical and sustainable food choices. As a result, the market is witnessing an influx of high-quality, responsibly produced yogurt products, further elevating consumer expectations and driving premium market growth.

Market Challenges Analysis

High Production Costs and Supply Chain Constraints

The China Fat-Free Yogurt Market faces significant challenges related to high production costs and supply chain inefficiencies. The manufacturing process for fat-free yogurt requires advanced processing techniques to maintain taste and texture while removing fat, leading to increased production expenses. For instance, dairy farmers in China must contend with rising production costs due to factors like feed shortages and geopolitical disruptions, which affect the overall cost of raw milk and subsequently impact fat-free yogurt production. Additionally, the demand for premium ingredients, such as probiotics, natural sweeteners, and organic dairy sources, further escalates costs. These expenses often translate to higher retail prices, making fat-free yogurt less accessible to price-sensitive consumers. Moreover, fluctuations in raw material prices, particularly milk and plant-based dairy alternatives, create uncertainty for manufacturers. Supply chain disruptions, including logistics bottlenecks and cold storage limitations, further impact product availability and shelf life, making it challenging for brands to expand their reach, especially in rural areas.

Intense Market Competition and Consumer Preference Shifts

The fat-free yogurt segment in China is witnessing intense competition from both domestic and international brands, making market differentiation a key challenge. Established dairy companies and emerging plant-based yogurt brands are continuously innovating to capture consumer attention, leading to pricing pressures and brand loyalty challenges. Additionally, shifting consumer preferences toward dairy-free and low-sugar alternatives pose a threat to traditional fat-free yogurt products. While demand for health-conscious options is growing, some consumers prefer alternative protein sources, such as nut-based or fermented plant-based yogurts, over traditional dairy-based fat-free options. Furthermore, skepticism regarding artificial additives and preservatives in processed yogurt products has prompted some consumers to seek homemade or fresh alternatives, reducing demand for packaged fat-free yogurt. To stay competitive, brands must invest in product differentiation, marketing strategies, and consumer education to reinforce the health benefits and quality of fat-free yogurt.

Market Opportunities

The China Fat-Free Yogurt Market presents substantial opportunities, driven by evolving consumer preferences and increasing health consciousness. The rising demand for functional and fortified yogurt opens avenues for manufacturers to introduce products enriched with probiotics, prebiotics, high-protein content, and essential vitamins. As consumers prioritize gut health, immune support, and weight management, brands that offer scientifically backed formulations will gain a competitive edge. Additionally, the growing interest in plant-based and lactose-free alternatives creates an opportunity for dairy companies to expand into soy, almond, oat, and coconut-based fat-free yogurt. The introduction of clean-label and organic products also aligns with shifting consumer demands for natural, additive-free ingredients, allowing brands to tap into the premium health-conscious segment.

The expansion of e-commerce and direct-to-consumer (DTC) models offers another significant growth opportunity for fat-free yogurt brands in China. With digital platforms like Alibaba’s Tmall, JD.com, and Pinduoduo driving online grocery sales, companies can leverage data analytics and targeted marketing to reach a broader consumer base. Subscription-based models, personalized nutrition solutions, and convenient home delivery services further enhance brand loyalty and repeat purchases. Additionally, the increasing focus on sustainable packaging and eco-friendly production can serve as a differentiating factor, attracting environmentally conscious buyers. Collaborations with fitness centers, health influencers, and nutritionists can also boost brand visibility and credibility, reinforcing fat-free yogurt as an essential component of a balanced diet. As disposable incomes and urbanization rates continue to rise, the market is poised for long-term expansion, with innovative product offerings and strategic marketing playing a key role in sustaining growth.

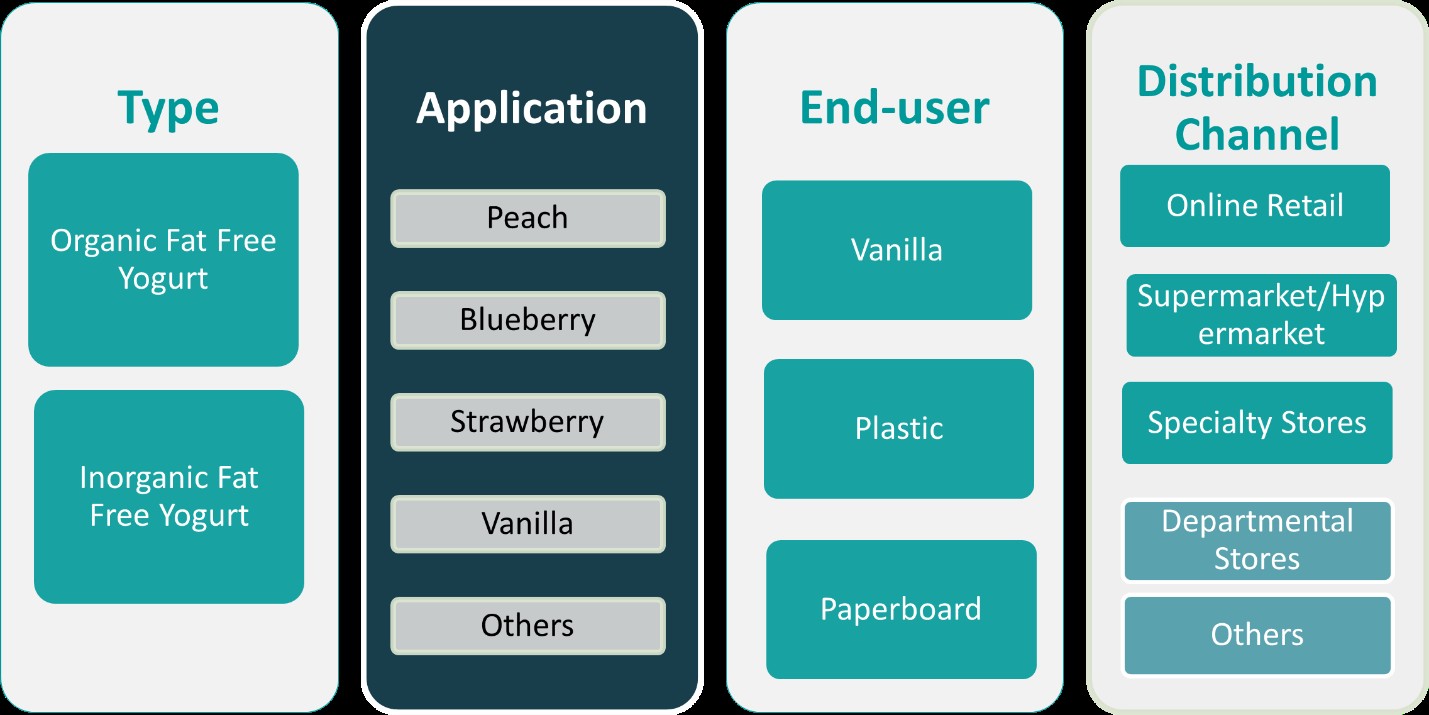

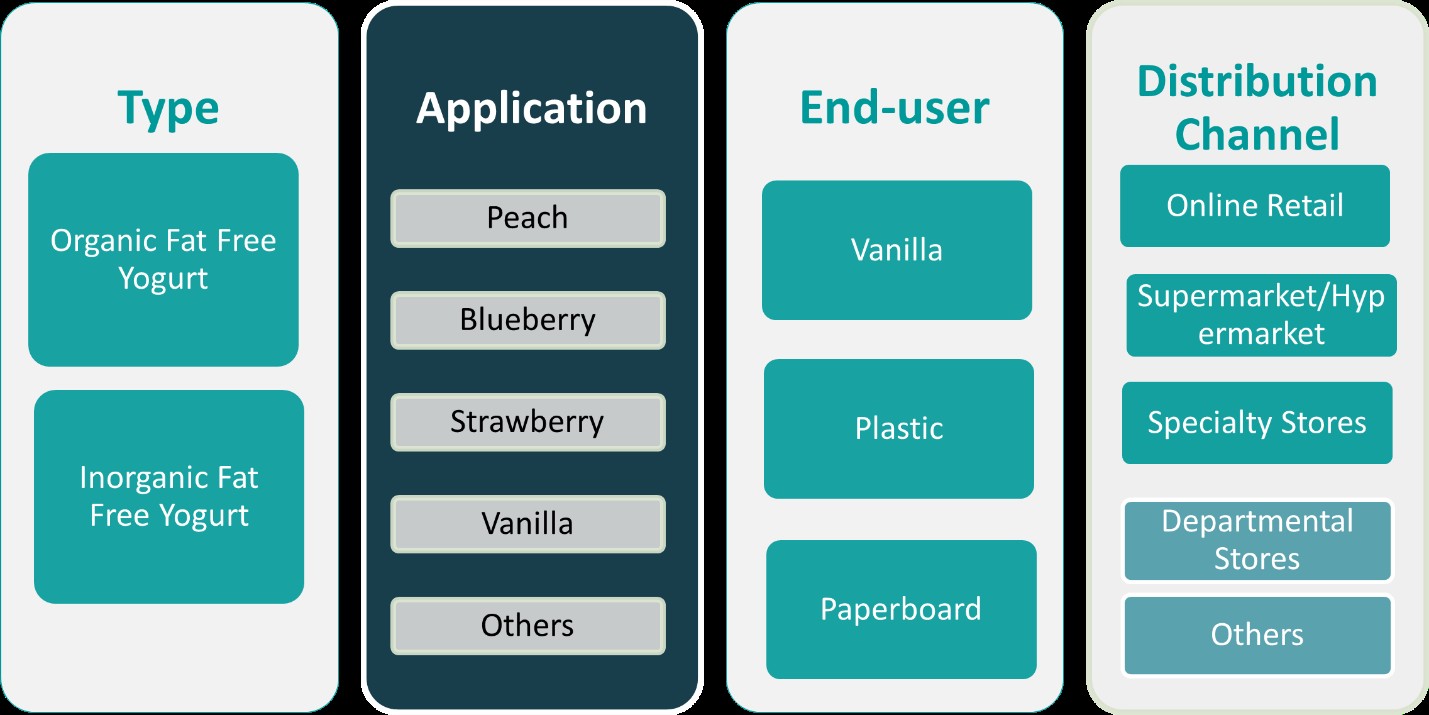

Market Segmentation Analysis:

By Type:

The China Fat-Free Yogurt Market is segmented into organic and inorganic fat-free yogurt, each catering to distinct consumer preferences. Organic fat-free yogurt is gaining popularity due to increasing demand for clean-label, chemical-free, and naturally sourced dairy products. Health-conscious consumers prefer organic variants as they are free from synthetic additives, pesticides, and genetically modified organisms (GMOs). The growing awareness of sustainable farming practices and the perception that organic dairy is nutritionally superior further support the expansion of this segment. However, higher production costs and premium pricing limit accessibility to a niche consumer base. On the other hand, inorganic fat-free yogurt continues to dominate the market due to affordability and wider availability. Conventional fat-free yogurt is extensively sold through supermarkets, convenience stores, and online platforms, making it more accessible to price-sensitive consumers. While inorganic yogurt benefits from cost-effectiveness and mass-market appeal, shifting consumer preferences toward healthier, natural alternatives are expected to drive stronger growth for organic fat-free yogurt in the long term.

By Application:

Based on flavor applications, the China fat-free yogurt market is segmented into peach, blueberry, strawberry, vanilla, and others. Fruit-based fat-free yogurt, particularly peach, blueberry, and strawberry, dominates the market due to rising consumer preference for natural flavors and added nutritional benefits. These flavors are widely consumed due to their refreshing taste, rich antioxidant content, and association with digestive health benefits. Strawberry fat-free yogurt holds a significant market share due to its versatility and widespread consumer acceptance, while blueberry-flavored variants are gaining traction due to their high antioxidant properties. Vanilla fat-free yogurt remains a popular choice for consumers who prefer a mild and creamy taste, often used as a base for smoothies or mixed with cereals. The “others” segment includes innovative flavors such as mango, mixed berries, and exotic fruit blends, which are gaining momentum among younger consumers seeking new taste experiences. As consumer preferences evolve, manufacturers are expected to expand their flavor offerings to attract a broader audience.

Segments:

Based on Type:

- Organic Fat-Free Yogurt

- Inorganic Fat-Free Yogurt

Based on Application:

- Peach

- Blueberry

- Strawberry

- Vanilla

- Others

Based on End- User:

Based on Distribution Channel:

- Online Retail

- Supermarket/Hypermarket

- Specialty Stores

- Departmental Stores

- Others

Based on the Geography:

- Beijing

- Shanghai

- Guangzhou

- Shenzhen

Regional Analysis

Beijing

Beijing holds the largest market share of approximately 30% in the China fat-free yogurt market, driven by a strong health-conscious consumer base and high disposable income levels. The city’s residents actively seek nutritious and functional dairy products, fueling demand for organic and probiotic-rich fat-free yogurt. The widespread presence of premium supermarkets, specialty organic stores, and online grocery platforms makes fat-free yogurt easily accessible to consumers. Additionally, Beijing’s thriving fitness culture and emphasis on healthy living further propel the market, with many consumers integrating fat-free yogurt into their daily diets. Government initiatives promoting healthy eating habits and dietary awareness campaigns also contribute to the market’s growth. As the demand for clean-label and plant-based yogurt alternatives rises, brands in Beijing are expanding their product offerings to include fortified and dairy-free fat-free yogurt variants, ensuring sustained market expansion.

Shanghai

Shanghai accounts for around 25% of the China fat-free yogurt market, largely due to the city’s affluent consumer base and increasing preference for premium dairy products. Consumers in Shanghai are particularly drawn to imported and high-quality organic yogurt, which has led to a surge in specialty dairy stores and international yogurt brands entering the market. The fast-paced urban lifestyle encourages higher consumption of on-the-go fat-free yogurt products, especially in single-serve and convenient packaging formats. The city’s strong e-commerce ecosystem, with platforms such as Tmall and JD.com, further supports the market by ensuring quick and easy access to a wide variety of fat-free yogurt brands. Additionally, Shanghai’s growing vegan and lactose-intolerant population is boosting demand for plant-based fat-free yogurt, prompting manufacturers to innovate with soy, almond, and oat-based alternatives to cater to this expanding consumer segment.

Guangzhou

Guangzhou holds a market share of approximately 22%, with increasing consumer interest in healthy and functional food products driving the market. The city has a younger demographic that is highly influenced by global food trends, contributing to the rising demand for low-fat and nutrient-rich dairy options. With a well-developed retail infrastructure, including major supermarket chains and convenience stores, consumers have easy access to various fat-free yogurt flavors and formats. Additionally, social media and influencer marketing play a key role in Guangzhou’s yogurt consumption trends, as health-conscious individuals frequently promote probiotic-rich dairy products. The presence of traditional herbal medicine influences has also led to fusion products that incorporate traditional Chinese ingredients, such as goji berries and ginseng, into fat-free yogurt. This innovation not only differentiates brands but also appeals to local consumer preferences for functional foods with added health benefits.

Shenzhen

Shenzhen captures around 23% of the fat-free yogurt market and is witnessing rapid expansion due to its digitally advanced and health-focused population. The city’s residents are early adopters of innovative food trends, making Shenzhen a key market for customized and premium fat-free yogurt offerings. The high concentration of working professionals and expatriates has fueled demand for convenient, ready-to-eat fat-free yogurt products, particularly those enriched with proteins, vitamins, and probiotics. Shenzhen’s robust e-commerce and direct-to-consumer (DTC) model also contribute to market growth, allowing brands to introduce subscription-based yogurt deliveries and personalized nutrition plans. Additionally, Shenzhen is seeing strong demand for sustainable and eco-friendly yogurt packaging, with consumers preferring biodegradable and recyclable containers. As the city continues to grow as a technology and wellness hub, the fat-free yogurt market in Shenzhen is expected to witness further advancements, including AI-driven consumer insights and product personalization strategies to enhance customer engagement.

Key Player Analysis

- Nestle

- Almarai

- Arla Foods amba

- ASDA

- Brummel & Brown

- Chobani, LLC

- Danone S.A.

- FAGE International S.A.

- Graham’s Dairies Limited

- Nature’s Fynd

- Nestle, S.A.

- Riverford Organic Farmers Ltd

- Sainsbury’s

- Stonyfield

- Target Corporation

- The Hain Celestial Group

- Wm Morrison Supermarkets Limited

- Yakult Honsha

- Yeo Valley

- Yoplait by General Mills Inc.

Competitive Analysis

The China Fat-Free Yogurt Market is highly competitive, with both domestic and international players vying for market share. Leading global brands like Nestle, Danone S.A., Yoplait by General Mills Inc., Chobani, LLC, and Arla Foods amba dominate the market with their established presence and diverse product offerings. These companies have introduced innovative fat-free yogurt options, catering to growing consumer demand for probiotic, organic, and plant-based variants. They capitalize on their strong distribution networks, both online and offline, to reach a broad consumer base. These brands leverage extensive distribution networks through supermarkets, convenience stores, and online platforms to expand their reach. Innovation in flavors and product formats, such as single-serve packs and on-the-go options, is helping brands capture the attention of health-conscious consumers. Additionally, sustainability has become an important competitive differentiator, with brands focusing on clean-label products and eco-friendly packaging to cater to environmentally conscious buyers. Pricing remains a critical factor, as some brands offer more affordable options while others target the premium segment. Local preferences also play a role, with some regional brands focusing on flavors and ingredients that resonate with Chinese consumers. As consumer demand for healthier dairy products continues to rise, the competition is expected to intensify, prompting brands to invest in research and development, marketing strategies, and supply chain optimization to maintain a competitive edge in the growing market.

Recent Developments

- In October 2024, Nestlé Lindahls expanded its high-protein range with new flavors, including fat-free protein yogurt pouches. However, these are not specifically labeled as fat-free yogurt but are part of a broader health-focused product line.

- In July 2024, Nestlé developed a technology to reduce fat in dairy ingredients by up to 60% without compromising taste or texture, though this is not specifically for fat-free yogurt.

Market Concentration & Characteristics

The China Fat-Free Yogurt Market exhibits a moderate level of market concentration, with a mix of global and local players competing for market share. Large international brands dominate the premium segment, offering a variety of fat-free yogurt options, including organic, probiotic, and plant-based variants, catering to health-conscious consumers. These brands leverage established distribution networks, extensive marketing campaigns, and strong brand loyalty to maintain a significant presence. On the other hand, local companies focus on offering more affordable products, often emphasizing regional flavors and preferences to cater to local tastes. The market is characterized by rapid product innovation, with companies introducing new flavors, packaging formats, and health-oriented products such as fortified yogurts. Price sensitivity remains a key characteristic, particularly in the lower-end segment, where cost-effective options are crucial for market penetration. Overall, the market is dynamic, with competition intensifying as consumer preferences evolve towards healthier and more sustainable products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The China Fat-Free Yogurt Market is expected to continue its strong growth, driven by rising health consciousness among consumers.

- Increasing demand for organic and plant-based yogurt variants will shape the market’s future trajectory.

- Probiotic-rich fat-free yogurt will gain more popularity as consumers seek digestive and immune health benefits.

- E-commerce platforms will play a pivotal role in reaching a larger consumer base, especially in urban areas.

- The trend towards sustainable packaging will become more prevalent as environmental concerns grow.

- Brands will focus on product innovation, offering new flavors and functional ingredients to meet diverse consumer preferences.

- Local brands will expand their presence by aligning products with regional tastes and preferences.

- The market will see increased competition in the premium segment, with both domestic and international brands vying for market share.

- Price-sensitive consumers will drive demand for affordable yet nutritious fat-free yogurt options.

- The rise of veganism and lactose intolerance will further fuel the demand for dairy-free alternatives in the fat-free yogurt category.