| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Industrial Fasteners Market Size 2024 |

USD 3,648.33 Million |

| France Industrial Fasteners Market, CAGR |

5.86% |

| France Industrial Fasteners Market Size 2032 |

USD 5,754.06 Million |

Market Overview:

The France Industrial Fasteners Market is projected to grow from USD 3,648.33 million in 2024 to an estimated USD 5,754.06 million by 2032, with a compound annual growth rate (CAGR) of 5.86% from 2024 to 2032.

The growth of the France industrial fasteners market is fueled by several key drivers. The strong performance of France’s manufacturing sector, particularly in automotive, aerospace, and machinery industries, plays a central role in driving demand for fasteners. These industries require high-quality, durable fasteners for various applications, from vehicle assembly to machinery construction. Additionally, ongoing infrastructure projects in the country, including developments in transportation, energy, and residential sectors, are creating a heightened need for reliable fastening solutions. Technological advancements also play a significant role in shaping the market, with innovations in materials, such as corrosion-resistant and lightweight fasteners, leading to improved product performance and durability. Furthermore, stringent regulatory standards in France are driving industries to invest in certified fastener solutions to ensure compliance with safety and quality guidelines.

France holds a significant position in the European industrial fasteners market, contributing to the region’s overall market growth. The country benefits from its strong industrial base and strategic location within Europe, which facilitates its role as a key player in the global supply chain. France’s manufacturing sectors, particularly automotive and aerospace, are essential contributors to the demand for industrial fasteners, driving both domestic consumption and export opportunities. The market is also supported by the country’s focus on innovation and quality production, aligning with European Union standards. As industrial and infrastructure projects continue to expand, particularly in sectors like energy and construction, France’s industrial fasteners market is poised for steady growth, reinforcing its regional dominance. The country’s commitment to advancing manufacturing processes and its emphasis on technological integration further solidify its competitive edge in the European market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Industrial Fasteners Market is projected to grow from USD 3,648.33 million in 2024 to USD 5,754.06 million by 2032, with a CAGR of 5.86% during the forecast period.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- The automotive, aerospace, and machinery sectors are key drivers of fastener demand, with a focus on high-performance and lightweight solutions, especially for electric vehicles and aerospace applications.

- France’s infrastructure development, including transportation, energy, and residential sectors, is significantly boosting the demand for durable, high-quality fasteners for large-scale construction projects.

- Technological advancements, such as the integration of automation, robotics, and 3D printing in fastener production, are enhancing efficiency, reducing costs, and contributing to market growth.

- Stringent regulatory compliance in France and the EU has led manufacturers to invest in high-quality, certified fasteners to meet international safety and environmental standards.

- Fluctuating raw material costs, particularly for steel, aluminum, and titanium, pose challenges to manufacturers, making it difficult to maintain stable pricing in the face of global market volatility.

- Supply chain disruptions, including transportation delays and labor shortages, have added strain to the market, affecting production timelines and increasing operational costs.

Market Drivers:

Demand from Key Industrial Sectors

The France industrial fasteners market is experiencing significant growth driven by the ongoing demand from critical industrial sectors such as automotive, aerospace, and machinery. These industries heavily rely on high-performance fasteners to ensure the structural integrity and functionality of their products. For instance, in the aerospace sector, Delta Metal, a French company, has developed eco-friendly hot forging and 3D printing technologies for producing high-strength fasteners from challenging materials such as titanium and Inconel, specifically to meet the rising need for corrosion-resistant, high-performance components in aircraft manufacturing. In the automotive industry, for instance, the shift towards lightweight vehicles and electric cars has increased the need for specialized fasteners designed for new materials, such as aluminum and composites. Similarly, in aerospace, the demand for corrosion-resistant and high-strength fasteners is escalating as manufacturers strive to meet stringent safety and durability standards. This widespread need for fasteners across diverse sectors directly contributes to the market’s robust expansion.

Infrastructure and Construction Growth

Infrastructure development in France has been a major driver for the industrial fasteners market. With numerous ongoing and upcoming projects in the transportation, energy, and residential sectors, the demand for fasteners continues to rise. Large-scale projects like the construction of high-speed rail networks, the expansion of airports, and the development of smart cities require fasteners for assembly and structural applications. As the French government invests in the improvement of national infrastructure, the need for durable, high-quality fastening solutions becomes critical to ensure long-term reliability and safety. This steady growth in infrastructure projects contributes substantially to the market’s overall expansion.

Technological Advancements in Fastener Solutions

The technological evolution in fastener solutions is another key driver for the market. Manufacturers are increasingly developing innovative fasteners that offer superior performance, such as corrosion-resistant, lightweight, and high-strength materials. For example, the use of hybrid fasteners combining plastic and metal elements is rising, especially in automotive and aerospace applications, where weight reduction and corrosion resistance are critical. These innovations are particularly important in industries that demand extreme precision and durability, such as aerospace and automotive. The integration of automation and robotics in the manufacturing process of fasteners has also enhanced production efficiency and reduced costs, further boosting market growth. Additionally, the rise of Industry 4.0 and smart manufacturing techniques, such as the use of advanced coatings and 3D printing technologies, are shaping the future of fastener production and increasing the demand for cutting-edge solutions in France.

Regulatory Compliance and Quality Standards

Stringent regulatory standards in France and the European Union have further driven the growth of the industrial fasteners market. Compliance with international safety and quality regulations is mandatory for industries that use fasteners in mission-critical applications. To meet these requirements, manufacturers are compelled to invest in high-quality fasteners that are certified for safety, reliability, and performance. These regulatory pressures, coupled with the increasing need for sustainability and eco-friendly production practices, are pushing companies to adopt advanced fastener solutions that adhere to both safety standards and environmental regulations. This continuous drive to meet regulatory demands ensures the steady growth of the industrial fasteners market in France.

Market Trends:

Rise in Adoption of Eco-Friendly Materials

A notable trend in the France industrial fasteners market is the increasing adoption of eco-friendly materials. With growing environmental concerns and stricter regulations on sustainability, industries are turning to fasteners made from recyclable or sustainable materials. Manufacturers are developing fasteners using eco-conscious materials like recycled steel, bio-based polymers, and corrosion-resistant alloys that minimize environmental impact. This trend aligns with the broader industry movement towards green manufacturing practices and helps meet the rising demand for sustainable products across various sectors. As regulations around carbon footprints and material waste tighten, eco-friendly fasteners are gaining prominence in both the automotive and construction industries in France.

Integration of Smart Fastening Solutions

The integration of smart technologies into fasteners is transforming the France industrial fasteners market. This trend involves the incorporation of sensors, RFID tags, and wireless monitoring capabilities into fasteners, allowing for real-time tracking and performance monitoring. The adoption of smart fasteners is particularly evident in industries that require precision, such as aerospace and automotive, where it is crucial to ensure the structural integrity of components over time. Smart fasteners not only enhance operational efficiency but also improve safety by providing valuable data that can predict potential failures or maintenance needs. This trend represents a shift towards more intelligent, data-driven manufacturing processes in France.

Growing Popularity of 3D Printing in Fastener Production

The use of 3D printing technology in the production of industrial fasteners is a growing trend in the French market. Additive manufacturing techniques enable the production of complex, customized fasteners that traditional manufacturing methods cannot achieve. This trend is particularly beneficial in industries like aerospace and automotive, where unique, high-precision fasteners are often required. For instance, Delta Metal, a French company, has successfully developed an eco-friendly technology that integrates 3D printing with hot forging for producing fasteners from challenging materials such as titanium and Inconel alloys. By leveraging 3D printing, manufacturers in France can produce smaller batches of highly specialized fasteners at lower costs and with shorter lead times. This shift towards additive manufacturing reflects the broader trend of digitization in industrial production and is expected to enhance the flexibility and efficiency of the fastener manufacturing process.

Increased Demand for Lightweight and High-Strength Fasteners

Another significant trend in the France industrial fasteners market is the growing demand for lightweight and high-strength fasteners. As industries like automotive and aerospace continue to focus on reducing weight and improving performance, the need for advanced fasteners made from lightweight materials such as titanium, aluminum, and composites is increasing. For instance, companies such as Bossard have developed bolts specifically for the automotive industry using advanced materials like titanium and high-strength steel to meet the sector’s requirements for reduced weight and enhanced durability. These materials offer superior strength-to-weight ratios, making them ideal for applications in vehicles, aircraft, and other machinery where minimizing weight without compromising durability is crucial. The shift towards lightweight and high-strength fasteners is driven by the need for improved fuel efficiency, lower emissions, and enhanced performance in various industrial applications in France.

Market Challenges Analysis:

Fluctuating Raw Material Costs

One of the primary challenges facing the France industrial fasteners market is the fluctuation in raw material costs. Fasteners are predominantly made from materials such as steel, aluminum, and titanium, and any changes in the prices of these raw materials can significantly impact production costs. The volatility in global steel and metal markets, often driven by geopolitical events, supply chain disruptions, or trade policies, can make it difficult for manufacturers to maintain stable pricing. This unpredictability in raw material costs presents a challenge for companies, particularly small and medium-sized manufacturers, as they struggle to balance profitability with competitive pricing in the market.

Supply Chain Disruptions

The France industrial fasteners market also faces supply chain challenges that can hinder market growth. Global supply chain disruptions, exacerbated by events like the COVID-19 pandemic, have made it increasingly difficult for fastener manufacturers to source raw materials and components on time. Transportation delays, labor shortages, and increased shipping costs have added further strain on the supply chain. This not only affects production timelines but also increases costs for manufacturers. In addition, the dependency on suppliers from regions such as Asia creates vulnerabilities in the supply chain, particularly in times of geopolitical tension or trade policy changes.

Competition from Low-Cost Manufacturers

Competition from low-cost fastener manufacturers, particularly those based in Asia, poses another significant restraint for the France industrial fasteners market. Many companies in countries like China and India can produce fasteners at lower costs due to cheaper labor and manufacturing overheads. This creates pricing pressure on French manufacturers, who often face challenges in competing with these low-cost imports while maintaining product quality. As a result, French companies are forced to focus on innovation, quality, and specialized fastener solutions to differentiate themselves in the market, which can be resource-intensive and costly.

Market Opportunities:

The France industrial fasteners market presents significant opportunities in emerging sectors such as renewable energy and electric vehicles (EVs). As the country shifts towards sustainable energy solutions, there is an increasing demand for fasteners in industries like wind and solar power installations. These renewable energy projects require durable, corrosion-resistant fasteners capable of withstanding harsh environmental conditions. Additionally, the rapid growth of the electric vehicle market is driving demand for lightweight and high-performance fasteners that cater to the need for energy efficiency and enhanced vehicle performance. Manufacturers who can innovate and provide specialized fasteners for these emerging industries are well-positioned to capitalize on the market’s growth potential.

Another promising opportunity lies in the growing adoption of smart and customized fasteners. With the rise of Industry 4.0, there is an increasing demand for fasteners integrated with smart technologies, such as sensors and RFID tags, which allow for real-time performance monitoring and predictive maintenance. As industries, particularly in aerospace, automotive, and machinery, seek to enhance operational efficiency and safety, the need for advanced fastening solutions is on the rise. Additionally, advancements in additive manufacturing and 3D printing technologies offer the potential to create custom fasteners tailored to specific industrial needs. Companies investing in smart and customized fastener solutions will be able to tap into a growing market driven by technological advancements and the increasing demand for precision and reliability in critical applications.

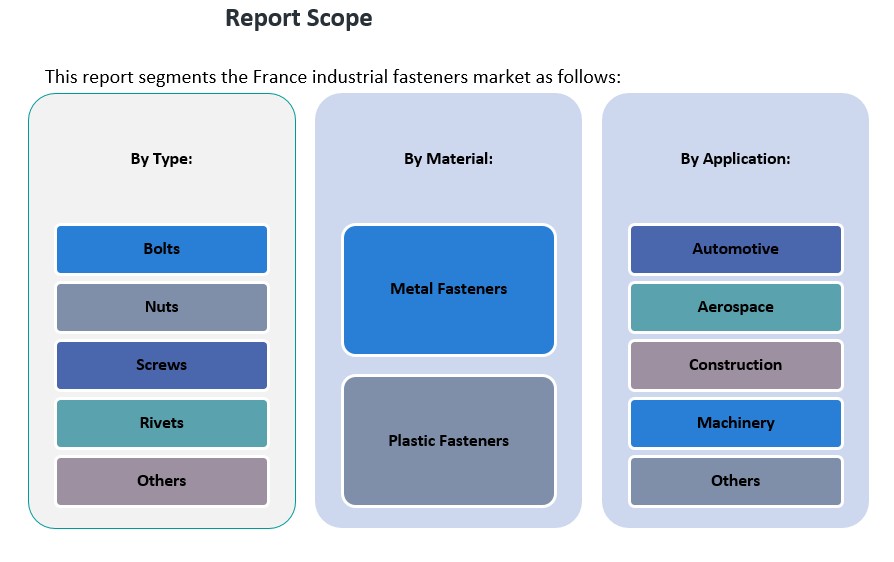

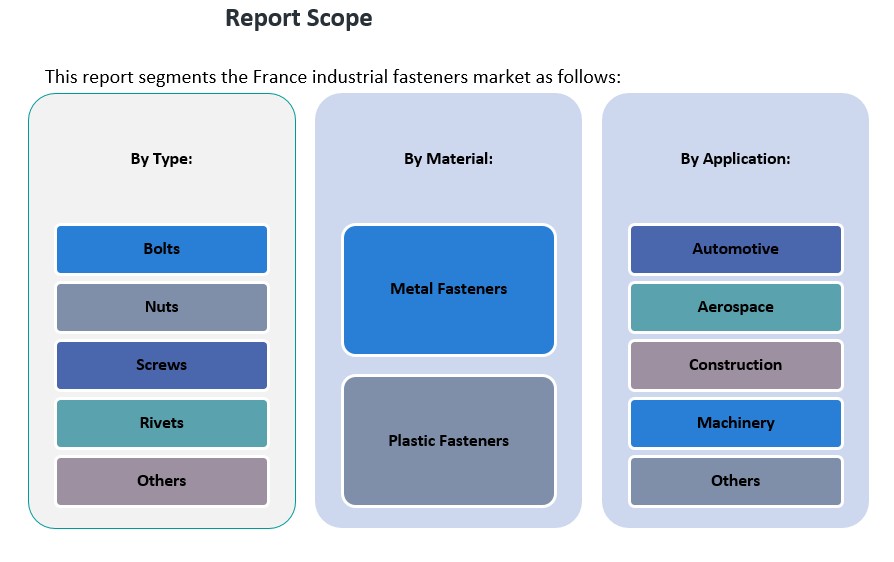

Market Segmentation Analysis:

The France industrial fasteners market is segmented by type, application, and material, each contributing uniquely to the overall market dynamics.

By Type Segment:

The market is primarily driven by bolts, nuts, screws, rivets, and other fastener types. Bolts and nuts account for a significant portion of the market, as they are integral to various industries like automotive, construction, and machinery. These fasteners are commonly used for heavy-duty applications requiring robust and secure joining solutions. Screws, another major segment, are widely used in precise applications in the automotive and aerospace industries due to their ease of use and versatility. Rivets are also popular, particularly in aerospace and construction sectors, where permanent fastening solutions are essential. The “Others” category includes specialized fasteners, catering to niche applications that demand unique properties.

By Application Segment:

The automotive and aerospace sectors dominate the industrial fasteners market in France, driving demand for high-performance and lightweight fasteners. Fasteners used in automotive manufacturing must meet stringent safety and performance standards, leading to a high demand for durable and corrosion-resistant solutions. Similarly, the aerospace sector requires fasteners that meet strict safety regulations. The construction sector is also a significant contributor, driven by infrastructure projects and the growing need for fasteners in building and civil engineering applications. Machinery manufacturing further drives the market, as fasteners are crucial for the assembly and functioning of industrial equipment.

By Material Segment:

The material segment is divided into metal and plastic fasteners. Metal fasteners dominate the market due to their superior strength and durability, essential for high-stress applications in automotive, aerospace, and construction industries. Plastic fasteners, however, are gaining traction in lighter applications, particularly in the automotive and electronics sectors, due to their cost-effectiveness and resistance to corrosion.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The France industrial fasteners market is experiencing steady growth, driven by regional industrial activities and sector-specific demands. While comprehensive regional market share data within France is limited, several key regions contribute significantly to the overall market dynamics.

Île-de-France (Paris Region)

Île-de-France, encompassing Paris and its surrounding areas, stands as a central hub for France’s industrial fasteners market. The region’s prominence in automotive manufacturing, aerospace engineering, and high-tech industries drives substantial demand for precision fasteners. Major aerospace companies and automotive manufacturers are based here, necessitating a consistent supply of specialized fasteners to meet stringent safety and performance standards.

Auvergne-Rhône-Alpes

The Auvergne-Rhône-Alpes region is another significant contributor, particularly in the automotive and machinery sectors. With a strong presence of manufacturing plants and engineering firms, the demand for durable and high-performance fasteners is robust. The region’s emphasis on innovation and quality manufacturing further bolsters its position in the industrial fasteners market.

Provence-Alpes-Côte d’Azur

In the southeastern part of France, the Provence-Alpes-Côte d’Azur region plays a vital role, especially in aerospace and defense industries. The presence of key aerospace companies and research institutions drives the need for advanced fastener solutions. This region’s focus on technological advancements and high-precision manufacturing supports the demand for specialized fasteners.

Other Regions

Other regions, including Nouvelle-Aquitaine, Occitanie, and Normandy, also contribute to the market, albeit to a lesser extent. These areas have growing industrial activities, particularly in construction and machinery sectors, which require a steady supply of industrial fasteners.

Key Player Analysis:

- LISI Group

- The Würth Group

- Bulten AB

- Bossard Group

- EJOT Holding GmbH & Co. KG

- Fabory Group

- Bolt & Nut Industry Ltd

- Precision Castparts Corp.

- Bufab Group

- Fischer Holding GmbH & Co.

Competitive Analysis:

The France industrial fasteners market is highly competitive, with a mix of established local and international players. Major manufacturers like Bulten Group, Würth Group, and ArcelorMittal dominate the market, offering a broad range of fasteners designed for automotive, aerospace, construction, and machinery applications. These companies leverage advanced manufacturing technologies, such as automation and robotics, to meet the growing demand for precision and high-performance fasteners. Local manufacturers also focus on product innovation, offering customized fastener solutions that comply with stringent European Union standards. Additionally, the increasing focus on sustainability has prompted several companies to develop eco-friendly fasteners made from recyclable materials. The market is also seeing the rise of smaller, specialized players focusing on niche applications in sectors like renewable energy and electronics. Competitive strategies include product diversification, technological innovation, and a strong emphasis on customer relationships to maintain a foothold in the evolving market.

Recent Developments:

- In February 2025, LISI Group, through its subsidiary LISI AUTOMOTIVE, completed the disposal of its French subsidiary LISI AUTOMOTIVE NOMEL SAS to ZB Invest GmbH. This move is part of LISI AUTOMOTIVE’s strategy to refocus on high value-added fastening solutions and mechanical components. LISI AUTOMOTIVE NOMEL, located in La Ferté Fresnel, France, generated €35.2 million in sales in 2024 and will be renamed ZB NOMEL. LISI subsidiaries will continue sourcing washers and nuts from ZB NOMEL for automotive applications.

- In December 2024, Bulten AB signed a letter of intent with ZJK Vietnam Precision Components Co., Ltd to establish a joint venture in Vietnam, aiming to start production in 2025. This expansion supports growing demand for micro screws in consumer electronics, particularly for customers with manufacturing in India and Vietnam. While the joint venture is outside France, it reflects Bulten’s broader strategy to diversify beyond automotive fasteners.

Market Concentration & Characteristics:

The France industrial fasteners market is characterized by a moderately concentrated structure, with a mix of established multinational corporations and specialized local manufacturers. Leading global players such as Würth Group, LISI Group, and Stanley Black & Decker hold significant market shares, leveraging their extensive product portfolios and advanced manufacturing capabilities. These companies benefit from economies of scale, strong distribution networks, and established relationships with key industries. In addition to these large enterprises, France hosts a robust base of small and medium-sized enterprises (SMEs) that cater to niche markets and offer customized fastening solutions. These SMEs often focus on specific applications, such as aerospace-grade fasteners or eco-friendly materials, allowing them to differentiate themselves in the competitive landscape. The market’s competitive dynamics are influenced by several factors. Technological advancements play a crucial role, with companies investing in automation, robotics, and additive manufacturing to enhance production efficiency and meet the evolving demands of industries like automotive and aerospace. Additionally, sustainability has become a key consideration, prompting manufacturers to develop fasteners made from recyclable materials and adopt energy-efficient production processes. However, challenges such as fluctuating raw material prices and competition from low-cost imports from regions like Asia pose ongoing pressures on profit margins. Despite these challenges, the France industrial fasteners market remains dynamic, with opportunities for growth driven by innovation, specialization, and strategic partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France industrial fasteners market is expected to maintain steady growth, driven by expanding automotive and aerospace sectors.

- Advancements in manufacturing technologies, including automation and 3D printing, will enhance production efficiency and product customization.

- The demand for lightweight, high-strength fasteners will increase due to the automotive industry’s focus on electric vehicles and fuel efficiency.

- Sustainability will play a significant role, with growing emphasis on eco-friendly and recyclable materials in fastener production.

- The construction industry’s expansion, particularly in infrastructure projects, will continue to drive demand for durable fastening solutions.

- Technological innovations such as smart fasteners with embedded sensors will open new market opportunities.

- Increased regional manufacturing in France will reduce dependency on imports and strengthen the domestic fastener supply chain.

- The rise in renewable energy projects, particularly wind and solar, will create demand for specialized fasteners in the energy sector.

- Smaller manufacturers will focus on niche markets, providing customized solutions for high-precision industries like aerospace.

- Competitive pressures from low-cost Asian imports will push French manufacturers to focus on quality, innovation, and specialization.