Market Overview:

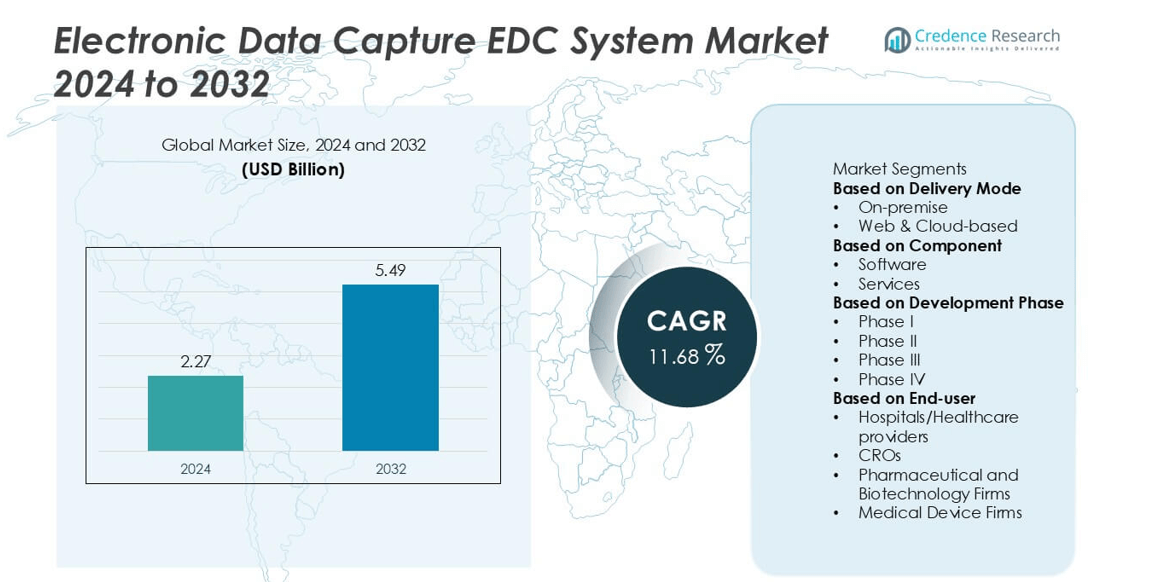

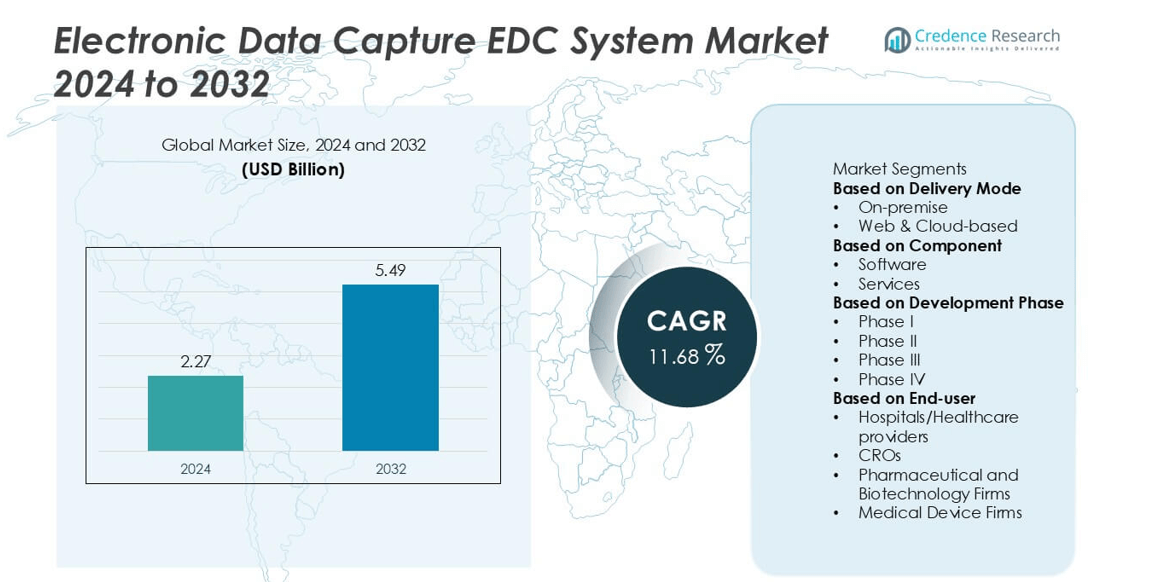

The Electronic Data Capture (EDC) System market was valued at USD 2.27 billion in 2024 and is projected to reach USD 5.49 billion by 2032, growing at a compound annual growth rate CAGR of 11.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Data Capture EDC System Market Size 2024 |

USD 2.27 billion |

| Electronic Data Capture EDC System Market, CAGR |

11.68% |

| Electronic Data Capture EDC System Market Size 2032 |

USD 5.49 billion |

The Electronic Data Capture (EDC) System market is highly competitive, with key players including Medidata Solutions, Inc., IQVIA Inc., Oracle, Veeva Systems, Clario, Castor, Calyx, IBM, DATATRAK International, Inc., and OpenClinica, LLC leading global operations. These companies dominate through advanced EDC platforms that integrate cloud technologies, artificial intelligence, and real-time analytics to enhance clinical trial efficiency and compliance. North America remains the leading region, accounting for 42% of the global market share in 2024, driven by strong technological infrastructure, high clinical research activity, and early adoption of digital solutions. Europe and Asia-Pacific follow as significant growth regions supported by expanding R&D investments and digital transformation initiatives in clinical data management.

Market Insights

- The Electronic Data Capture (EDC) System market was valued at USD 2.27 billion in 2024 and is projected to reach USD 5.49 billion by 2032, growing at a CAGR of 11.68% during the forecast period.

- Growing adoption of decentralized and virtual clinical trials, increasing R&D investments, and demand for real-time data management are key drivers accelerating market growth.

- The market is witnessing trends such as integration of AI and machine learning, expansion of cloud-based EDC platforms, and rising preference for mobile-compatible solutions in clinical data collection.

- The competitive landscape includes major players such as Medidata Solutions, Oracle, IQVIA, Veeva Systems, and Clario, focusing on product innovation, strategic alliances, and global expansion.

- Regionally, North America holds 42% of the market share, followed by Europe with 27% and Asia-Pacific with 20%, while the web & cloud-based segment dominates by delivery mode with over 65% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Delivery Mode

The Electronic Data Capture (EDC) System market by delivery mode is segmented into on-premise and web & cloud-based solutions. The web & cloud-based segment dominated the market in 2024, accounting for over 65% of the total share. This dominance is driven by the growing adoption of decentralized clinical trials, real-time data accessibility, and reduced infrastructure costs. Cloud-based platforms offer scalability, remote monitoring, and integration with other eClinical solutions, making them the preferred choice for pharmaceutical and biotechnology companies seeking efficiency, security, and flexibility in managing clinical trial data.

- For instance, Medidata Solutions offers its cloud-based Rave EDC platform, which has been utilized in over 36,000 trials and has more than 700,000 certified site users. The platform is known for its ability to efficiently manage data in large-scale clinical trials and helps to streamline clinical data management processes.

By Component

Based on component, the market is divided into software and services. The software segment held the largest share, capturing around 58% of the market in 2024. This dominance is attributed to increasing demand for advanced data collection tools that ensure accuracy, compliance, and faster analysis. The growing need for real-time data validation, audit trails, and interoperability with clinical trial management systems has further accelerated software adoption. However, the services segment is expected to grow steadily as organizations increasingly rely on professional support for system integration, maintenance, and regulatory compliance.

- For instance, Veeva Systems enhanced its Vault EDC software with integrated query management to improve data quality and ensure continuous compliance with GxP guidelines such as FDA 21 CFR Part 11 and EMA GCP guidelines. The system uses automation to minimize manual data entry effort during clinical trial processes

By Development Phase

The EDC System market by development phase includes Phase I, Phase II, Phase III, and Phase IV clinical trials. The Phase III segment emerged as the leading sub-segment, holding approximately 45% market share in 2024. This phase involves large-scale trials with extensive patient data, driving demand for robust and efficient EDC systems to manage complex datasets. The need for data accuracy, regulatory adherence, and faster trial completion timelines supports the widespread use of EDC in this stage. Additionally, growing R&D investments and the rising number of late-stage trials continue to fuel this segment’s growth.

Key Growth Drivers

Rising Adoption of Decentralized and Virtual Clinical Trials

The increasing shift toward decentralized and virtual clinical trials is a major growth driver for the Electronic Data Capture (EDC) System market. Pharmaceutical and biotech companies are adopting remote trial models to enhance patient participation and reduce operational costs. EDC systems enable seamless data collection from multiple sources, including wearable devices and remote monitoring tools. Their ability to support real-time access, ensure data integrity, and enhance trial efficiency has made them indispensable in decentralized settings, driving widespread adoption across global clinical research operations.

- For instance, IQVIA integrated its Orchestrated Clinical Trials (OCT) platform with remote sensors capable of capturing numerous biometric data points per participant daily. The system helps manage large volumes of real-time data across various virtual and hybrid studies.

Growing Demand for Real-Time Data Management and Compliance

The demand for real-time, accurate, and compliant data management solutions is propelling the growth of EDC systems. As clinical trials generate vast amounts of data, sponsors increasingly rely on EDC platforms to ensure data consistency, regulatory compliance, and faster decision-making. These systems streamline data collection, validation, and reporting while adhering to Good Clinical Practice (GCP) and FDA 21 CFR Part 11 standards. The ability to reduce errors, enhance transparency, and accelerate approvals significantly boosts their adoption in the life sciences sector.

- For instance, Oracle Life Sciences deployed its Clinical One EDC platform, which is designed to support numerous concurrent trials globally, providing a unified platform for collecting, managing, and harmonizing data from various sources.

Increasing R&D Investments in Clinical Research

Rising R&D spending by pharmaceutical and biotechnology companies is a key factor fueling the EDC market. As organizations intensify their efforts to develop new therapies, they require robust digital tools to manage complex trial data efficiently. EDC systems provide centralized, secure platforms for collecting and analyzing patient information across multiple trial phases. The growing focus on reducing time-to-market and improving drug success rates has led to a surge in EDC deployment, especially in late-phase and multi-regional clinical trials.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

A major trend shaping the EDC market is the integration of AI and ML technologies. These innovations enhance data analytics, automate error detection, and improve predictive modeling for clinical outcomes. AI-enabled EDC platforms can identify data anomalies in real time, optimize patient recruitment, and forecast trial performance. This trend is opening new opportunities for precision-driven clinical research, helping sponsors derive actionable insights and accelerate trial timelines while maintaining regulatory compliance and data quality.

- For instance, Clario has deployed its Artificial Intelligence (AI), Machine Learning (ML), and Deep Learning (DL) capabilities more than 1,600 times in the clinical trials it has supported. The average clinical trial generates 3.6 million data points, and Clario uses AI to analyze vast amounts of data to enhance decision-making.

Expansion of Cloud-Based and Mobile EDC Solutions

The growing adoption of cloud-based and mobile EDC systems presents significant market opportunities. Cloud deployment offers scalability, cost-efficiency, and global data accessibility, while mobile integration supports remote data entry and monitoring. This trend aligns with the rise of hybrid and decentralized trials, enabling sponsors to collect real-time data from geographically dispersed participants. As clinical research organizations increasingly favor flexible, collaborative digital ecosystems, the demand for cloud and mobile EDC platforms continues to rise steadily.

- For instance, Castor launched its unified cloud and mobile eClinical platform supporting over 15,000 studies across more than 90 countries with secure data synchronization. The system supports decentralized and site-less clinical trials through its encrypted cloud infrastructure that meets global compliance standards, including GDPR.

Key Challenges

Data Security and Privacy Concerns

Despite their advantages, EDC systems face ongoing challenges related to data security and privacy. The handling of sensitive patient information across global networks exposes systems to cybersecurity threats and compliance risks. Ensuring adherence to data protection regulations such as HIPAA and GDPR requires continuous investment in encryption, access control, and monitoring. Any data breach or non-compliance can undermine trust, delay trials, and result in financial or legal repercussions, posing a major restraint to market growth.

High Implementation Costs and Technical Complexity

The high initial investment required for EDC system deployment remains a significant barrier, particularly for small and mid-sized clinical research organizations. Implementation involves costs related to software licensing, training, and integration with existing clinical systems. Additionally, technical complexity in system customization and maintenance often demands skilled IT resources. These challenges can delay adoption and limit market penetration, especially in emerging regions where budget constraints and limited digital infrastructure persist.

Regional Analysis

North America

North America held the largest share of the Electronic Data Capture (EDC) System market in 2024, accounting for over 42% of the total revenue. The region’s dominance is driven by the strong presence of pharmaceutical and biotechnology companies, advanced healthcare infrastructure, and high adoption of digital clinical solutions. Supportive regulatory frameworks from the U.S. FDA and growing investments in clinical research further strengthen market growth. The increasing focus on decentralized trials and integration of AI-driven analytics continues to enhance the adoption of EDC platforms across the United States and Canada.

Europe

Europe captured around 27% of the EDC System market share in 2024, supported by expanding clinical research activities and strong regulatory emphasis on data integrity. Countries such as Germany, the United Kingdom, and France lead the adoption due to advanced research ecosystems and widespread use of eClinical technologies. The European Medicines Agency’s (EMA) digital transformation initiatives and growing collaborations between research institutions and pharmaceutical companies are driving the use of EDC solutions. Additionally, increasing government funding and cross-border trials within the EU enhance market growth prospects across the region.

Asia-Pacific

The Asia-Pacific region accounted for about 20% of the EDC System market share in 2024 and is expected to register the fastest growth during the forecast period. Rapid expansion of clinical trial activities in countries such as China, India, Japan, and South Korea is fueling demand for advanced data management tools. Rising investments by multinational pharmaceutical companies, growing patient recruitment efficiency, and supportive government policies are accelerating EDC adoption. Furthermore, the increasing penetration of cloud technologies and cost-effective trial operations make Asia-Pacific an attractive destination for global clinical research outsourcing.

Latin America

Latin America represented around 6% of the global EDC System market share in 2024, driven by growing clinical trial activities and improving healthcare infrastructure. Brazil, Mexico, and Argentina are emerging as key contributors due to their expanding pharmaceutical sectors and favorable regulatory reforms. The region is witnessing increasing partnerships between local CROs and global sponsors, promoting the adoption of EDC systems to ensure compliance and efficiency. However, limited technical expertise and inconsistent digital adoption across countries remain challenges, though gradual technological advancements are expected to support steady market growth.

Middle East & Africa

The Middle East & Africa (MEA) region accounted for around 5% of the EDC System market share in 2024, with growth primarily led by the United Arab Emirates, Saudi Arabia, and South Africa. The region is gradually embracing digital transformation in clinical research, supported by government initiatives to strengthen healthcare innovation. Increasing investments in clinical trials, coupled with partnerships with international pharmaceutical companies, are driving EDC system adoption. However, limited infrastructure and lower R&D expenditure compared to other regions pose challenges. Despite this, ongoing modernization of healthcare systems offers promising growth potential for EDC providers in MEA.

Market Segmentations:

By Delivery Mode

- On-premise

- Web & Cloud-based

By Component

By Development Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By End-user

- Hospitals/Healthcare providers

- CROs

- Pharmaceutical and Biotechnology Firms

- Medical Device Firms

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electronic Data Capture (EDC) System market is characterized by the strong presence of leading players such as Medidata Solutions, Inc., DATATRAK International, Inc., IQVIA Inc., Clario, Oracle, Castor, Veeva Systems, IBM, Calyx, and OpenClinica, LLC. These companies focus on technological innovation, strategic partnerships, and product enhancements to strengthen their market positions. Cloud-based platforms, AI-driven analytics, and integration with other eClinical tools remain central to their competitive strategies. Major players are investing heavily in developing scalable, secure, and interoperable solutions to support decentralized and hybrid trials. Mergers, acquisitions, and collaborations with contract research organizations (CROs) are also prevalent, enabling companies to expand their global footprint and service capabilities. Continuous advancements in automation, compliance management, and real-time data processing are further intensifying competition, positioning technology differentiation and customer-centric service models as key success factors in the evolving EDC market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Oracle Corporation announced enhancements to its Clinical One Data Collection EDC offering, adding AI-enabled EHR-EDC integration, expanded document-upload capabilities, and tighter safety-reporting workflows under ICH E2B(R3).

- In February 2025, Oracle was recognised as a Leader in the Everest Group PEAK Matrix® for life-sciences CTMS products, noting its ecosystem supports EDC integration, which underscores its positioning in EDC enablement.

- In October 2024, Medidata Solutions, Inc. announced the launch of Rave Lite, an extension of its Rave EDC product designed for Phase I and Phase IV trials.

- In March 2024, Veeva Systems announced that its Vault EDC platform had powered more than 1,000 study starts, marking a major adoption milestone

Report Coverage

The research report offers an in-depth analysis based on Delivery Mode, Component, Development Phase, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electronic Data Capture (EDC) System market will continue to expand rapidly, driven by increasing digital transformation in clinical research.

- Adoption of decentralized and hybrid clinical trial models will boost demand for cloud-based EDC platforms.

- Artificial intelligence and machine learning integration will enhance data accuracy, analysis, and predictive insights in clinical trials.

- Strategic collaborations between pharmaceutical companies and technology providers will accelerate product innovation.

- Regulatory support for digital data collection will encourage wider implementation of compliant EDC systems.

- The growing focus on patient-centric trials will increase the use of mobile and remote data capture solutions.

- Emerging economies in Asia-Pacific will witness strong growth due to expanding clinical trial activities and technological adoption.

- Cybersecurity advancements will become a key priority to ensure data integrity and patient privacy.

- Increased use of interoperable systems will streamline data exchange across eClinical platforms.

- Continuous R&D investments will strengthen market competitiveness and drive technological evolution in EDC solutions.