Market Overview:

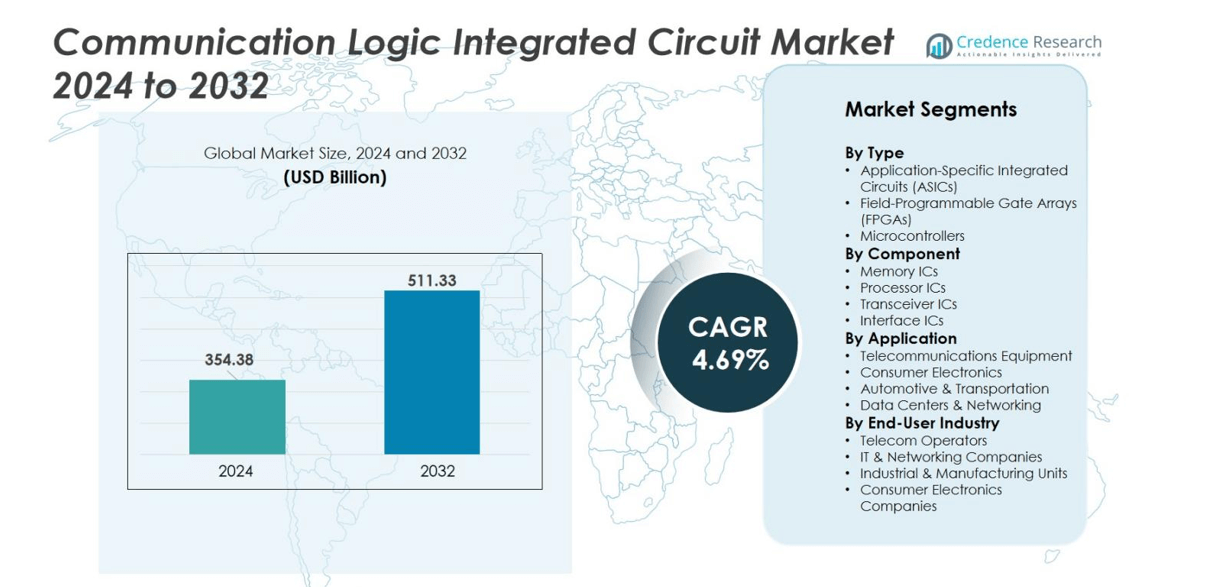

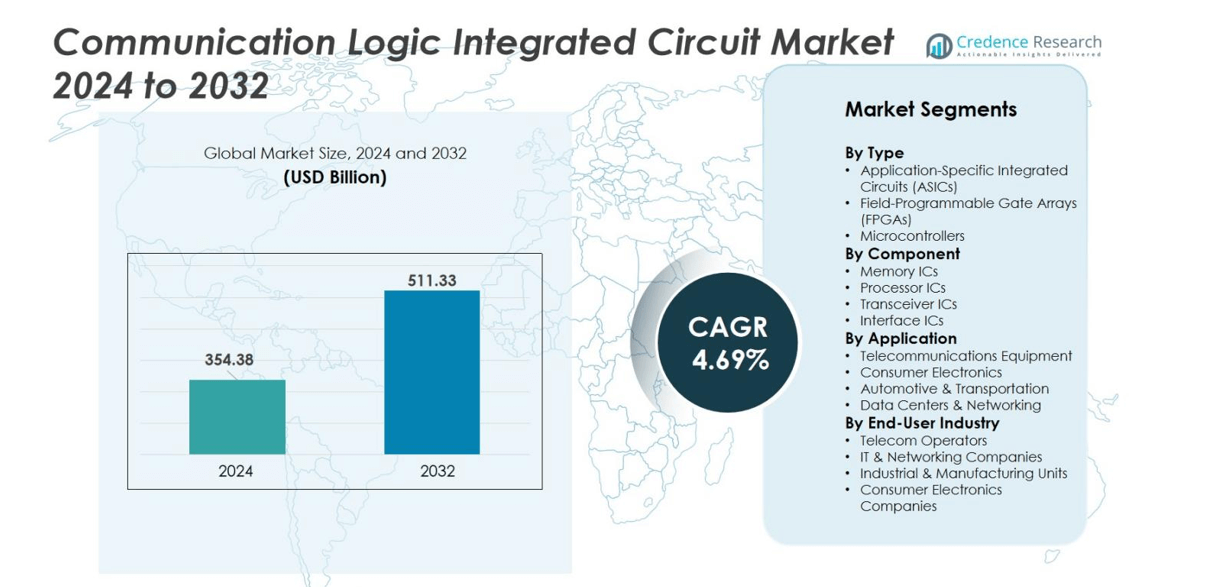

The Communication Logic Integrated Circuit market size was valued at USD 354.38 billion in 2024 and is anticipated to reach USD 511.33 billion by 2032, growing at a CAGR of 4.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Communication Logic Integrated Circuit MarketSize 2024 |

USD 354.38 billion |

| Communication Logic Integrated Circuit Market, CAGR |

4.69% |

| Communication Logic Integrated Circuit Market Size 2032 |

USD 511.33 billion |

Top players in the Communication Logic Integrated Circuit Market include STMicroelectronics N.V., Analog Devices, Inc., Broadcom Inc., Intel Corporation, and NXP Semiconductors N.V., which jointly drive innovation in ASICs, microcontrollers, and interface logic. These companies leverage deep design resources and global supply networks to capture significant market presence. Regionally, Asia‑Pacific leads with a 42.2 % market share in 2024. This dominance stems from strong manufacturing ecosystems in China, Taiwan, and South Korea, and dense demand from consumer electronics and telecom infrastructure sectors.

Market Insights

- The Communication Logic Integrated Circuit market was valued at USD 354.38 billion in 2024 and is projected to reach USD 511.33 billion by 2032, growing at a CAGR of 4.69%, with ASICs holding the largest type share of 38% and processor ICs dominating components at 40%.

- Strong demand from telecommunications, 5G rollout, and automotive electronics drives market growth, supported by rising adoption of IoT and smart devices across industries.

- Trends include integration of AI and machine learning into logic ICs, expansion of low-power and energy-efficient designs, and rapid adoption in consumer electronics and data centers.

- Competitive players such as Intel, Broadcom, STMicroelectronics, NXP, and Analog Devices focus on R&D, strategic partnerships, and high-performance product launches to strengthen market positioning.

- Asia-Pacific leads with 42.2% market share, followed by North America at 22% and Europe at 18%, while Latin America and MEA collectively hold 18%, reflecting strong regional demand and manufacturing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Communication Logic Integrated Circuit market is led by Application-Specific Integrated Circuits (ASICs), holding a dominant share of 38%. ASICs gain traction due to their customization for high-performance tasks in telecommunications and data centers, improving processing efficiency and power consumption. Field-Programmable Gate Arrays (FPGAs) follow with 27% share, favored for flexible design and rapid prototyping. Microcontrollers account for 20%, supported by growth in automotive and consumer electronics. Rising demand for compact, energy-efficient circuits and increasing adoption in 5G infrastructure drive growth across all types.

- For instance, ZTE demonstrated a 5G base station system where envelope tracking (ET) technology facilitates rapid voltage adjustments (on a millisecond or faster level) to the power amplifier, contributing to significant power savings while maintaining peak communication performance.

By Component

Processor ICs lead the component segment with a 40% market share, driven by high computational demand in data centers, networking equipment, and telecom infrastructure. Memory ICs contribute 25%, propelled by expanding storage needs and IoT deployments. Transceiver ICs hold 20% share, supporting high-speed data transfer in communications. Interface ICs capture 15%, facilitating seamless connectivity across devices. Continuous innovations in low-power designs, higher integration, and multi-functionality fuel adoption across industries, while strong investments by key players enhance performance and reliability.

- For instance, NVIDIA launched its H100 Tensor Core GPU which achieved 60 teraflops of AI performance, significantly advancing data center processing capabilities and accelerating machine learning workloads.

By Application

Telecommunications equipment dominates applications with a 35% share, driven by 5G rollout, network upgrades, and higher bandwidth demands. Consumer electronics follow with 28%, supported by smart devices, wearables, and home automation adoption. Automotive & transportation holds 20%, boosted by electric vehicle electronics and advanced driver-assistance systems. Data centers & networking contribute 17%, as cloud services expand and high-speed connectivity becomes critical. Increasing digitalization, IoT integration, and network infrastructure modernization act as primary growth drivers across all applications.

Key Growth Drivers

Rising Demand from Telecommunications and 5G Infrastructure

The growth of 5G networks and advanced telecom infrastructure drives demand for Communication Logic Integrated Circuits. Network operators require high-performance ASICs and FPGAs to handle increased data traffic, low-latency communication, and high-speed connectivity. Expansion of mobile broadband, deployment of small cells, and network densification create strong demand for customized logic ICs. Additionally, telecom equipment manufacturers integrate these circuits into base stations, routers, and switches to enhance signal processing and energy efficiency. Investments in upgrading legacy networks to 5G across North America, Europe, and Asia Pacific further bolster market expansion.

- For instance, Qualcomm’s Snapdragon X80 5G Modem-RF System enabled a record uplink speed of 516 Mbps using advanced SU-MIMO technology in collaboration with Ericsson and Telstra, demonstrating the ability of ASICs to support high data throughput in 5G networks.

Adoption of Consumer Electronics and IoT Devices

The proliferation of smart devices, wearables, and IoT applications fuels the market for microcontrollers and interface ICs. Consumer demand for compact, energy-efficient, and high-performance electronics drives manufacturers to incorporate advanced logic ICs. Smart home devices, personal gadgets, and connected appliances rely on these circuits for processing, connectivity, and memory management. Growth in IoT ecosystems across industrial, healthcare, and retail sectors further supports IC adoption, while advancements in low-power and multi-function designs enhance integration possibilities, creating continuous expansion opportunities for manufacturers.

- For instance, STMicroelectronics’ STM32WBA52 MCUs combine a 100 MHz ARM Cortex-M33 core with ultra-low-power modes achieving power savings during sleep, suitable for extended battery life in IoT ecosystems.

Expansion of Automotive and Industrial Applications

Automotive electrification and industrial automation propel market growth, with microcontrollers and processor ICs playing a central role. Electric vehicles, advanced driver-assistance systems, and infotainment platforms require precise, reliable, and high-speed logic ICs. Industrial sectors deploy these circuits in robotics, factory automation, and smart grid systems to improve operational efficiency and reduce downtime. Increasing investments in EV infrastructure, autonomous vehicles, and Industry 4.0 initiatives drive consistent demand for high-performance ICs. The need for durable, temperature-tolerant, and energy-efficient solutions motivates manufacturers to innovate, supporting long-term market growth.

Key Trends & Opportunities

Integration of AI and Machine Learning in ICs

AI-enabled ICs present opportunities for the Communication Logic Integrated Circuit market, particularly in edge computing and smart devices. Companies integrate machine learning capabilities into FPGAs and processor ICs to perform real-time data analysis, pattern recognition, and predictive operations. This trend enhances automation in industrial applications and improves consumer electronics performance. Increasing adoption of AI in telecom infrastructure, data centers, and autonomous vehicles provides avenues for new product development. Collaboration between IC manufacturers and AI software providers accelerates innovation, positioning the market to meet growing computational requirements efficiently.

- For instance, Intel’s Movidius Myriad X vision processing unit features a Neural Compute Engine capable of delivering over 1 trillion operations per second, enabling AI inferencing across edge applications in robotics and security cameras.

Shift Towards Energy-Efficient and Low-Power Designs

Energy-efficient ICs gain traction due to global emphasis on sustainability and reduced operational costs. Logic ICs with low power consumption appeal to telecom operators, data centers, automotive, and consumer electronics companies. Advances in semiconductor fabrication, smaller node processes, and multi-core architectures enable compact and efficient designs. Adoption of green electronics and government regulations promoting energy savings create favorable conditions for low-power IC adoption. Companies focusing on this segment can gain competitive advantage, while market growth benefits from rising demand for devices with longer battery life and reduced energy footprint.

- For instance, STMicroelectronics introduced power management ICs supporting wearables that optimize power efficiency while reducing chip size to just a few square millimeters.

Expansion in Emerging Markets

Emerging economies in Asia Pacific, Latin America, and the Middle East present significant growth opportunities. Increasing smartphone penetration, industrial automation, and digital infrastructure investments drive logic IC demand. Market players expanding manufacturing facilities, partnerships, and distribution networks in these regions capitalize on the rising need for telecom, consumer electronics, and automotive applications. Favorable government initiatives, increasing foreign direct investment, and urbanization further boost adoption. The combination of cost-effective labor and growing industrial demand makes emerging markets strategic growth hubs for Communication Logic Integrated Circuit manufacturers.

Key Challenges

Supply Chain Constraints and Semiconductor Shortages

The market faces challenges from global semiconductor supply chain disruptions and component shortages. Limited availability of high-quality wafers, raw materials, and fabrication capacity impacts production schedules. Geopolitical tensions, trade restrictions, and logistics bottlenecks exacerbate supply inconsistencies. Manufacturers struggle to meet growing demand from telecom, automotive, and consumer electronics sectors, leading to delayed deliveries and increased costs. These constraints necessitate strategic planning, diversified sourcing, and investment in domestic production facilities to mitigate risks and ensure steady supply for market growth.

High Manufacturing Costs and Technological Complexity

Producing advanced logic ICs requires significant capital investment and sophisticated technology. Fabrication processes for ASICs, FPGAs, and microcontrollers demand high-precision equipment, skilled workforce, and rigorous quality control. Rising costs of lithography, testing, and integration limit profitability, especially for smaller players. Additionally, technological complexity in designing low-power, high-speed, and multi-functional ICs creates development challenges. Companies must continuously innovate while managing expenses, making cost optimization and R&D efficiency critical for sustained market success.

Regional Analysis

North America

The North American region held 22% of the Communication Logic Integrated Circuit Market in 2024, driven by high investment in data centres, telecom infrastructure and automotive electronics. Tech‑companies and semiconductor design firms in the U.S. lead innovation and apply advanced processes to logic ICs. Government stimulus—like the CHIPS Act—boosts local manufacturing and supply‑chain resilience. The region’s strong R&D, fusion of cloud/edge applications and growing ADAS content in vehicles support steady market growth.

Europe

Europe accounted for 18% of the market in 2024. The region benefits from its strong automotive sector, industrial automation adoption and 5G telecom roll‑outs. Countries such as Germany leverage logic ICs in electric vehicles, smart factories and telecommunications equipment. EU‑wide semiconductor strategies and increased domestic fabrication activities support demand. Growth may be moderate compared to other regions but remains solid due to high‑value applications and regulatory support.

Asia‑Pacific

Asia‑Pacific dominated with about 42.2% of the market in 2024, the largest regional share globally. Manufacturing hubs in China, South Korea, Japan and Taiwan produce and consume significant volumes of logic ICs for consumer electronics, telecom infrastructure and automotive systems. Massive investments in 5G, IoT and EV zones drive rapid growth. The region’s foundry ecosystem and OEM network enable rapid scaling of communication logic IC demand and application deployment.

Latin America

Latin America holds 8% share of the communication logic IC market in 2024. Growth is driven by expanding consumer electronics adoption, telecom upgrades and the gradual introduction of automotive electronics. Brazil leads regional demand while local production remains limited. Market expansion depends on improved infrastructure, logistics, and increased foreign investment in semiconductor assembly and testing.

Middle East & Africa (MEA)

The MEA region captured 10% of the market in 2024. Telecom modernisation, smart city projects and increased adoption of connected devices fuel demand for logic ICs. While fabrication capacity is limited, regional governments and megaprojects are prompting domestic consumption. Growth opportunities exist in North Africa and Gulf states for low‑power, high‑efficiency logic solutions tailored for emerging networks and digital transformation programmes.

Market Segmentations:

By Type

- Application-Specific Integrated Circuits (ASICs)

- Field-Programmable Gate Arrays (FPGAs)

- Microcontrollers

By Component

- Memory ICs

- Processor ICs

- Transceiver ICs

- Interface ICs

By Application

- Telecommunications Equipment

- Consumer Electronics

- Automotive & Transportation

- Data Centers & Networking

By End-User Industry

- Telecom Operators

- IT & Networking Companies

- Industrial & Manufacturing Units

- Consumer Electronics Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Communication Logic Integrated Circuit market shows a moderate level of concentration and active strategic differentiation. Leading companies such as Intel Corporation, Broadcom Inc, and Texas Instruments Inc compete across custom logic, standard logic, and programmable logic segments. They leverage R&D investments and process node leadership to retain high-performance product portfolios. Many players also form alliances with telecom infrastructure firms, automotive OEMs, and data‑centre providers to secure long‑term design wins and embedded content. With emerging edge‑AI and 5G applications, firms focus on low‑power, high‑integration solutions to defend and expand market share. Continuous innovation, scale efficiencies, and strong design ecosystem partnerships drive competitive positioning in this evolving logic IC arena.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Broadcom Inc

- Intel Corporation

- Diodes Incorporated

- On Semiconductor Corporation

- Texas Instruments Inc

- NXP Semiconductors NV

- STMicroelectronics NV

- Toshiba Corporation

- Renesas Electronics Corporation

- Analog Devices Inc

Recent Developments

- In June 2025, SkyWater Technology completed the acquisition of Infineon’s Austin fabrication facility, expanding its U.S.-based communication IC production capacity.

- In May 2025, AMD acquired Enosemi to boost optical interconnect bandwidth capabilities for AI-driven data centers.

- In 2025, Nokia finalized its USD 2.3 billion acquisition of Infinera, integrating optical networking expertise into its mobile infrastructure silicon operations.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as next‑gen network infrastructures adopt advanced logic ICs.

- Increasing electrification of vehicles will boost demand for microcontrollers and processor ICs in mobility systems.

- Manufacturers will shift toward ultra‑low power logic ICs to serve battery‑constrained IoT and wearable devices.

- Custom ASICs and FPGAs will gain prominence as end users demand tailored solutions for telecom and data center applications.

- Growth in Asia Pacific will accelerate, reinforcing its leadership position and influencing global supply chains.

- Emerging players will form alliances with foundries and OEMs to gain faster design wins and reduce time‑to‑market.

- The push for energy efficiency and sustainability will drive uptake of high‑integrated logic ICs in consumer electronics and industrial segments.

- Demand for high‑speed transceiver and interface ICs will rise as data centers handle more complex workloads and elevated bandwidth.

- Market participants will face opportunities in servicing zonal electrical architectures in vehicles that require high‑bandwidth logical components.

- Continuous innovation in packaging, nodes, and integration will be critical to staying competitive in the logic IC segment.