| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Integrated Patient Management Market Size 2024 |

USD 16,976.00 million |

| Integrated Patient Management Market, CAGR |

7.75% |

| Integrated Patient Management Market Size 2032 |

USD 32,182.57 million |

Market Overview

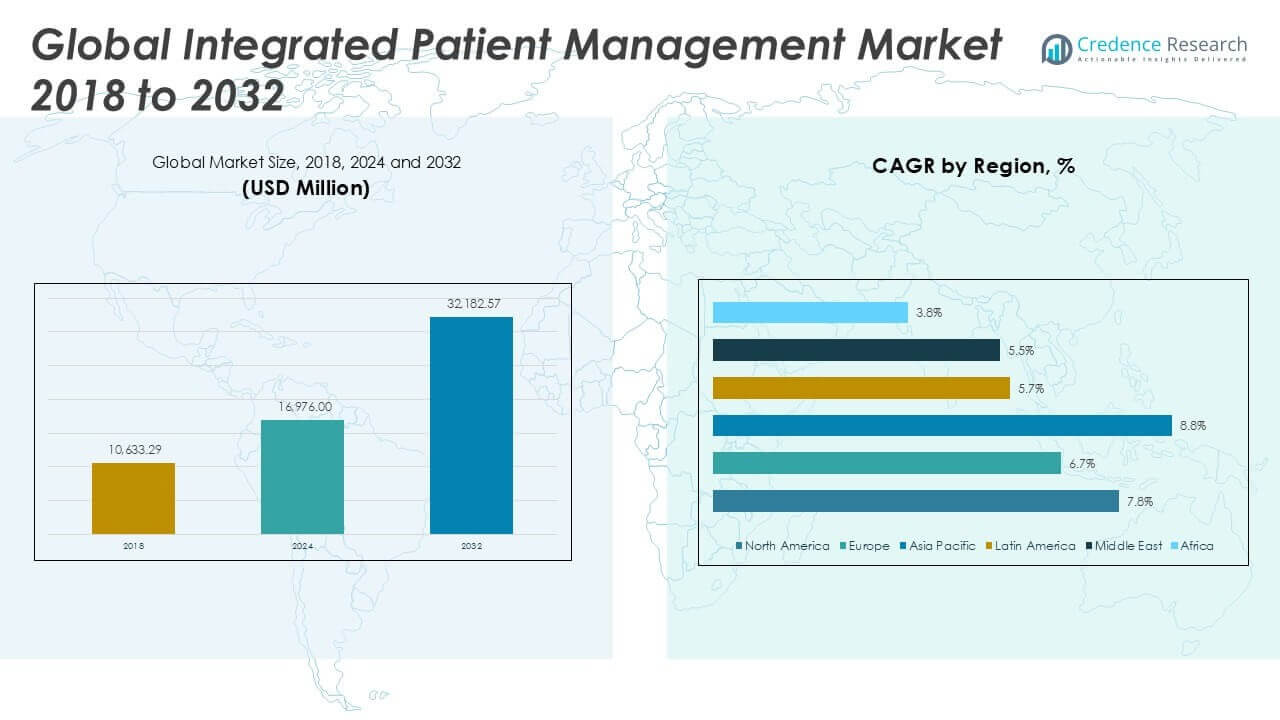

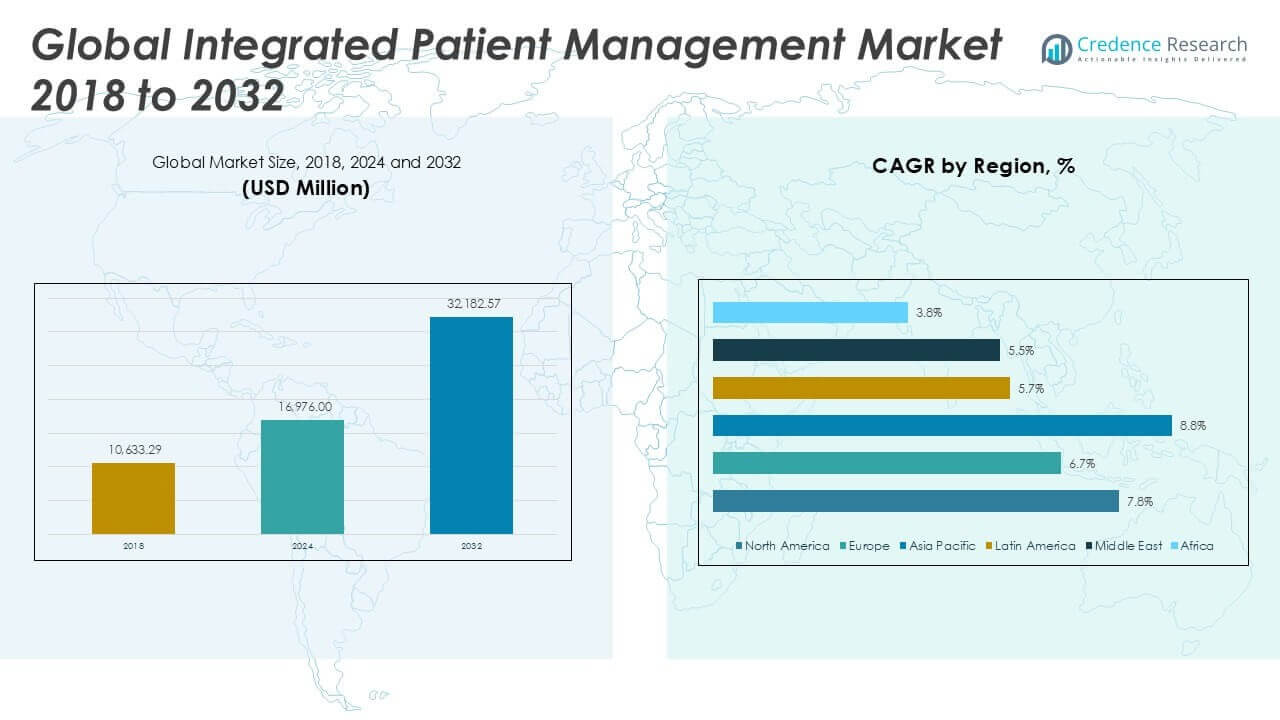

Integrated Patient Management Market size was valued at USD 10,633.29 million in 2018 to USD 16,976.00 million in 2024 and is anticipated to reach USD 32,182.57 million by 2032, at a CAGR of 7.75% during the forecast period.

The Integrated Patient Management Market is advancing rapidly due to the escalating need for streamlined healthcare operations, increased adoption of electronic health records, and a growing emphasis on patient-centric care. Healthcare providers are investing in integrated platforms to enhance interoperability, ensure seamless data exchange, and reduce administrative burdens. The rising incidence of chronic diseases and the expanding role of telemedicine further fuel demand for comprehensive patient management solutions. Government initiatives to improve healthcare infrastructure and enforce data security standards also strengthen market growth. In addition, technological advancements in artificial intelligence and cloud computing enable more efficient patient tracking, real-time analytics, and personalized care pathways. As healthcare organizations strive to optimize clinical workflows and improve patient outcomes, the adoption of integrated patient management systems is expected to accelerate, positioning the market for sustained expansion throughout the forecast period.

The Integrated Patient Management Market demonstrates robust growth across major regions, including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America leads due to advanced healthcare infrastructure, widespread adoption of digital health solutions, and supportive government policies. Europe follows with strong implementation of health IT standards and collaborative digital health initiatives, while Asia Pacific experiences rapid expansion fueled by rising healthcare investments and digital transformation in countries like China, Japan, and India. Key players shaping the competitive landscape include Cerner Corporation (Oracle Health), Epic Systems Corporation, and Allscripts Healthcare Solutions (Veradigm). These companies drive innovation through comprehensive patient management platforms, strategic partnerships, and continuous product development. Their focus on interoperability, data security, and integration of advanced analytics positions them at the forefront of the market, supporting healthcare providers worldwide in enhancing patient outcomes and operational efficiency.

Market Insights

Market Insights

- The Integrated Patient Management Market was valued at USD 16,976.00 million in 2024 and is projected to reach USD 32,182.57 million by 2032, registering a CAGR of 7.75% during the forecast period.

- Rising adoption of electronic health records, digital health technologies, and regulatory mandates for interoperability drive strong market growth across global healthcare systems.

- Key trends include the rapid expansion of telemedicine, integration of artificial intelligence and predictive analytics, and a heightened focus on data privacy and cybersecurity within patient management platforms.

- The competitive landscape features leading players such as Cerner Corporation (Oracle Health), Epic Systems Corporation, and Allscripts Healthcare Solutions (Veradigm), who invest heavily in research, development, and strategic partnerships to enhance their offerings.

- Market restraints include complex integration with legacy healthcare systems, high implementation costs, and ongoing challenges related to data security and regulatory compliance.

- Regionally, North America leads the market, supported by advanced infrastructure and high digital adoption, while Asia Pacific shows the fastest growth due to expanding healthcare investments in China, Japan, and India.

- The market is expected to benefit from increased cloud-based solution adoption, government initiatives supporting healthcare IT modernization, and the shift toward patient-centric care models across all major regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Digital Health Technologies

The Integrated Patient Management Market benefits from a widespread shift toward digital health technologies. Healthcare providers are transitioning from traditional, paper-based records to electronic health records (EHRs) and integrated platforms that centralize patient data. This shift supports real-time access to information, enabling healthcare professionals to make faster, more informed decisions. The adoption of digital systems streamlines patient management processes and minimizes errors in recordkeeping and communication. It also supports regulatory compliance by maintaining standardized documentation practices. With increasing patient volumes and complexity in care delivery, digital platforms have become critical to operational efficiency in healthcare settings.

- For instance, digital health interventions in India now cover approximately 80% of the population, 300,000 health facilities, and 400,000 health workers, enabled by supportive policies and regulations.

Increasing Focus on Patient-Centric Care Models

Patient-centric care is driving significant changes in healthcare delivery, and the Integrated Patient Management Market responds directly to this trend. Healthcare organizations prioritize solutions that provide a holistic view of patient health, supporting personalized treatment and preventive care. Integrated platforms aggregate medical histories, lab results, and treatment plans, facilitating better collaboration among multidisciplinary care teams. This comprehensive approach enhances patient engagement, improves satisfaction, and drives positive health outcomes. The demand for tools that foster transparent communication between patients and providers continues to grow, propelling investment in advanced patient management systems.

- For instance, the WHO Framework on Integrated People-Centered Health Services emphasizes the need for health systems designed around people rather than diseases, ensuring equitable access and quality care.

Government Initiatives and Regulatory Support

Government policies and regulations create a favorable landscape for the Integrated Patient Management Market. Authorities worldwide introduce mandates for interoperability, secure data exchange, and quality reporting to strengthen healthcare delivery. Incentive programs encourage healthcare facilities to adopt certified patient management technologies and ensure compliance with privacy standards such as HIPAA and GDPR. These initiatives promote the integration of disparate systems, paving the way for seamless information flow across the care continuum. The regulatory environment not only accelerates adoption but also ensures that solutions meet high standards of security and reliability.

Advancements in Artificial Intelligence and Cloud Computing

Technological innovation serves as a powerful growth driver for the Integrated Patient Management Market. Artificial intelligence tools enable predictive analytics, risk stratification, and decision support, empowering clinicians to deliver proactive and personalized care. Cloud-based solutions offer scalable infrastructure, enabling healthcare organizations to manage large volumes of patient data efficiently and cost-effectively. These technologies support remote monitoring, telehealth, and real-time collaboration among stakeholders. Enhanced data security, disaster recovery, and interoperability features strengthen the appeal of integrated solutions, supporting continued market expansion.

Market Trends

Expansion of Telemedicine and Remote Care Integration

Telemedicine and remote care are becoming essential components in the Integrated Patient Management Market. Healthcare providers are incorporating telehealth platforms with patient management systems to extend care beyond traditional settings. This integration streamlines virtual consultations, chronic disease management, and follow-up appointments while supporting continuity of care. The market witnesses a surge in remote patient monitoring tools and wearable devices that enable real-time health tracking. These advancements help clinicians intervene early and tailor care plans more effectively. The growing acceptance of virtual care models drives further demand for seamless digital integration across healthcare delivery networks.

- For instance, remote patient monitoring (RPM) has been increasingly adopted, with studies identifying key structural elements for successful implementation.

Emphasis on Interoperability and Data Exchange Standards

Interoperability stands out as a key trend in the Integrated Patient Management Market, reflecting the industry’s focus on connected care. Healthcare organizations implement open standards and robust data exchange protocols to ensure smooth communication among disparate systems. It allows providers to consolidate patient information from multiple sources, creating a comprehensive patient profile. This trend enhances clinical decision-making and reduces redundant tests or procedures, improving overall care quality. Regulatory frameworks also support this movement, driving adoption of solutions that align with national and international data standards. Stakeholders recognize interoperability as a cornerstone for future-ready healthcare ecosystems.

- For instance, India’s Ayushman Bharat Digital Mission (ABDM) aims to establish a national digital health ecosystem that facilitates interoperability with standardized protocols.

Increased Adoption of Artificial Intelligence and Predictive Analytics

Artificial intelligence and predictive analytics are transforming workflows in the Integrated Patient Management Market. Healthcare organizations deploy AI-driven algorithms for population health management, early detection of health risks, and resource optimization. It supports automation of administrative tasks, such as appointment scheduling and billing, reducing manual errors and administrative burden. Predictive analytics tools empower providers to anticipate patient needs and optimize resource allocation. This shift enables proactive care delivery, resulting in improved patient outcomes and operational efficiency. As AI capabilities mature, organizations increasingly embed these tools within their core patient management strategies.

Focus on Cybersecurity and Data Privacy Protection

Cybersecurity and data privacy have emerged as top priorities in the Integrated Patient Management Market. Healthcare providers invest in advanced security protocols to protect sensitive patient information and maintain compliance with evolving regulations. It deploys encryption, access controls, and real-time threat monitoring to safeguard digital records against cyber threats. Increased adoption of cloud-based platforms also prompts organizations to review and strengthen their data governance frameworks. Security concerns influence vendor selection, with buyers favoring solutions that demonstrate strong data protection measures. This heightened focus on privacy and security reinforces trust in integrated patient management solutions across the healthcare industry.

Market Challenges Analysis

Complex Integration and Legacy System Barriers

Complex integration requirements present a significant challenge for the Integrated Patient Management Market. Healthcare organizations often rely on legacy systems that lack compatibility with modern platforms, making seamless data migration and interoperability difficult. It creates operational disruptions and demands substantial resources for technical upgrades. Disparate data formats and inconsistent standards further hinder unified patient records and real-time information sharing. These challenges increase implementation costs and delay the realization of benefits from integrated solutions. Vendors must offer customizable interfaces and robust support to address integration complexities and promote adoption across diverse healthcare environments.

Data Security, Privacy Concerns, and Regulatory Compliance

The Integrated Patient Management Market faces mounting challenges related to data security, privacy, and compliance with evolving regulations. Healthcare providers handle large volumes of sensitive patient data, which attracts cyber threats and exposes vulnerabilities within digital infrastructure. It must adhere to stringent data protection laws, including HIPAA and GDPR, requiring advanced encryption, secure access controls, and continuous monitoring. Meeting these regulatory demands strains organizational resources and complicates the deployment of cloud-based and remote access solutions. Security breaches and compliance failures erode trust, impacting both patient confidence and provider reputation. Organizations must invest in comprehensive cybersecurity measures to safeguard data and sustain long-term market growth.

- For instance, the Digital Personal Data Protection Act, 2023 (DPDP Act) aims to uphold citizens’ rights by protecting their personal data, including sensitive healthcare information.

Market Opportunities

Expansion of Cloud-Based and Remote Healthcare Solutions

Cloud-based platforms and remote healthcare solutions present significant opportunities for the Integrated Patient Management Market. Healthcare providers seek scalable, flexible systems that support remote access, real-time data sharing, and telemedicine integration. It enables seamless collaboration among multidisciplinary care teams and enhances patient engagement across geographic boundaries. Adoption of cloud infrastructure reduces upfront investment and streamlines updates, making advanced patient management technologies more accessible to organizations of all sizes. The growing demand for virtual care and digital health services drives innovation in cloud-based solutions tailored for evolving healthcare needs. Vendors who offer robust, secure cloud integration stand to capture new market segments and accelerate digital transformation in healthcare.

Personalized Medicine and Advanced Analytics Adoption

Rising interest in personalized medicine and advanced analytics opens new avenues for the Integrated Patient Management Market. Healthcare organizations leverage integrated platforms to aggregate patient data, analyze risk factors, and tailor treatment plans to individual needs. It supports predictive analytics, population health management, and early intervention strategies, improving outcomes and operational efficiency. Integration of artificial intelligence and machine learning enhances diagnostic accuracy and enables proactive care models. As healthcare shifts toward value-based delivery, organizations adopting analytics-driven patient management systems gain a competitive edge. The ability to offer personalized, data-driven care strengthens provider reputation and fuels long-term market growth.

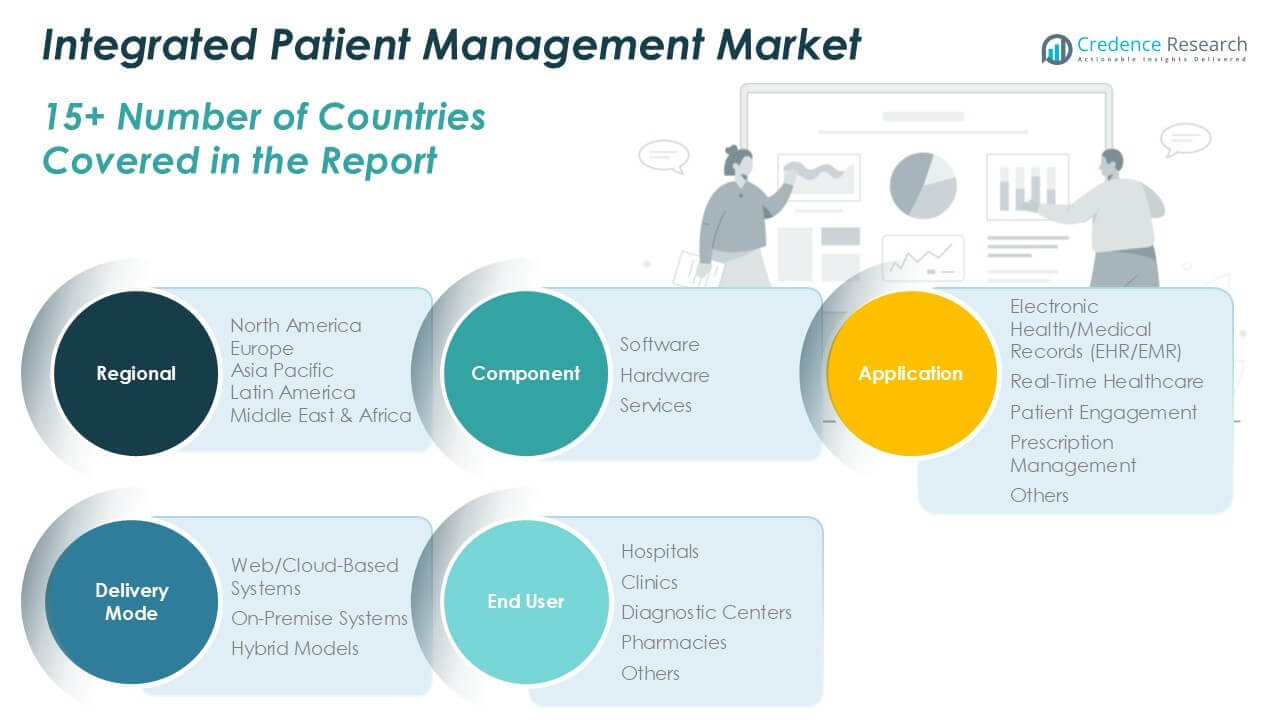

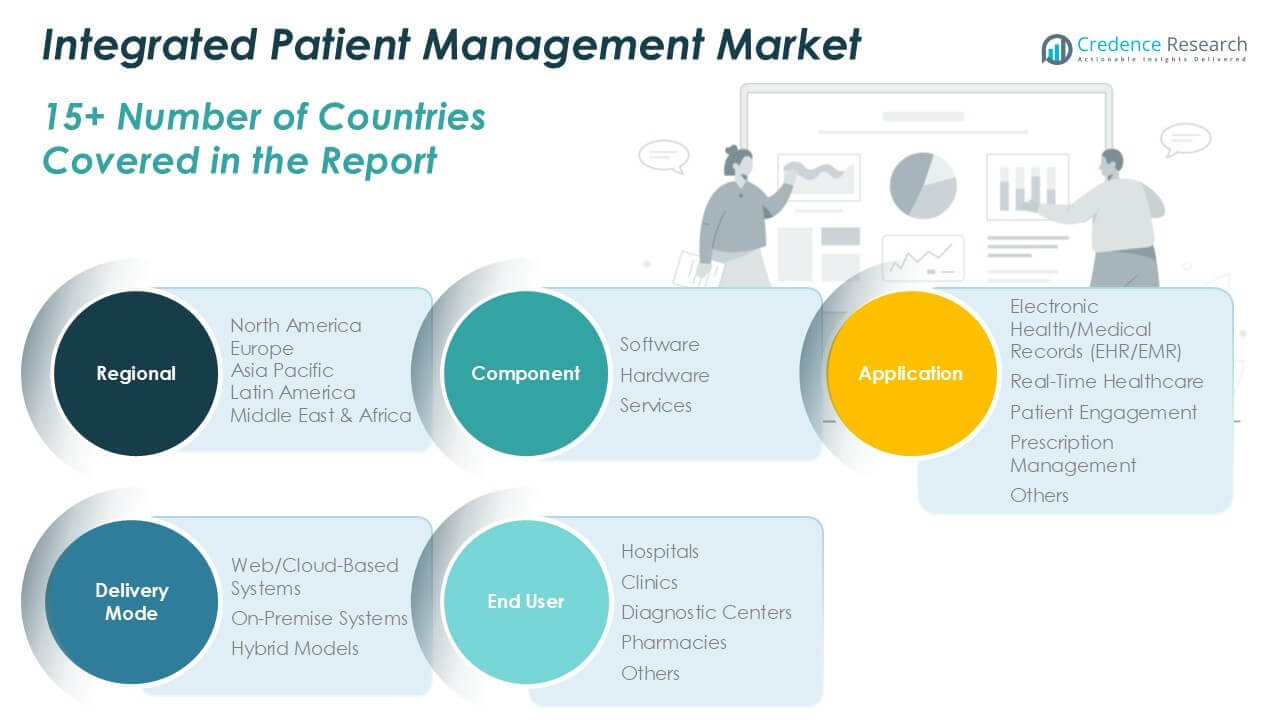

Market Segmentation Analysis:

By Component:

Software solutions command a significant market share, reflecting healthcare providers’ preference for comprehensive platforms that enable real-time data management, interoperability, and analytics-driven decision-making. These solutions are complemented by hardware, including servers, networking equipment, and medical devices that facilitate data capture and system connectivity within clinical workflows. Services, such as consulting, implementation, training, and technical support, play a vital role in ensuring successful deployment and ongoing optimization of integrated patient management systems, supporting both operational efficiency and user adoption.

By Application:

Electronic health/medical records (EHR/EMR) remain the foundation of the Integrated Patient Management Market, with growing regulatory mandates accelerating digital transformation and standardized health information exchange. The market also sees substantial adoption in infectious disease management, where integrated platforms support surveillance, reporting, and coordination of care, especially in the context of global public health concerns. Real-time healthcare solutions, including telemedicine and remote monitoring, enable providers to respond quickly to patient needs and optimize care delivery across locations. Patient engagement tools facilitate active patient participation in health management, improving adherence and satisfaction, while prescription management solutions streamline medication tracking and reduce errors. Other emerging applications continue to broaden the market’s impact across specialized clinical and administrative domains.

By Delivery Mode:

Delivery mode segmentation further defines the market landscape. Web/cloud-based systems lead adoption due to their scalability, cost-effectiveness, and support for remote and multi-site access, making them especially attractive for large healthcare networks and organizations pursuing digital transformation. On-premise systems persist in settings that require direct control over data and heightened security, often favored by institutions with established IT infrastructure or strict compliance requirements. Hybrid models are gaining momentum as they offer a balance of security, flexibility, and integration, enabling healthcare organizations to transition gradually and leverage both on-premise and cloud-based capabilities. The Integrated Patient Management Market capitalizes on these diverse segment strengths, positioning itself as a cornerstone of modern, efficient, and patient-centric healthcare delivery.

Segments:

Based on Component:

- Software

- Hardware

- Services

Based on Application:

- Electronic Health/Medical Records (EHR/EMR)

- Infectious Diseases

- Real-Time Healthcare

- Patient Engagement

- Prescription Management

- Others

Based on Delivery Mode:

- Web/Cloud-Based Systems

- On-Premise Systems

- Hybrid Models

Based on End User:

- Hospitals

- Clinics

- Diagnostic Centers

- Pharmacies

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Integrated Patient Management Market

North America Integrated Patient Management Market grew from USD 4,013.53 million in 2018 to USD 6,330.60 million in 2024 and is projected to reach USD 12,039.98 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.8%. North America is holding a 37% market share in 2024, maintaining its position as the leading regional market. The United States and Canada drive most of the demand, fueled by advanced healthcare infrastructure, strong adoption of electronic health records, and robust investments in healthcare IT. Regulatory initiatives and favorable reimbursement policies encourage ongoing digitization across care delivery networks. High prevalence of chronic diseases and expanding telehealth solutions reinforce regional market strength. North American vendors remain at the forefront of technological innovation, shaping best practices in integrated patient management.

Europe Integrated Patient Management Market

Europe Integrated Patient Management Market grew from USD 2,364.26 million in 2018 to USD 3,600.91 million in 2024 and is projected to reach USD 6,311.57 million by 2032, with a CAGR of 6.7%. Europe holds a 21% market share in 2024, supported by the widespread implementation of health IT standards and cross-border data exchange. Germany, the United Kingdom, and France represent key countries driving adoption, propelled by national e-health initiatives and strategic investments in patient-centered care. The region’s regulatory focus on data security and interoperability fuels market momentum. Increasing demand for real-time patient management and population health solutions accelerates the transition to integrated systems. Partnerships between public and private stakeholders support market expansion and digital health innovation.

Asia Pacific Integrated Patient Management Market

Asia Pacific Integrated Patient Management Market grew from USD 3,415.77 million in 2018 to USD 5,727.17 million in 2024 and is projected to reach USD 11,746.93 million by 2032, at a CAGR of 8.8%. Asia Pacific commands a 34% market share in 2024, making it the second largest regional market and the fastest-growing. China, Japan, and India are pivotal contributors, driven by large populations, rising healthcare expenditures, and rapid digital transformation of medical services. Government-led investments in smart hospitals and healthcare infrastructure drive demand for advanced patient management solutions. Expanding telemedicine networks and increased awareness of health information systems further propel market growth. Regional disparities in technology adoption create opportunities for vendors offering scalable, adaptable platforms.

Latin America Integrated Patient Management Market

Latin America Integrated Patient Management Market grew from USD 409.38 million in 2018 to USD 643.61 million in 2024 and is projected to reach USD 1,047.63 million by 2032, registering a CAGR of 5.7%. Latin America holds a 4% market share in 2024. Brazil and Mexico stand out as primary adopters, supported by growing investments in healthcare modernization and digital infrastructure. Public health initiatives, especially for infectious disease monitoring and remote care, stimulate demand for integrated systems. Budget constraints and varying regulatory landscapes challenge implementation but also foster demand for cost-effective, flexible solutions. International collaborations and regional digital health partnerships encourage further market penetration.

Middle East Integrated Patient Management Market

Middle East Integrated Patient Management Market grew from USD 303.69 million in 2018 to USD 443.98 million in 2024 and is projected to reach USD 712.96 million by 2032, reflecting a CAGR of 5.5%. The Middle East holds a 3% market share in 2024. The United Arab Emirates and Saudi Arabia spearhead regional growth, prioritizing digital transformation in healthcare through government vision plans and investment in smart hospital projects. Adoption is strongest in private healthcare and large urban centers, where integrated patient management improves care coordination. E-health initiatives focus on streamlining clinical workflows and patient experience. The region continues to attract global vendors and foster innovation through technology partnerships.

Africa Integrated Patient Management Market

Africa Integrated Patient Management Market grew from USD 126.65 million in 2018 to USD 229.72 million in 2024 and is projected to reach USD 323.50 million by 2032, at a CAGR of 3.8%. Africa accounts for a 1% market share in 2024. South Africa, Nigeria, and Kenya represent the most promising markets, driven by investments in health system strengthening and digital health pilot programs. Implementation remains limited by infrastructure gaps and funding constraints. International aid organizations play a key role in advancing integrated care models and health IT adoption. The region’s market offers untapped potential for scalable cloud-based patient management solutions designed for resource-limited settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cerner Corporation (Oracle Health)

- Epic Systems Corporation

- Allscripts Healthcare Solutions (Veradigm)

- McKesson Corporation

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Oracle Corporation

- IBM Corporation

- Athenahealth, Inc.

- NextGen Healthcare

- eClinicalWorks

- CareCloud Corporation

- Greenway Health, LLC

Competitive Analysis

The competitive landscape of the Integrated Patient Management Market is shaped by leading players such as Cerner Corporation (Oracle Health), Epic Systems Corporation, Allscripts Healthcare Solutions (Veradigm), McKesson Corporation, GE Healthcare, Philips Healthcare, Siemens Healthineers, Oracle Corporation, IBM Corporation, Athenahealth, NextGen Healthcare, eClinicalWorks, CareCloud Corporation, and Greenway Health. These companies compete by continuously investing in advanced technologies, expanding their product portfolios, and forming strategic partnerships to strengthen market presence. They focus on delivering comprehensive, interoperable platforms that integrate electronic health records, telehealth, and analytics to improve clinical workflows and patient outcomes. Innovation remains central, with leading firms adopting artificial intelligence, predictive analytics, and cloud-based solutions to enhance scalability, security, and real-time decision-making capabilities. Strong customer support, global service networks, and compliance with data protection regulations further differentiate these players. Market leaders actively pursue mergers, acquisitions, and collaborations to access new geographies and broaden solution offerings. Their efforts to address complex integration, user experience, and regulatory challenges position them as preferred partners for healthcare providers seeking robust, future-ready patient management solutions.

Recent Developments

- In January 2025, McKesson’s Practice Insights was selected as a Qualified Clinical Data Registry (QCDR) for MIPS, supporting oncology-specific quality measures, including the first patient-reported outcomes measure for health-related social needs resolution.

- In October 2024, Private equity firm Francisco Partners acquired AdvancedMD, a cloud-based medical office software provider that integrates practice management, electronic health records (EHR), patient engagement, and revenue cycle management solutions.

- In November 2024, ElevatePFS acquired NYX Health Eligibility Services to bolster its revenue cycle management services, particularly in Medicaid eligibility verification and enrollment services.

- In April 2023, Microsoft Corp., a technology company, and Epicnnounced a long-standing strategic collaboration to develop and integrate generative AI into healthcare by combining the scale and power of Azure OpenAI Service with Epic’s industry-leading electronic health record (EHR) software.

Market Concentration & Characteristics

The Integrated Patient Management Market exhibits moderate to high market concentration, with a few dominant players holding significant market shares due to their extensive portfolios and technological leadership. It is characterized by rapid innovation, strong demand for interoperable and scalable solutions, and a steady influx of investment in digital healthcare infrastructure. Leading vendors differentiate themselves through advanced functionalities such as artificial intelligence, predictive analytics, and integrated telehealth, which align with the evolving needs of healthcare providers. The market features high entry barriers stemming from stringent regulatory requirements, complex integration challenges, and the necessity for ongoing technical support. It is highly dynamic, shaped by continuous advancements in data security, cloud computing, and real-time analytics. Vendors compete not only on technology but also on service quality, global reach, and the ability to address both large healthcare networks and smaller clinics with flexible, customizable solutions.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Delivery Mode, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to experience significant growth, driven by the increasing adoption of digital health technologies and the need for efficient patient care coordination.

- Integration of artificial intelligence and machine learning will enhance predictive analytics, enabling proactive patient care and improved clinical decision-making.

- Cloud-based solutions will become more prevalent, offering scalability, cost-effectiveness, and remote accessibility for healthcare providers.

- The demand for interoperable systems will rise, facilitating seamless data exchange across various healthcare platforms and improving patient outcomes.

- Patient engagement tools, such as mobile health applications and patient portals, will gain traction, empowering individuals to actively participate in their healthcare management.

- The expansion of telemedicine and remote patient monitoring will support continuous care delivery, especially in underserved and rural areas.

- Regulatory initiatives and government support will encourage the adoption of integrated patient management systems, ensuring compliance with data privacy and security standards.

- The market will witness increased investment in cybersecurity measures to protect sensitive patient information and maintain trust in digital health solutions.

- Emerging markets, particularly in Asia-Pacific and Latin America, will offer new growth opportunities due to rising healthcare infrastructure development and digital transformation efforts.

- Strategic partnerships and collaborations among healthcare providers, technology companies, and stakeholders will drive innovation and the development of comprehensive patient management solutions.

Market Insights

Market Insights