Market Overview

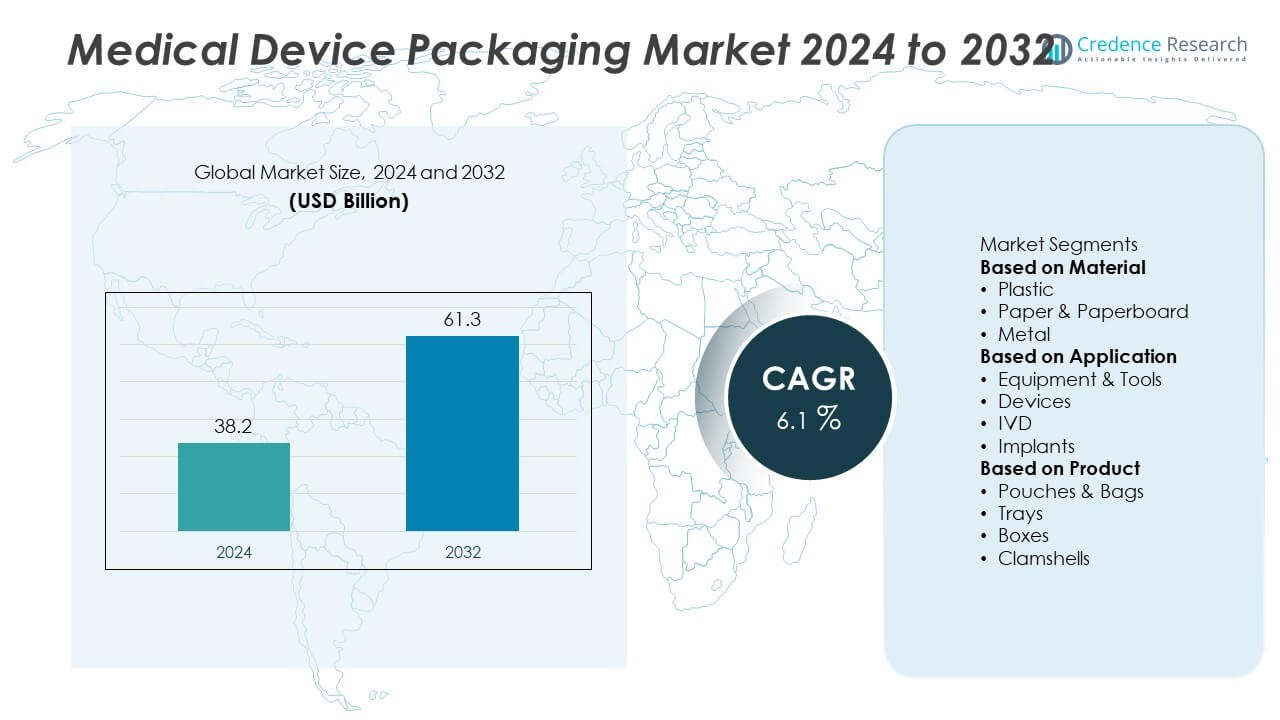

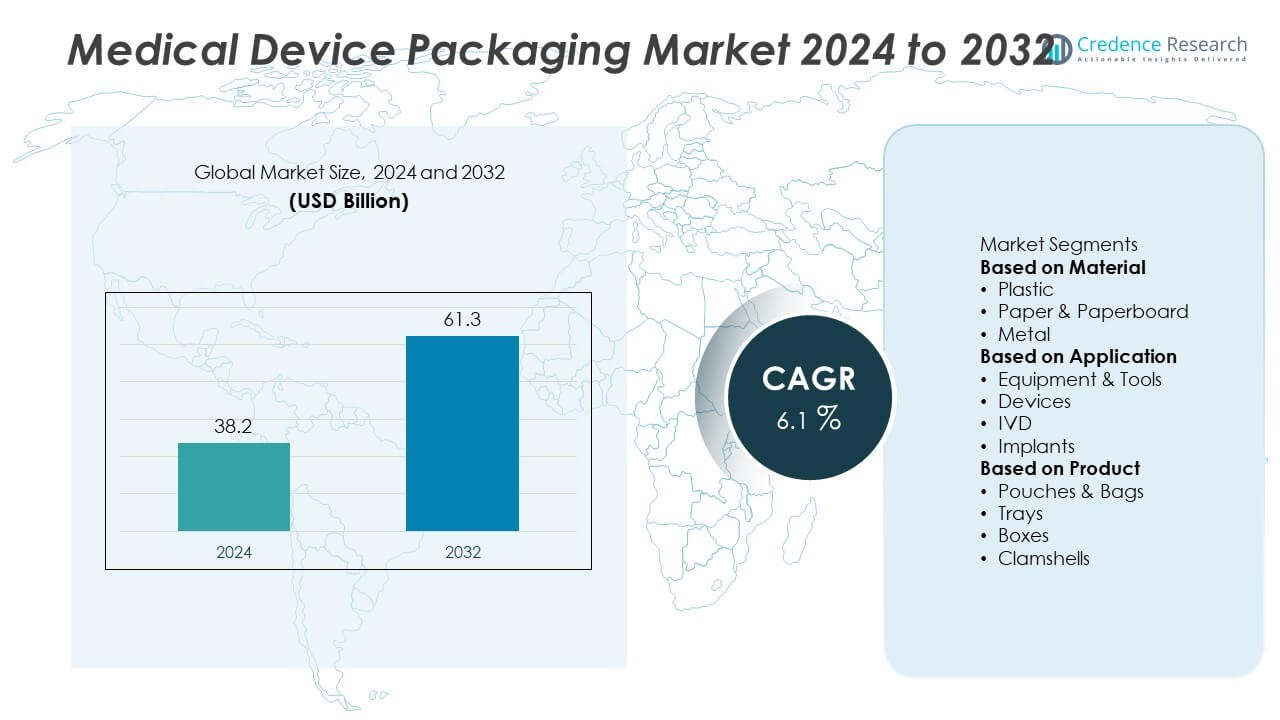

The Medical Device Packaging Market was valued at USD 38.2 billion in 2024 and is projected to reach USD 61.3 billion by 2032, expanding at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Device Packaging Market Size 2024 |

USD 38.2 Billion |

| Medical Device Packaging Market, CAGR |

6.1% |

| Medical Device Packaging Market Size 2032 |

USD 61.3 Billion |

The Medical Device Packaging Market grows through rising demand for sterile, durable, and compliant packaging solutions across surgical instruments, implants, and diagnostic devices. It benefits from strict regulatory requirements that push innovation in materials, seal integrity, and labeling.

The Medical Device Packaging Market demonstrates strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each contributing through unique drivers. North America leads with advanced healthcare infrastructure and stringent FDA regulations, encouraging demand for sterile and compliant packaging. Europe emphasizes sustainability, with countries such as Germany and the UK focusing on eco-friendly materials in line with strict EU directives. Asia-Pacific expands rapidly, driven by large-scale medical device production in China, Japan, and India, along with healthcare modernization. Latin America and the Middle East & Africa show gradual growth through rising imports of medical devices and investments in hospital infrastructure. Key players shaping the market include Amcor PLC, recognized for innovative sustainable packaging, DuPont, known for advanced Tyvek sterile barrier materials, Sealed Air, offering high-performance protective packaging, and Berry Global Inc., providing a wide range of flexible and rigid medical packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medical Device Packaging Market was valued at USD 38.2 billion in 2024 and is projected to reach USD 61.3 billion by 2032, expanding at a CAGR of 6.1% during the forecast period.

- Rising demand for sterile, durable, and tamper-evident packaging drives growth, as hospitals and clinics increasingly rely on single-use and diagnostic devices.

- Strong trends are seen in sustainable packaging materials such as recyclable plastics and bio-based polymers, along with smart packaging that supports traceability and anti-counterfeiting.

- Competition remains intense with leading players such as Amcor PLC, DuPont, Sealed Air, Berry Global Inc., and Tekni-Plex focusing on advanced barrier materials, innovation, and global expansion.

- High compliance costs linked to strict FDA, ISO, and EU regulations act as restraints, particularly for smaller firms, while raw material price fluctuations further pressure margins.

- North America leads with advanced healthcare and strict regulatory oversight, Europe emphasizes eco-friendly solutions, and Asia-Pacific expands rapidly through medical device manufacturing hubs in China, Japan, and India.

- Emerging opportunities arise from home healthcare adoption, rising personalized medicine demand, and integration of digital technologies into packaging for improved safety and supply chain efficiency.

Market Drivers

Rising Demand for Sterile and Safe Packaging Solutions

The Medical Device Packaging Market grows with rising demand for sterile and contamination-free packaging. Packaging solutions must protect devices from physical damage and microbial exposure during storage and transportation. It plays a vital role in maintaining product integrity across complex supply chains. Increasing use of single-use medical devices drives the need for reliable sterile barrier systems. Manufacturers invest in advanced packaging materials to ensure compliance with international safety standards. It reinforces the importance of packaging as a critical part of healthcare delivery.

- For instance, DuPont’s Tyvek sterile packaging material is used in more than 20 billion medical devices each year, ensuring microbial resistance and compatibility with multiple sterilization methods.

Growing Healthcare Infrastructure and Device Utilization

The Medical Device Packaging Market benefits from expanding healthcare infrastructure and rising use of diagnostic and surgical devices. Hospitals and clinics rely on well-packaged devices for safe and efficient operations. It ensures that devices remain functional and uncontaminated until use. Rising patient volumes and demand for minimally invasive procedures further increase the need for secure packaging. Emerging economies invest in healthcare modernization, driving higher adoption of packaged devices. It strengthens market growth by linking packaging to overall healthcare service delivery.

- For instance, Amcor is a leading producer of sterile, medical-grade packaging that meets ISO 11607 standards, supporting hospitals and medical device manufacturers. While the company’s annual production figures for specific medical films are not publicly disclosed, it does report overall annual sales. As of fiscal year 2024, Amcor’s net sales were $13.64 billion, and the company operated across 212 locations in 40 countries.

Regulatory Emphasis on Compliance and Quality Standards

The Medical Device Packaging Market advances with strict regulations from bodies such as the FDA and ISO. Packaging solutions must meet performance and sterility validation criteria before approval. It drives innovation in material design, seal integrity, and sterilization compatibility. Companies invest in testing and validation to meet global compliance benchmarks. Regulatory oversight increases demand for traceability and labeling in packaging. It positions compliance as a key driver influencing packaging design and production strategies.

Shift Toward Sustainable and Innovative Packaging Materials

The Medical Device Packaging Market experiences growth through adoption of sustainable and innovative packaging solutions. Companies explore recyclable plastics, biodegradable polymers, and lightweight designs to reduce environmental impact. It enables manufacturers to balance sustainability with the need for strength and sterility. Advanced materials also improve barrier protection and extend shelf life. Growing focus on eco-friendly solutions aligns with broader healthcare sustainability goals. It highlights packaging innovation as a major force shaping the industry’s future.

Market Trends

Adoption of Advanced Sterile Barrier Systems

The Medical Device Packaging Market shows a strong trend toward advanced sterile barrier systems. Packaging designs increasingly integrate high-performance films and coatings that provide enhanced microbial protection. It supports safe handling of surgical instruments, implants, and diagnostic devices across global supply chains. Manufacturers focus on packaging that withstands multiple sterilization methods, including gamma radiation and ethylene oxide. Growing complexity in medical devices accelerates demand for packaging tailored to diverse product specifications. It highlights sterile packaging innovation as a core trend in healthcare safety.

- For instance, Oliver Healthcare Packaging produces sterile barrier pouches with film laminates designed to withstand sterilization by gamma radiation. These products are validated through rigorous testing according to international standards, such as ISO 11607, to ensure they maintain sterility. A standard gamma radiation dose used in the industry for this purpose is 25 kilograys (kGy), and the company’s materials are tested to confirm their integrity post-sterilization.

Integration of Smart and Connected Packaging Solutions

The Medical Device Packaging Market evolves with the integration of smart and connected packaging. Companies deploy RFID tags, QR codes, and sensor-enabled solutions to track devices through distribution networks. It improves visibility, ensures authenticity, and reduces the risk of counterfeiting. Hospitals and clinics benefit from packaging that supports traceability and automated inventory management. Digital integration aligns with healthcare systems focused on efficiency and data-driven practices. It positions connected packaging as a growing trend in medical device logistics and security.

- For instance, Sealed Air (now known as SEE) has introduced smart packaging platforms under its digital brand, prismiq™, that can utilize RFID technology. These solutions are designed for traceability, supply chain optimization, and consumer engagement. In healthcare, Sealed Air’s medical packaging is used for applications like pharmaceuticals, vaccines, and medical devices, where it can be equipped with RFID to ensure product integrity and track items through the supply chain.

Focus on Lightweight and Eco-Friendly Packaging Materials

The Medical Device Packaging Market embraces lightweight and eco-friendly materials to address environmental concerns. Recyclable plastics, bio-based polymers, and paper-based solutions gain traction in sterile packaging applications. It helps manufacturers reduce carbon footprints while meeting regulatory and performance requirements. Lightweight materials also lower transportation costs and improve supply chain efficiency. Companies balance sustainability with durability and sterility standards in packaging design. It demonstrates a clear trend toward aligning healthcare packaging with global sustainability goals.

Customization and Patient-Centric Packaging Designs

The Medical Device Packaging Market trends toward customized packaging solutions tailored to specific medical devices. Companies design packaging that accommodates varying device sizes, shapes, and functional requirements. It ensures safe storage, easy handling, and user convenience for healthcare professionals. Patient-centric packaging focuses on usability, clarity of labeling, and accessibility features. Growing demand for home healthcare devices strengthens the need for intuitive packaging designs. It underscores customization as a trend that enhances safety, compliance, and user experience.

Market Challenges Analysis

High Costs of Compliance and Material Innovation

The Medical Device Packaging Market faces challenges from high costs linked to regulatory compliance and advanced material development. Companies must meet strict standards set by agencies such as the FDA and ISO, which demand rigorous testing and validation of packaging systems. It raises production costs and extends product development timelines. The push for sterile and durable packaging materials further increases investment in R&D. Smaller firms often struggle to compete with larger players that can absorb these expenses. It creates barriers to entry and limits the ability of new companies to scale in a competitive market.

Complex Supply Chains and Environmental Pressures

The Medical Device Packaging Market also confronts challenges from global supply chain disruptions and growing environmental pressures. Shortages of raw materials, rising transportation costs, and fluctuating supply conditions affect timely delivery of packaging solutions. It disrupts medical device manufacturers that depend on reliable and sterile packaging for critical healthcare operations. Growing emphasis on sustainability also forces companies to shift toward recyclable or bio-based materials while maintaining performance and sterility. It creates operational complexity and increases costs during material transitions. The need to balance compliance, sustainability, and supply chain efficiency remains a persistent challenge for the industry.

Market Opportunities

Expansion of Home Healthcare and Personalized Medicine

The Medical Device Packaging Market presents opportunities through the growing adoption of home healthcare and personalized medicine. Rising demand for portable diagnostic kits, wearable devices, and drug delivery systems requires packaging that ensures sterility, safety, and ease of use. It supports patient-centric designs with clear labeling, user-friendly openings, and tamper-evident features. The shift toward decentralized healthcare accelerates the need for packaging solutions tailored to self-administered devices. Manufacturers can capitalize on this trend by developing innovative packaging that combines convenience with compliance. It positions packaging as a critical link in enabling safe and effective home healthcare delivery.

Sustainability and Technological Advancements in Packaging

The Medical Device Packaging Market also gains opportunities from the drive toward sustainable and technologically advanced solutions. Healthcare providers and regulators push for recyclable and bio-based packaging materials that reduce environmental impact while maintaining sterility. It creates space for companies investing in green technologies and lightweight materials to stand out in a competitive landscape. Smart packaging technologies, such as RFID tags and digital sensors, also open avenues for enhanced traceability and inventory management. Hospitals and supply chains benefit from packaging that integrates both sustainability and digital innovation. It ensures long-term growth opportunities for manufacturers aligning with global healthcare and environmental priorities.

Market Segmentation Analysis:

By Material

The Medical Device Packaging Market is segmented by material into plastics, paper and paperboard, glass, and metals. Plastics dominate due to their versatility, lightweight nature, and strong barrier properties against contamination. It supports a wide range of sterile barrier systems including pouches, trays, and blister packs. Paper and paperboard gain traction in secondary packaging, offering recyclability and cost efficiency. Glass is used for specific applications such as vials and syringes, where transparency and chemical resistance are required. Metals find application in specialized cases, particularly for durable or reusable instruments. It reflects a market where plastics lead, but sustainability initiatives drive growth in paper-based and eco-friendly alternatives.

- For instance, Wipak Group is a leading global provider of sterile barrier systems, including paper-based materials for medical packaging. Wipak is known for offering sustainable alternatives, and while paper is one of its products, the company is primarily known for its multilayer films.

By Application

The Medical Device Packaging Market serves applications such as surgical instruments, diagnostic devices, implants, and drug delivery products. Packaging for surgical instruments emphasizes sterility and durability, often requiring high-performance films and laminates. It ensures instruments remain free from contamination during storage and transport. Diagnostic devices, including rapid tests and point-of-care kits, rely on packaging that balances sterility with user convenience. Implants demand packaging that preserves integrity and supports long shelf life. Drug delivery products, such as syringes and inhalers, depend on secure, tamper-evident solutions. It highlights the critical role of packaging in maintaining safety across diverse medical applications.

- For instance, Berry Global supplies packaging films and devices for syringes and other drug-delivery systems, while Tekni-Plex Healthcare delivers packaging trays for implantable medical devices and other long-term sterile storage applications.

By Product

The Medical Device Packaging Market is segmented by product into pouches, trays, clamshells, boxes, and blister packs. Pouches and trays lead due to their adaptability for various device types and sterilization methods. It provides secure sealing, flexibility in sizing, and compatibility with sterilization technologies. Clamshells and blister packs are widely used for smaller devices and consumables, offering visibility and convenience for healthcare providers. Boxes and cartons serve as secondary packaging, ensuring safe transport and labeling compliance. Growth in minimally invasive and disposable devices increases reliance on pouches and blister packaging. It reflects how product design in packaging aligns with evolving medical device requirements and regulatory standards.

Segments:

Based on Material

- Plastic

- Paper & Paperboard

- Metal

Based on Application

- Equipment & Tools

- Devices

- IVD

- Implants

Based on Product

- Pouches & Bags

- Trays

- Boxes

- Clamshells

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 32% share of the Medical Device Packaging Market, supported by advanced healthcare systems and strong presence of medical device manufacturers. The United States leads the region with significant production of surgical instruments, diagnostic kits, and implantable devices requiring sterile and durable packaging. It benefits from strict regulatory frameworks set by the FDA that emphasize compliance, traceability, and patient safety. Canada contributes through growing investments in biotechnology and medical research, which increase demand for specialized packaging solutions. Mexico adds to regional growth with rising exports of medical devices and supportive government policies that promote manufacturing hubs. It reinforces North America’s role as a major contributor to global packaging innovation and compliance standards.

Europe

Europe accounts for about 28% share of the Medical Device Packaging Market, driven by strong regulatory oversight and growing focus on sustainability. Countries such as Germany, France, and the UK lead demand with advanced healthcare infrastructure and high medical device utilization rates. It sees rapid adoption of eco-friendly and recyclable packaging materials as part of the European Union’s sustainability initiatives. The medical technology sector across Germany and Switzerland stimulates demand for advanced sterile packaging for implants and diagnostic equipment. Eastern European countries also contribute by expanding their role in medical device assembly and export. It underscores Europe’s focus on balancing innovation, safety, and environmental responsibility in packaging solutions.

Asia-Pacific

Asia-Pacific dominates the Medical Device Packaging Market with nearly 30% share, led by China, Japan, South Korea, and India. China drives growth with its vast medical device manufacturing sector and increasing healthcare investments. Japan and South Korea emphasize high-precision packaging for advanced electronics-based medical devices, supported by strong R&D infrastructure. India shows rising adoption of medical packaging due to expanding hospitals, clinics, and pharmaceutical manufacturing capacity. It benefits from government initiatives promoting healthcare modernization and localized production. Growing middle-class populations and demand for affordable healthcare accelerate the use of packaged disposable and diagnostic devices. It establishes Asia-Pacific as both the largest and fastest-evolving regional market.

Latin America

Latin America represents around 6% of the Medical Device Packaging Market, with Brazil and Mexico as the leading contributors. Brazil’s expanding healthcare system and investments in surgical and diagnostic equipment packaging drive steady demand. Mexico benefits from its role as a key exporter of medical devices to North America, requiring compliance-ready packaging solutions. Argentina and Chile show gradual growth through rising adoption of packaged implants and diagnostic tools. It faces challenges from regulatory diversity and limited infrastructure, yet modernization initiatives strengthen adoption of advanced packaging. It positions Latin America as a region with gradual but sustainable growth potential.

Middle East & Africa

The Middle East & Africa account for approximately 4% share of the Medical Device Packaging Market, supported by rising healthcare investments and infrastructure projects. Gulf countries such as the UAE and Saudi Arabia lead with large-scale hospital expansions and medical imports requiring reliable packaging. Africa contributes with growing demand for sterile packaging in pharmaceuticals and diagnostic kits, particularly in South Africa and Nigeria. It faces constraints from limited local manufacturing but benefits from increasing partnerships with international suppliers. Rising focus on healthcare modernization and patient safety sustains steady growth. It highlights the region’s emerging role in global medical device packaging adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Medical Device Packaging Market features leading players such as Amcor PLC, DuPont, SteriPack, Wipak Walothen GmbH, Sonoco Products Company, Sealed Air, Tekni-Plex Inc., Nelipak, Oliver, and Berry Global Inc. These companies focus on delivering packaging solutions that meet strict regulatory standards while maintaining sterility, durability, and user convenience. They invest heavily in research and development to introduce advanced barrier materials, recyclable plastics, and bio-based alternatives that align with sustainability goals. Innovation in sterile barrier systems, tamper-evident designs, and lightweight materials strengthens their market positions. Partnerships with medical device manufacturers and healthcare providers allow them to address evolving industry needs, particularly in surgical, diagnostic, and implant packaging. Companies also expand their geographic footprint through acquisitions and strategic collaborations to meet growing demand in Asia-Pacific and emerging markets. Intense competition drives continuous improvement in quality, compliance, and technology, reinforcing the market’s reliance on these established players for safe and efficient medical device packaging.

Recent Developments

- In June 2025, TekniPlex Healthcare opened a flagship Barrier Protection Systems Facility in Madison, Wisconsin, enhancing its capabilities in protective packaging solutions.

- In June 2025, Sealed Air collaborated with Qosina to introduce NEXCEL BIO1250, a robust co‑extruded bioprocessing bag film tailored for biotech and sterile packaging.

- In May 2025, Oliver Healthcare Packaging opened its ninth medical packaging manufacturing facility, a 120,000‑sq‑ft cleanroom plant in Johor, Malaysia, to expand production of medical‑grade pouches, lids, and roll stock.

- In April 2025, Amcor launched a state-of-the-art coating facility in Asia‑Pacific—the first in the region equipped with advanced air‑knife coating technology—to strengthen healthcare packaging supply chains.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart packaging with RFID and digital traceability will improve supply chain visibility.

- Demand for sustainable materials like bio-based and recyclable films will rise across healthcare packaging.

- Growth of home healthcare devices will drive need for user-friendly, tamper-evident packaging.

- Development of lightweight, multi-layer packaging will enhance sterilization compatibility and reduce waste.

- Custom packaging solutions that match device size and use-case will increase for better user experience.

- Regulatory pressures will push companies to invest in higher-performance barrier systems and validation technologies.

- On-demand and localized packaging production will expand through modular cleanroom facilities.

- Integration of anti-counterfeit features will increase to protect high-value implants and surgical tools.

- Emerging markets in Asia-Pacific and Latin America will show strong growth due to expanding healthcare infrastructure.

- Innovations in packaging automation and robotics will streamline production and reduce human error.