Market Overview

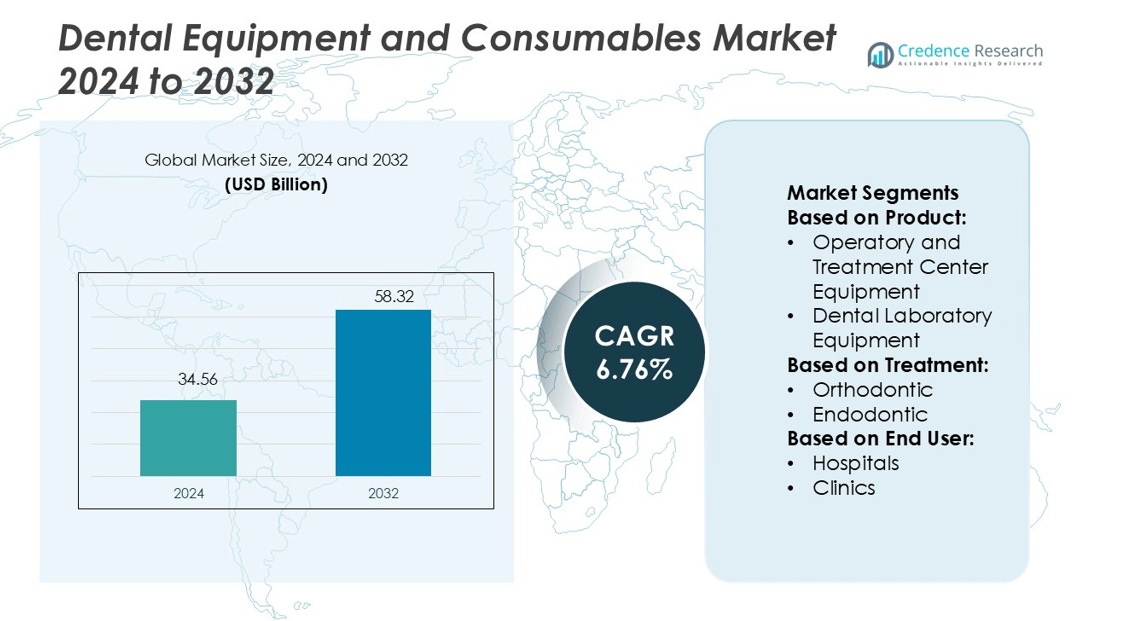

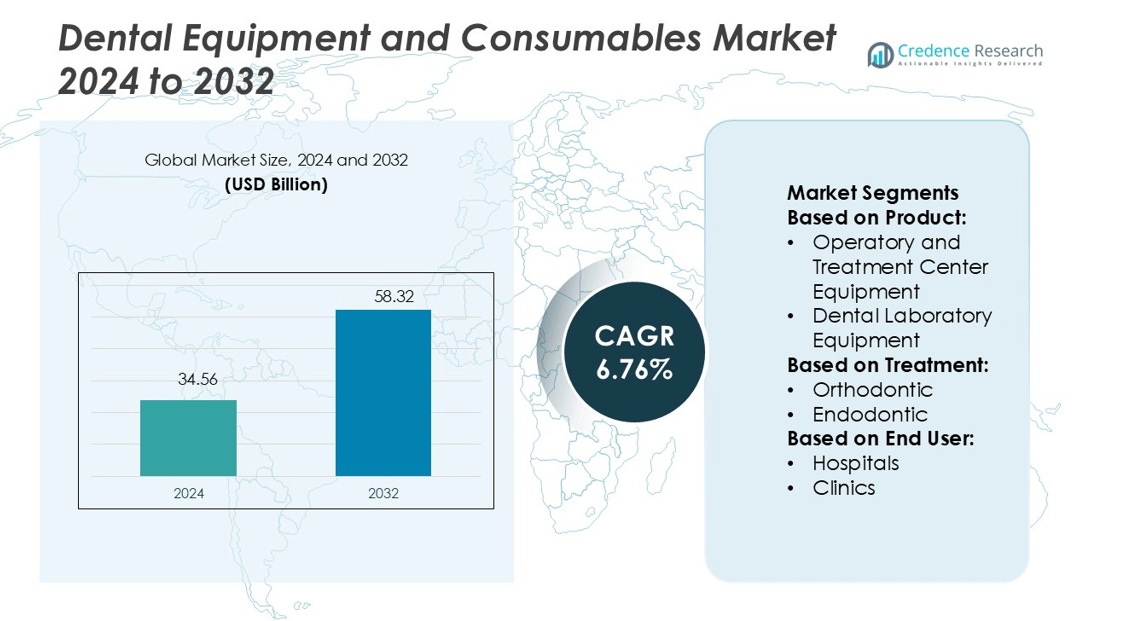

Dental Equipment and Consumables Market size was valued USD 34.56 billion in 2024 and is anticipated to reach USD 58.32 billion by 2032, at a CAGR of 6.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Equipment and Consumables Market Size 2024 |

USD 34.56 billion |

| Dental Equipment and Consumables Market, CAGR |

6.76% |

| Dental Equipment and Consumables MarketSize 2032 |

USD 58.32 billion |

The Dental Equipment and Consumables Market is driven by key players including Ivoclar, Benco Dental, 3M, Envista Holdings Corporation (Danaher Corporation), Henry Schein, Inc., Prime Dental Products Pvt. Ltd., Patterson Companies, Inc., Zimmer Biomet, Coltene Group, and GC Asia Dental. These companies focus on expanding their product portfolios through digital innovations, advanced implantology solutions, and precision restorative systems. Strategic investments in CAD/CAM technologies and sustainable materials strengthen their competitive positioning. North America leads the global market with a 35.4% share, supported by advanced healthcare infrastructure, high adoption of digital dental technologies, and a strong presence of organized dental service providers. This leadership is reinforced by steady investments, robust distribution networks, and growing demand for cosmetic dentistry.

Market Insights

- The Dental Equipment and Consumables Market was valued at USD 34.56 billion in 2024 and is expected to reach USD 58.32 billion by 2032, growing at a CAGR of 6.76%.

- Rising prevalence of dental disorders and growing demand for cosmetic dentistry are driving market expansion, supported by increased adoption of digital dental technologies and advanced treatment equipment.

- The market shows strong trends in CAD/CAM integration, AI-powered diagnostics, and minimally invasive procedures, improving clinical efficiency and patient outcomes.

- Intense competition among key players focuses on innovation, sustainable materials, and strategic partnerships, while high equipment costs and limited skilled professionals remain key restraints.

- North America leads the global market with a 35.4% share, followed by Europe at 28.6% and Asia Pacific at 23.1%, with operatory and treatment center equipment holding the dominant product segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Operatory and treatment center equipment leads the market with a 41.7% share in 2024. The dominance stems from rising adoption of advanced dental chairs, digital imaging systems, and integrated delivery units. These systems improve workflow efficiency, patient comfort, and procedural accuracy. Leading manufacturers are integrating touchless controls, intraoral scanners, and real-time monitoring to support precision dentistry. Dental lasers and diagnostic equipment are also gaining traction due to minimally invasive procedures and faster recovery times, but they trail behind operatory equipment in adoption rate across clinics and hospitals.

- For instance, Ivoclar offers the VivaScan intraoral scanner, which weighs 230 g and is designed to improve chairside productivity with efficient scanning. Separately, Dentsply Sirona manufactures the Intego Pro treatment center.

By Treatment

Prosthodontic procedures hold a 38.2% share, making them the dominant treatment segment. The growing prevalence of tooth loss, rising geriatric population, and advancements in implant technology drive this demand. Digital prosthodontics solutions, including CAD/CAM-based crowns, bridges, and implants, are widely used for improved fit and reduced chair time. Orthodontic and endodontic segments are expanding due to demand for aesthetic dental corrections and precision root canal treatments, but they remain smaller in market share compared to prosthodontics.

- For instance, 3M’s Chairside Zirconia can be fast sintered in approximately 20 minutes for a thin-walled crown using the CEREC® SpeedFire furnace, enabling single-visit prosthetic workflows.

By End User

Dental clinics account for 54.6% of the market, making them the leading end-user segment. Clinics benefit from fast technology adoption, shorter treatment times, and higher patient inflow. Investments in digital equipment, laser systems, and chairside CAD/CAM solutions enhance operational efficiency and treatment accuracy. Hospitals focus more on complex surgeries and emergency care, while other end users such as academic institutes and mobile dental units contribute moderately. The rapid expansion of private dental practices globally continues to strengthen the clinic segment’s lead.

Key Growth Drivers

Rising Prevalence of Dental Disorders

The increasing incidence of dental caries, periodontal diseases, and tooth loss is driving equipment demand. Higher awareness of oral hygiene and access to dental care accelerates procedural volumes in both developed and emerging economies. The World Health Organization reports that over 3.5 billion people are affected by oral diseases worldwide. This rise fuels investment in advanced operatory equipment, imaging technologies, and consumables. Growing patient inflow to clinics and hospitals directly boosts sales of implants, restorative materials, and dental instruments.

- For instance, Envista launched its DEXIS Ti2 intraoral sensor, which supports a 19.5 µm pixel size and a 1623 x 1324 pixel active area, enabling high-definition imaging with a lower radiation dose. The sensor also features advanced AI capabilities to aid in diagnostics.

Technological Advancements in Dental Care

Innovation in digital dentistry is transforming clinical workflows and patient outcomes. CAD/CAM systems, 3D imaging, intraoral scanners, and laser technologies enhance treatment precision and efficiency. Digital workflows reduce chair time, improve implant placement accuracy, and enable same-day prosthetics. Many clinics adopt AI-driven diagnostic tools for early disease detection. Manufacturers focus on compact, integrated systems to support streamlined procedures. This rapid integration of advanced technology strengthens market expansion, particularly in high-income countries and fast-developing healthcare systems.

- For instance, Henry Schein One’s Profitability Insights Suite collects real-time practice metrics from over 3,000 locations, integrating with 12 practice management systems engine lets practices monitor key performance data within seconds across metrics like collections and chair utilization.

Growing Demand for Cosmetic Dentistry

Rising focus on dental aesthetics is boosting demand for advanced restorative solutions. Teeth whitening, aligners, veneers, and implants are increasingly popular among young adults and urban populations. Social media influence and improved disposable incomes are key factors supporting this shift. Clinics are investing in laser systems, digital smile design tools, and aesthetic restorative materials. High patient preference for minimally invasive and same-day procedures drives adoption of premium consumables and advanced equipment, further propelling market growth worldwide.

Key Trends & Opportunities

Adoption of Digital and AI-Enabled Solutions

Digital dentistry is reshaping treatment planning, diagnosis, and patient engagement. Intraoral scanners, AI-powered diagnostic software, and chairside CAD/CAM systems enable precise, faster procedures. Clinics increasingly adopt cloud-based data storage for case management and seamless patient communication. This trend creates strong growth opportunities for companies offering integrated digital ecosystems. Demand for real-time monitoring and workflow automation is rising, particularly in developed markets.

- For instance, ROSA Knee System guides 3D trajectory planning, but its accuracy has been evaluated differently in various studies. The manufacturer, Zimmer Biomet, cites studies reporting an average difference of less than 1.0° and 1.0 mm between planned and executed resections.

Expansion of Dental Service Chains

The rise of organized dental service networks supports faster technology adoption. Chain clinics offer standardized care, modern infrastructure, and strong purchasing power. This structure accelerates procurement of high-performance equipment and consumables in bulk. Strategic partnerships between manufacturers and dental chains create long-term revenue opportunities. Emerging economies are seeing rapid growth in these chains, especially in urban areas.

- For instance, Coltene subsidiary SciCan launched the HYDRIM 112W G4 washer-disinfector. This unit, featuring G4 technology, supports automated documentation of every cycle for full process logging.

Shift Toward Minimally Invasive Procedures

Minimally invasive dental treatments are becoming the standard for patient comfort and faster recovery. The use of soft-tissue lasers, guided implantology, and adhesive dentistry supports this shift. These procedures reduce chair time and post-operative discomfort. Manufacturers develop compact, energy-efficient, and precise devices to meet this demand. This trend boosts consumables and laser technology adoption across clinics and hospitals.

Key Challenges

High Cost of Advanced Dental Equipment

Premium dental technologies such as CAD/CAM systems, 3D imaging devices, and dental lasers involve high upfront costs. This creates a financial barrier for small and mid-sized clinics, especially in developing economies. Limited reimbursement policies add to the challenge. Many providers delay upgrading their infrastructure due to these costs, slowing adoption rates. This factor affects overall market penetration and technology diffusion.

Shortage of Skilled Dental Professionals

Advanced digital equipment requires trained practitioners to operate effectively. Many regions, particularly low- and middle-income countries, face shortages of skilled dental professionals. Limited training programs and uneven access to continuing education hinder technology adoption. This skill gap affects treatment efficiency and return on investment for clinics. It remains a key barrier to widespread use of advanced dental solutions globally.

Regional Analysis

North America

North America holds a 35.4% share of the Dental Equipment and Consumables Market in 2024, leading globally. Strong healthcare infrastructure, advanced dental technologies, and a high prevalence of oral diseases drive growth. The U.S. dominates the regional market due to a large base of dental clinics, early technology adoption, and rising cosmetic dentistry demand. Widespread use of CAD/CAM systems, intraoral scanners, and laser systems enhances procedural efficiency. Canada follows with increased investments in preventive dental care and insurance coverage. Major manufacturers collaborate with dental service organizations, supporting stable market expansion across the region.

Europe

Europe accounts for 28.6% of the Dental Equipment and Consumables Market in 2024. The region benefits from universal dental care programs, strong reimbursement policies, and a growing elderly population. Germany, France, and the UK lead adoption of digital dentistry and implant solutions. Dental tourism in countries like Hungary and Poland supports equipment and consumables demand. EU regulations on patient safety and hygiene drive continuous modernization of dental facilities. The presence of major global manufacturers ensures early availability of innovative products, strengthening the region’s position as a key revenue contributor.

Asia Pacific

Asia Pacific captures 23.1% of the Dental Equipment and Consumables Market in 2024. Rapid urbanization, increasing disposable income, and a growing focus on oral health awareness fuel regional growth. China, Japan, and India drive demand through expanding dental service networks and government-backed healthcare initiatives. Rising medical tourism in Thailand and South Korea further boosts equipment and consumables adoption. Affordable technology integration and rising investment in digital dental infrastructure contribute to fast market expansion. Local manufacturers and global players are investing in strategic collaborations to strengthen distribution and technology reach.

Latin America

Latin America holds a 7.4% share of the Dental Equipment and Consumables Market in 2024. Brazil and Mexico are the primary contributors, supported by increasing private dental clinics and rising cosmetic dentistry trends. Expanding middle-class populations and improving healthcare access drive steady demand for restorative and preventive solutions. Although adoption of high-end digital systems remains slower compared to developed regions, ongoing investment in public health programs supports market growth. International manufacturers are entering partnerships with local distributors to increase technology penetration and address cost sensitivity in the region.

Middle East & Africa

The Middle East & Africa region accounts for 5.5% of the Dental Equipment and Consumables Market in 2024. Market growth is supported by healthcare modernization programs and rising awareness of dental hygiene. GCC countries, including the UAE and Saudi Arabia, lead adoption through investments in advanced dental clinics and cosmetic procedures. South Africa is seeing growing adoption of preventive and restorative solutions. Infrastructure gaps and limited specialist availability in several African nations restrain faster growth. However, strategic investments in dental tourism and public health programs create strong long-term opportunities for market players.

Market Segmentations:

By Product:

- Operatory and Treatment Center Equipment

- Dental Laboratory Equipment

By Treatment:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Dental Equipment and Consumables Market is shaped by leading players such as Ivoclar, Benco Dental, 3M, Envista Holdings Corporation (Danaher Corporation), Henry Schein, Inc., Prime Dental Products Pvt. Ltd., Patterson Companies, Inc., Zimmer Biomet, Coltene Group, and GC Asia Dental. The Dental Equipment and Consumables Market is highly competitive, driven by rapid technological advancements and expanding global demand. Companies prioritize innovation in CAD/CAM systems, intraoral scanners, and minimally invasive treatment tools to enhance precision and patient outcomes. Strategic mergers, acquisitions, and partnerships enable firms to strengthen their global footprint and optimize distribution networks. Focus on digital workflows, eco-friendly materials, and personalized dental solutions is increasing. Continuous investments in R&D support product differentiation and faster regulatory approvals. Strong competition also encourages the development of training platforms and service integration models to improve adoption rates and clinical efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ivoclar

- Benco Dental

- 3M

- Envista Holdings Corporation (Danaher Corporation)

- Henry Schein, Inc.

- Prime Dental Products Pvt. Ltd.

- Patterson Companies, Inc.

- Zimmer Biomet

- Coltene Group

- GC Asia Dental

Recent Developments

- In January 2025, Septodont Inc. and Premier Dental launched BufferPro, an 8.4% sodium bicarbonate buffering solution designed to streamline the administration of local anesthetics in dental procedures. BufferPro offers a one-step, sterile, single-use capsule containing 0.1 mL sodium bicarbonate, which raises the pH of anesthetic cartridges to near physiological levels, enhancing onset time and reducing procedural discomfort.

- In August 2024, Dentsply Sirona introduced the X-Smart Pro+ and Reciproc Blue in the U.S., offering a streamlined, one-file solution for endodontic procedures. This launch aims to simplify root canal treatments by providing a highly efficient and reliable system.

- In April 2024, Ivoclar Group, a key manufacturer of integrated solutions for high-quality dental treatments, revealed its partnership with SprintRay, a U.S.-based technology company. This collaboration aims to establish new benchmarks in 3D printing within the dental industry, enhancing the capabilities available to dentists, dental technicians, and hygienists.

- In February 2024, Illusion Dental Lab, a leading brand in the dental fraternity for superior and reliable quality dental products, celebrated 35 years of providing innovative, world-class dental products.

Report Coverage

The research report offers an in-depth analysis based on Product, Treatment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital dentistry will continue to dominate treatment workflows across clinics and hospitals.

- Adoption of AI-powered diagnostic tools will enhance accuracy and treatment planning.

- Demand for minimally invasive and same-day dental procedures will rise steadily.

- Cosmetic and aesthetic dentistry will see strong growth among urban populations.

- Integration of CAD/CAM and 3D printing will improve efficiency and reduce chair time.

- Global expansion of dental service chains will increase equipment and consumables demand.

- Investment in sustainable and biocompatible materials will gain more importance.

- Training programs and digital platforms will accelerate technology adoption.

- Strategic mergers and acquisitions will strengthen global distribution networks.

- Preventive dental care will become a key focus, driving demand for advanced solutions.