Market Overview

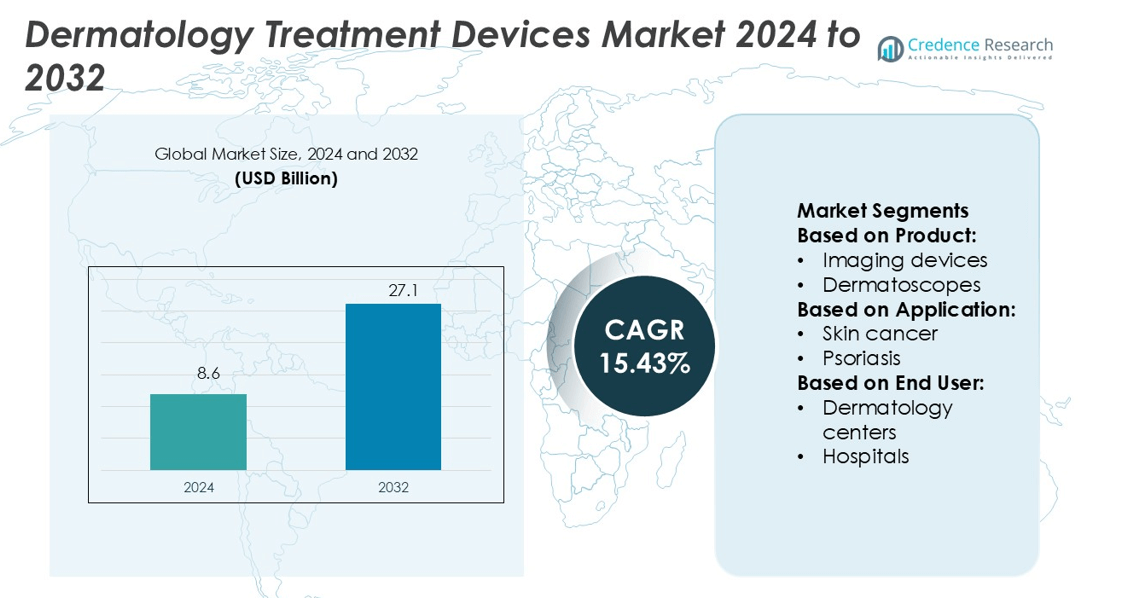

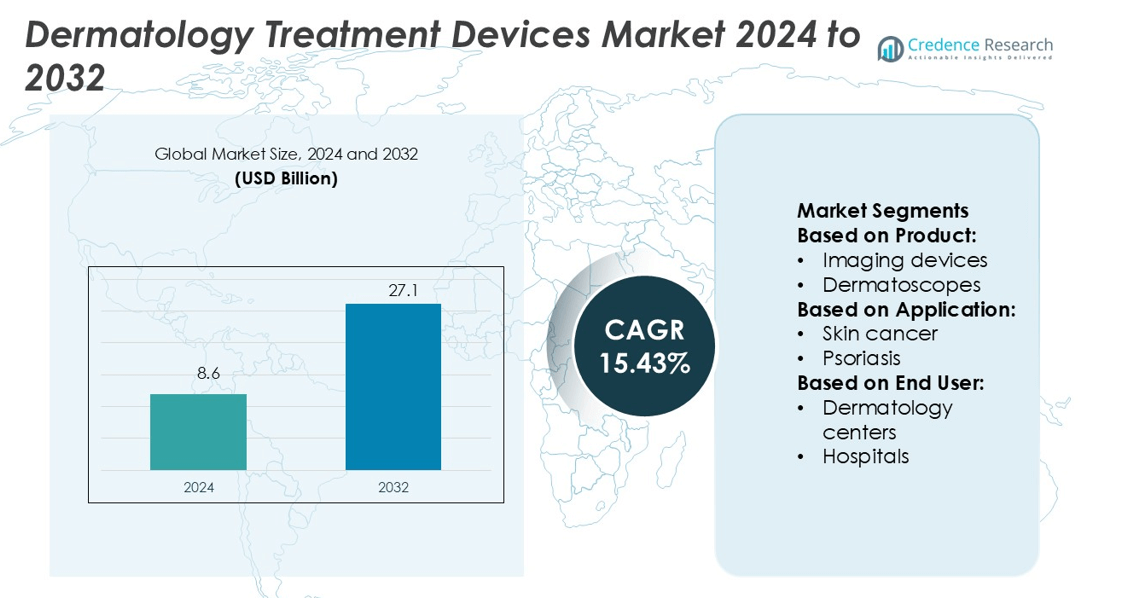

Dermatology Treatment Devices Market size was valued USD 8.6 billion in 2024 and is anticipated to reach USD 27.1 billion by 2032, at a CAGR of 15.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dermatology Treatment Devices Market Size 2024 |

USD 8.6 billion |

| Dermatology Treatment Devices Market, CAGR |

15.43% |

| Dermatology Treatment Devices Market Size 2032 |

USD 27.1 billion |

The dermatology treatment devices market is shaped by prominent players such as Nikon Corporation, STRATA Skin Sciences (MELA Sciences, Inc), ILLUCO Corporation Ltd, DermoScan GmbH, Abbott Diagnostics, Carl Zeiss Meditec AG, Caliber I.D Inc, BOMTECH ELECTRONICS CO, Michelson Diagnostics Limited, and Canfield Imaging Systems. These companies focus on advanced imaging technologies, precision laser systems, and AI-based diagnostic solutions to enhance clinical accuracy and patient outcomes. Strategic collaborations, product innovation, and regulatory approvals strengthen their market presence globally. North America leads the dermatology treatment devices market with a 34.2% share, supported by strong healthcare infrastructure, early adoption of advanced technologies, and high demand for aesthetic procedures. Continuous investment in R&D and expansion into outpatient and teledermatology segments are driving further growth and competitiveness in this region.

Market Insights

- The dermatology treatment devices market was valued at USD 8.6 billion in 2024 and is projected to reach USD 27.1 billion by 2032, growing at a CAGR of 15.43%.

- Rising demand for non-invasive and aesthetic dermatology procedures is driving market expansion across both developed and emerging regions.

- Companies are focusing on advanced imaging, precision laser systems, and AI-based diagnostic tools to strengthen their competitive positions.

- High equipment costs and limited access in low-resource settings remain key restraints, slowing adoption in some regions.

- North America leads with a 34.2% share, supported by strong infrastructure and early technology adoption, while Asia Pacific is rapidly expanding due to increasing disposable incomes and growing clinic networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Imaging devices dominate the dermatology treatment devices market with a 41.2% share in 2024. These systems enable high-resolution visualization and early detection of skin abnormalities, including melanoma and other skin cancers. Advancements such as 3D imaging, AI-powered lesion analysis, and improved diagnostic accuracy are driving their widespread adoption. Dermatoscopes and microscopes are also gaining traction, particularly in clinical diagnostics and academic research. The growing use of non-invasive diagnostic methods, combined with rising skin disease prevalence, is accelerating the demand for advanced imaging solutions in dermatology.

- For instance, Nikon Corporation offers the Eclipse Ci-L Plus microscope, which can achieve a magnification of 1000× using a 100× oil immersion objective and a 10× eyepiece.

By Application

Skin cancer represents the largest application segment, holding a 36.8% market share in 2024. The rising incidence of melanoma and non-melanoma cancers drives higher demand for advanced screening and treatment solutions. Early detection tools, coupled with real-time imaging and AI-assisted diagnosis, are improving clinical outcomes. Applications in acne, psoriasis, and hair and scalp disorders are also expanding due to increased awareness and availability of precision treatment devices. The integration of digital platforms with imaging devices supports remote diagnostics and continuous monitoring, further fueling growth across multiple dermatological conditions.

- For instance, STRATA Skin Sciences produces the XTRAC excimer laser, which uses a 308 nm wavelength for targeted treatment of psoriasis and vitiligo. The system delivers UVB light with precision targeting to spare healthy tissue.

By End-user

Dermatology centers lead the market with a 39.7% share, driven by their specialized infrastructure and advanced diagnostic capabilities. These centers adopt high-precision imaging devices and treatment equipment to offer targeted care and rapid interventions. Hospitals and clinics are also expanding their dermatology service portfolios through strategic investments in advanced devices. The growing focus on outpatient dermatological procedures, rising patient preference for specialized care, and the adoption of AI-based diagnostics are strengthening this segment’s dominance. The availability of skilled dermatologists and advanced infrastructure further enhances patient outcomes and procedural efficiency.

Key Growth Drivers

Rising Prevalence of Skin Disorders

The growing incidence of skin conditions such as acne, psoriasis, and skin cancer is fueling demand for advanced treatment devices. Early detection and personalized care drive the adoption of imaging systems, lasers, and light-based therapies. For example, the increasing rate of melanoma cases globally is pushing healthcare providers to invest in high-resolution diagnostic equipment. Expanding dermatology awareness programs and better patient access to specialist care further accelerate this growth. The growing emphasis on preventive dermatology also strengthens the market outlook.

- For instance, ILLUCO Corporation Ltd recently enhanced its IDS-1100 dermatoscope, which uses a 25 mm aperture and 32 white LEDs for uniform illumination. This device offers 10× magnification and supports both cross-polarized and parallel-polarized modes to reduce glare.

Technological Advancements in Dermatology Devices

Innovations in imaging, laser, and AI-driven diagnostic systems are transforming dermatology treatment. Advanced dermatoscopes and 3D imaging platforms support real-time lesion analysis and accurate disease detection. AI and machine learning enable faster diagnosis and support clinicians in treatment planning. Minimally invasive technologies improve patient experience while reducing recovery time. These developments enhance clinical outcomes, support personalized care, and increase device adoption across hospitals, clinics, and dermatology centers worldwide. Continuous R&D investments by key companies further drive market expansion.

- For instance, DermoScan GmbH offers the DermoScan X2 system for total body mapping, featuring two fixed-position digital cameras with 18-megapixel sensors for high-resolution photo documentation.

Rising Demand for Aesthetic and Cosmetic Procedures

The growing popularity of aesthetic treatments such as laser hair removal, skin resurfacing, and anti-aging procedures is driving demand for dermatology treatment devices. Patients increasingly prefer non-invasive or minimally invasive solutions with shorter downtime and visible results. Clinics and specialized dermatology centers are adopting high-performance laser and radiofrequency devices to meet this demand. Expanding medical tourism and higher disposable incomes in emerging markets also support this trend. This strong consumer shift toward cosmetic dermatology strengthens equipment sales and service adoption globally.

Key Trends & Opportunities

Integration of AI and Digital Technologies

The integration of AI and digital tools is reshaping dermatology diagnostics and treatment. AI algorithms assist clinicians in identifying skin lesions with high accuracy, improving early detection of skin cancers. Digital platforms enable remote consultations, boosting access to care. Advanced imaging software supports real-time data sharing and documentation. This digital shift reduces diagnostic errors and improves treatment planning. Device manufacturers investing in AI-driven solutions and cloud connectivity are well-positioned to capitalize on the expanding teledermatology segment.

- For instance, Abbott’s Alinity m molecular diagnostics platform is a fully automated, high-throughput system for infectious disease testing. It offers continuous loading and random access, with a maximum throughput of approximately 300 tests in an 8-hour shift and connectivity options for seamless data integration.

Rising Adoption of Non-Invasive Treatment Solutions

Non-invasive and minimally invasive dermatology procedures are gaining traction due to their faster recovery times and patient comfort. Laser and light-based therapies, RF systems, and advanced imaging devices support efficient treatment without surgical interventions. Growing patient awareness and demand for aesthetic enhancements further drive this trend. Clinics and hospitals increasingly invest in energy-based devices that offer precise results with minimal downtime. This shift opens new growth opportunities for manufacturers offering compact, user-friendly, and versatile equipment.

- For instance, Carl Zeiss Meditec AG’s CIRRUS 6000 OCT executes 100,000 A-scans per second, providing clinicians with high-speed, high-resolution depth imaging of ocular structures.

Growing Focus on Personalized Dermatology

Personalized treatment plans using patient-specific data are becoming a key opportunity in the dermatology devices market. AI-enabled imaging systems and digital platforms allow tailored diagnosis and therapy selection. Clinics use skin-type profiling, lesion mapping, and targeted therapy to improve outcomes. This trend enhances patient satisfaction and encourages repeat procedures. Companies offering customizable device solutions and software integrations can strengthen their competitive advantage in this growing segment.

Key Challenges

High Cost of Advanced Dermatology Devices

The high cost of advanced laser, imaging, and AI-integrated devices remains a significant challenge for smaller clinics and dermatology centers. High upfront investment limits adoption in emerging economies and rural healthcare settings. Maintenance, calibration, and staff training add to operational costs. This cost barrier often restricts technology access to larger hospitals and well-funded facilities. To overcome this, vendors need to focus on affordable financing models, leasing options, and cost-effective product innovations.

Shortage of Skilled Dermatology Professionals

Advanced dermatology devices require trained specialists for proper use, diagnosis, and treatment. The global shortage of skilled dermatologists and technicians creates operational limitations, especially in developing regions. This shortage delays adoption of complex imaging systems and limits patient access to advanced care. Additionally, inconsistent training standards across regions reduce the effectiveness of high-tech solutions. Expanding training programs, certification courses, and AI-assisted support tools can help address this workforce gap.

Regional Analysis

North America

North America dominates the dermatology treatment devices market with a 34.2% share in 2024. The region benefits from high healthcare spending, strong insurance coverage, and rapid adoption of advanced dermatology technologies. The United States leads the market, driven by early integration of laser and imaging devices in clinical settings. Growing demand for aesthetic procedures such as laser hair removal, skin tightening, and scar treatment supports market expansion. Key players actively launch innovative technologies and partner with hospitals and clinics. Favorable regulatory standards, coupled with robust research investments, further strengthen the region’s leadership in dermatology device adoption.

Europe

Europe holds a 28.5% share of the dermatology treatment devices market in 2024. Countries such as Germany, France, and the U.K. are major contributors due to their advanced healthcare infrastructure and strong cosmetic dermatology demand. Rising prevalence of skin cancer and increasing use of dermatoscopes drive steady growth. Public awareness campaigns and early disease screening initiatives strengthen device adoption. Supportive reimbursement frameworks and physician training programs encourage clinical integration. Continuous technology upgrades, along with expanding medical tourism in select countries, position Europe as a key regional market with consistent investment in dermatology treatment advancements.

Asia Pacific

Asia Pacific accounts for 25.8% of the dermatology treatment devices market in 2024. Rapid urbanization, growing disposable income, and increasing awareness of skin health are key growth factors. China, Japan, India, and South Korea are major hubs for both medical and cosmetic dermatology procedures. Expanding private healthcare infrastructure and favorable government initiatives accelerate technology adoption. Strong demand for affordable laser and diagnostic devices is reshaping the competitive landscape. Market participants focus on local manufacturing and strategic collaborations to meet rising patient volume. The region shows strong potential for rapid market expansion over the forecast period.

Latin America

Latin America represents 6.3% of the dermatology treatment devices market in 2024. Brazil and Mexico lead regional demand, supported by a growing aesthetic dermatology segment. Increased awareness of non-invasive procedures and expanding private clinic networks are boosting device adoption. Medical tourism, particularly in cosmetic treatments, is a strong driver for advanced laser and imaging technologies. However, inconsistent reimbursement structures limit broader clinical deployment. Market players are investing in distribution partnerships to enhance device accessibility. The region is witnessing steady growth, with rising investments in dermatology infrastructure and equipment modernization initiatives.

Middle East & Africa

The Middle East & Africa holds a 5.2% share of the dermatology treatment devices market in 2024. The Gulf Cooperation Council (GCC) countries drive regional growth with increasing adoption of laser and diagnostic devices. Rising prevalence of chronic skin conditions and high demand for aesthetic enhancements fuel market expansion. Governments are investing in healthcare infrastructure modernization and encouraging private sector participation. While access remains uneven across sub-Saharan Africa, urban centers are witnessing rapid clinic development. Strategic collaborations with international device manufacturers are improving availability. The region is positioned for gradual but consistent market growth.

Market Segmentations:

By Product:

- Imaging devices

- Dermatoscopes

By Application:

By End User:

- Dermatology centers

- Hospitals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dermatology treatment devices market is shaped by leading players such as Nikon Corporation, STRATA Skin Sciences (MELA Sciences, Inc), ILLUCO Corporation Ltd, DermoScan GmbH, Abbott Diagnostics, Carl Zeiss Meditec AG, Caliber I.D Inc, BOMTECH ELECTRONICS CO, Michelson Diagnostics Limited, and Canfield Imaging Systems. The dermatology treatment devices market is highly competitive, driven by rapid technological advancements and expanding clinical applications. Companies are investing in advanced laser systems, high-resolution imaging solutions, and AI-powered diagnostic tools to enhance treatment precision and speed. Strategic collaborations with hospitals and specialty clinics help strengthen market presence and accelerate product adoption. Firms are also focusing on affordable, portable devices to meet the rising demand in outpatient and aesthetic care settings. Strong emphasis on regulatory compliance, clinical validation, and training programs is improving trust and accessibility. This dynamic environment is fostering innovation, enabling faster product launches, and increasing patient access to advanced dermatology care worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nikon Corporation

- STRATA Skin Sciences (MELA Sciences, Inc)

- ILLUCO Corporation Ltd

- DermoScan GmbH

- Abbott Diagnostics

- Carl Zeiss Meditec AG

- Caliber I.D Inc

- BOMTECH ELECTRONICS CO

- Michelson Diagnostics Limited

- Canfield Imaging Systems

Recent Developments

- In December 2024, Electrocore, which is headquartered in New Jersey, announced that it has acquired NeuroMetrix and its platform called neuromodulation. Quell is a solution presented to treat fibromyalgia and lower extremity chronic pain.

- In November 2024, Beurer India Pvt. Ltd. introduced the GL 22 Blood Glucose Monitor. This innovative and user-friendly glucose monitoring solution manufactured under Beurer’s “Make in India” initiative.

- In May 2024, Abbott Medical, has launched the Abbott spinal cord stimulation system, which is approved by the U.S. FDA. It is designed for chronic and difficult-to-manage pain arriving from the arms, torso and legs.

- In March 2023, Candela Corporation, a global manufacturer of medical aesthetic devices announced that the dual-wavelength Frax Pro non-ablative fractional laser platform and the Nordlys multi-application platform with Selective Waveband Technology (SWT) were licensed and made available by Health Canada

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-invasive and minimally invasive dermatology treatments will continue to grow.

- AI-powered diagnostic and imaging tools will enhance clinical accuracy and treatment outcomes.

- Portable and home-use dermatology devices will gain stronger market adoption.

- Integration of teledermatology solutions will improve access to specialized care.

- Laser and energy-based technologies will see wider use in aesthetic and medical applications.

- Strategic collaborations between device makers and healthcare providers will increase.

- Advanced imaging solutions will support early detection and personalized treatment plans.

- Regulatory approvals and clinical validation will accelerate global product launches.

- Rising consumer awareness will boost demand for cosmetic dermatology procedures.

- Emerging markets will witness stronger investments in dermatology infrastructure and devices.