Market Overview

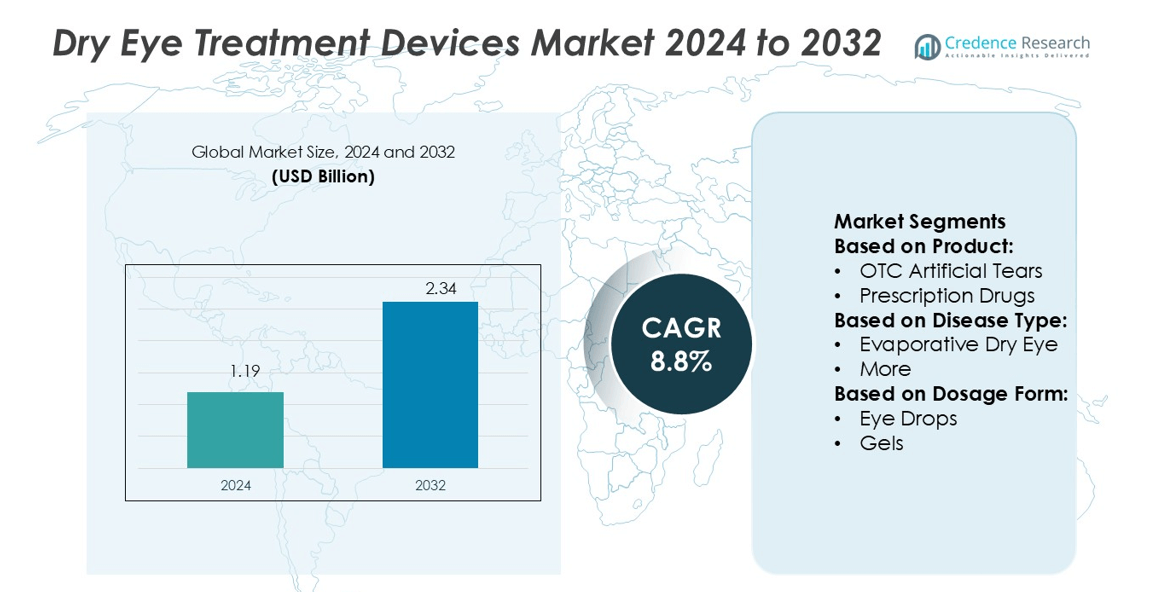

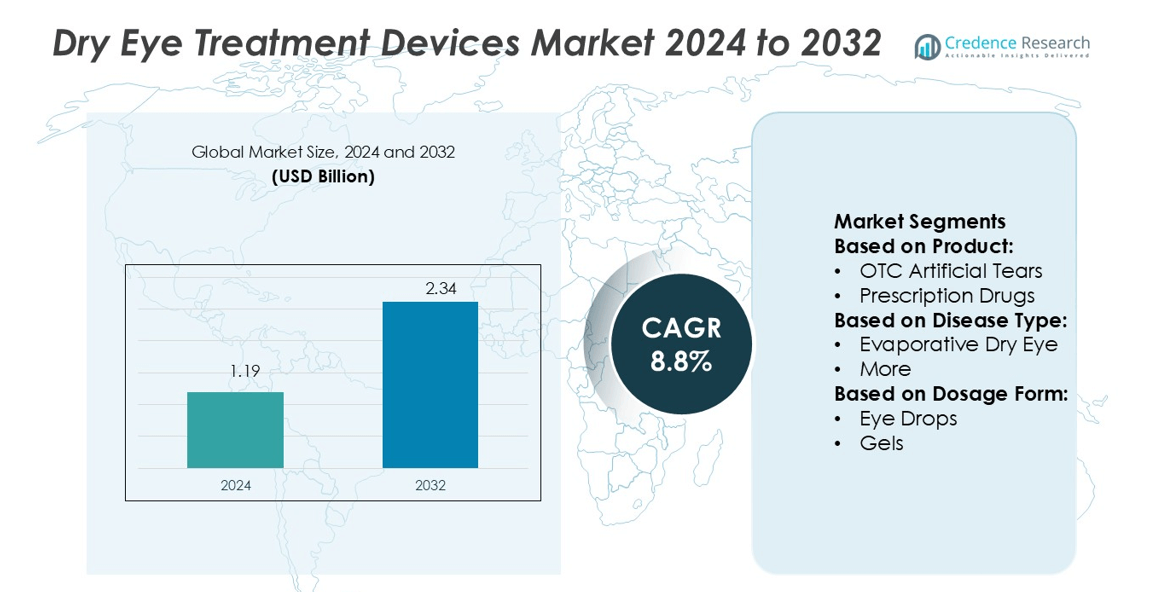

Dry Eye Treatment Devices Market size was valued USD 1.19 billion in 2024 and is anticipated to reach USD 2.34 billion by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Eye Treatment Devices Market Size 2024 |

USD 1.19 billion |

| Dry Eye Treatment Devices Market, CAGR |

8.8% |

| Dry Eye Treatment Devices Market Size 2032 |

USD 2.34 billion |

The Dry Eye Treatment Devices Market is driven by strong competition among leading companies including Johnson & Johnson Services, Inc., AFT Pharmaceuticals, Bausch Health Companies, Inc., Novartis AG, OASIS Medical, Sun Pharmaceutical Industries Ltd., Santen Pharmaceutical Co Ltd., Otsuka Pharmaceutical Co., Ltd., AbbVie, Inc., and Oyster Point Pharma, Inc. These players focus on innovation, product expansion, and strategic collaborations to strengthen their positions. Advanced drug-device combinations and patient-centric technologies are key areas of investment. North America leads the global market with a 38% share, supported by high adoption rates, strong healthcare infrastructure, and favorable reimbursement policies. The region’s focus on early diagnosis and advanced treatment solutions further enhances its market dominance.

Market Insights

- The Dry Eye Treatment Devices Market was valued at USD 1.19 billion in 2024 and is expected to reach USD 2.34 billion by 2032, growing at a CAGR of 8.8%.

- Rising prevalence of dry eye disorders and increasing demand for advanced treatment solutions are driving market growth.

- Adoption of smart and minimally invasive devices, along with strong R&D investments, is shaping major market trends.

- Intense competition among leading players is pushing product innovation, while high device costs and regulatory complexities act as restraints.

- North America holds a 38% share, leading the global market due to strong healthcare infrastructure, early diagnosis rates, and wide treatment adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

OTC artificial tears hold the dominant share at 47.2% in the dry eye treatment devices market. Their wide availability, affordability, and quick symptom relief drive this segment’s leadership. Growing use of preservative-free formulations further boosts adoption among patients with chronic symptoms. Prescription drugs, including anti-inflammatory and secretagogues, are gaining traction due to targeted therapeutic effects. However, OTC options remain the first line of treatment for mild and moderate cases, supported by increased self-medication trends and retail pharmacy expansions globally.

- For instance, Alcon, a competitor to Johnson & Johnson Vision, offers multidose preservative-free artificial tear formulations, such as Systane Hydration PF. These products feature a 10 mL delivery system, utilizing patented PureFlow® technology.

By Disease Type

Evaporative dry eye dominates the market with a 58.6% share, driven by the growing prevalence of meibomian gland dysfunction (MGD). Rising exposure to digital screens, low humidity environments, and aging populations contribute to higher incidence rates. Device-based treatments such as thermal pulsation systems and intense pulsed light therapy are increasingly adopted for this segment. These technologies improve meibomian gland function, offering long-lasting relief compared to lubricating drops. Preventive eye care programs and increased clinical awareness further strengthen this segment’s position.

- For instance, AFT distributes NovaTears®, a water-free eye drop formulation using patented EyeSol® technology, which delivers droplets of about 10–12 µL (versus 40–50 µL for water-based drops), with surface tension and viscosity four times lower than water — enabling better spread over the lipid layer and minimizing overflow.

By Dosage Form

Eye drops lead the dosage form segment with a 62.4% market share, supported by their ease of use and rapid symptom management. Patients prefer drops for daily relief, driving repeat purchases and high adherence rates. Pharmaceutical companies are launching preservative-free, lipid-enhanced, and nano-formulated drops to improve tear film stability. Gels and ointments remain important for severe cases, but drops dominate due to their convenience, portability, and broad prescription base. The rise of digital eye strain and allergic conditions continues to fuel demand for drop-based solutions.

Key Growth Drivers

Rising Prevalence of Dry Eye Disease

The increasing number of people affected by dry eye disease is driving demand for advanced treatment devices. Factors such as prolonged screen exposure, environmental pollution, and aging populations are contributing to higher incidence rates. For instance, global prevalence estimates range between 5% and 50% depending on region and demographic. This growing patient pool encourages greater adoption of devices like intense pulsed light systems and meibomian gland expression tools. Healthcare providers are prioritizing early diagnosis and effective intervention, creating strong growth opportunities for device manufacturers.

- For instance, Bausch + Lomb’s LipiFlow® Thermal Pulsation System delivers 42.5 °C controlled heat to the inner eyelid and applies a pressure of 12 mmHg for 12 minutes, directly targeting obstructed meibomian glands to restore lipid layer stability.

Technological Advancements in Treatment Devices

Rapid innovations in medical technology are boosting the efficiency and accuracy of dry eye treatments. Devices now integrate advanced diagnostics, real-time imaging, and targeted therapy delivery systems. Technologies such as thermal pulsation, light-based therapy, and automated tear analysis enhance patient outcomes and reduce procedure time. These advancements support more personalized treatment plans and increase clinical adoption. Manufacturers are investing in product development to improve device portability and ease of use, driving broader acceptance in both hospitals and specialty clinics.

- For instance, Johnson & Johnson Vision acquired TearScience® and offers the LipiView® II interferometer. This device records a 20-second video of the tear film interference pattern at 30 frames per second (FPS), enabling automatic lipid thickness measurement with nanometer precision.

Expanding Healthcare Infrastructure and Awareness

Growing healthcare investments and awareness initiatives are improving access to dry eye treatments. Governments and organizations are launching campaigns to increase early detection and patient education. Rising availability of ophthalmology clinics and ambulatory centers in emerging economies supports market expansion. Insurance coverage and reimbursement policies for dry eye procedures further strengthen demand. As more patients seek clinical solutions over OTC remedies, device utilization rates are increasing. This shift supports steady revenue growth for medical device suppliers worldwide.

Key Trends & Opportunities

Integration of AI and Digital Diagnostics

The integration of AI and digital technologies is transforming dry eye management. AI-enabled diagnostic systems offer automated tear film assessment, enabling faster and more accurate detection. Cloud-based platforms store patient data, supporting continuous monitoring and treatment optimization. This digital shift improves diagnostic precision and allows ophthalmologists to deliver customized care. Companies investing in connected solutions and tele-ophthalmology platforms are gaining a competitive edge, particularly in remote and underserved regions.

- For instance, NCELL encapsulation delivered up to 3× higher cyclosporine concentration in ocular tissues compared to a 0.05% emulsion in rabbit models, enabling more effective tissue exposure per dose.

Rising Demand for Non-Invasive Treatment Solutions

Patients increasingly prefer non-invasive treatment methods that offer faster recovery and minimal discomfort. Thermal pulsation therapy, light-based devices, and automated lid hygiene systems are gaining traction as alternatives to traditional approaches. These technologies reduce procedure time, improve patient compliance, and enhance treatment outcomes. Manufacturers focusing on ergonomic designs and compact, clinic-friendly systems are well-positioned to capitalize on this trend. Non-invasive solutions are also driving higher adoption rates in outpatient and specialty care settings.

- For instance, AbbVie recently launched Refresh Advanced OMEGA-3 Lubricant Eye Drops, packaged in 0.4 mL preservative-free single-use vials, combining flaxseed-derived omega-3 with HydroCell™ technology to stabilize tear film layers.

Expanding Adoption in Emerging Markets

Emerging economies present strong opportunities for market expansion due to rising disposable income and healthcare access. Rapid urbanization and increasing exposure to risk factors such as pollution and digital device use are driving demand. Local distributors and manufacturers are expanding their presence through partnerships and cost-effective product offerings. This trend supports the availability of affordable, innovative devices in countries across Asia Pacific, Latin America, and the Middle East. Growing medical tourism also boosts device demand in these regions.

Key Challenges

High Cost of Advanced Treatment Devices

The high cost of advanced diagnostic and treatment systems limits accessibility in price-sensitive markets. Many ophthalmology clinics face budget constraints that restrict the adoption of technologies such as thermal pulsation and light therapy. Patients in developing regions may rely on cheaper alternatives like OTC eye drops, slowing device uptake. Lack of sufficient reimbursement in several countries further exacerbates this challenge. Manufacturers face pressure to balance cost, innovation, and affordability to increase market penetration.

Lack of Standardized Diagnosis and Treatment Protocols

The absence of globally standardized protocols for dry eye diagnosis and management complicates device adoption. Variability in clinical practices leads to inconsistent outcomes, reducing confidence in newer treatment technologies. Many clinicians rely on subjective assessments rather than advanced tools, slowing integration into routine care. Regulatory differences across countries also hinder smooth product commercialization. Establishing clear guidelines and harmonized standards will be critical for widespread device acceptance and growth.

Regional Analysis

North America

North America holds a 38.6% market share in the global dry eye treatment devices market. Strong healthcare infrastructure, rising prevalence of dry eye syndrome, and early adoption of advanced medical technologies drive regional growth. The U.S. leads the market due to higher diagnosis rates and widespread availability of prescription and OTC treatment devices. Growing awareness campaigns and insurance coverage also support demand. Leading companies are launching innovative light-based and meibomian gland expression devices. Increased investments in R&D and the presence of major device manufacturers further solidify North America’s dominant position in the global market.

Europe

Europe accounts for 27.1% of the global dry eye treatment devices market. The region benefits from a growing aging population, rising digital screen usage, and a strong reimbursement structure. Countries like Germany, France, and the UK lead in device adoption through well-established ophthalmology networks. Regulatory approvals and CE-marked device launches support innovation. Increasing clinical trials and technology integration in diagnostic and therapeutic devices are boosting market penetration. Government health initiatives and higher patient awareness are also driving steady growth, making Europe the second-largest market after North America.

Asia Pacific

Asia Pacific captures a 23.4% share of the global dry eye treatment devices market. Rapid urbanization, increased digital device usage, and rising healthcare investments are major growth drivers. China, Japan, South Korea, and India are key markets showing strong adoption of light therapy and thermal pulsation devices. Expanding access to advanced ophthalmology care and growing middle-class populations support market expansion. Regional manufacturers are introducing cost-effective solutions, increasing accessibility in both urban and semi-urban areas. Rising awareness programs by healthcare agencies further accelerate device adoption across Asia Pacific.

Latin America

Latin America holds a 6.2% market share in the dry eye treatment devices market. Market growth is supported by improving healthcare infrastructure and increasing access to specialized eye care. Brazil and Mexico lead the region, driven by rising patient awareness and expanding private ophthalmology clinics. Manufacturers are focusing on affordable device offerings to penetrate underserved markets. Rising prevalence of dry eye disease due to environmental factors and increased screen exposure also supports adoption. Strategic partnerships between global device makers and local distributors are strengthening the regional supply network.

Middle East & Africa

The Middle East & Africa represent 4.7% of the global dry eye treatment devices market. Market growth is fueled by increasing investments in eye care infrastructure and a growing patient base. GCC countries, including Saudi Arabia and the UAE, lead adoption due to advanced healthcare systems and rising dry eye cases linked to arid climates. International device manufacturers are expanding distribution partnerships to tap into emerging markets. Awareness programs, rising medical tourism, and gradual improvement in diagnostic capabilities are contributing to steady market expansion in the region.

Market Segmentations:

By Product:

- OTC Artificial Tears

- Prescription Drugs

By Disease Type:

By Dosage Form:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Dry Eye Treatment Devices Market is shaped by key players such as Johnson & Johnson Services, Inc., AFT Pharmaceuticals, Bausch Health Companies, Inc., Novartis AG, OASIS Medical, Sun Pharmaceutical Industries Ltd., Santen Pharmaceutical Co Ltd., Otsuka Pharmaceutical Co., Ltd., AbbVie, Inc., and Oyster Point Pharma, Inc. The Dry Eye Treatment Devices Market is characterized by intense innovation and strategic expansion. Companies are focusing on developing advanced drug-device combinations, minimally invasive treatment solutions, and improved patient compliance technologies. Many firms are strengthening their global footprint through mergers, acquisitions, and strategic collaborations to enhance their product portfolios and market reach. R&D investment remains a key priority, with a strong emphasis on technologies that offer faster relief and long-term effectiveness. Additionally, increasing demand from emerging markets is pushing players to expand manufacturing capacity, improve affordability, and adapt products to regional healthcare needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Alcon Announces FDA Approval of TRYPTYR (acoltremon ophthalmic solution) 0.003% for the Treatment of the Signs and Symptoms of Dry Eye Disease marking a shift toward neuro-sensory modulation in treatment pathways.

- In October 2024, Novaliq and Laboratoires Théa announced that, Vevizye received approval from Europen commission to market the product for treating dry eye disease in adults. It is the first and only water-free ciclosporin 0.1% eye drop solution to receive approval in Europe.

- In May 2024, Nordic Pharma, Inc. launched LACRIFILL Canalicular Gel, a novel dry eye treatment cleared by the FDA. This cross-linked hyaluronic acid gel temporarily blocks tear drainage by occluding the canalicular system, allowing natural tears to bathe the eyes.

- In January 2024, Harrow announced the availability of Vevye, a patented, non-preserved cyclosporine ophthalmic solution of 0.1%. Utilizing a “water-free” semifluorinated alkane eyedrop technology, Vevye is prescribed for twice-daily (BID) dosing in the United States

Report Coverage

The research report offers an in-depth analysis based on Product, Disease Type, Dosage Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as awareness of dry eye conditions continues to grow.

- Demand for advanced and minimally invasive treatment devices will increase steadily.

- Companies will focus on integrating smart and connected technologies into treatment devices.

- R&D investment will rise to improve treatment precision and patient comfort.

- Emerging markets will offer new growth opportunities for device manufacturers.

- Strategic partnerships will strengthen distribution networks and global market presence.

- Personalized treatment solutions will gain traction with advancements in diagnostics.

- Regulatory approvals will accelerate as product innovation aligns with global standards.

- Home-based and portable treatment devices will see stronger adoption.

- Competition will intensify, driving faster innovation and improved product quality.