Market Overview

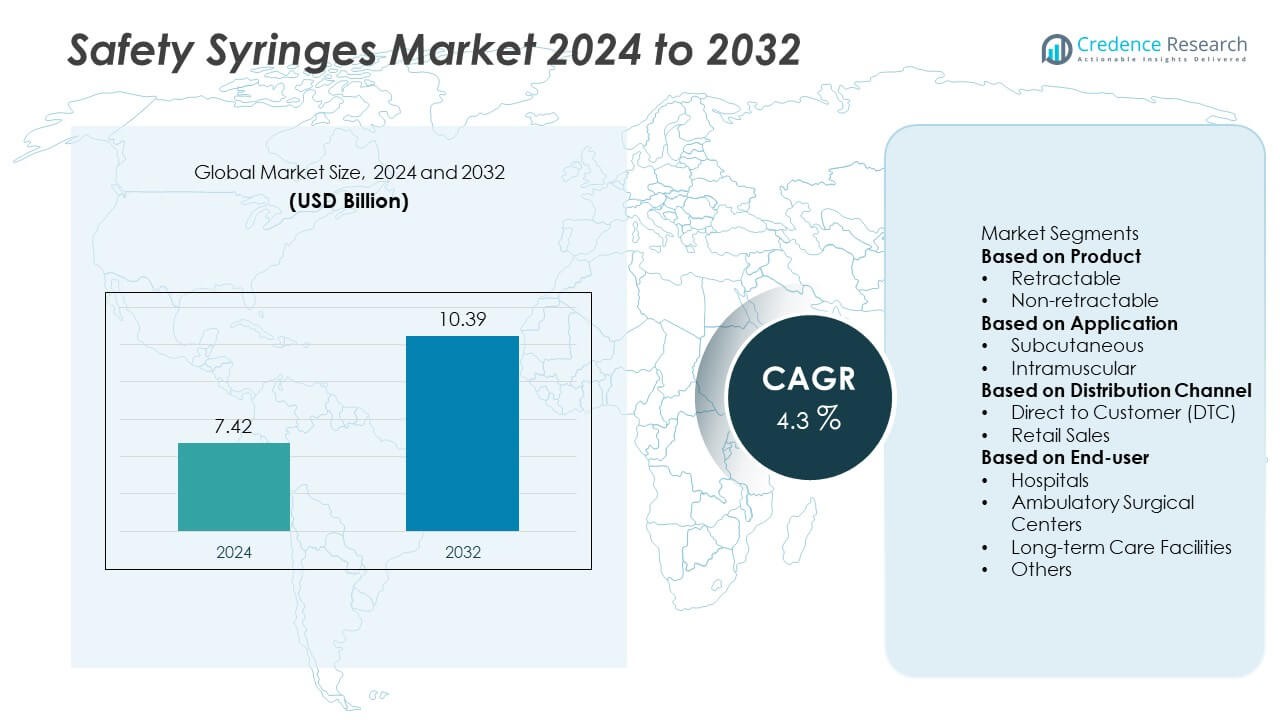

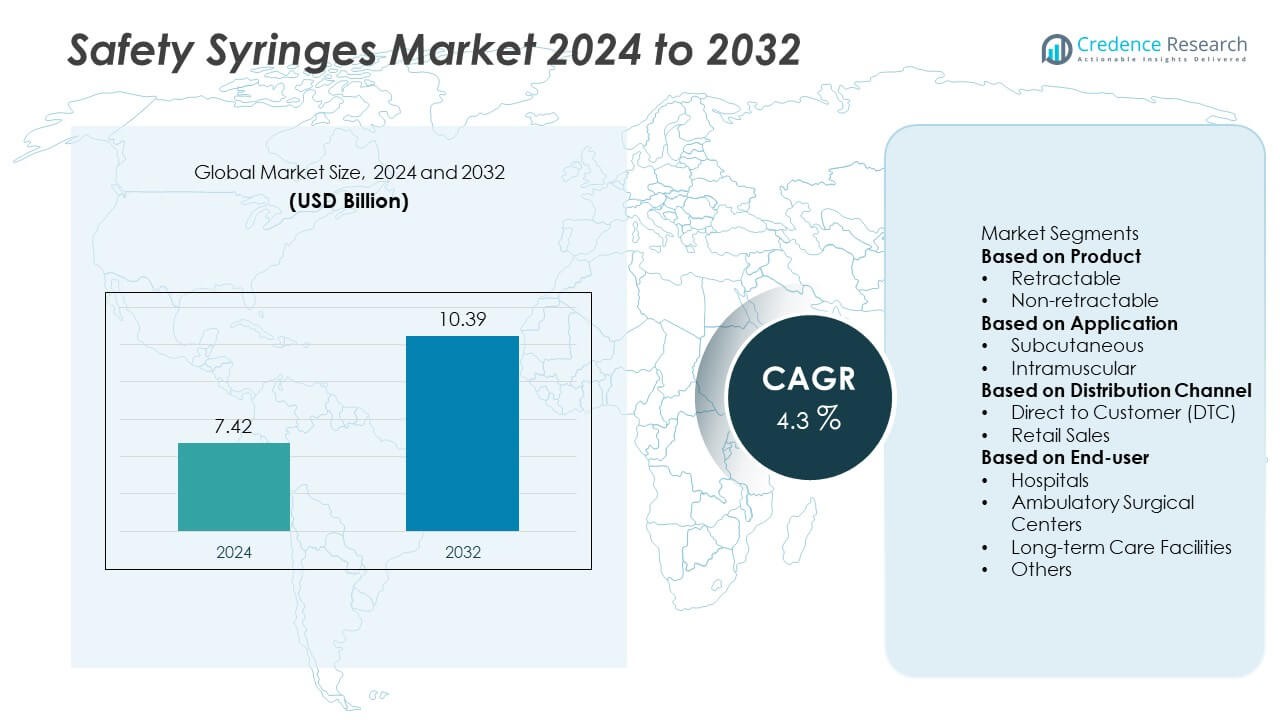

The global safety syringes market was valued at USD 7.42 billion in 2024 and is projected to reach USD 10.39 billion by 2032, registering a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Safety Syringes Market Size 2024 |

USD 7.42 Billion |

| Safety Syringes Market, CAGR |

4.3% |

| Safety Syringes Market Size 2032 |

USD 10.39 Billion |

The safety syringes market is led by prominent players such as Becton, Dickinson and Company (BD), Terumo Corporation, Smiths Medical, Nipro Corporation, Retractable Technologies, Inc., Gerresheimer AG, Medline Industries, LP, Hindustan Syringes & Medical Devices Ltd. (HMD), Baxter International Inc., and Cardinal Health, Inc. These companies dominate through innovative retractable and auto-disable syringe technologies that enhance healthcare worker safety and infection control. North America held the largest share of 36% in 2024, driven by advanced healthcare infrastructure and stringent safety mandates. Europe followed with 29%, supported by regulatory enforcement and hospital safety programs, while Asia Pacific accounted for 25%, fueled by expanding vaccination initiatives and domestic manufacturing growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global safety syringes market was valued at USD 7.42 billion in 2024 and is projected to reach USD 10.39 billion by 2032, registering a CAGR of 4.3% during 2025–2032.

- Rising awareness of needlestick injury prevention and strict regulatory mandates drive adoption of retractable and auto-disable syringes across hospitals and clinics.

- Increasing preference for eco-friendly and smart safety syringes with enhanced usability reflects a strong industry trend toward sustainable and connected healthcare solutions.

- Leading companies such as BD, Terumo, and HMD dominate the market through product innovation and large-scale vaccination support, while smaller players expand regional presence through cost-effective offerings.

- North America led with 36%, followed by Europe at 29% and Asia Pacific at 25%, while the retractable syringe segment held a 63% share, supported by global immunization programs and improved patient safety compliance.

Market Segmentation Analysis:

By Product

Retractable safety syringes dominated the market with a 63% share in 2024, driven by growing demand for enhanced needle safety and reduced risk of needlestick injuries. These syringes automatically retract the needle after use, minimizing contamination risk and supporting safe disposal. Increasing adoption in hospitals and vaccination programs boosts this segment’s growth. Non-retractable syringes, though cost-effective, are gradually losing ground due to stricter occupational safety guidelines. Ongoing product innovation and integration of automatic retraction mechanisms further strengthen the dominance of retractable safety syringes in global healthcare settings.

- For instance, Retractable Technologies, Inc. introduced the VanishPoint® 3 mL syringe featuring an auto-retracting mechanism that withdraws the needle into the barrel post-injection. The device eliminates needle reuse and complies with OSHA Bloodborne Pathogen Standards, offering enhanced safety during mass immunization and hospital injection procedures.

By Application

The intramuscular segment held a 58% share in 2024, making it the leading application category. Its dominance stems from extensive use in immunizations, antibiotics, and hormonal therapies that require deep tissue penetration. Safety syringes with retractable or protective mechanisms are increasingly preferred for these procedures to reduce accidental exposure. The subcutaneous segment, used for insulin and vaccine delivery, is growing steadily due to the expanding diabetic population. Enhanced precision, reduced injection pain, and self-administration convenience continue to drive demand in both application segments.

- For instance, Becton, Dickinson and Company (BD) launched its BD Integra™ 3 mL intramuscular syringe with a spring-based retracting needle. The clinician manually pushes the plunger rod to activate the retraction mechanism after the full injection is delivered, offering the choice to activate the safety feature either before or after withdrawing the needle from the patient.

By Distribution Channel

Retail sales accounted for a 54% share in 2024, emerging as the dominant distribution channel. Pharmacies, drug stores, and online platforms increasingly supply safety syringes to healthcare professionals and individuals for home-based treatments. Rising consumer awareness, e-commerce expansion, and availability of certified medical-grade syringes online have strengthened retail penetration. The direct-to-customer (DTC) channel is expanding with the growth of telemedicine and home healthcare services. However, retail networks remain the preferred choice due to broader access, competitive pricing, and reliable product availability.

Key Growth Drivers

Rising Needlestick Injury Prevention Initiatives

Global healthcare organizations are enforcing stricter safety regulations to reduce occupational exposure to bloodborne infections. The introduction of mandatory safety-engineered devices across hospitals and clinics has accelerated adoption of retractable syringes. Growing awareness among medical professionals and government-supported training programs further drive demand. Increased emphasis on infection control, supported by WHO and OSHA guidelines, continues to boost market growth for safety syringes with automatic retraction and protective mechanisms.

- For instance, ICU Medical, which acquired Smiths Medical in 2022, offers the Jelco® IntuitIV™ Safety I.V. Catheter. The device is a passive safety catheter with an integral needle tip-protector that automatically engages to cover the needle tip as it is withdrawn from the catheter.

Expanding Vaccination Programs Worldwide

Mass immunization campaigns are significantly increasing syringe consumption across both developed and emerging economies. The use of auto-disable and retractable syringes ensures patient safety and prevents reuse during vaccination drives. Global health organizations like UNICEF and GAVI support bulk procurement of safety syringes to improve compliance. This surge in immunization efforts, combined with national vaccination mandates, is expected to sustain steady demand for single-use safety syringes in the coming years.

- For instance, Hindustan Syringes & Medical Devices Ltd. (HMD) supplied over 1.2 billion auto-disable Kojak™ syringes for global immunization initiatives coordinated by UNICEF and WHO. Each syringe is designed to lock its plunger after a single injection, preventing reuse and ensuring safety during large-scale vaccination campaigns across more than 40 countries.

Growth in Home Healthcare and Self-Administration

The rise in chronic conditions such as diabetes and hormonal disorders is fueling demand for user-friendly injection devices. Patients increasingly prefer safety syringes for at-home administration due to their simplicity and lower risk of injury. Pharmaceutical companies are launching prefilled safety syringes compatible with self-use medications. Growing telemedicine adoption and expanding distribution through online pharmacies further accelerate this trend, making safety syringes a preferred option for home healthcare delivery.

Key Trends & Opportunities

Technological Integration and Smart Safety Mechanisms

Manufacturers are integrating advanced safety features such as automatic needle shielding, tamper indicators, and low-resistance plungers. Smart syringes with dose-tracking sensors and connectivity to digital platforms are emerging as next-generation products. These innovations enhance usability and compliance among healthcare professionals. Continuous product upgrades aligned with ISO standards present lucrative opportunities for manufacturers to differentiate their product portfolios in the global market.

- For instance, Gerresheimer AG developed its Gx InnoSafe® prefilled syringe system incorporating an integrated passive safety mechanism that activates automatically after injection without altering existing filling lines. The device supports 1 mL and 3 mL formats, includes a tamper-evident cap, and complies with ISO 11040-8 standards for prefillable glass syringes, ensuring safety and smart usability in hospital environments.

Rising Demand for Eco-Friendly Syringes

Growing environmental awareness is driving the shift toward recyclable and biodegradable syringe materials. Companies are developing eco-friendly syringes using medical-grade polypropylene and reduced plastic designs to lower disposal hazards. Adoption of sustainable manufacturing practices also improves brand reputation and regulatory compliance. Government support for green healthcare initiatives provides long-term growth potential for environmentally responsible safety syringe producers.

- For instance, Nipro Corporation manufactures disposable polypropylene syringes and has been recognized for its sustainability initiatives, which include broader environmental goals such as reducing energy consumption, improving recycling rates, and cutting CO₂ emissions across its operations.

Key Challenges

High Manufacturing and Product Cost

The integration of retractable and automatic safety mechanisms increases manufacturing complexity and costs. This makes safety syringes more expensive than conventional models, limiting adoption in price-sensitive regions. Small healthcare facilities and developing economies often prefer standard syringes due to budget constraints. Addressing this cost disparity through design optimization and local manufacturing remains a major challenge for market expansion.

Disposal and Waste Management Issues

Improper disposal of used syringes continues to pose environmental and public health risks. Even with safety features, challenges persist in segregating, sterilizing, and recycling syringe waste effectively. Inadequate waste management infrastructure in developing regions further complicates compliance with biohazard disposal regulations. Strengthening medical waste recycling systems and improving end-user awareness are essential to mitigate these challenges in the global safety syringes market.

Regional Analysis

North America

North America held the largest market share of 36% in 2024, driven by strong healthcare infrastructure and strict safety regulations from agencies such as OSHA and CDC. High adoption of advanced retractable syringes across hospitals and vaccination centers fuels market dominance. Growing prevalence of chronic diseases, increasing self-administration trends, and widespread vaccination programs strengthen regional demand. The presence of leading manufacturers in the U.S. further enhances product availability and innovation in needle safety technologies, reinforcing the region’s leadership in the safety syringes market.

Europe

Europe accounted for 29% of the global market in 2024, supported by stringent EU directives on needlestick injury prevention. Widespread integration of safety-engineered devices in hospitals under the EU Council Directive 2010/32/EU drives steady demand. Countries like Germany, France, and the U.K. invest in advanced syringe technologies and waste management systems to ensure healthcare worker safety. High awareness, continuous healthcare reforms, and favorable reimbursement frameworks further promote adoption across regional healthcare facilities.

Asia Pacific

Asia Pacific captured a 25% share in 2024, emerging as the fastest-growing regional market. Expanding immunization programs in India, China, and Japan are boosting demand for safe injection equipment. Increasing healthcare expenditure, government vaccination initiatives, and WHO-backed safety syringe mandates strengthen market penetration. Rapid growth of domestic syringe manufacturers enhances production capacity, lowering costs and improving regional accessibility. The region’s growing focus on infection control and local manufacturing policies continues to accelerate safety syringe adoption.

Latin America

Latin America represented a 6% market share in 2024, driven by expanding public health vaccination programs and infection prevention initiatives. Brazil and Mexico lead regional adoption due to their large healthcare networks and ongoing government efforts to standardize safe injection practices. Rising investments in healthcare infrastructure and collaborations with international organizations for immunization campaigns contribute to steady market expansion across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share in 2024, supported by gradual improvements in healthcare access and safety compliance. GCC countries such as Saudi Arabia and the UAE are increasingly implementing hospital safety standards, encouraging the use of retractable syringes. WHO and UNICEF-led vaccination drives in African nations are further boosting market demand. Limited local manufacturing, however, keeps the region dependent on imports, though ongoing health reforms are expected to drive future growth.

Market Segmentations:

By Product

- Retractable

- Non-retractable

By Application

- Subcutaneous

- Intramuscular

By Distribution Channel

- Direct to Customer (DTC)

- Retail Sales

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Long-term Care Facilities

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the safety syringes market is led by major players such as Becton, Dickinson and Company (BD), Terumo Corporation, Smiths Medical, Nipro Corporation, Retractable Technologies, Inc., Gerresheimer AG, Medline Industries, LP, Hindustan Syringes & Medical Devices Ltd. (HMD), Baxter International Inc., and Cardinal Health, Inc. These companies dominate through extensive product portfolios, strong global distribution networks, and continuous innovation in retractable and auto-disable syringe technologies. BD and Terumo maintain leadership positions through advanced product development and large-scale vaccination supply programs. Regional players such as HMD and Nipro focus on cost-effective production and local market expansion. Strategic collaborations with government health agencies, along with investments in sustainable and eco-friendly syringe manufacturing, further enhance their market presence. Continuous product upgrades and adherence to international safety standards sustain competitive intensity in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Becton, Dickinson and Company (BD)

- Terumo Corporation

- Smiths Medical

- Nipro Corporation

- Retractable Technologies, Inc.

- Gerresheimer AG

- Medline Industries, LP

- Hindustan Syringes & Medical Devices Ltd. (HMD)

- Baxter International Inc.

- Cardinal Health, Inc.

Recent Developments

- In July 2025, Terumo Corporation launched its Immucise™ Intradermal Injection System featuring a needle of 0.2 mm outside diameter and 1.15 mm length and designed for safer vaccine delivery into the dermal layer.

- In 2024, Hindustan Syringes & Medical Devices Ltd. inaugurated a new manufacturing line in India with capacity to produce 200 million safety syringes annually, supporting domestic vaccination and injection safety programmes.

- In September 2023, Sharps Technology acquired InjectEZ specialty copolymer syringe manufacturing facility to strengthen the company’s manufacturing capacity and expand its position in the syringe industry.

- In 2023, Terumo Corporation expanded its portfolio of syringes by launching insulin syringes for patients who require regular insulin injections.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for retractable safety syringes will continue to grow with stricter global safety norms.

- Integration of automatic retraction and smart tracking technologies will enhance syringe usability.

- Manufacturers will focus on eco-friendly and recyclable materials to meet sustainability goals.

- Expansion of vaccination programs worldwide will sustain steady market growth.

- Rising chronic disease cases will increase home-based self-administration using safety syringes.

- Partnerships between syringe makers and government health agencies will strengthen distribution networks.

- Local manufacturing initiatives in Asia and Africa will reduce import dependency.

- Product innovation will center on ergonomic design and single-handed operation.

- Stringent waste management and disposal regulations will influence syringe design upgrades.

- Growing healthcare investments in emerging economies will create new opportunities for market expansion.