Market Overview

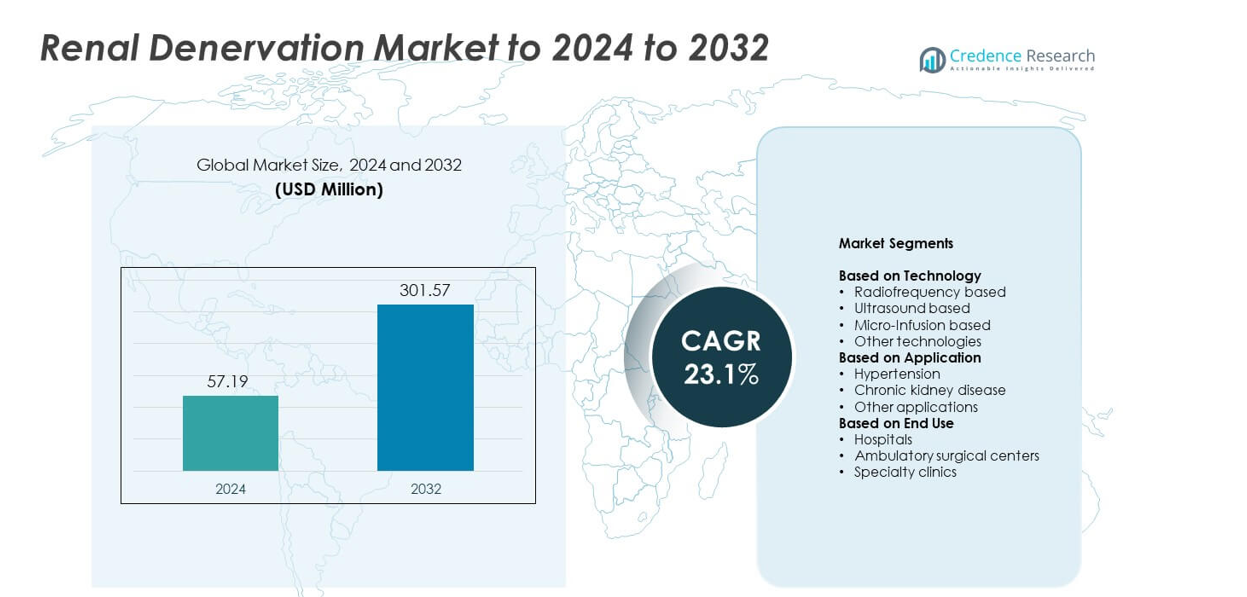

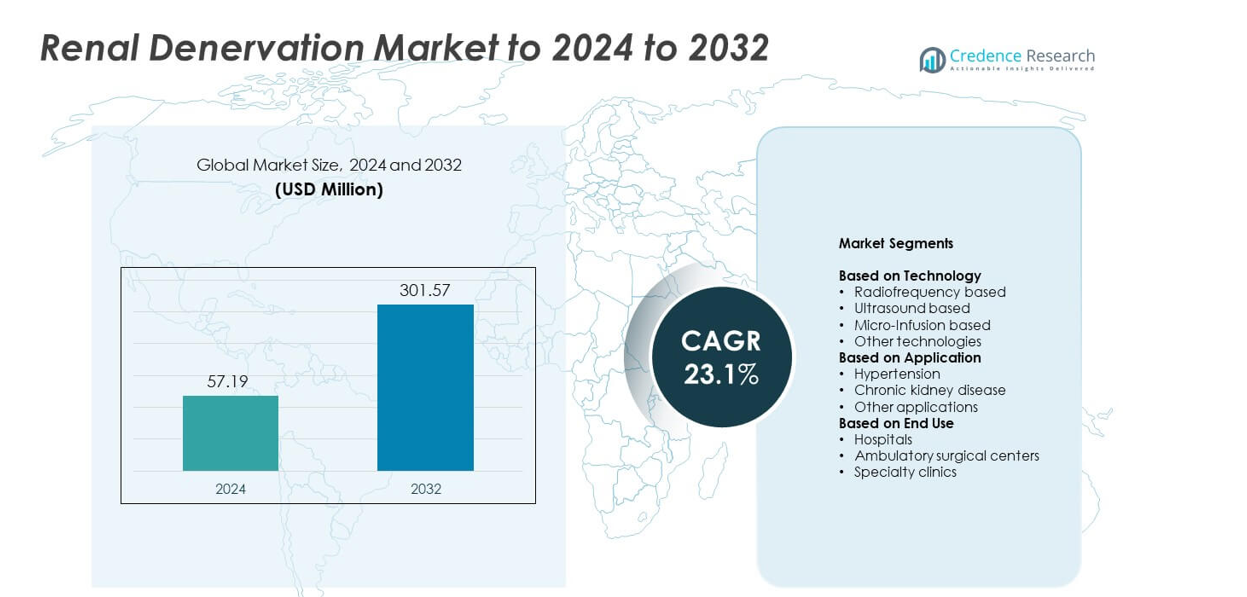

The renal denervation market size was valued at USD 57.19 million in 2024 and is anticipated to reach USD 301.57 million by 2032, at a CAGR of 23.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renal Denervation Market Size 2024 |

USD 57.19 million |

| Renal Denervation Market, CAGR |

23.1% |

| Renal Denervation Market Size 2032 |

USD 301.57 million |

The renal denervation market is led by major players such as Medtronic, Boston Scientific, Johnson & Johnson, Abbott, Terumo, Recor, Otsuka, Venus Medtech, Symple Surgical, and Ablative Solutions. These companies dominate through continuous product innovation, extensive clinical trials, and strong regulatory presence across global markets. They focus on enhancing catheter-based and energy-delivery technologies to improve procedural precision and patient outcomes. North America emerged as the leading region with a 38% market share in 2024, driven by advanced healthcare infrastructure, early technology adoption, and supportive reimbursement frameworks that encourage widespread procedural use and clinical integration.

Market Insights

- The renal denervation market was valued at USD 57.19 million in 2024 and is expected to reach USD 301.57 million by 2032, growing at a CAGR of 23.1%.

- Rising prevalence of treatment-resistant hypertension and increasing preference for minimally invasive procedures are key market drivers.

- Advancements in radiofrequency and ultrasound-based catheter technologies continue to shape market trends, improving safety and clinical efficiency.

- The market is highly competitive, with leading companies focusing on clinical validation, device innovation, and expanding regulatory approvals to strengthen global presence.

- North America led the market with a 38% share in 2024, followed by Europe at 31% and Asia Pacific at 22%, while the radiofrequency-based technology segment accounted for 64% of total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The radiofrequency-based segment dominated the renal denervation market with a 64% share in 2024. Its leadership is attributed to high procedural precision, shorter ablation times, and proven long-term efficacy in resistant hypertension cases. The technology’s minimally invasive approach reduces perioperative risks and enhances recovery outcomes. Major device manufacturers prioritize innovation in multi-electrode catheters and real-time feedback systems to improve renal nerve targeting. Growing clinical validation and favorable regulatory approvals continue to strengthen adoption across hospitals and specialty centers worldwide.

- For instance, Medtronic reported that three-year results from the SPYRAL HTN-ON MED trial showed a sustained reduction in office systolic blood pressure (OSBP) of 18.5 mmHg for the renal denervation (RDN) group compared to their baseline, confirming durable radiofrequency (RF) outcomes.

By Application

The hypertension segment held the largest market share of 72% in 2024, driven by the rising prevalence of treatment-resistant hypertension and the demand for non-pharmacological solutions. Renal denervation effectively lowers blood pressure in patients unresponsive to medication, supporting its clinical preference. Increasing awareness among physicians and expanding clinical trial evidence further promote procedure adoption. Additionally, continuous research demonstrating sustained efficacy and safety over long durations strengthens the segment’s growth potential within the global market.

- For instance, ReCor Medical’s RADIANCE II showed a −6.3 mmHg between-group difference in daytime ambulatory SBP at 2 months versus sham.

By End Use

Hospitals accounted for the dominant 58% share of the renal denervation market in 2024, supported by advanced infrastructure and availability of trained interventional cardiologists. These facilities are primary centers for conducting complex minimally invasive procedures and clinical trials. Hospitals also benefit from partnerships with device manufacturers for procedural training and technology integration. The rising number of hypertension and kidney disease cases managed in hospital settings reinforces demand for renal denervation procedures, driving the segment’s continued expansion.

Key Growth Drivers

Rising Burden of Treatment-Resistant Hypertension

The growing prevalence of treatment-resistant hypertension is a major driver for the renal denervation market. An increasing number of patients fail to achieve adequate blood pressure control with conventional drugs, creating demand for alternative therapies. Renal denervation offers durable blood pressure reduction and complements pharmacological treatment. Global health authorities emphasize early intervention, further promoting adoption. This rising patient pool directly supports procedure volume growth and encourages continued investment in device innovation.

- For instance, an AHA analysis of the 2009–2014 NHANES data reported that the prevalence of apparent treatment-resistant hypertension among US adults taking antihypertensive medication was 19.7%, or 10.3 million people, when applying the definition from the 2018 AHA Scientific Statement.

Advancements in Catheter-Based Technologies

Rapid technological innovation in catheter design and energy delivery systems enhances procedural accuracy and safety. Modern multi-electrode and ultrasound-based catheters ensure uniform ablation and minimize renal artery damage. These advancements improve clinical outcomes and shorten recovery time, driving preference among physicians. Continuous R&D efforts by leading manufacturers expand the range of compatible devices, boosting procedural confidence and patient acceptance. This technological progress remains a critical enabler of market expansion.

- For instance, Terumo’s IBERIS-HTN trial showed a −9.4 mmHg between-group difference in 24-hour SBP at 6 months, with 217 randomized patients.

Expanding Clinical Evidence and Regulatory Approvals

Increasing clinical trial success and regulatory clearances in major markets accelerate global adoption. Studies demonstrating consistent blood pressure reduction and long-term efficacy have strengthened physician confidence. Favorable outcomes from pivotal trials have led to broader approvals in Europe, the U.S., and Asia Pacific. This expanding evidence base drives institutional adoption and supports reimbursement inclusion, improving accessibility for patients worldwide. Regulatory momentum and medical validation collectively reinforce market growth.

Key Trends & Opportunities

Integration of Renal Denervation in Combination Therapy

A major trend involves integrating renal denervation with pharmacological treatment for improved hypertension control. Physicians are increasingly adopting hybrid management approaches to achieve stable long-term results. Combining denervation with antihypertensive drugs reduces overall pill burden and enhances patient compliance. This synergy is gaining traction in clinical protocols and expanding the therapy’s application scope across patient segments.

- For instance, SyMap Medical’s SMART trial achieved office SBP <140 mmHg with ~4 targeted ablations per main renal artery and reduced drug burden.

Growing Adoption of Ultrasound-Based Systems

Ultrasound-based renal denervation systems are gaining rapid acceptance due to precision and minimal invasiveness. These systems enable circumferential ablation with reduced procedural time compared to radiofrequency alternatives. Their ability to deliver controlled energy with minimal arterial injury enhances safety profiles. Increased physician familiarity and ongoing product launches are expanding ultrasound-based system penetration, presenting significant growth opportunities for manufacturers.

- For instance, Otsuka Medical Devices’ Paradise uRDN reported mean 5.6 sonications, total 38.9 seconds energy, and 98.7% bilateral ablation in RADIANCE II.

Key Challenges

High Procedure Cost and Limited Reimbursement

The high procedural cost and lack of consistent reimbursement frameworks remain key challenges for widespread adoption. Many healthcare systems consider renal denervation a premium procedure, restricting patient accessibility. Limited insurance coverage discourages hospital integration and delays large-scale deployment. Addressing these financial barriers through reimbursement expansion and cost-efficient device production is essential for market sustainability.

Variability in Clinical Outcomes Across Studies

Inconsistent results in early-stage clinical trials have affected confidence among healthcare providers. Differences in patient selection, procedural technique, and device design contribute to variable efficacy rates. Although newer studies show improvement, skepticism persists in some regions. Strengthening standardization of procedural protocols and enhancing operator training will be crucial to achieving uniform clinical success globally.

Regional Analysis

North America

North America led the renal denervation market with a 38% share in 2024. The region benefits from strong clinical adoption, advanced healthcare infrastructure, and early regulatory approvals. Increasing prevalence of treatment-resistant hypertension and favorable reimbursement policies further strengthen market expansion. The United States dominates due to extensive clinical trial activity and active participation by major device manufacturers. Canada also shows growing adoption driven by rising awareness of minimally invasive hypertension management. Continuous product innovations and physician training programs support sustained regional growth.

Europe

Europe accounted for 31% of the renal denervation market in 2024, supported by strong regulatory backing and wide clinical acceptance. Countries such as Germany, France, and the United Kingdom lead in adoption due to early CE-marked product availability. The region’s robust healthcare infrastructure and focus on non-pharmacological hypertension solutions boost demand. Expanding clinical data and government initiatives promoting innovative cardiovascular treatments further drive market penetration. Ongoing clinical trials and partnerships between hospitals and technology providers continue to enhance Europe’s market position.

Asia Pacific

Asia Pacific captured a 22% share of the renal denervation market in 2024, driven by rising hypertension cases and growing healthcare investments. China, Japan, and India are key contributors, supported by improving access to advanced cardiac care. Increasing awareness of minimally invasive procedures and the expansion of private healthcare networks foster regional growth. Local manufacturers are entering the segment through partnerships with global device makers. Rising government focus on hypertension screening programs also enhances procedural adoption across the region.

Latin America

Latin America held a 6% market share in 2024, supported by gradual adoption of advanced hypertension therapies. Brazil and Mexico are leading markets, benefiting from expanding private healthcare facilities and improving physician expertise. Awareness campaigns about resistant hypertension are promoting the use of renal denervation procedures. However, limited reimbursement coverage and higher device costs restrict faster penetration. Efforts to expand regional clinical studies and collaborations with international device suppliers are expected to enhance accessibility in the coming years.

Middle East & Africa

The Middle East and Africa region accounted for a 3% share of the renal denervation market in 2024. Growth is driven by improving healthcare infrastructure, rising cardiovascular disease prevalence, and adoption of modern treatment technologies in Gulf countries. The United Arab Emirates and Saudi Arabia are key growth centers due to expanding hospital capacities and supportive government health initiatives. However, low procedural awareness and limited specialist availability in parts of Africa slow adoption. Increasing investments in tertiary care facilities are expected to support steady regional growth.

Market Segmentations:

By Technology

- Radiofrequency based

- Ultrasound based

- Micro-Infusion based

- Other technologies

By Application

- Hypertension

- Chronic kidney disease

- Other applications

By End Use

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The renal denervation market is dominated by key players such as Medtronic, Boston Scientific, Johnson & Johnson, Abbott, Terumo, Recor, Otsuka, Venus Medtech, Symple Surgical, and Ablative Solutions. The competitive landscape is characterized by strong emphasis on clinical validation, product innovation, and global expansion. Leading companies are investing heavily in next-generation catheter systems and energy delivery technologies to enhance procedural accuracy and long-term safety. Continuous clinical trials across the U.S., Europe, and Asia Pacific aim to strengthen regulatory positions and support reimbursement inclusion. Strategic collaborations with hospitals and research institutions accelerate technology integration and physician training. Companies are also focusing on cost-efficient solutions and miniaturized devices to expand adoption in emerging markets. The growing shift toward minimally invasive cardiovascular treatments and positive clinical outcomes continue to intensify competition, driving rapid advancements and wider procedural acceptance in the global renal denervation market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Medtronic received FDA approval for its Symplicity Spyral Renal Denervation System, an innovative, minimally invasive procedure using radiofrequency (RF) energy to treat hypertension.

- In 2023, Recor Medical’s Paradise Ultrasound Renal Denervation System received FDA approval. Its approval was supported by positive results from the RADIANCE II and other clinical trials, which showed sustained blood pressure reduction compared to a sham procedure.

- In 2023, Ablative Solutions announced its Peregrine System Kit had met its primary endpoint in the TARGET BP I pivotal trial. The system uses alcohol to perform RDN, and the trial showed a statistically significant reduction in ambulatory blood pressure compared to a sham procedure.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The renal denervation market will expand rapidly with growing clinical validation worldwide.

- Integration of renal denervation into standard hypertension treatment protocols will increase.

- Advancements in catheter and energy delivery technology will improve procedural safety.

- Wider regulatory approvals across major markets will accelerate global commercialization.

- Rising awareness among cardiologists and nephrologists will enhance adoption rates.

- Development of cost-efficient systems will support accessibility in emerging economies.

- Expansion of reimbursement frameworks will strengthen patient acceptance and hospital use.

- Increasing collaboration between device manufacturers and research institutes will boost innovation.

- Clinical data demonstrating long-term efficacy will drive sustained market confidence.

- Growing investments in minimally invasive cardiovascular therapies will reinforce overall market growth.