Market Overview:

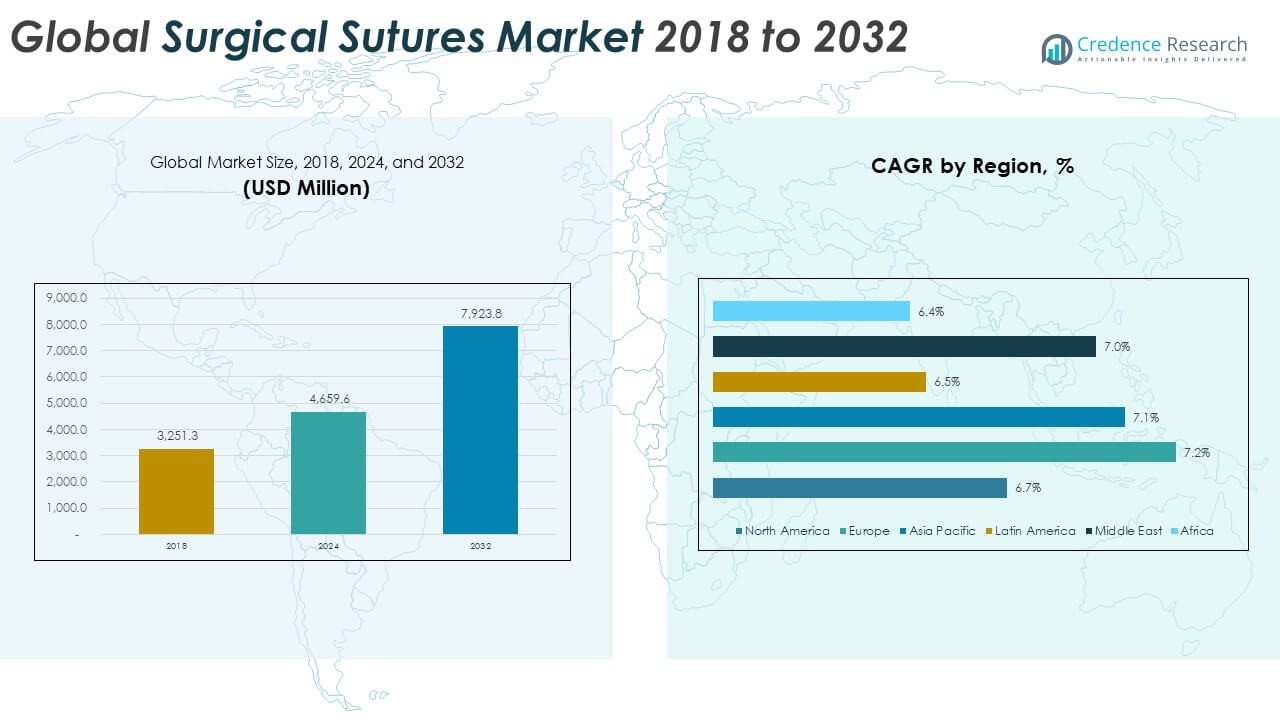

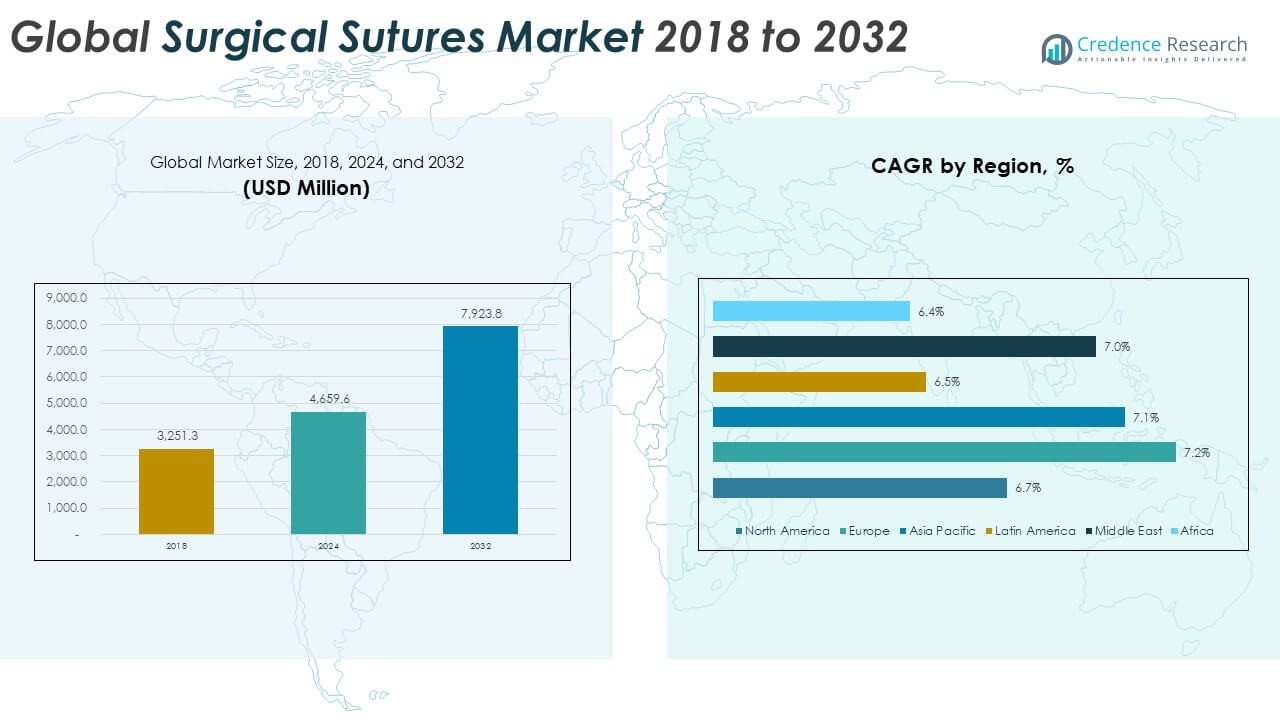

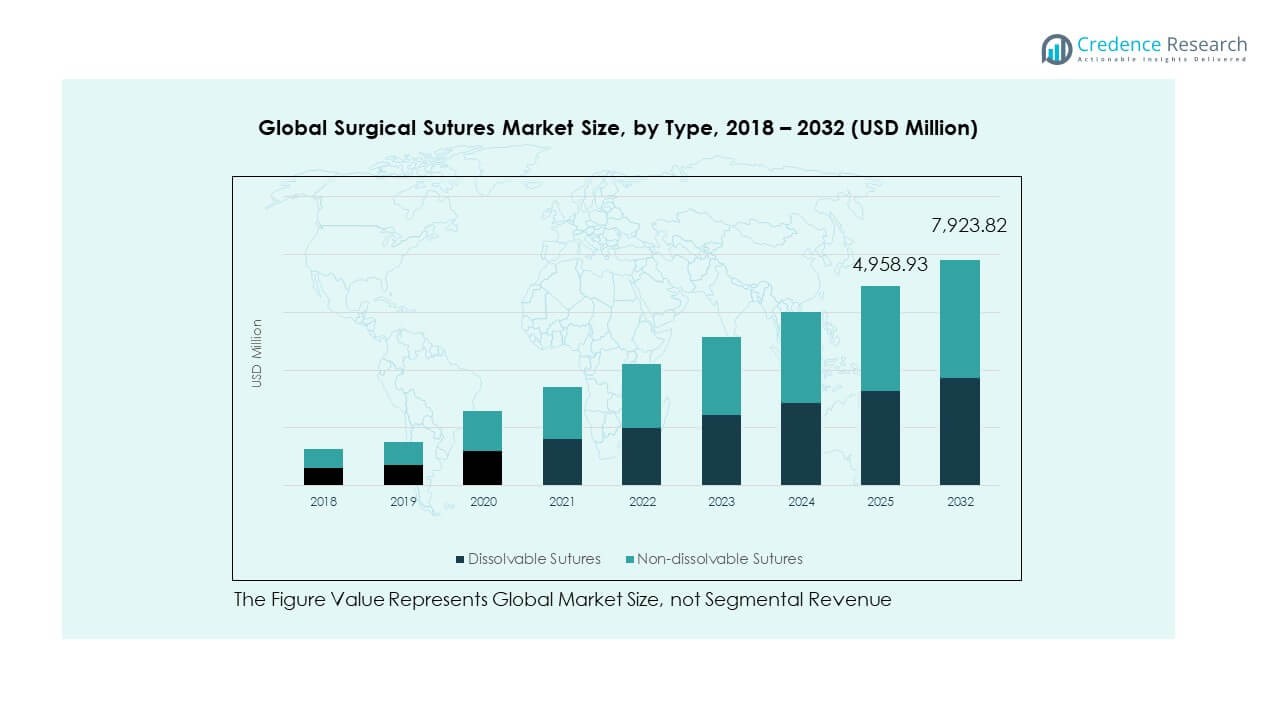

The Global Surgical Sutures Market size was valued at USD 3,251.3 million in 2018 to USD 4,659.6 million in 2024 and is anticipated to reach USD 7,923.8 million by 2032, at a CAGR of 6.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical Sutures Market Size 2024 |

USD 4,659.6 Million |

| Surgical Sutures Market, CAGR |

6.92% |

| Surgical Sutures Market Size 2032 |

USD 7,923.8 Million |

The market growth is driven by increasing surgical procedures worldwide, supported by rising cases of chronic diseases, trauma injuries, and cosmetic surgeries. Advancements in suture materials, such as absorbable and antimicrobial-coated sutures, improve wound healing and reduce infection risks. Growing demand for minimally invasive and robotic-assisted surgeries also strengthens product adoption across hospitals and surgical centers.

North America dominates the market due to high surgical volumes, advanced healthcare systems, and strong presence of major medical device companies. Europe follows closely, supported by growing healthcare spending and aging populations. The Asia Pacific region is emerging rapidly, driven by expanding healthcare infrastructure, increasing access to surgical care, and government initiatives promoting medical advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Surgical Sutures Market was valued at USD 3,251.3 million in 2018, reached USD 4,659.6 million in 2024, and is projected to hit USD 7,923.8 million by 2032, expanding at a CAGR of 6.92%.

- North America holds the largest share at 33%, driven by strong surgical infrastructure, advanced technology adoption, and the presence of key manufacturers. Europe follows with 28% share, supported by robust healthcare spending and innovation in absorbable sutures. Asia Pacific contributes 27%, fueled by rapid healthcare expansion and growing medical tourism.

- Asia Pacific is the fastest-growing region with a CAGR of 7.1%, led by rising surgical volumes, growing hospital investments, and government initiatives enhancing public healthcare systems.

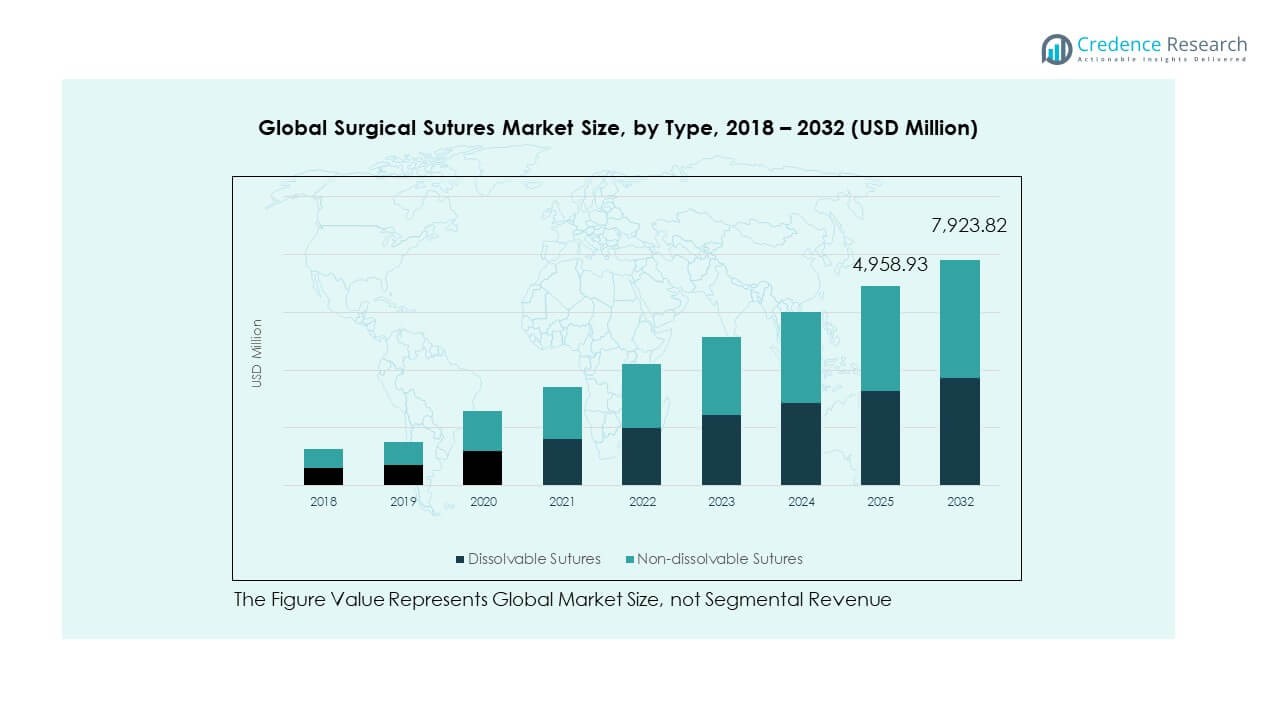

- Dissolvable sutures account for approximately 63% of the total market share, supported by their self-absorbing nature and preference in internal and minimally invasive surgeries.

- Non-dissolvable sutures represent about 37% share, driven by their high tensile strength and longer durability required for orthopedic and cardiovascular procedures.

Market Drivers:

Rising Surgical Procedures and Chronic Disease Burden

The Global Surgical Sutures Market is expanding due to the growing number of surgical procedures driven by chronic diseases such as cardiovascular disorders, cancer, and diabetes. Rising trauma and accident cases further create demand for efficient wound closure materials. Increasing preference for early surgical intervention supports market growth across developed and developing regions. It benefits from hospital infrastructure upgrades and the expansion of specialty surgical centers. The need for improved patient outcomes accelerates innovation in absorbable sutures. Growing awareness about surgical site infection prevention boosts product adoption. Rising medical tourism, especially in Asia and Latin America, contributes to market expansion. The combination of demographic shifts and healthcare access supports long-term growth.

- For instance, Ethicon’s Plus Sutures, coated with triclosan, have been recommended by the World Health Organization based on evidence showing their ability to inhibit suture bacterial colonization for seven days or more, helping to significantly lower the risk of surgical site infection, as demonstrated in numerous randomized controlled trials and meta-analyses published between 2008 and 2023.

Technological Advancements in Suture Materials and Designs

Continuous development of advanced suture materials is a strong growth driver. Modern sutures feature coatings that enhance biocompatibility and promote tissue healing. Absorbable sutures made from synthetic polymers are gaining popularity over traditional materials. The integration of antimicrobial coatings minimizes infection risk and improves recovery rates. Knotless barbed sutures reduce surgical time and improve precision in wound closure. It benefits from automation in suture production and innovation in packaging systems. The rising use of robotic and laparoscopic surgeries encourages the use of specialized sutures. Demand for materials compatible with next-generation surgical techniques continues to increase globally.

- For instance, a recent study published in a peer-reviewed medical journal investigated the efficacy of a new surgical technique for wound closure, finding a statistically significant reduction in operative time compared to the standard method.

Rising Adoption of Minimally Invasive and Cosmetic Surgeries

The growing trend toward minimally invasive and cosmetic procedures fuels demand for advanced sutures. These surgeries require fine and precise wound closure systems that ensure aesthetic outcomes. Surgeons prefer sutures offering minimal scarring and strong tensile strength. The shift toward patient-centric care encourages the use of biocompatible materials with quick absorption rates. It benefits from higher disposable income and growing awareness of personal appearance. Increasing access to aesthetic and reconstructive surgeries across Asia Pacific strengthens the market outlook. Hospitals are adopting sutures that support faster healing and reduced postoperative complications. The growing influence of social and lifestyle factors reinforces this segment’s expansion.

Growing Focus on Postoperative Care and Safety Standards

Rising focus on patient safety and postoperative care has led to higher adoption of surgical sutures meeting strict regulatory standards. Hospitals emphasize wound management protocols to reduce complications and hospital stay durations. It benefits from collaboration between healthcare institutions and manufacturers to develop high-performance products. Regulatory agencies such as the FDA and EMA promote innovation through material approvals. The demand for sutures with enhanced safety profiles strengthens global sales. Training programs for surgeons on suture application techniques support better patient outcomes. Growing investment in healthcare infrastructure drives market penetration in emerging regions. Awareness campaigns highlighting sterile and high-quality products further aid market growth.

Market Trends:

Growing Integration of Smart and Biodegradable Sutures

Manufacturers are developing smart sutures that monitor wound healing and deliver drugs locally. These innovations improve patient recovery and reduce hospital readmissions. The trend toward biodegradable and environment-friendly materials is gaining traction. Sutures designed to dissolve naturally without removal are preferred in modern surgical practice. It benefits from rising awareness about sustainability in medical consumables. Research in polymer science is leading to new composite materials with improved elasticity and strength. Integration of biosensors with sutures supports post-surgical monitoring in complex procedures. The convergence of healthcare and material technology is shaping the market’s innovation trajectory.

- For instance, in 2023, MIT and collaborating partners engineered smart tissue-derived biosensor sutures able to detect local inflammation and monitor healing progression, harnessing wireless electronic sensors for timely post-surgical infection detection and real-time tracking of tissue response.

Surge in Demand for Absorbable and Antimicrobial Sutures

Absorbable sutures are increasingly replacing traditional non-absorbable variants due to their convenience and safety. Their ability to dissolve within the body minimizes follow-up visits and improves patient satisfaction. Antimicrobial-coated sutures reduce the risk of infection and improve healing outcomes. It benefits from rising awareness about infection control in hospitals. Surgeons favor these products for critical and high-risk surgeries. Continuous R&D focuses on coating formulations that enhance antibacterial efficacy. The global push toward infection-free surgical environments drives this trend further. Growing hospital infrastructure modernization supports widespread adoption across regions.

Digitalization and Robotics in Surgical Applications

The adoption of robotic and computer-assisted surgeries is transforming the use of surgical sutures. Advanced robots require sutures with higher precision, consistency, and tensile strength. It benefits from the increasing use of automation in complex surgical procedures. Integration of digital control systems ensures uniform suture placement and minimal human error. Manufacturers are tailoring product designs to meet robotic system requirements. This trend improves surgical accuracy and shortens patient recovery time. The combination of robotics and smart materials represents a major innovation path. Growing training in robotic surgery techniques further enhances demand.

Shift Toward Personalized and Specialty Sutures

Surgeons are demanding sutures customized for specific surgical needs, such as ophthalmic, cardiovascular, or orthopedic applications. Personalized products improve compatibility with tissue types and healing rates. It benefits from advancements in 3D printing and custom polymer formulations. Specialty sutures designed for aesthetic and pediatric surgeries are gaining market traction. Hospitals prefer suppliers offering diverse product ranges with clinical validation. Manufacturers are focusing on tailor-made solutions for complex procedures. The shift toward personalized medicine supports this growing customization trend. Strategic collaborations between healthcare providers and manufacturers strengthen specialty product innovation.

Market Challenges Analysis:

Rising Competition and Pricing Pressure Among Manufacturers

The Global Surgical Sutures Market faces intense price competition among major and regional players. High production costs, coupled with pressure to offer affordable solutions, limit profitability. It faces challenges from low-cost manufacturers entering emerging economies. Hospitals often prefer cost-effective alternatives, creating margin compression for premium brands. Raw material price fluctuations further affect production stability. Stringent quality requirements demand continuous compliance investments. Maintaining differentiation through innovation becomes increasingly difficult in a price-sensitive market. Growing availability of substitutes like surgical staples and tissue adhesives also impacts demand.

Stringent Regulatory Frameworks and Risk of Surgical Complications

Regulatory approvals for new suture materials require extensive clinical data and compliance documentation. It slows market entry for innovative products and increases costs for manufacturers. Any product recall or performance issue can damage brand reputation significantly. The risk of suture-related infections or allergic reactions creates concerns among end users. Manufacturers must adhere to international standards, increasing operational complexity. Limited surgeon training in new suture technologies restricts rapid adoption. The lack of standardization across regions adds further regulatory challenges. Balancing safety, innovation, and cost-efficiency remains a persistent obstacle.

Market Opportunities:

Expanding Healthcare Infrastructure in Emerging Economies

The Global Surgical Sutures Market benefits from rapid healthcare development in Asia Pacific, Latin America, and the Middle East. Expanding hospital networks and increasing surgical capacities drive strong product demand. Governments are investing heavily in healthcare modernization and local production facilities. It gains from rising public health awareness and access to affordable surgeries. Growing medical tourism and favorable reimbursement policies attract new investments. Local manufacturers entering the market help reduce import dependence. The adoption of advanced wound care products supports continued growth.

Innovation in Smart and Biocompatible Suture Technologies

The growing trend toward smart and biocompatible sutures offers new business potential. Integration of sensors and drug delivery properties improves treatment outcomes. It gains from collaboration between material scientists and device manufacturers. Demand for biodegradable and multifunctional sutures is increasing across healthcare settings. Startups and established players are focusing on product differentiation through innovation. The development of next-generation polymers enhances product flexibility and healing efficiency. Global R&D initiatives are expected to open new growth avenues for manufacturers.

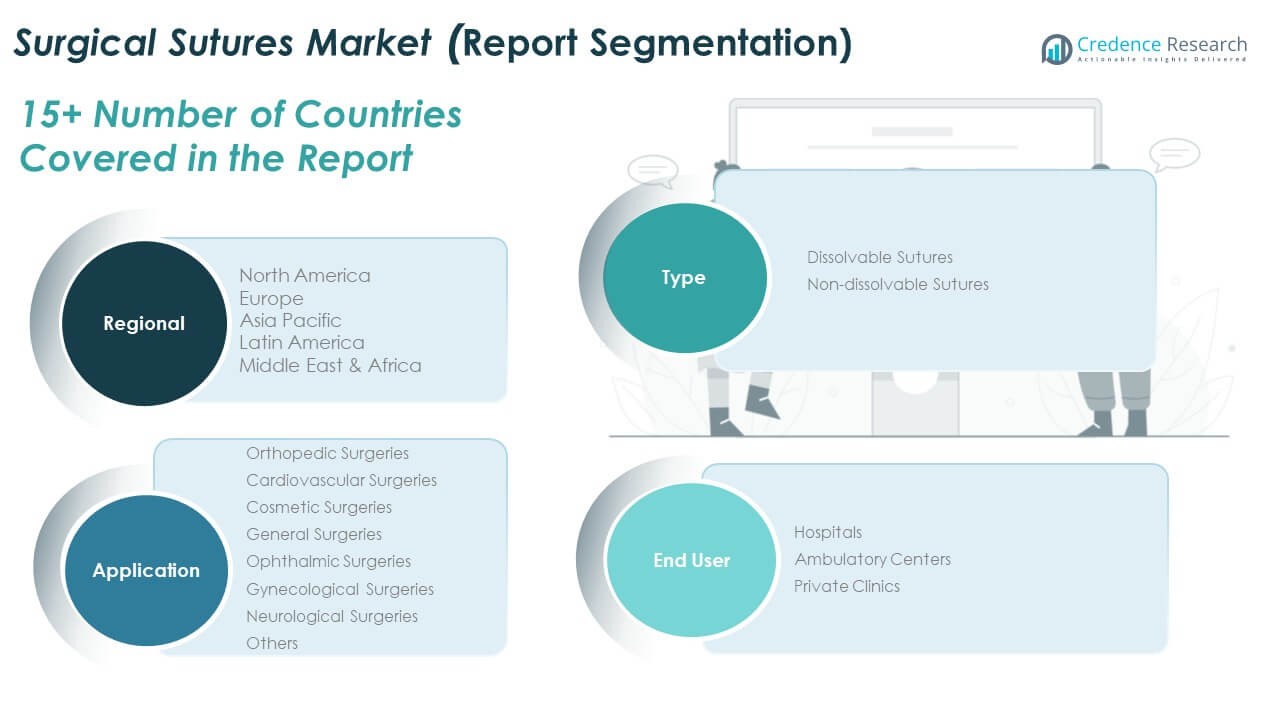

Market Segmentation Analysis:

By Type

The Global Surgical Sutures Market is segmented into dissolvable and non-dissolvable sutures. Dissolvable sutures dominate due to their ability to naturally degrade in the body, reducing the need for removal and postoperative visits. They are preferred in internal tissue repair and minimally invasive surgeries for better healing outcomes. Non-dissolvable sutures remain important in long-term tissue support, particularly in orthopedic and cardiovascular surgeries. Their high tensile strength and durability make them suitable for applications requiring extended wound stability. Continuous innovations in material coatings and biocompatibility strengthen both categories.

- For instance, commercial studies confirm that dissolvable stitches manufactured from synthetic polymers are preferred for multi-layer closure and minimize follow-up removal visits—as affirmed by clinical recommendations and major market reports in 2023 and 2024.

By Application

The market covers diverse surgical applications, including orthopedic, cardiovascular, cosmetic, general, ophthalmic, gynecological, neurological, and other surgeries. Orthopedic and cardiovascular surgeries account for significant revenue due to the rising incidence of trauma and heart-related disorders. Cosmetic surgeries are expanding rapidly with growing aesthetic awareness. General and gynecological surgeries sustain consistent demand in hospitals worldwide. Ophthalmic and neurological procedures are adopting advanced fine sutures to ensure precision and minimal tissue trauma. The broad clinical use of sutures supports overall market growth.

- For instance, advances in ophthalmic sutures have driven market growth in North America—where the ophthalmic sutures sector was valued at USD 467 million in 2024—and recent clinical reports highlight improved biocompatibility, smaller sizes for sensitive tissues, and precision for procedures such as corneal transplantation and retinal surgeries.

By End User

Hospitals hold the largest market share due to high patient inflow, advanced infrastructure, and the availability of specialized surgical departments. Ambulatory centers are witnessing fast growth driven by cost-effective outpatient procedures and quick recovery timelines. Private clinics play a growing role in elective and cosmetic surgeries, emphasizing patient comfort and personalized care. It benefits from a diversified end-user base, ensuring consistent demand across healthcare settings globally.

Segmentation:

By Type

- Dissolvable Sutures

- Non-Dissolvable Sutures

By Application

- Orthopedic Surgeries

- Cardiovascular Surgeries

- Cosmetic Surgeries

- General Surgeries

- Ophthalmic Surgeries

- Gynecological Surgeries

- Neurological Surgeries

- Others

By End User

- Hospitals

- Ambulatory Centers

- Private Clinics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Surgical Sutures Market size was valued at USD 1,073.59 million in 2018 to USD 1,520.01 million in 2024 and is anticipated to reach USD 2,542.75 million by 2032, at a CAGR of 6.7% during the forecast period. North America holds around 33% share of the global market. Strong healthcare infrastructure, high surgical volumes, and early adoption of advanced medical technologies drive growth across the region. The presence of leading players such as Medtronic, Johnson & Johnson, and B. Braun supports product innovation and market penetration. It benefits from favorable reimbursement systems and high awareness about infection control. The U.S. remains the primary contributor due to its growing aging population and rising elective surgeries. Canada and Mexico show increasing demand driven by improving healthcare access. Continued investments in minimally invasive surgery technologies sustain the region’s leadership position.

Europe

The Europe Global Surgical Sutures Market size was valued at USD 805.68 million in 2018 to USD 1,174.61 million in 2024 and is anticipated to reach USD 2,042.76 million by 2032, at a CAGR of 7.2% during the forecast period. Europe accounts for about 28% of the global market share. Growing demand for surgical interventions linked to cardiovascular and orthopedic conditions fuels market expansion. Rising awareness about wound care and surgical infection prevention strengthens product adoption. Germany, France, and the UK are the leading countries due to strong hospital infrastructure and healthcare spending. It benefits from technological advancements in biodegradable and antimicrobial sutures. The aging population and rise in outpatient surgeries also support consistent growth. Ongoing clinical research and government-backed medical innovation programs further enhance the regional outlook.

Asia Pacific

The Asia Pacific Global Surgical Sutures Market size was valued at USD 855.75 million in 2018 to USD 1,236.38 million in 2024 and is anticipated to reach USD 2,125.17 million by 2032, at a CAGR of 7.1% during the forecast period. Asia Pacific represents around 27% of the total market share. Rapid healthcare infrastructure development, increasing surgical procedures, and expanding medical tourism drive market growth. China, Japan, and India lead the region with growing healthcare investments and demand for advanced surgical consumables. It benefits from government initiatives to improve public health systems. The adoption of absorbable sutures is increasing due to their cost-effectiveness and ease of use. Expanding training programs for surgeons improve procedural quality and adoption rates. Growing private healthcare facilities strengthen the region’s contribution to global revenue.

Latin America

The Latin America Global Surgical Sutures Market size was valued at USD 238.00 million in 2018 to USD 332.49 million in 2024 and is anticipated to reach USD 545.95 million by 2032, at a CAGR of 6.5% during the forecast period. Latin America accounts for roughly 7% of the global market. Rising healthcare investments and expanding access to advanced medical procedures boost regional demand. Brazil dominates the market, supported by growing cosmetic and general surgeries. Mexico and Argentina follow with increased focus on surgical training and hospital modernization. It benefits from favorable government initiatives improving healthcare infrastructure. The growing presence of international medical device manufacturers enhances product availability. Expanding middle-class populations with higher health awareness also contribute to steady market expansion.

Middle East

The Middle East Global Surgical Sutures Market size was valued at USD 187.93 million in 2018 to USD 270.12 million in 2024 and is anticipated to reach USD 461.17 million by 2032, at a CAGR of 7.0% during the forecast period. The region represents nearly 4% of the global share. Growing healthcare expenditure and investments in hospital infrastructure drive market demand. GCC countries are leading due to large-scale healthcare reforms and advanced surgical centers. It benefits from increasing demand for wound care and elective surgeries. Israel and Turkey also contribute through innovation in medical device technologies. The adoption of modern suturing materials improves procedural efficiency and healing outcomes. Growing medical tourism and government partnerships with global suppliers strengthen market dynamics.

Africa

The Africa Global Surgical Sutures Market size was valued at USD 90.39 million in 2018 to USD 125.94 million in 2024 and is anticipated to reach USD 206.02 million by 2032, at a CAGR of 6.4% during the forecast period. Africa holds around 3% of the global market. Rising incidence of trauma, infectious diseases, and chronic disorders is increasing the need for surgical interventions. South Africa leads due to better healthcare infrastructure and higher surgical volumes. Egypt and Nigeria are emerging with ongoing public health investments. It benefits from global collaborations aiming to enhance surgical standards and material availability. Growth in regional medical training programs supports skill development among surgeons. Increasing adoption of basic wound management solutions strengthens local healthcare systems. Expansion of healthcare funding continues to enhance future market potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Solventum

- Medtronic

- Demetech Corporation

- Endoevolution LLC

- Johnson and Johnson Services, Inc.

- Braun

- Surgical Sutures Private Limited

- Lotus Surgical

- Life Line Sutures

- Orion Sutures

Competitive Analysis:

The Global Surgical Sutures Market is highly competitive, characterized by strong product portfolios, extensive R&D investments, and technological innovation. Leading players such as Johnson & Johnson, Medtronic, and B. Braun focus on expanding their surgical product ranges and strengthening distribution networks. It emphasizes product differentiation through antimicrobial coatings, absorbable materials, and biocompatible polymers. Regional manufacturers also contribute by offering cost-effective solutions to meet local demands. The market’s competition encourages consistent innovation, improved performance standards, and greater product safety. Strategic partnerships, acquisitions, and expansion into emerging markets are shaping the industry’s growth direction.

Recent Developments:

- In August 2025, Solventum completed the sale of its purification and filtration business to Thermo Fisher Scientific, a strategic divestment aiming to focus more on advanced wound care and surgical products, which includes their surgical sutures line. While not a product launch, this transaction directly impacts how Solventum will prioritize innovation and portfolio expansion in the surgical space.

- In September 2025, B. Braun completed the full acquisition of True Digital Surgery (TDS), a leader in digital robotic-assisted 3D surgical microscopy. With this move, B. Braun expanded its capabilities in advanced microsurgery solutions for neuro, spine, and ENT surgery, reinforcing its position as a leader in digital surgical technologies—closely related to their suture product ecosystem.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand for advanced absorbable sutures will drive innovation in biomaterials.

- Technological advances in coating and tensile strength will enhance product performance.

- Rising surgical procedures in developing regions will expand market penetration.

- Growing focus on infection control will boost antimicrobial suture demand.

- The adoption of smart sutures with drug-delivery capabilities will gain momentum.

- Mergers and acquisitions among key players will strengthen global presence.

- Robotic and minimally invasive surgeries will create new product design needs.

- Hospitals’ preference for cost-effective, high-quality sutures will intensify competition.

- Expanding regulatory harmonization will facilitate smoother international trade.

- Continuous R&D investment will sustain long-term growth and innovation cycles.