| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| A-(2-Chlorophenyl)-Glycine Market Size 2024 |

USD 1,966.69 Million |

| A-(2-Chlorophenyl)-Glycine Market, CAGR |

6.73% |

| A-(2-Chlorophenyl)-Glycine Market Size 2032 |

USD 3,438.29 Million |

Market Overview

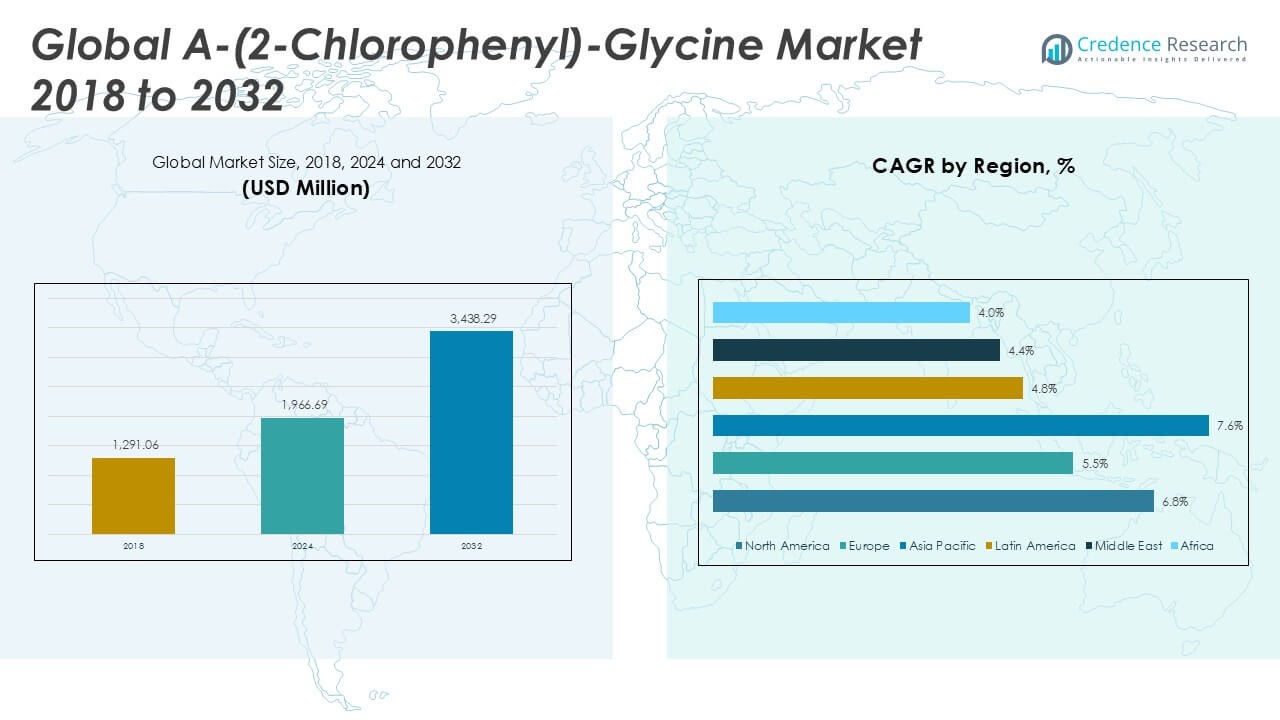

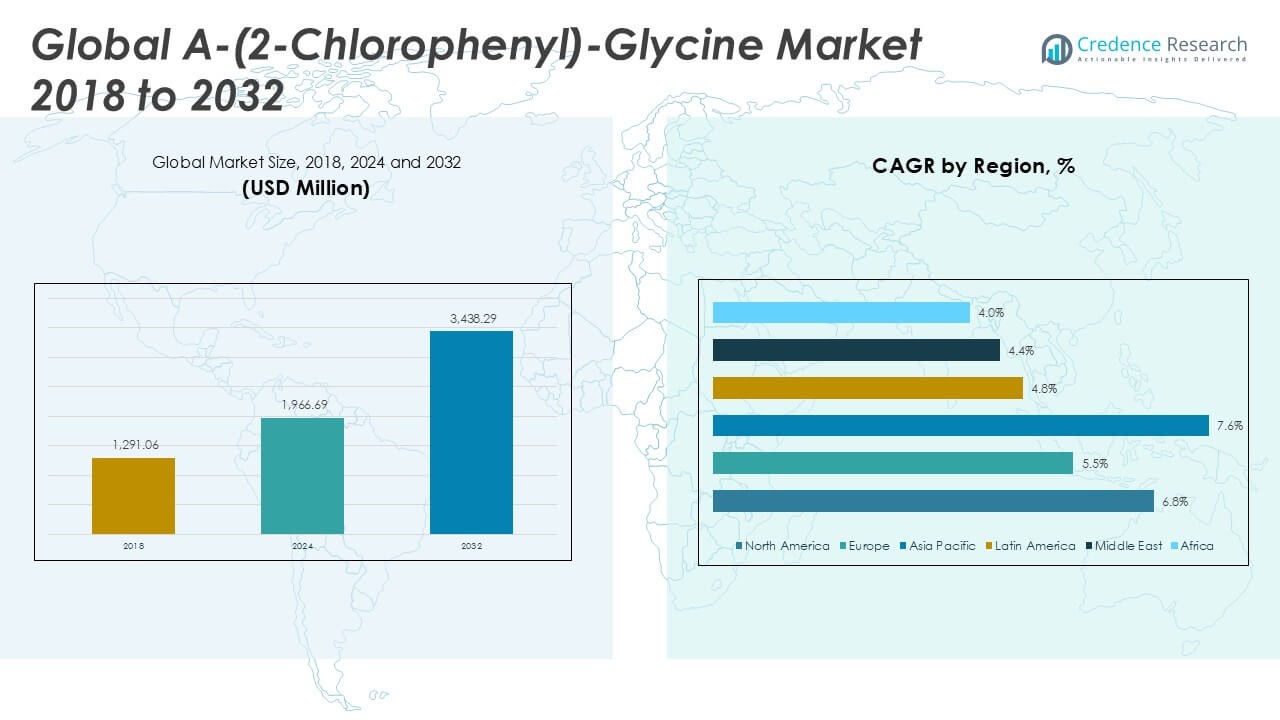

The A-(2-Chlorophenyl)-Glycine Market size was valued at USD 1,291.06 million in 2018, reached USD 1,966.69 million in 2024, and is anticipated to reach USD 3,438.29 million by 2032, at a CAGR of 6.73% during the forecast period.

The A-(2-Chlorophenyl)-Glycine market is experiencing robust growth, driven by rising demand from the pharmaceutical industry for advanced intermediates used in the synthesis of active pharmaceutical ingredients (APIs). Increasing prevalence of chronic diseases and a shift toward innovative drug formulations have fueled the adoption of specialty chemicals such as A-(2-Chlorophenyl)-Glycine. Additionally, technological advancements in chemical synthesis and a growing emphasis on research and development activities are contributing to market expansion. Stringent regulatory standards regarding quality and safety in pharmaceutical manufacturing have further heightened the need for high-purity intermediates. However, fluctuations in raw material prices and complex manufacturing processes present notable challenges. Key trends include increasing collaborations between chemical manufacturers and pharmaceutical companies, rising investment in green chemistry, and a focus on sustainable production methods. These factors collectively support the positive outlook and ongoing development of the global A-(2-Chlorophenyl)-Glycine market.

The A-(2-Chlorophenyl)-Glycine market demonstrates a geographically diverse landscape, with significant activity concentrated in North America, Europe, and Asia Pacific. North America benefits from a strong pharmaceutical industry and advanced research infrastructure, while Europe’s market is driven by high regulatory standards and a focus on innovation. Asia Pacific emerges as a major growth hub, supported by increasing pharmaceutical production and cost-efficient manufacturing environments, particularly in countries such as China, India, and Japan. Latin America, the Middle East, and Africa are steadily expanding through healthcare modernization and investments in local production capabilities. Key players shaping the competitive dynamics of the market include TCI Chemicals (Tokyo Chemical Industry Co., Ltd.), Sigma-Aldrich (Merck Group), and Shanghai Minstar Chemical Co., Ltd. These companies drive market innovation, ensure product quality, and maintain robust supply chains to meet the evolving demands of global pharmaceutical and research sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The A-(2-Chlorophenyl)-Glycine market was valued at USD 1,966.69 million in 2024 and is projected to reach USD 3,438.29 million by 2032, reflecting a CAGR of 6.73% during the forecast period.

- Increasing demand for high-purity pharmaceutical intermediates and robust investment in drug development drive market growth globally.

- The trend toward green chemistry and sustainable manufacturing processes is reshaping production strategies, with companies investing in eco-friendly synthesis and waste reduction.

- Competitive dynamics feature major players such as TCI Chemicals, Sigma-Aldrich (Merck Group), and Shanghai Minstar Chemical Co., Ltd., who focus on research partnerships, product quality, and supply chain strength.

- Market restraints include high production costs, complex synthesis requirements, and stringent regulatory standards that can challenge smaller manufacturers and affect profitability.

- Regional analysis highlights North America, Europe, and Asia Pacific as key markets, with Asia Pacific leading growth due to expanding pharmaceutical manufacturing and lower production costs.

- The market benefits from growing collaboration between chemical producers and pharmaceutical companies, enabling innovation and more efficient delivery of customized intermediates to meet evolving industry needs.

Market Drivers

Rising Demand from Pharmaceutical Sector Spurs Market Expansion

The A-(2-Chlorophenyl)-Glycine market is witnessing significant expansion due to the increasing requirement for high-quality intermediates in pharmaceutical manufacturing. Drug developers depend on this compound for the synthesis of various active pharmaceutical ingredients, particularly those used in advanced therapies and chronic disease management. Rapid growth in the global pharmaceutical industry, supported by investments in research and development, drives the consistent uptake of A-(2-Chlorophenyl)-Glycine. Growing cases of lifestyle-related and chronic conditions, such as diabetes and cardiovascular diseases, prompt pharmaceutical companies to seek reliable and effective chemical intermediates. The compound’s versatility and purity profile enable manufacturers to meet stringent regulatory standards, further strengthening its demand. It remains an essential component in the evolving landscape of pharmaceutical synthesis.

- For instance, Sigma-Aldrich (Merck Group) supports over 60,000 life science and pharmaceutical customers worldwide, supplying 300,000 products including more than 12,000 pharmaceutical intermediates.

Stringent Regulatory Standards Promote High-Purity Intermediate Adoption

Strict quality and safety regulations set by international health authorities are shaping the A-(2-Chlorophenyl)-Glycine market. Regulatory agencies such as the FDA and EMA require pharmaceutical companies to utilize high-purity raw materials in drug synthesis, encouraging the use of rigorously tested intermediates. This regulatory climate compels manufacturers to invest in advanced purification and quality assurance techniques, elevating the overall market value of A-(2-Chlorophenyl)-Glycine. Ensuring compliance with these standards increases confidence among drug developers and accelerates product approvals. High-purity intermediates minimize risks associated with impurities, which can compromise patient safety or delay regulatory clearances. The drive to comply with global standards keeps demand for quality intermediates strong.

- For instance, TCI Chemicals operates 10 ISO 9001:2015 and ISO 14001:2015 certified manufacturing and distribution centers in Japan, the U.S., Europe, China, and India, and offers over 30,000 chemicals with more than 98% purity.

Technological Advancements and Process Optimization Drive Growth

Continued innovation in chemical synthesis and process optimization plays a key role in expanding the A-(2-Chlorophenyl)-Glycine market. Advances in synthetic chemistry enable manufacturers to produce the compound with greater yield, consistency, and cost-efficiency. Process improvements also contribute to reduced environmental impact, aligning with the rising emphasis on green chemistry across the industry. Manufacturers leverage new catalysts and process automation to enhance product quality while minimizing waste and resource consumption. These innovations not only increase profitability but also appeal to customers seeking sustainable supply chains. It benefits from industry-wide efforts to boost operational efficiency and environmental stewardship.

Strategic Collaborations and Supply Chain Enhancements Support Market Resilience

Collaboration between chemical producers and pharmaceutical companies has become a defining feature of the A-(2-Chlorophenyl)-Glycine market. Partnerships facilitate technology transfer, streamline supply chains, and accelerate the development of customized intermediates. Robust supply chains ensure uninterrupted access to critical raw materials, helping market participants respond swiftly to shifting demand dynamics. Companies also invest in expanding production capacity to prevent bottlenecks and maintain reliable service levels. The focus on integrated supply networks and long-term partnerships supports stability and adaptability across the value chain. It continues to benefit from these collaborative approaches and supply chain advancements.

Market Trends

Increasing Emphasis on Sustainable and Green Chemistry Solutions

The A-(2-Chlorophenyl)-Glycine market is experiencing a clear shift toward sustainable and environmentally friendly production processes. Industry stakeholders are prioritizing the adoption of green chemistry principles, aiming to minimize the environmental footprint and ensure regulatory compliance. Companies have started integrating renewable raw materials and more efficient catalysts to reduce waste and emissions during manufacturing. Investments in eco-friendly technologies support the goal of achieving sustainable production without compromising product quality. End users in the pharmaceutical sector recognize the value of such initiatives, which often translate into stronger partnerships with suppliers prioritizing sustainability. It benefits from these trends by strengthening its position in an evolving global marketplace.

- For instance, BOC Sciences has implemented continuous flow chemistry systems that reduce organic solvent waste by 42,000 liters annually and improve reaction yields by up to 30%.

Growing Demand for High-Purity and Custom-Tailored Intermediates

Pharmaceutical manufacturers are seeking high-purity and application-specific intermediates, which propels innovation in the A-(2-Chlorophenyl)-Glycine market. Clients increasingly request custom synthesis services to meet exacting requirements for specific drug formulations. Producers respond by expanding their research and development capabilities and investing in advanced purification technologies. This focus on customization allows companies to differentiate themselves and capture new business opportunities in a competitive landscape. Tailored solutions also help address the complex needs of next-generation therapeutics and specialty drugs. It continues to advance through its ability to meet stringent purity and customization demands.

- For instance, Glentham Life Sciences delivered over 1,600 custom chemical batches to 52 countries in 2023, serving biotechnology and pharmaceutical R&D.

Expansion of Strategic Partnerships and Vertical Integration Initiatives

Collaboration between chemical producers and pharmaceutical firms is intensifying across the A-(2-Chlorophenyl)-Glycine market. Strategic partnerships and vertical integration have become key strategies for ensuring supply chain stability and consistent quality. By integrating operations, companies gain better control over raw material sourcing, production, and logistics, reducing the risk of disruptions. These efforts enable faster response to market shifts and regulatory changes while enhancing product traceability. It gains from deeper industry collaborations and supply chain optimization initiatives that support long-term growth and reliability.

Adoption of Digitalization and Advanced Analytical Technologies

The adoption of digital tools and sophisticated analytical technologies is shaping the competitive landscape in the A-(2-Chlorophenyl)-Glycine market. Industry players are investing in automation, real-time quality monitoring, and data-driven process control to improve manufacturing outcomes. Advanced analytics enhance efficiency, reduce costs, and ensure consistent product quality, providing a critical edge in regulated industries. Digitalization helps identify process bottlenecks and enables rapid troubleshooting, supporting continuous improvement. It remains at the forefront of these advancements, leveraging digital transformation to enhance value for customers and maintain a leadership position.

Market Challenges Analysis

Complex Manufacturing Processes and High Production Costs Limit Growth

The A-(2-Chlorophenyl)-Glycine market faces significant challenges due to the complexity of its manufacturing processes and the high costs associated with production. Sophisticated synthesis routes require advanced equipment, skilled personnel, and stringent quality controls, all of which increase operational expenses. Small and mid-sized manufacturers may struggle to invest in the necessary infrastructure or meet regulatory requirements for pharmaceutical-grade intermediates. Fluctuations in the prices and availability of raw materials further compound cost pressures, making it difficult to maintain stable margins. The need for continuous process optimization and technological upgrades adds to the overall expense burden. It encounters barriers to scalability when production costs outweigh profitability in competitive markets.

Stringent Regulatory Environment and Quality Assurance Demands

Strict regulatory frameworks present ongoing challenges for companies operating in the A-(2-Chlorophenyl)-Glycine market. Meeting global standards for purity, traceability, and safety demands robust quality assurance systems and frequent audits, raising compliance costs and operational risks. Failure to adhere to these regulations can result in shipment delays, product recalls, or loss of business opportunities. Evolving requirements from agencies such as the FDA and EMA require constant updates to quality protocols and documentation practices. Smaller firms, in particular, often find it challenging to navigate complex approval processes or invest in advanced compliance measures. It faces the dual pressure of upholding regulatory standards while sustaining business growth in an increasingly demanding environment.

Market Opportunities

Expansion into Emerging Pharmaceutical and Biotechnology Markets

The A-(2-Chlorophenyl)-Glycine market holds significant potential for growth by targeting emerging pharmaceutical and biotechnology sectors. Rapid development of new drug molecules and innovative therapies across Asia-Pacific, Latin America, and the Middle East increases demand for high-quality intermediates. Companies that build strategic partnerships or establish local production facilities can better serve these expanding regions and gain competitive advantages. The push for personalized medicine and biosimilar drugs further elevates the need for specialized intermediates, positioning the market for accelerated adoption. It benefits from early engagement with research-driven firms seeking advanced chemical solutions. Strong market presence in high-growth geographies creates pathways for revenue diversification and long-term success.

Development of Green Chemistry and Custom Synthesis Services

A growing emphasis on sustainable production offers new opportunities for manufacturers in the A-(2-Chlorophenyl)-Glycine market. Investment in green chemistry processes, such as the use of renewable raw materials and waste minimization techniques, aligns with evolving regulatory expectations and customer preferences. Companies offering tailored synthesis services can capture market share by providing intermediates optimized for specific drug formulations. These services support the pharmaceutical industry’s shift toward innovative and niche therapeutics, allowing firms to differentiate themselves. It finds momentum by integrating sustainability into core operations while responding to demand for customization. Leveraging these opportunities enables companies to enhance value propositions and build lasting partnerships with key clients.

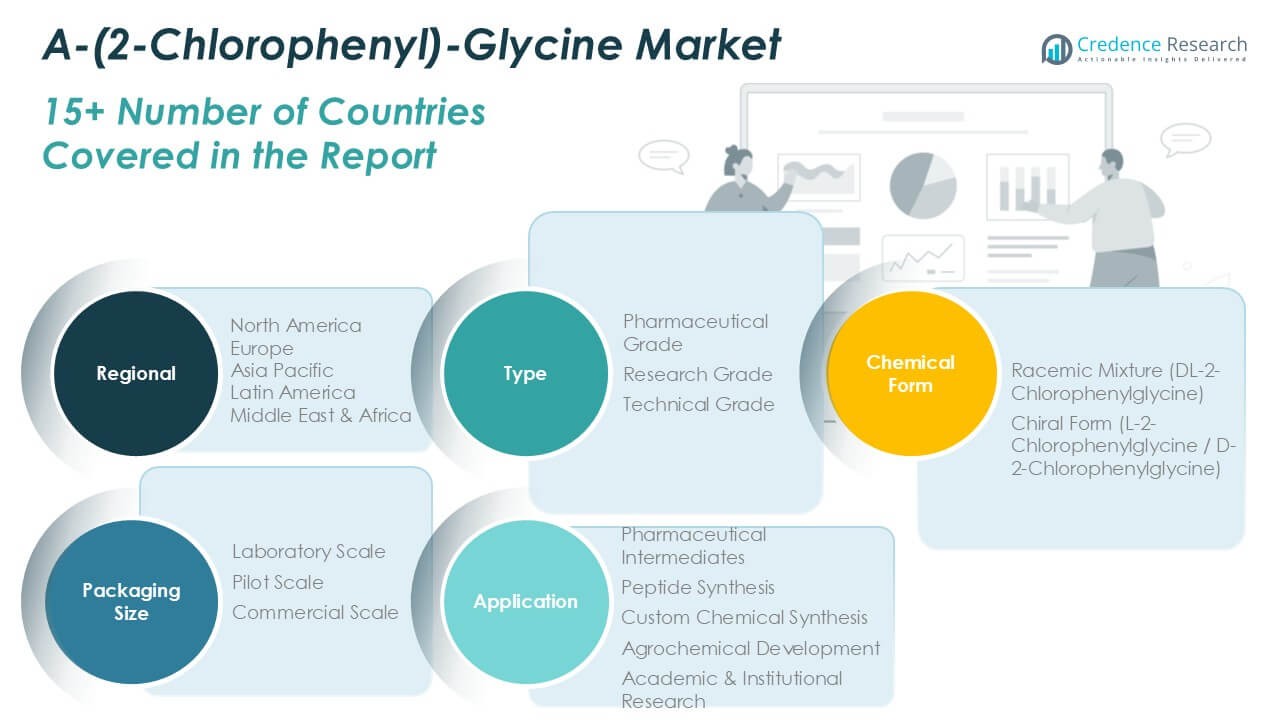

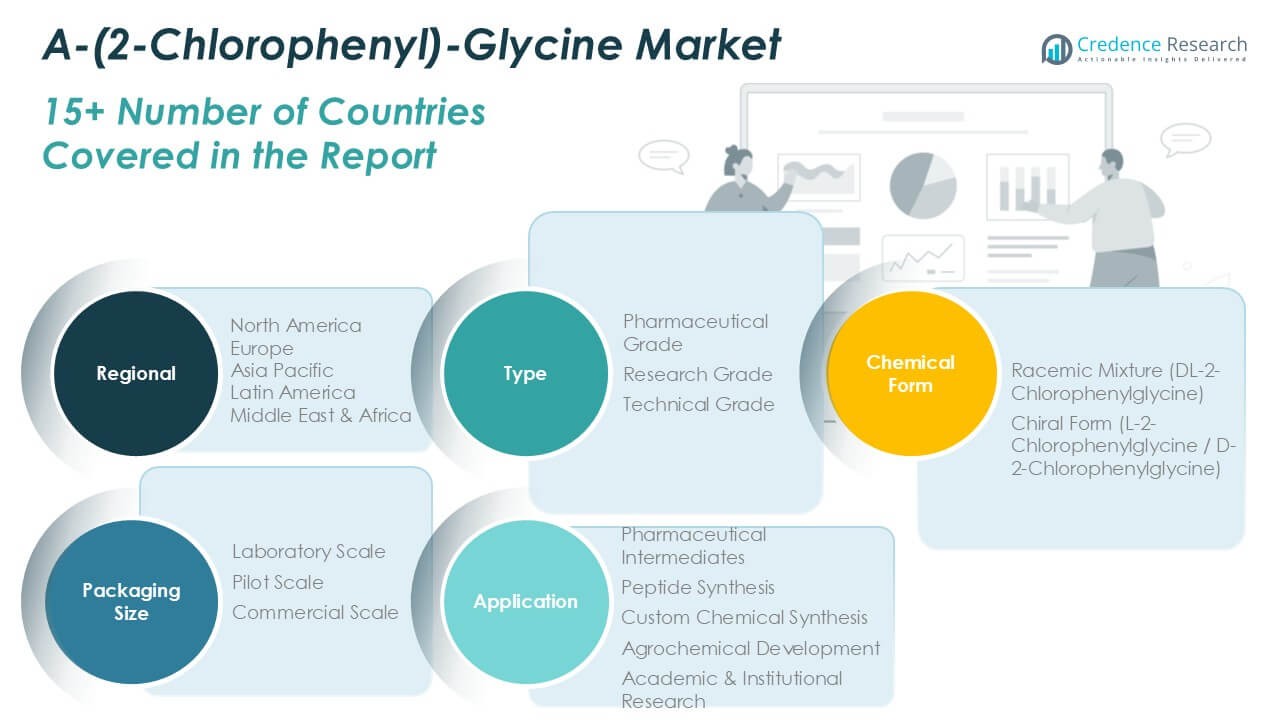

Market Segmentation Analysis:

By Grade:

pharmaceutical grade holds the largest share, driven by stringent quality requirements and extensive use as an intermediate in active pharmaceutical ingredient synthesis. It dominates due to demand from regulatory-compliant drug manufacturing, where high purity and quality assurance are essential. Research grade serves academic and laboratory settings, supporting experimental and small-scale studies, while technical grade addresses industrial and bulk applications where purity standards are less stringent.

- For instance, Sigma-Aldrich lists 817 pharmaceutical-grade compounds in its portfolio, which are distributed to more than 60 countries worldwide.

By Chemical Form:

The market distinguishes between racemic mixtures (DL-2-Chlorophenylglycine) and chiral forms (L-2-Chlorophenylglycine / D-2-Chlorophenylglycine). Racemic mixtures represent the standard production route and provide cost efficiency for processes where stereochemistry is not critical. The chiral forms, on the other hand, are vital for pharmaceutical synthesis requiring enantiomerically pure intermediates. It benefits from rising demand for chiral compounds in advanced drug development, where targeted therapies and regulatory expectations continue to grow.

- For instance, TCI Chemicals supplies over 120 chiral amino acids and derivatives, with annual production volume exceeding 150 metric tons.

By Packaging Size:

The market spans laboratory scale, pilot scale, and commercial scale. Laboratory-scale packaging supports R&D and quality control functions, catering to universities, research institutes, and small pharmaceutical labs. Pilot scale serves transitional phases between research and commercial production, providing flexible quantities for process optimization and product validation. Commercial scale dominates the segment, reflecting established demand from pharmaceutical and chemical manufacturing industries. It supports mass production and large-scale distribution, underlining the importance of robust supply chains and consistent quality standards.

Segments:

Based on Grade:

- Pharmaceutical Grade

- Research Grade

- Technical Grade

Based on Chemical Form:

- Racemic Mixture (DL-2-Chlorophenylglycine)

- Chiral Form (L-2-Chlorophenylglycine / D-2-Chlorophenylglycine)

Based on Packaging Size:

- Laboratory Scale

- Pilot Scale

- Commercial Scale

Based on Application:

- Pharmaceutical Intermediates

- Peptide Synthesis

- Custom Chemical Synthesis

- Agrochemical Development

- Academic & Institutional Research

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America A-(2-Chlorophenyl)-Glycine Market

North America A-(2-Chlorophenyl)-Glycine Market grew from USD 427.64 million in 2018 to USD 642.51 million in 2024 and is projected to reach USD 1,127.40 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.8%. North America is holding a 33% market share. The United States and Canada dominate the regional landscape, supported by a robust pharmaceutical industry, advanced research infrastructure, and strict regulatory requirements. Pharmaceutical manufacturers in the region demand high-purity intermediates, strengthening the uptake of A-(2-Chlorophenyl)-Glycine. The presence of key industry players and ongoing innovation in drug discovery reinforce North America’s market position. Government support for R&D and investments in biologics further sustain regional demand.

Europe A-(2-Chlorophenyl)-Glycine Market

Europe A-(2-Chlorophenyl)-Glycine Market grew from USD 254.93 million in 2018 to USD 368.22 million in 2024 and is projected to reach USD 588.73 million by 2032, posting a CAGR of 5.5%. Europe holds an 19% market share. Germany, France, and the United Kingdom represent the leading countries, with strong pharmaceutical and chemical sectors. Stringent quality standards and an emphasis on sustainable manufacturing processes drive market expansion. Regulatory compliance remains a priority, motivating investments in high-quality intermediates. Collaboration between research institutions and industry leaders fosters innovation and supports steady market growth. The region’s focus on specialty drugs and generics further boosts demand.

Asia Pacific A-(2-Chlorophenyl)-Glycine Market

Asia Pacific A-(2-Chlorophenyl)-Glycine Market grew from USD 500.22 million in 2018 to USD 793.73 million in 2024 and is expected to reach USD 1,482.67 million by 2032, registering a CAGR of 7.6%. Asia Pacific captures the largest market share at 40%. China, India, and Japan are the primary contributors, benefiting from expanding pharmaceutical production and increasing healthcare investment. The region’s competitive manufacturing costs and skilled workforce attract multinational players. Strong domestic demand and export opportunities support growth across pharmaceutical and specialty chemical segments. Rapid development in contract manufacturing organizations and research activities further fuel market momentum.

Latin America A-(2-Chlorophenyl)-Glycine Market

Latin America A-(2-Chlorophenyl)-Glycine Market grew from USD 51.07 million in 2018 to USD 76.65 million in 2024 and will reach USD 115.57 million by 2032, achieving a CAGR of 4.8%. Latin America accounts for 4% market share. Brazil and Mexico are the core markets, driven by healthcare modernization and growing pharmaceutical capabilities. Regulatory reforms and new manufacturing investments encourage adoption of high-quality intermediates. Partnerships with global companies and local expansion initiatives support market development. Demand for generic drugs and research collaborations present new avenues for regional growth.

Middle East A-(2-Chlorophenyl)-Glycine Market

Middle East A-(2-Chlorophenyl)-Glycine Market grew from USD 35.44 million in 2018 to USD 49.25 million in 2024 and will reach USD 72.35 million by 2032, reflecting a CAGR of 4.4%. The Middle East holds a 3% market share. The United Arab Emirates and Saudi Arabia lead with investments in healthcare infrastructure and pharmaceutical manufacturing. Efforts to diversify economies and establish local drug production bolster market opportunities. Companies in the region focus on supply chain efficiency and quality compliance to serve both local and export needs. Regulatory initiatives and partnerships with international firms contribute to industry growth.

Africa A-(2-Chlorophenyl)-Glycine Market

Africa A-(2-Chlorophenyl)-Glycine Market grew from USD 21.76 million in 2018 to USD 36.33 million in 2024 and is forecast to reach USD 51.56 million by 2032, achieving a CAGR of 4.0%. Africa commands a 2% market share. South Africa and Egypt are the main players, with growing pharmaceutical demand and improved healthcare access. International organizations and governments invest in capacity building and regulatory frameworks. Local manufacturers gradually adopt global standards for intermediate production. The region’s market potential increases as access to pharmaceuticals expands and foreign direct investment continues.

Key Player Analysis

- TCI Chemicals (Tokyo Chemical Industry Co., Ltd.)

- Shanghai Minstar Chemical Co., Ltd.

- Sigma-Aldrich (Merck Group)

- InvivoChem

- Glentham Life Sciences

- BOC Sciences

- Combi-Blocks Inc.

- Advance Scientific & Chemical

- VWR International (Avantor)

- Alfa Chemistry

Competitive Analysis

The competitive landscape of the A-(2-Chlorophenyl)-Glycine market is shaped by several leading players, including TCI Chemicals (Tokyo Chemical Industry Co., Ltd.), Sigma-Aldrich (Merck Group), Shanghai Minstar Chemical Co., Ltd., InvivoChem, Glentham Life Sciences, and BOC Sciences. These companies maintain a strong presence through their extensive product portfolios, advanced synthesis capabilities, and global distribution networks. They focus on research-driven product development, emphasizing high purity and quality assurance to address the stringent requirements of pharmaceutical and research customers. Key players invest heavily in technology upgrades and sustainable production methods, aligning with industry trends toward green chemistry and regulatory compliance. Strategic partnerships and collaborations with pharmaceutical firms and academic institutions enhance their ability to deliver customized solutions and respond swiftly to evolving market needs. By expanding production capacity and improving supply chain efficiency, these market leaders secure a competitive edge and build long-term client relationships. Their commitment to innovation, regulatory compliance, and operational excellence continues to define the competitive dynamics of the global A-(2-Chlorophenyl)-Glycine market.

Market Concentration & Characteristics

The A-(2-Chlorophenyl)-Glycine market exhibits a moderate to high level of concentration, with a select group of global players dominating market share and influencing pricing and quality standards. Companies such as TCI Chemicals, Sigma-Aldrich (Merck Group), Shanghai Minstar Chemical Co., Ltd., and BOC Sciences operate advanced manufacturing facilities and supply a broad customer base across pharmaceutical, research, and chemical sectors. It is characterized by stringent quality requirements, high barriers to entry, and a strong emphasis on research-driven innovation. Leading firms invest in sustainable production methods and digital process optimization, strengthening both efficiency and regulatory compliance. Product differentiation focuses on purity, consistency, and custom synthesis services to meet the exacting standards of pharmaceutical clients. The market values reliability in supply chains and technical support, with long-term contracts and collaborative projects common among established players. This structure supports stable growth and continuous advancement in product quality and service.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Grade, Chemical Form, Packaging Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The A-(2-Chlorophenyl)-Glycine market is expected to witness steady growth due to increasing demand in pharmaceutical intermediate applications.

- Advancements in drug synthesis technologies are likely to boost the production efficiency of A-(2-Chlorophenyl)-Glycine.

- The market is projected to benefit from the rising investments in R&D for developing novel active pharmaceutical ingredients.

- Growing prevalence of chronic diseases is anticipated to drive demand for compounds like A-(2-Chlorophenyl)-Glycine in drug formulation.

- Expansion of pharmaceutical manufacturing facilities in emerging economies will likely support market growth.

- Regulatory support for pharmaceutical ingredient development is expected to create a favorable market environment.

- Rising collaborations between chemical suppliers and pharmaceutical firms may enhance the supply chain and product availability.

- Increasing focus on precision medicine and targeted drug therapies may further drive the demand for high-purity intermediates.

- Stringent quality control standards and GMP compliance will remain essential for market competitiveness.

- Sustainability concerns and green chemistry practices are likely to influence production methods in the coming years.