Market Overview

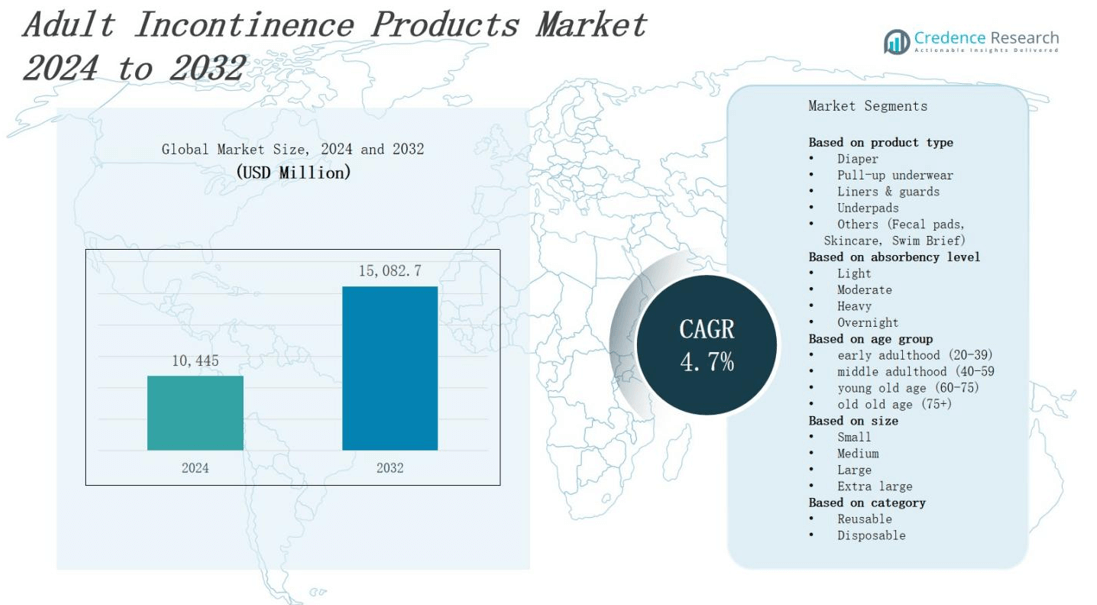

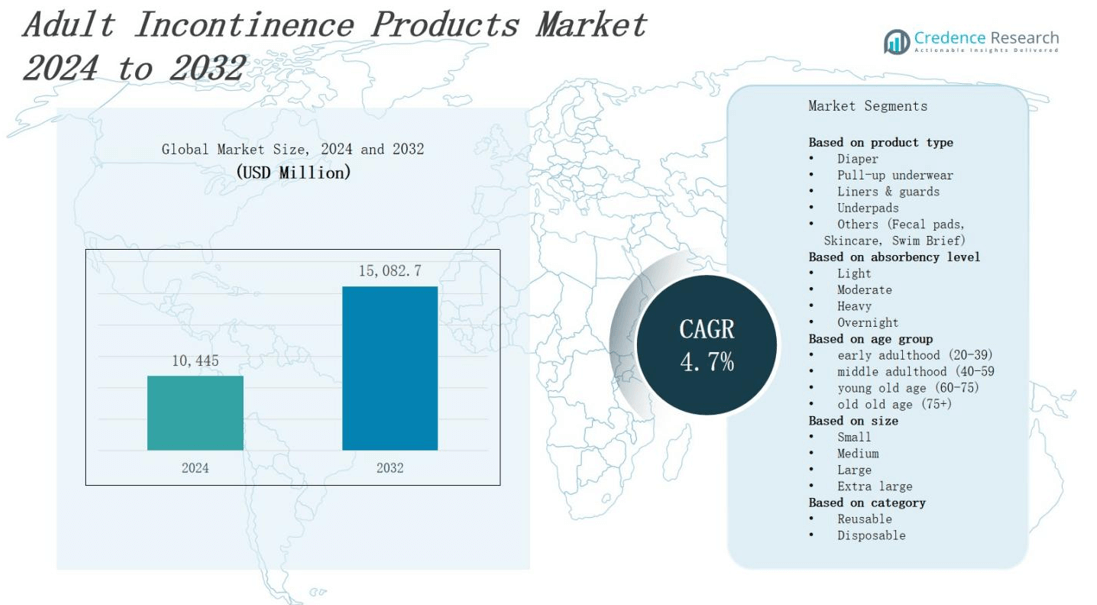

The adult incontinence products market is projected to grow from USD 10,445 million in 2024 to USD 15,082.7 million by 2032, registering a compound annual growth rate (CAGR) of 4.7%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adult Incontinence Products Market Size 2024 |

USD 10,445 million |

| Adult Incontinence Products Market, CAGR |

4.7% |

| Adult Incontinence Products Market Size 2032 |

USD 15,082.7 million |

The adult incontinence products market grows steadily due to the increasing aging population and rising prevalence of chronic conditions such as diabetes and neurological disorders. Growing awareness and reduced stigma around incontinence drive higher product adoption. Advances in product design, including improved absorbency, comfort, and discreetness, enhance user experience and expand the consumer base. Additionally, the rise in outpatient care and home healthcare services boosts demand for convenient, easy-to-use products. Technological innovations and expanding distribution channels, especially e-commerce, further support market growth by increasing accessibility and product variety. These factors collectively propel the market forward.

The adult incontinence products market spans key regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with 34% market share, followed by Europe at 28%. Asia-Pacific, holding 22%, shows the fastest growth due to rising healthcare awareness. Latin America and the Middle East & Africa account for 9% and 7% respectively, driven by improving infrastructure and aging populations. Leading players such as Procter & Gamble Co, Kimberly-Clark Corporation, Unicharm Corporation, Hollister Incorporated, Essity, and McKesson Corporation actively compete across these regions to expand their global footprint.

Market Insights

- The adult incontinence products market is projected to grow from USD 10,445 million in 2024 to USD 15,082.7 million by 2032, registering a CAGR of 4.7%.

- Increasing aging populations and rising prevalence of chronic diseases like diabetes and neurological disorders drive steady market growth.

- Advances in product design improve absorbency, comfort, and discreetness, enhancing user experience and expanding the consumer base.

- Growing awareness and reduced stigma encourage higher adoption rates, supported by public health campaigns and digital education platforms.

- Diversified distribution channels, especially e-commerce, boost product accessibility and availability, contributing to consistent sales growth.

- North America leads with 34% market share, followed by Europe at 28%, while Asia-Pacific grows fastest with 22% due to rising healthcare awareness.

- Latin America and the Middle East & Africa hold 9% and 7% shares respectively, driven by improving healthcare infrastructure and increasing aging populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Aging Population and Rising Chronic Conditions Fuel Demand

The adult incontinence products market benefits significantly from the global increase in the aging population. Older adults face higher risks of urinary and fecal incontinence due to natural physiological changes and age-related diseases. Chronic conditions such as diabetes, obesity, and neurological disorders further contribute to incontinence prevalence. It drives the need for reliable, comfortable products that improve quality of life. Healthcare providers emphasize early intervention, which increases product adoption across medical and homecare settings.

- For instance, Ontex has introduced innovative technologies like the X-Core channeled system, which absorbs moisture twice as fast while enhancing skin dryness and comfort, supporting women who make up most urinary incontinence sufferers.

Advancements in Product Innovation Enhance User Experience

Product innovation plays a critical role in expanding the adult incontinence products market. Manufacturers focus on improving absorbency, skin-friendliness, and odor control to meet consumer expectations. Lightweight and discreet designs reduce user embarrassment, encouraging broader acceptance. It also develops eco-friendly and reusable options to align with sustainability trends. Enhanced comfort and functionality strengthen consumer loyalty, increasing repeat purchases and market penetration.

- For instance, Eco by Naty offers biodegradable incontinence pads made from natural bamboo fiber, which are gentle on the skin and reduce plastic waste, aligning with sustainability goals.

Growing Awareness and Reduced Social Stigma Increase Adoption

Rising awareness about incontinence and its management drives the market’s growth. Public health campaigns and educational programs help reduce stigma, making consumers more willing to seek solutions. It empowers caregivers and patients to adopt incontinence products confidently. The increasing availability of information through digital platforms educates users on product choices and benefits. These factors contribute to higher market demand and support long-term expansion.

Expansion of Distribution Channels Boosts Accessibility

The adult incontinence products market grows through diversified distribution channels that improve product accessibility. E-commerce platforms enable discreet purchasing, attracting privacy-conscious consumers. Retail pharmacy chains and specialized medical stores expand their incontinence product offerings to meet rising demand. It also gains traction in emerging markets where healthcare infrastructure develops rapidly. Efficient supply chains ensure timely availability, supporting consistent sales growth and market stability.

Market Trends

Rising Adoption of Advanced Absorbent Materials Enhances Product Performance

The adult incontinence products market increasingly embraces advanced absorbent materials to improve product effectiveness and comfort. Innovations such as superabsorbent polymers and breathable fabrics provide better moisture retention and skin protection. It leads to reduced leakage and irritation, which significantly boosts consumer satisfaction. Manufacturers invest in research to develop thinner, more discreet products without compromising absorption capacity. This trend drives differentiation and attracts a broader customer base seeking reliable incontinence solutions.

- For instance, Manufacturers also integrate breathable, soft fabrics and LeakGuard™ leg cuffs to prevent side leakage and skin irritation, resulting in thinner yet highly absorbent products that offer discretion without compromising performance.

Shift Toward Eco-Friendly and Sustainable Product Options Gains Momentum

Sustainability gains importance within the adult incontinence products market, with growing demand for environmentally friendly alternatives. Companies focus on biodegradable materials, reusable products, and reduced plastic usage to address consumer concerns about environmental impact. It supports the shift from disposable to sustainable options, balancing convenience with ecological responsibility. This trend also encourages innovation in product design and packaging, helping brands position themselves as socially responsible and attract eco-conscious buyers.

Digital Platforms Facilitate Consumer Education and Product Accessibility

The adult incontinence products market benefits from increased engagement through digital platforms that offer product information and support. Online resources, including videos, reviews, and expert advice, empower consumers to make informed decisions. It facilitates discreet purchasing through e-commerce, enhancing convenience and privacy. Social media campaigns help normalize incontinence conversations, reducing stigma and encouraging product adoption. Digital tools also assist healthcare professionals in recommending suitable products, strengthening market penetration.

- For instance, Ontex’s iD brand includes consumer and professional support services such as ID-Direct, which facilitate product guidance and enhance user confidence through expert advice integrated with their product offerings.

Expansion into Emerging Markets Drives Global Market Growth

The adult incontinence products market sees rapid expansion in emerging economies due to rising healthcare awareness and improving infrastructure. Increasing urbanization and growing middle-class populations fuel demand for accessible and affordable incontinence care solutions. It benefits from government initiatives and rising investments in home healthcare services. Market players actively enter these regions through partnerships and localized product offerings. This geographic diversification strengthens overall market growth and opens new revenue streams.

Market Challenges Analysis

Social Stigma and Consumer Reluctance Hinder Market Expansion

The adult incontinence products market faces significant challenges due to persistent social stigma surrounding incontinence. Many potential users hesitate to acknowledge their condition or seek appropriate products because of embarrassment and cultural taboos. It limits early adoption and reduces overall market penetration. Caregivers and patients often delay using incontinence aids, which impacts product demand. Overcoming these psychological barriers requires targeted awareness campaigns and sensitive marketing strategies to normalize usage and foster acceptance.

High Product Costs and Limited Reimbursement Impact Affordability

Cost remains a major obstacle for the adult incontinence products market, particularly in low- and middle-income regions. Premium products with advanced features often come with higher price points, restricting access for price-sensitive consumers. It affects adoption rates, especially for prolonged usage where recurring expenses accumulate. Limited insurance coverage and reimbursement policies further reduce affordability for many users. Market players must balance innovation with cost-efficiency to broaden accessibility and sustain growth in diverse economic environments.

Market Opportunities

Growing Home Healthcare and Aging-in-Place Trends Expand Market Potential

The adult incontinence products market stands to benefit from the increasing preference for home healthcare and aging-in-place solutions. More seniors and patients with chronic conditions seek comfortable, convenient care at home rather than in institutional settings. It creates strong demand for easy-to-use, effective incontinence products that support independence and dignity. Healthcare providers and caregivers also prioritize products that simplify daily management. This trend opens avenues for tailored product lines and service models focused on home use, enhancing market reach and consumer loyalty.

Technological Integration and Personalized Solutions Offer New Growth Avenues

The adult incontinence products market can capitalize on technological advances and the rising demand for personalized care. Smart incontinence products with sensors and real-time monitoring improve patient outcomes and caregiver support. It enables proactive management of symptoms and reduces complications. Customized products based on individual needs and preferences gain traction among consumers seeking better comfort and fit. Embracing innovation in digital health and personalization enhances product differentiation and attracts new customer segments, driving sustainable growth.

Market Segmentation Analysis:

By Product Type

The adult incontinence products market segments prominently by product type, with diapers and pull-up underwear holding the largest shares. Diapers offer high absorbency and ease of use, making them preferred for moderate to severe incontinence cases. Pull-up underwear appeals to users seeking discreet, comfortable options that resemble regular underwear. Liners and guards cater to light absorbency needs, while underpads provide surface protection in bedding and furniture. Other products such as fecal pads, skincare items, and swim briefs address specialized requirements, broadening the market’s scope.

- For instance, Kimberly-Clark’s adult diapers feature adjustable tabs that ensure a secure and customizable fit, enhancing comfort and leak prevention, which is particularly valued by caregivers managing moderate to severe incontinence cases.

By Absorbency Level

Segmenting the adult incontinence products market by absorbency level reveals significant demand for heavy and overnight products. Heavy absorbency products meet the needs of users with moderate to severe leakage, providing extended protection and comfort. Overnight products offer maximum absorbency for prolonged use during sleep, addressing a critical market niche. Light and moderate absorbency segments serve consumers with minor leakage, often targeting early intervention or less severe cases. The variety in absorbency levels allows manufacturers to cater to diverse user needs effectively.

- For instance, the MEGAMAX Brief is the only 12-hour adult diaper on the market, offering maximum absorbency with a waterproof plastic backing and an extra-wide core to contain heavy leaks, serving users with complete bladder and bowel incontinence.

By Age Group

The adult incontinence products market shows strong segmentation by age group, with the young old (60-75) and old old (75+) age brackets driving most demand. Physiological changes and higher chronic disease prevalence in these groups increase incontinence incidence. Middle adulthood (40-59) represents a growing segment due to early onset conditions, while early adulthood (20-39) remains a smaller but emerging group linked to lifestyle and medical factors. Tailoring products to specific age-related needs supports better user experience and market penetration.

Segments:

Based on product type

- Diaper

- Pull-up underwear

- Liners & guards

- Underpads

- Others (Fecal pads, Skincare, Swim Brief)

Based on absorbency level

- Light

- Moderate

- Heavy

- Overnight

Based on age group

- early adulthood (20-39)

- middle adulthood (40-59

- young old age (60-75)

- old old age (75+)

Based on size

- Small

- Medium

- Large

- Extra large

Based on category

Based on price range

- Low (25$)

- Mid(25$-50$)

- High (>50$)

Based on consumer group

Based on distribution channel

-

- E-commerce

- Company websites

-

- Specialty Stores

- Mega retails stores

- Others (Individual stores, Departmental stores)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America commands the largest share of the adult incontinence products market, holding 34% of the global market. The region benefits from a well-established healthcare infrastructure and high awareness of incontinence management. It experiences strong demand due to the aging population and high prevalence of chronic diseases. Innovations in product design and wide availability through diverse distribution channels further fuel market growth. The presence of leading manufacturers and robust insurance coverage supports consumer access to premium products. North America continues to lead with significant investments in research and development, enhancing product offerings and user experience.

Europe

Europe accounts for 28% of the adult incontinence products market. The region demonstrates steady growth driven by increasing elderly demographics and growing healthcare expenditure. Countries such as Germany, the UK, and France contribute heavily to market demand due to advanced healthcare systems and public awareness campaigns. It benefits from government initiatives promoting home care and patient comfort. The market also experiences rising adoption of sustainable and innovative products. Strong regulatory frameworks encourage quality and safety standards, reinforcing consumer confidence.

Asia-Pacific

Asia-Pacific holds 22% of the adult incontinence products market and represents the fastest-growing region. Rising urbanization, expanding middle-class populations, and improving healthcare infrastructure propel market expansion. It witnesses increased awareness and reduced stigma around incontinence, boosting product acceptance. Emerging economies like China, India, and Japan drive demand with growing aging populations. Market players focus on affordable and localized products to capture this diverse market. E-commerce and retail penetration further enhance accessibility across urban and rural areas.

Latin America

Latin America accounts for 9% of the adult incontinence products market. Growing healthcare investments and rising awareness about incontinence management support steady market growth. It faces challenges related to affordability and infrastructure, but urban centers show higher product adoption. Brazil and Mexico lead regional demand with increasing focus on elderly care. The market benefits from expanding distribution networks and rising availability of innovative products.

Middle East & Africa

The Middle East & Africa holds 7% share of the adult incontinence products market. Market growth stems from improving healthcare facilities and growing aging populations in key countries such as Saudi Arabia and South Africa. It faces challenges including limited awareness and cultural stigma, which restrict wider adoption. However, government initiatives and increasing private sector participation encourage market development. Product customization and awareness programs offer opportunities to expand consumer base in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Essity

- Procter & Gamble Co

- Hayat Kimya

- McKesson Corporation

- Kimberly-Clark Corporation

- Unicharm Corporation

- Hollister Incorporated

- First Quality Consumer Products LLC

- Abena Holding A/S

- Kao Corporation

Competitive Analysis

The adult incontinence products market features intense competition among key players such as Procter & Gamble Co, Kimberly-Clark Corporation, Unicharm Corporation, and Hollister Incorporated, who lead through continuous innovation and product differentiation. It focuses on developing advanced absorbent materials and enhancing comfort to meet diverse consumer demands. Companies like Essity, First Quality Consumer Products LLC, McKesson Corporation, Abena Holding A/S, Hayat Kimya, and Kao Corporation strengthen their market position by expanding geographically and tailoring products to regional preferences. The rising demand for sustainable and eco-friendly options drives players to adopt biodegradable materials and responsible packaging. Strategic collaborations and competitive pricing further intensify rivalry, emphasizing quality, accessibility, and consumer education to capture and retain market share in a rapidly evolving healthcare sector.

Recent Developments

- In February 2023, Medline partnered with Synthase Collaborative to become the primary supplier of medical supplies, including incontinence care items, to several hospice and care organizations.

- In November 2023, Nobel Hygiene Pvt Ltd. launched Friends UltraThinz, slim disposable absorbent underpants designed for adult incontinence.

- In August 2023, Nexwear expanded its product range by acquiring Lily Bird, a direct-to-consumer brand focused on women’s incontinence products, enhancing innovation and customer reach.

- In 2024, Kimberly-Clark announced its “Powering Care” strategy, focusing on innovation to improve adult incontinence products like Depend and Poise to better serve consumers.

Market Concentration & Characteristics

The adult incontinence products market exhibits a moderately concentrated competitive landscape dominated by a few key multinational corporations such as Procter & Gamble Co, Kimberly-Clark Corporation, and Unicharm Corporation. These players leverage strong brand recognition, extensive distribution networks, and continuous product innovation to maintain market leadership. It also includes several regional and local manufacturers focusing on niche segments and price-sensitive consumers. The market features high entry barriers due to stringent regulatory requirements and significant investment in research and development. Consumer demand emphasizes product quality, comfort, and sustainability, prompting companies to invest in advanced materials and eco-friendly solutions. The market characteristics reflect steady growth driven by demographic shifts, evolving healthcare practices, and expanding homecare services. Strategic partnerships and mergers further shape the market dynamics, enabling companies to enhance their product portfolios and geographic reach. Overall, the market balances innovation with affordability to meet diverse consumer needs globally

Report Coverage

The research report offers an in-depth analysis based on Product Type, Absorbency Level, Age Group, Size, Category, Price Range, Consumer group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The aging global population will significantly increase demand for adult incontinence products worldwide.

- Manufacturers will prioritize developing products with improved absorbency, comfort, and skin-friendly materials.

- Sustainable and biodegradable products will gain popularity due to growing environmental awareness among consumers.

- Rising preference for home healthcare will boost the need for easy-to-use incontinence solutions.

- Digital platforms will expand consumer education, enabling informed choices and discreet online purchases.

- Emerging markets will experience rapid growth driven by improving healthcare infrastructure and awareness.

- Personalized products and smart technologies will offer better management and monitoring of incontinence conditions.

- E-commerce sales will grow rapidly, providing convenient access and discreet purchasing options.

- Increased awareness initiatives will help reduce stigma and promote early product adoption among users.

- Partnerships and acquisitions will enhance innovation, distribution, and global market presence for key players.