Market Overview

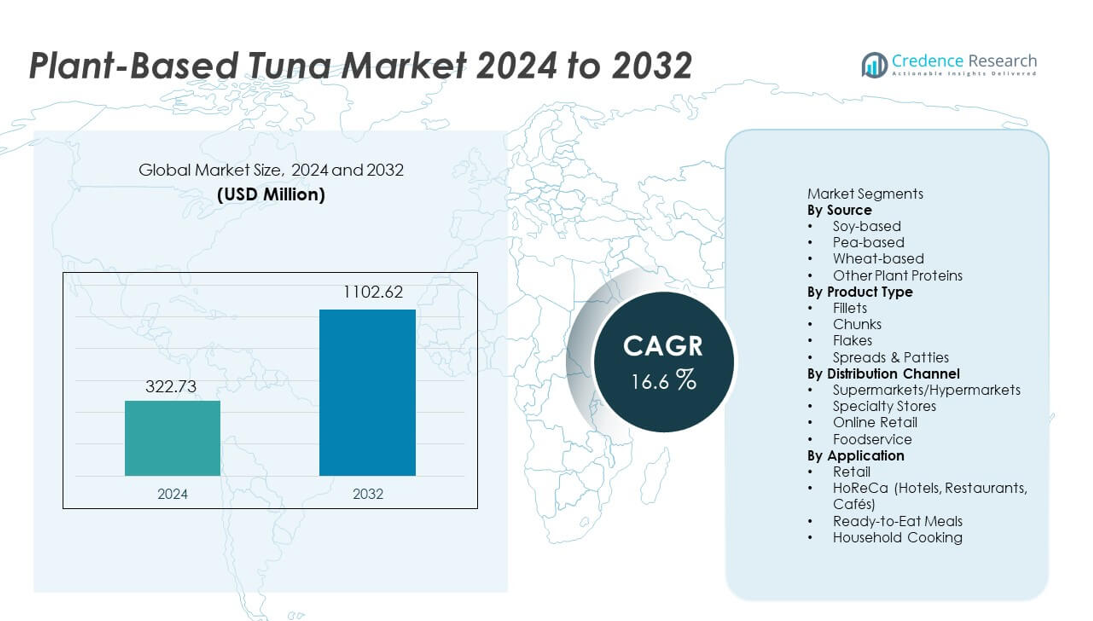

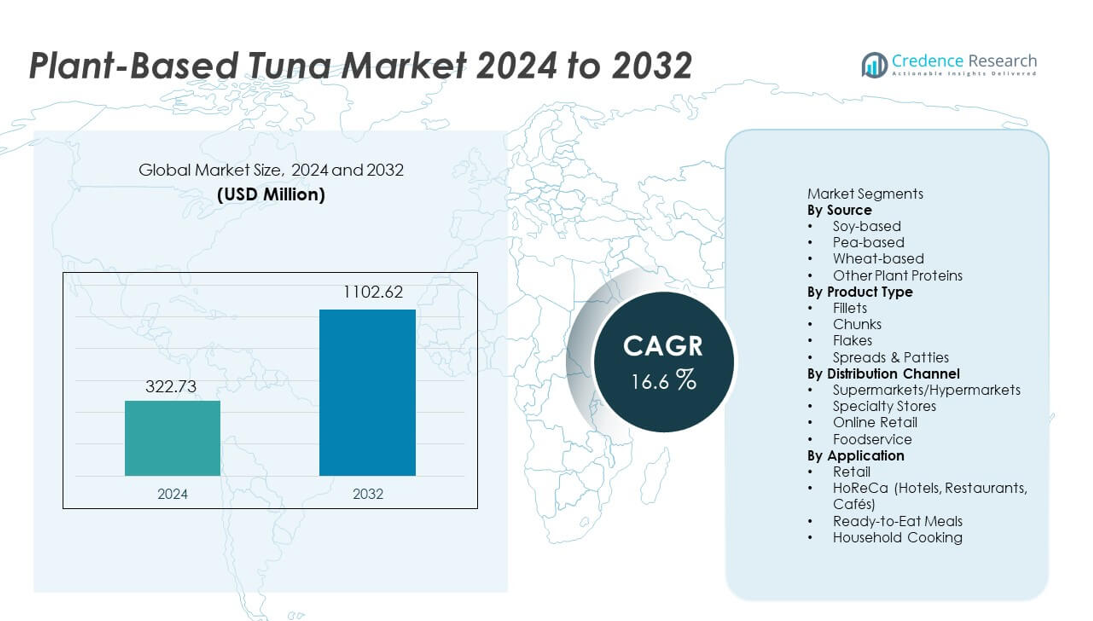

The Plant-Based Tuna Market reached USD 322.73 million in 2024 and is projected to grow to USD 1,102.62 million by 2032, expanding at a CAGR of 16.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant-Based Tuna Market Size 2024 |

USD 322.73 million |

| Plant-Based Tuna Market, CAGR |

16.6% |

| Plant-Based Tuna Market Size 2032 |

USD 1,102.62 million |

The Plant-Based Tuna market is shaped by leading innovators including Good Catch Foods, Ocean Hugger Foods, Sophie’s Kitchen, TUNO, New Wave Foods, Loma Linda, Akua, Wild Type, Kuleana, and Sushi Mushi, all of which focus on sustainable ingredients, improved texture engineering, and cleaner nutritional profiles. These companies expand global reach through wider retail placement, foodservice partnerships, and region-specific flavor development. North America leads the market with 38% share, driven by strong consumer interest in mercury-free seafood alternatives, rapid product innovation, and expanding supermarket availability, making it the most influential region in driving category adoption.

Market Insights

- The Plant-Based Tuna market reached USD 322.73 million in 2024 and will grow to USD 1,102.62 million by 2032 at a 16.6% CAGR, supported by rising demand for sustainable seafood alternatives.

- Market growth is driven by health awareness, interest in ocean-safe products, and strong performance of soy-based tuna, which holds 44% share due to its texture and protein density.

- Key trends include rapid innovation in algae-based flavor systems, improved extrusion for flaky texture, and expanding demand for chunk-style products, which lead the category with 41% share.

- Competition intensifies as brands enhance product authenticity and expand foodservice presence, while high production costs and ingredient price variability remain key restraints.

- Regionally, North America holds 38% share, Europe captures 33%, and Asia Pacific accounts for 20%, driven by strong flexitarian adoption, clean-label demand, and widening retail distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Soy-based tuna holds the dominant position with 44% share, driven by its strong protein content, firm texture, and ability to replicate traditional tuna profiles more accurately than other plant proteins. Manufacturers prefer soy due to its processing stability and wide availability, which supports consistent large-scale production. Pea-based variants grow steadily as allergen-friendly demand rises, while wheat-based options gain niche traction in blended formulations. Other plant proteins, including fava bean and chickpea, expand innovation opportunities, but soy remains the leading source due to superior binding performance and consumer familiarity across retail and foodservice sectors.

- For instance, Schouten Food produces a vegan tuna using soy protein that is widely distributed in European retail chains, benefiting from soy’s reliable supply.

By Product Type

Chunks lead the market with 41% share, supported by their versatility in salads, sandwiches, and ready meals. Consumers prefer chunk-style products because they closely mimic the texture and bite of conventional tuna, which drives strong adoption in both retail and HoReCa channels. Fillets appeal to premium buyers seeking whole-cut experiences, while flakes gain traction in prepared meals and spreads. Spreads & patties expand as convenient protein-rich options for quick snacks. Chunk formats remain dominant due to broad culinary compatibility, ease of use, and strong acceptance among first-time plant-based seafood buyers.

- For instance, Good Catch Foods markets chunk-style plant-based tuna alternatives that combine multiple proteins (pea, soy, chickpea, broad bean, lentil, white bean), allowing flexible use in sandwiches or salads.

By Distribution Channel

Supermarkets and hypermarkets dominate distribution with 53% share, benefiting from wide shelf presence, strong brand visibility, and frequent in-store promotions. These outlets provide easier access for mainstream consumers, supporting higher conversion rates for emerging plant-based seafood products. Specialty stores grow through targeted health-focused assortments, while online retail accelerates due to home delivery convenience and rapid expansion of vegan marketplaces. Foodservice adoption rises as restaurants explore sustainable seafood alternatives. However, supermarkets remain the leading channel due to their scale, diverse consumer base, and ability to introduce new brands effectively.

Key Growth Drivers

Rising Shift Toward Sustainable and Ethical Seafood Alternatives

Consumers seek seafood options that avoid overfishing, mercury exposure, and environmental harm, which boosts demand for plant-based tuna. Growing awareness of ocean depletion and microplastic contamination strengthens the move toward sustainable protein sources. Brands respond with clean-label, ocean-safe products that appeal to environmentally conscious buyers. This shift draws interest from flexitarians who reduce seafood intake but still want familiar flavors and textures. The trend supports rapid market expansion across retail, online platforms, and foodservice menus.

- For instance, Ocean Hugger Foods developed its tomato-based “Ahimi” tuna using five natural ingredients and confirmed zero microplastic presence through internal product testing, which removes contamination risk linked to raw tuna supply chains.

Advancements in Texture, Flavor, and Nutritional Engineering

Improved extrusion, fermentation, and flavor-enhancement technologies help manufacturers replicate tuna’s flaky structure and savory profile more accurately. These innovations increase consumer satisfaction and support repeat purchases in mainstream retail. Enhanced nutrient fortification, including omega-3 alternatives from algae, further boosts product appeal. Brands also develop versatile formats such as chunks, flakes, and fillets to match wide culinary uses. Continued R&D investment strengthens product realism and accelerates adoption across multiple regions.

- For instance, New Wave Foods uses algal oil with standardized DHA content to resemble the long-chain omega profile of seafood and improve nutritional parity.

Growing Retail and Foodservice Penetration

Major supermarkets expand plant-based seafood aisles, improving visibility and accessibility for plant-based tuna products. Foodservice operators introduce tuna-free sushi, wraps, and salads to meet rising sustainability expectations, which drives trial among non-vegan consumers. Stronger distribution networks and better cold-chain systems support consistent supply. Promotional campaigns and sampling programs also accelerate brand recognition. As retail partnerships widen and restaurant menus diversify, market reach grows across both mature and emerging regions.

Key Trends & Opportunities

Expansion of Clean-Label and Allergen-Friendly Formulations

Consumers prefer plant-based tuna products made from simple, transparent ingredients with minimal additives. Demand rises for allergen-friendly alternatives using pea, fava bean, or chickpea proteins instead of soy or wheat. Brands explore natural flavoring systems and algae-based nutritional enhancers to meet health-conscious preferences. This trend creates opportunities for premium offerings and supports higher price points. Clean-label innovation strengthens trust and positions plant-based tuna as a healthier seafood replacement.

- For instance, Nestlé’s Sensational Vuna has a limited ingredient list and provides significant protein per serving, using pea protein to offer a fish alternative verified through Nestlé product specification data.

Innovation in Global and Culinary Applications

Brands develop region-inspired flavors and formats suitable for sushi, poke bowls, Mediterranean dishes, and fusion meals. These innovations expand culinary versatility and attract younger consumers seeking novel seafood experiences. Restaurants experiment with plant-based tuna across wraps, salads, and appetizers, increasing exposure in foodservice. Product diversification through flavored chunks, spiced flakes, and marinated fillets creates new revenue streams. The trend enhances brand differentiation and strengthens market competitiveness.

- For instance, Current Foods’ plant-based tuna in sushi-grade form contains a notable amount of protein per portion, although significantly less than conventional tuna, and is used in a range of foodservice locations, including specific sushi bars and poke outlets.

Key Challenges

High Production Costs and Ingredient Price Variability

Plant-based tuna requires specialized proteins, algae oils, and processing technologies that raise manufacturing costs. Ingredient price fluctuations, especially for pea protein and algae extracts, affect pricing stability. Smaller producers struggle to reach competitive pricing due to limited scale. These cost pressures reduce affordability in certain regions and slow adoption against lower-priced canned tuna. Improving supply chains and scaling production remain essential to reduce long-term cost barriers.

Sensory and Consumer Perception Limitations

Despite improvements, some consumers still find plant-based tuna different from traditional tuna in taste, aroma, and moisture retention. Achieving authentic flakiness and sea-like flavor remains a key technical challenge. Skepticism around processed plant foods also affects acceptance among health-focused buyers. Meat and seafood eaters compare these products directly with real tuna, raising expectations for sensory accuracy. Overcoming these perception gaps is vital for broader market penetration and repeat purchase behavior.

Regional Analysis

North America

North America leads the Plant-Based Tuna market with 38% share, driven by strong demand for sustainable seafood alternatives and high adoption among flexitarian consumers. Supermarkets and online retailers expand shelf space, making tuna-free products widely accessible. Foodservice chains add plant-based tuna to sushi rolls, salads, and wraps, increasing exposure among mainstream diners. Strong innovation from U.S.-based startups accelerates product realism through improved texture and algae-based flavoring. Rising concerns about mercury and overfishing further strengthen regional growth as consumers seek safer and environmentally responsible options.

Europe

Europe holds 33% share, supported by advanced sustainability regulations, strong vegan population growth, and rising preference for clean-label seafood alternatives. Countries such as the United Kingdom, Germany, and the Netherlands show high adoption due to well-developed plant-based ecosystems and strong retailer commitments to ocean-friendly products. Foodservice operators integrate plant-based tuna into poke bowls, sandwiches, and ready meals, boosting trial among flexitarians. Continuous focus on carbon reduction and ethical sourcing strengthens regional demand. Investments in algae-derived omega-3 formulations further enhance nutritional positioning across European markets.

Asia Pacific

Asia Pacific accounts for 20% share, driven by a rising shift toward sustainable seafood replacements and growing health-conscious consumer behavior. Major markets like Japan, China, and Australia adopt plant-based tuna in sushi, rice bowls, and convenience meals. Rapid urbanization and expanding middle-class awareness support interest in low-mercury seafood alternatives. Local manufacturers introduce region-specific flavors and formats tailored to Asian cuisine. Online platforms play a major role in product distribution, helping brands reach young and tech-savvy consumers. Increased focus on marine conservation also fuels demand across coastal markets.

Latin America

Latin America captures 6% share, supported by growing environmental awareness and rising interest in plant-based diets among urban consumers. Brazil, Mexico, and Chile show increasing retail presence of plant-based seafood products, including tuna chunks and spreads. Younger buyers experiment with sustainable protein alternatives, driving steady demand. Foodservice expansion in cafés and fast-casual chains further boosts visibility. Limited local production and higher price sensitivity remain barriers, but awareness campaigns and expanding e-commerce channels help widen market reach across the region.

Middle East & Africa

The Middle East & Africa region holds 3% share, characterized by gradual adoption driven by premium retail formats and rising interest in sustainable protein options. The UAE and Saudi Arabia lead demand due to strong expatriate influence and wider availability of plant-based seafood products. Health-conscious consumers explore low-mercury, clean-label tuna alternatives, while foodservice outlets introduce plant-based sushi and wraps. Higher import dependency and pricing challenges slow mass-market penetration. However, ongoing expansion of vegan product lines and growth in online grocery platforms support incremental market growth.

Market Segmentations:

By Source

- Soy-based

- Pea-based

- Wheat-based

- Other Plant Proteins

By Product Type

- Fillets

- Chunks

- Flakes

- Spreads & Patties

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Foodservice

By Application

- Retail

- HoReCa (Hotels, Restaurants, Cafés)

- Ready-to-Eat Meals

- Household Cooking

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features key players such as Good Catch Foods, Ocean Hugger Foods, Sophie’s Kitchen, TUNO, New Wave Foods, Loma Linda, Akua, Wild Type, Kuleana, and Sushi Mushi. These companies focus on replicating the taste, texture, and nutritional profile of traditional tuna through advanced processing technologies, algae-based flavor systems, and improved protein blends. Leading brands expand retail and foodservice presence by offering versatile formats such as chunks, flakes, fillets, and spreads that fit various culinary applications. Partnerships with sushi chains, cafés, and meal kit platforms improve visibility and consumer trial rates. Many players prioritize clean-label formulations and omega-rich ingredients to appeal to health-conscious buyers. Continued investment in R&D, sustainable sourcing, and regional flavor innovation strengthens competition as companies work to differentiate their products in a fast-growing plant-based seafood category.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Akua

- TUNO

- Sushi Mushi

- Wild Type

- Good Catch Foods

- Kuleana

- Sophie’s Kitchen

- New Wave Foods

- Loma Linda

- Ocean Hugger Foods

Recent Developments

- In August 2025, Atlantic Natural Foods (ANF) completed the sale of its assets, including the Loma Linda and TUNO business units, to Century Pacific North America (CPNA) after bankruptcy proceedings. The sale allows for the continuation of the brands’ legacy products with supply to over 30 countries.

- In April 2025, TUNO’s parent company, Atlantic Natural Foods, filed for Chapter 11 bankruptcy amid challenges in the plant-based seafood sector.

- In 2024, Akua, known for seaweed-based alternatives including tuna explorations, ceased operations after facing logistical hurdles and market declines in plant-based meat.

Report Coverage

The research report offers an in-depth analysis based on Source, Product Type, Distribution Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as consumers seek sustainable and mercury-free seafood alternatives.

- Product realism will improve with better algae-based flavor systems and extrusion methods.

- Clean-label and allergen-friendly formulations will gain stronger market preference.

- Foodservice chains will expand plant-based tuna options in sushi, salads, and wraps.

- Regional flavor innovation will support broader adoption and repeat buying.

- Retailers will increase shelf presence for plant-based seafood categories.

- Scaling production will help reduce ingredient costs and improve affordability.

- Partnerships between brands and protein suppliers will accelerate R&D progress.

- Emerging markets will show faster uptake due to rising environmental awareness.

- Sustainability messaging will strengthen brand loyalty and long-term category growth.