Market Overview

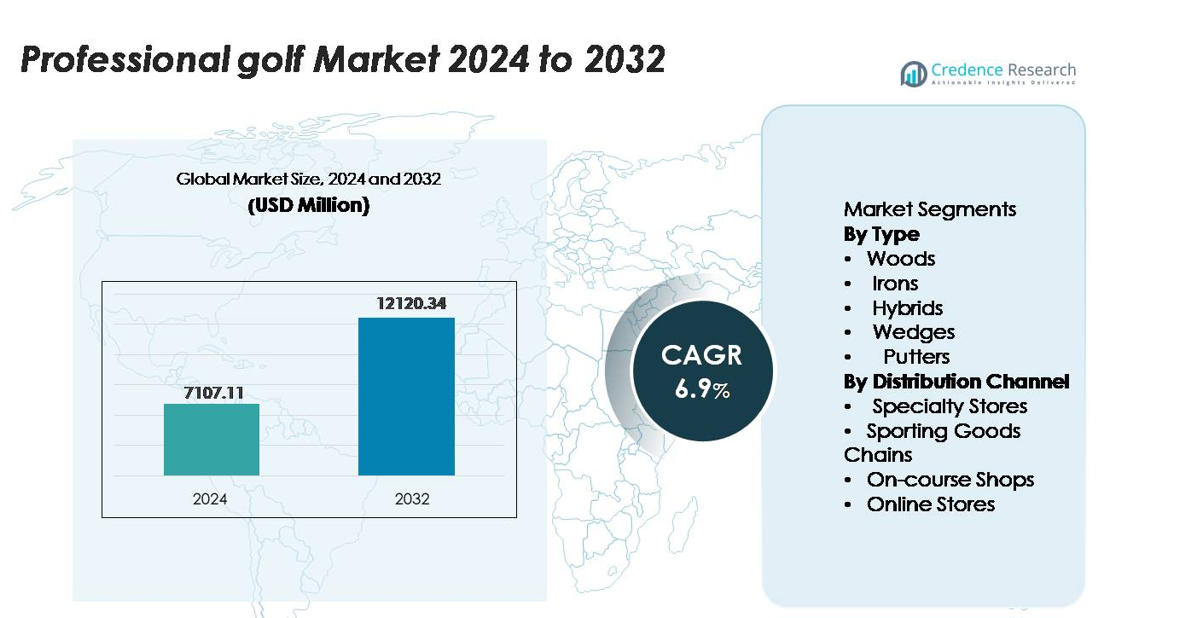

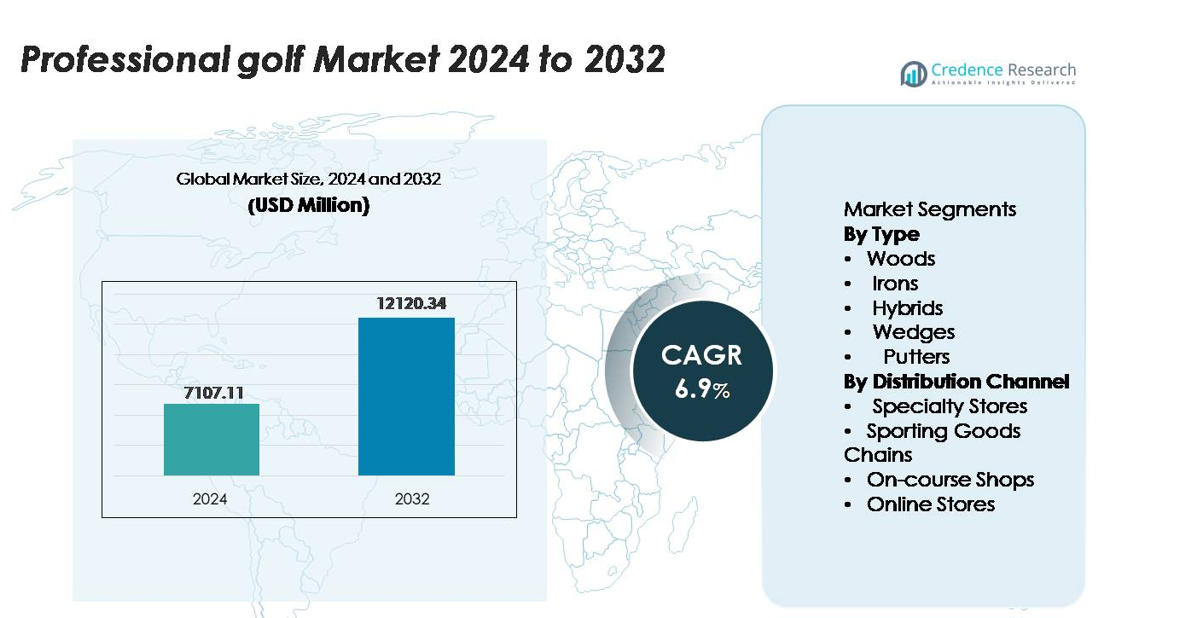

The Professional golf equipment market was valued at USD 7,107.11 million in 2024 and is projected to reach USD 12,120.34 million by 2032, expanding at a CAGR of 6.9% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Professional golf equipment market Size 2024 |

USD 7,107.11 million |

| Professional golf equipment market, CAGR |

6.9% |

| Professional golf equipment market Size 2032 |

USD 12,120.34 million |

The professional golf equipment market is shaped by leading players known for their technological innovation, premium product portfolios, and strong presence across global tours. Brands such as Titleist, TaylorMade, Callaway, Ping, Mizuno, and Cobra dominate the competitive landscape through continuous advancements in multi-material club construction, AI-optimized designs, and precision fitting technologies. Their endorsements with top PGA and European Tour athletes strengthen market positioning and influence product preference among professional and advanced amateur golfers. North America leads the global market with a 38% share, supported by mature golf infrastructure and high equipment spending, followed by Europe at 27% and Asia-Pacific at 25%, reflecting expanding participation and rising demand for professional-grade clubs.

Market Insights

- The professional golf equipment market was valued at USD 7,107.11 million in 2024 and is expected to reach USD 12,120.34 million by 2032, registering a CAGR of 6.9%, driven by rising demand for advanced clubs, premium fittings, and performance-focused innovations.

- Market growth is propelled by expanding professional tournaments, increasing adoption of personalized fitting technologies, and continuous advancements in multi-material engineering for woods, irons, and wedges.

- Key trends include the surge in custom-fitted equipment, rapid expansion of online retail channels, and AI-driven club design improving precision, forgiveness, and shot consistency across segments, with woods holding the dominant share.

- Competitive intensity remains high, led by Titleist, TaylorMade, Callaway, Ping, and Mizuno, who strengthen their positions through athlete endorsements, premium product launches, and advanced fitting studio networks.

- Regionally, North America leads with 38%, followed by Europe at 27% and Asia-Pacific at 25%, supported by strong participation rates and high demand for premium professional-grade equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Woods dominate the professional golf equipment segment, holding the largest market share due to their critical role in driving performance, distance optimization, and precision on long-range shots. Their leadership is reinforced by continuous innovations in multi-material head construction, high-moment-of-inertia designs, and adjustable loft technologies that cater to professional and advanced players. Irons and wedges also maintain strong demand because of their importance in approach and short-game accuracy, while hybrids gain traction among players seeking versatility and forgiveness. Putters remain essential, though growth is steadier, driven by incremental improvements in alignment systems and face-insert technologies.

- For instance, TaylorMade’s Stealth 2 Plus driver integrates a carbon face weighing 24 grams and a sliding 15-gram rear track weight, enabling precise shot-shape adjustment and improved energy transfer at impact.

By Distribution Channel

Specialty stores account for the dominant share of the professional golf equipment market, driven by their personalized fittings, expert guidance, and access to premium club customization services. Professional players and serious amateurs prefer these outlets for precision fitting sessions, launch-monitor assessments, and brand-specific fitting studios. Sporting goods chains continue to expand their presence by offering wider inventories and competitive pricing, while on-course shops remain important for immediate, event-driven purchases. Online stores show rapid growth as digital customization tools, virtual fitting platforms, and direct-to-consumer premium club launches enhance convenience and accessibility.

- For instance, Titleist Performance Institute (TPI) fitting centers use TrackMan 4 radar systems capable of capturing more than 27 data parameters per swing and operating at sampling rates above 40,000 measurements per second, enabling highly accurate club and shaft matching.

Key Growth Drivers

Rising Participation in Professional and Amateur Tournaments

A growing number of professional and semi-professional golf tournaments globally continues to stimulate demand for advanced golf equipment. Expanding PGA, LPGA, European Tour, and APAC-based events attract new athletes and elevate equipment standards, encouraging frequent upgrades. Amateur circuits and corporate leagues also fuel product replacement cycles as players seek performance-enhancing clubs tailored to precision, distance, and swing stability. The increasing availability of golf academies and professional coaching programs drives early adoption of high-performance woods, irons, and wedges, further reinforcing segment expansion. Improved course infrastructure, wider access to training facilities, and targeted initiatives to promote youth participation collectively strengthen market momentum. As more regions invest in golf tourism and international tournaments, equipment sales—especially premium clubs engineered for optimized ball flight and playability—continue to accelerate across both established and emerging markets.

- For instance, Callaway’s Paradym Ai Smoke driver, introduced with tour adoption in early 2024, incorporates a 360-degree carbon chassis reinforced with an internal titanium support structure, resulting in a total head construction that is 15% lighter than its immediate predecessor, the 2023 Paradym driver.

Continuous Innovation in Material Engineering and Club Technology

Ongoing advancements in clubface engineering, multi-material construction, and aerodynamic shaping significantly support market growth. Manufacturers integrate carbon composites, titanium alloys, tungsten weighting, and AI-driven design tools to enhance ball speed, forgiveness, and stability across varying swing profiles. Adjustable hosels, variable face thickness, and precision-milled putter faces allow players to fine-tune performance with unprecedented accuracy. Launch monitor data increasingly drives R&D decisions, enabling clubs optimized for spin control, launch angle, and moment of inertia. These innovations appeal strongly to professional golfers seeking competitive edge and to advanced amateurs adopting pro-level gear. The rapid evolution of personalized fitting systems, including 3D swing modeling and dynamic shaft fitting, strengthens demand for technologically advanced clubs. Collectively, these innovations p ush equipment boundaries and elevate consumer expectations, driving premiumization and repeat purchases.

- For instance, the TaylorMade 2024 Qi10 LS driver incorporates an Infinity Carbon Crown that covers approximately 97%of the crown area and a redesigned sole, enabling strategic mass redistribution used to position an 18-gram steel sliding weight in an innovative track system for enhanced inertia, lower spin, and adjustable shot bias.

Expansion of Golf Tourism and High-End Course Development

Global growth in golf tourism significantly strengthens demand for professional-grade equipment, particularly in Asia-Pacific, the Middle East, and Europe. Newly developed championship-level courses integrated into luxury resorts attract elite players who prefer on-site fittings and exclusive club releases. Countries investing in sports tourism—such as Japan, South Korea, UAE, and Thailand—promote year-round golfing, driving purchases of woods, irons, wedges, and precision-oriented putters. High-income travelers often buy new equipment during travel due to tax incentives, limited editions, or destination-specific product launches. Additionally, resort pro shops increasingly collaborate with leading brands to offer customized fittings using advanced simulation technology. As destination golf continues rising alongside premium hospitality experiences, professional equipment sales—especially high-margin custom clubs—experience robust traction.

Key Trends & Opportunities

Surge in Custom Fitting and Data-Driven Personalization

The professional golf equipment market is shifting strongly toward personalized, data-backed customization. Players increasingly rely on launch monitors, AI-assisted fitting tools, and 3D swing analysis to determine ideal club length, shaft flexibility, lie angle, and head design. Manufacturers now offer extensive fitting matrices across woods, irons, wedges, and putters, enabling precision matching with swing dynamics. This trend creates strong opportunities for premium product lines, adjustable club systems, and modular head–shaft configurations tailored to individual performance goals. Retailers and specialty stores benefit from this shift by offering in-store simulation labs with high-speed cameras and real-time feedback systems. The expanding ecosystem of personalized equipment unlocks new revenue streams, including subscription-based fitting programs and bespoke club-building services, enhancing market value and long-term customer loyalty.

- For instance, Foresight Sports’ GCQuad widely used in OEM fitting studios and by PGA Tour professionals captures ball and club data using four high-speed cameras operating at over 6,000 frames per second and delivers highly precise impact measurements, with documented accuracy sufficient to pinpoint strike location on the clubface with sub-millimeter consistency.

Growth of Online Retail and Direct-to-Consumer Premium Brands

The rapid expansion of digital retail creates significant opportunities for professional golf equipment suppliers. E-commerce platforms now offer virtual fitting tools, augmented reality visualization, and online shaft-selection interfaces, enabling players to purchase customized clubs without visiting physical stores. Direct-to-consumer premium brands are gaining visibility through online-exclusive product launches, limited editions, and influencer-led performance reviews. Higher transparency in product specifications, combined with ease of comparing technologies, accelerates online conversions for advanced clubs. Subscription-based demo programs—where players test clubs at home before purchasing—also drive engagement. As online retail continues evolving with personalized recommendation engines and interactive fitting workflows, manufacturers have a major opportunity to scale distribution globally, reduce retail overhead, and increase profit margins.

- For instance, Arccos’ AI-powered online fitting engine processes more than 1.3 billion on-course shots collected through sensors weighing approximately 7.34 grams each (for standard twist-in sensors), generating precise distance and dispersion metrics that guide remote club recommendations.

Key Challenges

High Cost of Professional-Grade Clubs and Limited Accessibility

Professional golf equipment remains expensive due to advanced material engineering, precision manufacturing, and extensive R&D investment. High-performance drivers, forged irons, tungsten-weighted wedges, and milled putters often exceed affordability for new or budget-conscious players. This cost barrier slows adoption across emerging markets and limits penetration among young players transitioning into competitive golf. Additionally, currency fluctuations and import duties increase retail prices in several countries, further widening accessibility gaps. Although financing and trade-in programs help, the overall affordability challenge restrains broader market growth, particularly for premium club categories that require frequent updates to maintain competitive performance.

Supply Chain Constraints and Material Sourcing Limitations

Manufacturers face persistent supply chain disruptions involving titanium, carbon fiber composites, and high-grade steel alloys used in professional golf club production. Fluctuations in material availability, coupled with increased freight costs and manufacturing delays, can impact inventory cycles and slow new product rollouts. Precision-milled components require highly specialized machining capabilities, which are limited to select regions, increasing dependency risks. Geopolitical tensions and transportation bottlenecks also affect cross-border distribution, delaying product launches and constraining retailer stock levels. As global demand for advanced materials rises across multiple industries, golf equipment manufacturers must navigate sourcing challenges while maintaining performance standards and production agility.

Regional Analysis

North America

North America holds the largest share of the professional golf equipment market, accounting for about 38% of global revenue. The region benefits from a highly established golf culture, strong PGA Tour influence, and high spending capacity among professional and advanced amateur players. The United States leads demand for premium woods, forged irons, and custom-fitted putters supported by widespread access to advanced fitting studios and state-of-the-art practice facilities. Golf tourism hotspots, corporate tournaments, and year-round play in states such as Florida, California, and Arizona further reinforce strong equipment replacement cycles.

Europe

Europe represents approximately 27% of the global market, driven by strong professional circuits, growing training academies, and increasing participation across the UK, Germany, Sweden, and Spain. The region’s mature golf infrastructure supports high adoption of technologically advanced irons, wedges, and precision-engineered putters. Demand is further strengthened by rising golf tourism in Scotland and Portugal, where professional-grade clubs remain heavily sought after. The presence of elite European Tour events and investment in high-performance training centers also contribute to continuous upgrades among professional and competitive amateur golfers.

Asia-Pacific

Asia-Pacific accounts for around 25% of the market and is the fastest-growing region, led by rising golf participation in Japan, South Korea, China, Thailand, and Australia. Strong investments in golf course development, national training programs, and youth talent initiatives drive equipment demand across premium categories. Professional players in Japan and Korea exhibit strong preference for high-precision irons and custom-engineered drivers, supporting brand-driven market expansion. Increasing popularity of international tournaments and the rise of golf tourism hubs across APAC continue to boost sales of advanced clubs and digitally customized fitting solutions.

Latin America

Latin America holds close to 6% of the global market, supported by growing interest in competitive golf in Mexico, Brazil, Argentina, and Chile. Expansion of regional tournaments and improved access to training facilities contribute to rising adoption of professional-level woods, irons, and wedges. Golf tourism in Mexico’s resort destinations remains a major growth enabler, driving sales through on-course shops and specialty stores. Although market penetration is still developing, increasing youth participation and expanding sponsorship programs are gradually strengthening demand for higher-end equipment lines.

Middle East & Africa

The Middle East & Africa region accounts for around 4% of the market, supported by rapid golf infrastructure development in the UAE, Saudi Arabia, and South Africa. High-end resorts and championship courses in Dubai and Abu Dhabi attract professional players and affluent tourists, driving demand for premium clubs and customized fittings. Government-backed sports initiatives and the hosting of international tournaments continue to elevate the region’s visibility. While overall participation remains modest, increasing investments in elite golf facilities and luxury pro shops support steady adoption of advanced professional equipment.

Market Segmentations:

By Type

- Woods

- Irons

- Hybrids

- Wedges

- Putters

By Distribution Channel

- Specialty Stores

- Sporting Goods Chains

- On-course Shops

- Online Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the professional golf equipment market is characterized by strong innovation, brand-driven loyalty, and continuous product advancements led by major global manufacturers. Companies focus heavily on R&D to develop high-performance woods, precision-forged irons, advanced hybrids, and technology-enhanced putters tailored to professional and elite amateur players. Leading brands emphasize multi-material engineering, AI-assisted clubface design, adjustable weighting systems, and data-driven custom fitting to differentiate their offerings. Strategic partnerships with PGA and European Tour athletes enhance product visibility and influence purchasing preferences across global markets. Additionally, manufacturers expand their presence through specialty fitting studios, exclusive product lines, and direct-to-consumer channels. As competition intensifies, companies increasingly invest in digital fitting platforms, premium customization programs, and limited-edition releases to strengthen market position and capture the growing demand for professional-grade golf equipment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dixon Golf, Inc.

- Adidas AG

- Robin Golf

- SUMITOMO Rubber Industries, Ltd.

- Callaway Golf Company

- Nike, Inc.

- Acushnet Holdings Corp.

- Amer Sports

- DICK’S Sporting Goods, Inc.

- BRIDGESTONE CORPORATION

Recent Developments

- In July 2025, the company Callaway Golf Company launched two new premium irons—the Apex Ti Fusion Plated and Apex Ti Fusion Plated 250—featuring a chrome-plated titanium finish, Ai Smart Face technology and urethane microspheres, available from July 25 2025.

- In February 2022, the company Sumitomo Rubber Industries, Ltd. announced initiatives to strengthen the “DUNLOP” brand’s equity within its global golf business, including tour-sponsorship engagements and brand repositioning efforts.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as professional tournaments and elite training programs attract more skilled players globally.

- Demand for advanced, multi-material clubs will rise as manufacturers enhance performance through AI-driven and data-backed engineering.

- Custom fitting will become a standard expectation, supported by the growth of simulation studios and personalized fitting technologies.

- Online retail will gain significant traction as virtual fitting tools and direct-to-consumer premium launches increase accessibility.

- Professional endorsements will strongly influence player preferences, driving rapid adoption of next-generation drivers, irons, and wedges.

- Sustainability initiatives will encourage manufacturers to explore eco-friendly materials and greener production processes.

- Growth in golf tourism and luxury resort courses will stimulate premium equipment sales across key destinations.

- Emerging markets in Asia-Pacific and the Middle East will experience rising participation, strengthening regional demand.

- Innovations in shaft technology and adjustable club systems will drive faster upgrade cycles among professionals.

- Competition will intensify as brands focus on limited editions and high-precision customization to differentiate their offerings.