Market Overview

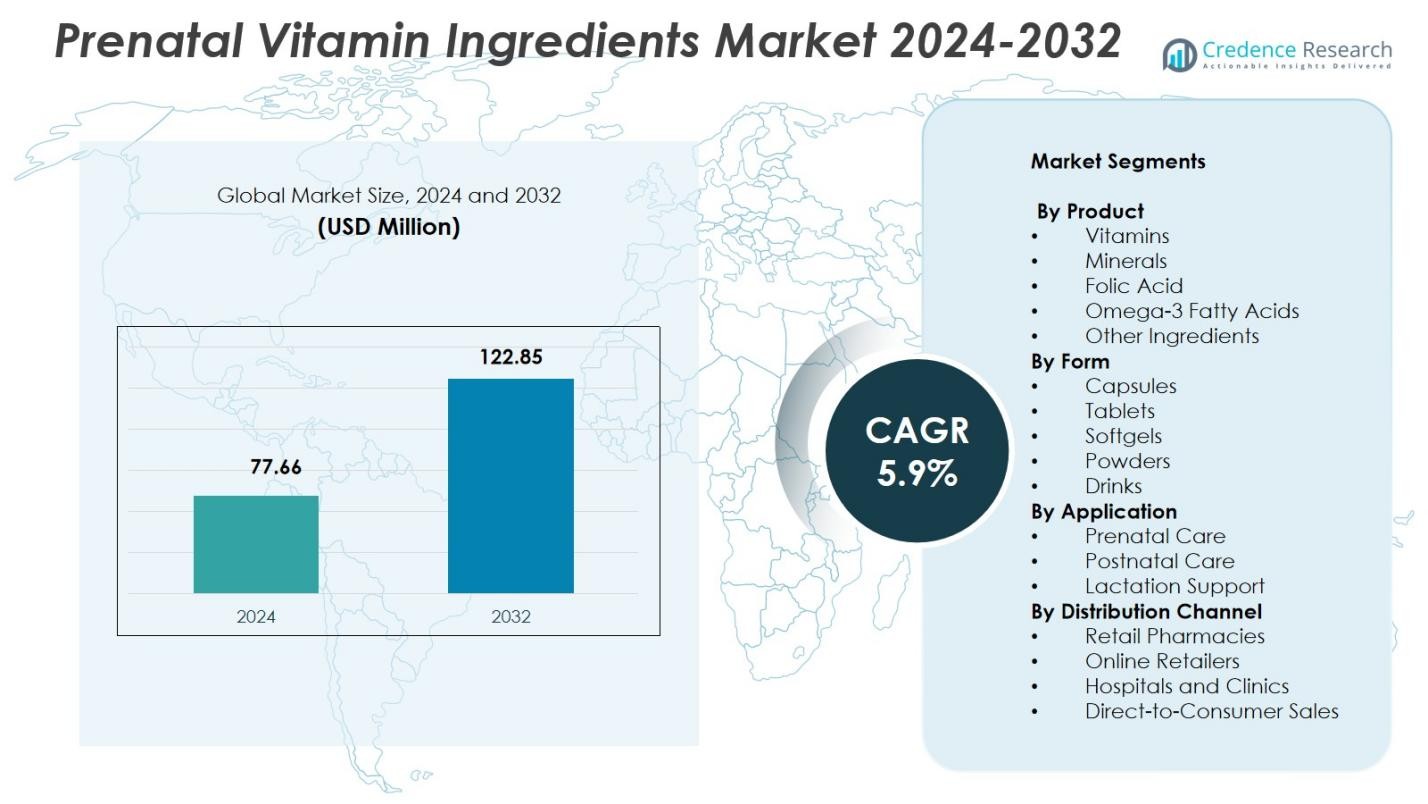

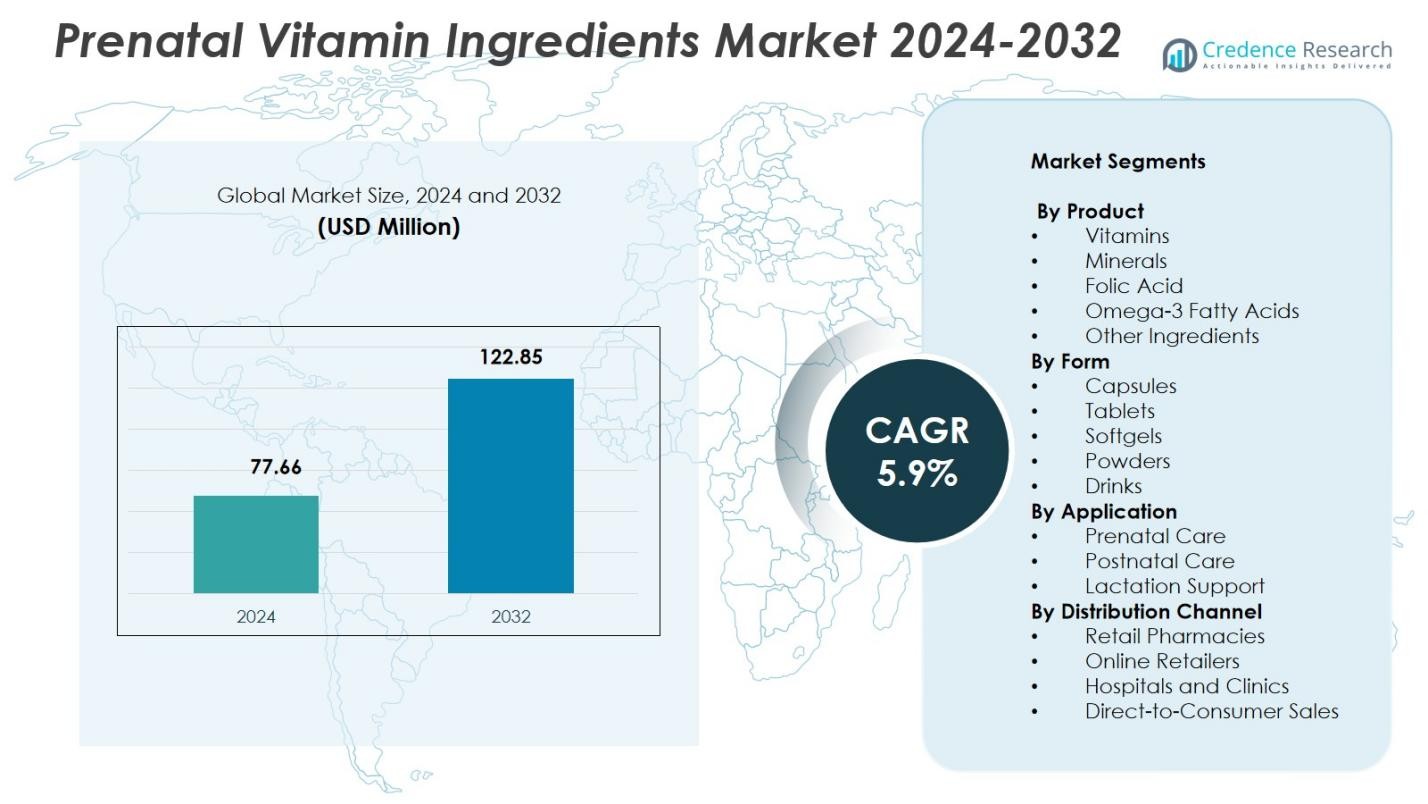

Prenatal Vitamin Ingredients Market size was valued at USD 77.66 Million in 2024 and is anticipated to reach USD 122.85 Million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prenatal Vitamin Ingredients Market Size 2024 |

USD 77.66 Million |

| Prenatal Vitamin Ingredients Market, CAGR |

5.9% |

| Prenatal Vitamin Ingredients Market Size 2032 |

USD 122.85 Million |

Prenatal Vitamin Ingredients Market features leading players such as DSM-Firmenich, BASF SE, Lonza Group, DuPont Nutrition & Biosciences, ADM, Gelita AG, Croda International, and Kerry Group, all focusing on innovation, ingredient purity, and bioavailability to support premium prenatal formulations. These companies drive advancements in methylated folate, chelated minerals, algae-based DHA, and bioactive nutrient complexes to meet rising maternal health demands. Regionally, North America led the Prenatal Vitamin Ingredients Market with a 34.6% share in 2024, supported by high awareness, strong healthcare recommendations, and early adoption of advanced prenatal supplementation across the U.S. and Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prenatal Vitamin Ingredients Market reached USD 77.66 Million in 2024 and will grow USD 122.85at a CAGR of 5.9% through 2032, driven by rising maternal nutrition needs.

- Market growth is supported by strong physician recommendations, with the Vitamins segment holding a 42.3% share in 2024 due to its essential role in fetal development and widespread inclusion in prenatal formulations.

- Clean-label, plant-based, and bioavailable nutrient trends continue to accelerate demand, especially for methylated folate, chelated minerals, and algae-derived DHA across global prenatal supplement brands.

- Key players such as DSM-Firmenich, BASF SE, Lonza Group, and DuPont advance ingredient innovation and expand partnerships, while quality compliance and strict regulatory requirements present notable restraints for manufacturers.

- Regionally, North America led with a 34.6% share in 2024, followed by Europe at 28.1% and Asia-Pacific at 23.7%, supported by strong maternal health programs and increasing adoption of premium prenatal formulations.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product:

The Prenatal Vitamin Ingredients Market shows strong differentiation across product categories, with Vitamins leading the segment with a 42.3% share in 2024 due to widespread inclusion in prenatal formulations and established clinical benefits for fetal development. Minerals, folic acid, omega-3 fatty acids, and other specialty nutrients continue to expand as brands focus on comprehensive maternal nutrition. Growth is driven by rising awareness of micronutrient deficiencies during pregnancy, increasing physician recommendations, and the shift toward premium formulations containing DHA, choline, and bioactive mineral complexes to enhance maternal and neonatal outcomes.

- For instance, Nature Made’s Prenatal Multi + Choline provides 265 mg of choline per daily capsule alongside folic acid and 200 mg DHA in the companion softgel, supporting baby’s brain, cognitive, and spinal cord development.

By Form:

Within the form segment, Tablets dominated with a 38.7% share in 2024, supported by their longer shelf life, formulation stability, and cost efficiency. Capsules, softgels, powders, and drinks continue to gain traction as consumers seek easier-to-digest and faster-absorbing formats, especially softgels enriched with DHA. Market expansion is driven by improved delivery technologies, greater adoption of gummy and liquid alternatives among women experiencing morning sickness, and increased brand focus on expanding multi-format portfolios to address diverse consumption preferences across global prenatal care markets.

- For instance, Garden of Life’s Dr. Formulated Prenatal DHA softgels deliver 550mg DHA plus 120mg EPA and 20mcg vitamin D3 in one daily serving from sustainably sourced tuna oil. These support fetal brain development without fishy aftertaste.

By Application:

In the application category, Prenatal Care remained the leading sub-segment with a 66.4% share in 2024, driven by growing maternal health awareness and rising obstetric recommendations for daily supplementation before and during pregnancy. Postnatal care and lactation support are gaining momentum as research highlights nutrient depletion following childbirth and the importance of DHA, iron, and multivitamins for breastfeeding mothers. Demand in this segment is propelled by the rise in planned pregnancies, improved healthcare access, and the increasing emphasis on continuity of maternal nutrition from preconception through postnatal stages.

Key Growth Drivers

Rising Maternal Health Awareness and Nutritional Deficiencies

The Prenatal Vitamin Ingredients Market benefits significantly from rising awareness of maternal nutrition and the increasing global occurrence of micronutrient deficiencies among pregnant women. Healthcare professionals emphasize early supplementation of folic acid, iron, omega-3 fatty acids, and essential vitamins to prevent neural tube defects and support fetal development. Growing access to digital health information encourages women to begin supplementation during preconception, strengthening long-term demand. Government-led maternal health initiatives and high adoption of premium formulations with bioavailable nutrients further accelerate market expansion across both developed and developing regions.

- For instance, Thorne Basic Prenatal provides 1.7 mg DFE of folate (L-5-MTHF) and 45 mg of iron bisglycinate per serving to support neural tube formation and prevent maternal anemia without causing constipation.

Expansion of Premium and Functional Prenatal Formulations

A strong growth driver emerges from the industry’s shift toward premium, functionally enhanced prenatal formulations that incorporate DHA, choline, methylated folate, and chelated minerals. These advanced ingredients provide improved absorption and targeted benefits, addressing energy balance, fetal cognitive development, and immune health. Brands increasingly rely on scientific validation and clinical evidence to support efficacy, appealing to health-conscious mothers. This move toward specialized blends boosts ingredient volumes, drives supplier innovation, and strengthens demand across multivitamin, softgel, and fortified beverage formats within global prenatal nutrition markets.

- For instance, TheraNatal Complete by Theralogix includes DHA alongside 5-methylfolate (5-MTHF), an alternative form of folate for easier absorption, and is NSF-certified for label accuracy with no harmful contaminants.

Increasing Healthcare Recommendations and Adoption of Preventive Care

Healthcare systems and obstetric specialists strongly promote prenatal supplementation as a preventive measure to reduce pregnancy-related complications and improve neonatal outcomes, providing a major boost to demand. Standardized guidelines recommending folic acid, iron, calcium, and omega-3 ingredients throughout pregnancy create consistent market pull. Growing insurance coverage for prenatal supplements in several regions and increased use of digital prescription platforms enhance accessibility. The trend toward preconception counseling encourages earlier adoption, extending the supplementation window and driving higher consumption of prenatal vitamin ingredients annually.

Key Trends & Opportunities

Rising Demand for Clean Label, Organic, and Plant-Based Ingredients

A key trend shaping the market is the rapid adoption of clean-label, organic, allergen-free, and plant-based prenatal ingredients. Expectant mothers increasingly prefer formulations free from synthetic additives, artificial colors, and animal-derived components. This shift creates strong opportunities for suppliers offering vegan DHA from algae, natural folate sources, whole-food vitamin blends, and sustainably sourced minerals. Transparency in sourcing and traceability programs enhances brand competitiveness, encouraging manufacturers to innovate in natural, eco-friendly ingredients that align with evolving consumer preferences across global prenatal supplement categories.

- For instance, Country Life Vitamins offers Realfood Organics Prenatal Multivitamin, featuring folate from an organic food blend including guava, mango, and lemon extracts, alongside fermented whole foods like kale and broccoli sprouts for gentle stomach absorption.

Innovation in Delivery Formats and Personalized Prenatal Nutrition

Growing consumer preference for convenient and personalized nutrition solutions drives strong opportunities in advanced delivery formats and tailored prenatal supplementation. Innovation in softgels, gummies, liquid shots, and powdered drink mixes enhances compliance, especially among women experiencing nausea or pill fatigue. Digital health platforms offering personalized nutrient recommendations based on genetics, lifestyle, and lab values further expand ingredient demand. This trend encourages ingredient diversification, including microencapsulated minerals, bioactive lipids, and controlled-release vitamins, creating new value segments in maternal nutrition solutions.

- For instance, Centrum introduced Prenatal Multivitamin Gummies with folic acid and DHA, providing two gummies daily with 11 key vitamins, iodine for healthy pregnancy support, and vitamin D for bone health in both mother and baby.

Key Challenges

Regulatory Complexity and Stringent Ingredient Compliance

The Prenatal Vitamin Ingredients Market faces major challenges due to stringent regulatory frameworks governing ingredient safety, claims, and permissible concentrations. Authorities closely monitor folic acid, iron, DHA, and herbal ingredients to ensure maternal and fetal safety, requiring extensive testing and documentation. Differences in regulations across the U.S., Europe, and Asia complicate global formulation strategies and increase compliance costs. Ingredient suppliers must continuously update technical dossiers and adhere to evolving standards, which can slow product launches and limit the introduction of novel nutrient sources.

High Sensitivity to Product Quality and Risk of Contamination

Quality concerns present a significant challenge, as prenatal supplements require exceptional purity due to the vulnerable target population. Contamination risks involving heavy metals, allergens, or inconsistent nutrient potency can severely damage brand credibility and impact ingredient suppliers. Manufacturers must maintain rigorous quality control, validated supply chains, and advanced testing processes to ensure safety. Any deviation can lead to recalls, regulatory scrutiny, and loss of consumer trust. This sensitivity increases manufacturing complexity and places pressure on suppliers to maintain superior safety standards consistently.

Regional Analysis

North America

North America dominated the Prenatal Vitamin Ingredients Market with a 34.6% share in 2024, driven by strong health awareness, widespread prenatal supplementation practices, and robust healthcare recommendations. High adoption of premium formulations containing DHA, methylated folate, and chelated minerals supports ingredient demand. The U.S. leads the region due to advanced manufacturing capabilities, strong retail penetration, and early supplementation trends among women planning pregnancies. Rising emphasis on clean-label, vegan, and allergen-free prenatal products further enhances growth, while continuous R&D investment from major brands accelerates innovation across vitamins, minerals, and omega-3 ingredient categories.

Europe

Europe accounted for a 28.1% share in 2024, supported by strong regulatory oversight, high nutritional awareness, and widespread adherence to maternal health guidelines. Countries such as Germany, the U.K., and France exhibit high demand for folic acid, iron, and organic or plant-based prenatal ingredients. The region benefits from strong healthcare infrastructure and rising preference for clinically validated formulations. Growth is also reinforced by expanding vegan populations seeking non-animal-derived DHA and bioactive nutrients. Increasing investment in sustainable ingredient sourcing and traceability programs drives further market expansion across prenatal vitamin ingredient suppliers.

Asia-Pacific

Asia-Pacific held a 23.7% share in 2024, emerging as one of the fastest-growing regional markets due to rising birth rates, improving maternal healthcare access, and increasing awareness of nutrient deficiencies during pregnancy. China, India, Japan, and South Korea drive demand for folic acid, iron, and DHA ingredients as governments promote mandatory prenatal supplementation programs. Expanding middle-class populations and greater willingness to purchase premium supplements also support market growth. Increased prevalence of anemia and micronutrient deficiencies among pregnant women further accelerates ingredient consumption across prenatal care and lactation support categories.

Latin America

Latin America captured a 7.8% share in 2024, driven by growing healthcare initiatives to reduce maternal and infant mortality rates. Brazil and Mexico dominate regional demand as prenatal supplementation becomes more integrated into public health programs. Rising awareness of folic acid and iron deficiency, coupled with expanding retail availability of fortified products, supports market expansion. Increasing urbanization and rising disposable income encourage women to adopt premium prenatal blends with DHA and bioavailable minerals. However, limited healthcare access in rural areas remains a challenge, creating uneven penetration across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 5.8% share in 2024, reflecting steady growth supported by improving maternal healthcare infrastructure and rising awareness of nutritional supplementation during pregnancy. Countries such as Saudi Arabia, the UAE, and South Africa show increasing demand for folic acid, iron, and multivitamin ingredients as healthcare campaigns highlight maternal nutrition needs. Expansion of private healthcare facilities and growing retail penetration drive product availability. Although economic disparities and limited access in remote areas constrain adoption, rising focus on preventive care and fortified supplements continues to boost demand across prenatal applications.

Market Segmentations:

By Product

- Vitamins

- Minerals

- Folic Acid

- Omega-3 Fatty Acids

- Other Ingredients

By Form

- Capsules

- Tablets

- Softgels

- Powders

- Drinks

By Application

- Prenatal Care

- Postnatal Care

- Lactation Support

By Distribution Channel

- Retail Pharmacies

- Online Retailers

- Hospitals and Clinics

- Direct-to-Consumer Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Prenatal Vitamin Ingredients Market features a diverse group of key players, including DSM-Firmenich, BASF SE, Lonza Group, DuPont Nutrition & Biosciences, Archer Daniels Midland Company, Gelita AG, Croda International, and Kerry Group. The competitive landscape reflects strong emphasis on innovation, ingredient purity, and bioavailability, as companies expand portfolios across vitamins, minerals, omega-3 fatty acids, and bioactive nutrient complexes. Leading suppliers invest in microencapsulation, fermentation-based folate, plant-derived DHA, and chelated mineral technologies to enhance absorption and safety. Strategic partnerships with prenatal supplement manufacturers strengthen supply-chain integration and drive co-development of premium, science-backed formulations. Companies increasingly focus on sustainability, traceability, and allergen-free ingredient production to align with clean-label consumer preferences. Regulatory compliance, quality assurance, and global distribution capabilities remain central differentiators as brands compete to meet rising maternal health standards across diverse regional markets.

Key Player Analysis

- MegaFood

- Rainbow Light

- Vitafusion

- Garden of Life

- SmartyPants

- Nature Made

- New Chapter

- Church & Dwight

- Nordic Naturals

- Deva Nutrition

Recent Developments

- In June 2024, Balchem launched Optifolin+®, a choline-enriched folate ingredient designed for prenatal and maternal nutrition formulations.

- In September 2025, BASF SE completed the sale of its Food & Health Performance Ingredients business (including omega-3 oils for human nutrition) to Louis Dreyfus Company (LDC), signaling a strategic shift in ingredient supply for prenatal supplements.

- In April 2025, Ritual announced the completion of a clinical study on its prenatal multivitamin reinforcing its product’s nutritional efficacy and supporting ingredient demand in prenatal formulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as prenatal supplementation becomes more integrated into global maternal health guidelines.

- Demand for plant-based, clean-label, and organic prenatal ingredients will rise as consumers prioritize natural and transparent formulations.

- Advanced nutrient forms such as methylated folate, chelated minerals, and algae-derived DHA will gain wider adoption for improved absorption and efficacy.

- Digital health platforms will increasingly support personalized prenatal nutrition plans, boosting demand for specialized ingredient blends.

- Manufacturers will expand research on fetal cognitive development, driving higher usage of choline, DHA, and bioactive lipid ingredients.

- Softgels, gummies, powders, and ready-to-drink prenatal formats will grow in popularity, enhancing ingredient diversification.

- Sustainability and traceability will become essential as brands adopt eco-friendly sourcing and responsible manufacturing.

- Clinical validation and evidence-based ingredient claims will influence purchasing decisions and strengthen product differentiation.

- Emerging markets will witness accelerated adoption due to rising healthcare access and awareness of maternal nutrient deficiencies.

- Strategic collaborations between ingredient suppliers and supplement brands will expand innovation and accelerate new product development.

Market Segmentation Analysis:

Market Segmentation Analysis: