Market Overview

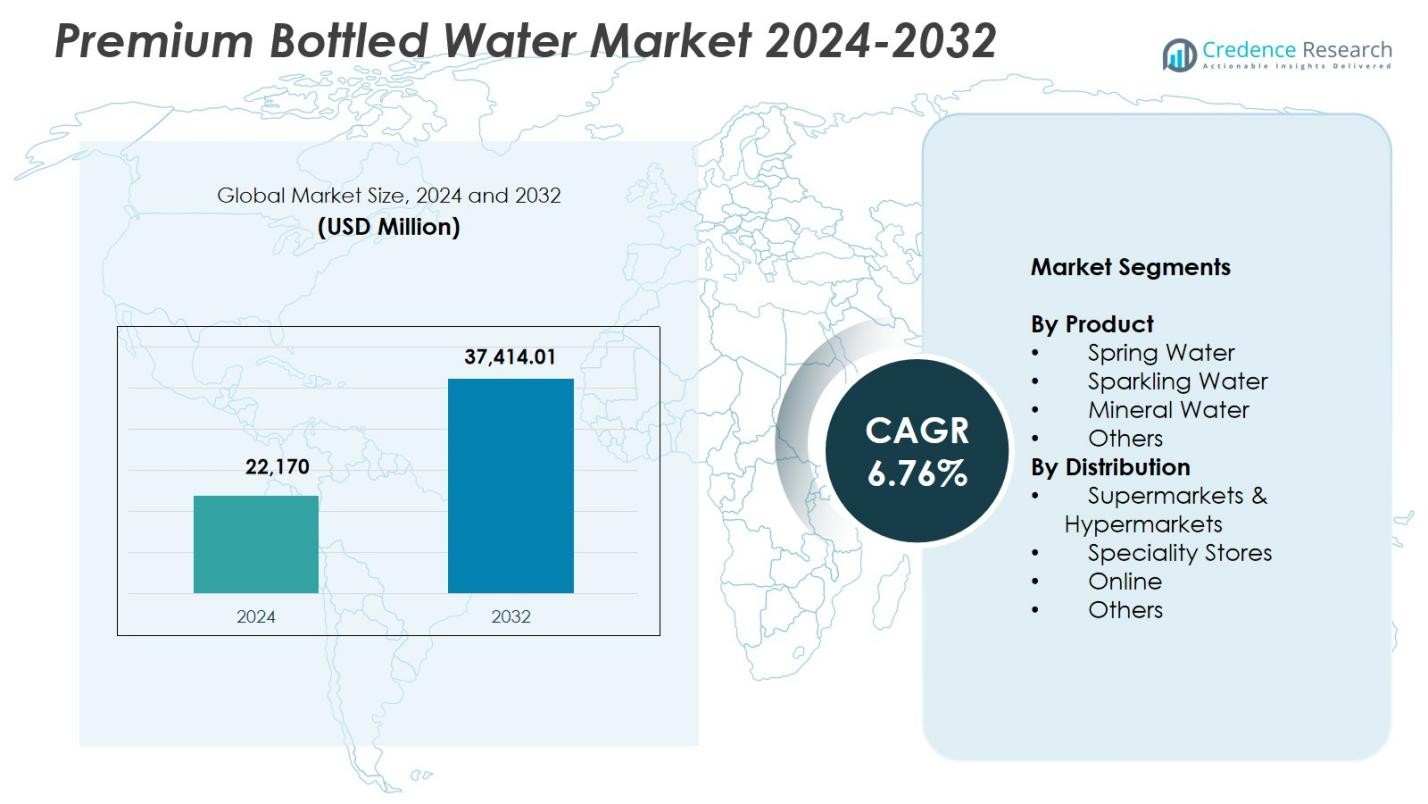

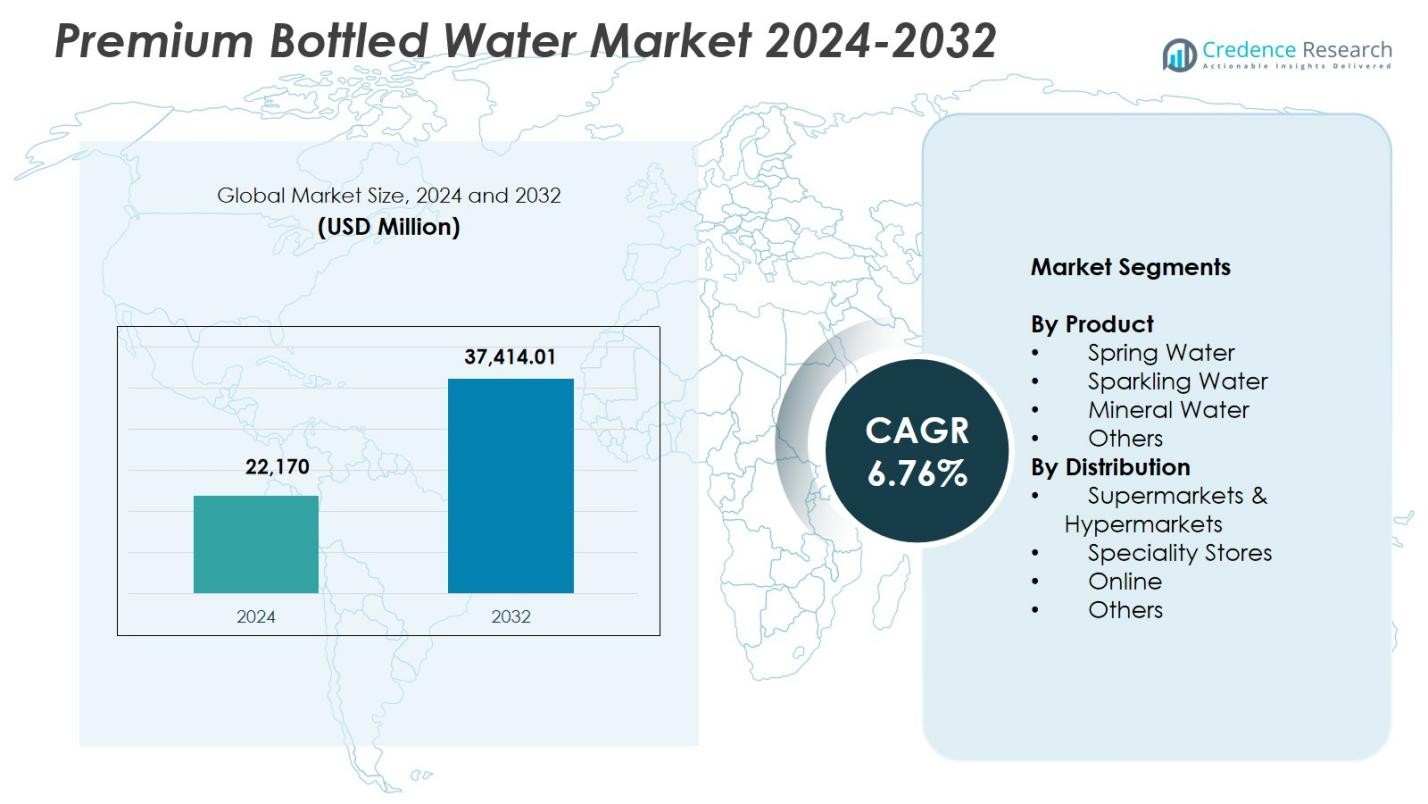

Premium Bottled Water Market size was valued at USD 22,170 Million in 2024 and is anticipated to reach USD 37,414.01 Million by 2032, at a CAGR of 6.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premium Bottled Water Market Size 2024 |

USD 22,170 Million |

| Premium Bottled Water Market, CAGR |

6.76% |

| Premium Bottled Water Market Size 2032 |

USD 37,414.01 Million |

Premium Bottled Water Market features leading players such as Bling H2O, Roiwater, Beverly Hills Drink Company, NEVAS GmbH, Lofoten Arctic Water AS, VEEN, Uisge Source, Berg Water, BLVD Water, and Alpine Glacier Water Inc., each strengthening their presence through premium sourcing, distinctive branding, and luxury positioning across retail and hospitality channels. North America emerged as the leading region with a 32.4% share in 2024, driven by strong consumer preference for natural, functional, and artisanal hydration products. Europe followed with a 29.7% share, supported by long-standing consumption of mineral and spring water and high adoption of sustainably packaged premium offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Premium Bottled Water Market reached USD 22,170 Million in 2024 and is set to grow at USD 37,414.01 a 6.76% CAGR through 2032, driven by rising demand for natural, purified, and luxury-positioned hydration products.

- Growing health consciousness fuels strong uptake of spring water, which held a 3% share in 2024, as consumers prefer minimally processed and mineral-rich sources over sugary beverages.

- Key trends include rising demand for functional, flavored, alkaline, and source-verified premium waters, along with increased adoption of eco-friendly and glass-based packaging aligned with sustainability goals.

- Major players expand visibility through artisanal extraction, high-end branding, and strategic partnerships across luxury hospitality, while pricing pressures and regulatory scrutiny on water sourcing and plastic waste act as key restraints.

- North America led with 4%, followed by Europe at 29.7% and Asia-Pacific at 23.8%, while supermarkets & hypermarkets dominated distribution with a 48.6% share, reinforcing strong retail-driven growth.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Spring water dominated the Premium Bottled Water Market with a 41.3% share in 2024, driven by strong consumer preference for naturally sourced, minimally processed hydration options. Its positioning as a clean-label product with inherent mineral content supports rising adoption across mature and emerging markets. Sparkling water held a significant portion of demand as health-conscious consumers shift from sugary carbonated drinks. Mineral water continued to expand due to its micronutrient profile, while the Others category gained traction through flavored, functional, and artisanal water offerings appealing to niche premium buyers.

- For instance, Evian spring water, filtered for 15 years through French Alps glacial rock, delivers 80 mg/L calcium and 26 mg/L magnesium for crisp hydration.

By Distribution Channel

Supermarkets & hypermarkets led the market with a 48.6% share in 2024, supported by broad product availability, premium shelf placement, and strong consumer trust in organized retail formats. These outlets drive higher volume sales through curated premium water sections and frequent promotional campaigns. Specialty stores accounted for meaningful growth as they cater to affluent buyers seeking luxury hydration brands. Online channels gained a notable share due to subscription models and doorstep delivery convenience, while Others, including HoReCa and airport retail, contributed to rising premium water consumption in on-the-go and luxury hospitality settings.

- For instance, Aava Natural Mineral Water doubled volumes after partnering with Amazon for direct premium alkaline water deliveries.

Key Growth Drivers

Rising Health Consciousness and Preference for Natural Hydration

Growing consumer awareness of health and wellness significantly accelerates demand for premium bottled water. Shoppers increasingly prefer natural, mineral-rich, and additive-free hydration alternatives over sugary beverages, driving strong uptake across urban and high-income populations. The perception of purity, superior quality, and functional benefits further strengthens market momentum. Brands emphasizing source authenticity, mineral composition, and sustainable extraction practices continue to attract health-focused consumers, reinforcing premium water’s position as a lifestyle-driven product category.

- For instance, FIJI Water draws from a protected Fijian rainforest aquifer, transitioning its 500 mL and 330 mL bottles to 100% recycled plastic (rPET) to highlight source purity and environmental responsibility.

Premiumization and Lifestyle-Based Consumption Patterns

Premium bottled water benefits from rising global interest in luxury lifestyle products and aspirational consumption. High-income consumers associate premium water with quality, exclusivity, and sophisticated living, fueling demand for artisanal, glacier-sourced, and heritage-positioned brands. Hospitality, fine-dining, and travel sectors enhance visibility through curated beverage menus featuring high-end water labels. Stylish packaging, brand storytelling, and luxury positioning encourage higher spending, while expanding retail exposure strengthens penetration across both mature and developing markets.

- For instance, Icelandic Glacial sources its naturally alkaline water from the Ölfus Spring in Iceland, featuring glacier-inspired bottle designs that evoke the landscape and emphasize sustainability through carbon-neutral production powered by geothermal and hydroelectric energy.

Expansion of Modern Retail and E-commerce Distribution

Growth of organized retail networks and e-commerce platforms strongly contributes to market expansion by offering broad accessibility and enhanced product visibility. Supermarkets, hypermarkets, and specialty stores provide premium shelf placement and curated assortments that drive consumer trial. Online channels introduce subscription services, bulk delivery, and direct-to-consumer models, enabling brands to reach geographically diverse buyers. Enhanced digital marketing, personalized recommendations, and transparent product information further support rapid adoption among digitally connected premium consumers.

Key Trends & Opportunities

Demand for Functional, Flavored, and Alkaline Premium Waters

A major trend influencing the market is the rising popularity of functional and enriched premium water varieties. Consumers actively seek alkaline, electrolyte-infused, flavored, and antioxidant-rich formulations that provide added health benefits. This creates strong opportunities for manufacturers to innovate with botanicals, natural flavor extracts, and performance-enhancing ingredients. Functional positioning helps brands differentiate in an increasingly crowded premium segment while appealing to fitness-oriented and wellness-driven users seeking value beyond hydration.

- For instance, Essentia produces ionized alkaline water with a pH of 9.5 or higher, purified through reverse osmosis and microfiltration.

Sustainability, Eco-Packaging, and Source Transparency

Growing environmental awareness is reshaping premium bottled water consumption, encouraging brands to introduce recyclable, biodegradable, and lightweight packaging solutions. Companies adopting responsibly sourced water, carbon-neutral operations, and transparent sustainability commitments gain a competitive advantage. Innovations such as plant-based bottles, refillable premium glass packaging, and blockchain-enabled source tracing enhance trust and brand loyalty. This trend presents strong opportunities for premium players to align with conscious consumer values while meeting emerging global regulatory requirements on plastic reduction.

- For instance, Belu Water sources its mineral water from the UK and packages it in lightweight bottles made with at least 40% recycled content that are 100% recyclable, while achieving carbon neutrality certification.

Key Challenges

Environmental Concerns and Increasing Regulatory Pressure

The industry faces significant scrutiny due to rising concerns over plastic waste, carbon emissions, and ecological impact of water extraction. Governments worldwide are implementing stricter regulations on single-use plastics, resource licensing, and sustainability disclosures. These pressures increase operational costs and require major investment in eco-friendly packaging and responsible sourcing practices. Failure to comply can affect brand reputation and restrict market access, forcing companies to adopt long-term environmental strategies.

High Pricing and Limited Accessibility in Emerging Markets

Premium bottled water often carries a significantly higher price point, limiting adoption among middle-income consumers and creating accessibility barriers in price-sensitive regions. Import duties, transportation costs, and premium packaging further elevate retail prices, restricting volume growth outside major urban centers. Local consumers may opt for affordable mainstream water options, while economic fluctuations intensify spending constraints. Brands must balance premium positioning with localized pricing strategies to expand penetration in developing markets.

Regional Analysis

North America

North America held a 32.4% share in 2024, driven by strong consumer preference for premium, natural, and functional hydration products. High-income groups, wellness trends, and rising adoption of sparkling and mineral-rich varieties support steady market expansion. The U.S. dominates regional demand due to extensive retail penetration, luxury lifestyle positioning, and brand-focused marketing. Growth in on-the-go premium consumption and increasing availability through specialty stores, fine-dining establishments, and e-commerce platforms further enhance market traction. Canada contributes additional momentum through rising interest in eco-friendly and source-verified premium bottled water.

Europe

Europe accounted for a 29.7% share in 2024, supported by long-standing consumption of mineral and spring water, particularly in markets such as Germany, France, Italy, and the UK. Strong cultural preference for naturally sourced hydration and stringent quality regulations reinforce premium product acceptance. The region’s extensive presence of artisanal and heritage-positioned brands boosts demand. Increasing consumption in hospitality, luxury travel, and fine-dining sectors further supports growth. Rising environmental consciousness accelerates adoption of sustainable packaging and glass-bottled premium water, enhancing brand differentiation across European markets.

Asia-Pacific

Asia-Pacific captured a 23.8% share in 2024, driven by rapid urbanization, rising disposable incomes, and growing health awareness among young and affluent consumers. Premium water demand is fueled by concerns over tap-water safety and expansion of organized retail. Countries such as China, Japan, India, and South Korea show strong adoption of mineral, alkaline, and functional premium water formats. E-commerce plays a central role in boosting accessibility across metropolitan areas. Increasing penetration in hospitality chains, airports, and premium dining further enhances market visibility, positioning Asia-Pacific as the fastest-growing premium water consumption hub.

Latin America

Latin America secured a 7.6% share in 2024, supported by growing interest in premium hydration products among urban consumers in Brazil, Mexico, Argentina, and Chile. Rising health consciousness and lifestyle upgrades contribute to expanding demand for mineral-rich and naturally sourced premium water. Retail modernization and improved supply chain networks enhance product availability across major cities. However, high pricing relative to income levels presents growth challenges. Premium brands are increasingly targeting affluent segments and hospitality channels, while sustainability-focused packaging initiatives improve brand perception and create new opportunities within the region.

Middle East & Africa

The Middle East & Africa region accounted for a 6.5% share in 2024, influenced by hot climatic conditions, rising tourism, and strong consumption of bottled water across premium hospitality sectors. Countries such as the UAE, Saudi Arabia, and South Africa drive demand through luxury dining, hotels, and airport retail. Premium brands benefit from high expatriate populations and growing preference for imported artisanal and sparkling water. Increasing investments in retail infrastructure and higher disposable incomes support gradual market expansion. Sustainability initiatives and premium glass packaging adoption further attract environmentally conscious consumers looking for high-quality hydration choices.

Market Segmentations:

By Product

- Spring Water

- Sparkling Water

- Mineral Water

- Others

By Distribution

- Supermarkets & Hypermarkets

- Speciality Stores

- Online

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Premium Bottled Water Market includes major players such as Bling H2O, Roiwater, Beverly Hills Drink Company, NEVAS GmbH, Lofoten Arctic Water AS, VEEN, Uisge Source, Berg Water, BLVD Water, and Alpine Glacier Water Inc. These companies strengthen their market presence by emphasizing source purity, artisanal extraction, premium packaging, and strong brand storytelling. Many brands highlight origin-specific attributes such as glacier meltwater, artesian wells, deep aquifers, and volcanic springs to differentiate themselves in a crowded premium segment. Luxury positioning across hospitality, fine dining, and travel retail further enhances brand visibility. Several players invest in eco-friendly packaging, glass bottling, and carbon-neutral sourcing to meet rising sustainability expectations. Expansion through online platforms, exclusive partnerships with luxury hotels, and curated retail placement supports targeted consumer reach. With increasing demand for functional and lifestyle-driven hydration, companies continue to innovate through flavored variants, mineral-rich formulations, and designer bottle aesthetics to reinforce brand exclusivity.

Key Player Analysis

- Berg Water

- NEVAS GmbH

- BLVD Water

- Alpine Glacier Water Inc.

- VEEN

- Beverly Hills Drink Company

- Uisge Source

- Lofoten Arctic Water AS

- Bling H2O

- Roiwater

Recent Developments

- In November 2025, a new bottled water made entirely from air launched in India, marking a novel entry into the premium water segment.

- In November 2025, AQUAIR launched — becoming India’s first bottled water brand produced entirely from air under a collaboration between AeroNero Solutions Pvt. Ltd. and OI Brewing Co..

- In August 2025, B Water & Beverage unveiled a Disney-licensed line of premium bottled water packaged in sustainable aluminum containers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Premium bottled water consumption will rise as health-conscious consumers increasingly choose natural and additive-free hydration.

- Demand for artisanal, source-verified, and luxury-positioned water brands will strengthen across hospitality and fine-dining channels.

- Functional premium water, including alkaline, electrolyte-infused, and antioxidant-rich variants, will gain broader adoption.

- Sustainability initiatives will accelerate, with brands expanding glass, biodegradable, and plant-based packaging solutions.

- Online retail and subscription-based delivery models will significantly increase market accessibility.

- Emerging markets will witness rapid uptake driven by urbanization, lifestyle upgrades, and rising disposable incomes.

- Technological integration will grow, enabling digital traceability, QR-based origin verification, and smart packaging.

- Partnerships with luxury hotels, airlines, and travel retail operators will enhance global brand visibility.

- Product diversification through flavored, botanical, and wellness-oriented variants will expand consumer segments.

- Regulatory pressure on water sourcing and packaging waste will shape long-term strategic investments and sustainability practices.

Market Segmentation Analysis:

Market Segmentation Analysis: