Market Overview

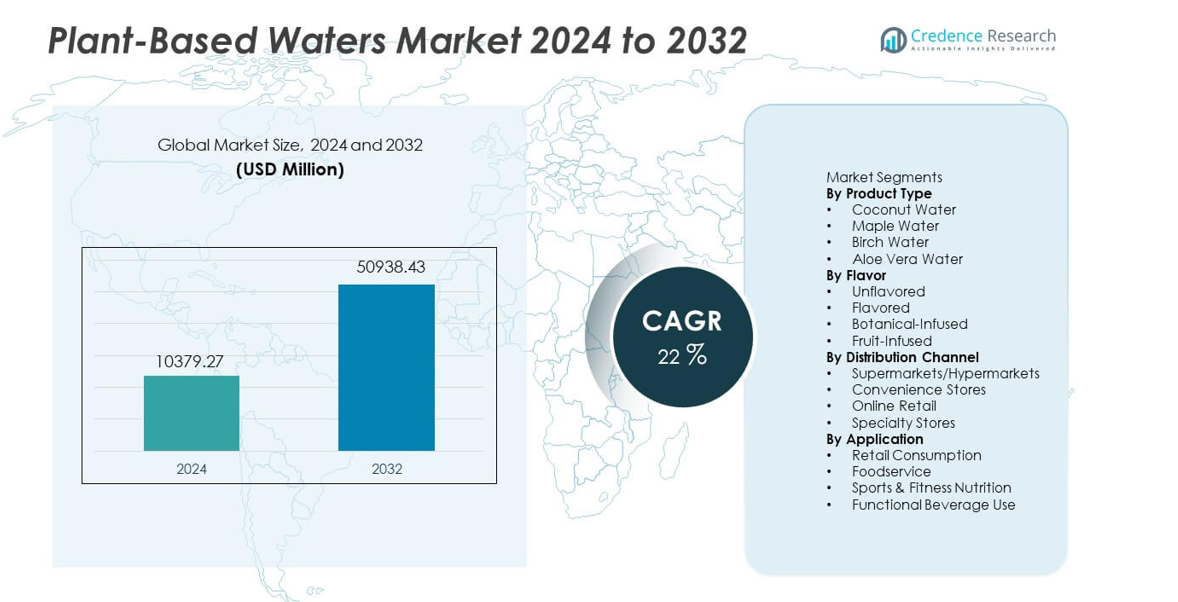

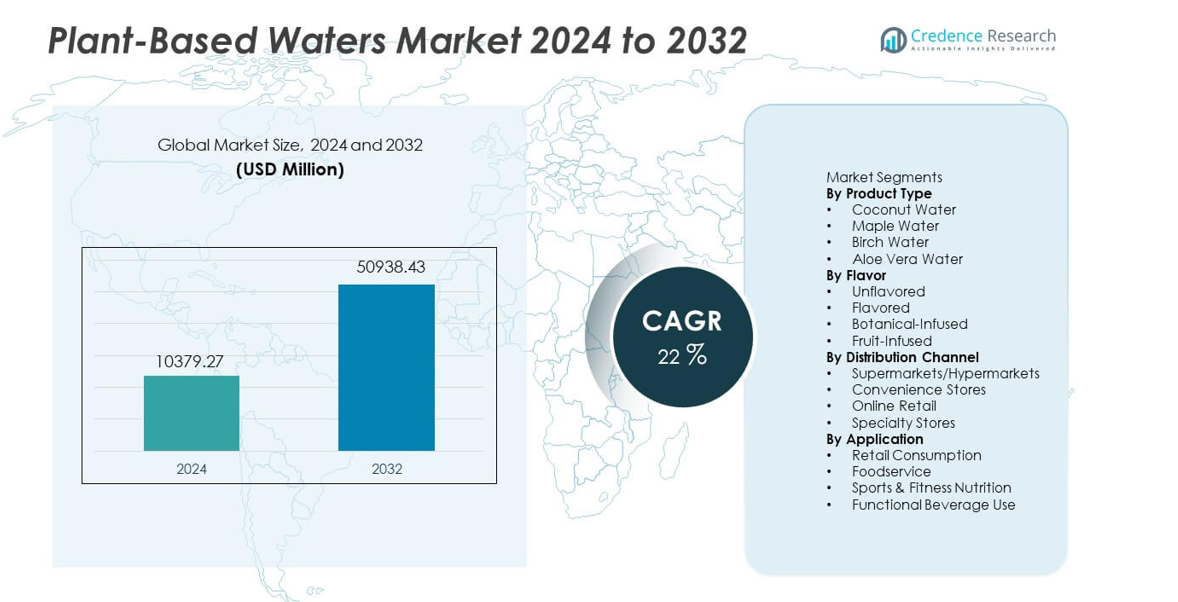

The Plant-Based Waters market was valued at USD 10,379.27 million in 2024 and is projected to reach USD 50,938.43 million by 2032, expanding at a CAGR of 22% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant-Based Waters Market Size 2024 |

USD 10,379.27 million |

| Plant-Based Waters Market, CAGR |

22% |

| Plant-Based Waters Market Size 2032 |

USD 50,938.43 million |

Top players in the Plant-Based Waters market include Vita Coco, Harmless Harvest, PepsiCo, Coca-Cola, Maple 3, Happy Tree, TREO Birch Water, Drink Simple, Aloe Gloe, and Wai Koko, each expanding their reach through clean-label offerings and strong retail partnerships. These companies focus on flavor innovation, sustainable sourcing, and advanced processing methods to meet rising demand for natural hydration. North America leads the market with 37% share, supported by high awareness of plant-based wellness products and strong e-commerce adoption. Europe follows with 28% share, driven by strict clean-label standards and growing interest in functional, low-sugar beverages.

Market Insights

- The Plant-Based Waters market reached USD 10,379.27 million in 2024 and will hit USD 50,938.43 million by 2032, growing at a CAGR of 22.

- Demand grows as clean-label hydration gains traction, with coconut water leading the product segment at 46% share, supported by strong retail visibility and fitness-driven use.

- Innovation remains strong as brands expand botanical and fruit-infused flavors, driven by rising interest in natural wellness and low-sugar beverage options across global markets.

- Competition intensifies as major players strengthen supply chains, improve sustainability practices, and widen digital distribution to retain share in fast-growing premium categories.

- North America leads with 37% share, followed by Europe at 28%, Asia Pacific at 22%, Latin America at 8%, and Middle East & Africa at 5%, reflecting diverse adoption patterns and strengthening regional demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Coconut water leads this segment with 46% share, supported by strong use as a natural hydration drink and wide retail penetration. Brands expand value through clean-label positioning, steady supply chains, and rising preference for low-calorie beverages. Maple water and birch water gain traction due to mineral-rich profiles that appeal to wellness-focused buyers. Aloe vera water shows steady growth as immunity-based claims influence purchase decisions. Product innovation, regional sourcing, and premium packaging boost consumer trust and extend reach across developed and emerging markets.

- For instance, PepsiCo expanded its O.N.E. Coconut Water line through expanded distribution, while Coca-Cola previously owned and then sold ZICO in a separate transaction, with the brand later reacquired by its founder who then relaunched it in North America.

By Flavor

Unflavored plant-based waters dominate this segment with 52% share, driven by demand for clean, additive-free drinks. Consumers favor simple hydration options with minimal processing, which supports strong adoption across fitness and lifestyle categories. Flavored options gain pace as brands introduce tropical blends with natural sweeteners and low-calorie formulations. Botanical-infused variants grow due to rising interest in calming and detox-oriented drinks. Fruit-infused blends remain niche but expand through limited-edition launches that target younger buyers seeking novelty.

- For instance, Vita Coco released several flavored SKUs, which extend beyond just coconut-pineapple and coconut-mango formats, and distributed these products widely through many retail doors in the United States.

By Distribution Channel

Supermarkets and hypermarkets hold the leading 41% share, supported by broad shelf space, private-label rollouts, and strong brand visibility. Retail chains promote plant-based waters through bundled deals and health-focused aisles, which increase impulse purchases. Convenience stores achieve stable growth due to rising demand for ready-to-drink hydration options in urban areas. Online retail expands quickly as buyers seek doorstep delivery, subscription packs, and wider product variety. Specialty stores attract premium shoppers who prefer artisanal or region-specific plant-water brands.

Key Growth Driers

Growing Demand for Natural and Clean-Label Hydration

The market grows as consumers shift toward natural hydration drinks with simple ingredient lists and minimal processing. Plant-based waters gain strong traction due to their electrolyte content, low sugar levels, and clean-label appeal. Fitness users and wellness-focused buyers prefer these beverages over synthetic sports drinks. Brands highlight purity, sustainable sourcing, and traceability to strengthen trust. Wider retail presence and flavor innovation also support higher adoption across both developed and emerging regions.

- For instance, Harmless Harvest sources coconuts from certified organic farms in Thailand and processes water each year using proprietary multi-step micro-filtration technology.

Expansion of Functional and Nutrient-Enhanced Formulations

Functional plant-based waters gain momentum as companies add vitamins, antioxidants, and botanical extracts. These enhanced variants attract health-conscious users seeking daily wellness support. Functional claims such as immunity, detox, and energy enhancement increase market visibility. Brands invest in R&D to refine nutrient stability and flavor balance in low-calorie formats. Growing interest in preventive health and active lifestyles drives demand for fortified beverages across retail and online channels.

- For instance, the ZICO brand, now a part of the PowerPlant Ventures portfolio, offers a variety of coconut water options, including some with added ingredients like vitamin C in certain older or flavored blends, confirmed under FDA nutrition labeling guidelines.

Rising Popularity of Sustainable and Eco-Friendly Beverages

Sustainability drives strong growth as consumers prefer drinks sourced from renewable plant materials with lower environmental impact. Coconut, birch, and maple waters align with this shift due to sustainable harvesting and reduced carbon footprints. Brands adopt recyclable packaging and eco-friendly supply chains to appeal to environmentally aware buyers. Retailers expand shelf space for green-labeled products, strengthening category confidence. This trend supports long-term brand loyalty and pushes companies to enhance transparency and ethical sourcing practices.

Key Trends & Opportunities

Innovation in Flavor Profiles and Botanical Blends

Flavor innovation creates new opportunities as brands introduce botanical and fruit-infused blends that appeal to younger buyers. Herbal ingredients such as mint, hibiscus, and ginger enhance taste and deliver perceived wellness benefits. Limited-edition flavors and region-inspired profiles help brands stand out in crowded beverage aisles. This trend supports premium positioning and allows companies to tap into niche health segments. Expanding flavor diversity drives experimentation and repeat purchases across global markets.

- For instance, TREO Birch Water launched a variety of flavored birch blends and expanded placement to many stores across the United States, including major retailers like Wegmans and Stop & Shop.

Growth of Digital Retail and Subscription-Based Models

Online retail emerges as a major opportunity as consumers seek convenience, broader product access, and personalized bundles. Subscription models encourage repeat purchases by offering curated assortments and discounts. Digital platforms support targeted marketing based on lifestyle data and flavor preferences. Brands use e-commerce to test new formulations and gather fast consumer feedback. Rising mobile shopping adoption and improved logistics further accelerate digital channel growth.

- For instance, Maple 3, a leading company in the Canadian maple water industry, distributes its products through various online and physical retailers, including national e-grocers like Amazon.ca and Avril Supermarché, to meet the growing consumer interest in natural, healthy beverages.

Key Challenges

High Production Costs and Supply Chain Sensitivity

Plant-based waters face cost pressures linked to seasonal crop yields, labor intensity, and complex extraction processes. Coconut and maple water supply chains rely on specific climates, making them vulnerable to weather fluctuations and regional disruptions. Rising transport and packaging costs add further strain. Smaller brands struggle to maintain competitive pricing, which limits mass-market penetration. Efficient sourcing and improved processing technologies are essential to lower long-term production costs.

Limited Consumer Awareness in Emerging Markets

Awareness gaps hinder growth in regions where plant-based hydration drinks remain unfamiliar. Many consumers still rely on traditional beverages, reducing adoption of premium-priced plant-based options. Limited marketing exposure and fewer product demonstrations slow trial intent. Retail availability also remains inconsistent in rural and semi-urban areas. Brands must invest in education campaigns, sampling programs, and localized messaging to build trust and encourage first-time purchases across new markets.

Regional Analysis

North America

North America leads the market with 37% share, driven by strong demand for clean-label hydration products and wide acceptance of coconut and aloe-based waters. The region benefits from high retail visibility, extensive flavor innovation, and strong promotion of low-calorie beverages. Fitness communities and wellness programs support consistent adoption across the United States and Canada. E-commerce platforms expand access to premium plant-based waters, boosting repeat purchases. Major brands invest in sustainable packaging and transparent sourcing, which strengthens consumer trust and drives long-term category growth across mainstream and specialty channels.

Europe

Europe holds 28% share, supported by rising interest in natural hydration, botanical blends, and low-sugar beverages. Consumers in Western Europe favor plant-based options with clear environmental claims and ethical sourcing. Retailers expand product assortments as demand grows for organic and vegan-friendly drinks. Flavor diversity, including birch and maple waters, gains popularity among health-driven buyers. Stringent regulations on artificial additives push brands to refine clean-label formulations. Increased sustainability awareness and growth of functional beverage segments strengthen market expansion across Germany, the UK, France, and Nordic countries.

Asia Pacific

Asia Pacific accounts for 22% share, fueled by growing health awareness, rapid urbanization, and rising acceptance of functional hydration products. Coconut water enjoys strong cultural relevance in Southeast Asia, which supports high consumption levels. Expanding middle-class populations in China and India drive demand for premium, low-sugar beverage options. E-commerce adoption helps brands reach wider audiences with diverse pack formats. Local manufacturers introduce cost-effective plant-water variants, enhancing affordability. Increasing interest in natural wellness trends strengthens long-term growth across emerging markets in the region.

Latin America

Latin America captures 8% share, driven by expanding demand for clean hydration and strong presence of coconut water across Brazil and Mexico. Younger consumers adopt plant-based beverages as healthier alternatives to carbonated drinks. Retailers increase shelf space for flavored and functional variants that align with local taste preferences. Economic shifts influence buying patterns, yet demand for natural and low-calorie drinks remains steady. Strong tropical fruit supply supports innovation in infused plant-water blends. Growing social media influence boosts product discovery across online channels, supporting broader market penetration.

Middle East & Africa

The Middle East & Africa region holds 5% share, supported by rising interest in hydration-focused wellness products in urban centers. Hot climates drive steady demand for refreshing, low-sugar beverages, including coconut and aloe-based waters. Premium imports dominate due to limited local production capacity. Retail chains expand offerings within health-oriented aisles, improving visibility. Higher disposable incomes in Gulf countries boost adoption of premium and flavored variants. However, price sensitivity and limited consumer awareness in parts of Africa slow widespread growth, creating room for targeted education and sampling initiatives.

Market Segmentations:

By Product Type

- Coconut Water

- Maple Water

- Birch Water

- Aloe Vera Water

By Flavor

- Unflavored

- Flavored

- Botanical-Infused

- Fruit-Infused

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

By Application

- Retail Consumption

- Foodservice

- Sports & Fitness Nutrition

- Functional Beverage Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading companies such as Vita Coco, Harmless Harvest, PepsiCo, Coca-Cola, Maple 3, Happy Tree, TREO Birch Water, Drink Simple, Aloe Gloe, and Wai Koko, all working to strengthen their presence through product innovation and wider distribution. Market leaders focus on clean-label formulations, advanced flavor development, and sustainable sourcing to appeal to health-driven consumers. Companies invest in new extraction methods that maintain nutrient integrity while improving shelf stability. Retail partnerships expand visibility across supermarkets, convenience chains, and online platforms. Many brands adopt recyclable packaging and transparent supply chains to enhance credibility. Premium players emphasize functional claims, while emerging brands target niche segments with botanical-infused and limited-edition blends. Rising competition encourages continuous branding efforts, regional diversification, and stronger digital engagement strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vita Coco

- Harmless Harvest

- PepsiCo (O.N.E. Coconut Water)

- Coca-Cola (ZICO)

- Maple 3

- Happy Tree Maple Water

- TREO Birch Water

- Drink Simple

- Aloe Gloe

- Wai Koko

Recent Developments

- In June 2023, Vita Coco partnered with Bluestone Lane to create a Coconut Water Cold Brew drink using Vita Coco coconut water.

- In January 2023, Vita Coco launched a “Barista MLK” coconut-based milk (plant-milk) variety in collaboration with Alfred Coffee

Report Coverage

The research report offers an in-depth analysis based on Product Type, Flavor, Distribution Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label hydration will rise as consumers shift toward natural wellness products.

- Brands will expand functional formulations that include vitamins, minerals, and botanical extracts.

- Flavor innovation will increase as companies introduce regional and seasonal blends.

- Sustainable packaging will gain priority as buyers favor eco-friendly and recyclable materials.

- Digital retail growth will strengthen due to higher subscription use and targeted marketing.

- Emerging markets will see faster adoption as awareness of plant-based hydration improves.

- Supply chain optimization will become key as brands work to reduce production costs.

- Partnerships with fitness and lifestyle platforms will expand consumer reach.

- Premium and specialty plant-water variants will grow as health-focused buyers seek higher quality.

- Investment in R&D will rise to enhance nutrient stability, shelf life, and processing efficiency.