Market Overview

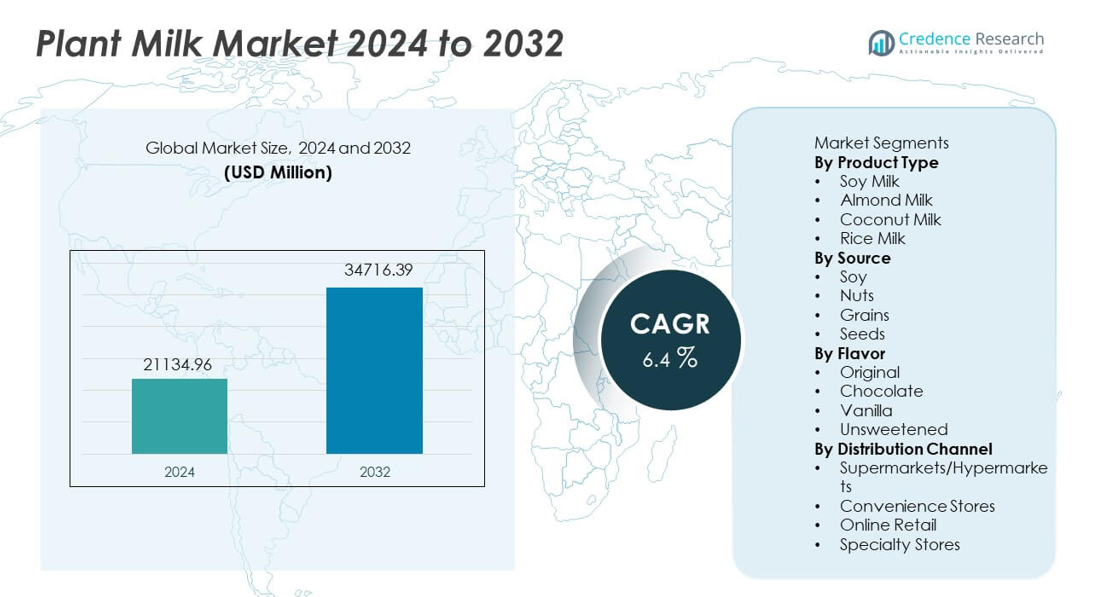

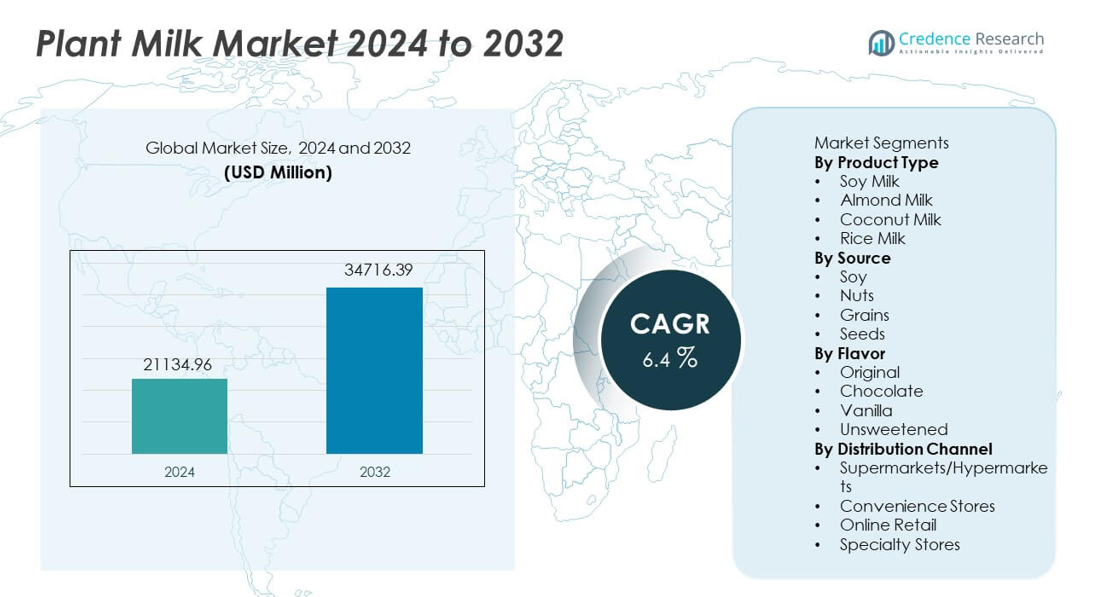

The Plant Milk market was valued at USD 21,134.96 million in 2024 and is projected to reach USD 34,716.39 million by 2032, expanding at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant Milk Market Size 2024 |

USD 21,134.96 million |

| Plant Milk Market, CAGR |

6.4% |

| Plant Milk Market Size 2032 |

USD 34,716.39 million |

Top players in the Plant Milk market include Danone, Oatly, Blue Diamond Growers, Califia Farms, Alpro, Silk, Ripple Foods, Elmhurst, So Delicious, and Pacific Foods, each expanding their reach through fortified recipes, clean-label positioning, and broader distribution networks. These brands invest in sustainable sourcing, low-sugar formulations, and barista-grade variants to meet changing taste preferences and dairy-free lifestyles. North America leads the market with 39% share, driven by strong lactose-free adoption and high demand for oat and almond milk, while Europe holds 32% share supported by clean-label consumption and sustainability awareness.

Market Insights

- The Plant Milk market reached USD 21,134.96 million in 2024 and will reach USD 34,716.39 million by 2032, growing at a CAGR of 6.4.

- Growth rises as consumers adopt lactose-free diets and vegan lifestyles, with soy milk leading the product segment at 39% share due to strong nutritional benefits and broad retail penetration.

- Trends expand as oat, almond, and barista-style variants gain popularity in cafés and foodservice, supported by rising wellness preferences and sustained global interest in dairy alternatives.

- Competition intensifies as leading brands invest in fortified formulations, sustainable ingredient sourcing, and flavor innovation to strengthen category presence across supermarkets and online channels.

- North America leads with 39% share, followed by Europe at 32%, Asia Pacific at 20%, Latin America at 6%, and Middle East and Africa at 3%, reflecting diverse adoption, flavor preferences, and economic patterns across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Soy milk leads this segment with 39% share, supported by strong nutritional profiles, high protein content, and wide acceptance as a dairy alternative. Almond milk shows steady growth due to its low-calorie appeal and strong penetration in retail channels. Coconut milk gains traction in Asian and Western markets due to versatile culinary applications. Rice milk remains niche yet expands through increased lactose-free and hypoallergenic demand. Growing vegan adoption and rising health awareness continue to push demand across product types, while regional brands introduce fortified and organic variants that strengthen category reach.

- For instance, Danone reports that Silk Soymilk contains 8 grams of protein per cup, which matches the protein content of dairy milk according to USDA nutritional data.

By Source

Soy dominates the source category with 41% share, driven by strong availability, cost-effectiveness, and recognized nutritional benefits. Nuts gain strong popularity across almond, cashew, and hazelnut sources, supported by premium positioning and taste preferences. Grains experience steady adoption as oat and rice options become mainstream due to creamy texture and allergen-friendly properties. Seed-based milk, including hemp and flax, grows gradually with sustainability-focused buyers. Functional benefits and evolving formulations help strengthen acceptance across all source categories.

- For instance, Oatly reports 2 grams of beta-glucan per 250-milliliter serving, based on EFSA reviewed nutritional statements.

By Flavor

Original flavor holds 46% share, driven by preference for natural taste profiles and suitability for both beverages and cooking. Unsweetened plant milk gains momentum among health-conscious consumers who seek reduced sugar intake. Vanilla flavor finds steady acceptance in coffee and bakery applications, while chocolate-focused products attract younger demographics. Product innovation focuses on low-sugar, fortified formulations and barista-style variants that improve texture and foam performance. Retail chains continue expanding flavor assortments as consumption becomes more lifestyle driven across global markets

Key Growth Drivers

Rising Shift Toward Lactose-Free and Vegan Alternatives

Demand rises as consumers adopt dairy-free diets due to lactose intolerance, vegan lifestyles, and growing awareness of animal welfare. Plant milk products offer low-cholesterol benefits and allergen-friendly alternatives that appeal to health-focused buyers. Retail chains expand shelf presence for soy, almond, and oat variants, increasing visibility across regions. Foodservice outlets adopt plant milk options in coffee and bakery menus, strengthening mainstream penetration. Continued awareness of dairy allergies, environmental impacts, and ethical consumption supports strong long-term growth across global markets.

- For instance, Starbucks confirmed that company-owned stores across various regions, including the U.S., Canada, the UK, China, and parts of Europe, now list almond, soy, and oat milk as permanent menu items, according to its sustainability reporting and recent announcements, with some locations removing the extra charge for these options.

Expansion of Functional and Fortified Plant Milk Products

Growth accelerates as manufacturers introduce fortified plant milk enriched with calcium, vitamins, and plant-based proteins. Consumers seek clean-label beverages that deliver nutritional equivalence to dairy milk. Barista editions improve foaming performance for coffee applications, supporting sales in cafés and beverage outlets. Functional blends featuring omega-3, probiotics, and mineral additives gain traction among wellness buyers. These innovations help reduce nutritional gaps, encouraging broader use among children and adults seeking healthy replacements.

- For instance, Alpro confirms 120 milligrams of calcium per 100 milliliters in its fortified soya drink, documented under EU nutrition claims regulation.

Increasing Preference for Sustainable and Low-Carbon Choices

Demand strengthens as plant milk aligns with sustainability goals, lower greenhouse emissions, and responsible ingredient sourcing. Consumers who seek eco-friendly lifestyles adopt almond, oat, soy, and coconut milk due to reduced environmental impact compared to dairy. Brands highlight sustainable farming, recyclable packaging, and water-efficient production to boost credibility. Rapid growth of sustainability campaigns and environmental awareness among younger demographics supports long-term category expansion.

Key Trends & Opportunities

Rapid Growth of Oat and Seed-Based Variants

Oat milk shows fast adoption due to creamy taste, allergen-friendly composition, and café-ready performance. Seed-based offerings such as hemp and flax expand among sustainability-focused consumers looking for nutrient-rich choices. Manufacturers introduce flavored and barista-style oat variants to enhance foodservice use. This trend supports premium pricing and greater brand differentiation in competitive aisles.

- For instance, Oatly states its flagship oat drink contains a specific amount of beta-glucan per serving, which contributes to the daily amount referenced in EFSA-approved health claims.

Rising Penetration in Foodservice and Coffee Chains

Foodservice adoption expands as cafés, bakeries, and beverage outlets add plant milk options for coffee, smoothies, and desserts. Barista-grade formulations improve texture, dairy-like frothing, and flavor stability. Partnerships with coffee retailers boost trial and accelerate category normalization in daily consumption patterns.

- For instance, Pret A Manger confirms plant-based milk alternatives are available across all UK stores, alongside organic dairy options, under corporate responsibility updates.

Key Challenges

Higher Retail Pricing Compared to Traditional Dairy Milk

Plant milk remains costlier than dairy due to ingredient sourcing, production processes, and limited economies of scale. Price sensitivity slows adoption in budget-conscious markets. Manufacturers strive to lower costs through regional ingredient sourcing and optimized production technologies, but affordability remains a constraint.

Allergen and Ingredient Labeling Complexity

Soy, nuts, and gluten-linked ingredients require strict labeling under regional safety regulations. This creates uncertainty among sensitive consumers and restricts broader household usage. Brands must invest in clear labeling and allergen-free production practices to expand adoption across larger demographics.

Regional Analysis

North America

North America leads the market with 39% share, driven by rising adoption of dairy-free diets, strong vegan movements, and high awareness of lactose intolerance. Retail chains dedicate larger shelf space for plant milk, supported by barista-style variants and fortified offerings. Consumers prefer almond and oat milk due to nutritional positioning and low-calorie claims. Foodservice and coffee chains expand menus with plant-based options, boosting mainstream usage. Marketing campaigns around sustainability and animal welfare also support category growth. Increasing demand across the United States and Canada strengthens long-term regional expansion.

Europe

Europe holds 32% share, supported by strong preference for clean-label and dairy-free beverages across leading markets such as the United Kingdom, Germany, France, and Italy. High lactose intolerance in Southern Europe strengthens demand, while Western Europe drives clean-label innovation. Oat and soy milk remain widely adopted across retail channels, supported by eco-conscious buyers and strong sustainability awareness. Government regulations on dairy labeling and sugar reduction encourage healthier consumption behavior. Premium organic products gain momentum across supermarkets and specialty stores.

Asia Pacific

Asia Pacific accounts for 20% share, fueled by traditional soy consumption and rising lactose intolerance among large populations in China, India, and Japan. Expanding middle-class income and growing café culture increase demand for plant-based beverages. Coconut milk holds strong cultural use in Southeast Asia, while almond and oat products gain popularity among health-conscious youth. E-commerce growth allows premium and imported brands to reach new consumers across urban centers. Government initiatives promoting plant-based diets and wellness further support regional adoption.

Latin America

Latin America captures 6% share, driven by increased awareness of plant-based nutrition and rising adoption in Brazil, Mexico, and Argentina. Consumers shift toward dairy alternatives due to lactose intolerance and interest in low-fat beverages. Supermarkets expand assortments of soy and coconut milk, influenced by tropical ingredient availability and rising wellness trends. Economic conditions impact premium product purchases, but steady interest in healthy beverages supports ongoing demand. Foodservice outlets increasingly introduce plant milk options across urban regions.

Middle East & Africa

Middle East and Africa hold 3% share, supported by growing interest in healthier beverages and rising urban consumption in Gulf countries and South Africa. Lactose intolerance rates encourage steady demand for soy and almond-based alternatives. Premium imports dominate due to limited local production and reliance on international brands. Retail expansion increases visibility in health-focused categories, but affordability challenges slow wider penetration. Education campaigns and sampling initiatives will help drive future growth in emerging markets across the region.

Market Segmentations:

By Product Type

- Soy Milk

- Almond Milk

- Coconut Milk

- Rice Milk

By Source

By Flavor

- Original

- Chocolate

- Vanilla

- Unsweetened

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading companies such as Danone, Oatly, Blue Diamond Growers, Califia Farms, Alpro, Silk, Ripple Foods, Elmhurst, So Delicious, and Pacific Foods, all working to expand their portfolios across various plant-based milk formats. Major players invest in product innovation, fortified formulations, and barista-style variants that support adoption in foodservice channels. Companies strengthen distribution through retail partnerships, e-commerce strategies, and global expansion initiatives. Many brands emphasize sustainable sourcing, recyclable packaging, and ethical ingredient selection to appeal to eco-conscious buyers. Regional players introduce nut-based and grain-based milk at affordable price points, intensifying competition. Premium brands focus on flavor innovation and nutritional equivalence to dairy, while new entrants target niche segments such as organic, unsweetened, and allergen-free plant milk. Growing competition encourages continuous R&D, improved taste profiles, and greater global branding efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Danone launched Silk Protein, a range of plant-based milks containing 13 grams of complete protein and 3 grams of fiber per serving, aimed at reinvigorating interest in plant-based dairy while targeting a gap in protein-focused plant-based drinks.

- In February 2024, Califia Farms launched Califia Farms Complete. The product highlights nine essential nutrients and 8 grams of protein per serving from a pea, chickpea, and fava bean blend.

- In January 2024, Oatly launched Unsweetened and Super Basic in the U.S. Unsweetened offers 0g sugar and 40 calories per serving, while Super Basic uses four ingredients

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Flavor, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dairy-free beverages will rise as lactose intolerance awareness increases.

- Brands will expand barista-grade formulations that improve foaming and texture.

- Functional and fortified plant milk will gain traction across wellness categories.

- Oat and seed-based products will grow due to sustainable sourcing appeal.

- Digital retail platforms will support wider access across international markets.

- Clean-label preferences will drive low-sugar and additive-free product development.

- Foodservice adoption will expand as coffee chains add plant milk options.

- Regional flavor innovation will rise to match local preferences and cuisines.

- Supply chain efficiency will become key as brands aim to reduce production costs.

- Investments in R&D will increase to enhance nutritional equivalence with traditional dairy