Market Overview

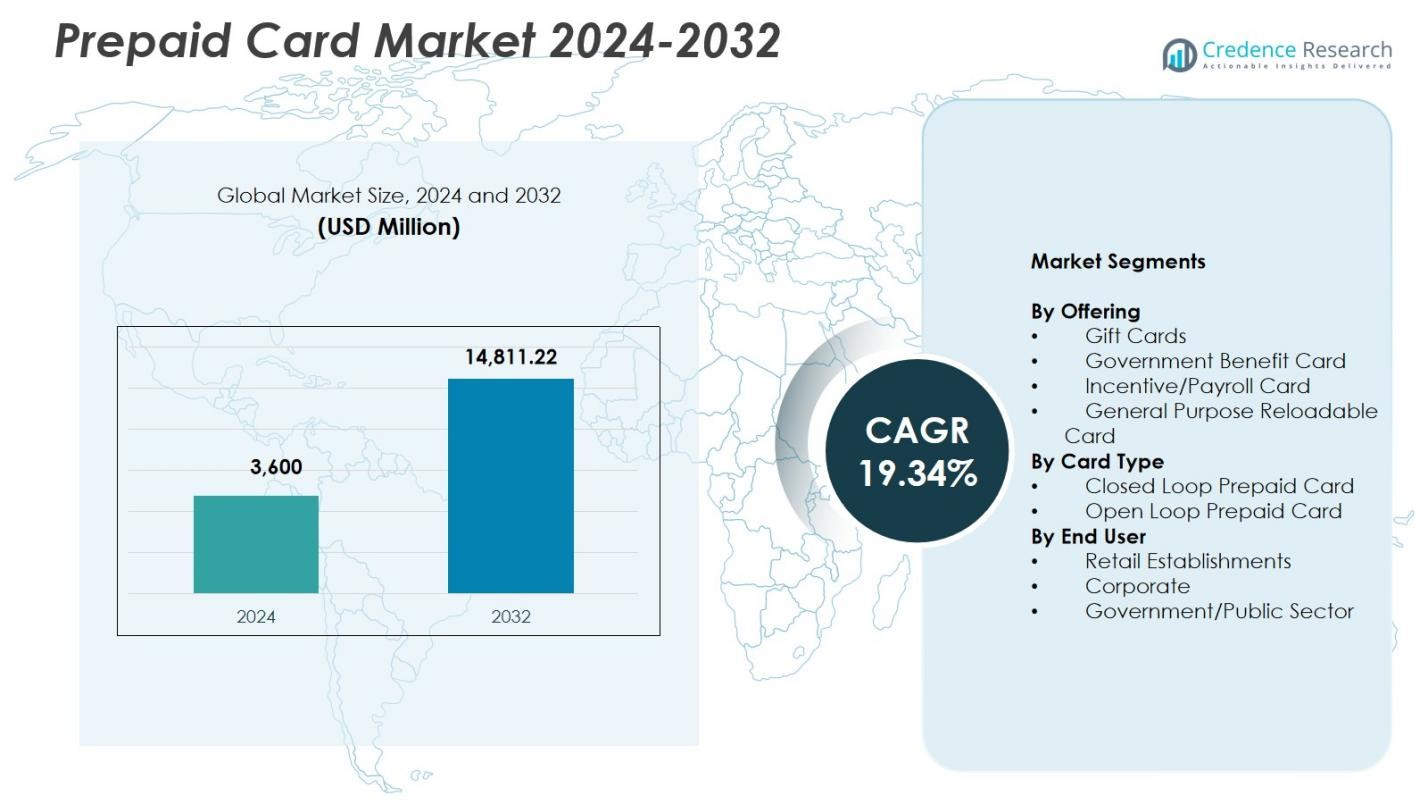

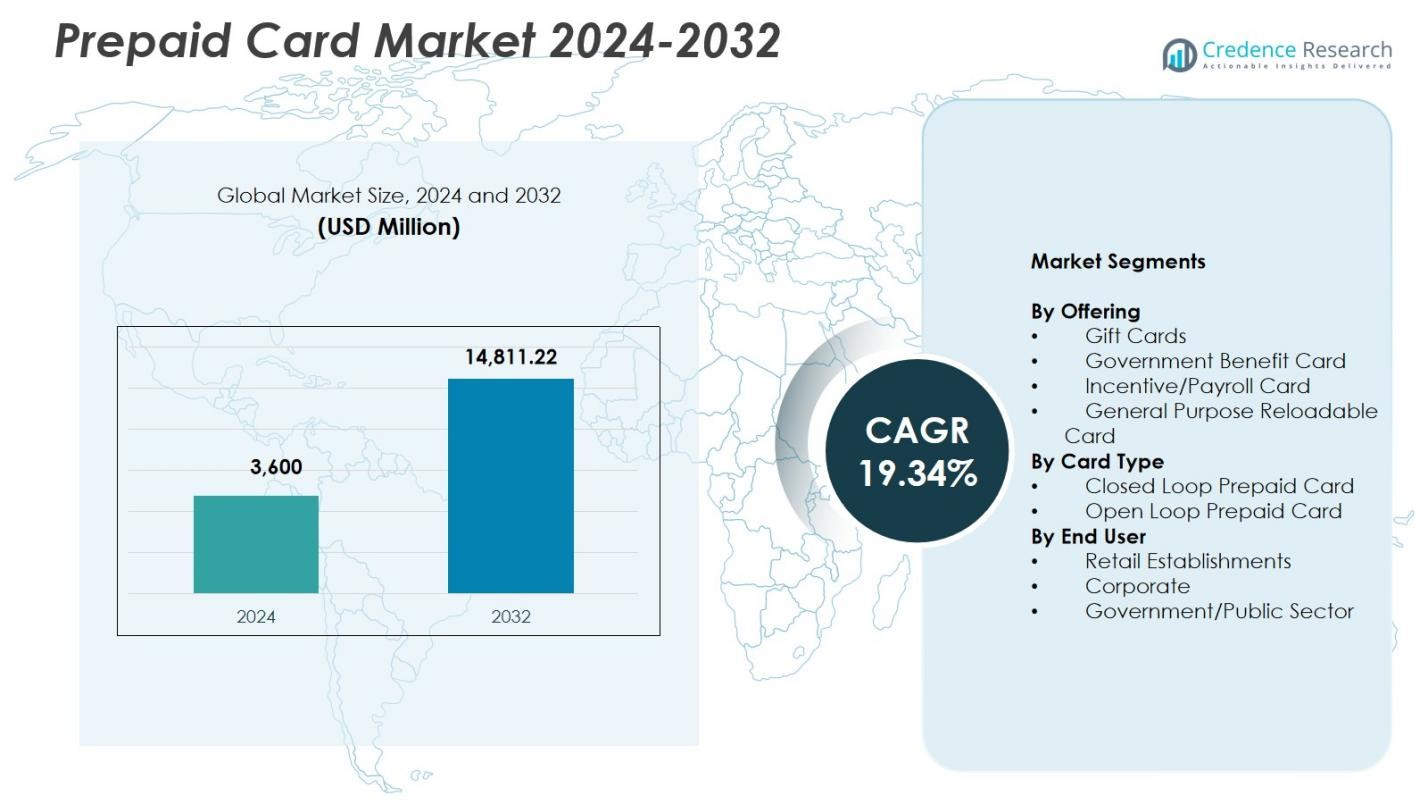

Prepaid Card Market size was valued USD 3,600 Million in 2024 and is anticipated to reach USD 14,811.22 Million by 2032, at a CAGR of 19.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prepaid Card Market Size 2024 |

USD 3,600 Million |

| Prepaid Card Market, CAGR |

19.34% |

| Prepaid Card Market Size 2032 |

USD 14,811.22 Million |

Prepaid Card Market features leading players such as Visa Inc., MasterCard Inc., American Express Company, Green Dot Corporation, Citigroup, Total System Services Inc., Kaiku Finance LLC, Mango Financial Inc., The PNC Financial Services Group Inc., and BBVA Compass Bancshares Inc., each strengthening their presence through diversified prepaid solutions and digital payment innovations. These companies focus on enhancing open loop and general-purpose reloadable card offerings while expanding partnerships with retailers, corporates, and government agencies. North America led the Prepaid Card Market with a 39.4% share in 2024, driven by strong fintech adoption, digital banking growth, and extensive prepaid integration across e-commerce and institutional payment systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prepaid Card Market recorded USD 3,600 Million in 2024 and will reach USD 14,811.22 Million by 2032, reflecting a CAGR of 19.34%.

- Strong market growth is driven by rising digital payment adoption, with the General Purpose Reloadable segment holding 41.6% share due to its versatility, financial inclusion support, and integration with mobile wallets.

- A key trend is the rapid expansion of open loop prepaid cards, dominating with 58.3% share as consumers prefer multi-merchant, cross-border, and e-commerce–enabled payment solutions.

- Leading players such as Visa, MasterCard, American Express, Green Dot, and Citigroup strengthen market presence through product innovation, card network expansion, and fintech collaborations.

- North America led with 39.4% share in 2024, followed by Europe at 27.8% and Asia-Pacific at 22.6%, while retail establishments dominated end-user adoption with 46.2% share across global prepaid ecosystems.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Offering:

In the Prepaid Card Market, the General Purpose Reloadable (GPR) Card segment accounted for 41.6% market share in 2024, emerging as the dominant offering due to its versatility, financial inclusion benefits, and growing use among unbanked and underbanked consumers. Its reloadable feature supports recurring transactions, digital payments, and contactless usage, driving rapid adoption across retail and online channels. Gift cards and payroll cards continue to expand, but GPR cards lead growth as banks, fintech firms, and employers increasingly integrate them into mobile wallets and digital salary-disbursement ecosystems, accelerating market penetration.

- For instance, Green Dot’s Prepaid Visa Debit Card enables users to reload funds at retailers like Walmart and 7-Eleven, supports direct deposit for paychecks up to two days early, and integrates with mobile apps for bill pay and spending tracking, aiding unbanked consumers in everyday purchases.

By Card Type:

The Open Loop Prepaid Card segment commanded 58.3% market share in 2024, making it the leading segment due to its universal acceptance across ATM networks, e-commerce platforms, and point-of-sale terminals. These cards support multi-merchant transactions, international payments, and integration with mobile payment systems, driving strong adoption among consumers and corporates. Rising demand for cross-border remittances, travel spending, and digital banking solutions further boosts the preference for open loop cards. Closed loop cards remain significant for brand-specific loyalty programs, but open loop solutions dominate because of their flexibility and broad financial utility.

- For instance, Blackhawk Network partnered with Mastercard to transition open-loop prepaid products to paper-based materials, achieving 60% paper conversion by end-2022 and targeting 75% by end-2023 to reduce plastic waste while maintaining usability wherever Mastercard is accepted.

By End User:

The Retail Establishments segment held 46.2% market share in 2024, emerging as the dominant end-user category as retailers increasingly deploy prepaid cards for customer loyalty, refunds, promotions, and omnichannel transactions. The segment benefits from expanding digital commerce, rising consumer preference for cashless purchases, and retailers’ adoption of prepaid programs to enhance customer retention. Corporate use of prepaid cards for expense management and employee incentives is growing, while public-sector demand rises for welfare distribution and subsidy payments. However, retail maintains leadership due to continuous expansion of closed loop and open loop card integrations across digital retail ecosystems.

Key Growth Drivers

Rising Demand for Cashless and Digital Payment Solutions

The Prepaid Card Market grows significantly as consumers and businesses accelerate their shift toward cashless transactions, driven by digital banking adoption, widespread smartphone penetration, and increasing reliance on e-commerce platforms. Prepaid cards provide secure, fee-controlled payment options that appeal to unbanked and underbanked populations. Their integration with mobile wallets, contactless payment systems, and online checkout gateways further enhances utility. Government initiatives promoting digital financial inclusion and real-time electronic payments continue to strengthen demand, positioning prepaid cards as a core component of modern payment ecosystems.

- For instance, Mastercard partners with Spain’s Correos to issue Bono Cultural Joven prepaid cards, providing 18-year-olds a €400 grant restricted to cultural products and activities, enhancing targeted spending while tracking usage patterns.

Expansion of Government and Corporate Disbursement Programs

Government benefit distribution, salary disbursement, and corporate incentive programs increasingly rely on prepaid cards to ensure fast, transparent, and cost-efficient fund transfers. These cards streamline welfare payments, subsidies, tax refunds, and payroll processing, reducing administrative overhead and improving accessibility for recipients. Corporations utilize prepaid cards for travel expenses, employee incentives, and expense management to eliminate cash handling inefficiencies. The scalability of prepaid platforms and enhanced fraud-prevention capabilities enable broader institutional adoption, thereby sustaining strong growth momentum across both public and private sectors.

- For instance, ICICI Bank’s PayDirect Card enables companies to preload employee salaries, reimbursements, and incentives onto reloadable EMV chip-based cards, making funds available instantly on payday for ATM withdrawals and POS purchases.

Growing Retail Adoption and Consumer Loyalty Initiatives

Retail establishments continue to drive prepaid card expansion through extensive loyalty, promotional, and gift-card programs designed to enhance customer engagement and stimulate repeat purchases. Prepaid formats allow retailers to strengthen brand recognition and gain valuable insights into consumer spending patterns. Rising omnichannel retail strategies integrate prepaid cards across in-store and online platforms, increasing transaction volumes. As consumers seek flexible and secure payment options for shopping, travel, and entertainment, retail-driven prepaid solutions experience strong demand, reinforcing their role as an essential tool in personalized commerce and digital retail ecosystems.

Key Trends & Opportunities

Integration of Prepaid Cards with Mobile Wallets and Fintech Ecosystems

A major trend shaping the Prepaid Card Market is the rapid integration of prepaid cards into mobile wallets, neobanking platforms, and fintech ecosystems. This convergence enhances transactional convenience, enabling users to manage balances, track spending, and perform digital transfers instantly. Fintech firms leverage APIs and embedded finance solutions to launch innovative prepaid offerings tailored to gig workers, students, frequent shoppers, and travelers. As biometric authentication, contactless payments, and AI-based fraud detection advance, prepaid solutions gain new opportunities in digital-first payment models and global fintech collaborations.

- For instance, DoorDash provides Dashers with DasherDirect, a Stride Bank-issued Business Prepaid Visa Card accessible via a mobile app, allowing gig workers to deposit earnings for debit spending and no-fee ATM withdrawals at Allpoint network locations.

Expansion of Cross-Border and E-Commerce Payment Applications

Growing international travel, rising cross-border e-commerce activity, and increasing remittance flows create strong opportunities for prepaid cards with multi-currency, global acceptance, and enhanced security features. Open loop prepaid cards offer seamless international transactions without traditional banking constraints, appealing to travelers, migrant workers, and online shoppers. E-commerce marketplaces increasingly adopt prepaid cards for secure checkout, refunds, and loyalty rewards. As online spending accelerates and consumers seek low-risk alternatives to credit cards, prepaid cards emerge as essential tools supporting global digital commerce growth.

- For instance, Thomas Cook India launched the Borderless Prepaid Multi-Currency Travel Card, supporting 12 global currencies for seamless transactions at over 70 million Mastercard and Visa merchant establishments in more than 200 countries.

Key Challenges

Stringent Regulatory Compliance and Anti-Fraud Requirements

The Prepaid Card Market faces challenges due to evolving regulatory frameworks governing KYC, AML, transaction monitoring, and consumer protection. Providers must implement costly compliance systems and advanced fraud-detection tools to meet regulatory expectations. Heightened scrutiny over anonymous prepaid cards and cross-border transactions increases operational complexity. Compliance burdens may limit market entry for smaller fintech companies, slow product launches, and elevate administrative expenses. Balancing innovation with regulatory adherence remains a critical challenge that shapes product design, distribution, and risk-management strategies.

Intensifying Pressure from Alternative Digital Payment Methods

Prepaid cards face growing competition from mobile banking apps, digital wallets, Buy Now Pay Later (BNPL) solutions, and real-time payment platforms. These alternatives offer instant transfers, integrated budgeting tools, and flexible credit options, which may reduce prepaid card usage among digital-native consumers. As fintech ecosystems evolve, prepaid card providers must differentiate offerings through value-added features, personalization, and improved user experience. Failure to innovate could weaken market traction, especially among younger demographics who increasingly favor app-based financial tools over traditional prepaid instruments.

Regional Analysis

North America

North America held 39.4% market share in 2024, leading the Prepaid Card Market due to the strong presence of fintech ecosystems, widespread digital banking adoption, and high consumer preference for cashless transactions. The U.S. drives significant growth through extensive use of general-purpose reloadable cards, payroll cards, and government benefit disbursements. Retailers and e-commerce platforms increasingly deploy prepaid solutions for loyalty, refunds, and promotions, reinforcing market expansion. Strong regulatory frameworks, rising gig-economy payments, and advanced fraud-prevention technologies further strengthen prepaid card penetration across consumer and corporate segments.

Europe

Europe captured 27.8% market share in 2024, supported by expanding digital payments infrastructure, strong financial inclusion initiatives, and rising adoption of open loop prepaid cards for travel, corporate spending, and online shopping. The region benefits from regulated electronic money frameworks and growing demand for secure alternatives to credit cards. Government agencies increasingly utilize prepaid instruments for welfare payments, while retailers deploy gift and loyalty cards across omnichannel networks. Cross-border e-commerce growth, tourism recovery, and adoption of contactless prepaid solutions accelerate market momentum across major countries including the U.K., Germany, France, and Italy.

Asia-Pacific

Asia-Pacific accounted for 22.6% market share in 2024, emerging as the fastest-growing region driven by rapid digitization, expanding fintech adoption, and large unbanked populations transitioning toward prepaid financial tools. Governments promote prepaid solutions for subsidy distribution, transit systems, and public-sector payments. Mobile wallets integrated with prepaid cards strengthen market development, particularly in India, China, and Southeast Asia. Retail and e-commerce sectors increasingly leverage prepaid formats for promotional campaigns and digital rewards. The region’s strong economic growth, rising online transactions, and expanding merchant acceptance networks continue to create substantial future opportunities.

Latin America

Latin America recorded 6.4% market share in 2024, supported by growing demand for secure, low-cost financial solutions among unbanked and underbanked populations. Prepaid cards gain momentum for payroll, government aid distribution, and retail transactions as digital payment ecosystems mature across Brazil, Mexico, Chile, and Colombia. Fintech companies actively introduce reloadable prepaid cards linked to mobile banking platforms, enhancing financial accessibility and security. E-commerce expansion and increasing adoption of contactless payments further drive growth. However, market progression faces challenges related to regulatory variability and slower financial infrastructure modernization in certain economies.

Middle East & Africa

The Middle East & Africa region held 3.8% market share in 2024, with growth driven by digital banking initiatives, government-led financial inclusion programs, and rising demand for prepaid cards among migrant workers for remittances and salary disbursements. GCC countries adopt prepaid solutions for travel, retail, and corporate expense management, while African nations increasingly integrate prepaid cards into mobile money ecosystems. Retailers and public-sector bodies use prepaid formats for loyalty, subsidy distribution, and transit payments. Despite infrastructure limitations in some markets, expanding fintech participation and regulatory modernization continue to support regional prepaid card adoption.

Market Segmentations:

By Offering

- Gift Cards

- Government Benefit Card

- Incentive/Payroll Card

- General Purpose Reloadable Card

By Card Type

- Closed Loop Prepaid Card

- Open Loop Prepaid Card

By End User

- Retail Establishments

- Corporate

- Government/Public Sector

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Prepaid Card Market features major players such as Visa Inc., MasterCard Inc., American Express Company, Green Dot Corporation, Citigroup, Total System Services, Inc., Kaiku Finance LLC, Mango Financial Inc., The PNC Financial Services Group Inc., and BBVA Compass Bancshares Inc. These companies strengthen their market presence through extensive card networks, diversified prepaid offerings, and continuous innovation in digital payment technologies. Leading brands focus on expanding open loop and general-purpose reloadable solutions, enhancing security features, and integrating prepaid cards with mobile wallets and fintech platforms. Strategic partnerships with retailers, government agencies, and corporate entities support growth across disbursement programs and loyalty ecosystems. Investments in fraud prevention, AI-driven analytics, and cross-border payment capabilities further differentiate providers in a rapidly evolving digital payments environment, while emerging fintech firms intensify competition with customizable, app-based prepaid solutions tailored for underserved and digital-native populations.

Key Player Analysis

- Green Dot Corporation

- Citigroup

- Kaiku Finance, LLC

- The PNC Financial Services Group, Inc.

- Mango Financial, Inc.

- American Express Company

- BBVA Compass Bancshares, Inc.

- Total System Services, Inc.

- MasterCard Inc.

- Visa, Inc.

Recent Developments

- In September 2025, Zaggle Prepaid Ocean Services Ltd. entered an agreement with Mastercard Asia Pacific Pte. Ltd. to launch and promote co-branded domestic prepaid cards across India.

- In May 2025, Green Dot Corporation announced that it is exploring strategic alternatives and potential sale, signaling possible M&A activity as part of a broader restructuring.

- In August 2025, Zum Rails and Mastercard Inc. launched a new prepaid card programme in Canada to support faster business payments.

- In February 2024, Awash Bank S.C. in Ethiopia, in partnership with Mastercard, launched a new Mastercard-branded international prepaid card and online payment gateway services.

Report Coverage

The research report offers an in-depth analysis based on Offering, Card Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Prepaid Card Market will expand rapidly as digital payments adoption accelerates across consumer and corporate segments.

- Integration of prepaid cards with fintech platforms and mobile wallets will strengthen user convenience and transaction efficiency.

- Government agencies will increasingly rely on prepaid cards for welfare distribution, subsidies, and public-sector payments.

- Open loop prepaid cards will gain wider adoption due to their versatility in domestic and cross-border transactions.

- Retailers will continue to drive growth through loyalty programs, gift cards, and omnichannel shopping incentives.

- Corporate demand for prepaid cards will rise for employee incentives, expense control, and travel spending management.

- Enhanced security features such as tokenization and biometric authentication will increase user trust and adoption.

- Growth in e-commerce and gig-economy platforms will boost prepaid card usage among digital-first consumers.

- Fintech collaborations will introduce advanced, customizable prepaid solutions for underserved populations.

- Regulatory modernization across regions will support transparent, compliant, and scalable prepaid ecosystems.

Market Segmentation Analysis:

Market Segmentation Analysis: