Market Overview

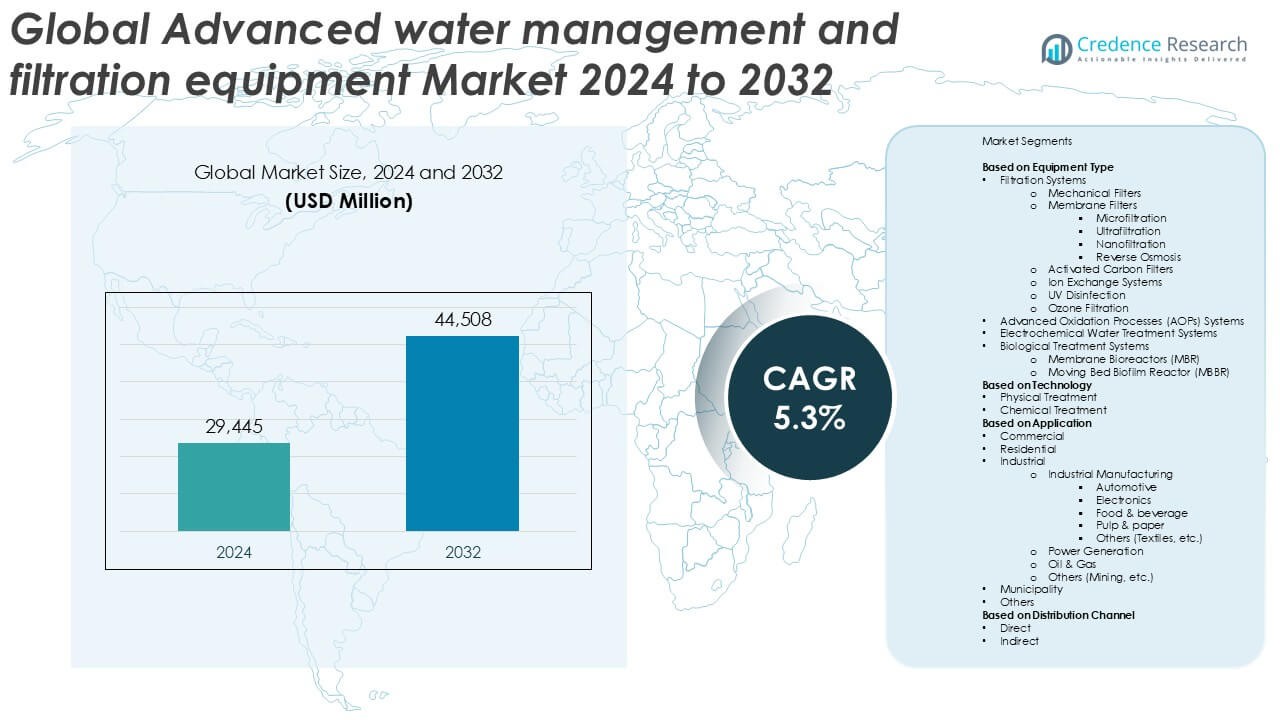

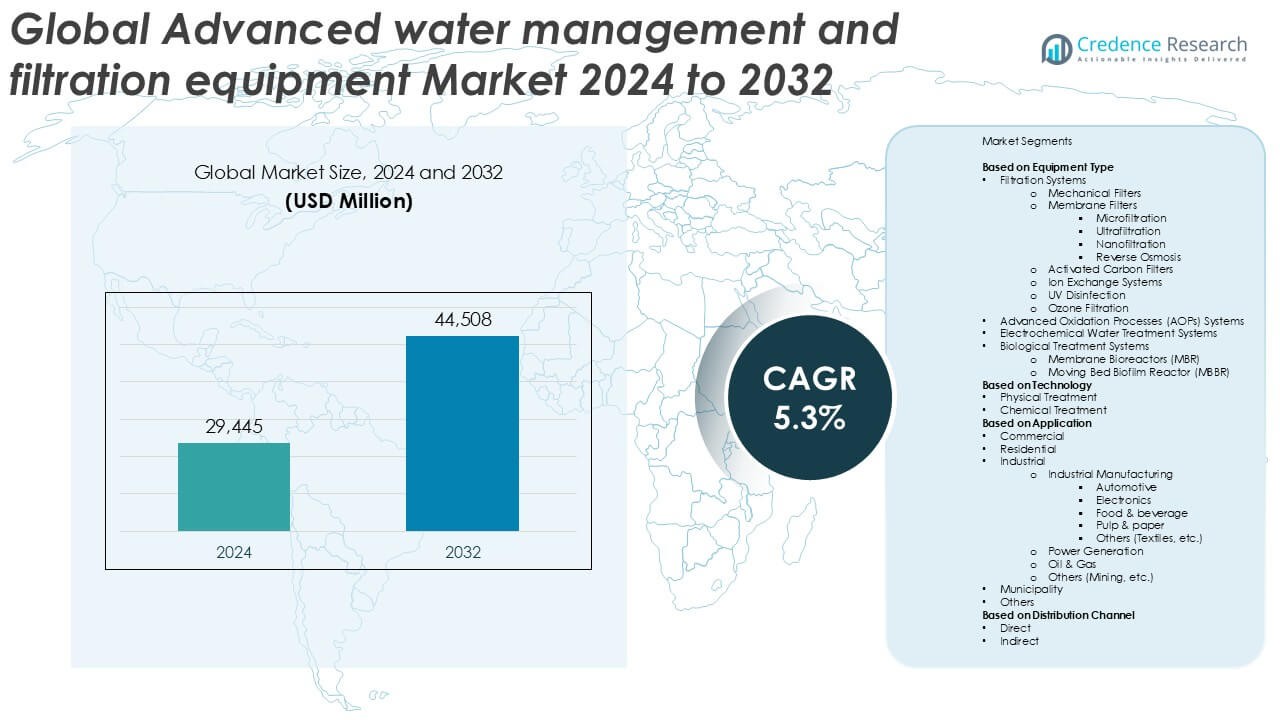

The Advanced Water Management and Filtration Equipment Market was valued at USD 29,445 million in 2024 and is projected to reach USD 44,508 million by 2032, growing at a CAGR of 5.3% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Water Management and Filtration Equipment Market Size 2024 |

USD 29,445 Million |

| Advanced Water Management and Filtration Equipment Market, CAGR |

5.3% |

| Advanced Water Management and Filtration Equipment Market Size 2032 |

USD 44,508 Million |

The Advanced Water Management and Filtration Equipment Market is driven by growing global water scarcity, stricter environmental regulations, and rising industrial demand for sustainable water solutions. Governments and industries are investing in advanced technologies to improve water quality and ensure regulatory compliance. The market is witnessing key trends such as the integration of smart monitoring systems, increased adoption of decentralized and modular treatment units, and a strong shift toward energy-efficient, eco-friendly filtration solutions.

The Advanced Water Management and Filtration Equipment Market demonstrates strong geographical presence across North America, Europe, and Asia Pacific, driven by infrastructure upgrades, industrial growth, and regulatory enforcement. North America leads the market, followed by Europe, while Asia Pacific shows rapid expansion due to urbanization and rising water demand. Key players include Xylem Inc., Pall Corporation, Alfa Laval AB, Pentair plc, Kurita Water Industries Ltd., Toray Industries, and GEA Group AG, all contributing to innovation, product development, and global market competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Advanced Water Management and Filtration Equipment Market was valued at USD 29,445 million in 2024 and is projected to reach USD 44,508 million by 2032, growing at a CAGR of 5.3%.

- Rising water scarcity and stricter environmental regulations are driving the demand for advanced filtration and treatment systems across sectors.

- Integration of smart technologies, such as IoT-enabled sensors and automated monitoring, is transforming water management infrastructure.

- Key players like Xylem Inc., Pentair plc, Alfa Laval AB, and Kurita Water Industries Ltd. focus on innovation and strategic expansion to strengthen market presence.

- High capital costs and technical complexity in operating advanced systems remain major restraints in cost-sensitive regions.

- North America holds the largest market share at 32.4%, followed by Europe at 27.1%, and Asia Pacific at 22.8%, with emerging markets driving future growth.

- Demand for modular, decentralized, and energy-efficient systems is growing across municipal, industrial, and residential applications.

Market Drivers

Rising Global Water Scarcity and Increasing Demand for Clean Water Drive Market Expansion

The Advanced Water Management and Filtration Equipment Market is primarily driven by the urgent need to address global water scarcity and declining water quality. Rapid urbanization, population growth, and industrialization continue to place stress on existing freshwater resources. Governments and utilities are prioritizing investments in advanced water infrastructure to ensure reliable access to clean water. The market benefits from rising public awareness of water conservation and the harmful effects of untreated water. It plays a critical role in supporting municipal, industrial, and agricultural sectors that require effective water treatment solutions. This growing dependence on advanced systems boosts long-term market demand.

- For instance, Xylem Inc. deployed its advanced water reuse system for the City of Los Angeles’ Terminal Island Water Reclamation Plant, increasing potable water production by 4.5 million gallons per day using its Wedeco UV disinfection and ozone oxidation technologies.

Stringent Environmental Regulations Accelerate Technology Adoption Across Sectors

Tightening regulatory frameworks related to water discharge and quality standards are pushing industries to adopt more efficient water management technologies. The Advanced Water Management and Filtration Equipment Market aligns closely with compliance efforts under national and international environmental laws. Regulatory bodies are enforcing stricter limits on contaminants and mandating the use of sustainable technologies. It drives demand for filtration systems capable of removing complex pollutants and ensuring wastewater meets discharge criteria. Industry players are integrating advanced monitoring and treatment solutions to reduce environmental impact. The focus on regulatory compliance supports consistent investment in innovative equipment.

- For instance, Veolia Water Technologies implemented its Actiflo® Carb process at the Tianjin Bohua Chemical Plant in China to meet China’s Class I-A wastewater discharge standard. The system treats 10,000 cubic meters per day of industrial wastewater and achieves biochemical oxygen demand (BOD) reduction to below 10 mg/L and total suspended solids (TSS) to below 5 mg/L, ensuring full compliance with stringent regulatory discharge requirements.

Industrial and Agricultural Sectors Increase Focus on Water Efficiency and Sustainability

Manufacturing and agricultural operations are key contributors to water consumption and wastewater generation. To reduce operational costs and comply with water-use efficiency targets, these sectors are investing in modern water filtration and recycling systems. The Advanced Water Management and Filtration Equipment Market supports this shift by offering scalable and high-performance solutions. It helps improve water reuse, reduce reliance on freshwater sources, and limit environmental degradation. Companies are embedding water stewardship into their sustainability strategies, increasing uptake of smart water technologies. This trend supports steady growth in industrial and agricultural applications.

Technological Advancements Enhance Equipment Efficiency and Market Competitiveness

Ongoing innovation in membrane filtration, reverse osmosis, UV disinfection, and real-time monitoring tools is expanding the application scope of advanced water treatment systems. The Advanced Water Management and Filtration Equipment Market benefits from these advancements, which improve efficiency, reliability, and cost-effectiveness. It enables users to achieve better filtration outcomes with reduced energy and maintenance requirements. Integration of automation and AI-driven diagnostics is improving system performance and reducing operational risk. Equipment manufacturers are differentiating through modular and compact designs tailored to various end-use needs. These innovations are making advanced systems more accessible and scalable across sectors.

Market Trends

Integration of Smart Technologies and Automation Shapes Modern Water Infrastructure

The adoption of smart water management systems is becoming a significant trend across municipal and industrial applications. Sensors, IoT platforms, and data analytics are enhancing real-time monitoring and control of water treatment operations. The Advanced Water Management and Filtration Equipment Market is seeing strong interest in automated filtration systems that support predictive maintenance and remote diagnostics. It enables users to optimize water usage, detect leakages early, and ensure compliance with regulatory standards. Digital integration is helping utilities improve efficiency while reducing manual intervention. This trend is reshaping traditional water treatment models into more agile and responsive systems.

- For instance, Suez Water Technologies & Solutions deployed its Aquasuite AI-powered monitoring platform for the Vitens Water Utility in the Netherlands, enabling the real-time control of 34 water treatment plants and 96 pumping stations, with predictive analytics reducing unplanned maintenance interventions by 125 cases annually and optimizing water pressure across 13,000 kilometers of pipeline.

Growing Preference for Decentralized and Modular Water Treatment Solutions

Demand is shifting toward compact, decentralized treatment systems that can be deployed in remote or resource-constrained areas. The Advanced Water Management and Filtration Equipment Market is adapting to this preference with modular units that offer scalability and flexibility. It supports applications in rural communities, small industries, and disaster relief operations. These systems reduce dependency on large-scale centralized infrastructure and enable localized water reuse. Manufacturers are focusing on portable designs that offer rapid deployment and ease of maintenance. This shift aligns with the global push for equitable and sustainable water access.

- For instance, Pentair plc introduced its FreshPoint Easy Flow modular system for deployment in rural India, where it now supplies treated drinking water to over 2,300 villages, each unit capable of producing up to 4,000 liters per day of potable water through multi-stage filtration and UV disinfection, all operated with a single-phase power supply of 230 volts.

Increased Adoption of Sustainable and Energy-Efficient Filtration Technologies

Sustainability has become a major focus across the water treatment industry, influencing both product development and procurement decisions. The Advanced Water Management and Filtration Equipment Market is witnessing rising demand for systems that consume less energy and use eco-friendly materials. It reflects the growing pressure on industries to reduce their carbon and water footprints. Manufacturers are introducing solutions that maximize filtration performance while minimizing operational costs and environmental impact. New membrane materials and low-pressure filtration techniques are gaining popularity. These innovations support long-term environmental goals and enhance market competitiveness.

Expansion of Industrial Applications Across Emerging Economies Boosts Demand

Industries in emerging markets are increasing investments in advanced water treatment systems to support manufacturing growth and regulatory compliance. The Advanced Water Management and Filtration Equipment Market is expanding into regions such as Asia-Pacific, Latin America, and parts of Africa. It benefits from rising infrastructure development and government initiatives focused on sustainable water use. Industrial zones and economic corridors are adopting high-capacity filtration and recycling systems to meet production needs. Market players are forming partnerships and establishing local facilities to serve growing regional demand. This trend is accelerating global market penetration and revenue generation.

Market Challenges Analysis

High Capital Investment and Maintenance Costs Restrict Widespread Adoption

The Advanced Water Management and Filtration Equipment Market faces a key challenge in the form of high initial capital requirements. Sophisticated treatment technologies and integrated systems demand significant investment in equipment, infrastructure, and skilled personnel. It creates entry barriers for small municipalities and mid-sized industrial units with limited budgets. Long-term operational and maintenance expenses further add to the financial burden. System upgrades, replacement parts, and energy consumption continue to weigh on total ownership costs. These economic constraints slow down adoption, particularly in developing regions where financial and technical resources remain limited.

Complex Regulatory Landscape and Limited Technical Expertise Impede Implementation

Water treatment regulations vary significantly across countries and regions, creating compliance challenges for global market participants. The Advanced Water Management and Filtration Equipment Market must align with diverse environmental standards and certification processes. It complicates equipment design, manufacturing, and deployment strategies for multinational vendors. In many areas, the lack of trained operators and technical support personnel limits effective implementation. End users often struggle to manage and maintain advanced systems without adequate expertise. This regulatory and technical complexity can lead to operational inefficiencies, system downtime, and reduced return on investment.

Market Opportunities

Rising Investments in Smart Cities and Infrastructure Modernization Create Growth Prospects

Global initiatives to build smart cities and upgrade aging infrastructure are opening new avenues for advanced water treatment technologies. The Advanced Water Management and Filtration Equipment Market stands to benefit from increased public and private investments in resilient and efficient water systems. It supports real-time monitoring, automated operations, and data-driven decision-making, aligning with urban development goals. Municipalities are seeking solutions that improve water quality, reduce losses, and enhance distribution efficiency. These projects provide long-term demand for scalable and intelligent equipment. Market players offering integrated and adaptable systems are well-positioned to capitalize on this infrastructure transformation.

Emerging Markets and Industrial Expansion Offer Untapped Revenue Streams

Rapid industrialization in regions such as Asia-Pacific, Africa, and Latin America is creating significant opportunities for water management solutions. The Advanced Water Management and Filtration Equipment Market can expand by meeting the rising demand for water reuse, pollution control, and regulatory compliance. It plays a crucial role in helping industries such as pharmaceuticals, food processing, and chemicals reduce operational risks and improve sustainability. Governments in these regions are promoting cleaner production methods, incentivizing adoption of advanced technologies. Local partnerships, capacity building, and affordable solutions tailored to regional needs can unlock long-term market potential. Companies that address both cost and performance will gain a competitive edge.

Market Segmentation Analysis:

By Equipment Type:

The Advanced Water Management and Filtration Equipment Market includes a broad range of equipment types tailored to diverse water treatment needs. Filtration systems represent the most widely used category, with mechanical filters, membrane filters, activated carbon filters, and ion exchange systems playing essential roles across residential, industrial, and municipal applications. Membrane filters are gaining strong traction, especially in reverse osmosis, nanofiltration, ultrafiltration, and microfiltration processes, due to their ability to handle complex contaminants. UV disinfection and ozone filtration systems are frequently deployed in sensitive applications requiring microbial control. The market also includes Advanced Oxidation Processes (AOPs), electrochemical water treatment, and biological treatment systems such as Membrane Bioreactors (MBR) and Moving Bed Biofilm Reactors (MBBR), which serve specialized industrial and municipal treatment needs.

- For instance, Toray Industries, Inc. supplied its ROMEMBRA™ reverse osmosis membranes to the Tuas Desalination Plant in Singapore, treating 137,000 cubic meters per day of seawater. The plant uses a multi-stage membrane system, including 1,408 pressure vessels and 11,264 membrane elements, achieving recovery rates above 45 cubic meters per hour per train under continuous operation.

By Technology:

The market is segmented into physical and chemical treatment methods. Physical treatment includes filtration and disinfection processes, while chemical treatment involves coagulation, precipitation, and chemical oxidation. The Advanced Water Management and Filtration Equipment Market supports both approaches depending on contamination levels, operational efficiency, and end-user requirements. It allows users to choose between or integrate both methods to meet regulatory standards and improve water quality outcomes. The ability to combine technologies within a single system is driving demand for hybrid treatment solutions.

- For instance, Kurita Water Industries Ltd. installed a hybrid treatment system combining electro-oxidation and coagulation at a semiconductor manufacturing facility in Japan. The system treated 1,200 cubic meters per day of wastewater containing fluorine and COD pollutants. The integrated unit reduced COD levels to under 20 mg/L and fluoride concentration to less than 1 mg/L, meeting stringent discharge requirements while reducing chemical use by 18 kilograms per day.

- Bottom of Form

By Application:

The market spans residential, commercial, industrial, and municipal sectors. The industrial segment holds a major share, driven by sub-sectors such as automotive, electronics, food and beverage, pulp and paper, and textiles, all of which require precise water quality control. Power generation and oil and gas industries also demand high-capacity, durable systems to meet operational needs and environmental regulations. The Advanced Water Management and Filtration Equipment Market also serves municipalities focused on safe drinking water supply and wastewater treatment. It offers opportunities in smaller segments like mining and other specialized applications where water quality directly affects operational efficiency and compliance.

Segments:

Based on Equipment Type

- Filtration Systems

- Mechanical Filters

- Membrane Filters

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

- Activated Carbon Filters

- Ion Exchange Systems

- UV Disinfection

- Ozone Filtration

- Advanced Oxidation Processes (AOPs) Systems

- Electrochemical Water Treatment Systems

- Biological Treatment Systems

- Membrane Bioreactors (MBR)

- Moving Bed Biofilm Reactor (MBBR)

Based on Technology

- Physical Treatment

- Chemical Treatment

Based on Application

- Commercial

- Residential

- Industrial

- Industrial Manufacturing

- Automotive

- Electronics

- Food & beverage

- Pulp & paper

- Others (Textiles, etc.)

- Power Generation

- Oil & Gas

- Others (Mining, etc.)

- Municipality

- Others

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a dominant position with a 32.4% market share in 2024, driven by stringent water quality regulations, early adoption of advanced technologies, and significant investments in upgrading municipal water infrastructure. The United States leads the region due to ongoing modernization of water utilities and strong industrial demand across sectors such as power generation, pharmaceuticals, and food and beverage. High awareness of water conservation, coupled with active government support through the Environmental Protection Agency (EPA) and infrastructure bills, reinforces market growth. Canada also contributes steadily through expanding investments in decentralized and remote water systems for rural and indigenous communities. It benefits from widespread adoption of membrane filtration and ultraviolet (UV) disinfection technologies across both municipal and industrial users.

Europe

Europe accounts for 27.1% of the global market share, supported by a robust regulatory framework and long-standing emphasis on environmental sustainability. Countries such as Germany, France, the United Kingdom, and the Netherlands are investing heavily in smart water grids and energy-efficient filtration systems. The region is focusing on reducing water loss in distribution networks and improving wastewater reuse rates through advanced biological and membrane technologies. The European Union’s Water Framework Directive and urban wastewater treatment directives create strong demand for compliant systems. It supports adoption of ozone filtration, electrochemical treatment, and AOPs systems in both public and private sectors. Industrial manufacturing and food processing remain key contributors to regional equipment demand.

Asia Pacific

Asia Pacific captures 22.8% of the market share, reflecting rapid industrialization, population growth, and government initiatives to address water scarcity and pollution. China, India, and Southeast Asian countries are deploying large-scale municipal and industrial water treatment projects. It supports rising demand for membrane bioreactors (MBRs), reverse osmosis systems, and decentralized filtration solutions across urban and peri-urban areas. Industrial sectors such as electronics, textiles, and chemicals are investing in water reuse systems to meet tightening environmental norms. Governments in the region are encouraging private sector participation and foreign investment to bridge infrastructure gaps. Urbanization trends and growing awareness of waterborne diseases further support residential and commercial adoption. The diverse regional needs present strong opportunities for both high-end and cost-effective equipment providers.

Latin America

Latin America represents 9.6% of the global market, with Brazil and Mexico as key growth drivers. The region is facing increasing water stress, particularly in densely populated urban areas and agricultural zones. It is investing in infrastructure upgrades and decentralization to expand access to clean water and improve sanitation. Industrial sectors such as mining, food processing, and oil and gas contribute to rising demand for filtration and disinfection systems. The market benefits from government-backed water sustainability programs and international aid supporting rural water projects. Challenges related to funding and technical expertise persist, but growing regulatory attention is creating opportunities for equipment providers focused on affordable, efficient solutions.

The Middle East and Africa (MEA)

The Middle East and Africa (MEA) account for 8.1% of market share, led by demand from water-scarce regions and desalination-intensive economies such as Saudi Arabia, UAE, and South Africa. The market is shaped by arid climates, reliance on non-conventional water sources, and the need for advanced treatment of industrial and municipal wastewater. It supports deployment of reverse osmosis and UV disinfection systems across both urban centers and remote communities. Governments are increasing public-private partnerships to meet long-term water security goals. Water reuse in agriculture and industrial processing is becoming a strategic priority. While infrastructure gaps remain in parts of Africa, international development funding and growing urbanization are gradually expanding access to filtration technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pall Corporation

- Doosan Enpure

- Bluewater Group

- Toray Industries, Inc.

- GEA Group AG

- Pentair plc

- Lenntech B.V.

- Kurita Water Industries Ltd.

- CDE Group

- Alfa Laval AB

- Amiad Water Systems Ltd.

- Hydranautics

- Calgon Carbon Corporation

- Xylem Inc.

- MANN+HUMMEL Water & Fluid Solutions

Competitive Analysis

The Advanced Water Management and Filtration Equipment Market is highly competitive, with leading players focusing on innovation, strategic partnerships, and global expansion to strengthen their market position. Key players include Xylem Inc., Pall Corporation, Alfa Laval AB, Pentair plc, Kurita Water Industries Ltd., Toray Industries, GEA Group AG, Hydranautics, Calgon Carbon Corporation, MANN+HUMMEL Water & Fluid Solutions, Lenntech B.V., Bluewater Group, Amiad Water Systems Ltd., Doosan Enpure, and CDE Group. These companies invest heavily in research and development to enhance product efficiency, reduce energy consumption, and integrate smart technologies such as IoT-enabled monitoring. They also tailor solutions to meet the varying regulatory standards and operational needs across regions. Strategic acquisitions and collaborations are common, allowing companies to expand their portfolios and access new markets. For instance, Xylem focuses on digital water solutions, while Pentair emphasizes sustainable filtration systems for industrial and residential use. Kurita and Toray Industries leverage their expertise in membrane and chemical treatments to serve high-demand industrial sectors. The competitive landscape remains dynamic, with innovation, compliance capability, and adaptability to emerging market needs serving as key differentiators.

Recent Developments

- In April 2025, Bluewater introduced a new line of high-capacity, mobile, outdoor dispensers in the US that remove up to 99.7% of contaminants including PFAS, heavy metals, microplastics, and more. These systems are designed for sporting events and public venues, helping reduce plastic waste and cut carbon emissions.

- In March 2025, Veolia Water Technologies introduced the ToroJet system, an advanced nutshell filtration technology designed to meet the stringent produced water polishing requirements in the oil and gas industry. This innovative system achieves a 98% solids removal efficiency and reduces hydrocarbon concentrations to less than 2 milligrams per liter, making produced water suitable for reinjection, reuse, or discharge. The ToroJet system features a grade-level media cleaning system, eliminating the need for top-mounted backwash equipment, thereby reducing capital expenses and enhancing operational safety.

- In February 2025, Pall introduced a new MF/NF system utilizing advanced hollow-fiber technology. This system is designed to significantly reduce operational costs by 15-20%, while ensuring consistent, high-quality water production and eliminating the need for sludge management. The modular design allows for rapid integration across various industries including chemical processing, power, food & beverage, mining, and pulp and paper. It also features touch-screen controls for ease of operation.

- In November 2024, Scottish Water announced an USD 900 million framework for advanced ceramic membrane water treatment, demonstrating the growing adoption of advanced filtration technologies in the water treatment sector. The framework, which includes the installation of ceramic membrane technology across multiple water treatment facilities in Scotland, aims to enhance water quality and operational efficiency. This significant investment indicates the increasing market demand for advanced water management and filtration equipment, particularly ceramic membranes, which offer superior durability and filtration capabilities compared to traditional polymer-based membranes.

- In October 2024, The Saudi government’s announced a USD 106 billion investment in water projects by 2030 which indicates significant growth potential in the advanced water management and filtration equipment market. The investment, which includes the construction of three water desalination plants in the Red Sea region, demonstrates the increasing demand for sophisticated water treatment solutions in water-scarce regions. This development aligns with the broader market trend of governments implementing advanced water management infrastructure to ensure sustainable water supply.

Market Concentration & Characteristics

The Advanced Water Management and Filtration Equipment Market exhibits moderate to high market concentration, with a mix of global leaders and specialized regional players competing across segments. It is characterized by strong technological innovation, regulatory-driven demand, and high entry barriers due to capital intensity and technical complexity. The market favors companies with robust R&D capabilities, global distribution networks, and regulatory compliance expertise. It is innovation-focused, with growing emphasis on energy-efficient, modular, and automated systems tailored to sector-specific needs. Demand spans municipal, industrial, and residential applications, each requiring customized solutions for varying water quality challenges. The market is also defined by long-term contracts, especially in municipal and industrial sectors, which reinforce vendor-client relationships and recurring revenue streams. Mergers, acquisitions, and partnerships are shaping the competitive landscape, enabling companies to expand portfolios and geographic reach. The Advanced Water Management and Filtration Equipment Market values adaptability, compliance, and reliability in performance across diverse environmental and operational conditions.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Technology, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global demand will grow due to increasing water scarcity and industrial water reuse initiatives

- Integration of AI and predictive analytics into systems will enhance operational efficiency

- Modular and decentralized treatment units will expand into remote and underserved regions

- Energy‑saving filtration technologies will gain traction with sustainability mandates

- Public‑private partnerships will spur infrastructure investment in emerging markets

- Manufacturers will focus on scalable solutions to support rapid urban growth

- Adoption of hybrid physical‑chemical treatment systems will rise in complex treatment scenarios

- Enhanced membrane materials will boost lifespan and reduce maintenance frequency

- Cross-sector collaborations between tech firms and equipment vendors will accelerate innovation

- Regulatory tightening worldwide will fuel demand for advanced treatment compliance equipment