Market Overview

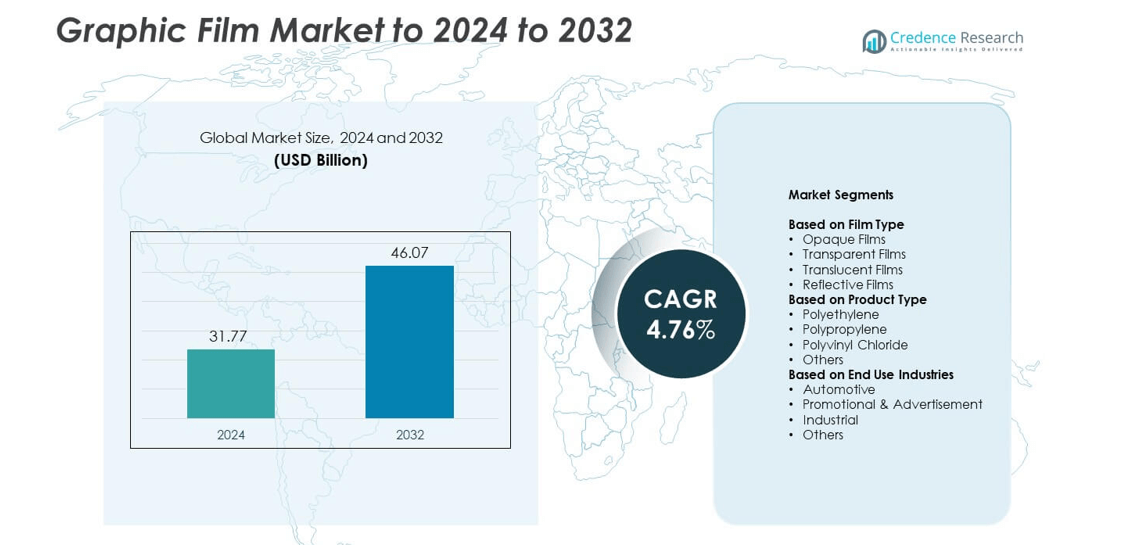

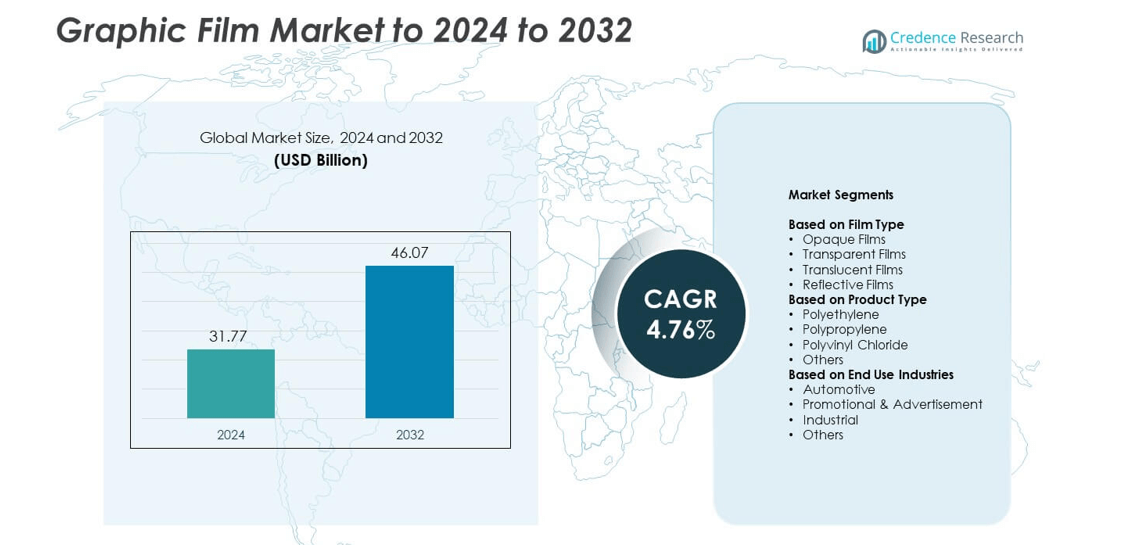

The global graphic film market size was valued at USD 31.77 billion in 2024 and is anticipated to reach USD 46.07 billion by 2032, at a CAGR of 4.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Graphic Film Market Size 2024 |

USD 31.77 billion |

| Graphic Film Market, CAGR |

4.76% |

| Graphic Film Market Size 2032 |

USD 46.07 billion |

The graphic film market is led by major players such as Avery Dennison Corporation, 3M, Orafol Group, Arlon Graphics LLC, Hexis S.A.S., Ritrama S.p.A., Mactac LLC, Spandex AG, Dunmore, The Griff Network, and FDC Graphic Films Inc. These companies focus on developing high-performance films with superior printability, durability, and environmental compliance. Continuous investment in sustainable materials and advanced coating technologies strengthens their market competitiveness. North America leads the global market with a 37% share, supported by strong demand from automotive, retail, and advertising industries, followed by Europe with 28% and Asia Pacific with 25%.

Market Insights

- The graphic film market was valued at USD 31.77 billion in 2024 and is projected to reach USD 46.07 billion by 2032, growing at a CAGR of 4.76%.

- Rising demand for vehicle wraps, outdoor signage, and promotional materials is driving market expansion across automotive and retail sectors.

- Sustainable and recyclable film materials are becoming key trends as manufacturers adopt bio-based polymers and low-VOC coatings.

- The market is moderately competitive, with players focusing on advanced coating, digital printing compatibility, and expansion in emerging economies.

- North America leads with a 37% share, followed by Europe with 28% and Asia Pacific with 25%, while opaque films account for the largest segment share of 41% in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Film Type

Opaque films dominated the graphic film market in 2024 with a 41% share. These films are widely used in advertising, vehicle wraps, and outdoor signage due to their superior color vibrancy and UV resistance. Their ability to conceal surfaces while providing high-quality print resolution makes them a preferred choice for branding applications. Transparent and translucent films are gaining traction in architectural glazing and interior décor, while reflective films are increasingly used in traffic and safety applications. Growth is driven by rising demand for durable, visually appealing promotional materials.

- For instance, Durability ratings for Arlon’s SLX Cast Wrap vary depending on the product version and region. While the original product was rated for up to 7 years outdoors unprinted, newer versions and the SLX+ Cast Wrap are rated for up to 10 years unprinted in some regions

By Product Type

Polyvinyl chloride (PVC) films held the largest market share of 46% in 2024. PVC films offer excellent flexibility, printability, and resistance to weathering, making them ideal for outdoor and automotive uses. They support vibrant color reproduction, enhancing visual impact in signage and fleet graphics. Polypropylene and polyethylene films are growing in popularity due to their eco-friendly properties and recyclability, aligning with sustainable branding trends. Market growth is propelled by technological advances in polymer processing and the shift toward long-lasting, customizable film solutions.

- For instance, LINTEC ECO-2000ZC is an approx. 2 mil (0.05 mm) optically clear polyester for glazing graphics.

By End Use Industries

The promotional and advertisement segment accounted for the largest share of 48% in 2024. Graphic films are extensively used in billboards, point-of-sale displays, and vehicle wraps to enhance brand visibility. Their versatility and ease of installation make them cost-effective tools for short- and long-term campaigns. The automotive industry also represents a significant share due to the growing trend of vehicle customization and protective wraps. Increasing investments in advertising infrastructure and rising retail competition continue to fuel demand for high-performance graphic films.

Key Growth Drivers

Rising Demand for Vehicle Wrapping and Fleet Graphics

The growing popularity of vehicle wraps and fleet branding is a major driver for the graphic film market. Businesses increasingly use customized wraps for advertising, offering cost-effective and mobile marketing solutions. The demand for durable, UV-resistant, and easy-to-apply films supports adoption across automotive and transportation sectors. This trend is reinforced by expanding commercial fleets and consumer interest in personalized vehicle aesthetics.

- For instance, According to Avery Dennison datasheets and ICS Performance Guarantee bulletins, when paired with specific DOL overlaminates, the MPI 1105 can carry a vertical warranty of up to 8 years. The exact warranty period is zone-based, dependent on the geographic location and is significantly reduced for non-vertical applications

Expanding Outdoor Advertising and Promotional Campaigns

The rapid expansion of outdoor advertising has boosted the consumption of high-quality graphic films. These films offer excellent visual appeal and durability, making them ideal for billboards, posters, and retail displays. Increased marketing spending by brands and advancements in wide-format digital printing technologies further support this demand. The growing need for flexible, weather-resistant promotional materials strengthens market growth.

- For instance, JCDecaux’s digital revenue reached 39% of 2024 group revenue, reflecting rapid DOOH screen rollouts.

Advancements in Printing and Coating Technologies

Innovations in printing and coating technologies are transforming the performance of graphic films. UV-curable inks, improved lamination methods, and nanocoatings enhance color stability, surface finish, and environmental resistance. These developments enable manufacturers to offer films suitable for complex designs and longer outdoor exposure. The integration of digital printing also supports short-run customization and sustainability goals.

Key Trends and Opportunities

Shift Toward Sustainable and Recyclable Film Materials

Manufacturers are increasingly focusing on developing eco-friendly graphic films using bio-based or recyclable polymers. Demand for low-VOC adhesives and solvent-free coatings aligns with global sustainability goals. This shift not only reduces environmental impact but also enhances brand reputation among eco-conscious consumers. The trend creates opportunities for innovation in biodegradable substrates and closed-loop recycling systems.

- For instance, Solar Gard (Saint-Gobain) has published 12 verified Environmental Product Declarations (EPDs) that collectively cover 92 architectural films, with warranties varying by application.

Growing Adoption in Architectural and Interior Applications

Graphic films are gaining popularity in interior décor and architectural applications such as window films, wall graphics, and surface coverings. Their easy installation, design flexibility, and aesthetic appeal make them suitable for commercial and residential spaces. The expansion of modern infrastructure and demand for creative interiors are generating new growth opportunities for decorative and functional films.

- For instance, INEOS Inovyn launched two PVC recycling pilot plants in 2024, targeting a 40 kt industrial unit by 2030

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of raw materials such as PVC, polypropylene, and polyethylene pose a major challenge for manufacturers. Price instability impacts production costs and profitability, particularly for small and mid-sized players. Dependence on petroleum-based inputs further exposes the market to supply chain disruptions. Managing these fluctuations requires long-term supplier agreements and investment in alternative materials.

Environmental Regulations and Disposal Concerns

Stringent environmental regulations related to plastic waste and recycling hinder the widespread use of conventional graphic films. Disposal of non-recyclable materials and limited infrastructure for recycling remain key issues. Manufacturers are under pressure to shift toward sustainable formulations while maintaining film performance. Compliance with evolving global standards increases production complexity and operational costs.

Regional Analysis

North America

North America held the largest share of 37% in the graphic film market in 2024. The region’s dominance is driven by high demand from the automotive, retail, and advertising sectors. Expanding use of vehicle wraps, wall graphics, and outdoor promotional displays continues to boost market growth. The United States leads due to strong digital printing infrastructure and brand marketing investments. The presence of major manufacturers and a growing focus on sustainable film solutions further enhance regional competitiveness across commercial and industrial applications.

Europe

Europe accounted for a 28% share of the graphic film market in 2024. The region benefits from high adoption of eco-friendly films supported by stringent environmental regulations. Countries such as Germany, the United Kingdom, and France lead the demand for recyclable and low-VOC materials. Strong automotive production and advertising sectors contribute to steady consumption. Continuous innovations in print technology and sustainable film coatings are promoting market expansion, particularly in vehicle wrapping and architectural décor applications across the region.

Asia Pacific

Asia Pacific captured a 25% share of the global graphic film market in 2024. Rapid industrialization and rising advertising expenditure across China, India, and Japan are driving strong growth. Expanding e-commerce and retail sectors are increasing demand for promotional signage and packaging films. The availability of low-cost raw materials and manufacturing facilities further supports production efficiency. Increasing investment in infrastructure, along with the region’s growing automotive and construction industries, is positioning Asia Pacific as the fastest-growing regional market.

Latin America

Latin America held a 6% share of the graphic film market in 2024. The region’s growth is supported by rising demand for advertising displays, vehicle graphics, and retail branding materials. Brazil and Mexico dominate due to expanding automotive production and infrastructure projects. Improvements in digital printing technologies and distribution networks are making high-quality films more accessible. Growing investments in commercial spaces and public advertising are expected to enhance regional adoption of graphic films across diverse end-use sectors.

Middle East & Africa

The Middle East & Africa accounted for a 4% share of the graphic film market in 2024. Market growth is driven by infrastructure development, rising retail branding, and vehicle customization trends. The UAE and Saudi Arabia are key markets, supported by large-scale commercial and tourism projects. Increasing investment in outdoor advertising and smart city developments is boosting the demand for durable, weather-resistant films. Although growth is moderate compared to other regions, expanding construction and automotive activities are supporting steady regional progress.

Market Segmentations:

By Film Type

- Opaque Films

- Transparent Films

- Translucent Films

- Reflective Films

By Product Type

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

By End Use Industries

- Automotive

- Promotional & Advertisement

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The graphic film market features prominent players such as Avery Dennison Corporation, 3M, Orafol Group, Arlon Graphics LLC, Hexis S.A.S., Ritrama S.p.A., Mactac LLC, Spandex AG, Dunmore, The Griff Network, and FDC Graphic Films Inc. The competitive landscape is characterized by continuous innovation, with companies investing heavily in advanced coating technologies, digital printing compatibility, and sustainable material development. Leading firms focus on expanding product portfolios through bio-based and recyclable film solutions to meet rising environmental standards. Strategic partnerships with printing and advertising service providers are enhancing market penetration across automotive, retail, and industrial sectors. Global players are strengthening regional distribution networks and scaling production capacities to cater to increasing customization demands. Continuous R&D efforts are aimed at improving durability, weather resistance, and print clarity, while mergers and acquisitions are being leveraged to consolidate market presence and expand geographic reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Avery Dennison Corporation

- 3M

- Orafol Group

- Arlon Graphics LLC

- Hexis S.A.S.

- Ritrama S.p.A.

- Mactac, LLC

- Spandex AG

- Dunmore

- The Griff Network

- FDC Graphic Films Inc.

Recent Developments

- In 2024, Avery Dennison Corporation Introduced new colors for its Supreme Wrapping Film and specialized textured architectural films for interior applications

- In 2023, ORAFOL launched and promoted an expanded matte color range for its ORACAL 651 film.

- In 2022, Avery Dennison Corporation partnered with Siser North America to launch the EasyPSV Starling film and expanded its product line with new offerings.

Report Coverage

The research report offers an in-depth analysis based on Film Type, Product Type, End Use Industries and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of eco-friendly and recyclable graphic films will drive sustainable market expansion.

- Demand for vehicle wraps and fleet graphics will continue to strengthen across commercial sectors.

- Advancements in digital printing technologies will enhance film quality and customization options.

- Increased use of graphic films in interior décor and architectural applications will boost product diversity.

- Rising advertising investments across retail and outdoor sectors will sustain long-term growth.

- Development of bio-based polymers will help reduce environmental impact and regulatory pressure.

- Smart films with self-healing and anti-graffiti coatings will gain wider acceptance in urban markets.

- Growing construction and automotive industries in Asia Pacific will accelerate regional demand.

- Strategic collaborations between film manufacturers and print technology providers will enhance innovation.

- Continuous R&D in coating and lamination processes will improve durability and weather resistance.