Market Overview

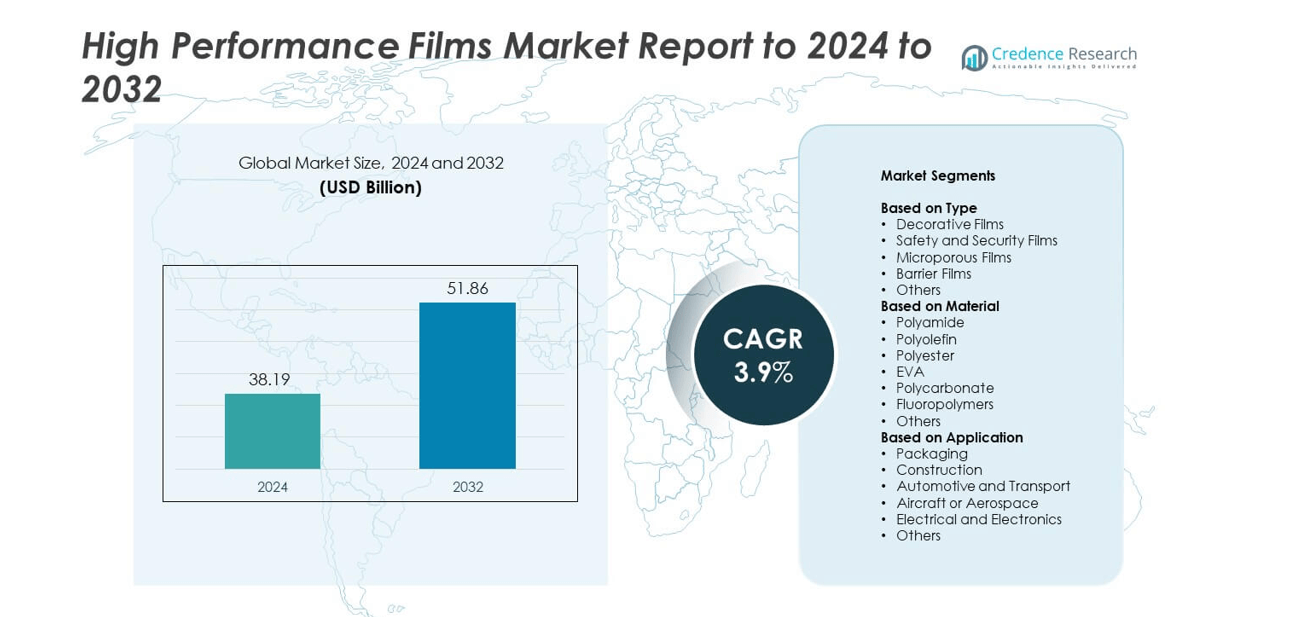

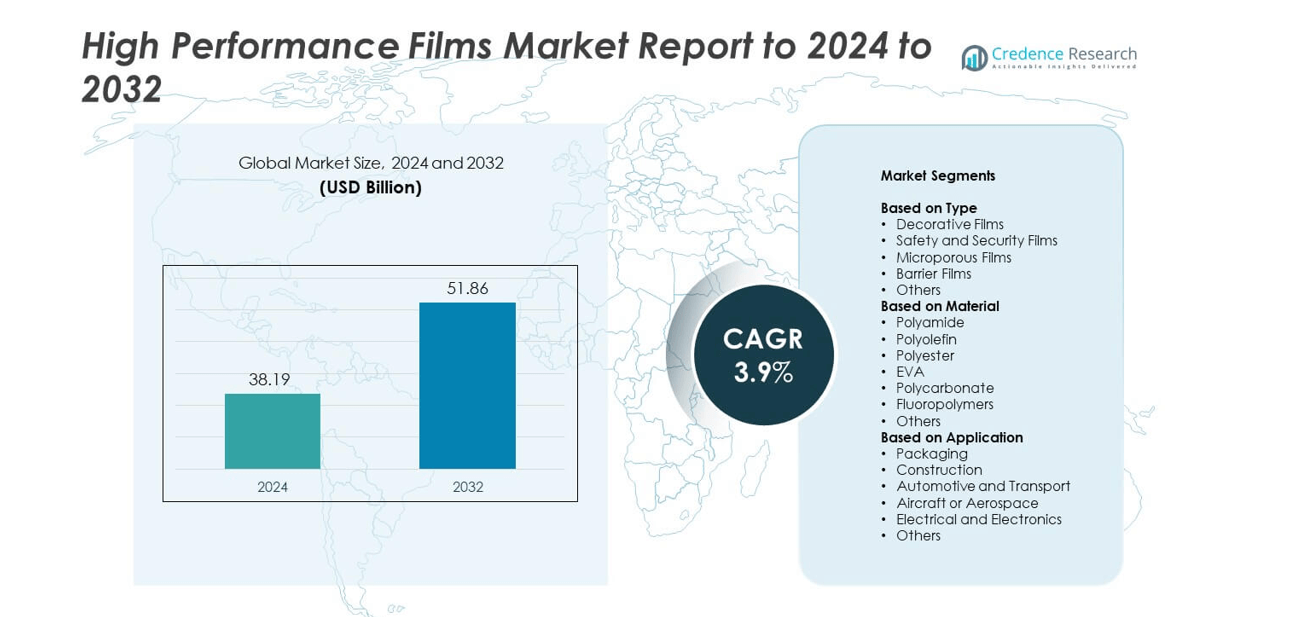

High Performance Films Market Report size was valued USD 38.19 Billion in 2024 and is anticipated to reach USD 51.86 Billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Performance Films Market Size 2024 |

USD 38.19 Billion |

| High Performance Films Market, CAGR |

3.9% |

| High Performance Films Market Size 2032 |

USD 51.86 Billion |

The High Performance Films Market Report is led by major players such as 3M Company, Eastman Chemical Company, Covestro, Solvay S.A., Honeywell International Inc., E.I. DuPont de Nemours and Company, Toray Industries, Bayer AG, Evonik Industries AG, Dow Chemical Company, Clariant AG, and Bemis Company Inc. These companies focus on innovation, product diversification, and sustainability through bio-based and recyclable film technologies. North America leads the global market with a 37% share in 2024, supported by strong industrial infrastructure and advanced packaging and electronics sectors. Europe follows closely, driven by environmental regulations and growing adoption of high-performance materials.

Market Insights

- The High Performance Films Market Report was valued at USD 38.19 billion in 2024 and is projected to reach USD 51.86 billion by 2032, expanding at a CAGR of 3.9% during the forecast period.

- Growth is driven by increasing demand for lightweight, durable, and recyclable materials across packaging, electronics, and automotive sectors. Rising sustainability initiatives further boost adoption in green manufacturing.

- Market trends include the development of bio-based films, nanocomposite coatings, and advanced multilayer structures that enhance strength, heat resistance, and transparency.

- Competition remains strong with global players investing in R&D, automation, and sustainable product portfolios. Companies are expanding production capacities and forming strategic alliances to enhance regional presence.

- North America leads with a 37% share, followed by Europe at 29% and Asia Pacific at 24%. Barrier films dominate with a 39% segment share, supported by rising demand in packaging and electronics industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Barrier films held the largest share of 39% in the High Performance Films Market in 2024. Their dominance stems from their superior protection against oxygen, moisture, and chemical exposure. These films are widely used in packaging and electronic components to enhance durability and shelf life. Decorative and safety films also showed steady growth, supported by demand in architecture and automotive interiors. Increasing use of advanced multilayer structures and high-barrier coatings continues to strengthen this segment’s leadership across consumer goods, healthcare, and industrial applications.

- For instance, TOPPAN’s GL-BARRIER PP (GL-BP) shows WVTR 0.2 g/m²·day at 40 °C/90%RH and OTR 0.1 cc/m²·day·atm at 30 °C/70%RH.

By Material

Polyester accounted for the dominant 36% share in 2024, driven by its strength, clarity, and cost-efficiency. It is widely adopted in flexible packaging, electrical insulation, and industrial laminates. The material’s thermal stability and recyclability enhance its suitability for sustainable manufacturing. Polycarbonate and fluoropolymers followed closely, supported by high-performance needs in electronics and aerospace. The growing focus on lightweight materials and improved mechanical resistance continues to promote polyester’s strong presence in high-volume end-use industries.

- For instance, DuPont Teijin Films’ Melinex 197 lists tensile strength at break of 207 MPa (MD) and 234 MPa (TD) per ASTM D882A.

By Application

Packaging led the market with a 42% share in 2024, supported by extensive use in food, pharmaceutical, and industrial sectors. High performance films provide moisture resistance, gas barrier protection, and extended product shelf life. The increasing demand for eco-friendly and lightweight packaging materials further drives adoption. Construction and automotive applications are also expanding, supported by rising use of energy-efficient coatings and impact-resistant films. Rapid industrialization and growing e-commerce logistics sustain packaging’s leadership within the market.

Key Growth Drivers

Rising Demand for Advanced Packaging Solutions

The growing need for durable and lightweight packaging materials is a major growth driver. High performance films offer superior moisture and gas barrier protection, extending product shelf life. The shift toward eco-friendly and recyclable packaging is increasing their adoption in food, beverage, and pharmaceutical industries. Additionally, the demand for flexible and transparent packaging with high mechanical strength supports consistent market expansion across consumer goods and industrial applications.

- For instance, Mitsubishi Chemical’s TECHBARRIER™ HX cites OTR 0.1 cc/m²·day·atm and WVTR 0.08 g/m²·day for SiOx-coated film.

Expansion of Electronics and Automotive Applications

High performance films are increasingly used in electric vehicles, displays, and circuit protection. Their heat resistance, optical clarity, and dimensional stability make them ideal for insulation and optical films. Automotive manufacturers use these materials to reduce component weight and improve fuel efficiency. In electronics, thin and durable films are vital for flexible displays and printed circuits. The ongoing rise in EV production and digital device demand strengthens this segment’s contribution to overall market growth.

- For instance, before selling its film business in 2022, SKC operated 21 PET film production lines with a combined annual capacity of 240,000 tons, a capacity that was achieved upon the completion of its Jiangsu plant in 2013.

Growing Adoption in Construction and Infrastructure Projects

The expanding use of energy-efficient and durable building materials drives film demand in construction. High performance films are applied for window insulation, surface protection, and safety glazing. They enhance building energy efficiency by reducing UV and heat penetration. Increasing urbanization and the push for green building certification are boosting their usage in both residential and commercial projects. The adoption of advanced film technologies supports sustainable infrastructure development globally.

Key Trends and Opportunities

Shift Toward Sustainable and Bio-Based Materials

Manufacturers are focusing on developing recyclable and bio-based high performance films to meet sustainability goals. These materials help reduce plastic waste while maintaining strength, flexibility, and barrier performance. Growing consumer and regulatory pressure to lower carbon emissions accelerates the use of compostable film formulations. This trend opens new opportunities for innovation in food packaging and industrial laminates that comply with global environmental standards.

- For instance, Amcor’s AmLite HeatFlex Recycle-Ready reports up to 60% lifecycle carbon-footprint reduction versus PET/ALU/PP baselines.

Integration of Nanotechnology and Coating Innovations

Advancements in nanotechnology are enabling high performance films with enhanced scratch resistance, conductivity, and gas barrier properties. Functional coatings and nanocomposites improve film performance in demanding environments such as aerospace and electronics. Companies are investing in multilayered and plasma-treated films to deliver higher durability and optical clarity. This trend supports diversification into specialized applications, creating long-term opportunities in high-value sectors.

- For instance, Beneq’s ALD moisture barriers achieve WVTR as low as 1×10⁻⁶ g/m²·day with film thickness under 50 nm.

Key Challenges

High Production and Material Costs

The manufacturing of high performance films involves expensive polymers and complex processing technologies. These factors increase production costs and limit adoption in cost-sensitive markets. Additionally, fluctuating prices of raw materials like polyesters and fluoropolymers affect profit margins. To remain competitive, manufacturers are focusing on process optimization and scaling production capabilities to balance cost with performance.

Environmental Concerns and Recycling Limitations

Most high performance films use multilayer structures, making recycling difficult. Their complex composition of mixed polymers hinders separation and reuse. Growing environmental regulations and waste management issues challenge producers to design more sustainable materials. The lack of large-scale recycling infrastructure further adds to the problem, pushing the industry toward research in biodegradable and circular economy-compatible solutions.

Regional Analysis

North America

North America held the largest market share of 37% in 2024, driven by strong demand from packaging, automotive, and electronics industries. The United States leads the region with significant consumption of high performance films in flexible packaging and construction. Growth in electric vehicles and renewable energy applications further supports product utilization. Companies are investing in sustainable and recyclable film technologies to meet tightening environmental regulations. Technological advancements and increasing adoption of high-barrier films across industrial sectors continue to strengthen North America’s leadership in the global market.

Europe

Europe accounted for a 29% share in 2024, supported by rising use of high performance films in automotive and green construction projects. The region’s focus on reducing carbon emissions and promoting recyclable materials drives strong demand. Germany, France, and the United Kingdom lead production due to their advanced manufacturing bases. Growth in electric vehicles, solar modules, and packaging innovations further accelerates market expansion. Stringent EU sustainability directives and growing R&D investments in bio-based film technologies are enhancing regional competitiveness.

Asia Pacific

Asia Pacific captured a 24% share in 2024, emerging as the fastest-growing regional market. China, Japan, South Korea, and India are key contributors, driven by rapid industrialization and expanding electronics manufacturing. The region benefits from large-scale production capacities and cost-efficient polymer supply chains. Increasing adoption of high-barrier and specialty films in food packaging, solar panels, and medical applications is propelling growth. The demand for lightweight automotive materials and flexible electronic components continues to expand the regional footprint.

Latin America

Latin America represented an 6% share in 2024, led by growing demand in Brazil and Mexico. The market is expanding with increasing investments in food packaging, automotive, and construction sectors. Rising urbanization and infrastructure projects are boosting the use of protective and decorative films. Local manufacturers are adopting advanced multilayer technologies to enhance film durability and performance. The shift toward sustainable packaging materials also creates growth potential across consumer and industrial applications.

Middle East and Africa

The Middle East and Africa accounted for a 4% market share in 2024, supported by growth in construction, infrastructure, and energy projects. The adoption of heat-resistant and UV-protective films is increasing in architectural and industrial uses. The Gulf countries are focusing on building energy-efficient structures, while South Africa and Egypt are witnessing rising demand from packaging industries. Limited local production capacity is encouraging imports from Asia and Europe. Continuous urban expansion and regulatory support for green materials are driving gradual market growth.

Market Segmentations:

By Type

- Decorative Films

- Safety and Security Films

- Microporous Films

- Barrier Films

- Others

By Material

- Polyamide

- Polyolefin

- Polyester

- EVA

- Polycarbonate

- Fluoropolymers

- Others

By Application

- Packaging

- Construction

- Automotive and Transport

- Aircraft or Aerospace

- Electrical and Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

3M Company, Eastman Chemical Company, Covestro, Solvay S.A., Honeywell International Inc., E.I. DuPont de Nemours and Company, Toray Industries, Bayer AG, Evonik Industries AG, Dow Chemical Company, Clariant AG, and Bemis Company Inc. are the leading players shaping the competitive landscape of the High Performance Films Market. The competition is defined by innovation in advanced polymer technologies, improved thermal stability, and superior barrier performance. Companies focus on sustainable production, developing recyclable and bio-based film solutions to meet global environmental regulations. Continuous investment in R&D enhances product functionality for packaging, electronics, and automotive applications. Strategic collaborations, mergers, and capacity expansions remain key approaches to strengthen global supply chains and improve market reach. Increasing emphasis on nanocomposites, multilayer structures, and energy-efficient processing supports differentiation in product performance. The market competition continues to intensify as firms adopt automation and digitalization to achieve precision manufacturing and optimize production efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M Company

- Eastman Chemical Company

- Covestro

- Solvay S.A.

- Honeywell International Inc.

- I. DuPont de Nemours and Company

- Toray Industries

- Bayer AG

- Evonik Industries AG

- Dow Chemical Company

- Clariant AG

- Bemis Company Inc.

Recent Developments

- In 2025, Toray launched the new PICASUS™ VT nano-multilayer film to eliminate double images in automotive heads-up displays (HUDs) when viewed through polarized sunglasses

- In 2025, DuPont introduced UV™ 26GNF Photoresist, a non-fluorine photoresist for more sustainable semiconductor manufacturing.

- In 2024, Clariant AG, At the NPE 2024 trade show, Clariant unveiled a new range of sustainable film solutions designed to reduce the environmental impact of plastics.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recyclable and bio-based high performance films will continue to rise.

- Packaging applications will remain the largest revenue contributor in the global market.

- Rapid adoption of advanced coatings will enhance durability and optical clarity.

- Automotive and aerospace industries will expand usage for lightweight, heat-resistant materials.

- Growth in electric vehicles will drive demand for insulating and protective films.

- Asia Pacific will experience the fastest growth due to large-scale manufacturing expansion.

- Digital printing and flexible electronics will create new product innovation opportunities.

- Companies will invest more in multilayer and nanocomposite film technologies.

- Stricter environmental regulations will push for circular and low-emission production models.

- Strategic mergers and capacity expansions will strengthen global supply chain resilience.