| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Engine Market Size 2024 |

USD 104.6 million |

| Aircraft Engine Market, CAGR |

7.53% |

| Aircraft Engine Market Size 2032 |

USD 187.4 million |

Market Overview

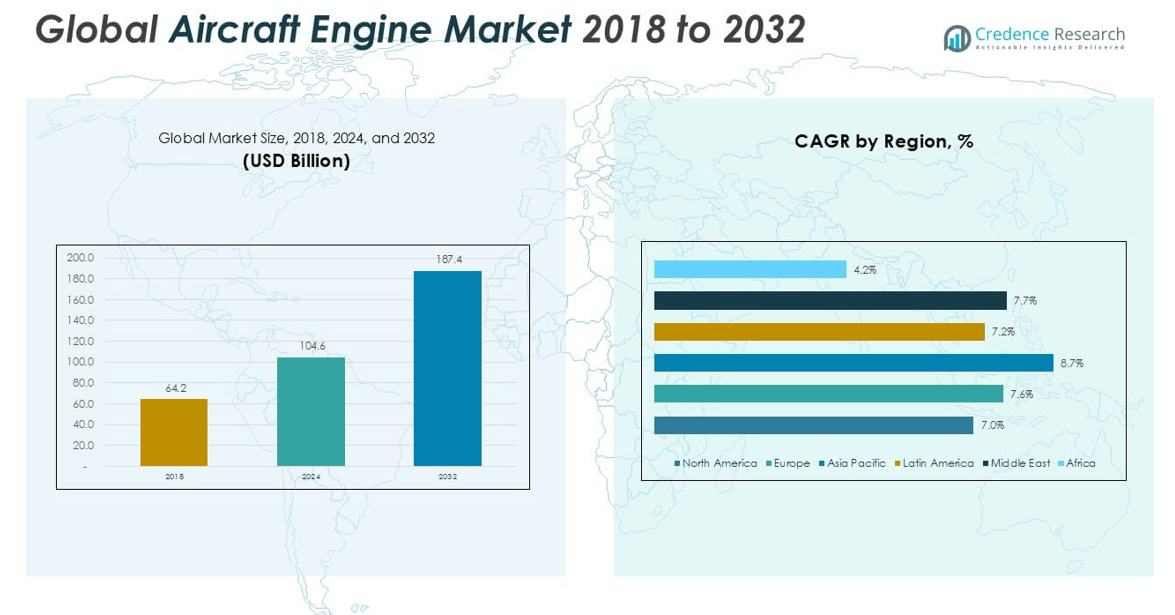

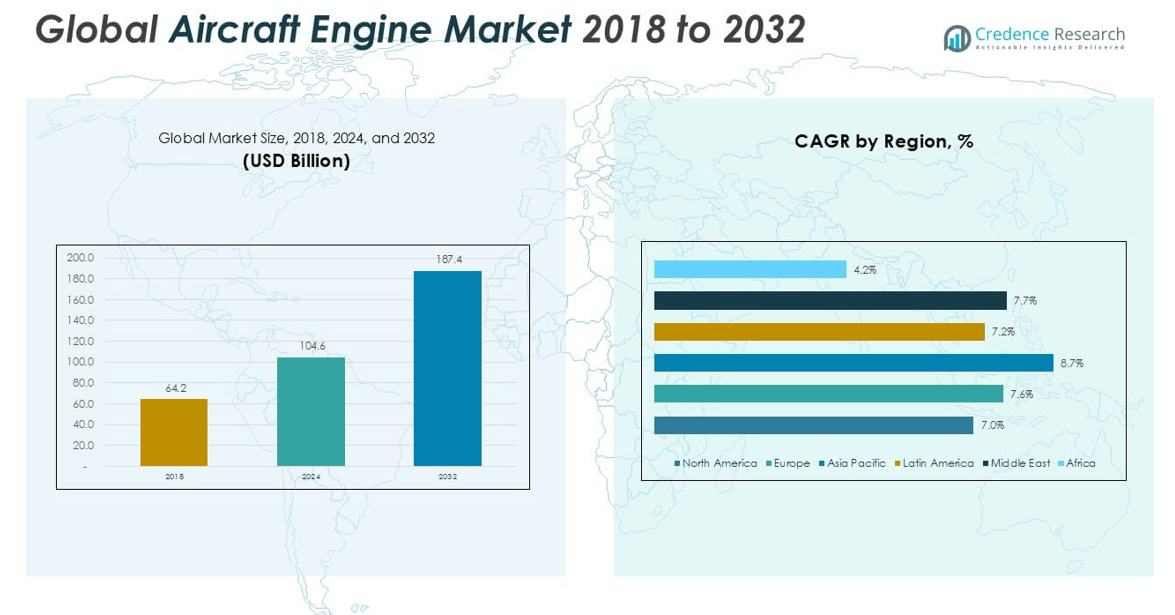

The Global Aircraft Engine Market is projected to grow from USD 104.6 million in 2024 to an estimated USD 187.4 million by 2032, with a compound annual growth rate (CAGR) of 7.53% from 2025 to 2032.

The market is strongly influenced by the rising adoption of lightweight materials and hybrid-electric propulsion systems aimed at improving fuel efficiency and reducing carbon emissions. Key trends include increasing demand for next-generation engines that offer lower noise levels, better performance, and compliance with stringent environmental regulations. Additionally, the development of sustainable aviation fuels (SAFs) and continuous technological innovations in engine design are shaping the future of the industry. The growing emphasis on reducing operating costs and enhancing engine lifecycle further supports market growth.

Geographically, North America holds a significant share of the global aircraft engine market due to the presence of leading aircraft and engine manufacturers, coupled with high defense expenditure. Europe and Asia-Pacific are also emerging as key regions, driven by increasing aircraft deliveries and expanding commercial aviation sectors, especially in China and India. Major players in the market include General Electric, Rolls-Royce Holdings, Pratt & Whitney, Safran, and Honeywell International, who continue to invest in research and development to maintain their competitive edge.

Market Insights

- The Global Aircraft Engine Market is projected to grow from USD 104.6 million in 2024 to USD 187.4 million by 2032, at a CAGR of 7.53%.

- Rising global air travel and increasing demand for fuel-efficient, low-emission engines are driving strong market growth.

- Technological advancements in hybrid-electric propulsion systems and the adoption of lightweight materials support the development of next-generation engines.

- Surging aircraft deliveries and the replacement of aging fleets create significant demand for modern, high-performance aircraft engines.

- High development costs, complex regulatory approvals, and raw material supply constraints limit the pace of new engine introductions.

- North America dominates the market due to major engine manufacturers and high military aircraft procurement.

- Asia-Pacific shows the fastest growth, supported by rising passenger traffic, regional fleet expansions, and increasing aircraft investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Air Passenger Traffic and Fleet Expansion Fuel Demand for Aircraft Engines

The Global Aircraft Engine Market benefits significantly from the surge in global air passenger traffic and the increasing need for new aircraft to meet this demand. Airlines continue to expand their fleets to accommodate the growing number of travelers, driving the requirement for both new and replacement engines. Emerging markets in Asia-Pacific and the Middle East show rapid growth in air travel, supporting large aircraft procurement orders. Airlines aim to enhance operational efficiency and profitability by introducing modern, fuel-efficient aircraft into their fleets. Aircraft manufacturers, in turn, rely on engine producers to supply advanced engines that meet performance and sustainability targets. This expanding demand strengthens the engine manufacturers’ production pipelines and growth outlook.

- For instance, in 2024, global passenger traffic reached 9,500,000,000 passengers, and Airbus alone delivered 766 commercial aircraft to 86 customers worldwide, with a year-end backlog of 8,658 aircraft, reflecting the scale of fleet expansion and the corresponding demand for aircraft engines.

Technological Advancements Drive Demand for Fuel-Efficient and Low-Emission Engines

The Global Aircraft Engine Market experiences robust growth due to technological progress focused on producing engines with superior fuel efficiency and lower emissions. Manufacturers develop next-generation engines that reduce operating costs and improve aircraft performance. Airlines prioritize engines that meet stricter environmental regulations and help control fuel expenses. The industry’s push towards sustainability encourages the adoption of lightweight materials and advanced aerodynamics in engine design. Engine makers invest heavily in research to produce quieter, more reliable, and less carbon-intensive engines. This focus on innovation continues to elevate the competitiveness of fuel-efficient engines across the market.

- For instance, major global carriers have shifted toward next-generation engines like the CFM LEAP and Pratt & Whitney GTF series, which deliver up to 15,000–35,000 pounds of thrust and are installed on thousands of new aircraft, supporting airlines’ goals for reduced fuel consumption and emissions

Growing Military Aircraft Modernization Programs Support Market Expansion

The Global Aircraft Engine Market gains from increasing defense budgets allocated to modernizing military aircraft fleets worldwide. Governments invest in new fighter jets, transport aircraft, and unmanned aerial vehicles to strengthen national security and operational capabilities. These defense programs create steady demand for advanced aircraft engines with high performance and durability standards. Military agencies seek engines that deliver superior thrust, speed, and operational reliability in diverse conditions. Manufacturers develop engines tailored to defense specifications, contributing to market growth. This segment offers long-term opportunities as military modernization remains a strategic priority for several nations.

Rising Focus on Sustainable Aviation Fuels and Hybrid-Electric Propulsion Systems

The Global Aircraft Engine Market advances as the aviation industry adopts sustainable aviation fuels (SAFs) and explores hybrid-electric propulsion solutions. Airlines and manufacturers actively seek engines compatible with SAFs to reduce greenhouse gas emissions. Engine developers align their designs to support SAF integration without compromising performance. The push for cleaner propulsion systems accelerates innovation in hybrid-electric and fully electric engine concepts. Regulatory authorities encourage the transition to sustainable engines through stringent emission standards. It compels engine manufacturers to deliver more environmentally friendly solutions that meet evolving global requirements.

Market Trends

Increasing Demand for Lightweight and Composite Materials in Aircraft Engine Design

The Global Aircraft Engine Market is witnessing a strong shift towards the use of lightweight and composite materials in engine components. Engine manufacturers aim to reduce overall engine weight to improve fuel efficiency and aircraft range. Composites provide higher strength-to-weight ratios and better resistance to extreme temperatures. Airlines prefer engines built with these materials to lower fuel consumption and enhance payload capacity. The adoption of advanced manufacturing techniques such as 3D printing supports the integration of complex, lightweight parts. This trend is reshaping engine production and accelerating the development of efficient designs.

- For instance, in 2024, one leading engine manufacturer reported using over 2,000 composite fan blades and more than 800 3D-printed lightweight parts in the production of next-generation commercial jet engines, according to company production data and industry surveys.

Growing Preference for Engine Maintenance, Repair, and Overhaul (MRO) Services

The Global Aircraft Engine Market is experiencing increased demand for engine maintenance, repair, and overhaul (MRO) services to extend engine life and optimize performance. Airlines focus on maintaining their existing fleets to control capital expenditure and manage operational costs. MRO providers expand their global networks to offer faster and more reliable services. Engine manufacturers strengthen their aftermarket services to build long-term partnerships with airline operators. It drives recurring revenue and enhances customer retention. The rising complexity of modern engines further reinforces the need for specialized MRO capabilities.

- For instance, in 2024, global MRO service providers completed over 25,000 aircraft engine overhauls, with major hubs in Asia, Europe, and North America, as documented in industry association reports and government aviation maintenance records.

Rising Investments in Hybrid-Electric and Fully Electric Propulsion Systems

The Global Aircraft Engine Market is moving towards hybrid-electric and fully electric propulsion technologies driven by the industry’s commitment to sustainability. Aircraft engine developers explore electric solutions to achieve lower carbon emissions and meet future regulatory targets. Companies invest in research programs and prototype testing to evaluate the commercial viability of electric propulsion. It supports the long-term goal of transitioning to greener aviation alternatives. Several collaborations between aerospace companies and technology firms aim to fast-track electric engine innovation. These efforts create new growth opportunities within the market

Expanding Production of Narrow-Body Aircraft to Support Regional Connectivity

The Global Aircraft Engine Market benefits from the growing production of narrow-body aircraft, which play a key role in expanding regional and domestic air travel. Airlines invest in narrow-body fleets to serve high-frequency, short-to-medium haul routes efficiently. Aircraft manufacturers increase narrow-body output to meet the rising orders from both low-cost and full-service carriers. It supports engine makers focusing on delivering reliable, fuel-efficient engines for this aircraft category. The demand for single-aisle aircraft remains stable, reinforcing the need for high-performance narrow-body engines. This trend sustains consistent engine deliveries and long-term market growth.

Market Challenges

High Development Costs and Regulatory Hurdles Restrain Innovation and Commercialization

The Global Aircraft Engine Market faces significant challenges due to the high costs associated with research, development, and certification of advanced propulsion systems. Engine manufacturers must invest heavily in technologies that meet stringent fuel efficiency and emission standards. Regulatory compliance processes are complex and time-consuming, often delaying product launches and increasing financial risks. Smaller players struggle to keep up with the capital requirements and global certifications, limiting competitive diversity. It must also navigate evolving environmental policies across regions, which often lack harmonization and create uncertainty in long-term planning. These financial and regulatory burdens slow down innovation and limit the pace of market expansion.

- For instance, the cost of certifying a new commercial aircraft engine under international standards can reach about 25,000,000 units, with total research and development expenses for a single new engine program often exceeding 1,000,000,000 units, posing a substantial barrier for all but the largest manufacturers

Supply Chain Instability and Material Constraints Disrupt Production Schedules

The Global Aircraft Engine Market is also impacted by global supply chain disruptions and limited availability of critical raw materials. The production of advanced engine components depends on specialized alloys and precision manufacturing tools, many of which face sourcing delays. It must deal with logistical bottlenecks and geopolitical tensions that affect supplier reliability. Skilled labor shortages further complicate engine assembly and maintenance operations. Delays in parts delivery and quality assurance issues lead to increased lead times for both OEMs and MRO providers. These factors hinder the industry’s ability to meet rising demand and affect customer satisfaction.

Market Opportunities

Escalating Development Costs and Stringent Certification Slow Market Agility

The Global Aircraft Engine Market encounters mounting pressure from rising R&D expenses and complex certification requirements. Developing next-generation engines demands large capital investments, often stretching timelines and straining budgets. It must align with strict environmental and performance regulations, which vary across regions and extend approval cycles. Smaller manufacturers struggle to sustain innovation under these constraints, reducing market competitiveness. Compliance with global aviation authorities such as EASA and FAA involves exhaustive testing, documentation, and audits. These challenges delay time-to-market for new engine models and limit the speed at which technological advancements reach operators.

Persistent Supply Chain Disruptions and Raw Material Scarcity Undermine Production

The Global Aircraft Engine Market continues to face operational risks due to unstable global supply chains and raw material shortages. High-performance engine manufacturing depends on rare metals and precision components, many of which are sourced from politically sensitive or disrupted regions. It often experiences delays in procurement and delivery, affecting production schedules and aircraft rollout timelines. Skilled labor shortages in machining, assembly, and inspection further reduce efficiency across the value chain. OEMs and MRO providers deal with inconsistent supplier performance and quality control challenges. These issues restrict the industry’s ability to meet growing global demand and maintain customer commitments.

Market Segmentation Analysi

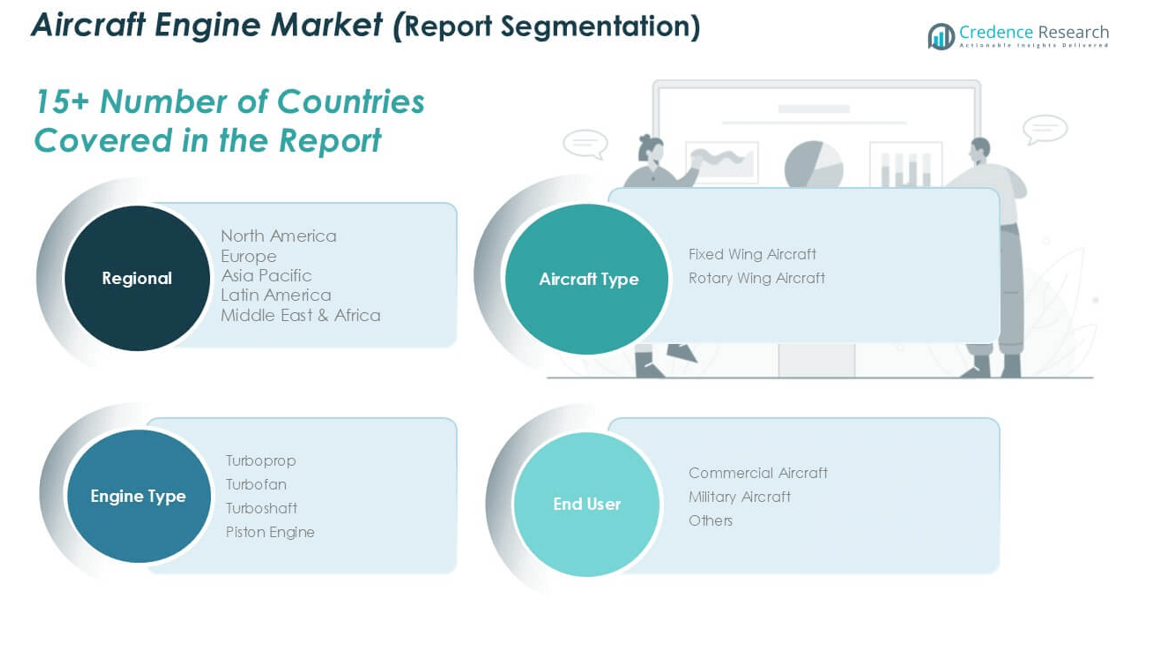

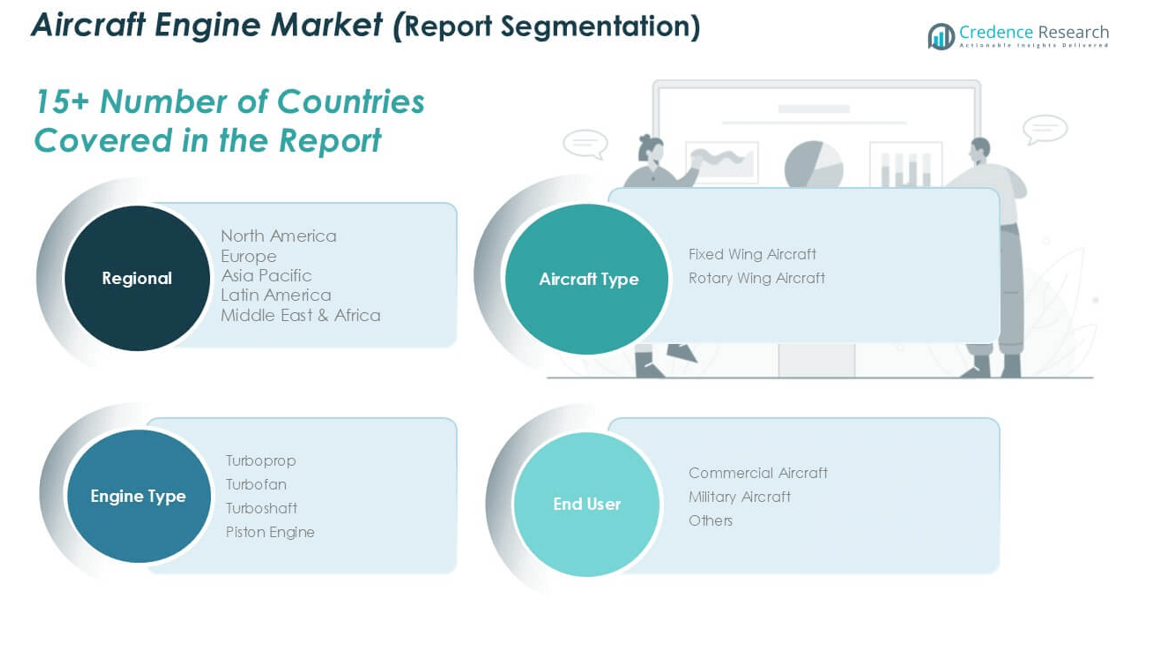

By Aircraft Type

The Global Aircraft Engine Market is segmented by aircraft type into fixed wing and rotary wing aircraft. Fixed wing aircraft dominate the market due to their widespread use in both commercial and military applications. It benefits from a high number of deliveries of commercial airliners and business jets, supported by growing passenger demand and fleet renewals. Rotary wing aircraft, including helicopters, hold a smaller share but play a critical role in defense, emergency medical services, and civil operations. The rotary segment sees steady growth in military procurement and civil utility applications, driving demand for compact and efficient engines.

- For instance, according to the General Aviation Manufacturers Association, in 2023, there were 1,393 fixed wing aircraft and 862 rotary wing aircraft delivered globallyreflecting the continued dominance of fixed wing platforms in new engine installations.

By Engine Type

The market is categorized by engine type into turboprop, turbofan, turboshaft, and piston engines. Turbofan engines lead the segment due to their extensive use in commercial aviation for medium and long-haul aircraft. It supports high efficiency, reduced emissions, and quieter operations, aligning with airline requirements and environmental regulations. Turboprop engines remain essential for short-haul and regional flights, especially in developing regions with limited infrastructure. Turboshaft engines are primarily used in helicopters and military platforms. Piston engines cater to smaller general aviation aircraft and pilot training fleets, offering simplicity and cost-effectiveness for light-duty applications.

- For instance, industry data from 2023 show that more than 18,000 turbofan engines were in active service with commercial airlines worldwide, while approximately 6,500 turboprop, 4,200 turboshaft, and 23,000 piston engines were operational across various aviation segments.

By End User

The Global Aircraft Engine Market by end user includes commercial aircraft, military aircraft, and others. Commercial aircraft dominate engine demand, supported by growing airline networks, rising passenger traffic, and the shift toward fuel-efficient fleet upgrades. It accounts for the majority of engine orders and long-term service agreements. Military aircraft contribute significantly through defense modernization programs and increasing investments in advanced combat and transport aircraft. The “others” segment includes general aviation, cargo operators, and specialized mission aircraft, which require customized engine solutions for niche applications.

Segments

Based on Aircraft Type

- Fixed Wing Aircraft

- Rotary Wing Aircraft

Based on Engine Type

- Turboprop

- Turbofan

- Turboshaft

- Piston Engine

Based on End User

- Commercial Aircraft

- Military Aircraft

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Aircraft Engine Market

North America accounted for the largest share of the global Aircraft Engine Market in 2024, holding approximately 31.3% of the total market with a value of USD 32.74 billion, projected to reach USD 56.21 billion by 2032 at a CAGR of 7.0%. The region leads due to strong demand from commercial aviation, established aircraft OEMs, and significant defense spending. It benefits from major engine manufacturers such as GE Aviation and Pratt & Whitney, which support technological innovation and large-scale engine production. The U.S. Air Force and commercial carriers continue to upgrade fleets with fuel-efficient engines. It also maintains a robust aftermarket ecosystem, supporting long-term service contracts and MRO facilities.

Europe Aircraft Engine Market

Europe captured a 24.8% share of the Aircraft Engine Market in 2024, valued at USD 26.01 billion, and is expected to reach USD 46.84 billion by 2032, growing at a CAGR of 7.6%. The region is home to global aerospace leaders such as Rolls-Royce and Safran, which drive advancements in engine design and sustainability. Demand remains strong across both commercial and military aviation, supported by intra-regional travel, fleet modernization, and defense initiatives. European countries invest in cleaner propulsion technologies, including hybrid-electric and hydrogen-based engines. It also benefits from collaborative EU aerospace programs enhancing R\&D capabilities and regional competitiveness.

Asia Pacific Aircraft Engine Market

Asia Pacific held a 21.5% share in 2024, with a market value of USD 22.47 billion, projected to rise to USD 43.94 billion by 2032, at a CAGR of 8.7%, the fastest among all regions. Rapid urbanization, increasing disposable income, and expanding airline networks in China, India, and Southeast Asia fuel engine demand. It sees high growth in commercial aviation, with rising aircraft deliveries and fleet expansions. Regional governments support domestic aircraft manufacturing and engine production programs. China’s COMAC and India’s HAL are driving regional capability enhancements. The market supports robust OEM activity and long-term service agreements for airline operators.

Latin America Aircraft Engine Market

Latin America contributed 11.0% of the Aircraft Engine Market in 2024, with revenues of USD 11.56 billion, expected to grow to USD 20.20 billion by 2032, recording a CAGR of 7.2%. Fleet upgrades by regional airlines and increasing intra-regional air connectivity support market expansion. Brazil and Mexico represent key markets, driven by growing tourism and trade. It faces challenges such as economic instability and infrastructure limitations but continues to invest in aviation development. Demand for regional jets and narrow-body aircraft sustains engine procurement. OEMs are expanding their presence to cater to localized MRO and parts supply needs.

Middle East Aircraft Engine Market

The Middle East held a 8.4% share of the market in 2024, valued at USD 8.80 billion, and is forecasted to reach USD 15.93 billion by 2032, expanding at a CAGR of 7.7%. Strong investments by Gulf countries in expanding airline fleets and airport infrastructure drive demand. It focuses on high-thrust engines for wide-body aircraft, supporting long-haul routes. National carriers like Emirates and Qatar Airways play a critical role in sustaining procurement. The defense sector also contributes through acquisition of modern military aircraft. Engine manufacturers form strategic partnerships with local firms to support regional MRO capacity.

Africa Aircraft Engine Market

Africa held the smallest market share of 2.9% in 2024, with a value of USD 3.04 billion, expected to grow to USD 4.25 billion by 2032 at a CAGR of 4.2%. It faces challenges related to limited aviation infrastructure and low fleet density but shows signs of gradual development. Regional air traffic is rising, supported by initiatives to improve connectivity and affordability. Countries like South Africa, Kenya, and Ethiopia lead market activity in engine procurement and airline growth. It attracts support from global aviation bodies for technology transfer and training programs. The long-term outlook depends on investment in aviation capacity and economic stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- General Electric (GE) Aviation

- Rolls-Royce Holdings plc

- Pratt & Whitney (Raytheon Technologies Corporation)

- Safran Aircraft Engines

- Honeywell Aerospace

- MTU Aero Engines AG

- IHI Corporation

- Aero Engine Corporation of China (AECC)

- Klimov (United Engine Corporation)

- Engine Alliance (GE Aviation and Pratt & Whitney Joint Venture)

Competitive Analysis

The Global Aircraft Engine Market is highly consolidated, with a few major players dominating global supply and innovation. Companies such as GE Aviation, Rolls-Royce, Pratt & Whitney, and Safran Aircraft Engines lead the market with advanced engine portfolios and strong global distribution networks. It is shaped by long-term OEM agreements, high entry barriers, and intense focus on R\&D. Strategic partnerships and joint ventures enable technology sharing and cost management. Engine manufacturers compete on performance, fuel efficiency, emissions compliance, and aftermarket service capabilities. Emerging players focus on regional markets and niche applications, while leading firms expand their MRO networks to retain customer loyalty.

Recent Developments

- In July 2025, GE Aerospace (formerly General Electric Aviation) received US government approval to resume exports of its LEAP-1C and CF34 engines to China’s COMAC, facilitating the production of the C919 and C929 aircraft. This decision, following a period of suspended licenses, signals a potential easing of trade tensions between the US and China.

- In June 2025, Rolls-Royce announced an order from AviLease for 20 Trent XWB-97 engines, which will power ten Airbus A350F freighter aircraft. This order was part of a larger announcement of Rolls-Royce securing contracts for 142 aircraft engines in June 2025. The Trent XWB-97 is the highest-thrust variant in the Trent engine family and is designed to meet the demanding requirements of the air cargo sector.

Market Concentration and Characteristics

The Global Aircraft Engine Market exhibits high market concentration, dominated by a few major players with advanced technological capabilities and extensive global reach. It is capital-intensive, requiring significant investment in R&D, manufacturing, and regulatory compliance. The market favors long-term partnerships between engine manufacturers and aircraft OEMs, supported by complex supply chains and after-sales service agreements. Entry barriers remain high due to stringent certification processes, intellectual property requirements, and established customer loyalty. It is characterized by a strong focus on innovation, fuel efficiency, and emissions reduction, with growing interest in hybrid-electric and sustainable propulsion systems. Competitive advantage depends on performance, reliability, and lifecycle support offerings.

Report Coverage

The research report offers an in-depth analysis based on Aircraft Type, Engine Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market owth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to see strong demand for engines with improved fuel efficiency, driven by airline efforts to reduce operational costs and meet sustainability targets.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will drive future aircraft engine sales due to rapid fleet expansion and increasing passenger traffic.

- Engine manufacturers are investing heavily in hybrid-electric and fully electric propulsion systems to support the industry’s transition toward carbon-neutral aviation.

- The aftermarket segment, particularly maintenance, repair, and overhaul (MRO), will see steady growth as operators focus on extending aircraft service life and minimizing downtime.

- Governments will invest in advanced fighter jets and surveillance aircraft, driving the demand for high-performance military engines with enhanced thrust and stealth capabilities.

- Real-time data analytics, predictive maintenance, and AI-based diagnostics will become standard, improving reliability, safety, and operational efficiency across global fleets.

- Future engines will incorporate composite materials and advanced alloys to reduce weight, enhance durability, and improve overall fuel economy.

- Partnerships will grow between global engine manufacturers and regional players to expand local production, support MRO networks, and meet offset obligations.

- Tightening emission and noise regulations will push engine makers to develop cleaner combustion technologies and adopt sustainable aviation fuel (SAF) compatibility.

- Leading players will boost R\&D spending to stay ahead in the development of next-generation propulsion systems and secure long-term contracts with aircraft OEMs.