Market Overview:

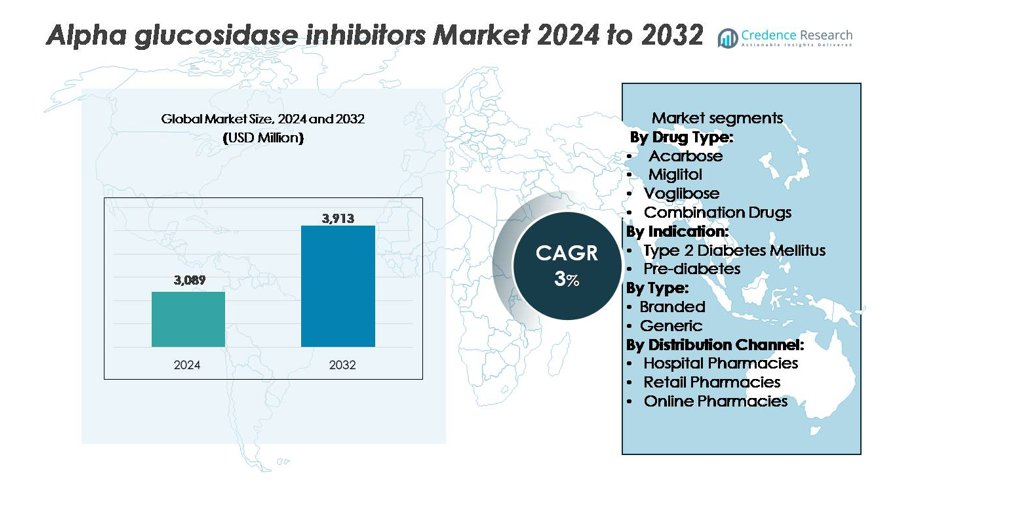

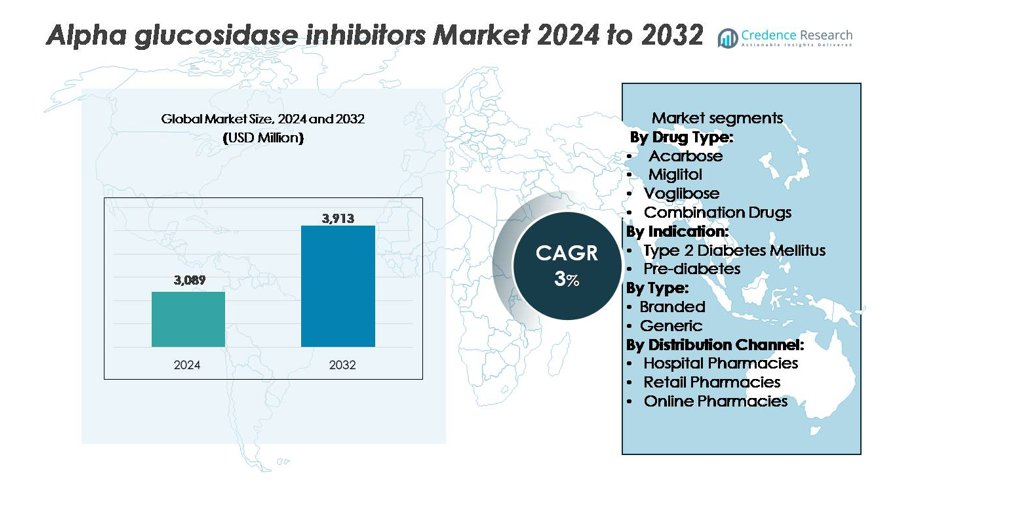

The global Alpha Glucosidase Inhibitors Market was valued at USD 3,089 million in 2024 and is projected to reach USD 3,913 million by 2032, expanding at a CAGR of 3% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpha Glucosidase Inhibitors Market Size 2024 |

USD 3,089 million |

| Alpha Glucosidase Inhibitors Market, CAGR |

3% |

| Alpha Glucosidase Inhibitors Market Size 2032 |

USD 3,913 million |

The Alpha Glucosidase Inhibitors Market is led by major players including Bayer AG, Takeda Pharmaceutical Company Limited, Pfizer Inc., Merck KGaA, Glenmark Pharmaceuticals, Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd. These companies maintain a strong presence through extensive product portfolios, advanced R&D capabilities, and strategic distribution networks across global markets. Bayer AG remains a frontrunner with its well-established Acarbose formulations, while Takeda and Merck KGaA leverage strong regional dominance in Asia-Pacific and Europe. North America leads the global market with a 37% share, followed by Europe with 30%, supported by high adoption rates, strong healthcare infrastructure, and growing emphasis on diabetes management programs.

Market Insights

- The Alpha Glucosidase Inhibitors Market was valued at USD 3,089 million in 2024 and is projected to reach USD 3,913 million by 2032, expanding at a CAGR of 3% during 2025–2032.

- Market growth is driven by the rising global diabetes prevalence, expanding geriatric population, and growing adoption of oral anti-diabetic therapies for type 2 diabetes management.

- Increasing focus on combination drug formulations and technological advancements in oral drug delivery are key market trends enhancing therapeutic effectiveness and patient compliance.

- Competition remains moderate, with Bayer AG, Takeda, Pfizer, and Merck KGaA leading through innovation, while generics by Sun Pharma and Teva expand affordability across emerging economies.

- Regionally, North America holds 37% share, followed by Europe at 30% and Asia-Pacific at 25%; by drug type, Acarbose leads with 42%, while Type 2 Diabetes Mellitus remains the dominant indication with 77% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Type

Acarbose leads the Alpha Glucosidase Inhibitors Market with a 42% share due to its proven effectiveness in controlling postprandial glucose levels. It remains widely prescribed as a first-line adjunct therapy for type 2 diabetes, driven by its strong clinical profile and cost efficiency. Miglitol and Voglibose also hold steady market positions, particularly in regions emphasizing mild glycemic control. Combination drugs are gaining importance for offering enhanced therapeutic outcomes through synergistic effects, improving patient adherence, and reducing side effects associated with monotherapy.

- For instance, Kissei Pharmaceutical’s GLUBES OD tablets, a fixed-dose combination of Mitiglinide calcium hydrate and Voglibose, showed a reduction of 37 mg/dL in 2-hour post-meal glucose levels in diabetic patients compared to monotherapy results.

By Indication

Type 2 diabetes mellitus dominates the market, accounting for 77% of total revenue. The segment’s strength stems from the rising global prevalence of diabetes, especially in aging populations and individuals with obesity. Alpha glucosidase inhibitors are favored for their mechanism of delaying carbohydrate absorption and improving glycemic control. The pre-diabetes segment is also growing rapidly, driven by increased early diagnosis initiatives and lifestyle-related risk awareness. Preventive treatment adoption continues to expand, especially in Asia-Pacific and North America, supporting future market growth.

- For instance, Sanofi SA partners with organizations like the International Diabetes Federation (IDF) and the Public Health Foundation of India (PHFI) on the Kids & Diabetes in Schools (KiDS) program, an education initiative to raise awareness and support for children with Type 1 diabetes and promote healthy lifestyles to prevent Type 2 diabetes. The structured KiDS program has been introduced into classrooms in over 2,100 schools across 45 countries, engaging more than 340,000 children and around 19,800 teachers.

By Type

Branded drugs hold a commanding 61% market share, supported by physician trust, product consistency, and extensive clinical validation. Leading pharmaceutical companies focus on brand differentiation through enhanced formulations and patient-friendly dosage forms. The generic segment, however, is expanding at a faster pace due to patent expirations and affordability advantages in emerging economies. Increasing government support for generic drug use and expanding local manufacturing capacities are fueling this growth, making generics a critical driver for broader healthcare access worldwide.Top of Form

Key Growth Drivers

Rising Global Diabetes Prevalence

The increasing prevalence of diabetes is a primary factor driving the Alpha Glucosidase Inhibitors Market. Lifestyle changes, sedentary behavior, and poor dietary habits are contributing to a sharp rise in type 2 diabetes cases globally. According to the International Diabetes Federation, more than 530 million adults are currently affected by diabetes worldwide, and this number continues to grow each year. Alpha glucosidase inhibitors play a vital role in managing postprandial hyperglycemia, making them a preferred therapy option among healthcare professionals. The rising focus on early diagnosis and preventive care further supports drug adoption, particularly in emerging economies with increasing healthcare access.

- For instance, a multicenter, double-blind, placebo-controlled trial over 16 weeks demonstrated a mean reduction of approximately 41 mg/dL (2.26 mmol/L) in postprandial plasma glucose for the acarbose 100 mg group. A separate multi-national observational study (GlucoVIP), which included data from 1,996 Indian patients, found a larger mean reduction of 74.4 mg/dL in 2-hour postprandial plasma glucose after an average of 12.4 weeks of treatment under real-life conditions.

Growing Adoption of Oral Anti-Diabetic Therapies

Oral anti-diabetic drugs, including alpha glucosidase inhibitors, are witnessing strong demand due to their convenience, cost-effectiveness, and non-invasive nature. Patients prefer oral medications over injectable options such as insulin because of easier administration and improved compliance. Pharmaceutical companies are expanding product portfolios by introducing improved formulations with fewer side effects and enhanced tolerability. The use of these inhibitors as adjunct therapies alongside other oral drugs enhances glucose control and reduces long-term complications. In addition, healthcare providers increasingly recommend combination therapy strategies, which has boosted the usage of alpha glucosidase inhibitors across different patient groups and treatment stages.

Expanding Geriatric Population and Preventive Healthcare Focus

The growing elderly population, which is more susceptible to diabetes and metabolic disorders, is fueling market expansion. Aging affects insulin sensitivity and glucose metabolism, making alpha glucosidase inhibitors an essential part of diabetic management for older adults. Moreover, the shift toward preventive healthcare is increasing screening rates for pre-diabetes and early-stage glucose intolerance. Governments and healthcare organizations are running public awareness campaigns to encourage proactive treatment, which drives prescription rates for these inhibitors. This trend, combined with enhanced healthcare infrastructure and improved drug availability, continues to support the market’s long-term growth potential.

Key Trends & Opportunities

Development of Combination Therapies

The trend toward combination therapy is reshaping the Alpha Glucosidase Inhibitors Market. Combining these inhibitors with other oral anti-diabetic drugs such as metformin or DPP-4 inhibitors enhances treatment effectiveness and improves glycemic control. Pharmaceutical companies are actively developing fixed-dose combinations to simplify dosage and increase adherence. These formulations offer synergistic benefits, such as reduced gastrointestinal side effects and sustained glucose regulation. The growing preference for personalized and patient-centric therapies further boosts the potential of combination drugs, creating lucrative opportunities for innovation and clinical advancements in the coming years.

- For instance, Kissei Pharmaceutical Co., Ltd. introduced GLUBES Combination OD tablets (Mitiglinide calcium hydrate/Voglibose), which have demonstrated significant reductions in both postprandial glucose levels and HbA1c values in various Japanese clinical trials. Multiple studies have confirmed the drug’s efficacy and its ability to provide better glucose control than monotherapy (mitiglinide or voglibose alone).

Rising Penetration in Emerging Economies

Emerging economies are becoming major growth hubs for the Alpha Glucosidase Inhibitors Market due to expanding healthcare access, rising disposable incomes, and growing awareness of diabetes management. Governments across Asia-Pacific, Latin America, and the Middle East are strengthening healthcare infrastructure and promoting affordable medication access. Pharmaceutical firms are leveraging this opportunity by introducing region-specific formulations and low-cost generics. Increasing adoption of digital health tools and telemedicine platforms in these regions further supports patient monitoring and prescription compliance, enhancing long-term treatment outcomes and driving sustained market growth.

- For instance, Sun Pharmaceutical Industries Ltd. offers a voglibose formulation in India and Southeast Asia for managing Type 2 diabetes. Clinical studies have shown that voglibose, an alpha-glucosidase inhibitor, is effective at reducing postprandial (after-meal) glucose excursions and HbA1c levels, both as monotherapy and in combination with other anti-diabetic drugs like metformin.

Technological Advancements in Drug Formulation

Advancements in pharmaceutical technology are improving drug stability, bioavailability, and patient tolerability. Innovations such as controlled-release formulations and microencapsulation are reducing side effects commonly associated with alpha glucosidase inhibitors. These technologies enhance drug absorption and maintain consistent therapeutic levels over longer durations. Additionally, companies are focusing on optimizing tablet coatings and delivery systems to improve gastrointestinal tolerance. Such formulation innovations not only strengthen product competitiveness but also encourage broader acceptance among healthcare professionals and patients.

Key Challenges

Gastrointestinal Side Effects and Limited Tolerability

One of the major challenges hindering market expansion is the occurrence of gastrointestinal side effects such as bloating, flatulence, and diarrhea, commonly linked to alpha glucosidase inhibitor therapy. These adverse effects often lead to poor patient adherence and therapy discontinuation. Despite efforts to develop improved formulations, tolerability issues persist among sensitive patient populations. Physicians sometimes prefer alternative oral anti-diabetic drugs with better side-effect profiles, reducing the overall adoption of alpha glucosidase inhibitors. Continuous R&D efforts are being directed toward minimizing these effects through dose optimization and combination therapy approaches.

Strong Competition from New Drug Classes

The growing popularity of newer anti-diabetic drug classes, such as SGLT2 inhibitors and GLP-1 receptor agonists, poses a significant challenge to the Alpha Glucosidase Inhibitors Market. These advanced therapies offer additional benefits like weight reduction, cardiovascular protection, and improved glycemic control, which attract both patients and clinicians. The rapid uptake of these novel drug classes has reduced the growth potential for traditional therapies in developed markets. To remain competitive, manufacturers of alpha glucosidase inhibitors must focus on innovation, expanding applications, and strategic collaborations to maintain their presence in a rapidly evolving therapeutic landscape.

Regional Analysis

North America

North America leads the Alpha Glucosidase Inhibitors Market with a 37% share, driven by a high diabetes prevalence and advanced healthcare infrastructure. The United States dominates the region due to strong R&D investment, widespread clinical adoption, and high awareness of oral anti-diabetic therapies. Pharmaceutical giants actively develop improved formulations with enhanced tolerability, boosting patient adherence. Supportive reimbursement policies and growing preventive healthcare initiatives further strengthen regional growth. Canada also contributes significantly, supported by government-led diabetes prevention programs and expanding access to branded and generic formulations across hospital and retail pharmacy networks.

Europe

Europe holds a 30% share in the Alpha Glucosidase Inhibitors Market, supported by strong demand across major economies such as Germany, the UK, France, and Italy. The region benefits from well-established healthcare systems and rising prescription rates for oral anti-diabetic drugs. Increasing elderly population and government-backed diabetes awareness campaigns enhance drug adoption. Germany leads the regional market with robust pharmaceutical manufacturing and distribution infrastructure. Meanwhile, Eastern European nations are witnessing higher adoption of generic formulations due to affordability and expanding healthcare coverage. Regulatory harmonization across the EU also facilitates consistent market access.

Asia-Pacific

Asia-Pacific captures a 25% share and represents the fastest-growing region in the Alpha Glucosidase Inhibitors Market. The rising incidence of diabetes, coupled with lifestyle changes and dietary habits, drives demand across China, Japan, and India. Japan remains a key contributor due to the high use of Voglibose and favorable reimbursement frameworks. India’s expanding healthcare infrastructure and availability of cost-effective generics are fueling rapid market growth. Increasing healthcare expenditure, growing awareness of early-stage diabetes management, and strong government initiatives toward chronic disease control further position Asia-Pacific as a major future revenue contributor.

Latin America accounts for an 5% share of the Alpha Glucosidase Inhibitors Market, supported by growing diabetes prevalence and improving healthcare accessibility. Brazil and Mexico lead the regional market, driven by increasing patient awareness and expanding retail pharmacy networks. Public health initiatives promoting diabetes screening and treatment adherence are boosting prescription rates. Multinational pharmaceutical companies are introducing affordable branded and generic formulations tailored to regional affordability needs. Despite moderate growth, challenges such as uneven healthcare coverage and price sensitivity influence overall adoption, making local partnerships essential for deeper market penetration.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, with gradual expansion supported by increasing diabetes awareness and improving healthcare infrastructure. Countries such as Saudi Arabia, South Africa, and the UAE are leading due to higher healthcare investments and growing prevalence of type 2 diabetes. Hospital pharmacies remain the primary distribution channel, supported by physician-prescribed treatments and brand availability. Rising collaborations between global and local pharmaceutical companies are expanding access to oral anti-diabetic medications. However, limited healthcare budgets and low diagnosis rates still pose challenges to wider regional adoption.

Market Segmentation

By Drug Type:

- Acarbose

- Miglitol

- Voglibose

- Combination Drugs

By Indication:

- Type 2 Diabetes Mellitus

- Pre-diabetes

By Type:

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Alpha Glucosidase Inhibitors Market is moderately consolidated, with leading pharmaceutical companies focusing on innovation, strategic partnerships, and regional expansion to strengthen their market presence. Key players such as Bayer AG, Takeda Pharmaceutical Company Limited, Pfizer Inc., Merck KGaA, and Glenmark Pharmaceuticals dominate the global landscape through robust product portfolios and extensive distribution networks. These firms emphasize R&D investments to develop improved formulations with enhanced gastrointestinal tolerability and better efficacy. Generic manufacturers, including Sun Pharmaceutical Industries Ltd. and Teva Pharmaceutical Industries, are expanding access in price-sensitive markets through affordable alternatives. Strategic collaborations and licensing agreements help global companies penetrate emerging economies, particularly in Asia-Pacific and Latin America. Continuous regulatory approvals, product differentiation, and the rise of combination drug therapies are shaping competitive dynamics. Overall, innovation-driven competition and expanding therapeutic applications are defining the growth strategies of both established and emerging players in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novartis AG

- Reddy’s Laboratories Ltd.

- Sanofi SA

- Bayer AG

- Emcure Pharmaceuticals Ltd.

- Merck & Co.

- Sun Pharmaceutical Industries Ltd.

- Lupin Ltd.

- Alkem Laboratories Ltd.

- Cipla Limited

Recent Developments

- In September 2023, Amicus Therapeutics received FDA approval for Pombiliti (cipaglucosidase alfa-atga) plus Opfolda 65mg (miglustat) capsules. This dual-component therapy is designed for adults with Pompe disease (LOPD) weighing greater than or equal to 40 kg who show no improvement with their latest enzyme replacement therapy (ERT). The late-onset Pompe disease, a rare and life-risking lysosomal disorder, results from the deficit of the alpha-glucosidase enzyme acid.

- In June 2022, the European Commission approved the marketing of an enzyme replacement therapy (ERT), Nexviadyme (avalglucosidase alfa), intended for the extended treatment of both infantile-onset and late-onset Pompe disease. This rare and progressive muscle disorder now has an approved medicine in Europe, marking the first such approval since 2006

Report Coverage

The research report offers an in-depth analysis based on Drug type, Indication, Type, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, driven by the global rise in diabetes cases.

- Increased demand for oral anti-diabetic therapies will support consistent product adoption.

- Combination drug formulations will gain higher acceptance due to improved efficacy and patient compliance.

- Generic drug manufacturers will expand market access in cost-sensitive regions.

- Technological advancements will enhance drug stability and reduce gastrointestinal side effects.

- Pharmaceutical companies will focus on developing region-specific formulations to meet local healthcare needs.

- Asia-Pacific will emerge as the fastest-growing region due to expanding healthcare infrastructure.

- Partnerships and collaborations will strengthen global distribution and product innovation.

- Preventive healthcare initiatives will drive early diagnosis and treatment of pre-diabetes.

- Continuous regulatory approvals and product diversification will sustain long-term market competitiveness.