Market Overview

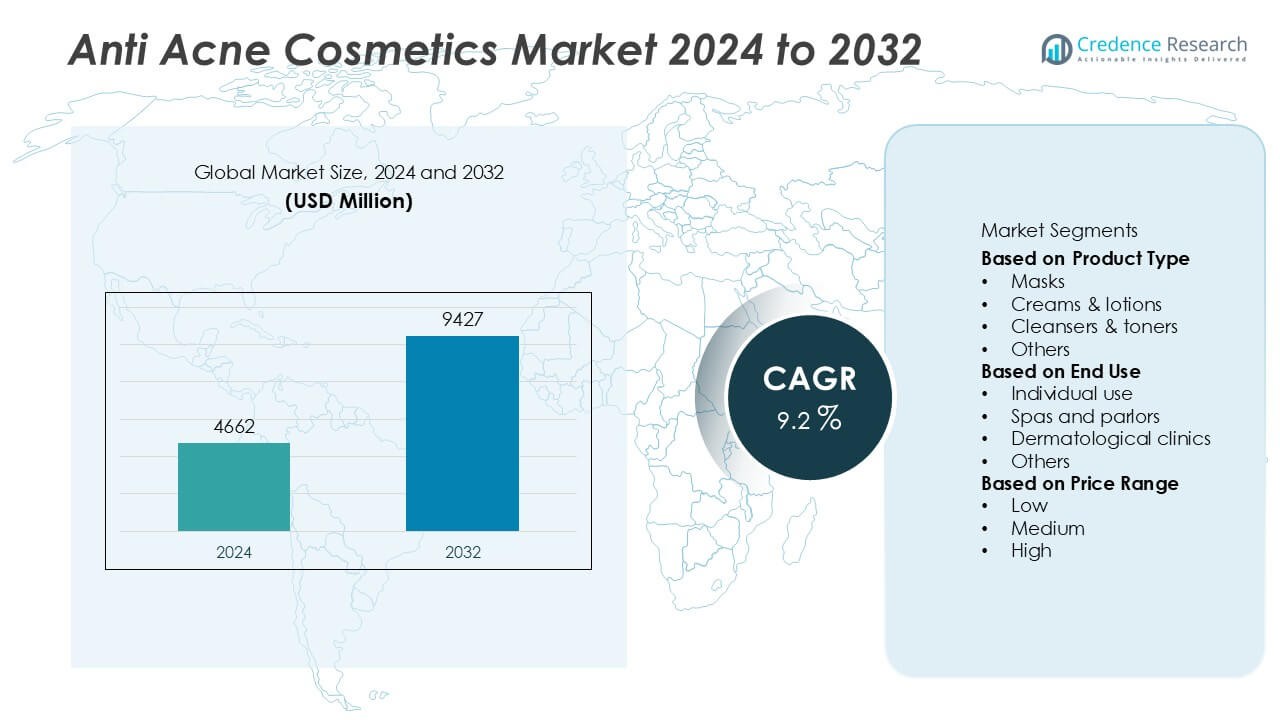

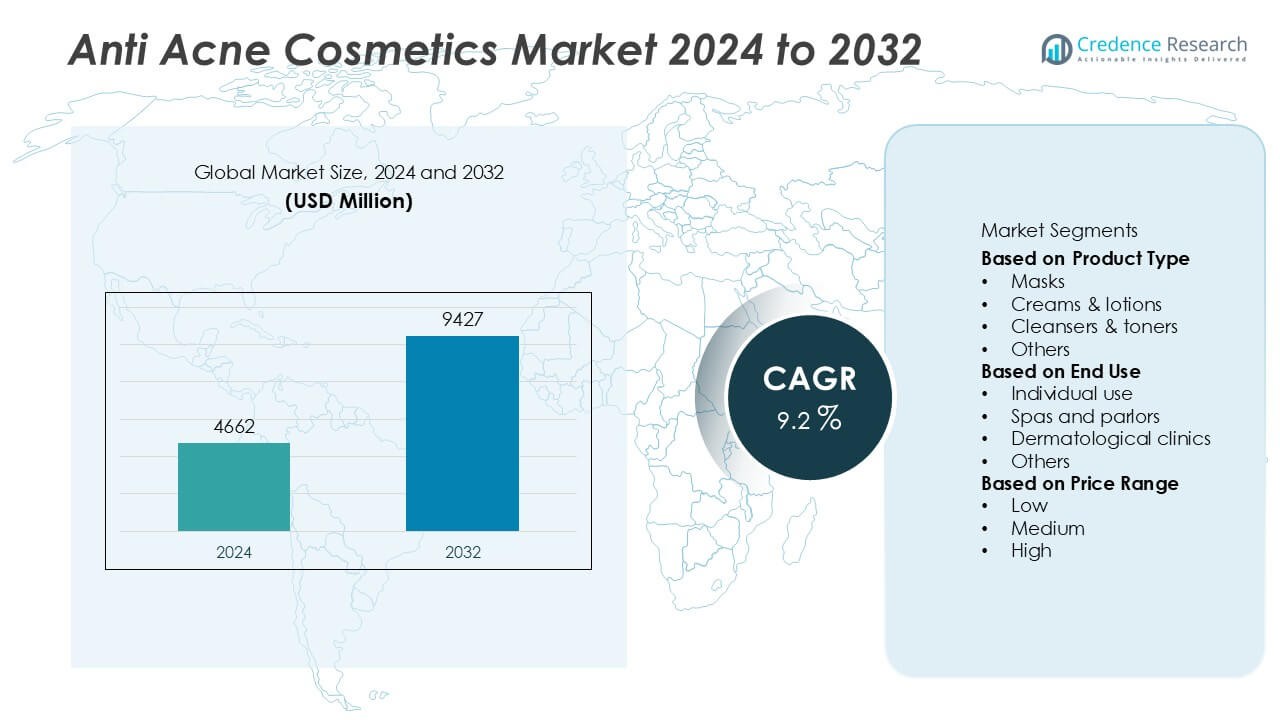

The global Anti-Acne Cosmetics Market was valued at USD 4,662 million in 2024 and is projected to reach USD 9,427 million by 2032, growing at a compound annual growth rate CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Acne Cosmetics Market Size 2024 |

USD 4,662 Million |

| Anti-Acne Cosmetics Market, CAGR |

9.2% |

| Anti-Acne Cosmetics Market Size 2032 |

USD 9,427 Million |

The anti-acne cosmetics market is dominated by major players such as L’Oréal, Johnson & Johnson, Beiersdorf AG, Amorepacific Corporation, Honasa Consumer Ltd., Kao Corporation, Mario Badescu Skin Care, Cetaphil, Natura &Co, and Blackbird Skincare. These companies lead the market through continuous innovation, dermatologically tested formulations, and strong brand equity across global skincare segments. North America remains the leading region, accounting for 32.4% of the total market share in 2024, supported by high consumer awareness, strong retail networks, and demand for premium skincare. Europe and Asia-Pacific follow closely, driven by sustainability-focused innovation and rising consumer spending on advanced anti-acne solutions.

Market Insights

- The global Anti-Acne Cosmetics market was valued at USD 4,662 million in 2024 and is projected to reach USD 9,427 million by 2032, growing at a CAGR of 9.2% during the forecast period.

- Market growth is driven by the rising prevalence of acne among teenagers and adults, increasing awareness of skincare, and the availability of dermatologist-recommended formulations for daily use.

- Key trends include the surge in demand for natural and organic products, innovations in ingredient technology, and the expansion of online and direct-to-consumer sales channels.

- The market is highly competitive with leading players such as L’Oréal, Johnson & Johnson, Beiersdorf AG, and Amorepacific Corporation focusing on product innovation and strategic partnerships; however, intense price competition and product sensitivity challenges limit growth.

- Regionally, North America holds 32.4% share, followed by Europe (27.6%) and Asia-Pacific (24.9%); by product type, creams and lotions dominate with 42.1% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The creams and lotions segment dominated the anti-acne cosmetics market in 2024, accounting for approximately 42.1% of total market share. This dominance is driven by their ease of application, multifunctional benefits, and inclusion of potent active ingredients such as salicylic acid, retinoids, and niacinamide that help treat and prevent acne effectively. Consumers prefer these products for their moisturizing properties and suitability for daily skincare routines. Masks and cleansers & toners are also gaining traction as supplementary treatments, while innovative product forms such as serums and patches in the “others” category are expanding rapidly due to targeted efficacy and new delivery technologies.

- For instance, L’Oréal’s La Roche-Posay Effaclar Duo uses 5.5% micronized benzoyl peroxide. The formula pairs with lipo-hydroxy acid for micro-exfoliation. Visible results are claimed in under 3 days. The treatment targets pimples, blackheads, and whiteheads.

By End Use

The individual-use segment led the market with an estimated 56.3% share in 2024, reflecting growing consumer awareness of skincare and the convenience of self-administered acne treatments. Increasing availability of over-the-counter anti-acne products and personalized skincare solutions has strengthened this segment. The rise of e-commerce platforms and social media-driven beauty trends has further encouraged consumers to adopt self-care routines. Spas and parlors, along with dermatological clinics, collectively hold a smaller share but continue to attract consumers seeking specialized or advanced acne treatment services.

- For instance, HydraFacial’s clarifying protocol applies 7.5% glycolic acid with 2% salicylic acid. Peer-reviewed evaluations document the same percentages during clinical treatments. Systems run on cart-based consoles in dermatology clinics. The peel step precedes extraction and targeted serum infusion.

By Price Range

The medium-price range segment held the largest share of around 48.1% in 2024, supported by strong consumer demand for affordable yet high-quality acne treatment products. This segment appeals to middle-income consumers seeking effective formulations without premium pricing. Brands operating in this category emphasize clinically tested ingredients and dermatologist-recommended claims to build trust. The high-price range segment is expanding steadily, fueled by luxury skincare innovations and organic formulations, while the low-price segment remains prominent in emerging markets where cost-sensitive consumers prefer basic, mass-market anti-acne solutions.

Key Growth Drivers

Rising Prevalence of Acne and Skin Concerns

The growing incidence of acne among teenagers and adults worldwide remains a primary driver of the anti-acne cosmetics market. Increased exposure to pollution, hormonal fluctuations, and lifestyle stress has amplified acne-related issues across demographics. Consumers are actively seeking targeted skincare solutions that provide both prevention and treatment benefits. The growing awareness of skin health and the accessibility of dermatological information through digital platforms have further encouraged early adoption of anti-acne products, thereby fueling steady market growth globally.

- For instance, Galderma’s Differin Gel 0.1% adapalene cut total lesion counts by 49% at week 12 versus 37% with tretinoin 0.025% in a randomized trial. Non-inflammatory lesions fell 46% and inflammatory lesions 48% with adapalene. The study enrolled several hundred patients and confirmed faster onset with lower irritation.

Expanding Skincare Awareness and Personal Grooming Trends

Increasing emphasis on personal appearance and self-care, particularly among younger consumers, is significantly boosting demand for anti-acne cosmetics. Social media influence, beauty blogs, and celebrity endorsements have reshaped beauty routines and driven awareness of skin-friendly products. Additionally, the rise of gender-neutral skincare has expanded the consumer base, encouraging both men and women to invest in acne management products. This cultural shift toward daily skincare maintenance continues to strengthen product penetration across diverse age groups and income segments.

- For instance, Neutrogena Rapid Clear Stubborn Acne Spot Gel uses 10% benzoyl peroxide and reduces size and redness in 2 hours. CeraVe Acne Foaming Cream Wash pairs 4% benzoyl peroxide with ceramides for barrier support. Paula’s Choice Skin Perfecting Liquid delivers 2% salicylic acid for pore decongestion.

Innovation in Product Formulation and Ingredient Technology

Continuous innovation in product formulation is another major growth catalyst. Manufacturers are developing advanced formulations using bioactive ingredients, probiotics, and plant-based extracts that address acne without causing irritation. The integration of dermatologically tested and clinically proven components enhances product credibility and efficacy. Moreover, innovations in nanotechnology, encapsulation, and sustainable packaging are enabling brands to differentiate themselves in a competitive market. These advancements not only improve performance but also align with consumer demand for clean, safe, and environmentally conscious skincare solutions.

Key Trends & Opportunities

Surge in Demand for Natural and Organic Formulations

Consumers are increasingly shifting toward natural and organic anti-acne products, driven by concerns over synthetic chemicals and long-term skin safety. Brands are responding with formulations free from parabens, sulfates, and artificial fragrances, instead incorporating botanical extracts and essential oils. This trend aligns with the global clean beauty movement and growing consumer trust in sustainable skincare. The preference for eco-friendly packaging and cruelty-free production further enhances the market appeal of these natural anti-acne cosmetics.

- For instance, Caudalie’s Vinopure serum lists 97% natural-origin ingredients. A clinical test reported 86% users saw fewer blemishes after 7 days. The formula uses wintergreen-derived salicylic acid and a bottle with 25% recycled glass.

Growth of E-commerce and Direct-to-Consumer Channels

The rapid expansion of e-commerce platforms and direct-to-consumer (D2C) brands presents a major opportunity for market growth. Online retail enables consumers to access a broad range of anti-acne products, compare formulations, and read reviews before purchase. Brands are leveraging digital marketing, influencer collaborations, and subscription models to strengthen consumer engagement and retention. This online shift is particularly pronounced among millennials and Gen Z consumers, who prefer convenience, personalization, and transparency in their skincare purchases.

- For instance, Honasa’s The Derma Co sold over 10,000,000 units in the last financial year. The parent plans to expand direct retail reach from 100,000 to 150,000 stores. The scale shows strong online-to-offline conversion for acne actives.

Key Challenges

High Product Sensitivity and Risk of Side Effects

Despite technological advancements, certain anti-acne cosmetics may cause skin irritation, dryness, or allergic reactions, particularly among individuals with sensitive skin. Negative consumer experiences can hinder brand reputation and slow adoption rates. Formulating effective yet gentle products that balance efficacy and safety remains a major challenge for manufacturers. Compliance with dermatological testing standards and transparent ingredient labeling are essential to mitigate these risks and maintain consumer trust in the long term.

Intense Market Competition and Price Pressure

The anti-acne cosmetics market is highly competitive, with numerous global and regional players offering similar products across multiple price tiers. This saturation exerts downward pressure on pricing and profit margins. Established brands face stiff competition from emerging clean beauty startups and online-only D2C labels that aggressively target niche consumer groups. To maintain competitiveness, companies must continually invest in innovation, marketing, and brand differentiation-factors that increase operational costs and impact overall profitability.

Regional Analysis

North America

North America dominated the global anti-acne cosmetics market in 2024, holding a 32.4% market share. The region’s strong performance is driven by high consumer awareness of skincare, the presence of major cosmetic brands, and a well-established retail infrastructure. Increasing cases of adult acne, coupled with the popularity of dermatologically tested and premium skincare products, continue to fuel demand. The United States remains the primary revenue contributor, supported by rising adoption of personalized skincare solutions and a growing preference for clean, vegan, and cruelty-free formulations among health-conscious consumers.

Europe

Europe accounted for a 27.6% share of the global anti-acne cosmetics market in 2024. Demand in this region is supported by rising skin health awareness, an aging population seeking effective acne treatments, and increasing acceptance of men’s grooming products. Countries such as Germany, France, and the United Kingdom are key contributors due to high spending on premium skincare and a strong preference for organic formulations. Regulatory support for clean-label ingredients and sustainable packaging also encourages innovation among European brands, driving consistent market expansion across both developed and emerging European economies.

Asia-Pacific

The Asia-Pacific region held a 24.9% share of the anti-acne cosmetics market in 2024 and is expected to register the fastest growth through 2032. The expansion is fueled by a large youth population, growing disposable incomes, and increasing influence of K-beauty and J-beauty trends. Rising pollution levels and climate-related skin issues are further propelling the use of anti-acne skincare products. Countries such as China, Japan, South Korea, and India are key markets where consumers are embracing dermatologically advanced and affordable solutions. Local and international brands are intensifying competition through digital marketing and product innovation.

Latin America

Latin America represented a 9.1% market share in 2024, driven by growing skincare awareness and expanding retail channels. Brazil and Mexico are leading markets, supported by a young demographic and rising adoption of beauty routines inspired by global trends. Consumers in this region are increasingly favoring acne treatments with natural and herbal ingredients due to sensitivity concerns and climatic factors. The penetration of international brands, alongside the rise of domestic cosmetic manufacturers, is enhancing product availability. Continued urbanization and the influence of social media are expected to sustain moderate growth through 2032.

Middle East & Africa

The Middle East & Africa region captured a 6.0% share of the global anti-acne cosmetics market in 2024. Market growth is supported by rising disposable income, improving skincare awareness, and increased access to premium cosmetic products through digital and retail channels. The United Arab Emirates and South Africa are among the leading markets, driven by strong consumer interest in advanced dermatological and cosmetic treatments. However, the region still faces limited product penetration in rural areas. As awareness of acne-related skin issues grows, international brands are expanding their presence, supported by online retail platforms and targeted marketing.

Market Segmentations:

By Product Type

- Masks

- Creams & lotions

- Cleansers & toners

- Others

By End Use

- Individual use

- Spas and parlors

- Dermatological clinics

- Others

By Price Range

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global anti-acne cosmetics market is characterized by the presence of key players such as Mario Badescu Skin Care, Kao Corporation, Johnson & Johnson, Honasa Consumer Ltd., L’Oréal, Beiersdorf AG, Amorepacific Corporation, Blackbird Skincare, Natura &Co, and Cetaphil. These companies compete through product innovation, brand differentiation, and strategic marketing to strengthen their market positions. Leading brands focus on expanding their product portfolios with dermatologist-tested, clean-label, and vegan formulations to meet evolving consumer preferences. Collaborations with dermatologists, celebrity endorsements, and digital marketing strategies are increasingly used to boost brand visibility and consumer engagement. Furthermore, mergers, acquisitions, and investments in research and development are helping companies enhance product efficacy and sustainability. The growing importance of e-commerce and personalized skincare solutions is also reshaping competition, with both established and emerging brands adopting omnichannel distribution strategies to capture a broader and more tech-savvy consumer base.

Key Player Analysis

- Mario Badescu Skin Care

- Kao Corporation

- Johnson & Johnson

- Honasa Consumer Ltd.

- L’Oréal

- Beiersdorf AG

- Amorepacific Corporation

- Blackbird Skincare

- Natura &Co

- Cetaphil

Recent Developments

- In October 2024, Johnson & Johnson consumer spinoff Kenvue’s Neutrogena announced an innovation-focused collaboration with leading dermatologists to accelerate acne product development.

- In September 2024, Tikitoro, a trusted brand in holistic skincare and parent education, launched two new products: the Tikitoro Anti-Acne Spot Corrector and Tikitoro Anti-Dandruff Scalp Serum.

- In April 2024, SkinMedica, a brand by Allergan Aesthetics (an AbbVie company), introduced two new acne-focused products: the Acne Clarifying Treatment and Pore Purifying Gel Cleanser.

- In February 2024, Kao Corporation launched the Bioré Zero series in Asia, expanding sweat- and humidity-control care that supports oily, breakout-prone skin in hot climates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End Use, Price Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The anti-acne cosmetics market will continue to expand steadily through 2032, supported by rising consumer focus on skincare health and appearance.

- Increasing adoption of personalized skincare products will drive innovation and brand differentiation.

- Natural, organic, and clean-label formulations will gain higher consumer preference across all price segments.

- Technological advancements such as AI-driven diagnostics and ingredient innovation will enhance product efficacy.

- E-commerce and direct-to-consumer sales channels will dominate distribution, improving global accessibility.

- The medium-price range category will maintain leadership due to strong demand for quality and affordability.

- Asia-Pacific will emerge as the fastest-growing regional market, driven by youth demographics and beauty trends.

- Collaborations between cosmetic brands and dermatologists will strengthen credibility and consumer trust.

- Competition will intensify as new entrants and niche brands focus on sustainable and cruelty-free solutions.

- Continuous R&D investment and digital marketing strategies will shape the future of brand growth and market expansion.