Market Overview:

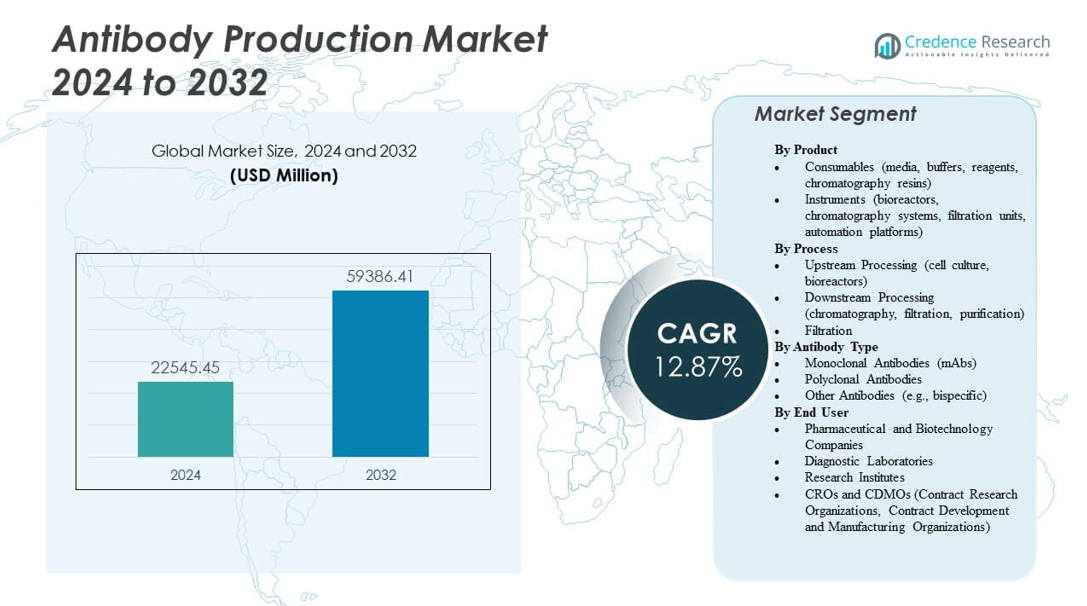

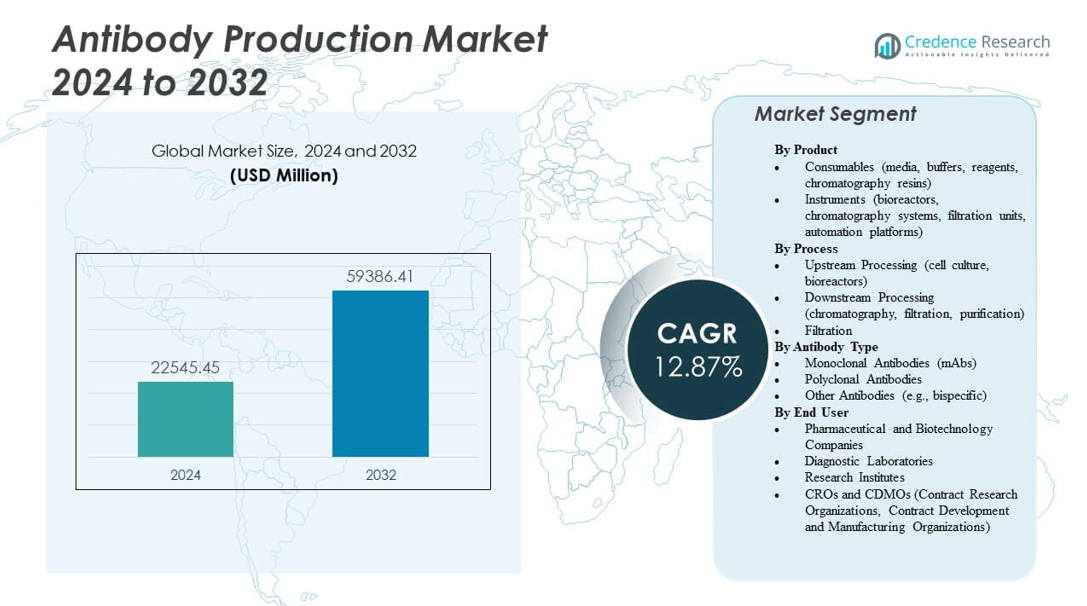

The Antibody Production Market is projected to grow from USD 22,545.45 million in 2024 to an estimated USD 59,386.41 million by 2032, with a compound annual growth rate (CAGR) of 12.87% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antibody Production Market Size 2024 |

USD 22,545.45 million |

| Antibody Production Market, CAGR |

12.87% |

| Antibody Production Market Size 2032 |

USD 59,386.41 million |

Market growth is driven by increasing demand for therapeutic antibodies and expanding biologics research across pharmaceutical and biotechnology sectors. Rising prevalence of chronic diseases and advancements in monoclonal antibody technology fuel innovation. Companies invest in automated bioprocessing, improved expression systems, and single-use manufacturing platforms to enhance yield and reduce contamination risks. Growing R&D funding and favorable regulatory support further encourage new antibody development and commercialization worldwide.

North America leads the market due to advanced research infrastructure, strong biotech presence, and robust healthcare spending. Europe follows with established biomanufacturing clusters and regulatory support for biologics production. Asia-Pacific is emerging rapidly, driven by investments in local biopharma manufacturing, government incentives, and rising clinical research activities in countries such as China, India, and South Korea.

Market Insights:

- The Antibody Production Market is expected to grow from USD 22,545.45 million in 2024 to USD 59,386.41 million by 2032, at a CAGR of 12.87%.

- Rising demand for monoclonal antibodies and biologics drives large-scale production across pharmaceutical industries.

- Increasing prevalence of chronic and autoimmune diseases accelerates research in therapeutic antibody development.

- Technological advancements in bioreactors, cell culture systems, and purification processes enhance manufacturing efficiency.

- High production costs and complex regulatory requirements remain major restraints for market participants.

- North America leads due to its strong biotech infrastructure and heavy investment in biopharmaceutical R&D.

- Asia-Pacific is emerging rapidly with growing biologics manufacturing facilities and supportive government initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Focus on Therapeutic Antibodies in Biopharmaceutical Research

The Antibody Production Market experiences significant growth due to the rising demand for monoclonal antibodies in treating chronic and infectious diseases. Biopharmaceutical firms prioritize targeted therapies to improve patient outcomes and minimize side effects. Continuous R&D investment in recombinant DNA technology and hybridoma techniques enhances production efficiency. The industry’s focus on developing humanized and fully human antibodies has boosted success rates in clinical trials. It benefits from advancements in expression systems such as CHO and HEK293 cells. Increasing healthcare awareness supports greater antibody adoption. The growing prevalence of cancer and autoimmune disorders accelerates demand. Government funding for biologics research continues to expand the global therapeutic pipeline.

Expansion of Bioprocessing Technologies Driving Production Efficiency

Advancements in bioprocessing technology drive large-scale antibody manufacturing. The Antibody Production Market benefits from the adoption of single-use systems that reduce contamination and downtime. Automation in upstream and downstream processes improves yield consistency and reproducibility. Bioreactors equipped with real-time monitoring ensure optimal cell culture conditions. Continuous processing methods enhance scalability and lower operational costs. Improved purification technologies such as Protein A chromatography increase recovery rates. The integration of analytics into manufacturing supports process validation. Biopharma companies increasingly invest in modular production facilities to boost flexibility. These innovations collectively strengthen the global production landscape.

- For instance, in June 2024, WuXi Biologics installed three 5,000-liter single-use bioreactors at its Hangzhou facility, increasing total drug substance manufacturing capacity from 8,000 liters to 23,000 liters and substantially enhancing operational flexibility for global clients.

Rising Demand for Personalized Medicine and Targeted Therapies

Growing adoption of personalized medicine supports the steady expansion of antibody-based therapeutics. The Antibody Production Market gains traction from precision targeting in oncology and immunology. Physicians prefer monoclonal antibodies for their higher efficacy and safety profiles. Pharmaceutical firms collaborate with diagnostic developers to match therapies with biomarkers. Such integration reduces trial-and-error treatments in complex diseases. Advancements in genomics and proteomics enable better antibody design. Pharmaceutical pipelines now emphasize biologics over small molecules. The trend toward individualized treatment continues to fuel research funding. It positions antibodies as a cornerstone of next-generation therapies.

Growing Investments from Public and Private Sectors in Biomanufacturing Infrastructure

Governments and private investors actively fund antibody production capabilities to strengthen healthcare systems. The Antibody Production Market expands with biomanufacturing parks, innovation clusters, and academic partnerships. Public funding supports innovation in biologics production methods. Pharmaceutical companies establish regional manufacturing units to ensure supply security. This decentralization minimizes dependency on imports during high-demand periods. Strategic collaborations between biotech startups and established firms promote advanced process development. Investment in training programs develops skilled bioprocessing professionals. These collective initiatives create a robust global production framework for antibody therapies.

- For instance, Fujifilm Diosynth expanded its Billingham, UK microbial biomanufacturing facility in 2024, commissioning two 4,000-liter fermenters and tripling its microbial biologics production throughput as part of a £100 million strategic investment.

Market Trends

Shift Toward Humanized and Bispecific Antibody Development

Ongoing innovation in antibody engineering shapes the competitive landscape. The Antibody Production Market sees strong momentum in humanized and bispecific formats offering enhanced specificity. Researchers employ advanced genetic engineering to create dual-target antibodies for improved efficacy. Bispecific antibodies gain adoption in oncology and autoimmune treatment pipelines. Humanized variants help reduce immunogenic reactions in patients. This trend reflects growing scientific collaboration between academic institutions and biotech companies. Regulatory agencies provide faster review pathways for these advanced therapies. Continuous innovation ensures expanded therapeutic applications. It solidifies antibodies as key assets in modern drug discovery.

Integration of Artificial Intelligence and Automation in Antibody Design

Technological progress in automation and data analytics transforms how antibodies are developed. The Antibody Production Market leverages AI algorithms for faster identification of viable candidates. Machine learning models optimize sequence design and predict binding affinities. Robotics-assisted workflows shorten production timelines and reduce manual errors. Integration of digital twins improves process control and scalability. Companies implement predictive analytics for quality management and resource optimization. Data-driven insights enhance reproducibility in large-scale operations. The adoption of smart biomanufacturing strengthens competitive advantage across the biopharma sector. It redefines production efficiency and innovation potential.

- For instance, Insilico Medicine reported moving from AI-driven target discovery to Phase 1 clinical trials for an anti-fibrotic drug in under 30 months, significantly reducing the development timeline compared to industry averages. This achievement was highlighted in press releases and validated through public clinical milestone records.

Growing Adoption of Single-Use and Modular Bioreactor Systems

Single-use technologies are transforming production strategies in biopharmaceutical manufacturing. The Antibody Production Market witnesses rising adoption of disposable bioreactors for flexibility and lower capital costs. These systems reduce cleaning requirements and contamination risk. Modular facilities allow quicker setup and scalability across production sites. The approach supports smaller clinical batches and pilot-scale studies efficiently. Improved bioreactor materials enhance oxygen transfer and cell growth stability. Industry players prefer hybrid systems combining stainless steel and disposable components. This shift enhances manufacturing resilience and cost control. Global suppliers continue to expand portfolios with innovative modular solutions.

Focus on Sustainable and Environmentally Responsible Manufacturing Practices

Sustainability is becoming integral to biologics manufacturing strategies. The Antibody Production Market incorporates green bioprocessing to reduce energy consumption and waste. Companies adopt recyclable materials and minimize solvent use in purification. Energy-efficient bioreactors and closed-loop water systems enhance environmental performance. Regulatory agencies encourage sustainable practices in facility certification. Process optimization helps lower carbon footprints without compromising yield. Firms integrate renewable energy sources into large production units. Stakeholders recognize that eco-conscious manufacturing enhances brand image. These sustainable strategies ensure long-term operational efficiency and regulatory compliance.

- For instance, Lonza’s 2024 sustainability report confirmed a 27 % reduction in absolute greenhouse gas (GHG) emissions at the Visp site from 2020 to 2023 by upgrading to closed-loop energy systems and integrating renewable power, as evidenced by annual disclosures in corporate environmental filings.

Market Challenges Analysis

High Production Costs and Process Complexity in Large-Scale Manufacturing

Manufacturing antibodies remains capital-intensive due to high material and operational costs. The Antibody Production Market faces economic constraints during process scale-up. Protein A resins, specialized culture media, and purification steps add to expenses. Maintaining optimal culture conditions requires advanced bioreactors and skilled labor. Process validation and regulatory compliance raise overall costs further. Smaller biotech firms often struggle to fund consistent large-scale production. Variability in yields during scale-up also impacts profitability. It pushes manufacturers to explore cost-effective downstream technologies for future sustainability.

Stringent Regulatory Framework and Supply Chain Limitations

The global market faces challenges in meeting complex regulatory standards across multiple jurisdictions. The Antibody Production Market must comply with evolving guidelines on quality and biosafety. Regulatory reviews for biologics often extend product timelines. Variations in approval procedures between regions create market entry delays. Supply chain disruptions affect the availability of raw materials and reagents. Transportation of temperature-sensitive biologics remains logistically demanding. Limited harmonization of standards hinders international collaboration. It compels companies to establish localized production networks to reduce compliance risks.

Market Opportunities

Expanding Role of Antibody Therapeutics in Emerging Healthcare Markets

Developing countries are increasingly investing in biopharmaceutical infrastructure. The Antibody Production Market gains traction from expanding healthcare access and government initiatives. Local manufacturing capabilities in Asia-Pacific, Latin America, and the Middle East are strengthening. Contract manufacturing organizations (CMOs) offer scalable solutions for regional needs. Rising prevalence of cancer and infectious diseases fuels antibody demand. International partnerships help transfer technology to domestic producers. Local production reduces costs and shortens delivery cycles. It opens new revenue streams and enhances market competitiveness globally.

Innovation in Next-Generation Antibody Formats and Bioconjugates

Next-generation antibodies offer diverse opportunities in therapeutic innovation. The Antibody Production Market benefits from advances in antibody-drug conjugates, nanobodies, and Fc-engineered molecules. These formats enable enhanced tissue penetration and therapeutic precision. Pharmaceutical firms collaborate with biotech startups to develop multifunctional antibodies. Improvements in linker chemistry enhance payload stability and safety. The growing acceptance of antibody-based diagnostics expands application areas. Automation in conjugation and purification supports faster commercialization. These developments position antibody technologies at the forefront of modern therapeutics innovation.

Market Segmentation Analysis:

By Product

The Antibody Production Market by product includes consumables and instruments that support large-scale biologics manufacturing. Consumables such as media, buffers, reagents, and chromatography resins hold a major share due to their frequent use and critical role in maintaining product consistency. It benefits from continuous advancements in purification resins and media formulations, improving process efficiency. Instruments including bioreactors, chromatography systems, filtration units, and automation platforms enable scalable and high-yield production. The growing preference for automated and single-use instruments drives efficiency and flexibility across facilities.

- For instance, Sartorius’ BIOSTAT STR® single-use bioreactor platform has demonstrated scalable peak antibody titers of up to 7.8 g/L at the 1,000 L fed-batch scale and comparable results at commercial scales, as evidenced by published bioprocess performance data and technical validation reports.

By Process

The process segment includes upstream processing, downstream processing, and filtration. The Antibody Production Market relies on upstream processes like cell culture and bioreactors to achieve optimal antibody expression. Downstream operations focus on purification and recovery, ensuring high product quality. Filtration supports product clarification and virus removal, maintaining compliance with safety standards. It benefits from innovations in process integration and continuous production that enhance throughput and reduce waste.

By Antibody Type

Monoclonal antibodies dominate this segment due to their precision, therapeutic effectiveness, and broad clinical applications. The Antibody Production Market also includes polyclonal antibodies, valued for their ability to detect multiple epitopes, enhancing diagnostic accuracy. Other antibodies, such as bispecific formats, are gaining interest for dual-targeting capabilities in oncology and autoimmune diseases. It continues to evolve with research investments in next-generation antibody formats offering higher specificity and stability.

- For instance, Amgen and its Xencor partner launched IMDELLTRA, the first and only FDA-approved bispecific T-cell engager (BiTE®) therapy for extensive-stage small cell lung cancer in 2024, with disclosed clinical trial data supporting specific target engagement and response rates in published regulatory filings and press releases.

By End User

Pharmaceutical and biotechnology companies lead the end-user segment, driven by rising biologics production and therapeutic development. The Antibody Production Market also serves diagnostic laboratories focusing on assay development and disease detection. Research institutes contribute through basic and translational research in antibody engineering. CROs and CDMOs expand rapidly, offering outsourcing services to reduce production timelines and operational costs. It supports the global biologics ecosystem through strong collaboration and scalable manufacturing solutions.

Segmentation:

By Product

- Consumables (media, buffers, reagents, chromatography resins)

- Instruments (bioreactors, chromatography systems, filtration units, automation platforms)

By Process

- Upstream Processing (cell culture, bioreactors)

- Downstream Processing (chromatography, filtration, purification)

- Filtration

By Antibody Type

- Monoclonal Antibodies (mAbs)

- Polyclonal Antibodies

- Other Antibodies (e.g., bispecific)

By End User

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Research Institutes

- CROs and CDMOs (Contract Research Organizations, Contract Development and Manufacturing Organizations)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America dominates the Antibody Production Market with a market share of 38%. The region benefits from advanced biotechnology infrastructure, strong government funding, and a large concentration of pharmaceutical companies. The United States leads due to high R&D investments and the presence of major players engaged in biologics production. Canada contributes through growing academic and contract manufacturing activities. It benefits from favorable regulatory frameworks that support clinical development and biologics commercialization. Expanding therapeutic pipelines and faster biologic approvals continue to strengthen North America’s position in the global landscape.

Europe

Europe accounts for a 30% market share, supported by established biopharmaceutical hubs and innovation-focused research centers. The region’s growth is driven by advanced biomanufacturing capabilities in countries such as Germany, the United Kingdom, and Switzerland. Strong collaborations between research institutions and biotech firms enhance innovation in antibody engineering. Regulatory frameworks across the European Medicines Agency (EMA) ensure consistent production standards and safety. It continues to benefit from government-led initiatives that promote life sciences and cross-border R&D funding. Rising demand for biosimilars also supports production expansion in Western and Northern Europe.

Asia-Pacific

Asia-Pacific holds a 24% market share and shows the fastest growth trajectory in antibody production. China, India, and South Korea drive regional expansion through increasing biologics manufacturing capacity and domestic innovation programs. The Antibody Production Market in this region gains momentum from low-cost production advantages and government incentives. Japan leads in technological innovation, while India strengthens its role as a global contract manufacturing hub. Regional collaborations and growing exports of biosimilars improve competitiveness. It is expected to record consistent growth, supported by expanding healthcare infrastructure and local investment in biopharmaceutical research.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Thermo Fisher Scientific

- Merck KGaA (MilliporeSigma)

- Danaher Corp. (Cytiva & Pall)

- Sartorius Stedim Biotech SA

- Lonza Group

- Eppendorf

- AGC Biologics

- Wuxi Biologics

- Charles River Laboratories

- Boehringer Ingelheim BioXcellence

- Samsung Biologics

- GenScript

- Rentschler Biopharma SE

- KBI Biopharma

- Polpharma Biologics

Competitive Analysis:

The Antibody Production Market is highly competitive, driven by global biomanufacturers and technology providers advancing large-scale biologics production. Leading companies such as Thermo Fisher Scientific, Merck KGaA, Danaher Corporation, and Sartorius Stedim Biotech dominate through strong portfolios in bioprocessing systems, reagents, and automation. It witnesses active participation from contract manufacturers like Lonza, Wuxi Biologics, and Samsung Biologics, offering end-to-end antibody development and production services. Firms such as Boehringer Ingelheim BioXcellence and Rentschler Biopharma SE strengthen their position through advanced GMP-certified facilities and global client partnerships. Continuous innovation in single-use bioreactors, chromatography systems, and purification technologies sustains competitive differentiation. Strategic collaborations, capacity expansions, and R&D investments define market leadership among top players.

Recent Developments:

- In November 2025, Ailux, a subsidiary of XtalPi, entered a strategic collaboration with Eli Lilly to accelerate the discovery and development of bispecific antibodies using Ailux’s AI-powered engineering platform, a move positioned to advance next-generation therapeutic molecules and bring innovative antibody solutions to clinical development.

- In October 2025, OPKO Health’s ModeX Therapeutics initiated a research collaboration with Regeneron to develop multispecific antibody candidates that use both ModeX’s MSTAR platform and Regeneron’s proprietary binders, focusing on select therapeutic indications and expanding capabilities in multispecific antibody technologies.

- In October 2025, Thermo Fisher Scientific, revealed a major investment of ₹160 crore to expand its Bangalore R&D Centre, which now features a Center for Excellence focused on antibody design, development, manufacturing, and the integration of automation and analytics for immunoassays, protein analysis, and cell-based studies.

- In October 2025, Merck KGaA (MilliporeSigma) announced its definitive agreement to acquire the chromatography business of JSR Life Sciences. Expected to close by mid-2026, the acquisition will add advanced Protein A chromatography technology, strengthening MilliporeSigma’s downstream processing capabilities for faster and more efficient monoclonal antibody production.

- In August 2025, Sartorius Stedim Biotech SA, announced a partnership and strategic investment up to $3 million in Nanotein Technologies. This collaboration focuses on commercializing and jointly developing novel NanoSpark cell activation reagents and products, designed to enhance immune cell expansion critical for antibody-based therapies in cell and gene therapy markets.

Report Coverage:

The research report offers an in-depth analysis based on Product, Process, Antibody Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for monoclonal antibodies will continue to strengthen biopharmaceutical pipelines.

- Continuous bioprocessing adoption will enhance production efficiency and reduce operational downtime.

- Integration of automation and AI-driven analytics will optimize yield and process consistency.

- Expansion of CDMO capacities will address the rising outsourcing trend among pharmaceutical companies.

- Regional manufacturing hubs in Asia-Pacific will emerge as key contributors to global supply.

- Advancements in single-use technologies will increase flexibility across research and manufacturing facilities.

- Investment in sustainable bioprocessing will drive eco-efficient antibody production.

- New antibody formats such as bispecific and Fc-engineered molecules will expand therapeutic applications.

- Strategic collaborations between biopharma and academic institutions will accelerate innovation.

- Enhanced regulatory harmonization will support faster approvals and global market access.