Market Overview:

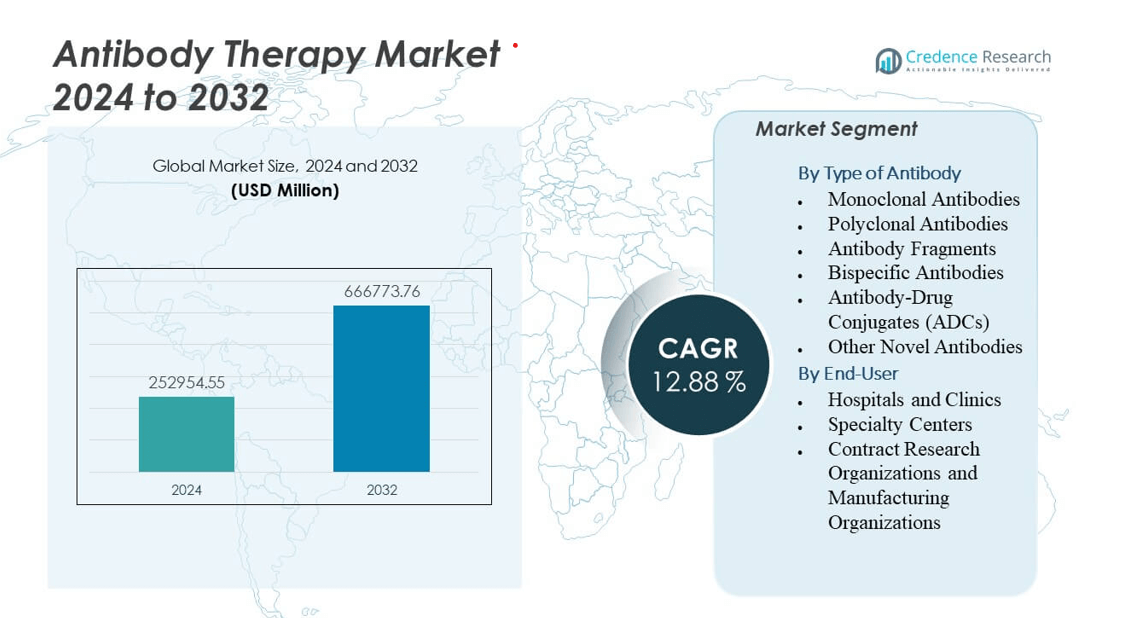

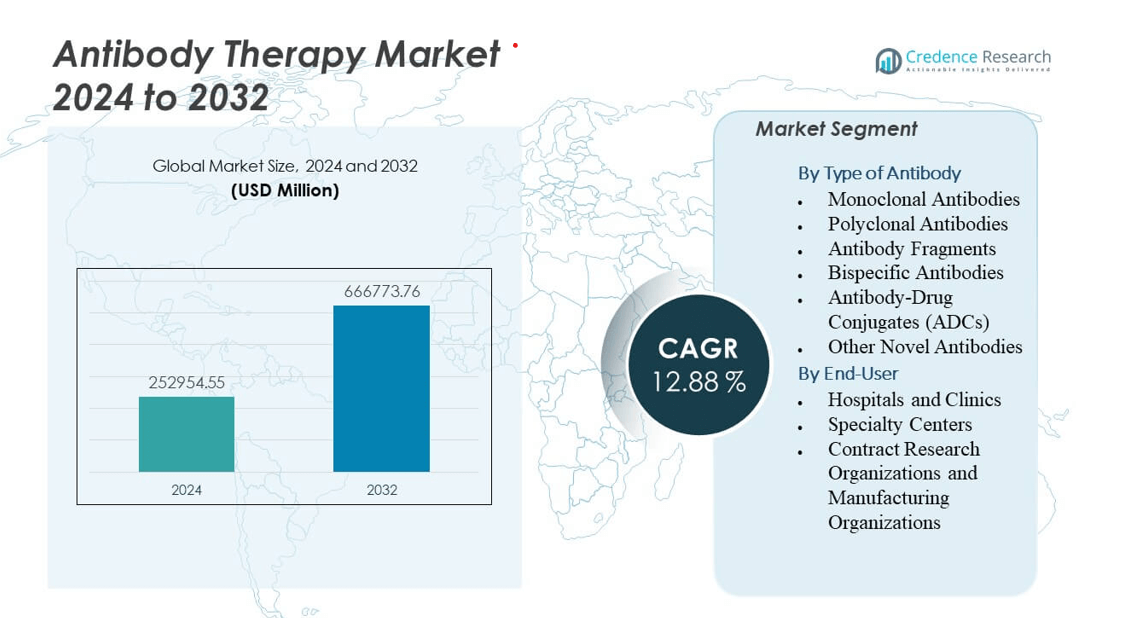

The Antibody Therapy Market is projected to grow from USD 252,954.55 million in 2024 to an estimated USD 666,773.76 million by 2032, with a compound annual growth rate (CAGR) of 12.88% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antibody Therapy Market Size 2024 |

USD 252,954.55 million |

| Antibody Therapy Market, CAGR |

12.88% |

| Antibody Therapy Market Size 2032 |

USD 666,773.76 million |

Rising demand for targeted biologics and growing focus on precision medicine drive the growth of the antibody therapy market. Increasing prevalence of chronic diseases, including cancer and autoimmune disorders, encourages investment in novel therapeutic antibodies. Pharmaceutical companies accelerate innovation in monoclonal and bispecific antibodies to improve treatment efficacy and reduce adverse effects. Favorable regulatory approvals and strong clinical outcomes further support adoption across oncology and immunology applications worldwide.

North America dominates the antibody therapy market due to strong R&D investments, robust healthcare infrastructure, and early adoption of biologics. Europe follows with advanced biomanufacturing capabilities and supportive regulatory systems. Asia-Pacific is emerging as the fastest-growing region, driven by expanding biotechnology sectors, growing patient populations, and rising government funding for biologic research in countries such as China, Japan, and South Korea

Market Insights:

- The Antibody Therapy Market is projected to grow from USD 252,954.55 million in 2024 to USD 666,773.76 million by 2032, registering a CAGR of 12.88%.

- Growing adoption of targeted biologics and precision medicine continues to drive strong market expansion.

- Rising prevalence of chronic conditions, including cancer and autoimmune disorders, boosts demand for antibody-based treatments.

- High development and manufacturing costs remain key restraints, limiting access in low-income regions.

- North America leads due to robust healthcare infrastructure and advanced biopharmaceutical R&D capabilities.

- Europe follows with strong biologics manufacturing networks and supportive regulatory environments.

- Asia-Pacific emerges as the fastest-growing region, driven by expanding biotech sectors and improving healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Prevalence of Chronic and Autoimmune Diseases Accelerates Therapeutic Adoption

The increasing global incidence of chronic diseases, including cancer, rheumatoid arthritis, and multiple sclerosis, drives the demand for advanced antibody-based treatments. The Antibody Therapy Market benefits from physicians preferring targeted therapeutic options over traditional small molecules. Immunotherapy offers improved patient outcomes with fewer side effects, increasing adoption rates in clinical settings. Continuous rise in geriatric populations also supports demand for long-term treatment solutions. Many healthcare systems integrate antibody therapies into oncology and autoimmune treatment protocols. Pharmaceutical companies intensify research to identify new disease targets and antibody structures. High diagnostic accuracy encourages early intervention with monoclonal antibodies. The market expansion aligns closely with growing healthcare investments in precision medicine.

- For instance, the FDA approved Roche/Genentech’s Tecentriq (atezolizumab) as adjuvant therapy for resected stage II–IIIA NSCLC with PD‑L1 ≥1% based on IMpower010, which showed a disease‑free survival hazard ratio of 0.66 versus best supportive care in 476 patients, establishing routine use in early lung cancer care pathways.

Rapid Advancements in Monoclonal Antibody Engineering Improve Therapeutic Efficacy

Innovation in antibody design technologies supports the creation of more specific, stable, and potent therapeutics. The introduction of bispecific and antibody-drug conjugate platforms enhances targeted delivery and reduces systemic toxicity. The Antibody Therapy Market benefits from advancements in glycoengineering and Fc-modification that extend antibody half-life and activity. Emerging biotechnologies enable high-yield production with reduced development timelines. Contract manufacturing organizations invest in advanced cell-line development tools to improve efficiency. Regulatory acceptance of novel antibody classes like IgG4 and nanobodies fosters clinical exploration. It achieves higher patient response rates through improved affinity and better safety profiles. These developments strengthen the position of antibody therapies within modern healthcare frameworks.

- For instance, Amgen’s blinatumomab (BLINCYTO) achieved a 44% complete remission rate in the Phase III TOWER study for relapsed or refractory B-cell precursor acute lymphoblastic leukemia, as documented in Amgen’s clinical data and peer-reviewed publications confirming its efficacy as a bispecific T-cell engager.

Expanding Biopharmaceutical Investments Strengthen Research and Development Capabilities

Growing capital inflow from global pharmaceutical and biotechnology firms fuels innovation in antibody discovery and production. Companies prioritize in-house biologics pipelines and partnerships with research institutes to expand therapeutic portfolios. The Antibody Therapy Market gains from strategic alliances focused on developing next-generation immune-oncology and infectious disease antibodies. Governments support R&D with funding initiatives and faster regulatory pathways. Academic institutions collaborate with private players to scale preclinical to commercial transitions. It drives consistent development of humanized and fully human monoclonal antibodies. Advanced analytics and AI-assisted drug design optimize candidate selection and testing. The surge in patent filings and clinical trials reflects rising research intensity across regions.

Increasing Patient Awareness and Access to Advanced Biologics Drive Market Penetration

Improved public awareness about biologic therapies and their clinical benefits accelerates adoption across multiple disease areas. The Antibody Therapy Market experiences growth through rising inclusion of antibody-based drugs in national formularies. Healthcare providers promote early diagnosis and personalized medicine approaches using antibody diagnostics and treatments. Broader insurance coverage and reimbursement policies in developed nations strengthen affordability. Expanding hospital infrastructure in emerging economies enhances product accessibility. It boosts treatment adherence through lower adverse event profiles and higher therapeutic success. The growing role of digital health and telemedicine platforms supports patient education about biologic therapies. Pharmaceutical marketing strategies emphasize treatment safety and long-term disease control.

Market Trends

Emergence of Bispecific Antibodies Enhances Target Specificity and Treatment Outcomes

Bispecific antibody formats have gained traction due to their dual-target binding capability, improving therapeutic precision. The Antibody Therapy Market sees expanding applications in oncology and immunology with higher tumor-killing efficiency. Pharmaceutical companies launch platforms that reduce off-target toxicity and enhance immune response modulation. It leads to increased research into multi-specific antibody configurations that combine functional diversity with safety. Clinical trials show promising outcomes for bispecific antibodies in hematologic and solid malignancies. Rising FDA approvals support their integration into treatment guidelines. Biotech firms invest in next-generation linker technologies for better payload control. The trend strengthens the competitiveness of biopharmaceutical innovators.

- For instance, Roche’s bispecific antibody glofitamab (Columvi®) received FDA priority review in January 2023 based on pivotal Phase I/II trial data—showing a 40% complete response rate (CR) and 51.6% objective response rate (OR) in 155 patients with heavily pre-treated relapsed or refractory large B-cell lymphoma. At 12 months, 73.1% of patients who achieved a CR maintained their response, with the median duration of CR not reached during the study.

Adoption of Artificial Intelligence in Antibody Design Accelerates Development Efficiency

AI-based tools streamline the discovery and optimization of antibodies by predicting structure and binding affinities. The Antibody Therapy Market benefits from reduced R&D timelines and improved screening accuracy. Machine learning models help identify therapeutic candidates with enhanced stability and lower immunogenicity. Companies employ deep learning platforms for epitope prediction and lead optimization. It improves pipeline productivity while minimizing costly experimental iterations. Cloud-based computational systems integrate with laboratory data for seamless antibody profiling. Startups collaborate with large pharmaceutical firms to apply AI in antibody engineering workflows. The approach reshapes discovery strategies and increases the success rate of clinical candidates.

- For instance, Absci Corporation announced a collaboration with AstraZeneca in December 2023, leveraging Absci’s generative AI platform to deliver a therapeutic candidate antibody for an oncology target. The agreement, valued up to $247 million, enables Absci’s platform to design antibodies, collect data, and validate candidates in cycles as short as six weeks, enabling rapid and scalable antibody discovery for complex targets.

Shift Toward Subcutaneous and Long-Acting Formulations Enhances Patient Compliance

Pharmaceutical manufacturers prioritize the development of user-friendly delivery systems to improve treatment adherence. The Antibody Therapy Market embraces subcutaneous formulations and depot injections that reduce hospital visits. Patients prefer home-based administration over intravenous infusions for convenience. It also reduces healthcare costs and boosts patient satisfaction levels. Formulation scientists design extended-release systems to maintain consistent drug plasma levels. Biotechnology firms explore nanoparticle and microneedle-assisted antibody delivery technologies. Healthcare providers adopt these innovations to enhance patient-centric care models. The approach aligns with the growing focus on personalized and value-based medicine.

Rising Collaborations and Licensing Deals Accelerate Market Expansion

The competitive landscape features frequent collaborations between pharmaceutical giants and biotech startups to develop novel antibody therapeutics. The Antibody Therapy Market grows through licensing agreements, joint ventures, and co-development programs. These partnerships enable resource sharing, faster clinical progression, and market access optimization. It ensures technological advancement while minimizing financial risks. Companies focus on regional manufacturing alliances to ensure global distribution efficiency. Academic institutions join hands with industry leaders for translational research. The surge in M&A activities reflects consolidation trends across the biopharma sector. Such collaborations enhance innovation speed and regulatory success rates.

Market Challenges Analysis

High Manufacturing Complexity and Cost Constraints Limit Market Scalability

Production of antibody therapeutics demands advanced infrastructure, strict quality control, and skilled expertise. The Antibody Therapy Market faces challenges due to high upstream and downstream processing expenses. It relies heavily on bioreactor capacity, purified cell lines, and cold chain logistics. Manufacturing disruptions often lead to supply delays and increased pricing pressure. Many small and mid-sized firms struggle with maintaining GMP compliance standards. The cost-intensive nature of antibody purification and fill-finish operations restricts entry for new players. Patent expirations and biosimilar competition add financial strain to established brands. Governments and regulatory bodies continue to seek cost-reduction solutions through process optimization technologies.

Regulatory Hurdles and Clinical Failure Risks Impact Product Approvals

Stringent clinical evaluation standards delay market entry for new antibody-based drugs. The Antibody Therapy Market encounters frequent trial terminations due to poor efficacy or safety issues. It demands extensive validation and long-term post-marketing surveillance. Regulatory bodies require detailed immunogenicity assessments, prolonging approval timelines. Developers face challenges in scaling successful preclinical results to clinical outcomes. Limited patient diversity in trials hampers generalization across populations. Unexpected immune responses can lead to setbacks in advanced-stage studies. These barriers emphasize the need for adaptive trial designs and predictive biomarker-based testing to improve approval success.

Market Opportunities

Expansion of Personalized Medicine Creates New Growth Frontiers

Integration of genomics and proteomics with antibody development reshapes targeted treatment strategies. The Antibody Therapy Market gains opportunities through personalized therapeutic regimens guided by molecular diagnostics. It enables clinicians to match antibody profiles with patient-specific biomarkers. Pharmaceutical companies develop companion diagnostics to support precision dosing. Growth in predictive analytics allows efficient patient selection and enhanced treatment efficacy. Healthcare providers adopt data-driven models for continuous therapy monitoring. The trend supports differentiation in competitive markets through customized therapy portfolios. Advancements in digital health tools complement this opportunity by supporting real-time treatment optimization.

Emerging Market Expansion and Growing Biosimilar Acceptance Broaden Global Reach

Rising investments in healthcare infrastructure across developing economies create untapped commercial potential. The Antibody Therapy Market benefits from growing acceptance of biosimilar antibodies as cost-effective alternatives. It supports affordability while maintaining therapeutic standards. Regional manufacturers in Asia-Pacific and Latin America strengthen domestic production capacities. Local governments encourage clinical trials and technology transfer initiatives to improve accessibility. Expanding patient pools and favorable regulatory reforms boost regional demand. Companies leverage strategic partnerships to ensure rapid entry into these emerging markets. Broader awareness campaigns and physician training programs further drive long-term adoption momentum.

Market Segmentation Analysis:

By type, monoclonal antibodies dominate the Antibody Therapy Market due to their proven clinical success and extensive therapeutic range. These antibodies offer high specificity and favorable safety profiles, making them the backbone of targeted treatment across oncology and autoimmune disorders. Polyclonal antibodies continue to hold importance in infectious disease and toxin neutralization, while antibody fragments gain attention for improved tissue penetration and diagnostic use. Bispecific antibodies represent a fast-evolving class offering dual-target action and better immune modulation. Antibody-drug conjugates (ADCs) deliver strong oncology potential through precise cytotoxic payload delivery, reducing systemic effects. Other novel antibodies, including nanobodies, expand future possibilities by targeting smaller, complex antigens with enhanced binding efficiency.

- For instance, 13 bispecific antibodies including Amgen’s blinatumomab and Genentech’s glofitamab have received global regulatory approval as of 2024, with evidence that blinatumomab achieves complete minimal residual disease response in nearly 80% of acute lymphoblastic leukemia patients in pivotal trials.

By end-user, hospitals and clinics account for the largest share due to the growing number of antibody-based therapies administered under specialized supervision. Specialty centers play a vital role in personalized treatment programs, particularly in oncology and autoimmune disease management. Contract research organizations and manufacturing organizations show the fastest growth, driven by outsourcing trends, rising biologics production, and clinical development partnerships. It benefits from expanding R&D collaboration between pharmaceutical firms and biotech innovators, strengthening supply chains and accelerating market accessibility.

- For instance, Akeso’s bispecific antibody ivonescimab, in collaboration with international CROs, is advancing in 14 Phase III multicenter global trials as of November 2025, including three prior successful breakthrough designations in China for antibody therapeutics.

Segmentation:

By Type of Antibody

- Monoclonal Antibodies

- Polyclonal Antibodies

- Antibody Fragments

- Bispecific Antibodies

- Antibody-Drug Conjugates (ADCs)

- Other Novel Antibodies

By End-User

- Hospitals and Clinics

- Specialty Centers

- Contract Research Organizations and Manufacturing Organizations

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Antibody Therapy Market, accounting for 38% of global revenue. Strong biotechnology infrastructure, advanced healthcare systems, and a large patient population with chronic diseases support market dominance. The United States leads with extensive R&D investments, a high number of clinical trials, and quick regulatory approvals. It benefits from the presence of key players such as Amgen, Regeneron, and Bristol-Myers Squibb that focus on monoclonal and bispecific antibodies. Canada also contributes through rising adoption of biologic drugs and government-backed research grants. Increasing awareness of targeted therapies strengthens demand across oncology and autoimmune applications in this region.

Europe captures 30% of the Antibody Therapy Market, supported by well-established biologics manufacturing capabilities and active government initiatives. Germany, the United Kingdom, and Switzerland lead the region in antibody innovation and export. It benefits from a strong collaboration network among academic institutions, contract research organizations, and pharmaceutical firms. The European Medicines Agency’s streamlined regulatory framework supports faster drug approvals and market entry. Rising investments in oncology and immunology pipelines further boost regional adoption. Expanding biosimilar acceptance and advanced healthcare coverage sustain long-term growth across major EU markets.

Asia-Pacific holds 25% of the Antibody Therapy Market and represents the fastest-growing regional segment. Countries such as China, Japan, and South Korea experience rising demand driven by improved healthcare access and growing biotechnology ecosystems. It gains momentum from regional manufacturing partnerships, cost-effective clinical trials, and expanding local biopharma capacity. Japan maintains leadership in antibody drug innovation, while China shows rapid growth in contract manufacturing and R&D collaborations. Government funding in precision medicine and oncology accelerates adoption across emerging economies. Expanding patient pools and infrastructure development position Asia-Pacific as a key future growth center for antibody-based therapeutics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Roche (F. Hoffmann-La Roche Ltd.)

- Regeneron Pharmaceuticals

- Eli Lilly and Company

- Merck & Co., Inc.

- Johnson & Johnson

- Bristol-Myers Squibb

- GlaxoSmithKline plc (GSK)

- Novartis AG

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca

- Sanofi

Competitive Analysis:

The Antibody Therapy Market is characterized by strong competition among global pharmaceutical and biotechnology leaders. Companies such as Roche, Johnson & Johnson, and Bristol-Myers Squibb maintain leadership through established monoclonal antibody portfolios and continuous innovation. It benefits from increasing collaborations between major players like Eli Lilly, Regeneron, and Sanofi to expand bispecific and antibody-drug conjugate pipelines. Strategic mergers and licensing deals drive access to advanced antibody platforms and faster commercialization. Amgen, AstraZeneca, and AbbVie strengthen their presence with diversified immunology and oncology products. Emerging biotechnology firms focus on AI-driven antibody design and next-generation constructs to compete with established brands. Continuous investment in R&D, clinical trials, and manufacturing scalability defines the competitive intensity across the market.

Recent Developments:

- In November 2025, Roche announced positive Phase III results for its antibody therapy Gazyva/Gazyvaro (obinutuzumab) in patients with systemic lupus erythematosus (SLE), demonstrating a significant reduction in disease activity. This follows the recent US FDA approval of Gazyva/Gazyvaro for lupus nephritis, marking a crucial expansion of Roche’s antibody portfolio targeting autoimmune conditions.

- In November 2025, Eli Lilly entered into a strategic collaboration with Ailux, a subsidiary of XtalPi, to leverage Ailux’s AI-powered bispecific antibody engineering platform for discovering and developing new therapies across multiple indications.

- In September 2025, Lilly formed a multi-target drug discovery collaboration with Prellis Biologics, aiming to use artificial lymph node organoid technology and AI to rapidly generate high-affinity human antibodies for next-generation therapeutics

Report Coverage:

The research report offers an in-depth analysis based on Type of Antibody and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for targeted biologics will strengthen innovation and clinical adoption in the Antibody Therapy Market.

- Advancements in bispecific and multispecific antibody formats will broaden treatment possibilities across complex diseases.

- AI-driven discovery platforms will shorten development timelines and improve antibody design precision.

- Expansion of antibody-drug conjugates will transform oncology treatments through better therapeutic selectivity.

- Strategic partnerships between pharmaceutical and biotech firms will accelerate new product development.

- Regulatory flexibility for biologics and biosimilars will support faster market entry and affordability.

- Growing investments in manufacturing infrastructure will improve production capacity and global supply consistency.

- Increased focus on personalized medicine will drive antibody use in precision therapeutic regimens.

- Rising adoption in emerging markets will expand access and boost overall market penetration.

- Continuous R&D in antibody fragments and nanobodies will create next-generation therapeutics with enhanced safety profiles.