Market Overview:

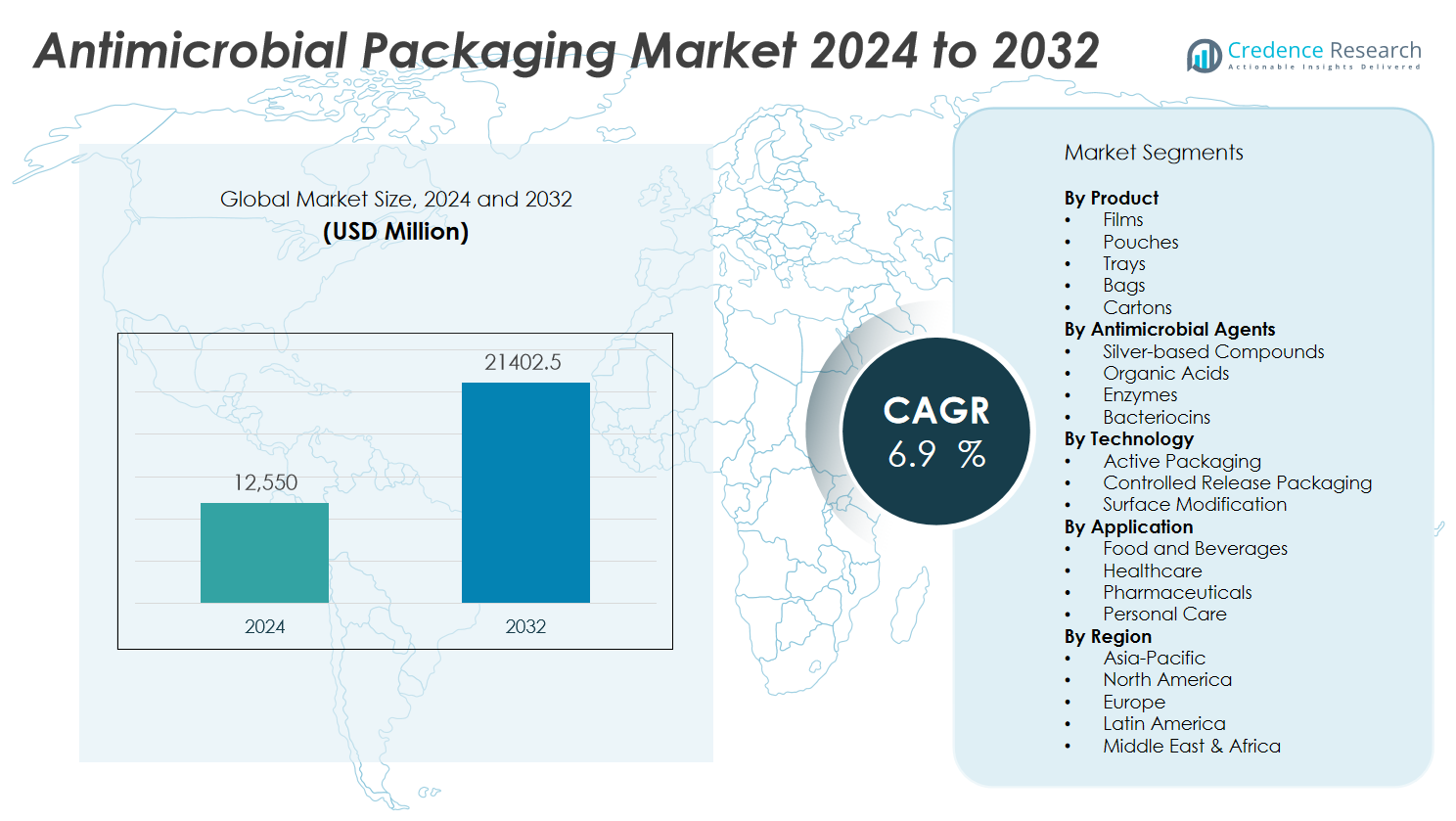

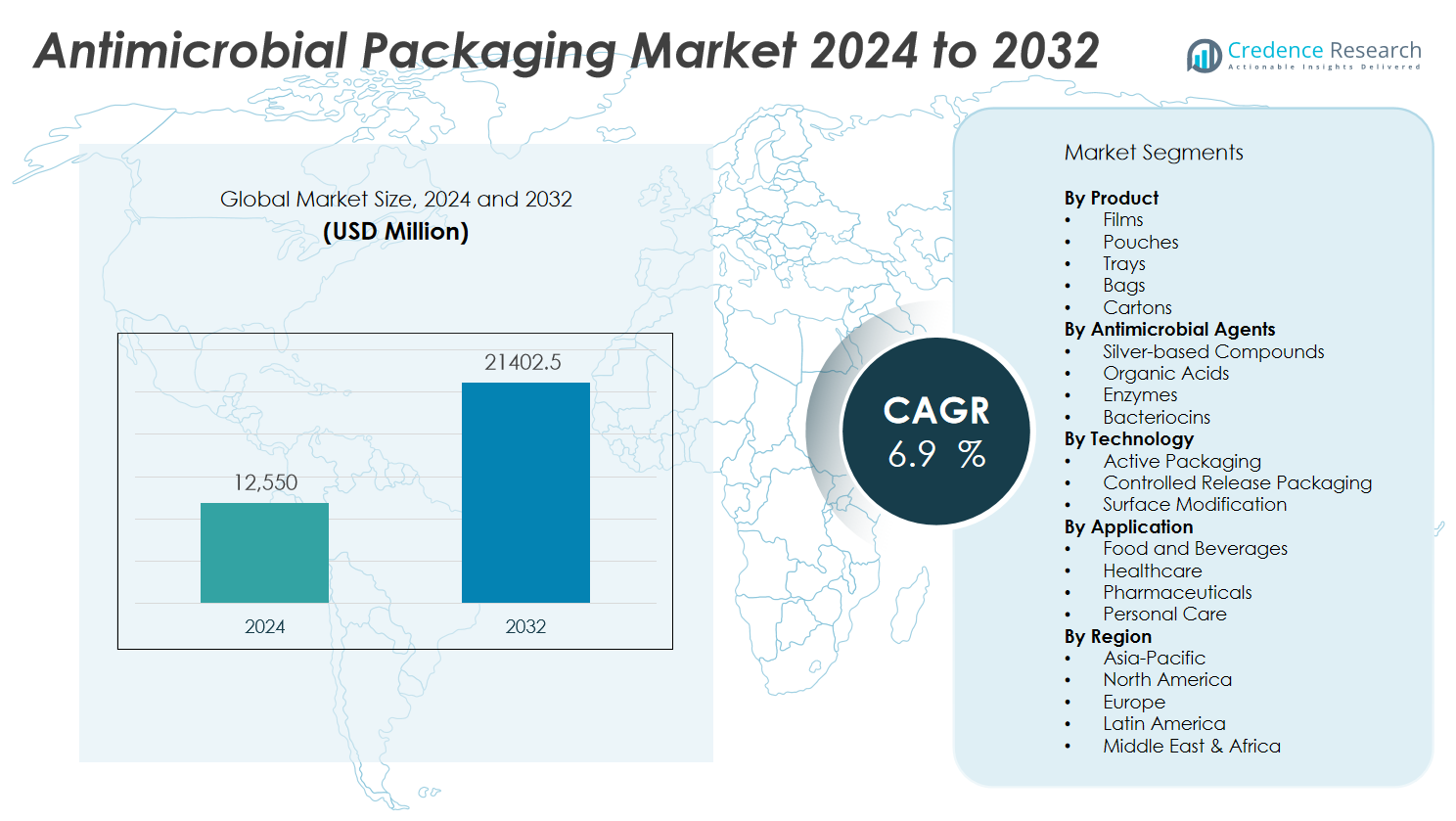

The Antimicrobial packaging market size was valued at USD 12,550 million in 2024 and is anticipated to reach USD 21402.5 million by 2032, at a CAGR of 6.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antimicrobial Packaging Market Size 2024 |

USD 12,550 Million |

| Antimicrobial Packaging Market, CAGR |

6.9 % |

| Antimicrobial Packaging Market Size 2032 |

USD 21402.5 Million |

Key market drivers include heightened concerns over foodborne illnesses, stricter regulatory requirements for safety and hygiene, and rapid growth in the packaged food sector. Antimicrobial packaging leverages materials and technologies—such as silver-based compounds, organic acids, and essential oils—to inhibit the growth of bacteria, mold, and fungi on packaged goods. Food processors and pharmaceutical companies are prioritizing packaging innovations to reduce product recalls, boost consumer confidence, and comply with international safety standards. The expansion of e-commerce and changing consumption patterns are also accelerating the adoption of active and intelligent packaging solutions, with antimicrobial features viewed as value-added enhancements.

Regionally, the Asia-Pacific region holds the largest share of the antimicrobial packaging market, driven by robust growth in processed food production, urbanization, and rising healthcare spending in China, India, Japan, and South Korea. North America remains a key contributor due to strict regulations and active investment in research and development by companies such as Avient Corporation, DUNMORE, BioCote Limited, Microban International, and Takex Labo Co. Ltd. Europe follows with strong demand for sustainable, bio-based materials, while Latin America and the Middle East are witnessing increased adoption, supported by export growth and rising consumer demand for packaged goods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The antimicrobial packaging market reached USD 12,550 million in 2024 and is forecast to hit USD 21,402.5 million by 2032.

- Heightened concerns over foodborne illnesses, stricter regulations, and packaged food growth drive robust market demand.

- Manufacturers use materials such as silver-based compounds, organic acids, and essential oils to inhibit bacteria, mold, and fungi.

- Food processors and pharmaceutical companies focus on packaging innovations to cut recalls and meet safety standards.

- Regulatory complexity and high production costs challenge market growth, especially for new entrants and smaller firms.

- Asia-Pacific leads with a 43% share, driven by rapid industrialization and investment in China, India, Japan, and South Korea.

- North America and Europe follow, supported by strict regulations, strong R&D, and increasing adoption of sustainable, bio-based packaging.

Market Drivers:

Heightened Focus on Food Safety and Shelf Life Extension:

Consumer demand for safe, high-quality food products continues to fuel growth in the antimicrobial packaging market. Food manufacturers rely on antimicrobial packaging to reduce the risk of contamination by bacteria, mold, and fungi. This approach helps preserve freshness, maintain sensory qualities, and extend the shelf life of packaged goods. Regulatory bodies worldwide are enforcing strict standards for food safety, prompting companies to adopt advanced packaging solutions. Food recalls and concerns over foodborne illnesses create a strong incentive for brands to implement antimicrobial technologies. It supports brand reputation and addresses consumer expectations for hygienic packaging.

- For instance, the EU-funded NanoPack project developed advanced nanomaterial-based antimicrobial film that prevented mold growth in bread for at least 3 weeks, and extended the shelf life of yellow cheese by 50% in real-world trials—demonstrating a significant achievement in both food safety and product longevity.

Stringent Regulatory Standards and Compliance Initiatives:

Government regulations mandate rigorous safety protocols in packaging, especially for food and pharmaceutical products. The antimicrobial packaging market benefits from these requirements, as manufacturers strive to comply with evolving global and regional standards. Organizations such as the FDA and EFSA monitor the use of active agents and approve materials based on efficacy and safety. Compliance with such frameworks drives innovation in packaging materials and application methods. Companies invest in research and quality assurance to ensure their products meet or exceed regulatory requirements. It creates opportunities for new entrants and existing players to offer differentiated solutions.

- For instance, Symphony Environmental Technologies received FDA approval for its d2p antimicrobial technology in polyethylene bread packaging after nearly 10 years of research and development, satisfying stringent food-contact safety standards and making it the sole approved provider for this specific application under the Food Contact Notification procedure.

Rapid Expansion of the Packaged Food and Beverage Sector:

The rise of urbanization and changing consumer lifestyles accelerate demand for ready-to-eat and packaged food products. The antimicrobial packaging market addresses industry needs for safety, convenience, and extended shelf life in processed foods. Manufacturers seek innovative materials that can inhibit microbial growth without compromising product integrity. The growth of online grocery channels and modern retail further strengthens the case for effective packaging solutions. It helps reduce spoilage, minimizes returns, and improves consumer trust in packaged goods. The adoption of antimicrobial technologies in beverages, dairy, and bakery segments supports market growth.

Ongoing Technological Advancements and Product Innovations:

Material science and nanotechnology continue to transform the antimicrobial packaging market with new product offerings. Research and development teams introduce advanced antimicrobial agents, including natural extracts and nanoparticles, to meet diverse application requirements. Sustainable packaging and bio-based antimicrobial additives attract attention from eco-conscious consumers and regulatory bodies. Companies collaborate with research institutions to validate efficacy and improve performance of active packaging solutions. It enables the launch of packaging formats with enhanced protective properties. Integration of intelligent sensors and tracking features further adds value for manufacturers and end-users.

Market Trends:

Rising Adoption of Natural and Bio-Based Antimicrobial Agents:

The antimicrobial packaging market is experiencing a notable shift toward natural and bio-based antimicrobial agents. Food and pharmaceutical companies now prioritize the use of plant-derived extracts, enzymes, and essential oils to inhibit microbial growth. This trend responds to consumer preferences for clean-label and environmentally friendly solutions. Research and development teams focus on replacing traditional chemical agents with safer, sustainable alternatives. It encourages investment in biodegradable films and coatings that complement broader sustainability goals. Regulatory pressures and public awareness about chemical safety accelerate the adoption of these materials in packaging applications.

- For instance, Urmia University researchers in Iran doubled the shelf life of high-moisture mozzarella cheese to 8 days at 7°C using an antimicrobial coating based on carboxymethyl cellulose and natamycin, significantly reducing mould and yeast counts.

Integration of Intelligent Packaging and Digital Technologies:

Integration of smart and intelligent packaging features has become a key trend in the antimicrobial packaging market. Manufacturers develop packaging formats with embedded sensors, indicators, and RFID tags that monitor freshness and detect contamination. These digital technologies provide real-time information on product condition and shelf life, helping both retailers and consumers ensure safety. It supports supply chain transparency and enhances the value proposition of antimicrobial packaging solutions. Companies leverage data analytics to optimize inventory management and minimize waste. Collaboration between technology providers and packaging firms continues to drive new product launches in this segment.

- For instance, a team from the Indian Institute of Technology (IIT) Hyderabad developed a food packaging material using bacterial cellulose blended with silver nanoparticles, which successfully preserved tomatoes for around 30 days without microbial spoilage in controlled studies—over triple the natural shelf life of tomatoes under ambient conditions.

Market Challenges Analysis:

Regulatory Complexity and Compliance Barriers:

Regulatory complexity remains a primary challenge for the antimicrobial packaging market. Manufacturers must comply with diverse regulations set by agencies such as the FDA, EFSA, and other regional authorities. The approval process for new antimicrobial agents often involves extensive safety testing and documentation. It can delay product launches and raise development costs. Companies face ongoing scrutiny regarding the migration of active agents into food products, prompting frequent revisions to formulations and processes. Navigating these regulatory hurdles requires significant investment in research and regulatory expertise.

High Production Costs and Limited Consumer Awareness:

High production costs present another obstacle for the antimicrobial packaging market. Advanced materials and technologies tend to increase overall manufacturing expenses, which can affect pricing competitiveness. Small and medium enterprises struggle to adopt these solutions due to resource constraints. Limited consumer awareness of antimicrobial packaging benefits further restricts market penetration. It creates challenges for brands attempting to justify higher prices or differentiate products in crowded retail environments. Economic pressures in emerging markets amplify cost concerns and slow adoption rates.

Market Opportunities:

Expansion of Application Areas Beyond Food and Beverage:

The antimicrobial packaging market offers strong opportunities in sectors beyond food and beverage. Healthcare, pharmaceuticals, and personal care industries seek solutions that extend shelf life and ensure product safety. Medical device packaging and wound care products present attractive avenues for antimicrobial innovation. Companies can develop specialized formats that address the unique needs of each sector. It enables manufacturers to diversify portfolios and capture new revenue streams. Growth in these segments also drives research into novel materials and delivery mechanisms.

Rising Demand for Sustainable and Smart Packaging Solutions:

Rising environmental awareness creates new opportunities for sustainable antimicrobial packaging solutions. The market favors bio-based films, compostable coatings, and recyclable materials that combine antimicrobial properties with eco-friendly features. Manufacturers investing in smart packaging—such as sensors and indicators—can offer value-added solutions for freshness monitoring and traceability. It helps brands differentiate products in competitive markets and align with consumer expectations. Collaborations with technology firms and material suppliers further accelerate the development of next-generation packaging formats.

Market Segmentation Analysis:

By Product:

The antimicrobial packaging market segments by product into pouches, trays, bags, cartons, films, and others. Films and pouches account for the largest share due to their extensive use in food, beverage, and healthcare packaging. Manufacturers favor flexible formats for their versatility, lightweight nature, and cost efficiency. Rigid packaging, such as trays and cartons, also secures a significant share, especially for medical devices and pharmaceutical products that demand high protection standards. It supports growth in sectors requiring extended shelf life and contamination prevention.

- For instance, researchers at Urmia University doubled the shelf life of high-moisture mozzarella cheese by applying an antimicrobial carboxymethyl cellulose coating with natamycin, significantly reducing mould and yeast counts over eight days at 7°C.

By Antimicrobial Agents:

Key antimicrobial agents include organic acids, enzymes, bacteriocins, metal ions such as silver and copper, and natural extracts. Silver-based compounds lead the segment, widely adopted for their broad-spectrum efficacy against bacteria and fungi. Natural agents, such as essential oils and plant extracts, gain momentum as consumer demand for clean-label products rises. It encourages research into sustainable solutions and alternative actives that meet safety and regulatory criteria.

- For instance, nisin, produced commercially as Nisaplin® by Danisco, is globally approved as a biopreservative and is used in over 50 countries to control Listeria and Clostridia contamination in dairy and processed meats, offering broad-spectrum protection in food matrices.

By Technology:

Antimicrobial packaging employs active packaging, controlled release, and surface modification technologies. Active packaging dominates the market by providing continuous microbial inhibition throughout the product’s shelf life. Controlled release systems allow precise dosing of antimicrobial agents, enhancing effectiveness. Surface modification introduces functional coatings that reduce contamination risks on packaging surfaces. It ensures product safety, quality, and extended usability across multiple applications.

Segmentations:

By Product:

- Films

- Pouches

- Trays

- Bags

- Cartons

- Others

By Antimicrobial Agents:

- Silver-based Compounds

- Organic Acids

- Enzymes

- Bacteriocins

- Essential Oils

- Metal Ions (Copper, Zinc)

- Natural Extracts

By Technology:

- Active Packaging

- Controlled Release Packaging

- Surface Modification

By Application:

- Food and Beverages

- Healthcare

- Pharmaceuticals

- Personal Care

- Others

By Region:

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 43% of the antimicrobial packaging market, driven by rapid industrialization and significant investments in food processing, healthcare, and pharmaceutical manufacturing. China, India, Japan, and South Korea serve as major contributors, benefitting from expanding urban populations and increased demand for packaged goods. The region’s manufacturing infrastructure and supportive government initiatives foster technological adoption. Companies in Asia-Pacific focus on product innovation to meet stringent regulatory standards and evolving consumer preferences. It creates a competitive landscape where local players and global firms actively expand production capacities. The region’s leadership position is expected to continue throughout the forecast period.

North America :

North America accounts for 26% of the antimicrobial packaging market, supported by advanced regulatory frameworks and high consumer awareness. The United States leads regional demand with strong food safety standards enforced by the FDA and USDA. Pharmaceutical and healthcare sectors in the region also fuel adoption of antimicrobial packaging solutions. Key market participants invest in R&D to deliver compliant and effective packaging materials. It drives innovation and accelerates the introduction of new products with enhanced safety features. The region’s focus on sustainability and smart packaging technology supports continued growth and market stability.

Europe:

Europe captures 21% of the antimicrobial packaging market, propelled by robust sustainability initiatives and increasing preference for eco-friendly materials. Countries including Germany, France, and the United Kingdom spearhead regulatory action to limit chemical migration and encourage the use of bio-based additives. The region’s mature food processing and pharmaceutical industries sustain high demand for antimicrobial solutions. Leading packaging companies invest in biodegradable materials and recyclable formats to align with European Union directives. It positions Europe as a key market for sustainable innovation and regulatory compliance. The region’s steady growth outlook is strengthened by continued investment in advanced packaging technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Avient Corporation

- DUNMORE

- BioCote Limited

- Microban International

- Takex Labo Co. Ltd.

- Linpac Senior Holdings Ltd. (Klöckner Pentaplast)

- Oplon Pure Sciences Ltd.

Competitive Analysis:

The antimicrobial packaging market features a mix of established global players and specialized regional firms, driving competition through product innovation and technological advancement. Key competitors include Avient Corporation, DUNMORE, BioCote Limited, Microban International, and Takex Labo Co. Ltd. These companies invest heavily in research and development to introduce advanced antimicrobial agents, sustainable materials, and application-specific packaging formats. It encourages partnerships with food, healthcare, and pharmaceutical brands to expand market presence and address evolving industry nesseds. Competitive strategies focus on regulatory compliance, product differentiation, and rapid adaptation to shifting consumer preferences. The market values proven efficacy, safety, and continuous development, positioning leading players to capture emerging growth opportunities and strengthen global reach.

Recent Developments:

- In July 2025, Avient Corporation launched the first grade in its new ColorMatrix™ Amosorb™ Oxyloop™ portfolio of oxygen scavengers to enhance PET packaging recyclability.

- In April 2023, BioCote antimicrobial technology was applied to the full range of Stuart benchtop laboratory equipment by Cole-Parmer, offering enhanced microbial protection in laboratory environments.

- In July 2025, BASF SE and Equinor signed a ten-year strategic partnership agreement for the annual delivery of up to 23terawatt hours of natural gas to BASF in Europe.

Market Concentration & Characteristics:

The antimicrobial packaging market demonstrates moderate concentration, with a mix of global leaders and regional players shaping the competitive landscape. Leading companies such as BASF, Mondi, Amcor, Dunmore Corporation, and Berry Global drive innovation and maintain strong brand presence. The market features frequent product launches, collaborations, and investments in sustainable materials and smart technologies. It encourages differentiation through advanced antimicrobial agents, eco-friendly solutions, and application-specific formats. Barriers to entry include regulatory complexity, high R&D costs, and the need for proven safety and efficacy. The market values agility, continuous product development, and adherence to global safety standards.

Report Coverage:

The research report offers an in-depth analysis based on Product, Antimicrobial Agents, Technology, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Innovations in biodegradable and bio-based antimicrobial materials will transform packaging practices.

- Manufacturers will integrate smart sensors and freshness indicators to enhance supply chain traceability.

- Regulatory agencies will intensify scrutiny of antimicrobial agents, prompting higher safety and efficacy standards.

- Collaborations between packaging firms and technology providers will accelerate product development.

- Growth in e-commerce and global food distribution will increase demand for extended-shelf-life packaging.

- Healthcare and pharmaceutical sectors will drive adoption of antimicrobial packaging for sterile applications.

- Consumer preference for clean-label and eco-friendly products will encourage formulation of natural antimicrobial agents.

- Investment in nanotechnology and encapsulation methods will improve agent stability and release control.

- Regional expansion in emerging markets—particularly in Asia and Latin America—will offer new development avenues

- Companies that emphasize sustainability, cost efficiency, and regulatory compliance will secure competitive advantage in the Antimicrobial packaging market