Market Overview:

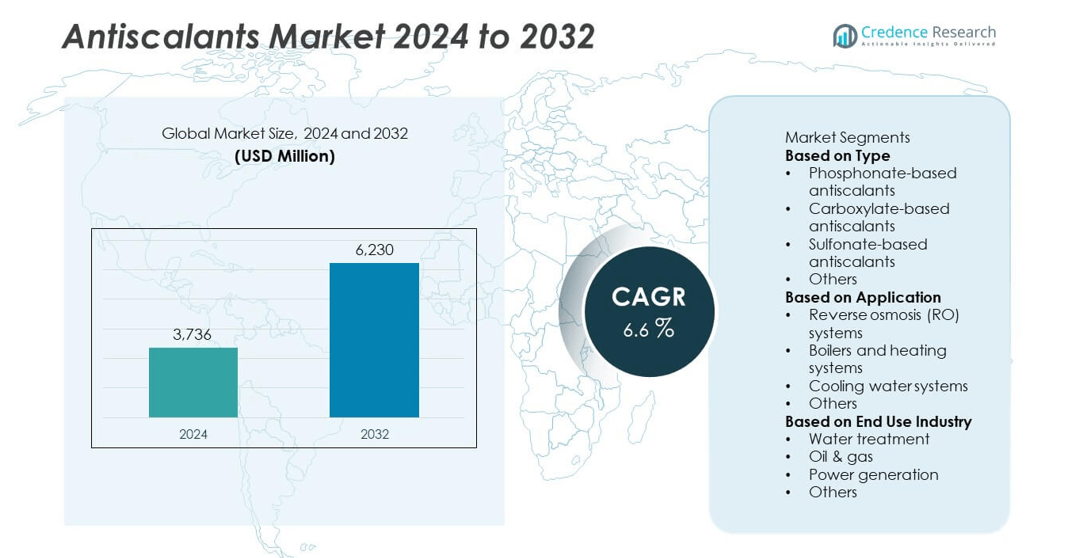

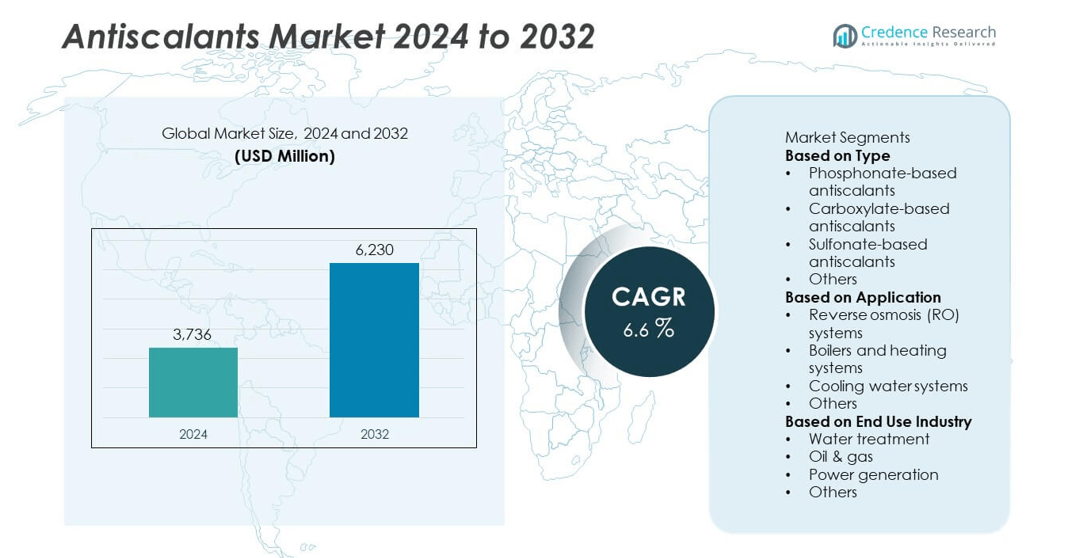

The global antiscalants market was valued at USD 3,736 million in 2024 and is projected to reach USD 6,230 million by 2032, registering a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antiscalants Market Size 2024 |

USD 3,736 million |

| Antiscalants Market, CAGR |

6.6% |

| Antiscalants Market Size 2032 |

USD 6,230 million |

The top players in the antiscalants market include Kurita, Veolia, Dow, Syensqo, Italmatch, Ecolab, BASF, Solenis, Acuro Organics, and Kemira. These companies lead through innovation in eco-friendly and high-performance formulations for desalination, power generation, and industrial water treatment. Asia-Pacific dominated the global market with a 37.5% share in 2024, driven by rising industrialization, expanding desalination capacity, and growing water reuse initiatives across China and India. North America followed with a 27.8% share, supported by strong demand in power and oil & gas sectors, while Europe accounted for 24.6% share, led by stringent environmental standards and a shift toward phosphate-free antiscalants.

Market Insights

- The global antiscalants market was valued at USD 3,736 million in 2024 and is projected to reach USD 6,230 million by 2032, growing at a CAGR of 6.6% during the forecast period.

- Rising demand for efficient water treatment and desalination processes across industrial, municipal, and power sectors drives the market, with the water treatment industry holding a 45% share due to large-scale usage in RO and cooling systems.

- Key trends include the development of phosphate-free and biodegradable polymer-based antiscalants, driven by global sustainability goals and stricter discharge regulations.

- Leading players such as Kurita, BASF, Ecolab, Veolia, and Kemira are focusing on R&D, product expansion, and eco-friendly innovations to strengthen their global presence and meet growing industrial requirements.

- Asia-Pacific led the market with a 37.5% share in 2024, followed by North America at 27.8% and Europe at 24.6%, supported by strong industrialization, regulatory initiatives, and technological advancements in water treatment infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the type segment, the sulfonate-based antiscalants lead with an estimated share of around 30-35 % in 2024, supported by their superior thermal stability and performance in high-pressure environments. These products excel in oil & gas and desalination sectors where barium sulfate and calcium sulfate scaling challenges arise. Their ability to function in both acidic and alkaline conditions enhances adoption. Meanwhile phosphonate-based antiscalants exhibit rapid growth due to their effectiveness in RO membranes and cooling towers, driving expansion across water treatment applications.

- For instance, Italmatch Chemicals S.p.A. offers the Belgard® product range, including formulations like Belgard® EV2030 and Albrivap® 141, specifically designed for use as antiscalants in thermal desalination systems (such as MSF and MED units).

By Application

Within the application segment, the reverse osmosis (RO) systems sub-segment holds the dominant share, estimated at around 40 % in 2024, as increasing desalination and brackish water treatment plants rely heavily on scale control chemicals. Antiscalants in RO systems prevent membrane fouling and scaling, thereby enhancing system life and reducing downtime. Growth in membrane technology and stricter water purity regulations drive demand. Boilers and heating systems and cooling water systems follow as important applications due to their high susceptibility to scale formation and the need for maintenance-saving solutions.

- For instance, Kurita Water Industries Ltd. validated its Kuriverter® IK-110 antiscalant in a 3,600 m³/day RO plant, reducing differential pressure increases across membranes from 0.35 bar/week to under 0.05 bar/week. The trial extended membrane cleaning intervals from 30 days to 180 days, improving system uptime by over 700 operational hours annually under real-field conditions.

By End-Use Industry

In the end-use industry segment, the water treatment industry dominates with about 45 % share in 2024, driven by municipal and industrial focus on clean water reuse and stricter environmental discharge norms. Antiscalants help maintain equipment efficiency in water and wastewater treatment plants, desalination facilities and large-scale membrane systems. The oil & gas sector stands out as a strong growth area, thanks to its high consumption of water in extraction, production and refining processes, which increases scaling risks and thus demand for advanced antiscalants.

Key Growth Drivers

Rising Demand for Desalination and Water Reuse

Global water scarcity is accelerating the expansion of desalination and water reuse projects. Antiscalants play a critical role in reverse osmosis and multi-stage flash systems by preventing scale buildup and extending membrane life. Countries in the Middle East, Asia-Pacific, and Africa are investing heavily in desalination plants to secure freshwater supply. Growing dependence on seawater desalination in industrial and municipal applications directly boosts antiscalant consumption, as continuous operation efficiency and cost savings remain key priorities for plant operators.

- For instance, Veolia Water Technologies offers the Hydrex® 4000 series as a range of chemical products, including antiscalants approved by major membrane manufacturers, designed to protect and extend the lifespan of reverse osmosis membranes.

Industrial Expansion and Power Generation Growth

Increasing industrial activity across oil & gas, petrochemical, and power generation sectors is driving higher water treatment requirements. Boilers, condensers, and cooling systems in these facilities face heavy scaling, making antiscalants vital for performance stability. Rapid urbanization and rising electricity demand in emerging economies further support market expansion. The need for efficient process water management and reduced downtime in thermal power plants strengthens antiscalant adoption across large industrial operations.

- For instance, Ecolab’s Nalco Water business deployed its 3D TRASAR™ antiscalant monitoring system across a 1,200 MW coal-fired power station in India. The technology uses over 40 real-time sensors to track scaling indices, enabling automated dosage adjustments that reduced condenser cleaning frequency from every 90 days to 240 days and improved heat-exchange efficiency by 2.8 MW of net output.

Stringent Environmental and Regulatory Standards

Governments worldwide are tightening water quality and discharge standards, encouraging the use of advanced antiscalants. Environmental regulations promote eco-friendly, biodegradable, and phosphate-free formulations that minimize chemical residues. Industrial facilities are adopting high-performance polymeric products to meet compliance and sustainability targets. The shift toward green chemistry creates opportunities for innovation in environmentally safe antiscalants. These developments support market growth while enabling industries to achieve operational efficiency and regulatory alignment simultaneously.

Key Trends and Opportunities

Adoption of Green and Biodegradable Antiscalants

Sustainability is driving the transition to non-toxic, biodegradable antiscalant chemistries. Manufacturers are developing phosphate-free and polymer-based formulations with minimal environmental impact. Demand for green products is strong in Europe and North America, where discharge limits on phosphonates are strict. These new formulations maintain performance in harsh operating environments while meeting global eco-label requirements. The growing preference for sustainable chemicals provides significant opportunities for product differentiation and long-term contracts with environmentally conscious clients.

- For instance, Kemira Oyj’s “KemEguard®” series includes phosphorus-free biodegradable antiscalants designed for desalination and membrane applications. The product line supports use in feed waters with total dissolved solids up to 70,000 mg/L and features homopolymers with molecular weights around 1,200 g/mol that degrade under aerobic conditions per OECD 306 testing protocols.

Digitalization and Predictive Maintenance Integration

Digital monitoring and predictive maintenance are transforming the water treatment industry. Smart dosing systems and IoT-enabled monitoring devices optimize antiscalant performance in real time. Data-driven insights allow operators to predict scaling trends and adjust chemical feed rates efficiently. Companies integrating digital platforms into chemical management systems gain better operational control and reduced chemical waste. This trend supports higher adoption of intelligent water treatment solutions across desalination, industrial cooling, and process water plants.

- For instance, Solenis deployed its OnGuard™ 3S analyzer and OnGuard™ P controller in a mineral-processing facility treating flows between 450 m³/hr and 1,100 m³/hr. The system recorded scale build-up metrics every 15 minutes, and the automated dosing reduced antiscalant consumption by 20% while enabling a shift from manual dosing to fully automated chemical feed control.

Emerging Markets and Infrastructure Investments

Rapid industrialization in Asia-Pacific, Latin America, and the Middle East is creating strong opportunities for antiscalant suppliers. Governments are investing in large-scale desalination projects, wastewater recycling plants, and industrial infrastructure to meet rising water demand. Local production capabilities and technology partnerships are expanding to support regional growth. These investments strengthen supply chains and reduce dependence on imports, paving the way for long-term market expansion across emerging economies.

Key Challenges

Environmental Concerns and Chemical Residue Management

Despite their benefits, certain phosphonate-based antiscalants contribute to environmental pollution through phosphorus discharge. Strict disposal regulations in Europe and North America limit the use of conventional formulations. This forces manufacturers to reformulate or replace phosphorous-containing products, increasing production costs. Developing efficient yet eco-safe alternatives remains a challenge. Balancing performance and biodegradability is crucial to maintaining competitiveness and meeting global sustainability requirements.

Price Volatility and Raw Material Constraints

Fluctuations in raw material prices, especially for phosphonates and polymers, affect overall manufacturing costs. Supply chain disruptions and geopolitical tensions also influence raw material availability. These challenges pressure producers to maintain stable pricing while ensuring quality and regulatory compliance. High R&D costs for new formulations further strain profitability. Strategic sourcing, backward integration, and regional partnerships are increasingly vital for mitigating volatility and ensuring steady supply in a competitive global market.

Regional Analysis

North America

North America held a 27.8% share of the global antiscalants market in 2024, supported by the region’s strong industrial water treatment infrastructure and growing desalination activities. The United States leads the market due to increasing adoption of antiscalants in power generation, oil & gas, and municipal water facilities. Stricter environmental regulations from the EPA encourage the use of biodegradable, phosphate-free products. Rising investments in wastewater recycling and industrial water reuse projects further enhance demand. Key players are focusing on digital water management systems and sustainable chemistries to strengthen their market presence across the region.

Europe

Europe accounted for 24.6% of the global market share in 2024, driven by high regulatory standards for water quality and strong adoption of green water treatment solutions. Countries such as Germany, France, and the United Kingdom are major consumers due to large-scale industrial operations and strict wastewater management laws. The European Green Deal and REACH regulations are promoting the use of eco-friendly polymer-based antiscalants. Growth in desalination plants across Southern Europe and rising demand in power and manufacturing sectors continue to support regional expansion. Sustainability and circular water usage remain central to market growth.

Asia-Pacific

Asia-Pacific dominated the antiscalants market with a 37.5% share in 2024, led by China, India, Japan, and South Korea. Rapid urbanization, rising industrial output, and growing water scarcity are driving large-scale adoption of antiscalants in desalination and industrial cooling systems. China’s expanding petrochemical and power generation sectors significantly contribute to market growth. India’s investments in wastewater recycling and municipal treatment facilities further boost demand. Local production capacity expansion and increasing focus on cost-effective, high-performance formulations strengthen the region’s leadership. Government initiatives promoting water conservation and industrial efficiency are expected to sustain strong growth through 2032.

Latin America

Latin America captured a 6.1% share of the global antiscalants market in 2024, with Brazil and Mexico leading due to expanding industrial and energy sectors. The region’s growing reliance on water treatment solutions for mining, oil refining, and power generation drives adoption. Governments are investing in desalination plants and municipal wastewater projects to combat water shortages in arid regions. Increasing awareness of scaling control in industrial systems also supports demand. Partnerships with international chemical producers are improving access to advanced formulations and digital monitoring technologies, enhancing operational efficiency and reducing treatment costs.

Middle East & Africa

The Middle East and Africa held a 4.0% share of the global market in 2024, driven by extensive desalination capacity and rapid industrial development. Saudi Arabia, the UAE, and South Africa are major markets due to their heavy dependence on seawater desalination for potable and industrial water supply. Continuous investments in reverse osmosis and multi-stage flash distillation systems fuel demand for high-performance antiscalants. The region’s focus on energy-efficient desalination and sustainability initiatives promotes adoption of environmentally safe formulations. Strategic collaborations between global suppliers and regional utilities further support long-term market growth.

Market Segmentations:

By Type

- Phosphonate-based antiscalants

- Carboxylate-based antiscalants

- Sulfonate-based antiscalants

- Others

By Application

- Reverse osmosis (RO) systems

- Boilers and heating systems

- Cooling water systems

- Others

By End Use Industry

- Water treatment

- Oil & gas

- Power generation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the antiscalants market includes key players such as Kurita, Veolia, Dow, Syensqo, Italmatch, Ecolab, BASF, Solenis, Acuro Organics, and Kemira. These companies focus on developing advanced antiscalant formulations that enhance water system performance, prevent scaling, and ensure environmental compliance. Strategic initiatives include mergers, product innovations, and global partnerships to expand presence in industrial water treatment and desalination applications. For instance, BASF and Kemira continue to invest in sustainable, biodegradable polymer chemistries, while Veolia and Ecolab emphasize integrated water management solutions combining chemical and digital services. Kurita and Italmatch lead in developing eco-efficient phosphonate alternatives for high-temperature operations. Meanwhile, Dow and Solenis strengthen their competitive edge through R&D in membrane-compatible and low-fouling products. The market remains moderately consolidated, with leading players prioritizing sustainability, performance efficiency, and technological collaboration to capture long-term growth opportunities across diverse end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kurita

- Veolia

- Dow

- Syensqo

- Italmatch

- Ecolab

- BASF

- Solenis

- Acuro Organics

- Kemira

Recent Developments

- In April 2024, Italmatch Chemicals S.p.A. unveiled a new biodegradable antiscalant technology aimed at household, industrial and institutional water treatment applications.

- In April 2024, Syensqo N.V. announced a specialty antiscalant formulation free of phosphonates, aimed at environmentally-sensitive brine systems such as forward-osmosis reuse installations.

- In 2024, Dow Inc. announced enhancements to its ACUMER™ scale inhibitor/antiscalant portfolio, including traceable polymer technology for complex production waters

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The antiscalants market will grow steadily with increasing global demand for clean water.

- Expansion of desalination plants will remain a key growth driver across coastal regions.

- Adoption of eco-friendly and phosphate-free formulations will accelerate due to environmental regulations.

- Industrial sectors will continue to rely on antiscalants for maintaining operational efficiency and system longevity.

- Technological advancements in polymer-based products will enhance performance under extreme conditions.

- Integration of digital monitoring and smart dosing systems will optimize antiscalant usage and cost efficiency.

- Asia-Pacific will remain the fastest-growing region due to industrialization and infrastructure development.

- Strategic collaborations between chemical manufacturers and water utilities will support market expansion.

- Increased focus on circular water economy and wastewater recycling will create new opportunities.

- Continuous R&D investment will drive innovation in high-efficiency, low-toxicity antiscalant solutions.