Market Overview:

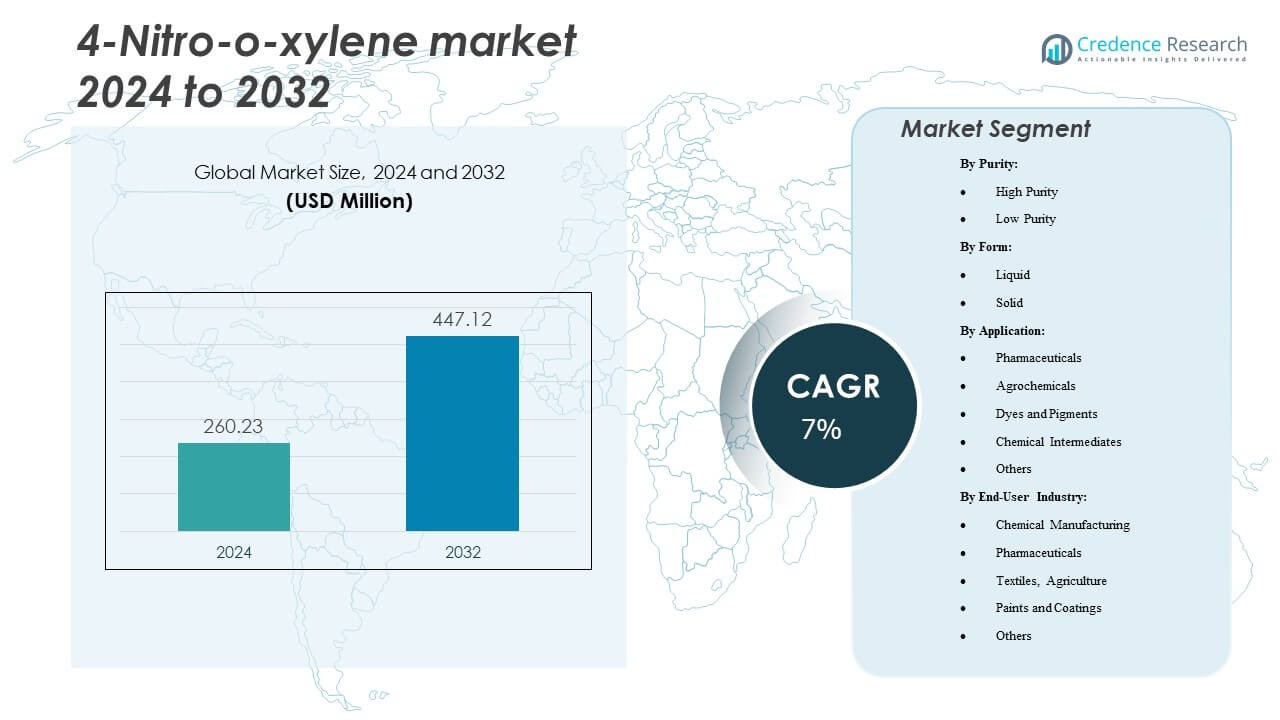

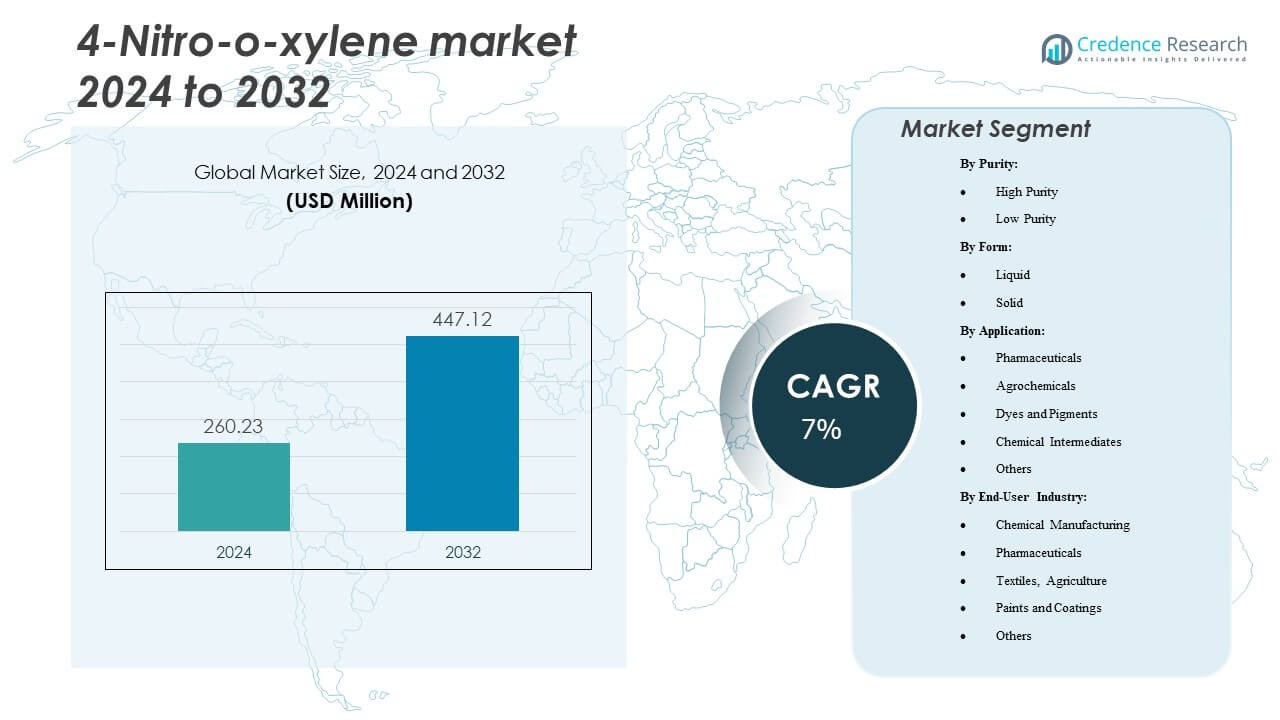

The 4-Nitro-o-xylene market is projected to grow from USD 260.23 million in 2024 to an estimated USD 447.12 million by 2032, with a compound annual growth rate (CAGR) of 7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 4-Nitro-o-xylene Market Size 2024 |

USD 260.23 Million |

| 4-Nitro-o-xylene Market, CAGR |

7% |

| 4-Nitro-o-xylene Market Size 2032 |

USD 447.12 Million |

Market growth is mainly fueled by increasing demand for high-quality intermediates in pharmaceuticals and agrochemicals, where 4-Nitro-o-xylene is used for synthesizing specialty products. Expanding healthcare and agricultural sectors, significant investments in research and development, and new technology adoption continue to boost production capacity and application diversity. Enhanced efficiency in chemical processing and the push for product innovation strengthen its role in global supply chains, supporting the broader specialty chemicals industry.

Regionally, Asia Pacific leads the 4-Nitro-o-xylene market due to well-developed chemical manufacturing infrastructure and vibrant industrial activity, especially in China and India. North America and Europe remain important, driven by advanced pharmaceutical and specialty chemical industries. Meanwhile, Latin America and the Middle East & Africa show potential for future growth, supported by rising industrialization, investments in manufacturing, and shifting demand patterns for specialty intermediates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The 4-Nitro-o-xylene market is projected to rise from USD 260.23 million in 2024 to USD 447.12 million by 2032, reflecting robust growth.

- Pharmaceutical intermediates and agrochemical applications remain the main drivers, with ongoing R&D enhancing versatility.

- Demand from dyes, pigments, and specialty chemicals supports market expansion and strengthens sector integration.

- Technological advancements increase availability of high-purity 4-Nitro-o-xylene, driving new applications and process efficiencies.

- Cost and regulatory challenges restrain market momentum but continue pushing manufacturers toward compliance and operational optimization.

- Asia Pacific dominates, led by China and India with strong manufacturing infrastructure and continuous industrial growth.

- Emerging regions in Latin America and the Middle East & Africa show steady potential, promoted by industrial investments and agricultural activity.

Market Drivers

Reflecting Pharmaceutical and Agrochemical Industry Expansion

The consistent expansion of the pharmaceutical sector stands out as a central driver within the 4-Nitro-o-xylene market. Pharmaceutical companies rely on 4-Nitro-o-xylene as an intermediate for synthesizing critical drug components, underlying its essential role in innovative medicine formulation. The growth of the global pharmaceutical industry, particularly in emerging economies, continues to enhance the consumption of this compound. Strong investments in healthcare infrastructure and research have reinforced its importance, especially where regulatory bodies push for high-quality intermediates. The need to meet rising population health demands creates a sustainable upward trajectory. Agrochemicals also bolster demand due to persistent efforts to improve crop yield and food security. Increases in agricultural activities and a push for productivity have boosted the use of 4-Nitro-o-xylene in manufacturing herbicides and pesticides. The integration of new chemical synthesis technology in both pharmaceutical and agricultural sectors ensures this market maintains growth.

- For instance, Bayer inaugurated a new manufacturing facility in Berlin, Germany, in November 2023, dedicated to sterile formulation, filling, and freeze-drying of pharmaceuticals, supporting the global supply of therapies such as Eylea for ophthalmology, and strengthening its leadership in high-demand, high-quality intermediates.

Technological Developments and Advancements in Chemical Processing Supporting Market Dynamics

The adoption of advanced technologies in chemical synthesis and processing allows industry participants to achieve higher yields and better product quality for 4-Nitro-o-xylene applications. Innovations in catalyst technology and manufacturing processes help reduce production costs and environmental impact, enhancing the appeal of 4-Nitro-o-xylene as a preferred intermediate. Industry experts highlight that investment in research and development across chemical enterprises further supports these trends. It enables organizations to discover novel uses and blend 4-Nitro-o-xylene into broader product portfolios. With a shift towards automation and cleaner production technologies, it enjoys increased utilization in multiple synthesis streams. Sophisticated laboratory infrastructure has accelerated the pace of product development in the pharmaceutical and agricultural verticals, further solidifying 4-Nitro-o-xylene’s strategic value.

Expanding Demand in Agrochemicals and Specialty Chemicals Industries Elevating Market Growth

The role of 4-Nitro-o-xylene as a key intermediate in the agrochemicals sector intensifies its market demand, as companies seek to develop effective herbicides, insecticides, and fungicides. Growing world population pressures the agricultural sector to maximize productivity, where 4-Nitro-o-xylene-based formulations play a pivotal role. Industry stakeholders leverage this compound for cost-effective manufacturing, aligning production with higher efficiency and sustainability standards. The specialty chemicals segment has also emerged as a strong demand contributor, driven by rising application diversity in industrial coatings, pigments, and dyes. As textile industries grow, requirements for high-quality colorants and finishing agents benefit 4-Nitro-o-xylene consumption. Global chemical companies increasingly focus on value-added products through R&D, ensuring continued relevance for this market.

Globalization and Manufacturing Hubs’ Emergence Driving Regional Demand Patterns

The rise of significant manufacturing hubs in the Asia-Pacific region notably strengthens the 4-Nitro-o-xylene market proposition. China and India host robust chemical production infrastructure, supporting large-scale pharmaceutical and agrochemical manufacturing. Government support for industrial expansion, policy incentives, and increased foreign investment underpin regional growth. North America and Europe retain major market shares, buoyed by advanced healthcare and chemical manufacturing capabilities. Developing nations in Latin America and the Middle East capture emerging growth, targeting food security and industrial modernization. Regional integration and new trade alliances allow manufacturers to optimize supply chains and expand market reach, making the 4-Nitro-o-xylene market increasingly global in scope.

- For example, Jay Finechem operates a manufacturing facility in Vapi, India, equipped with advanced production and quality control systems that comply with international regulatory standards. The company exports specialty and fine chemical intermediates to global markets, supporting diversified industrial supply chains.

Market Trends

Shifting Focus Toward Sustainable Chemistry and Circular Economy Principles in the 4-Nitro-o-xylene Market

Companies participating in the 4-Nitro-o-xylene market pursue sustainability by investing in green chemistry practices and reducing negative environmental impact. Circular economy initiatives inspire organizations to minimize waste, recycle process intermediates, and foster energy efficiency in manufacturing operations. Regulatory frameworks, particularly in Europe and North America, incentivize sustainable production, steering development towards eco-friendly technologies. Market players introduce cleaner production techniques, emphasizing value chain transparency and raw material traceability. Stakeholders respond to consumer and end-user demand for lower environmental impact by adapting eco-centric product development strategies. The adoption of sustainable practices enhances brand positioning, creates differentiation, and addresses tightening global environmental regulations.

- For instance, BASF’s Ludwigshafen site utilized its Verbund system to save 17.3 million megawatt-hours of energy and avoid 3.5 million metric tons of CO₂ emissions in 2023 by recycling heat and integrating production processes.

Integration of Digital Technologies and Data-Driven Insights Transforming Market Operations

Digitalization reshapes market operations in the 4-Nitro-o-xylene industry, delivering real-time monitoring, predictive maintenance, and process optimization capabilities. Companies deploy automation, artificial intelligence, and advanced analytics to optimize batch processes, maintain product consistency, and reduce downtime. It helps detect inefficiencies early and improves asset utilization, leading to operational cost reductions. Data-driven insights enable manufacturers to predict market trends, adjust production levels, and identify potential supply chain bottlenecks preemptively. Digital process transformation allows for faster adaptation to consumer needs, regulatory updates, and volatile market dynamics. Industry leaders recognize digital technology as a competitive differentiator, helping them enhance market share and profitability.

Product Differentiation and Innovative Applications Promoting Market Diversification

The search for innovative applications provides a distinctive market trend, encouraging producers to develop differentiated grades of 4-Nitro-o-xylene for emerging markets. High-purity segment growth attracts pharmaceutical and electronics manufacturers seeking superior performance intermediates. Companies innovate in value-added applications, such as advanced materials and niche specialty products, broadening market capitalization. Competitive differentiation strategies include extensive application development, custom synthesis, and specialty packaging. These trends drive higher margins, foster customer loyalty, and attract global buyers from diversified industries. The evolving preference for tailored solutions supports long-term demand for 4-Nitro-o-xylene products.

Market Regionalization and Expansion into Untapped Geographies Shaping Market Landscape

Regionalization emerges as a significant trend, with stakeholders targeting underpenetrated markets to diversify revenue streams. Southeast Asia, Latin America, and Africa present new urbanization and industrialization opportunities. Enterprises capitalize on government-driven incentives, local capacity building, and supply chain localization to tap into these areas. Establishing production or distribution bases in emerging economies leads to greater market accessibility and compliance with local regulations. Proactive industry participants monitor demographic transitions and regulatory shifts to adapt product portfolios for varied requirements. These strategic moves stimulate overall market expansion for the 4-Nitro-o-xylene industry.

- For instance, Indian specialty-chemical manufacturer Anupam Rasayan reports a combined installed capacity of about 27,200 tonnes per annum across its units a concrete example of how regional producers scale capacity to serve local and export demand.

Market Challenges

Relating to Cost, Regulation, and Supply Chain Volatility

Managing cost and regulatory compliance remains a fundamental challenge in the 4-Nitro-o-xylene market. Volatile raw material costs, particularly for xylene feedstock, consistently affect profit margins for manufacturers. Fluctuations tied to oil prices, global supply-demand disruptions, and shifting economic cycles create unpredictability in procurement and planning. Stringent regulatory scrutiny, particularly for health and environmental protection, mandates adherence to strict production and quality standards, driving up compliance costs. Manufacturers must also cope with evolving regional and international chemical legislation, which can restrict operational flexibility and market access. It is imperative to balance efficiency with regulatory requirements to avoid disruptions that could hurt competitiveness or increase operational expenses.

Industry Facing Environmental Pressures and Sustainability Constraints

Environmental sustainability presents a formidable challenge for the 4-Nitro-o-xylene market, as stakeholders must address the ecological and health impacts of production. Regulators and consumers are pushing for reduced waste generation, lower emissions, and adoption of cleaner manufacturing technologies. It faces increasing costs for waste management, emissions mitigation, and treatment of hazardous byproducts. Environmental audits and certifications, especially in developed regions, further impact operational budgets and compliance strategies. Companies unwilling or unable to invest in sustainable solutions may experience diminished brand reputation or lose access to lucrative markets. Navigating this landscape requires proactive adoption of green practices, continued innovation, and transparency throughout the value chain.

Market Opportunities

Pharmaceutical Growth, Innovation, and Collaboration

Expanding pharmaceutical industries globally represent a prominent opportunity in the 4-Nitro-o-xylene market. Growth in demand for active pharmaceutical ingredients highlights the significance of high-purity intermediates. Companies investing in research and development, pursuing strategic partnerships, and leveraging technology use it to develop new drug formulations and enhance supply resilience. Collaboration with universities, research organizations, and global supply networks accelerates discovery of new compounds and production routes. It creates favorable conditions for market entry in emerging economies by linking local capacity with global expertise. Firms focusing on rapid innovation and agile development seize emerging opportunities as healthcare needs evolve worldwide.

Leveraging New Regional Markets and Value-Added Applications for Market Expansion

Market expansion prospects remain strong as companies explore untapped regions with rising industrialization and urbanization. Targeting countries across Southeast Asia, Latin America, and Africa enables access to new user industries and growing consumer bases. The pursuit of value-added applications, including specialty chemicals, pigments, and electronic intermediates, unlocks higher margins and diverse revenue streams. Companies adapt product portfolios to fit local regulatory frameworks, consumer preferences, and industrial setups in these regions. Strategic localization and tailored marketing initiatives support competitive differentiation and enduring presence. It positions leading manufacturers advantageously to capitalize on the next wave of global economic growth

Market Segmentation Analysis:

By Purity: The high purity segment in the 4-Nitro-o-xylene market serves pharmaceutical synthesis and laboratory processes, where strict quality standards and traceability are vital. It finds primary use as an intermediate for drug development, research, and advanced specialty chemicals, commanding a premium for its reliability and consistent performance. Low purity 4-Nitro-o-xylene remains essential in bulk chemical and agrochemical sectors, offering cost-effective raw material options for large-scale manufacturing. It supports broad applications where less stringent specifications suffice, ensuring steady demand from producers focused on price competitiveness and volume supply.

- For instance, Merck’s For Synthesis product line is produced under an ISO 9001:2015–certified quality management system, reflecting adherence to international standards for consistency and quality in laboratory chemical manufacturing.

By Form: Liquid form is dominant in the 4-Nitro-o-xylene market, supplying chemical and pharmaceutical manufacturing where solubility and convenience in handling are required. Its versatility, ease of dosing, and formulation compatibility make it the preferred choice for continuous industrial processes. Solid form remains essential for niche uses, supporting stability needs for transport, storage, and distinct reaction environments. It finds adoption in applications demanding long shelf-life and precise measurement, contributing to specialized product offerings in the 4-Nitro-o-xylene market.

- For instance, Sigma-Aldrich provides reagent grade liquid 4-Nitro-o-xylene at ≥98.0% purity, with full batch documentation, supporting pharmaceutical and advanced chemical synthesis applications

By Application: The application profile of the 4-Nitro-o-xylene market encompasses pharmaceuticals, agrochemicals, dyes and pigments, and chemical intermediates. Pharmaceutical manufacturing leads demand due to the compound’s critical role in synthesizing medication ingredients, closely followed by growing use in crop protection chemicals and the production of textile and coating dyes.

By end-user industries, chemical manufacturing and pharmaceuticals dominate, supported by the compound’s versatile intermediate properties. The textiles, agriculture, and paints and coatings sectors continue to expand practical uses for 4-Nitro-o-xylene, with ongoing research and diversification contributing to future growth potential in allied industries.

Segmentation:

By Purity:

By Form:

By Application:

- Pharmaceuticals

- Agrochemicals

- Dyes and Pigments

- Chemical Intermediates

- Others

By End-User Industry:

- Chemical Manufacturing

- Pharmaceuticals

- Textiles, Agriculture

- Paints and Coatings

- Others

By Region:

- Asia Pacific: China, India, Japan, South Korea, Australia, Southeast Asia

- North America: United States, Canada

- Europe: Germany, France, Italy, United Kingdom, Spain, Russia, Others

- Latin America: Mexico, Brazil, Others

- Middle East & Africa: Saudi Arabia, South Africa, UAE, Others

Regional Analysis:

Asia Pacific holds a commanding position in the 4-Nitro-o-xylene market, representing the largest regional share of around 40–45%. China and India drive consumption through robust pharmaceutical, agrochemical, and chemical manufacturing industries. Accelerated industrialization and continued investment in process innovation underpin regional growth, with the market projected to expand at a CAGR exceeding 6% through the forecast period. Its dominance rests on the concentration of leading producers and rising demand for specialty chemicals in rapidly evolving economies.

North America accounts for an estimated 20–25% of the 4-Nitro-o-xylene market. The region’s advanced healthcare infrastructure and strong chemical industry support steady consumption of high-purity intermediates, with sustained demand in pharmaceuticals, dyes, and agrochemicals. Ongoing investments in agricultural modernization and research activities reinforce market presence, securing North America’s reputation for reliable supply and quality standards. It continues to provide growth opportunities for manufacturers responding to regulatory and innovation-driven shifts in demand.

Europe commands roughly 25–30% of market share in the 4-Nitro-o-xylene market, led by established healthcare and specialty chemical sectors. Germany, France, Italy, and the UK serve as key markets, leveraging sophisticated production capabilities and rising demand for advanced chemical intermediates. The region’s textile and paint industries fuel further expansion in dyes and pigments applications. Stringent environmental policies and technological advancements support ongoing market development, positioning Europe as a dynamic market for differentiated product offerings and research-driven innovations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The competitive landscape of the 4-Nitro-o-xylene market features a mix of well-established global companies and regional specialists offering a range of high-purity chemical intermediates. Major multinational chemical firms such as BASF SE, Dow Chemical Company, and Eastman Chemical Company hold sizable market shares based on their extensive product portfolios, strategic research and development, and supply chain presence. Manufacturers in China and India, including Reshmika Minerals & Chemicals Private Limited, Anupam Rasayan India Ltd., and AARTI Industries Limited, enhance market competitiveness through scale and diversified applications. It benefits from capacity expansions, partnerships, and mergers designed to increase production and address rising demand from pharmaceuticals, agrochemicals, and specialty chemicals. Industry participants compete on product quality, purity, operational efficiency, and sustainability. Many focus on innovation and regulatory compliance to remain agile as customer requirements evolve and environmental standards tighten.

Recent Developments:

- In October 2025, BASF SE announced a binding agreement with Carlyle and Qatar Investment Authority to carve out its coatings business into a standalone entity, valued at €7.7 billion. As part of the transaction, BASF will retain a 40% equity stake in the new company and expects the deal to close in Q2 2026, positioning BASF for continued growth and innovation in specialty chemicals markets.

- In June 2025, Dow Chemical Company revealed its intention to divest its 50% interest in the DowAksa joint venture to its partner Aksa Akrilik Kimya Sanayii A.Ş., a transaction expected to close in Q3 2025. The strategic move will allow Dow to focus on its core downstream business areas, aiming for balanced capital allocation and alignment with high-value specialties in the chemical segment.

- In February 2025, Anupam Rasayan India Ltd signed a long-term supply agreement with a leading US multinational to deliver high-performance specialty chemicals for advanced polymer applications. This 10-year deal, valued at approximately ₹1,697 crore, marks the company’s expansion into sophisticated polymer segments and reinforces its relationship with global customers in defense and aeronautics.

Report Coverage:

The research report offers an in-depth analysis based on purity, form, application and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Pharmaceutical manufacturing remains a leading driver of demand, with expanding drug synthesis fueling continued growth in the 4-Nitro-o-xylene market.

- Growth in the agrochemical sector boosts market expansion, as producers seek intermediates for more effective pesticides and herbicides.

- Rising demand for dyes and pigments, especially in textiles and printing, ensures persistent consumption of 4-Nitro-o-xylene among specialty chemical firms.

- The Asia Pacific region retains dominance, leveraging strong industrial infrastructure and robust demand from China and India.

- North America and Europe maintain strong market shares, supported by advanced healthcare, chemical manufacturing, and ongoing industry innovation.

- Advancements in purification technology are making high-purity 4-Nitro-o-xylene more accessible, driving new applications in critical industries.

- Stringent global regulatory standards are pushing for improved product quality, supporting growth in the high-purity segment.

- Companies are investing in research and development, exploring innovative uses beyond traditional pharmaceutical and agricultural applications.

- Expansion into untapped regions across Latin America, the Middle East, and Africa presents opportunities for diversified market participants.

- Strategic partnerships, mergers, and acquisitions among key players will shape future competition, driving technological progress and efficiency.