Market Overview

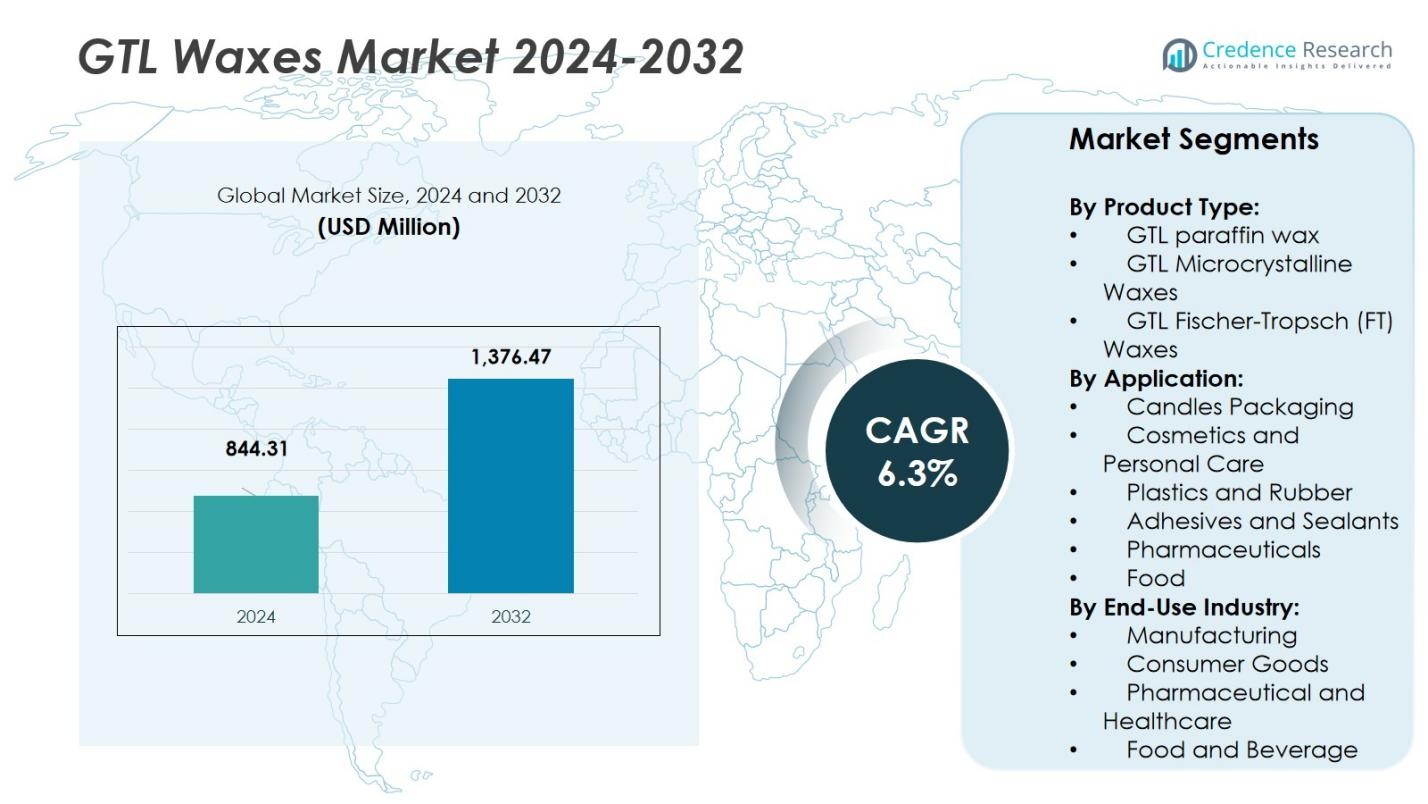

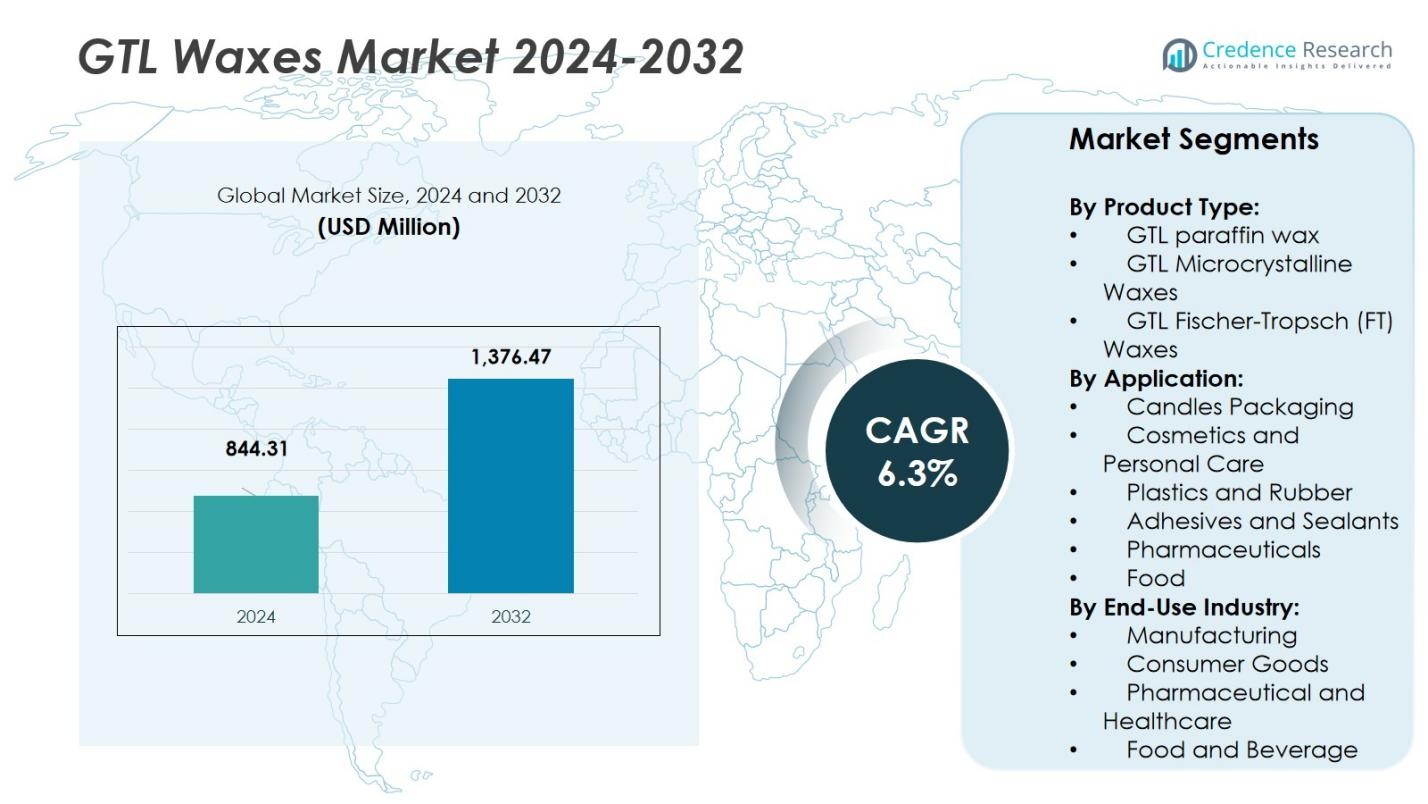

The GTL Waxes Market size was valued at USD 844.31 million in 2024 and is anticipated to reach USD 1,376.47 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GTL Waxes Market Size 2024 |

USD 844.31 Million |

| GTL Waxes Market, CAGR |

6.3% |

| GTL Waxes Market Size 2032 |

USD 1,376.47 Million |

The GTL Waxes Market features prominent players including BASF SE, Clariant, Numaligarh Refinery Limited, Trecora Resources, Indian Oil Corporation Ltd (IOCL), Goyel Chemical Corporation, Nippon Seiro Co., Ltd., Avery Dennison Corporation, Marcusoil, and Mitsui Chemicals, Inc. These companies lead the market through advanced technologies and strong distribution networks. The Asia Pacific region holds a dominant position with a market share of 65.9%, driven by high demand in countries like China, India, and Japan, where industries such as cosmetics, packaging, and personal care are rapidly growing. North America is also witnessing substantial growth, fueled by the demand for high-purity waxes in the cosmetics and food packaging sectors. Europe, with a market share of 12.5%, is focusing on sustainable and premium products, while regions like the Middle East, Africa, and Latin America offer growth opportunities despite currently holding smaller market shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The GTL Waxes Market was valued at USD 844.31 million in 2024 and is expected to reach USD 1,376.47 million by 2032, growing at a CAGR of 6.3% during the forecast period.

- Rising demand for high-quality candles, sustainable packaging, and eco-friendly products are key drivers fueling market growth. Increasing consumer preference for clean-burning, premium candles is boosting the use of GTL paraffin wax.

- Growing focus on sustainability and clean production processes is driving trends in GTL wax innovation, with a focus on high-purity waxes for cosmetics and food packaging applications.

- The market faces restraints such as high production costs due to the energy-intensive Fischer-Tropsch process, which may limit price competitiveness in cost-sensitive industries.

- The Asia Pacific region dominates with 65.9% market share, followed by North America (15%) and Europe (12.5%), with emerging growth opportunities in the Middle East, Africa, and Latin America.

Market Segmentation Analysis:

By Product Type:

The GTL Waxes market is segmented into GTL paraffin wax, GTL microcrystalline waxes, and GTL Fischer-Tropsch (FT) waxes. Among these, GTL paraffin wax dominates the segment, holding the largest market share due to its wide application in industries like candles, cosmetics, and packaging. This product type accounts for approximately 45% of the overall market share. The growing demand for high-quality, clean-burning candles and packaging solutions is driving the growth of this sub-segment. The superior quality and consistency of GTL paraffin wax, derived from the Fischer-Tropsch process, further fuel its market dominance.

- For instance, Evonik Industries AG focuses on GTL Fischer-Tropsch waxes applied in cosmetics and personal care products, leveraging their high melting point and purity obtained via the Fischer-Tropsch process for enhanced product quality.

By Application:

The GTL Waxes market is utilized in various applications, including candles, packaging, cosmetics and personal care, plastics and rubber, adhesives and sealants, pharmaceuticals, and food. The dominant sub-segment within this category is the candles application, which holds a significant share of about 40%. The increasing consumer preference for high-quality candles, driven by their clean burn and lack of harmful emissions, is propelling the demand for GTL paraffin wax in this segment. Additionally, the growing interest in luxury candles and aromatherapy further contributes to the market expansion.

- For instance, Shell GTL Waxes are widely used in premium candle manufacturing due to their high purity, odorless nature, and ability to support vibrant colors and fragrances, making them a preferred choice for luxury candle brands seeking clean-burning products.

By End-Use Industry:

In terms of end-use industries, the GTL Waxes market is primarily segmented into manufacturing, consumer goods, pharmaceutical and healthcare, and food and beverage. The consumer goods sector leads this segment, accounting for nearly 50% of the market share. This dominance is attributed to the extensive use of GTL waxes in the production of candles, cosmetics, and packaging materials, all of which are key components of consumer goods. The rising disposable income, coupled with a growing demand for premium consumer goods, continues to drive growth in this sub-segment, making it the largest contributor to the market.

Key Growth Drivers

Rising Demand for High-Quality Candles

The increasing consumer demand for premium, clean-burning candles is a major driver for the GTL Waxes market. GTL paraffin wax, which is known for its superior quality and minimal soot production, is preferred by manufacturers of high-end candles. The growing popularity of aromatherapy and luxury candles, particularly in the North American and European markets, fuels the demand for these waxes. For instance, leading candle brands like Yankee Candle and Bath & Body Works rely on GTL waxes for their products, ensuring clean burns and longer-lasting fragrances.

- For instance, Shell’s GTL Sarawax waxes, known for their high linearity and consistent quality, are widely used in candles to ensure clean burns and vibrant color.

Growth in Cosmetics and Personal Care Industry

The rising demand for high-quality, sustainable products in the cosmetics and personal care industry is contributing to the growth of the GTL Waxes market. These waxes, especially GTL microcrystalline wax, are valued for their smooth texture, stability, and non-reactivity, making them ideal for use in skincare products, lipsticks, and lotions. As consumer preferences shift towards more eco-friendly and natural formulations, manufacturers are increasingly adopting GTL waxes as part of their sustainability initiatives. The growing focus on eco-friendly packaging further boosts this market segment.

- For instance, Shell Silk Alkane, a GTL-derived ingredient, enhances cosmetics manufacturing sustainability by providing a vegan, biodegradable, and virtually odorless alternative to crude oil derivatives, suitable for skincare and makeup formulations.

Expanding Applications in Packaging and Food Industry

The increasing use of GTL waxes in packaging, particularly for food products, is driving market growth. These waxes offer superior resistance to moisture, making them ideal for use in food packaging, particularly in the production of waxed paper and coated packaging materials. The food industry’s growing focus on safety, sustainability, and product preservation is driving this trend. As consumer demand for clean-label products and eco-friendly packaging increases, the application of GTL waxes in packaging is expected to expand significantly, boosting overall market growth.

Key Trends & Opportunities

Shift Towards Sustainable and Eco-Friendly Products

There is a growing trend toward sustainability and eco-consciousness among consumers, which presents an opportunity for GTL waxes. These waxes, especially GTL paraffin, are derived from natural gas through the Fischer-Tropsch process, making them a cleaner, more sustainable alternative to conventional petroleum-based waxes. The increasing consumer preference for eco-friendly candles, cosmetics, and packaging products is driving manufacturers to adopt GTL waxes, thus presenting growth opportunities in markets where sustainability is a major purchasing factor, such as Europe and North America.

- For instance, IGI Wax offers fully refined paraffin waxes including BPI Certified Compostable options, advancing sustainability in candles, cosmetics, and packaging with cleaner refining methods and innovations in biodegradable blends.

Technological Advancements in Wax Production

Technological innovations in wax production, particularly the Fischer-Tropsch synthesis method, offer significant opportunities for growth in the GTL Waxes market. This process allows for the production of high-purity waxes with consistent quality, which is crucial for demanding applications like cosmetics and food packaging. Ongoing advancements in production technology are helping reduce costs, improve yield, and enhance the overall quality of GTL waxes, making them more accessible to a wider range of industries. As technology continues to evolve, it will drive the expansion of the market, especially in emerging economies.

- For instance, ExxonMobil emphasizes strict quality control in its Fischer-Tropsch wax production, ensuring high consistency and low pour point through catalytic processes, supporting demanding applications requiring stable wax characteristics.

Key Challenges

High Production Costs

One of the key challenges facing the GTL Waxes market is the high production cost associated with the Fischer-Tropsch process. While this method yields high-quality, pure waxes, it is energy-intensive and requires significant investment in infrastructure and technology. As a result, the production costs for GTL waxes are generally higher than those of traditional paraffin waxes derived from crude oil. This can limit the price competitiveness of GTL waxes, particularly in cost-sensitive markets and industries, posing a challenge to broader market adoption.

Supply Chain Disruptions and Raw Material Availability

The availability and stability of raw materials for the production of GTL waxes can present challenges, particularly in regions with limited access to natural gas resources. Supply chain disruptions, such as those caused by geopolitical tensions, natural disasters, or regulatory changes, can lead to fluctuations in the cost and availability of raw materials. This creates uncertainty for manufacturers relying on a steady supply of high-quality feedstock. Ensuring a stable and reliable supply chain is crucial for sustaining growth and meeting market demand in the GTL Waxes market.

Regional Analysis

Asia Pacific

The Asia Pacific region commands a dominant position in the GTL Waxes market, holding a market share of 65.9% in 2022. This leadership is driven by strong consumer demand in countries like China, India, and Japan, along with robust packaging, cosmetics, and pharmaceutical industries. Rapid urbanization and rising disposable incomes have increased the demand for candle, personal care, and food-packaging wax applications. The region also benefits from the availability of feedstock and local production advantages, which further reinforce its dominance in the GTL wax supply chains.

North America

North America holds a smaller share of the global GTL Waxes market, contributing around 15% to the overall market. Despite its smaller share, the region is experiencing high growth, driven by the mature cosmetics and food packaging sectors that increasingly demand high-purity GTL waxes. With strong infrastructure, a number of key market players, and growing consumer preference for premium wax formulations, North America is expected to see a steady increase in demand for GTL waxes, particularly in the premium application segments, over the next few years.

Europe

Europe holds a significant portion of the GTL Waxes market with a market share of 12.5%. The demand in this region is particularly strong in cosmetics, adhesives, and specialty applications. The market share is moderate due to stringent regulations, high environmental standards, and increasing demand for sustainable wax alternatives. GTL waxes, known for their cleaner composition, are becoming more popular in premium applications, despite cost pressures and competition from other waxes. As a result, Europe is poised for steady but slower growth compared to Asia Pacific and North America.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region holds a smaller share, accounting for around 4% of the global GTL Waxes market. However, the region presents a growing opportunity due to its natural gas resources and increasing downstream value-chain activities. MEA’s strategic location for feedstock, combined with its role in export flows, strengthens its relevance in the market. While infrastructure constraints and market fragmentation temper growth, the region’s investments in petrochemicals and upstream integration position it for future expansion in the GTL wax market.

Latin America

Latin America holds a modest share of approximately 2.5% in the global GTL Waxes market. The region offers incremental growth potential, particularly in candle, packaging, and personal care applications. Driven by the expansion of consumer goods and packaging sectors, Latin America is seeing steady demand for GTL waxes. However, infrastructure gaps and feedstock scarcity remain challenges. Despite these constraints, the region’s growth is expected to be supported by targeted investments and trade flows from adjacent regions, enhancing its role in the GTL wax value chain.

Market Segmentations:

By Product Type:

- GTL paraffin wax

- GTL Microcrystalline Waxes

- GTL Fischer-Tropsch (FT) Waxes

By Application:

- Candles Packaging

- Cosmetics and Personal Care

- Plastics and Rubber

- Adhesives and Sealants

- Pharmaceuticals

- Food

By End-Use Industry:

- Manufacturing

- Consumer Goods

- Pharmaceutical and Healthcare

- Food and Beverage

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The GTL Waxes market is characterized by a competitive landscape with several prominent players such as Sasol, ExxonMobil, Royal Dutch Shell, and Chevron Phillips Chemical Company leading the market. These companies have a strong foothold in the production of GTL waxes, leveraging advanced technologies and extensive distribution networks. The competition is driven by factors such as product quality, innovation in manufacturing processes, and the ability to meet growing demand for sustainable and high-purity waxes. Key players focus on expanding their production capacities and enhancing product offerings to cater to diverse applications such as candles, cosmetics, packaging, and adhesives. Strategic collaborations, mergers, and acquisitions are commonly used to strengthen market position. Additionally, increasing demand for eco-friendly and cleaner products is prompting companies to invest in the development of more sustainable wax formulations. The competition remains fierce, with companies seeking to differentiate through product innovation and superior customer service.

Key Player Analysis

- AVERY DENNISON CORPORATION (U.S.)

- Marcusoil (U.S.)

- Nippon Seiro Co., Ltd. (Japan)

- Clariant (Switzerland)

- BASF SE (Germany)

- Trecora Resources (U.S.)

- Goyel Chemical Corporation (India)

- Indian Oil Corporation Ltd (IOCL) (India)

- Numaligarh Refinery Limited (India)

- Mitsui Chemicals, Inc. (Japan)

Recent Developments

- In July 2025, Shell MDS Malaysia introduced the new high-purity wax product line “Shell GTL SaraCare”, designed for personal-care and cosmetics applications, during the International Energy Week.

- In February 2025, Sasol Chemicals launched new micronised GTL FT wax products, SASOLWAX LC Spray 30 G and LC Spray 30 G-EF, offering approximately 32% lower carbon footprint.

- In April 2024, ExxonMobil Corporation launched a new wax product brand “Prowaxx™”.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The GTL Waxes market is expected to grow significantly due to rising demand in the cosmetics, packaging, and food industries.

- Increasing consumer preference for eco-friendly, sustainable products will drive the adoption of GTL waxes in various applications.

- Technological advancements in the Fischer-Tropsch process will improve the production efficiency and quality of GTL waxes.

- Growing demand for premium candles and clean-burning waxes will contribute to the market’s expansion.

- The shift towards sustainable packaging solutions will drive increased use of GTL waxes in food and beverage packaging.

- North America and Europe are likely to see steady growth as consumer demand for high-purity, eco-friendly waxes rises.

- The Asia Pacific region will remain a key growth driver, supported by rapid urbanization and increased disposable incomes.

- Emerging markets, particularly in Latin America and the Middle East, present new opportunities for GTL wax producers.

- Competition will intensify as more players enter the market and existing companies expand production capacities.

- The market will continue to face challenges such as high production costs and the availability of raw materials for GTL wax production.