Market overview

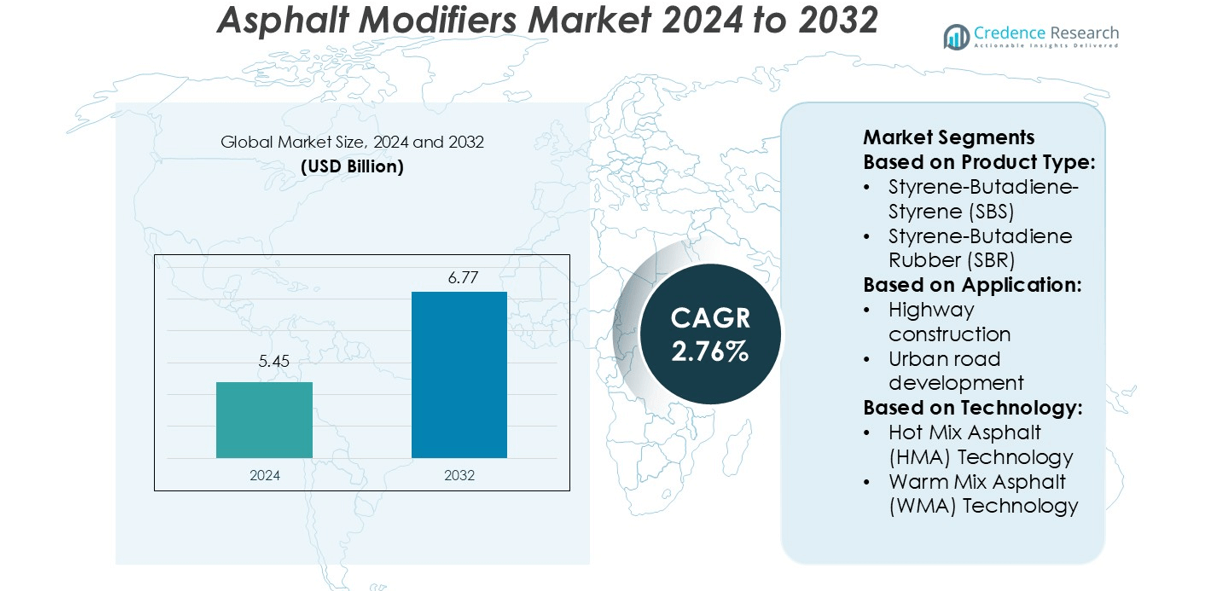

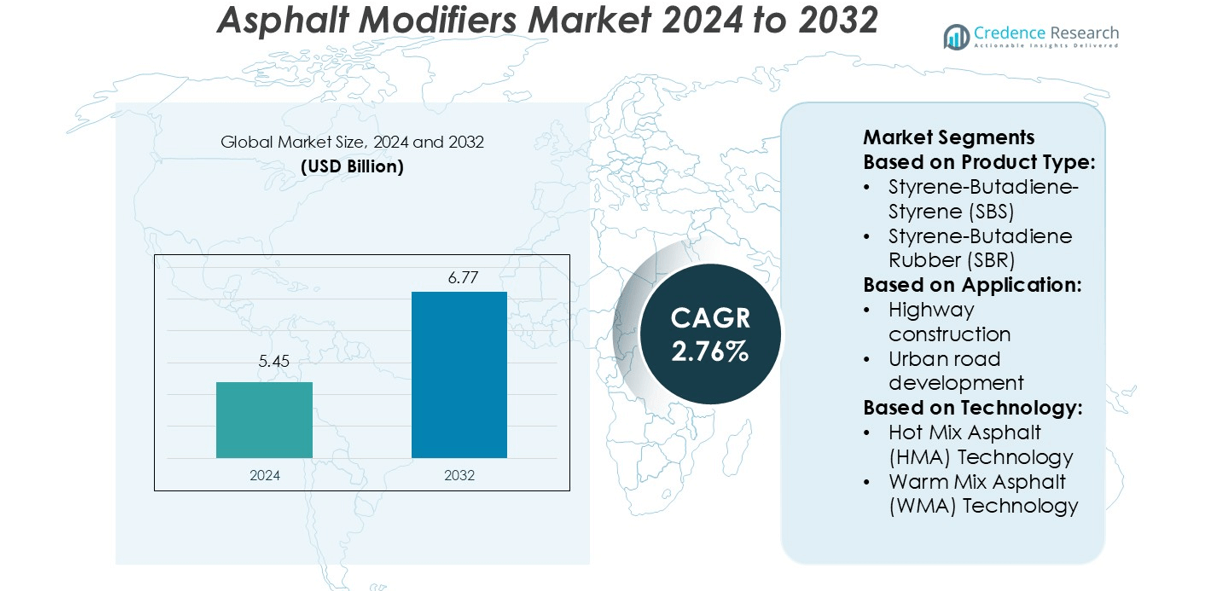

Asphalt Modifiers Market size was valued USD 5.45 billion in 2024 and is anticipated to reach USD 6.77 billion by 2032, at a CAGR of 2.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asphalt Modifiers Market Size 2024 |

USD 5.45 billion |

| Asphalt Modifiers Market, CAGR |

2.76% |

| Asphalt Modifiers Market Size 2032 |

USD 6.77 billion |

The Asphalt Modifiers Market is shaped by major participants such as Honeywell International Inc., Ingevity Corporation, BASF SE, Sasol Limited, Evonik Industries AG, The Dow Chemical Company, DuPont de Nemours, Inc., Kraton Corporation, Nouryon (formerly AkzoNobel Specialty Chemicals), and Arkema Group. These companies focus on product innovation, sustainability, and advanced polymer solutions to enhance pavement performance and longevity. Asia-Pacific leads the global market with a 34% share, driven by large-scale infrastructure development, urbanization, and government investments in durable road networks. Strategic initiatives emphasizing recycled materials and warm-mix asphalt technologies continue to strengthen the region’s dominance in sustainable road construction.

Market Insights

- The Asphalt Modifiers Market was valued at USD 5.45 billion in 2024 and is projected to reach USD 6.77 billion by 2032, growing at a CAGR of 2.76%.

- Growth is driven by rising demand for durable road infrastructure and enhanced pavement performance. Polymer-based modifiers improve resistance to rutting, cracking, and aging, extending road life under heavy traffic and extreme climates.

- Key participants such as Honeywell International Inc., BASF SE, and Kraton Corporation invest in sustainable polymer innovations and R&D collaborations to improve asphalt mix stability and performance.

- A major restraint is the high cost of polymer-modified asphalts compared to traditional materials, which limits adoption in developing economies with budget constraints.

- Asia-Pacific dominates the Asphalt Modifiers Market with a 34% share, supported by large-scale infrastructure projects, government initiatives for sustainable road construction, and growing adoption of recycled and warm-mix asphalt technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Polymer modifiers lead the Asphalt Modifiers Market, driven by their superior performance in enhancing pavement strength and flexibility. Among them, Styrene-Butadiene-Styrene (SBS) holds the dominant share due to its ability to improve elasticity, rutting resistance, and temperature stability. SBS-modified asphalt extends pavement life and reduces maintenance needs, making it ideal for heavy-traffic roads. Styrene-Butadiene Rubber (SBR) and Ethylene Vinyl Acetate (EVA) also gain traction for cost-effectiveness and compatibility with recycled asphalt. Continuous innovation in polyethylene and polypropylene modifiers further supports sustainable road construction practices across developed and developing regions.

- For instance, Ingevity’s Evotherm® warm-mix asphalt additive has been used in over 300,000 miles of pavement globally, and allows asphalt mix production temperatures to be reduced by up to 90 °F (≈50 °C) compared to conventional hot-mix asphalt.

By Application

Road construction and paving represent the largest application segment in the Asphalt Modifiers Market, supported by global infrastructure investments and government-backed road expansion programs. This segment benefits from the widespread adoption of polymer-modified asphalt to ensure high durability and load-bearing capacity in varied climatic conditions. Highway construction and urban road development also experience strong growth, emphasizing performance longevity and reduced lifecycle costs. The growing demand for overlay applications and crack sealing in developed markets highlights the shift toward preventive maintenance strategies to extend road service life efficiently.

- For instance, Sasol’s SASOBIT® synthetic hard wax additive enables paving temperature reductions of up to 30 K when added at 3.0 wt % in the bitumen-mix. Within a Hamburg wheel-tracking test, an asphalt mix modified with 3.0 wt % SASOBIT showed a rut depth of 1.1 mm after 20,000 cycles at 60 °C.

By Technology

Hot Mix Asphalt (HMA) technology dominates the Asphalt Modifiers Market, accounting for the highest market share due to its proven reliability and compatibility with diverse polymer modifiers. HMA offers superior compaction, stability, and resistance to moisture damage, making it the preferred choice for highways and urban pavements. Warm Mix Asphalt (WMA) and recycling technologies are gaining traction for their environmental and cost-saving benefits. Cold in-place recycling and plant-based recycling approaches support sustainability goals by minimizing material waste and energy consumption in asphalt production and maintenance processes.

Key Growth Drivers

Rising Infrastructure Development and Urbanization

Rapid urbanization and infrastructure expansion are major factors driving the Asphalt Modifiers Market. Governments are investing heavily in road, highway, and airport construction projects to support economic growth. Asphalt modifiers enhance pavement durability, load-bearing strength, and resistance to deformation, making them ideal for high-traffic roads. Increasing public-private partnerships and smart city initiatives further boost asphalt demand. The focus on long-lasting and eco-friendly pavements continues to accelerate modifier adoption across both developed and developing regions.

- For instance, Evonik’s TEGO® Addibit F4 HB additive is heat-stable up to 280 °C and is used in asphalt production to improve performance. In lab tests, its addition to base bitumen has been shown to significantly improve wheel-tracking resistance, thereby reducing rutting compared to unmodified asphalt.

Growing Demand for High-Performance Pavement Materials

The need for superior-quality road surfaces that withstand extreme weather and heavy loads is increasing. Asphalt modifiers improve flexibility, fatigue resistance, and crack prevention, extending pavement lifespan. Rising traffic congestion and heavy transportation activities drive the use of polymer-modified asphalt in both highways and urban roads. Government emphasis on sustainable, low-maintenance materials supports technological innovation in asphalt modification. Manufacturers continue developing customized solutions for regional climates and performance standards to meet evolving construction requirements.

- For instance, Dow reports that its ELVALOY™ Reactive Elastomeric Terpolymer (RET) allowed asphalt binders to resist more than double the traffic load and improve durability by up to 30% in lab testing.

Increasing Adoption of Sustainable and Recycled Materials

The growing emphasis on sustainability is promoting the use of recycled asphalt and bio-based modifiers. These materials reduce carbon emissions, conserve natural resources, and lower lifecycle costs. Governments are implementing policies favoring green construction and circular economy practices. Technological advancements in warm-mix asphalt and recycling techniques improve energy efficiency and performance. The trend toward eco-friendly road materials is fostering long-term market growth as industries adopt environmentally responsible infrastructure solutions.

Key Trends & Opportunities

Integration of Advanced Polymer Technologies

Continuous innovation in polymer chemistry is enhancing the mechanical performance of asphalt modifiers. The introduction of high-reactivity polymers improves elasticity, rutting resistance, and thermal stability. New formulations allow better blending compatibility and ease of processing. Demand for specialty elastomers such as SBS and EVA is growing due to their proven performance in diverse climates. This trend presents opportunities for material suppliers to develop advanced, cost-effective polymer blends tailored for specific regional requirements.

- For instance, DuPont’s Elvaloy® 4170 Reactive Elastomeric Terpolymer (RET) is effective at modifier levels as low as 0.5 % by weight of asphalt binder and has a melt flow rate of 8 g/10 min at 190 °C.

Expansion of Cold and Warm Mix Asphalt Technologies

The industry is shifting toward energy-efficient mixing processes such as Warm Mix Asphalt (WMA) and Cold Mix Asphalt (CMA). These technologies lower production temperatures, reduce emissions, and improve workability. Their compatibility with modified binders and recycled aggregates enhances pavement sustainability. The adoption of such technologies is expanding across Europe, North America, and Asia-Pacific. Manufacturers offering high-performance modifiers optimized for these processes are gaining a competitive edge in the global market.

- For instance, Kraton’s “CirKular+ Paving Circularity Series” enables incorporation of up to 50 % reclaimed asphalt pavement (RAP) content in surface layers when used alongside Kraton D-grade SBS polymers.

Growing Focus on Pavement Preservation and Maintenance

Aging road networks and limited maintenance budgets are increasing focus on pavement preservation. Modified asphalts are used in surface treatments, overlays, and crack sealing to extend service life. Governments are prioritizing cost-effective maintenance over full reconstruction. The use of polymer-based sealants and rejuvenators ensures improved durability and reduced lifecycle costs. This creates steady demand for high-quality modifiers across both developed and developing infrastructure systems.

Key Challenges

High Production Costs of Polymer-Modified Asphalt

The manufacturing of polymer-modified asphalt involves high material and processing costs. Advanced polymers such as SBS and EVA require specialized mixing and temperature control equipment. These costs pose challenges for small and mid-sized contractors in emerging economies. Fluctuations in raw material prices, particularly synthetic rubber and bitumen, add financial uncertainty. The need to balance performance benefits with affordability remains a major restraint for broader market adoption.

Limited Awareness and Technical Expertise in Developing Regions

In many developing countries, awareness of asphalt modification technologies remains low. Construction contractors often rely on traditional materials due to cost and technical barriers. Lack of trained personnel and inadequate equipment limit effective implementation. The absence of standardized testing and performance specifications further delays adoption. Industry players must invest in training, technical support, and demonstration projects to promote widespread use of asphalt modifiers in emerging markets.

Regional Analysis

North America

North America holds a 32% share of the Asphalt Modifiers Market, driven by large-scale infrastructure renovation and smart transportation projects. The U.S. leads due to high adoption of polymer-modified asphalt in highway maintenance and urban road upgrades. The Federal Highway Administration’s sustainability initiatives promote the use of warm-mix and recycled asphalt technologies. Canada also invests heavily in cold-climate pavement durability solutions. Rising demand for cost-efficient, long-life roads continues to strengthen modifier consumption across the region, with emphasis on advanced polymers and eco-friendly binders to enhance performance under varying weather conditions.

Europe

Europe accounts for a 27% market share, supported by stringent environmental regulations and widespread infrastructure modernization. Countries like Germany, France, and the UK lead adoption of sustainable asphalt technologies such as warm-mix and cold recycling methods. The European Union’s Green Deal encourages use of low-emission and energy-efficient materials in road construction. Polymer modifiers, particularly SBS and EVA, dominate due to superior rutting and fatigue resistance. Government-backed investments in highway maintenance and transnational road networks continue to drive steady demand for modified asphalt across the continent.

Asia-Pacific

Asia-Pacific dominates the Asphalt Modifiers Market with a 34% share, fueled by rapid urbanization, industrialization, and expanding road construction projects. China, India, and Japan are key contributors, investing in durable, climate-adaptive pavements for highways and urban infrastructure. Government initiatives like India’s Bharatmala and China’s Belt and Road drive large-scale modifier usage. Growing focus on warm-mix and recycled asphalt technologies further supports sustainable infrastructure growth. Increasing private investments in smart city projects and logistics corridors continue to accelerate asphalt modifier demand across developing economies in the region.

Latin America

Latin America holds a 4% share of the Asphalt Modifiers Market, driven by ongoing infrastructure development and road rehabilitation programs. Brazil and Mexico lead regional demand with investments in highways, airports, and industrial access roads. Government emphasis on improving road quality and durability is increasing polymer-modified asphalt use. However, fluctuating raw material costs and limited technical expertise hinder broader adoption. Growing partnerships with international material suppliers and adoption of warm-mix technologies are gradually enhancing efficiency and sustainability in regional road construction practices.

Middle East & Africa

The Middle East & Africa region captures a 3% share of the Asphalt Modifiers Market, primarily driven by rapid infrastructure expansion in GCC countries. Saudi Arabia and the UAE are investing in expressways, industrial roads, and airport runways under their national development programs. High-temperature-resistant polymer modifiers are in demand to enhance performance under harsh climates. In Africa, road modernization projects in South Africa, Kenya, and Nigeria are fueling gradual market growth. Government collaborations with global contractors and rising urbanization are expected to strengthen regional adoption of advanced asphalt modifiers.

Market Segmentations:

By Product Type:

- Styrene-Butadiene-Styrene (SBS)

- Styrene-Butadiene Rubber (SBR)

By Application:

- Highway construction

- Urban road development

By Technology:

- Hot Mix Asphalt (HMA) Technology

- Warm Mix Asphalt (WMA) Technology

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Asphalt Modifiers Market features strong competition among key players, including Honeywell International Inc., Ingevity Corporation, BASF SE, Sasol Limited, Evonik Industries AG, The Dow Chemical Company, DuPont de Nemours, Inc., Kraton Corporation, Nouryon (formerly AkzoNobel Specialty Chemicals), and Arkema Group. The Asphalt Modifiers Market is highly competitive, characterized by continuous innovation and technological advancement. Companies are investing heavily in polymer chemistry, sustainable formulations, and performance enhancement technologies to meet global infrastructure demands. The market is witnessing a shift toward eco-friendly and recycled asphalt modifiers that improve pavement lifespan, reduce emissions, and enhance resistance to temperature fluctuations. Strategic collaborations between manufacturers, research institutions, and government bodies are accelerating product development and standardization. Focus on warm-mix asphalt, bio-based additives, and high-reactivity polymers is driving competition, with firms emphasizing quality consistency, cost efficiency, and compliance with evolving environmental regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Heartland Paving Partners has announced the purchase of MacAdam Company, thereby broadening the regional strength and partnering itself with the proven industry leader.

- In February 2025, Sripath Technologies, an American chemical company known for its work in asphalt, has launched the warm mix additive called PHALANX. This incorporates new advancements for improved compaction of hot asphalt mixtures as well as PMB mixes, while at the same time targeting lower temperatures for compaction and production.

- In July 2024, Brenntag SE has partnered with Nouryon in order to offer an extended portfolio of high-quality products, especially anti-stripping agents and emulsifiers for asphalt, and to further consolidate the partnership with Nouryon.

- In February 2024, Shrieve, one of the major chemical supply and distribution firms, has announced the launching of fresh asphalt additives among the European market. With the company entering Europe, the launching of the PROGILINE® ECO-T range shows the commitment of Shrieve to providing highly sustainable products

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for polymer-modified asphalt will continue to grow with expanding global infrastructure projects.

- Adoption of warm-mix and cold-mix technologies will rise due to lower emissions and energy savings.

- Governments will increasingly promote sustainable and recycled materials in road construction.

- Investment in R&D will strengthen the development of bio-based and high-performance modifiers.

- Smart infrastructure initiatives will boost the use of advanced asphalt additives for durability.

- Asia-Pacific will maintain market leadership with large-scale road modernization programs.

- Digital technologies will enhance process control and quality monitoring in asphalt production.

- Collaboration between manufacturers and public agencies will expand to standardize modifier usage.

- Growth in highway rehabilitation and maintenance projects will drive long-term product demand.

- Companies will focus on cost-effective, climate-resilient solutions to meet regional performance needs.