Market Overview

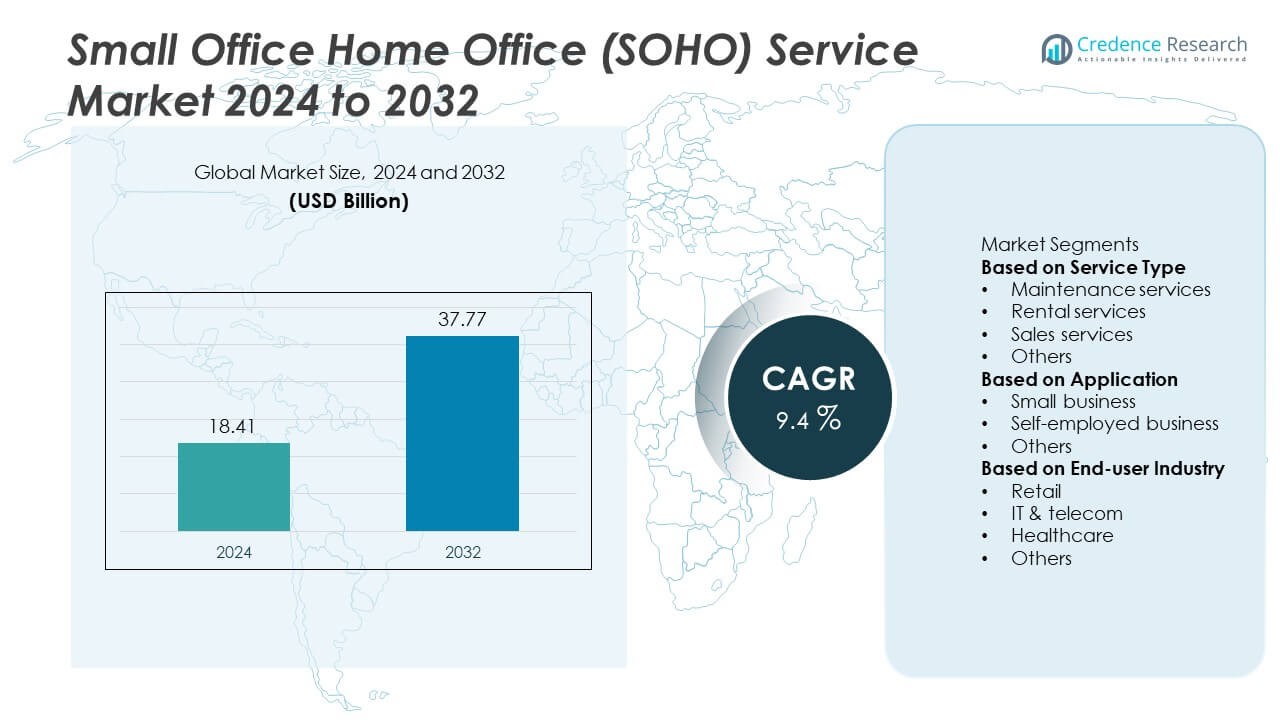

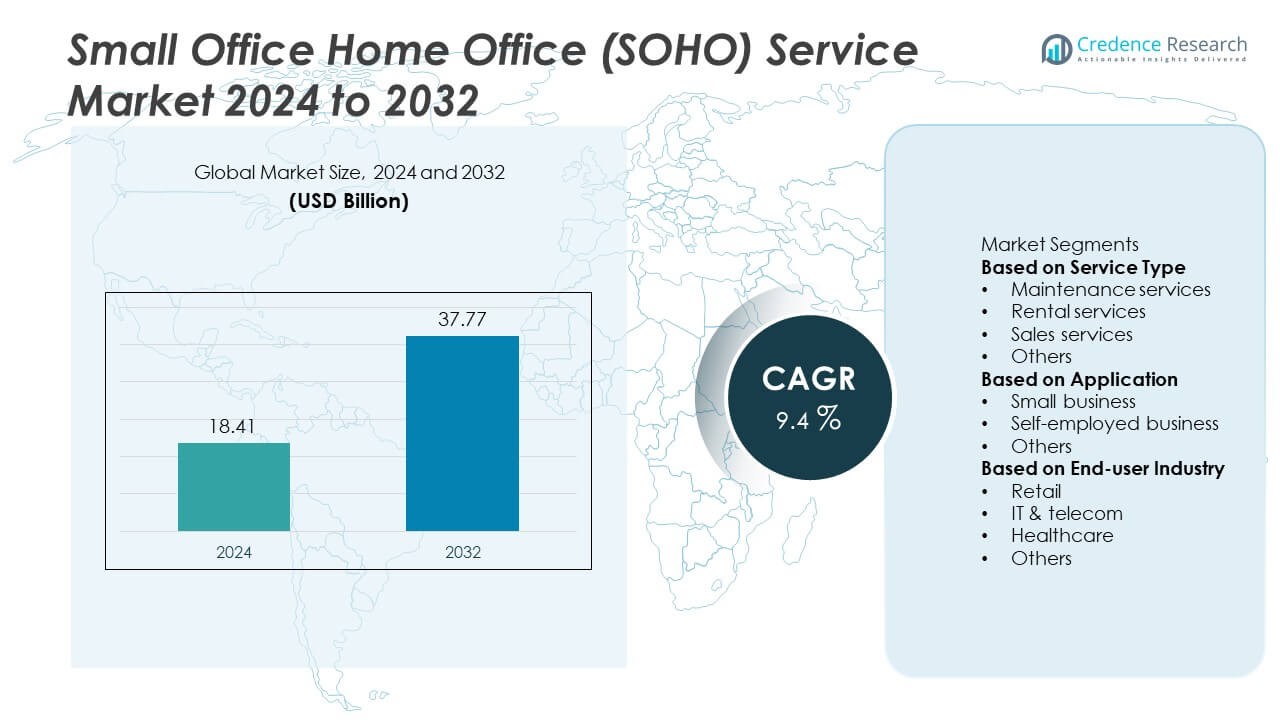

The global Small Office Home Office (SOHO) Service Market was valued at USD 18.41 billion in 2024 and is projected to reach USD 37.77 billion by 2032, growing at a CAGR of 9.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Office Home Office (SOHO) Service Market Size 2024 |

USD 18.41 Billion |

| Small Office Home Office (SOHO) Service Market, CAGR |

9.4% |

| Small Office Home Office (SOHO) Service Market Size 2032 |

USD 37.77 Billion |

The global Small Office Home Office (SOHO) Service market is led by key players including Mailchimp, Cisco Systems Inc., Netgear Inc., Intuit Inc., HP Inc., LegalZoom, Dell Technologies, Microsoft Corporation, Google LLC, and Dropbox. These companies dominate the market through innovative service portfolios covering IT infrastructure, cloud storage, software solutions, and business support services tailored for small enterprises and freelancers. North America led the market with a 36.8% share in 2024, supported by strong digital infrastructure and widespread remote work adoption. Europe followed with 28.5%, driven by a robust SME ecosystem, while Asia-Pacific, holding 24.6%, is expected to register the fastest growth through 2032 due to rapid digitalization and startup expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Small Office Home Office (SOHO) Service market was valued at USD 18.41 billion in 2024 and is projected to reach USD 37.77 billion by 2032, growing at a CAGR of 9.4% during 2025–2032.

- Rising remote and hybrid work adoption across small businesses and freelancers is driving strong demand for IT support, cloud services, and maintenance solutions.

- The market is witnessing trends toward cloud-based infrastructure, AI-enabled service management, and the integration of smart office technologies for improved efficiency.

- Key players such as Mailchimp, Cisco Systems Inc., Microsoft Corporation, Dell Technologies, and Google LLC are focusing on service diversification, SaaS platforms, and regional expansion to strengthen competitiveness.

- North America led the market with a 36.8% share, followed by Europe with 28.5%, while Asia-Pacific accounted for 24.6% and is expected to grow fastest; the maintenance services segment dominated with a 39.5% share in 2024.

Market Segmentation Analysis:

By Service Type

The maintenance services segment held the largest share of 39.5% in the Small Office Home Office (SOHO) Service market in 2024. This dominance is driven by the growing need for regular equipment upkeep, network support, and IT system optimization among small and home-based businesses. Maintenance ensures operational continuity and minimizes downtime, which is crucial for remote setups. The increasing reliance on connected devices and digital workspaces also contributes to this growth. Rental and sales services are gaining momentum as startups and freelancers seek cost-effective, flexible access to modern office infrastructure.

- For instance, Cisco Systems Inc. enhanced its Webex Suite with AI-powered diagnostic tools benefiting small office clients requiring real-time troubleshooting. The tools can help reduce network issues, improve call quality, and provide faster resolution for IT administrators.

By Application

The small business segment dominated the SOHO Service market with a 54.2% share in 2024. Its leadership is attributed to the rising number of micro and small enterprises adopting remote and hybrid work models. These businesses depend on professional maintenance, IT support, and telecommunication services to manage daily operations efficiently. The growing preference for scalable service models, especially in the technology and consulting sectors, supports the segment’s continued expansion. Self-employed professionals, including freelancers and consultants, also represent a fast-growing segment due to increasing digital entrepreneurship.

- For instance, Microsoft Corporation enhanced its Teams Premium offering with intelligent meeting recap tools that automatically generate AI notes, tasks, and personalized timeline markers for users who have a Teams Premium or Copilot license.

By End-user Industry

The IT & telecom industry accounted for a 42.8% share of the SOHO Service market in 2024, emerging as the dominant end-user segment. This growth is driven by widespread digitalization and high dependence on communication tools, cloud platforms, and technical maintenance services. The sector’s need for uninterrupted connectivity and secure data management further strengthens demand. The retail industry is also expanding its SOHO presence, using remote service models to manage logistics and online sales operations. Meanwhile, healthcare adoption is rising due to telemedicine, digital consultation, and home-based service delivery models.

Key Growth Drivers

Rising Adoption of Remote and Hybrid Work Models

The global shift toward remote and hybrid work environments is a primary driver of the SOHO Service market. Small businesses and self-employed professionals increasingly depend on managed IT, communication, and support services to sustain productivity. Affordable internet access and digital collaboration tools are expanding the market base. Organizations are investing in maintenance and rental services to reduce operational costs, while employees prioritize flexible setups that enhance work-life balance and efficiency, fueling long-term demand for SOHO solutions.

- For instance, HP Inc. recorded over 32 million active HP Smart users, indicating strong adoption of connected print and productivity tools among home-based professionals.

Growth of Small and Micro Enterprises

The rapid expansion of small and micro businesses worldwide significantly boosts the SOHO Service market. These enterprises rely on scalable, low-cost IT and infrastructure services to manage day-to-day operations. Governments in emerging economies are promoting entrepreneurship through financial incentives and digitalization programs, further stimulating market adoption. The need for technical support, communication tools, and office setup services among these businesses is strengthening the demand for SOHO maintenance and rental solutions globally.

- For instance, Zoho Corporation surpassed 100 million users across its cloud applications suite, showcasing increasing adoption by micro and self-employed businesses.

Technological Advancement and Service Digitalization

Advancements in cloud computing, managed IT services, and remote monitoring technologies are driving market growth. Digital platforms now offer integrated solutions combining maintenance, networking, and system updates for SOHO setups. Automation and AI-based service management tools improve performance and cost efficiency, making these services more accessible. The increasing integration of IoT-enabled devices and smart office systems enhances connectivity and performance, enabling users to manage operations seamlessly from home or small business environments.

Key Trends & Opportunities

Rising Demand for Managed IT and Cloud Services

Growing reliance on digital operations and cloud-based systems creates strong opportunities in the SOHO Service market. Managed IT services provide continuous monitoring, data backup, and software updates without requiring in-house expertise. The expansion of cloud storage and collaboration platforms supports scalability for small offices. Service providers are also launching subscription-based models for easier adoption, helping freelancers and startups access enterprise-grade IT infrastructure at lower costs, thereby strengthening the market presence of cloud-based SOHO solutions.

- For instance, Google Workspace reported over 3 billion active users across its collaboration tools, reflecting rising small-business adoption of managed cloud solutions for flexible and secure remote operations.

Expansion of Smart Office Infrastructure

Smart office adoption is becoming a key trend in the SOHO segment, with technologies like IoT sensors, automation tools, and remote access systems enhancing efficiency. These solutions optimize power usage, enable real-time system diagnostics, and support advanced communication setups. The growing preference for intelligent and energy-efficient equipment among small businesses presents lucrative opportunities for vendors. Manufacturers and service providers are collaborating to offer bundled packages that include installation, maintenance, and performance monitoring for smart office systems.

- For instance, Honeywell’s building automation platforms offer AI-driven sensors and analytics for real-time environmental control and predictive maintenance across diverse commercial setups, leveraging technology featured in over 10 million buildings worldwide.

Growing Emphasis on Cybersecurity Solutions

As remote work expands, data privacy and network security have become critical concerns for SOHO users. Service providers are offering cybersecurity packages including endpoint protection, VPN access, and secure data management. The increasing awareness of phishing and ransomware risks is encouraging small offices to invest in comprehensive protection frameworks. This trend creates new opportunities for cybersecurity vendors and managed service providers offering cost-effective, scalable protection tailored for small and home-based enterprises.

Key Challenges

High Initial Setup and Maintenance Costs

Establishing SOHO environments requires significant upfront investment in hardware, software, and secure networking infrastructure. Many small businesses face budget constraints that limit access to premium IT and communication solutions. Ongoing maintenance expenses, including software updates and system monitoring, further add to cost pressures. These financial barriers slow market penetration among startups and freelancers, particularly in developing regions where affordability remains a major concern for widespread SOHO service adoption.

Data Privacy and Connectivity Concerns

Data protection and consistent connectivity remain major challenges in the SOHO Service market. Small businesses often operate with limited cybersecurity infrastructure, making them vulnerable to data breaches and network downtime. Dependence on unreliable or low-speed internet connections can disrupt communication and reduce productivity. Addressing these issues requires investment in secure cloud systems and advanced networking solutions. However, limited technical knowledge among users further complicates implementation, hindering efficient utilization of SOHO service capabilities.

Regional Analysis

North America

North America held the largest share of 36.8% in the Small Office Home Office (SOHO) Service market in 2024. The region’s dominance is attributed to widespread remote work adoption, advanced IT infrastructure, and the presence of leading service providers. The United States drives most of the demand, supported by a large base of freelancers, startups, and small enterprises. Strong broadband connectivity and growing use of cloud-based collaboration tools enhance market growth. Increasing investments in managed IT, cybersecurity, and maintenance services continue to support North America’s leadership in the SOHO Service industry.

Europe

Europe accounted for a 28.5% share of the global SOHO Service market in 2024. Growth in this region is driven by digital transformation initiatives, high internet penetration, and government support for small business operations. Countries such as Germany, the United Kingdom, and France lead adoption due to strong technological readiness and a growing self-employed workforce. The region’s emphasis on data privacy, compliance, and green office infrastructure further supports market expansion. European service providers are increasingly offering flexible rental and maintenance packages tailored for SMEs and home-based businesses.

Asia-Pacific

Asia-Pacific captured a 24.6% share of the SOHO Service market in 2024 and is projected to record the fastest growth through 2032. The region benefits from rapid digitalization, a rising number of startups, and the increasing adoption of hybrid work models. Countries such as China, India, Japan, and South Korea are key contributors to demand. Government initiatives promoting entrepreneurship and remote work flexibility are further supporting growth. Expanding internet access, low-cost cloud services, and affordable maintenance solutions are accelerating SOHO adoption among small enterprises and freelancers across the region.

Latin America

Latin America accounted for a 5.8% share of the global SOHO Service market in 2024. Brazil, Mexico, and Argentina lead the region’s growth due to the expanding gig economy and rising adoption of digital collaboration tools. The shift toward flexible work environments and increased use of virtual office services are driving demand. Growing awareness of IT support and managed service solutions among small businesses is also contributing to market expansion. Regional telecom providers are investing in infrastructure improvements to enhance connectivity and support sustainable SOHO operations across emerging urban centers.

Middle East & Africa

The Middle East & Africa region held a 4.3% share of the global SOHO Service market in 2024. Rising internet penetration, increasing numbers of entrepreneurs, and growing investment in ICT infrastructure are fueling market growth. The United Arab Emirates and Saudi Arabia dominate the regional market, driven by rapid digital transformation and smart city initiatives. Expanding freelance and remote work culture is encouraging adoption of managed IT and rental services. Despite slower overall development compared to other regions, ongoing technological modernization is expected to sustain steady market growth through the forecast period.

Market Segmentations:

By Service Type

- Maintenance services

- Rental services

- Sales services

- Others

By Application

- Small business

- Self-employed business

- Others

By End-user Industry

- Retail

- IT & telecom

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Small Office Home Office (SOHO) Service market is characterized by the presence of major players such as Mailchimp, Cisco Systems Inc., Netgear Inc., Intuit Inc., HP Inc., LegalZoom, Dell Technologies, Microsoft Corporation, Google LLC, and Dropbox. These companies compete through diverse service offerings, including cloud storage, IT management, hardware solutions, digital marketing, and business setup support. Leading vendors focus on developing integrated service platforms that combine communication, security, and productivity tools tailored for small and home-based enterprises. Strategic collaborations, software-as-a-service (SaaS) models, and subscription-based offerings are key competitive differentiators. Players are also investing in AI-driven automation, cybersecurity, and scalable infrastructure to enhance service reliability. With rising demand from freelancers and microbusinesses, these firms are expanding regional footprints and strengthening digital ecosystems to capture growing opportunities in the global SOHO Service market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mailchimp

- Cisco Systems Inc.

- Netgear Inc.

- Intuit Inc.

- HP Inc.

- LegalZoom

- Dell Technologies

- Microsoft Corporation

- Google LLC

- Dropbox

Recent Developments

- In September 2025, Cisco Systems Inc. introduced advanced AI-powered solutions within its Webex contact-center and networking portfolio, reinforcing its push into collaboration services for small offices and hybrid work.

- In July 2025, Intuit Inc. expanded its IDEAS accelerator program nationally to nine U.S. cities, supporting small business growth with its digital tools and services.

- In April 2025, Microsoft Corporation launched its 2025 Release Wave 1, offering hundreds of new features across Dynamics 365 and Power Platform—enhancing cloud services for small and home offices.

- In March 2025, HP Inc. announced at its “HP Amplify 2025” conference a portfolio of 80+ PCs, AI-powered print tools and services aimed at small businesses and hybrid work environments.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, End-user Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Remote and hybrid work models will continue to drive strong demand for SOHO services.

- Cloud-based collaboration and storage solutions will become central to business operations.

- AI and automation will enhance service delivery and system maintenance efficiency.

- Cybersecurity solutions will gain importance to protect remote business networks.

- Subscription-based and managed service models will attract small business users.

- Integration of IoT and smart office systems will improve connectivity and performance.

- Vendors will focus on offering scalable and cost-effective IT and communication services.

- Digital transformation in developing economies will open new growth opportunities.

- Partnerships between technology providers and telecom operators will expand service coverage.

- Asia-Pacific will emerge as the fastest-growing region due to rapid digital adoption and SME expansion.