| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Industrial Fasteners Market Size 2024 |

USD 29,395.79 Million |

| Asia Pacific Industrial Fasteners Market, CAGR |

7.34% |

| Asia Pacific Industrial Fasteners Market Size 2032 |

USD 51,805.99 Million |

Market Overview:

The Asia Pacific Industrial Fasteners Market is projected to grow from USD 29,395.79 million in 2024 to an estimated USD 51,805.99 million by 2032, with a compound annual growth rate (CAGR) of 7.34% from 2024 to 2032.

Several factors are driving the growth of the Asia Pacific Industrial Fasteners Market. The automotive sector remains a primary contributor, with rising vehicle production, particularly in China, India, and Japan, leading to higher demand for specialized fasteners capable of meeting stringent performance standards. Additionally, infrastructure development initiatives across emerging economies are driving the use of construction fasteners in residential, commercial, and public sector projects. The electronics industry also supports market expansion, fueled by the proliferation of consumer electronics, where miniaturized and high-precision fasteners are critical. Advancements in material science, including the use of composites, stainless steel, and titanium, are enabling manufacturers to develop durable, corrosion-resistant, and lightweight fasteners that cater to evolving industrial needs. Furthermore, the growing emphasis on sustainable manufacturing practices is encouraging the adoption of recyclable and eco-friendly fastener materials, creating new opportunities for market players.

Regionally, China dominates the Asia Pacific Industrial Fasteners Market, accounting for the largest revenue share, owing to its massive manufacturing base, high automotive production, and continuous investments in infrastructure projects. India is witnessing rapid growth, supported by initiatives like “Make in India,” which are boosting domestic manufacturing and construction activities. Japan maintains a strong presence, driven by its advanced automotive, aerospace, and electronics industries, which demand precision-engineered fastening solutions. Southeast Asian countries such as Vietnam, Thailand, and Indonesia are emerging as key markets due to increasing foreign direct investments, expansion of manufacturing hubs, and infrastructure development programs. Collectively, the Asia Pacific region offers a dynamic and diversified landscape for industrial fasteners, with each sub-region contributing uniquely to overall market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Asia Pacific Industrial Fasteners Market is projected to grow from USD 29,395.79 million in 2024 to USD 51,805.99 million by 2032, registering a robust CAGR of 7.34%.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- Rising automotive production, particularly in China, India, and Japan, continues to fuel strong demand for specialized, high-performance fasteners.

- Expanding infrastructure development initiatives across emerging economies are driving the adoption of durable construction fasteners for residential, commercial, and public sector projects.

- The growing electronics and electrical manufacturing industries are increasing demand for miniaturized and high-precision fastening solutions, supporting market expansion.

- Advancements in material science, including the use of stainless steel, titanium, and engineered polymers, are enabling manufacturers to develop lightweight, corrosion-resistant fasteners.

- Volatile raw material prices and high competition among regional and international players remain key challenges impacting profitability and market stability.

- China leads the regional market with the largest revenue share, followed by India, Japan, and Southeast Asian countries such as Vietnam, Thailand, and Indonesia emerging as fast-growing markets.

Market Drivers:

Strong Growth in the Automotive Industry

The automotive industry serves as a significant driver for the Asia Pacific Industrial Fasteners Market. With China, Japan, India, and South Korea being among the largest automotive producers globally, the demand for specialized, high-strength fasteners continue to rise. The shift toward electric vehicles (EVs) has further accelerated the need for lightweight and durable fastening solutions that enhance energy efficiency without compromising vehicle safety and structural integrity. For instance, the Pacific Northwest National Laboratory (PNNL) developed a Rotating Hammer Riveting Tool that enables the use of lightweight magnesium and aluminum rivets without preheating, reducing the time needed to join each rivet to just 0.25 seconds, compared to the conventional 1 to 3 seconds. Additionally, increasing investments by global and domestic automakers in production facilities across emerging economies are bolstering fastener demand, further supporting market expansion in the region.

Expanding Construction and Infrastructure Projects

Large-scale infrastructure development across Asia Pacific is a critical factor propelling the market’s growth. Government-led initiatives focusing on smart cities, transportation networks, energy projects, and industrial corridors are significantly driving the consumption of industrial fasteners. Countries such as India, Indonesia, Vietnam, and the Philippines are experiencing a surge in residential, commercial, and public sector construction activities. This expansion directly translates to heightened demand for fastening solutions used in structural assemblies, ensuring safety, durability, and compliance with building standards, thus positively influencing the fasteners market.

Rising Electronics and Electrical Manufacturing Activities

The rapid proliferation of electronics manufacturing in Asia Pacific is another important driver. Countries like China, South Korea, Taiwan, and Japan lead in electronics production, creating strong demand for miniature, high-precision fasteners. Consumer electronics, wearable technology, and advanced computing devices require specialized fastening components that offer precision, reliability, and minimal weight. For example, in November 2023, Nippon Industrial Fastener Corporation (NIFCO) announced a USD 33.37 million investment in a new manufacturing plant for automotive plastic components in Karnataka, India, highlighting the region’s ongoing commitment to expanding fastener production for the electronics and automotive sectors. The growing popularity of 5G infrastructure, Internet of Things (IoT) devices, and smart appliances further fuels the need for innovative fastening solutions tailored to compact and technologically advanced designs, contributing substantially to the industrial fasteners market growth.

Technological Advancements and Material Innovation

Technological advancements and innovations in material science are significantly transforming the industrial fasteners landscape. Manufacturers are increasingly developing fasteners with enhanced properties such as corrosion resistance, higher tensile strength, and reduced weight by using materials like stainless steel, titanium, and engineered polymers. The adoption of automated manufacturing processes, including cold forging and precision machining, enables the production of complex fastener designs with superior quality and consistency. Furthermore, the emphasis on sustainable manufacturing practices is driving the use of eco-friendly materials and recyclable fasteners, aligning with global environmental standards and strengthening the market’s future growth trajectory.

Market Trends:

Increased Adoption of Lightweight Fasteners

The increasing emphasis on energy efficiency and performance optimization is leading to a higher adoption of lightweight fasteners across industries. For example, in the automotive sector, the growing popularity of electric vehicles (EVs) is driving demand for lightweight fasteners, as these components are essential for reducing vehicle weight and maximizing battery range. Manufacturers are focusing on designing fasteners made from advanced materials such as aluminum alloys, carbon composites, and high-strength engineered plastics. This trend is particularly prominent in sectors like aerospace, automotive, and consumer electronics, where reducing overall weight directly contributes to improved fuel efficiency and product durability. Companies are investing in research and development to produce fastening solutions that meet stringent performance requirements without adding significant weight to the final product.

Shift Toward Customized and Application-Specific Fasteners

Demand for customized, application-specific fastening solutions is gaining momentum across the Asia Pacific region. Industries such as construction, energy, marine, and healthcare increasingly require fasteners tailored to specific operational environments and load conditions. For instance, in high-temperature applications, companies are offering fasteners made from advanced materials like ceramics, which can withstand temperatures up to 1,700°C, and PEEK® polymers, which maintain mechanical integrity at temperatures up to 176°C. As a result, manufacturers are offering product portfolios that include corrosion-resistant, heat-tolerant, and vibration-proof fasteners. This growing need for customization is driving collaborations between fastener producers and end-user industries, leading to the development of innovative fastening technologies that address the unique challenges of diverse applications.

Growth of the Renewable Energy Sector

The renewable energy sector, particularly solar and wind energy, is emerging as a new avenue for fastener demand in Asia Pacific. Governments across the region are investing heavily in clean energy projects to meet carbon reduction goals and ensure energy security. Solar farms, offshore wind installations, and hydroelectric projects require durable, high-performance fastening systems capable of withstanding harsh environmental conditions. This trend is encouraging manufacturers to design fasteners that offer enhanced resistance to corrosion, UV exposure, and extreme temperatures, supporting the development of sustainable energy infrastructure.

Integration of Smart Manufacturing Practices

The Asia Pacific industrial fasteners industry is increasingly embracing smart manufacturing technologies such as Industry 4.0, robotics, and digital quality control systems. Automated production lines equipped with real-time monitoring and precision control are enhancing manufacturing efficiency and product consistency. The use of digital twin technologies and predictive maintenance systems is helping manufacturers optimize production processes and improve the quality of fasteners. This integration of advanced manufacturing practices not only reduces operational costs but also enables faster turnaround times and greater flexibility in meeting diverse customer requirements, shaping the future of the regional fasteners market.

Market Challenges Analysis:

Fluctuating Raw Material Prices

Volatility in raw material prices remains a significant restraint for the Asia Pacific Industrial Fasteners Market. Steel, aluminum, titanium, and specialty alloys, which form the backbone of fastener production, are subject to price fluctuations due to changing global supply-demand dynamics, trade regulations, and geopolitical tensions. Sudden increases in material costs directly impact the profitability of manufacturers, forcing them to either absorb losses or pass costs on to consumers, thereby affecting overall market competitiveness. Moreover, disruptions in supply chains, particularly for specialized materials sourced internationally, can lead to production delays and reduced operational efficiency.

High Competition and Technological Complexity

Intense competition among regional and international players presents an ongoing challenge for fastener manufacturers in Asia Pacific. Companies are compelled to constantly innovate and enhance product offerings to differentiate themselves in a crowded market. At the same time, the rising complexity of customer requirements, particularly in sectors such as aerospace, automotive, and electronics, demands sophisticated engineering capabilities and adherence to stringent quality standards. For example, manufacturers must now provide advanced fastening solutions with properties like high vibration resistance or compatibility with automated assembly processes, which demand significant engineering expertise and capital investment. Smaller manufacturers often face difficulties in keeping pace with technological advancements and meeting specialized demands, resulting in market fragmentation and limiting growth opportunities for less-resourced players. Balancing cost efficiency with the need for high-performance, customized fasteners continues to be a pressing challenge for industry participants.

Market Opportunities:

Expanding manufacturing activities across emerging economies present a major opportunity for the Asia Pacific Industrial Fasteners Market. Countries such as India, Vietnam, Thailand, and Indonesia are witnessing significant growth in industrialization, supported by government initiatives promoting domestic manufacturing and foreign direct investments. The establishment of new automotive plants, electronics assembly units, and heavy machinery production facilities is driving demand for a wide range of industrial fasteners. Additionally, the growing trend of reshoring and diversification of supply chains away from traditional hubs like China is encouraging multinational corporations to invest in production bases across Southeast Asia, creating robust opportunities for fastener suppliers to expand their reach and product offerings.

The rise of advanced sectors such as electric vehicles, renewable energy, and aerospace further enhances the market’s potential. The transition toward lightweight, energy-efficient, and sustainable products is increasing the need for specialized fastening solutions that can meet rigorous performance and safety standards. Companies that invest in research and development to create innovative, high-strength, corrosion-resistant, and eco-friendly fasteners are well-positioned to capitalize on this emerging demand. Moreover, the integration of digital technologies into manufacturing and supply chain operations provides fastener producers the chance to improve efficiency, enhance product customization, and strengthen customer relationships, paving the way for long-term growth in the competitive Asia Pacific market.

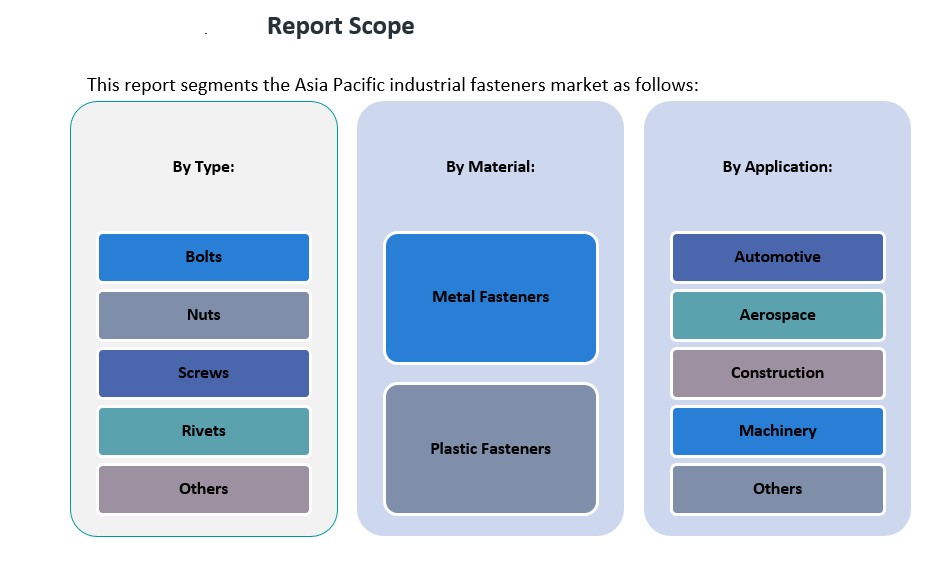

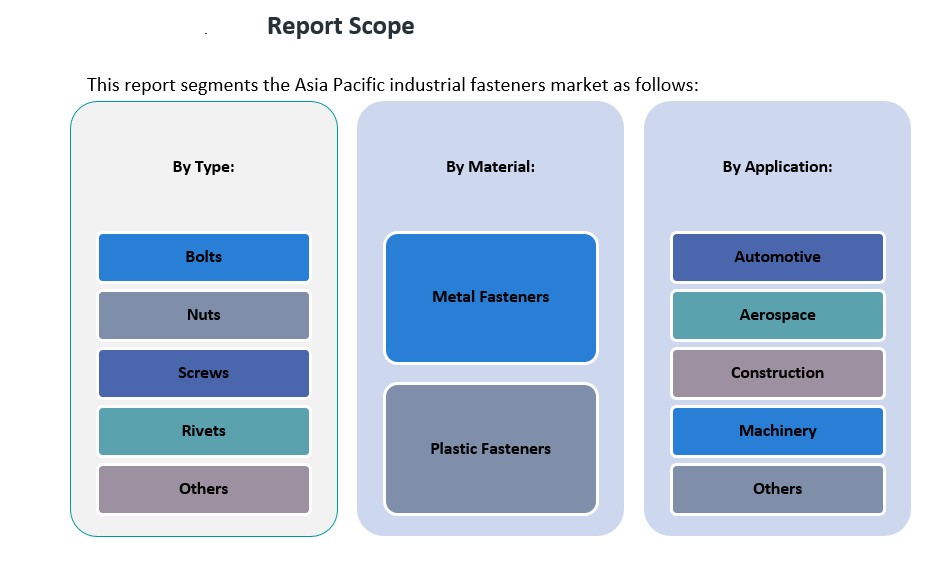

Market Segmentation Analysis:

The Asia Pacific Industrial Fasteners Market is segmented by type, application, and material, reflecting the diverse industrial requirements across the region.

By type, bolts account for a significant market share due to their extensive use in automotive, construction, and heavy machinery sectors. Nuts and screws also command a substantial portion of the market, driven by their critical role in assembly operations across industries. Rivets are witnessing growing demand in aerospace and construction sectors, where high-strength and vibration-resistant fastening is essential. The “others” category, including washers and pins, supports niche applications across manufacturing and electronics.

By application, the automotive sector dominates the market, fueled by high vehicle production and the growing shift toward electric mobility. The construction segment follows closely, supported by infrastructure development initiatives across emerging economies. Aerospace applications are also gaining momentum, driven by rising investments in domestic aircraft production and maintenance services. Machinery manufacturing continues to generate consistent demand for durable and reliable fasteners, ensuring operational stability. The “others” category, including electronics and energy, is expanding rapidly as industries seek lightweight and specialized fastening solutions for innovative applications.

By material, metal fasteners hold the largest market share due to their strength, durability, and suitability for demanding industrial environments. Stainless steel, carbon steel, and titanium fasteners are particularly favored in automotive, aerospace, and construction projects. Meanwhile, plastic fasteners are experiencing increasing adoption in electronics, automotive interiors, and lightweight assemblies, where corrosion resistance and weight reduction are critical factors.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

China holds the dominant position in the Asia Pacific Industrial Fasteners Market, accounting for 58% of the regional market share in 2024. The country’s strong manufacturing base, extensive automotive production, and ongoing infrastructure development projects continue to drive significant demand for industrial fasteners. Major investments in sectors such as renewable energy, aerospace, and electric vehicles further bolster China’s fastener consumption, with companies increasingly focusing on advanced fastening technologies to meet evolving industry standards.

India represents the second-largest market in the region, contributing 18% of the total market share. Rapid industrialization, urbanization, and government initiatives like “Make in India” are encouraging substantial growth across automotive, construction, and manufacturing sectors. The increasing focus on infrastructure modernization, including smart cities, highways, and energy projects, is significantly boosting demand for a wide range of fastening solutions. India’s emerging position as a global manufacturing hub for both domestic and export markets is expected to further strengthen its fasteners industry in the coming years.

Japan captures around 12% of the regional market share, driven by its advanced automotive, electronics, and aerospace industries. Japanese manufacturers emphasize precision engineering, high performance, and quality, resulting in strong demand for specialized and miniaturized fasteners. The country’s consistent investments in research and development across new mobility solutions, robotics, and energy-efficient infrastructure projects continue to support market growth, maintaining Japan’s influential role in the regional landscape.

Southeast Asian countries, including Vietnam, Thailand, Indonesia, and Malaysia, collectively account for 9% of the Asia Pacific Industrial Fasteners Market. These nations are emerging as attractive manufacturing destinations due to competitive labor costs, improving infrastructure, and proactive government policies promoting foreign direct investment. The growth of automotive assembly plants, electronics production, and construction projects across Southeast Asia is creating new opportunities for fastener manufacturers seeking to diversify their customer base.

Australia and South Korea together represent the remaining 3% of the regional market share. In Australia, the mining, construction, and renewable energy sectors drive steady demand for industrial fasteners. In South Korea, the presence of leading automotive and electronics manufacturers supports consistent growth, with additional emphasis on fasteners designed for advanced technologies, including electric vehicles and 5G infrastructure. Both countries, though smaller in overall share, play important roles in niche high-value segments within the broader regional market.

Key Player Analysis:

- Nifco Inc.

- Shanghai Prime Machinery Co. Ltd.

- Meidoh Co. Ltd.

- Sundram Fasteners Limited

- Agrati Group

- HIL Ltd.

- Bhansali Fasteners

- Zhejiang Huantai Fastener Co., Ltd.

- Kyocera Corporation

- Nippon Industrial Fasteners Company (Nifco)

Competitive Analysis:

The Asia Pacific Industrial Fasteners Market is highly competitive, characterized by the presence of both global manufacturers and strong regional players. Leading companies such as Nifco Inc., Stanley Black & Decker, Illinois Tool Works Inc., and Nippon Industrial Fasteners Company (Nifco) maintain a dominant presence by offering a wide range of high-quality, application-specific fasteners. Regional companies like Sundram Fasteners Limited, LISI Group, and Shanghai Prime Machinery Company focus on expanding their portfolios and improving cost competitiveness to capture greater market share. Continuous investments in research and development, coupled with strategic mergers, acquisitions, and partnerships, are common strategies employed to strengthen market positioning. Moreover, players are emphasizing the production of lightweight, corrosion-resistant, and high-performance fasteners to meet evolving industry demands, particularly in the automotive, aerospace, and construction sectors. Technological innovation and a focus on sustainability are becoming critical differentiators in this dynamic and growing regional market.

Recent Developments:

- In January 2024, Meidoh Co. Ltd., a leading automotive fastener manufacturer, acquired Pilgrim Screw Corporation, a prominent aerospace fastener producer based in the United States. This acquisition marks Meidoh’s diversification into the aerospace sector, expanding its product offerings and global reach. The move is expected to strengthen Meidoh’s position as a world-class fastener manufacturer.

- In March 2024, HIL Ltd., part of the CK Birla Group, signed an agreement to acquire Crestia Polytech and its subsidiaries, including the Topline brand, for ₹265 crores. This acquisition significantly enhances HIL’s presence in the pipes and fittings segment, nearly doubling its revenue and tripling its production capacity, especially in Eastern India. The move also grants HIL access to patented technologies in electrofusion fittings and water tanks, strengthening its position in infrastructure and government projects.

Market Concentration & Characteristics:

The Asia Pacific Industrial Fasteners Market exhibits a moderate to high level of market concentration, with a mix of large multinational corporations and numerous regional players competing for market share. Leading firms dominate key segments through extensive product portfolios, strong distribution networks, and continuous innovation, while smaller manufacturers cater to niche applications and localized demand. The market is characterized by high price sensitivity, increasing customization requirements, and a growing emphasis on product quality and reliability. Technological advancements, particularly in materials science and automated manufacturing processes, are reshaping production practices and enabling faster, more precise fastener development. Sustainability is becoming a notable characteristic, with rising demand for recyclable and eco-friendly fasteners across industries. Furthermore, the market reflects a dynamic competitive landscape, where responsiveness to changing customer needs, the ability to offer application-specific solutions, and investment in smart manufacturing capabilities are essential for long-term success.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising electric vehicle production will drive increased demand for lightweight and high-performance fasteners.

- Expansion of renewable energy projects will create new opportunities for corrosion-resistant fastening solutions.

- Growth in infrastructure development across emerging economies will sustain strong fastener consumption.

- Increasing adoption of automation and robotics in manufacturing will push demand for precision-engineered fasteners.

- Advancements in material science will enable the development of ultra-lightweight and eco-friendly fasteners.

- Surge in consumer electronics manufacturing will boost demand for miniaturized fastening components.

- Diversification of supply chains will encourage investments in Southeast Asia, expanding regional production bases.

- Implementation of Industry 4.0 practices will streamline fastener manufacturing processes and improve customization capabilities.

- Rising emphasis on environmental sustainability will drive innovations in recyclable and biodegradable fasteners.

- Strategic mergers and acquisitions among key players will intensify competition and foster market consolidation.