Market Overview

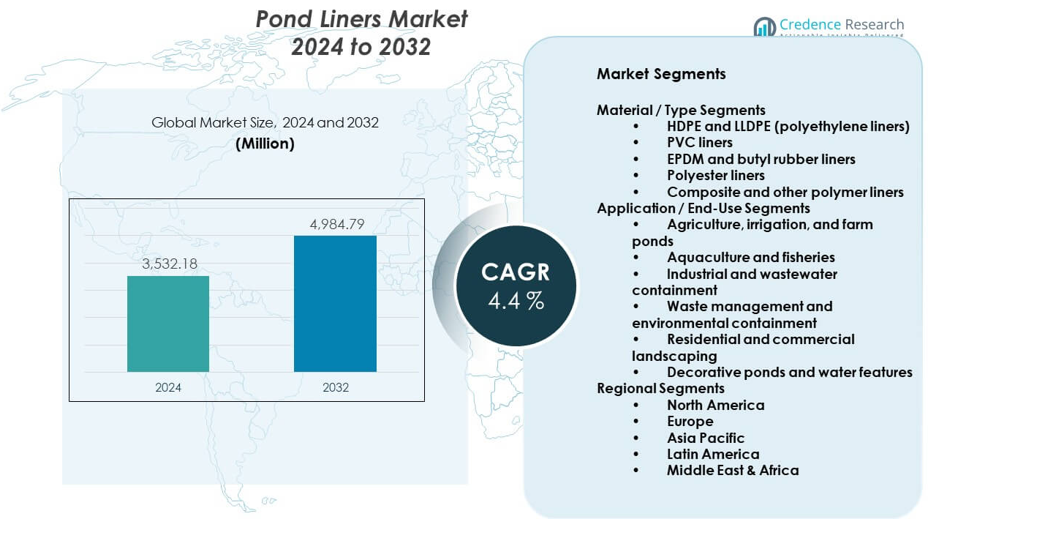

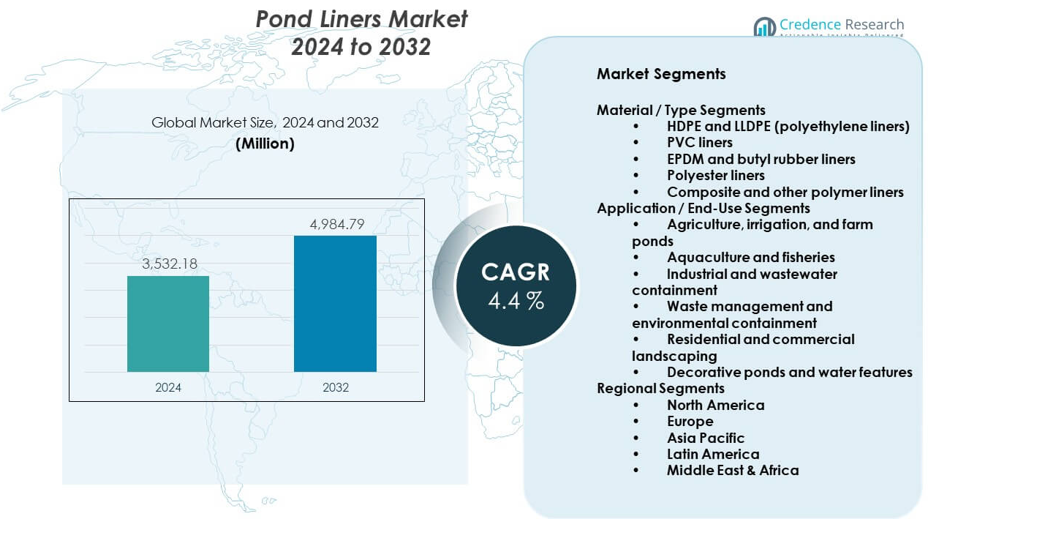

The Pond Liners Market is projected to grow from USD 3,532.18 million in 2024 to USD 4,984.79 million by 2032. The market is expected to register a CAGR of 4.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pond Liners Market Size 2024 |

USD 3,532.18 million |

| Pond Liners Market, CAGR |

4.4% |

| Pond Liners Market Size 2032 |

USD 4,984.79 million |

Market growth is driven by rising demand for efficient water management solutions. Landscaping projects use pond liners to ensure water retention and shape control. Aquaculture farms rely on liners to maintain water quality and limit seepage losses. Agriculture uses lined ponds for irrigation storage during dry seasons. Durable polymer liners resist UV exposure and weather stress. Easy installation supports residential adoption. Growing interest in decorative ponds and backyard water features also boosts demand.

North America leads the market due to strong landscaping and aquaculture activity. The United States shows high adoption across residential and commercial projects. Europe follows, supported by garden design trends and environmental standards. Germany and the United Kingdom remain key contributors. Asia Pacific emerges as a fast-growing region. China and India benefit from expanding aquaculture and irrigation needs. Latin America shows steady growth, supported by agriculture development and water conservation efforts.

Market Insights:

- The market stood at USD 3,532.18 million in 2024 and will reach USD 4,984.79 million by 2032, with a CAGR of 4.4%. Growth reflects steady demand from water management, aquaculture, and landscaping projects. Long service life and material durability support repeat demand.

- North America leads with about 35% share due to strong landscaping and industrial use. Asia Pacific follows with nearly 30% share, driven by aquaculture and irrigation expansion. Europe holds around 25% share, supported by environmental standards and garden design demand.

- Asia Pacific is the fastest-growing region with close to 30% share. Rapid aquaculture growth, irrigation projects, and infrastructure development drive expansion. Rising water conservation efforts further support demand.

- By material, HDPE and LLDPE liners account for about 45% share due to strength and chemical resistance. PVC and EPDM liners together hold nearly 35% share, supported by flexibility and UV resistance.

- By application, agriculture and aquaculture together represent around 50% share. Industrial, wastewater, and environmental containment account for nearly 30%, supported by regulatory compliance needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Efficient Water Retention Across Multiple Applications

The Pond Liners Market benefits from strong demand for reliable water containment solutions. Landscaping projects require controlled water storage for ponds and water features. Aquaculture operators depend on liners to maintain stable water conditions. Agriculture uses lined ponds to reduce seepage losses. Industrial sites adopt liners for wastewater and effluent containment. Urban expansion increases demand for artificial ponds. Recreational parks invest in durable pond infrastructure. This driver supports steady volume demand. It also improves long-term replacement cycles.

- For instance, Solmax supplies HDPE geomembranes with permeability below 1×10⁻¹³ cm/s, supporting long-term water retention in large containment ponds.

Expansion of Aquaculture and Fisheries Infrastructure Worldwide

Aquaculture growth supports sustained demand for pond liners. Fish farming requires controlled pond depth and hygiene. Liners prevent soil contamination and water loss. The Pond Liners Market gains from commercial fish and shrimp farms. Governments support aquaculture for food security goals. Private operators invest in lined ponds for higher yields. Liners reduce pond maintenance needs. This driver strengthens adoption in coastal and inland regions.

- For instance, AGRU produces HDPE pond liners with thicknesses up to 3.0 mm, widely used in industrial-scale aquaculture ponds exceeding several hectares.

Growth of Residential Landscaping and Decorative Water Features

Homeowners increasingly invest in backyard ponds and gardens. Decorative ponds require flexible and durable liners. Landscape designers prefer liners for shape customization. Retail garden centers promote ready-to-install liner solutions. The Pond Liners Market benefits from DIY pond projects. Residential construction supports outdoor aesthetic upgrades. Liners extend pond life and reduce repair costs. This driver supports steady residential demand.

Need for Durable Materials in Harsh Environmental Conditions

Outdoor ponds face UV exposure and weather stress. Pond liners provide resistance to puncture and aging. HDPE and EPDM liners support long service life. Industrial users prefer liners with chemical resistance. The Pond Liners Market gains from durability-focused buying decisions. Long lifespan reduces total ownership costs. Buyers prioritize material performance over price alone. This driver supports premium product segments.

Market Trends:

Shift Toward High-Performance and Multi-Layer Polymer Liners

Manufacturers focus on advanced polymer formulations. Multi-layer liners offer improved strength and flexibility. Customers seek products with higher tear resistance. The Pond Liners Market reflects preference for engineered materials. Suppliers invest in material science upgrades. Performance-based differentiation gains importance. High-performance liners support larger pond projects. This trend favors branded products.

- For instance, Carlisle SynTec offers highly flexible non-reinforced EPDM liners that achieve elongation at break above 300% to accommodate ground movement in complex pond designs. Conversely, their reinforced EPDM liners prioritize dimensional stability and high puncture resistance, with elongation limited by an internal fabric scrim to ensure structural integrity in specialized applications like vertical walls or mechanically attached systems.

Growing Preference for Eco-Friendly and Non-Toxic Materials

Environmental awareness influences material selection. Buyers prefer liners safe for fish and plants. Non-toxic formulations gain traction in aquaculture. The Pond Liners Market aligns with sustainability goals. Regulators encourage eco-safe water containment products. Manufacturers highlight recyclable polymer options. Green positioning supports brand value. This trend shapes product development strategies.

- For instance, Firestone Building Products’ EPDM pond liners (branded as PondGard) are specifically formulated to be inert and safe for aquatic life, as confirmed by testing reports from the UK Water Research Centre.

Rising Adoption of Custom-Cut and Prefabricated Liners

End users demand precise liner dimensions. Custom-cut liners reduce installation time. Prefabricated shapes suit standard pond designs. The Pond Liners Market adapts to convenience-driven demand. Contractors value reduced labor requirements. Retail channels promote ready-fit solutions. Custom options improve installation accuracy. This trend supports value-added services.

Increased Use of Pond Liners in Industrial Water Management

Industries use lined ponds for effluent control. Liners help meet regulatory water standards. Mining and construction sites adopt lined reservoirs. The Pond Liners Market expands beyond landscaping uses. Industrial buyers demand thicker liner grades. Compliance needs drive procurement decisions. Liners support controlled waste handling. This trend broadens end-use scope.

Market Challenges Analysis:

High Initial Material and Installation Cost Sensitivity

Cost remains a key barrier for some buyers. Premium liners carry higher upfront prices. Small-scale users delay adoption due to budget limits. The Pond Liners Market faces price comparison pressure. Installation costs add to total expenditure. DIY users risk improper installation. Low-cost alternatives reduce perceived value. This challenge affects volume growth in price-sensitive regions.

Performance Issues from Improper Installation and Handling

Incorrect installation leads to liner damage. Wrinkles and poor base preparation cause failures. The Pond Liners Market suffers reputation risk from misuse. End users lack technical installation knowledge. Damage reduces liner lifespan. Warranty claims increase supplier burden. Education gaps limit product performance perception. This challenge affects long-term customer trust.

Market Opportunities:

Expansion of Aquaculture and Irrigation Projects in Emerging Economies

Developing regions invest in water storage infrastructure. Aquaculture expansion supports liner demand growth. Irrigation ponds require leak-proof solutions. The Pond Liners Market benefits from rural development programs. Governments fund water conservation projects. Private farms seek efficient pond construction. Liners enable scalable pond deployment. This opportunity supports regional expansion.

Innovation in Lightweight and Easy-to-Install Liner Solutions

Demand grows for user-friendly liner products. Lightweight materials simplify transport and handling. The Pond Liners Market gains from installation-focused innovation. Contractors value reduced labor time. Homeowners prefer simple installation steps. Foldable liners suit small projects. Product innovation improves market accessibility. This opportunity supports wider adoption.

Market Segmentation Analysis:

Material / Type Segments

The Pond Liners Market includes a wide range of material options tailored to performance needs. HDPE and LLDPE liners lead due to high strength, chemical resistance, and long service life. PVC liners support flexible designs and cost-sensitive projects. EPDM and butyl rubber liners serve applications that need high elasticity and UV resistance. Polyester liners address lightweight and temporary pond requirements. Composite and other polymer liners combine durability with enhanced puncture resistance. Material selection depends on pond size, exposure conditions, and lifespan expectations.

- For instance, BTL Liners manufactures reinforced polyethylene liners with tear resistance exceeding 400 N, supporting heavy-duty pond applications.

Application / End-Use Segments

Agriculture, irrigation, and farm ponds represent a major demand segment due to water storage needs. Aquaculture and fisheries rely on liners to maintain water quality and pond stability. Industrial and wastewater containment uses liners for controlled water handling. Waste management and environmental containment demand high-performance liners for regulatory compliance. Residential and commercial landscaping drives demand for flexible and easy-to-install liners. Decorative ponds and water features support steady sales in the consumer segment. Each application favors specific liner properties based on durability, flexibility, and environmental exposure.

- For instance, Aquascape Inc. supplies EPDM pond liners used in koi ponds exceeding 50,000 gallons, supporting long-term water clarity and structural integrity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

Material / Type Segments

- HDPE and LLDPE (polyethylene liners)

- PVC liners

- EPDM and butyl rubber liners

- Polyester liners

- Composite and other polymer liners

Application / End-Use Segments

- Agriculture, irrigation, and farm ponds

- Aquaculture and fisheries

- Industrial and wastewater containment

- Waste management and environmental containment

- Residential and commercial landscaping

- Decorative ponds and water features

Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Pond Liners Market, accounting for about 35% of global demand. Strong adoption across landscaping, aquaculture, and industrial containment supports this position. The United States leads regional consumption due to large-scale pond construction projects. Agriculture uses liners for irrigation storage and runoff control. Residential landscaping also supports steady volume demand. Regulatory focus on water management supports industrial liner use. It benefits from established suppliers and high material quality standards.

Europe

Europe represents nearly 25% of the global Pond Liners Market share. Countries such as Germany, the United Kingdom, and France drive regional demand. Landscaping and decorative pond projects support consistent consumption. Environmental compliance pushes demand for high-quality liners in waste and wastewater containment. Aquaculture activity in coastal and inland areas also contributes. EPDM and PVC liners see strong preference across the region. It gains stability from mature construction and environmental policies.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific accounts for around 30% of the Pond Liners Market and shows the fastest growth pace. China and India lead due to expanding aquaculture and irrigation needs. Infrastructure development supports industrial and environmental containment use. Latin America holds close to 6% share, supported by agriculture expansion. Middle East & Africa represent nearly 4% share, driven by water storage projects. Harsh climate conditions increase demand for durable liners. It benefits from rising investment in water conservation initiatives.

Key Player Analysis:

- AGRU

- GSE Environmental LLC / Solmax

- BTL Liners

- Carlisle (Carlisle SynTec / Carlisle Construction Materials)

- Firestone Building Products

- Emmbi Industries Limited

- HongXiang New Geo-Material Co. Ltd.

- Aquascape Inc.

- Industrial & Environmental Concepts Inc.

- Fab-Seal Industrial Liners Inc.

- DLM Plastics

- Mypondliner

- Tarp PVC

- Inspired By Water Ltd.

- BPM Geosynthetics

- Western Environmental Liner

Competitive Analysis:

The Pond Liners Market shows moderate consolidation with global and regional manufacturers competing on material quality, durability, and customization. Leading players focus on HDPE, EPDM, and composite liners to meet varied application needs. Product reliability and long service life support brand preference among industrial and agricultural buyers. Pricing strategies vary by region and liner thickness. Distribution strength plays a key role in market reach. Companies invest in technical support to reduce installation failures. The Pond Liners Market benefits from steady replacement demand. It remains competitive through product differentiation and application-specific solutions.

Recent Developments:

- In October 2025, Industrial & Environmental Concepts Inc. announced an exciting milestone in its 20+ year partnership with Riverview, LLP through the Grace Dairy project. Grace Dairy, a 10,500-head farm in Minnesota, will feature IEC’s innovative biogas collection covers on all four storage basins, marking a significant addition to their ongoing collaboration in sustainable agricultural solutions. This partnership demonstrates IEC’s commitment to developing and implementing biogas collection technologies for large-scale agricultural operations.

- In October 2025, Emmbi Industries Limited took a significant strategic step by establishing a wholly owned subsidiary named Zastian EZ-LLC in Ras Al Khaimah, United Arab Emirates. The subsidiary, approved by the company’s Board of Directors on October 17, 2025, will focus on manufacturing FIBC Jumbo Bags and represents Emmbi’s expansion into international markets, with the entity registered with the Ras Al Khaimah Economic Zone Authority (RAKEZ). This move supports Emmbi’s broader strategy of expanding its presence in specialized packaging solutions globally.

- In August 2025, D&M Plastics (also referenced as DLM Plastics in some contexts) was acquired by JBT in a strategic move to expand the company’s global presence and operational capacity. The acquisition, announced in August 2025, strengthens JBT’s ability to offer local, agile, and reliable industrial solutions to support critical developments of North American customers in ISO7 cleanrooms. D&M Plastics, established in 1972 as a leader in plastic injection molding with significant presence in the healthcare sector, expanded JBT’s production space and capabilities.

Report Coverage:

The research report offers an in-depth analysis based on material type and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Aquaculture expansion will sustain long-term liner demand

- Irrigation pond development will support rural adoption

- Durable polymer liners will gain preference

- Composite liners will see wider industrial use

- Custom-cut liners will improve installation efficiency

- Environmental containment projects will rise steadily

- Emerging economies will drive volume growth

- Residential landscaping will support retail sales

- Material innovation will enhance liner lifespan

- Distribution partnerships will strengthen regional presence