Market Overview

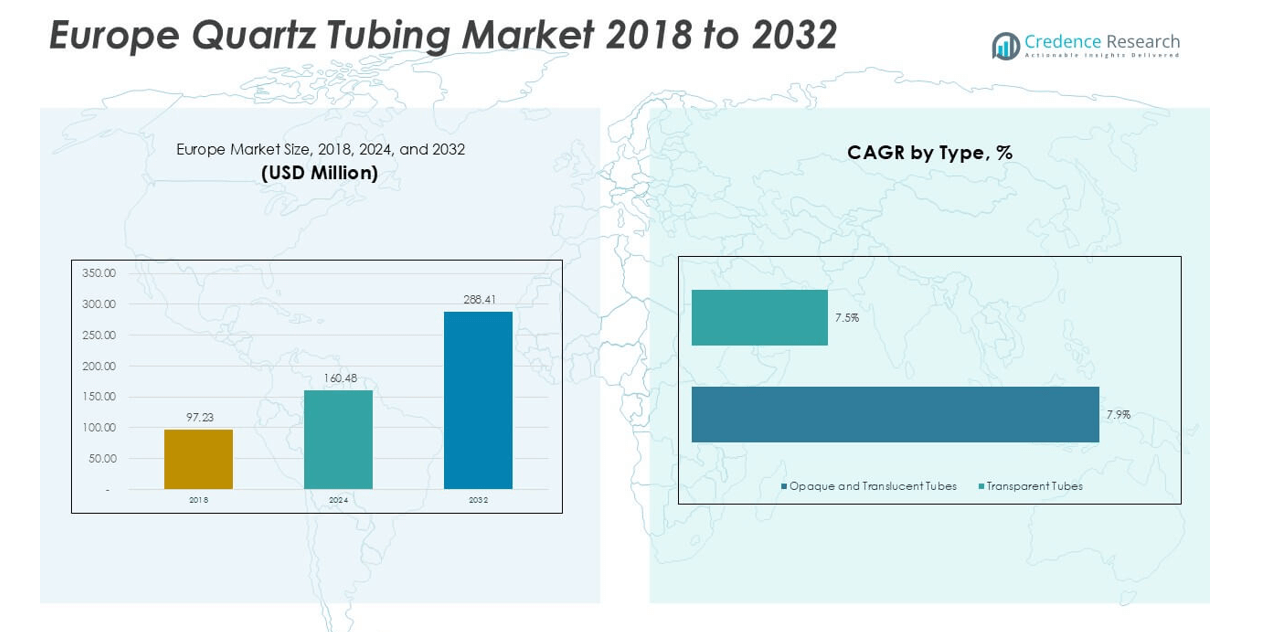

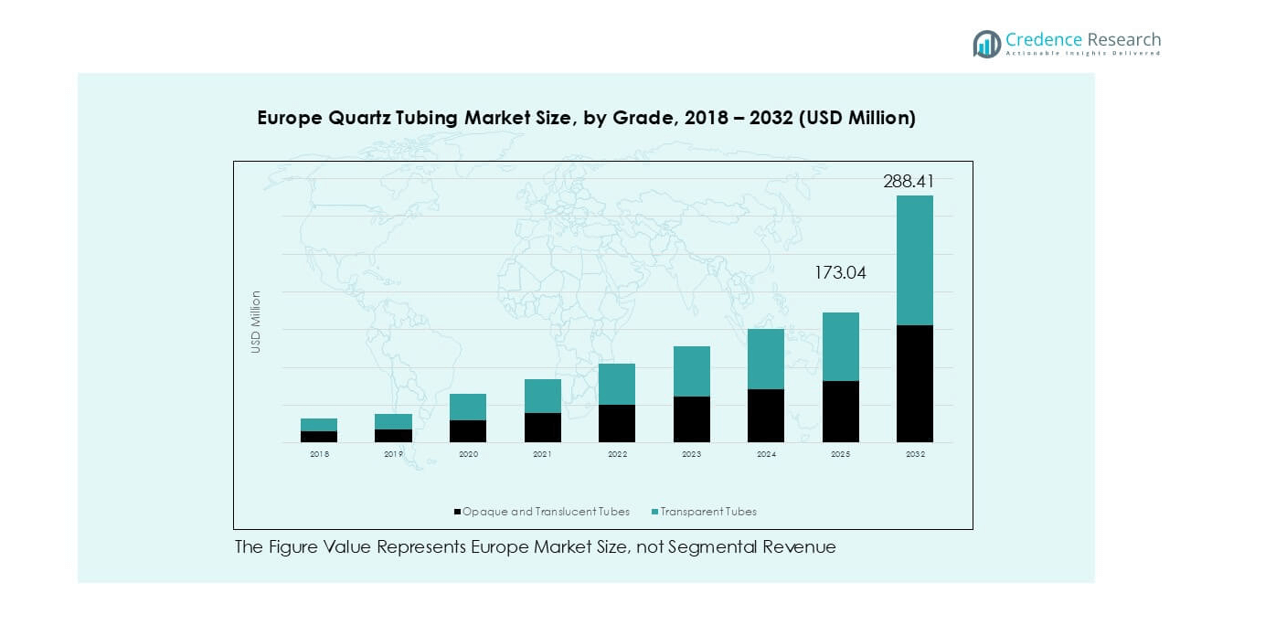

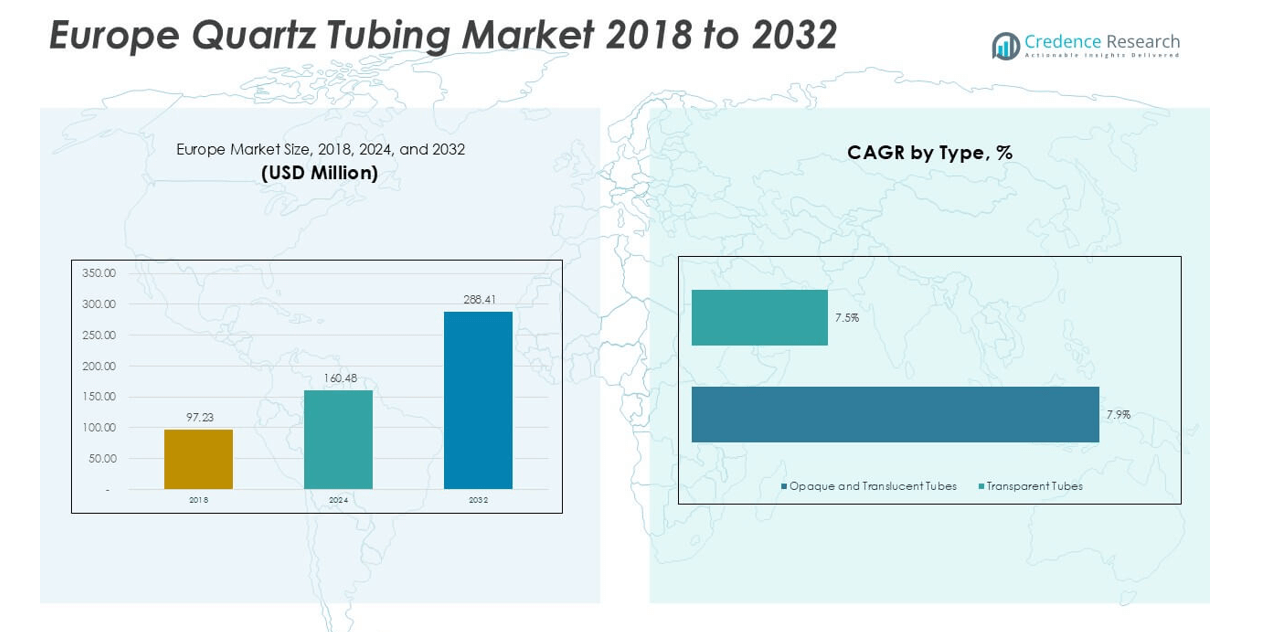

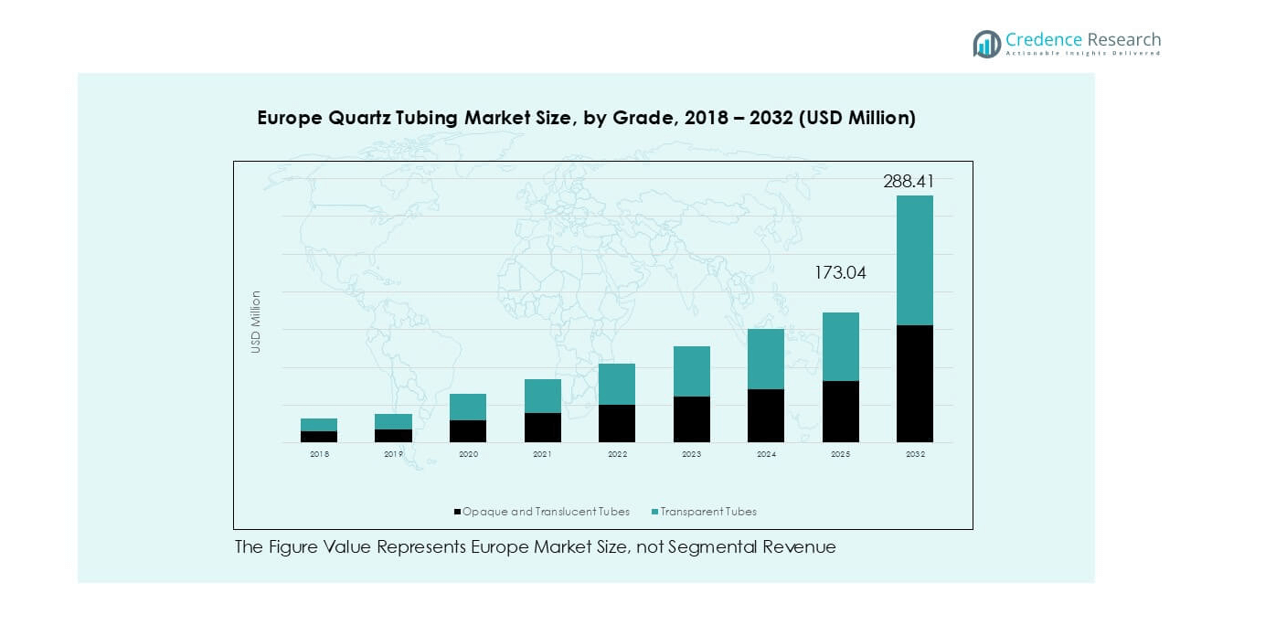

Europe Quartz Tubing market size was valued at USD 97.23 million in 2018 and increased to USD 160.48 million in 2024. The market is anticipated to reach USD 288.41 million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Tubing Market Size 2024 |

USD 160.48 million |

| Europe Quartz Tubing Market, CAGR |

7.6% |

| Europe Quartz Tubing Market Size 2032 |

USD 288.41 million |

The Europe quartz tubing market is led by major players such as Heraeus, QSIL, WONIK Quartz Europe, Raesch Quarz (Germany) GmbH, GVB GmbH, and proQuarz GmbH, each competing through high-purity materials, precise forming capabilities, and strong regional supply networks. These companies support key industries such as semiconductors, industrial heating, UV disinfection, and specialty optics, driving steady procurement across Europe. Germany remains the leading regional market, holding 28% share due to its strong semiconductor base and advanced manufacturing ecosystem. France, the U.K., and Italy–Spain follow as significant contributors, supported by robust industrial and research activities.

Market Insights

- The Europe quartz tubing market reached USD 160.48 million in 2024 and is set to grow to USD 288.41 million by 2032 at a 7.6% CAGR, reflecting strong demand across industrial and high-purity applications.

- Market growth is driven by rising semiconductor investments, strong demand for UV-C systems, and increased adoption of high-temperature quartz components across chemicals and advanced manufacturing.

- Key trends include a shift toward ultra-high-purity transparent tubes, automation in forming and inspection lines, and growing use in photonics, specialty lighting, and energy-research applications.

- Competition features major players such as Heraeus, QSIL, WONIK Quartz Europe, and Raesch Quarz, with segment leadership held by opaque and translucent tubes at 58% share and industrial applications at 46% share.

- Regionally, Germany leads with 28%, followed by France at 14%, the U.K. at 12%, Italy–Spain at 17%, Russia at 10%, and Turkey at 9%, reflecting varied industrial and semiconductor activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

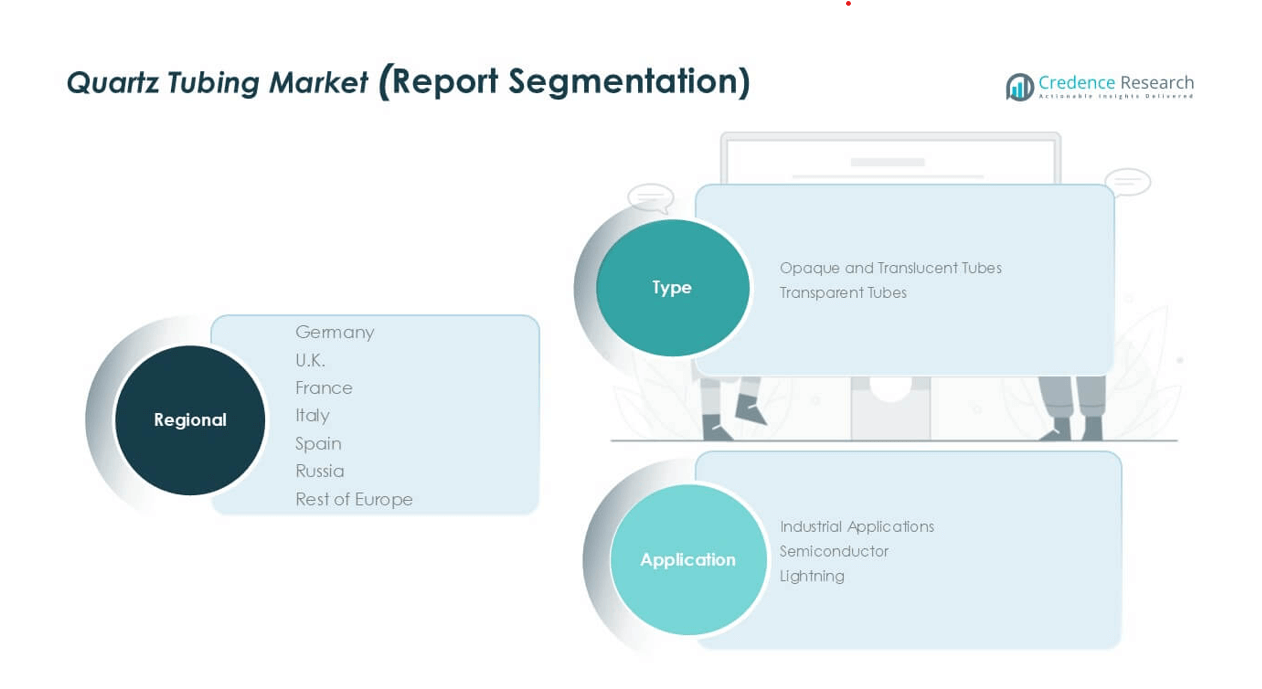

Market Segmentation Analysis:

By Type

Opaque and translucent tubes hold the dominant share of about 58% in the Europe quartz tubing market. Demand grows due to strong use in industrial furnaces, UV systems, and high-temperature processing units that rely on strong thermal stability. Manufacturers benefit from steady orders from chemical plants, glass processors, and environmental equipment producers that prefer durable and cost-efficient tubing. Transparent tubes expand at a faster pace as semiconductor, photonics, and laboratory customers seek higher purity and tighter dimensional control for precision processes.

- For instance, QSIL’s fused-silica tubes for European industrial users feature thermal expansion near 0.55×10⁻⁶/K and OH content below 10 ppm, which supports high-temperature furnace and UV-system performance.

By Application

Industrial applications lead the market with roughly 46% share, supported by broad use in heating systems, reactors, and purification units across Germany, France, and the U.K. Growth stems from higher investment in advanced manufacturing and stricter emission norms that increase adoption of quartz components. The semiconductor segment shows rapid expansion as fabs require high-purity transparent tubes for diffusion, RTP, and wafer-handling steps. The lighting segment remains steady, driven by UV-C lamp production and specialty illumination systems used in healthcare and water treatment.

- For instance, Heraeus supplies UV-C quartz tubes with transmittance levels above 85% at 254 nm and thermal-shock resistance suitable for rapid on-off lamp cycling, supporting strong demand in European disinfection and water-treatment systems.

Key Growth Drivers

Rising Semiconductor Fabrication Expansion Across Europe

Semiconductor capacity expansion acts as a strong growth engine for Europe’s quartz tubing market. New fabrication projects in Germany, Ireland, and Italy increase demand for high-purity transparent quartz tubes used in diffusion, oxidation, and wafer-handling steps. Chip manufacturers prefer quartz components due to strong thermal endurance and low contamination risk, which improves yield stability during high-temperature cycles. Government incentives under the EU Chips Act encourage fabs to upgrade equipment, supporting higher consumption of advanced quartzware. Growing investment in power electronics, automotive chips, and photonics further boosts long-term demand. Rising adoption of EVs and industrial automation deepens the need for specialized quartz products.

- For instance, Momentive supplies semiconductor-grade quartz tubes with certified metallic impurities below 1 ppm and operating stability above 1,050 °C, supporting diffusion and LPCVD processes in European 300-mm fabs.

Growing Adoption of UV and Industrial Heating Technologies

Expansion of UV disinfection, advanced thermal processing, and industrial heating systems strengthens market growth across Europe. Industries such as chemicals, pharmaceuticals, and water treatment rely on opaque and translucent quartz tubing for stable performance under rapid heating and corrosive environments. Demand rises as factories upgrade infrastructure to meet stringent environmental and energy-efficiency regulations. Quartz tubes support long lamp life and reliable thermal shock resistance, making them vital in UV-C reactors and high-intensity heating lines. Municipal water authorities and indoor-air treatment providers continue adopting UV systems, pushing volume growth. Industrial furnace manufacturers also increase procurement as they shift to cleaner and more precise heating technologies.

- For instance, Heraeus manufactures UV-C quartz tubes with transmission above 85% at 254 nm and thermal-shock resistance validated through rapid heating cycles, supporting their use in European water-treatment and air-sanitization equipment.

Expansion of Advanced Material Processing and Research Activities

Europe’s strong focus on advanced materials, clean-energy technologies, and R&D boosts quartz tubing consumption. Research institutes, battery-material developers, and ceramics manufacturers require controlled, high-purity environments achievable with quartzware. Transparent and opaque tubes play key roles in sintering, calcination, and thermal-cycling procedures. Growth in lithium-ion battery materials, hydrogen research, and optical materials strengthens quartz usage due to strict purity needs and high-temperature resilience. Universities and labs also expand procurement of custom-dimension tubes for analytical and experimental setups. Government funding for energy innovation continues to stimulate demand across pilot research lines.

Key Trends & Opportunities

Shift Toward High-Purity and Tight-Tolerance Quartz Tubing

A major trend involves rising demand for ultra-high-purity quartz tubing with stricter dimensional accuracy driven by semiconductor, photonics, and specialty optics customers. European suppliers invest in cleaner melting technologies, precision forming, and automated inspection systems to reduce micro-defects and particle shedding. This shift creates a strong opportunity for manufacturers that can supply consistent tube quality for advanced thermal tools. High-purity products become essential as fabs transition to finer geometries and more demanding diffusion processes. Growth in EV power devices, laser systems, and analytical instruments expands the premium segment.

- For instance, QSIL uses automated laser-measurement systems that hold tube-diameter tolerances within ±0.1 mm while delivering hydroxyl levels under 10 ppm, supporting advanced oxidation and CVD processes in European fabs.

Increasing Adoption of UV-C and Specialty Lighting Applications

Growing interest in UV-C disinfection, medical lighting, and specialty illumination creates new opportunities for quartz tubing producers. Demand increases as hospitals, commercial buildings, and municipal utilities adopt UV-based systems for air, water, and surface treatment. European lighting manufacturers prefer quartz tubes due to high UV transmittance, long operating life, and strong thermal resistance. The trend also aligns with sustainability goals as UV technology replaces chemical disinfectants. Specialty lighting for horticulture, phototherapy, and industrial curing further expands growth prospects for transparent and doped quartz tubing.

- For instance, Heraeus produces UV-C quartz tubes with transmission above 85% at 254 nm and heat stability validated at temperatures exceeding 1,000 °C, enabling long lamp life in medical and water-treatment systems across Europe.

Automation and Customization in Industrial Processing Lines

Automation trends across European manufacturing create opportunities for quartz tubing suppliers to offer customized, ready-to-integrate components. Producers focus on tubes with precise tolerances suitable for robotic handling, automated heating zones, and sensor-integrated systems. Customized quartzware supports advanced thermal uniformity, longer equipment lifetime, and reduced downtime. This trend grows as industries upgrade their plants under digital-transformation and energy-efficiency programs. Tailored products for chemical reactors, glass processing, and high-temperature furnaces strengthen market penetration.

Key Challenges

High Production Costs and Dependence on High-Purity Raw Materials

A major challenge stems from the high cost of producing premium quartz tubing, which depends on high-purity silica feedstock and energy-intensive melting processes. European manufacturers face cost pressure from fluctuating raw-material prices and rising energy tariffs across the region. Maintaining consistent purity levels and preventing contamination during forming and annealing adds to production complexity. These cost barriers often limit competitiveness against suppliers in Asia with lower operating expenses. Smaller producers struggle to scale capacity, affecting supply stability for advanced applications.

Supply Chain Constraints and Lead-Time Pressures

The Europe quartz tubing market faces logistical challenges linked to long lead times, import dependencies, and limited regional production of specialized quartz products. Semiconductor and industrial customers require stable supply for continuous operations, but disruptions in raw material sourcing or furnace downtime can delay deliveries. Cross-border transport regulations and energy-related production curtailments further increase uncertainty. OEMs increasingly seek diversified suppliers, yet capacity remains concentrated among a few global players. These constraints slow expansion efforts and require manufacturers to invest in regional supply resilience.

Regional Analysis

Italy and Spain

Italy and Spain hold a combined share of about 17% in the Europe quartz tubing market, supported by strong demand from industrial heating, glass processing, and environmental technologies. Both countries invest in UV-based water treatment and adopt high-temperature quartz components in ceramics, chemicals, and metallurgical operations. Semiconductor-related usage remains limited but grows with ongoing electronics assembly expansion. Local furnace and lamp manufacturers increase procurement of opaque and translucent tubes due to reliable thermal shock resistance. Government support for clean-energy and industrial modernization projects further boosts the adoption of durable quartz products across industrial clusters.

Germany

Germany accounts for approximately 28% of the market, making it the leading regional consumer of quartz tubing. Its strong semiconductor ecosystem, advanced manufacturing plants, and chemical processing hubs drive high demand for transparent and tight-tolerance quartz tubes. Growth accelerates as German fabs invest in new diffusion and RTP tools, while UV-C disinfection systems gain traction across water treatment networks. Robust R&D activity in photonics, specialty optics, and material science also lifts consumption. Precision-focused industries prefer European-made tubing due to strict quality standards, supporting consistent procurement across industrial and research sectors.

United Kingdom

The United Kingdom holds around 12% market share, driven by rising adoption in research labs, specialty lighting, and high-purity industrial processing lines. Universities, photonics centers, and material-science institutes continue to procure transparent quartz tubes for controlled high-temperature applications. Demand increases from UV-C air and water disinfection projects in healthcare and municipal sectors. Growth in semiconductor packaging, optics manufacturing, and pilot-scale clean-energy research further strengthens the market. Local industries emphasize reliability and contamination-free performance, which supports steady imports of high-grade quartz products.

Turkey

Turkey represents nearly 9% of the Europe quartz tubing market, supported mainly by strong industrial heating, metallurgy, and glass-processing activities. Local manufacturers use opaque and translucent quartz tubes for high-temperature furnaces, annealing systems, and UV-based purification equipment. Expanding chemical production and increased focus on energy-efficient process upgrades fuel additional demand. While semiconductor usage remains small, specialty lighting and environmental systems show gradual adoption. Turkey’s developing industrial base continues to invest in modern equipment, which drives steady procurement of durable quartz components for long production cycles.

France

France holds about 14% market share, supported by strong adoption in pharmaceuticals, water treatment, and advanced materials research. The country invests heavily in UV-C disinfection systems for industrial and municipal use, increasing demand for both transparent and translucent quartz tubes. France’s aerospace, optics, and specialty-chemicals sectors also rely on high-purity quartz components for controlled processing steps. Growth in photonics and semiconductor-adjacent industries strengthens interest in tight-tolerance tubing. Supportive government programs for clean technology and high-performance materials continue to lift market expansion.

Russia

Russia accounts for nearly 10% of the market, driven by industrial heating, metallurgy, and chemical-processing plants that use durable quartz tubing for high-temperature cycles. Demand also comes from UV-C water treatment systems adopted by municipal utilities and industrial facilities. Semiconductor activity remains small but stable, with limited consumption of high-purity transparent tubes. Research institutes continue to use quartzware in material testing and optical studies. Despite supply-chain constraints and import dependence, industries prioritize quartz products due to long service life and strong thermal stability, sustaining steady market demand.

Market Segmentations:

By Type

- Opaque and Translucent Tubes

- Transparent Tubes

By Application

- Industrial Applications

- Semiconductor

- Lighting

By Geography

- Italy and Spain

- Germany

- United Kingdom

- Turkey

- France

- Russia

Competitive Landscape

The competitive landscape of the Europe quartz tubing market features a mix of global leaders and specialized regional manufacturers that focus on high-purity materials, tight dimensional accuracy, and strong supply reliability. Companies such as Heraeus, QSIL, WONIK Quartz Europe, and Raesch Quarz (Germany) GmbH maintain strong positions due to advanced melting technologies, automated forming lines, and extensive product portfolios that meet semiconductor, industrial, and UV-lighting needs. Regional suppliers like GVB GmbH and proQuarz GmbH strengthen competition by offering customized tubing solutions and faster delivery cycles tailored to European clients. Asian players, including TOSOH, Fudong Lighting, and Aoxin Quartz, expand their presence through cost-competitive transparent and opaque tubes, increasing pricing pressure. Market rivalry intensifies as semiconductor expansion, UV-C adoption, and industrial modernization drive demand for higher-grade quartzware. Companies invest in precision forming, defect-reduction systems, and application-specific tubing to secure long-term supply contracts with fabs, OEMs, and research institutes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GVB GmbH

- Heraeus

- QSIL

- TOSOH

- Fudong Lighting

- Aoxin Quartz

- Sentro Tech

- proQuarz GmbH

- WONIK Quartz Europe

- Raesch Quarz (Germany) GmbH

Recent Developments

- In Jan 2025, Heraeus combined high-performance materials units into Heraeus Covantics to expand its technology leadership in high-purity quartz and fused silica products.

- In Nov 2024, Momentive Technologies promoted two long-serving executives into global quartz and ceramics leadership roles, strengthening its quartz business focus

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as Europe expands semiconductor fabrication and advanced packaging capacity.

- High-purity transparent tubes will gain faster growth due to tighter process-control needs.

- UV-C disinfection systems will drive steady procurement across water, air, and surface treatment.

- Industrial furnace and heating-equipment upgrades will support long-term use of opaque tubes.

- Photonics, optics, and research labs will increase adoption for precision thermal applications.

- Automation in forming and inspection will improve product consistency and reduce defect rates.

- Regional suppliers will focus on customized tubing to meet specialized industrial needs.

- Competition will intensify as Asian manufacturers expand presence with cost-efficient products.

- Sustainability efforts will push industries toward longer-life, energy-efficient quartz components.

- Supply-chain resilience initiatives will encourage localized production and strategic partnerships.