| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ASIC Emulation and Prototyping Systems Market Size 2023 |

USD 545.89Million |

| ASIC Emulation and Prototyping Systems Market, CAGR |

14.17% |

| ASIC Emulation and Prototyping Systems Market Size 2032 |

USD 1,692.98 Million |

Market Overview:

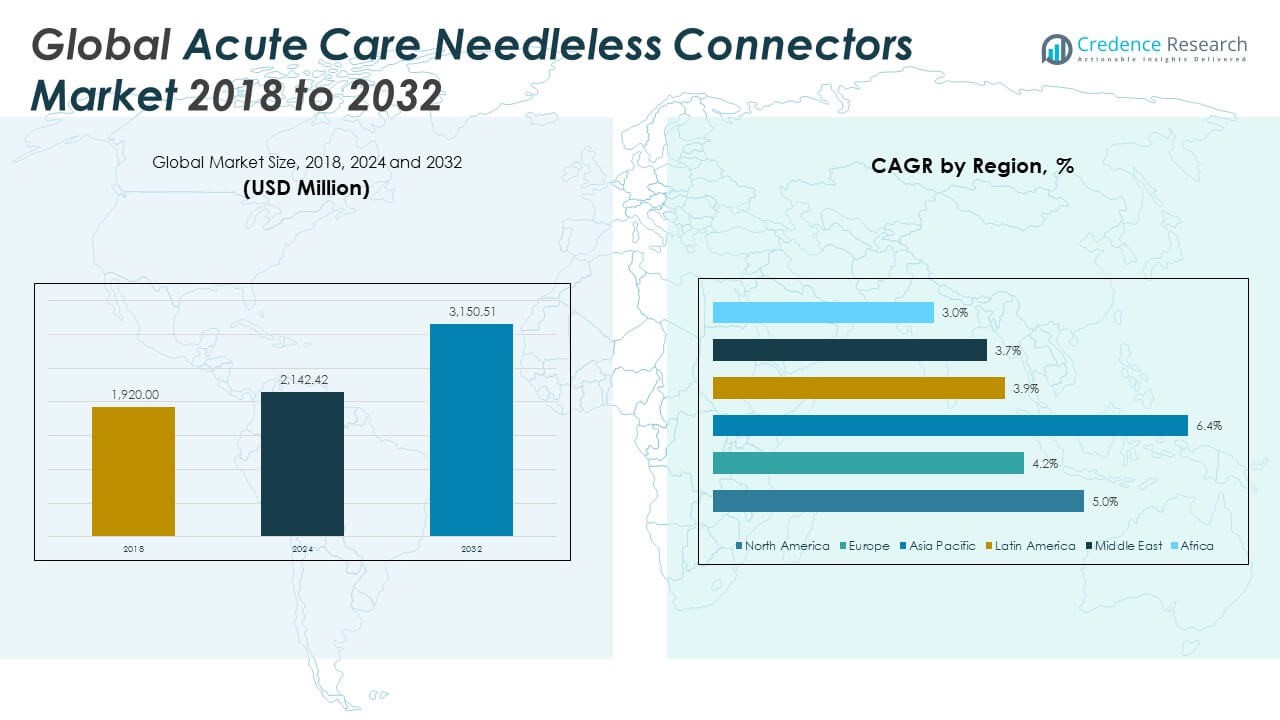

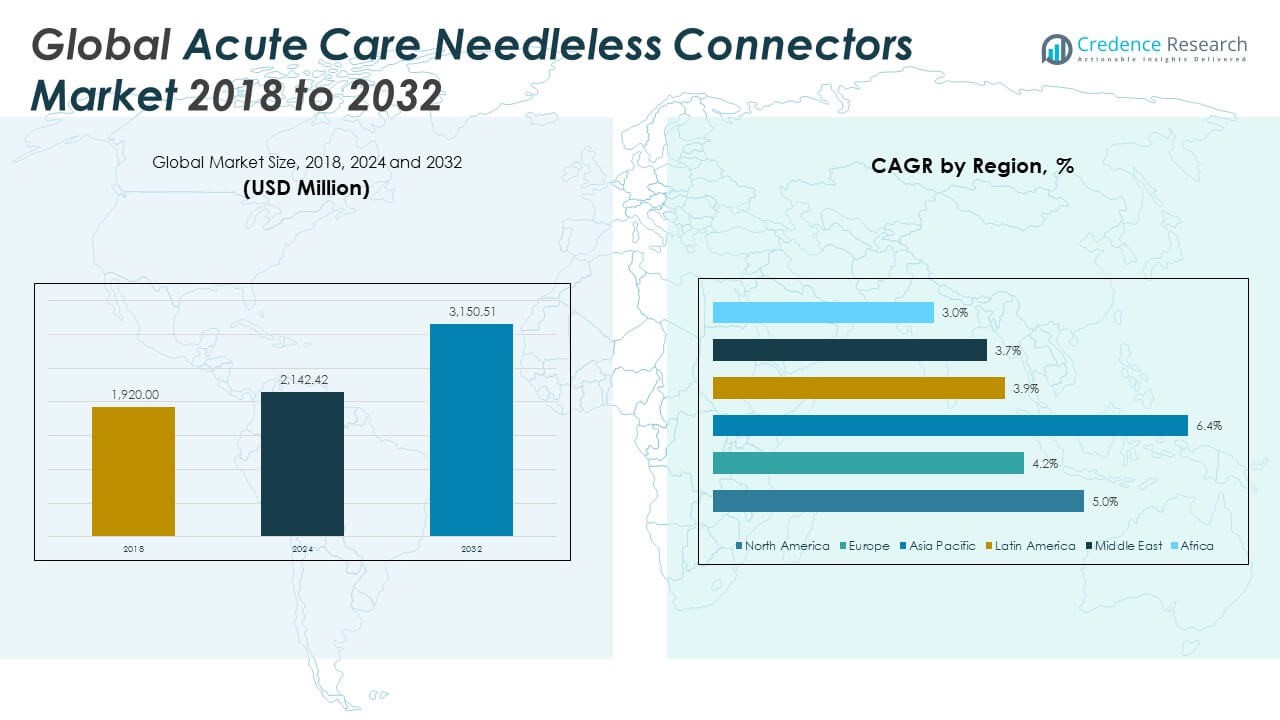

The ASIC Emulation & Prototyping Systems Market size was valued at USD 268.58 million in 2018 to USD 545.89 million in 2024 and is anticipated to reach USD 1,692.98 million by 2032, at a CAGR of 14.17% during the forecast period.

The increasing complexity of ASIC and SoC designs is a primary factor driving the demand for emulation and prototyping systems. With applications across AI, automotive electronics, 5G, and consumer devices, modern chips integrate billions of transistors and require early-stage validation to avoid expensive errors. ASIC emulation and FPGA-based prototyping allow teams to detect hardware bugs early, accelerate time-to-market, and enable hardware-software co-development. This is critical in markets where product launch windows are narrowing. Cost efficiency also plays a vital role, as early verification reduces the risk of silicon respins. Moreover, advancements in cloud-based verification platforms have enhanced remote collaboration, scalability, and resource optimization, supporting the growing adoption of emulation-as-a-service models. These systems are increasingly equipped with advanced debugging tools, high-speed interfaces, and scalable architectures, further expanding their role in chip development workflows.

North America holds the largest share of the ASIC emulation and prototyping systems market, driven by high investments in semiconductor innovation, advanced design toolchains, and strong presence of major players in the U.S. The region benefits from robust demand in data centers, AI processors, automotive ADAS, and telecom infrastructure. Meanwhile, Asia-Pacific is witnessing the fastest growth, supported by the expanding consumer electronics and automotive sectors in China, Japan, South Korea, and Taiwan. Governments in the region are also promoting semiconductor self-reliance, which is boosting demand for advanced verification technologies. Europe follows with notable contributions from industrial automation and automotive R&D in Germany and the Nordic countries. Although still emerging, regions such as Latin America and the Middle East are showing potential as local semiconductor ecosystems evolve, particularly in education, defense, and telecom infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market is experiencing strong growth, expanding from USD 268.58 million in 2018 to USD 545.89 million in 2024, with expectations to reach USD 1,692.98 million by 2032.

- Increasing ASIC and SoC design complexity across AI, 5G, and automotive sectors is driving demand for early validation and robust prototyping tools.

- Hardware-assisted emulation and FPGA-based prototyping are essential for reducing silicon errors, enabling concurrent hardware-software development.

- Cloud-based platforms are accelerating adoption by offering scalable, remote-accessible environments that reduce infrastructure costs and support agile workflows.

- High initial investment and integration complexity present challenges for small and mid-sized firms, limiting widespread adoption despite market growth.

- The market faces toolchain fragmentation, with compatibility and standardization gaps affecting workflow efficiency across global teams.

- North America holds the largest market share, while Asia Pacific is the fastest-growing region due to its booming electronics sector and government support for semiconductor independence.

Market Drivers:

Rising Complexity in Semiconductor Design Necessitates Advanced Verification Platforms

The Global ASIC Emulation & Prototyping Systems Market is expanding due to increasing design complexity in modern integrated circuits. AI accelerators, 5G baseband chips, and automotive SoCs now require verification of billions of transistors across multiple domains. Traditional software simulation methods fall short in speed and scalability, making hardware-assisted emulation and FPGA-based prototyping essential. These systems enable early-stage detection of functional bugs and allow parallel hardware-software development. This capability is vital in meeting compressed product development timelines and strict quality standards. Companies rely on these platforms to avoid the high costs of silicon re-spins and missed market opportunities.

- For example, Cadence’s Palladium Z3 Enterprise Emulation Platformfeatures a compiled capacity of up to 36 billion gates per system and the ability to support 17 virtual users per system, enabling parallel verification tasks.

Demand for Faster Time-to-Market and Efficient Tape-Out Processes Drives Adoption

In a competitive semiconductor landscape, reducing design cycle time is critical. The Global ASIC Emulation & Prototyping Systems Market benefits from the urgent need to accelerate product tape-out. It helps engineering teams achieve faster pre-silicon validation by allowing real-world testing at near-system speeds. Rapid prototyping supports software validation and driver development before silicon is available. This efficiency contributes to faster commercialization and supports agile development cycles. It also gives design houses a competitive edge in securing IP design wins and customer loyalty.

Cost Optimization and Risk Mitigation Support Market Growth Across Verticals

Cost reduction plays a central role in driving the adoption of emulation and prototyping systems. These tools significantly lower the risk of costly post-silicon failures, which could delay product launches and impact revenue. The Global ASIC Emulation & Prototyping Systems Market supports cost-effective iterative design, enabling multiple design refinements before tape-out. It also reduces dependency on physical test chips and allows scalable verification in a virtual environment. For large enterprises and startups alike, this efficiency enhances R&D budget management. The reduction in risk and improvement in time-to-yield further incentivize investment in these platforms.

Emergence of Cloud-Enabled Verification and Scalable Infrastructure Accelerates Adoption

Cloud-based emulation and prototyping infrastructure has gained momentum, transforming the way verification is deployed and scaled. The Global ASIC Emulation & Prototyping Systems Market is leveraging this shift to offer remote accessibility, high availability, and elastic computing power. It enables geographically dispersed teams to collaborate seamlessly on large designs without requiring extensive in-house hardware. Cloud integration supports rapid iteration and parallel job execution, optimizing development timelines. This flexibility aligns with the growing preference for design-as-a-service models and remote engineering operations. It allows semiconductor firms to scale their verification workflows in line with project complexity and team needs.

- For example, Nvidiaadopted Cadence’s CloudBurst platform to support global teams working on large AI and graphics chip designs. This allowed geographically dispersed engineers to access high-capacity Palladium and Protium systems on-demand, eliminating the need for dedicated on-premise hardware clusters.

Market Trends:

Integration of AI and Machine Learning Enhances Verification Intelligence

Vendors are embedding artificial intelligence and machine learning into emulation and prototyping workflows to optimize verification processes. AI algorithms analyze historical test data, predict failure-prone areas, and prioritize simulation paths for higher test coverage. This trend is reshaping the verification landscape by reducing manual test creation and improving accuracy. The Global ASIC Emulation & Prototyping Systems Market is witnessing growing interest in intelligent automation that accelerates bug detection and design validation. It supports faster convergence during verification cycles and improves design quality through adaptive learning. This capability also enables predictive maintenance for hardware systems used in prototyping environments.

Shift Toward Modular and Scalable Emulation Architectures

Design houses are adopting modular emulation platforms that allow flexible configuration and scaling across projects of different complexity. Traditional monolithic systems are being replaced by solutions offering modular hardware and software components that can adapt to evolving verification demands. The Global ASIC Emulation & Prototyping Systems Market is responding with platforms that support incremental capacity expansion without requiring complete system upgrades. It supports resource optimization and ensures long-term return on investment. This modularity also facilitates easier integration with EDA toolchains and enhances usability across verification teams. Companies benefit from streamlined deployment and reduced hardware redundancy.

- For example, Mentor’s Veloce Strato supports scaling from single-board to full-rack configurationswith up to 15 interconnected racks per deployment, meeting the needs of complex projects ranging from IoT ASICs to high-end automotive processors.

Growing Adoption of Unified Hardware-Software Co-Design Workflows

There is a clear trend toward unifying hardware and software design workflows in a single verification environment. Emulation and prototyping platforms are now supporting co-simulation between RTL and embedded software stacks, bridging the traditional gap between hardware and software teams. The Global ASIC Emulation & Prototyping Systems Market is aligning with this trend by enabling synchronized development and testing of drivers, firmware, and middleware. It accelerates system-level validation and reduces integration issues during post-silicon phases. This approach enhances design maturity and supports functional safety compliance in industries such as automotive and aerospace. The convergence of workflows fosters collaboration and reduces verification cycles.

Emphasis on Energy-Efficient Verification Infrastructure

Sustainability and energy efficiency are becoming priorities in verification environments. Vendors are designing emulation and prototyping systems with low-power components, efficient cooling mechanisms, and optimized processing to minimize environmental impact. The Global ASIC Emulation & Prototyping Systems Market is seeing demand for systems that deliver performance without high energy costs. It aligns with corporate ESG goals and supports the deployment of green design labs. Power-aware verification strategies are also gaining traction, enabling design teams to validate power behavior early in the development process. These systems are increasingly benchmarked not just for performance, but also for operational efficiency.

- For instance, Synopsys ZeBu Empower includes power-aware verification features such as clock domain optimization and multi-level thermal monitoring, reducing total lab energy costs by up to $250,000 per year for large installations. These innovations are part of targeted ESG strategies, further enabling deployment in green design environments.

Market Challenges Analysis:

High Initial Investment and Operational Complexity Limit Adoption Among Small Enterprises

The significant upfront cost of emulation and prototyping systems poses a major challenge, especially for small and mid-sized design houses. These systems require specialized hardware, integration with advanced EDA toolchains, and skilled personnel for effective deployment and maintenance. The Global ASIC Emulation & Prototyping Systems Market faces hurdles in expanding beyond established enterprises due to this financial barrier. It becomes difficult for startups and cost-sensitive firms to justify the investment without guaranteed design volumes or funding. Maintenance, upgrades, and training further add to total ownership costs. The lack of standardized tools across vendors also contributes to integration issues, reducing accessibility for broader market segments.

Toolchain Fragmentation and Compatibility Issues Affect Workflow Efficiency

The fragmented nature of verification toolchains creates challenges in achieving seamless workflows. Compatibility issues between emulation platforms, software simulators, and design environments often slow down project timelines and introduce manual overhead. The Global ASIC Emulation & Prototyping Systems Market must address interoperability concerns to support efficient cross-functional collaboration. It often requires custom interfaces and proprietary drivers, limiting flexibility and increasing setup times. These issues become more pronounced in geographically distributed teams where synchronized tool access is critical. Without improved standardization, many organizations struggle to scale verification environments efficiently.

Market Opportunities:

Expansion of AI, Automotive, and IoT Verticals Creates New Application Scope

The rising adoption of ASICs in artificial intelligence, electric vehicles, and IoT devices opens strong growth avenues for verification platforms. These domains demand faster design cycles, robust validation, and early hardware-software integration. The Global ASIC Emulation & Prototyping Systems Market can benefit from increasing investments in advanced driver-assistance systems (ADAS), AI accelerators, and smart sensors. It provides solutions to validate these complex, high-performance chips under real-world scenarios before production. Emerging verticals require scalable verification environments that support evolving design architectures. This demand creates a long-term opportunity for providers offering application-specific emulation and prototyping platforms.

Growing Interest in Cloud-Based and Remote Verification Infrastructure

Remote engineering models and global design teams are fueling demand for cloud-enabled verification solutions. The Global ASIC Emulation & Prototyping Systems Market can capitalize on this shift by delivering flexible, on-demand emulation capacity through cloud infrastructure. It enables teams to run distributed simulations, share debug data in real time, and reduce hardware dependency. This model supports cost-effective scaling for large projects and aligns with hybrid work environments. Vendors that offer secure, scalable, and collaborative cloud platforms are well-positioned to attract both enterprise and mid-tier clients. Cloud-first strategies also appeal to organizations seeking to modernize legacy verification workflows.

Market Segmentation Analysis:

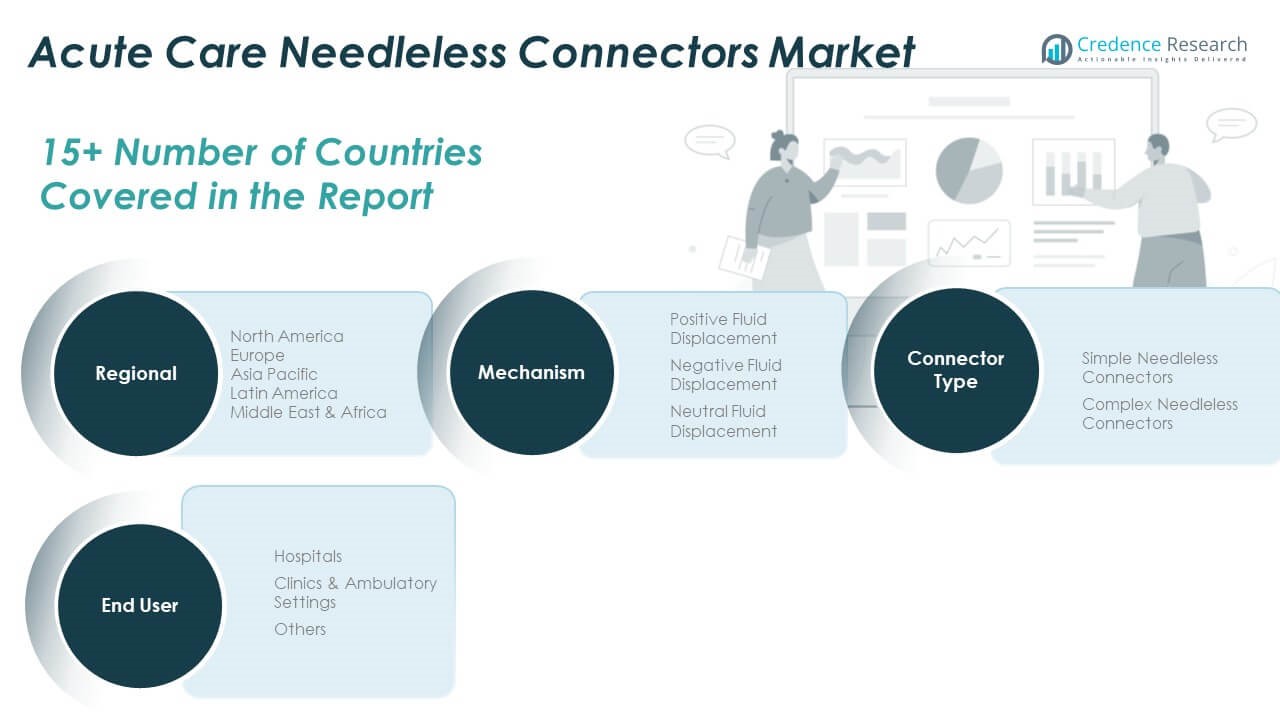

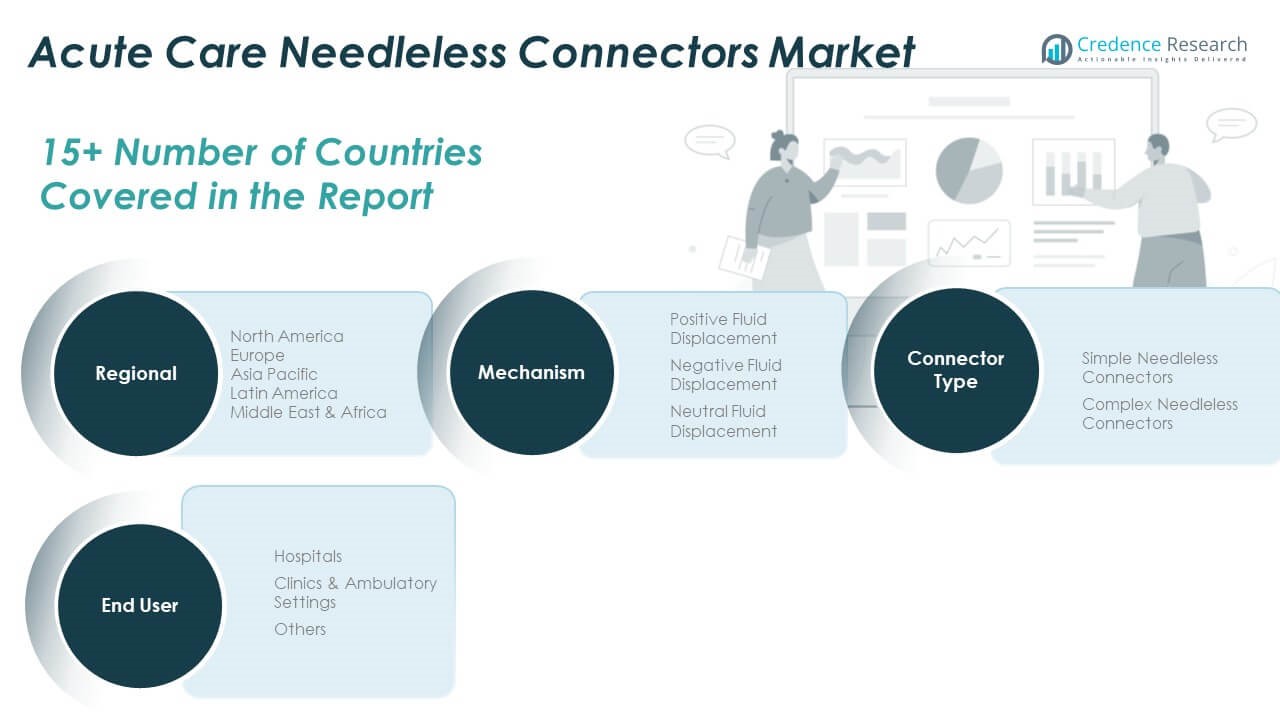

The Global ASIC Emulation & Prototyping Systems Market is segmented by type, application, and end-use industry, reflecting its wide adoption across multiple design and verification workflows.

By type, hardware emulation systems lead due to their ability to handle complex SoC designs with high-speed debugging and scalability. FPGA-based prototyping systems follow, offering flexibility and real-world performance testing, particularly useful in embedded software validation. Hybrid emulation-prototyping platforms are gaining traction for their combined strengths, supporting seamless transitions between functional validation and system integration.

- For example, Synopsys ZeBu Hybrid enabled a major automotive supplier to switch seamlessly between fast functional emulation and hardware prototyping. They verified ISO 26262-compliant automotive controllers by conducting both driver validation and system integration testing on a hybrid platform, achieving over 2 million cycles per second system-level performanceand speeding time-to-market by 20%.

By application, ASIC design verification and validation hold the largest share, driven by the need to detect functional errors early in the design cycle. Software integration and checkout represent a critical phase, enabling early co-development and reducing time-to-market. System-level debugging supports comprehensive analysis of hardware-software interaction, while pre-silicon software development is vital for early deployment of drivers and firmware.

By end-use industry, consumer electronics dominates due to continuous innovation in smart devices and multimedia processors. Automotive and transportation are rapidly expanding segments, driven by demand for ADAS and in-vehicle infotainment systems. Telecommunications benefits from growing 5G infrastructure, while industrial automation and other sectors contribute through applications in robotics, smart grids, and edge devices.

- For instance, Cadence Palladium Z2 and Protium were used for protocol stack and baseband processor validation in a leading 5G infrastructure provider’s ASICs, reducing integration issues and supporting deployments in hundreds of operator networks worldwide.

Segmentation:

By Type

- Hardware Emulation Systems

- FPGA-Based Prototyping Systems

- Hybrid Emulation-Prototyping Platforms

By Application

- ASIC Design Verification & Validation

- Software Integration & Checkout

- System-Level Debugging

- Pre-Silicon Software Development

By End Use Industry

- Consumer Electronics

- Automotive and Transportation

- Telecommunications

- Industrial Automation

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America ASIC Emulation & Prototyping Systems Market size was valued at USD 79.29 million in 2018 to USD 158.69 million in 2024 and is anticipated to reach USD 494.17 million by 2032, at a CAGR of 14.2% during the forecast period. North America holds a 28.2% share of the Global ASIC Emulation & Prototyping Systems Market, driven by its leadership in semiconductor innovation and adoption of advanced verification technologies. It benefits from a strong presence of major EDA vendors, large fabless design firms, and extensive R&D investments in the U.S. The region supports early adoption of emulation platforms across AI, data center, and defense sectors. It also leads in deployment of cloud-based and hybrid verification environments, enabling agile engineering collaboration. Favorable government initiatives and IP protection regulations further attract global design activities to North America. The market continues to expand through the adoption of scalable, modular systems by both startups and enterprise players.

Europe

The Europe ASIC Emulation & Prototyping Systems Market size was valued at USD 54.34 million in 2018 to USD 104.87 million in 2024 and is anticipated to reach USD 298.15 million by 2032, at a CAGR of 12.9% during the forecast period. Europe accounts for a 18.6% share of the Global ASIC Emulation & Prototyping Systems Market, supported by strong industrial automation, automotive, and aerospace R&D. Countries like Germany, the Netherlands, and France drive innovation through public-private semiconductor initiatives and EU-funded research programs. The region favors verification platforms that align with ISO 26262 and other safety standards. It emphasizes energy-efficient and sustainable emulation systems in line with EU climate targets. Increasing semiconductor self-sufficiency initiatives also expand the regional demand for prototyping tools. The market is strengthening through collaborative efforts between OEMs, research labs, and fabless IC firms.

Asia Pacific

The Asia Pacific ASIC Emulation & Prototyping Systems Market size was valued at USD 112.33 million in 2018 to USD 237.12 million in 2024 and is anticipated to reach USD 782.16 million by 2032, at a CAGR of 15.0% during the forecast period. Asia Pacific commands the largest share at 39.5% of the Global ASIC Emulation & Prototyping Systems Market, led by China, Taiwan, Japan, and South Korea. The region’s dominance stems from its expansive semiconductor manufacturing base and rapidly growing consumer electronics and automotive sectors. Demand is rising for emulation systems that support large, complex SoCs and real-time software validation. Government investments in chip design capability and education further fuel adoption of advanced prototyping tools. Major foundries and design service providers are deploying scalable emulation infrastructure to support international clients. The region’s ecosystem benefits from a dense concentration of design talent, foundries, and OEMs.

Latin America

The Latin America ASIC Emulation & Prototyping Systems Market size was valued at USD 12.15 million in 2018 to USD 24.37 million in 2024 and is anticipated to reach USD 66.50 million by 2032, at a CAGR of 12.3% during the forecast period. Latin America holds a 3.2% share of the Global ASIC Emulation & Prototyping Systems Market, with growing activity in Brazil, Mexico, and Argentina. The market is driven by government-funded research centers and universities integrating ASIC design programs. It is in an early stage but shows rising demand for emulation platforms in telecom and embedded systems. International collaborations are enabling access to cloud-based verification platforms and modular FPGA tools. Emerging startups and academic institutions are adopting affordable, entry-level emulation systems for IP development and prototyping. Public-private partnerships may further accelerate regional capacity in chip design and verification.

Middle East

The Middle East ASIC Emulation & Prototyping Systems Market size was valued at USD 7.07 million in 2018 to USD 13.07 million in 2024 and is anticipated to reach USD 33.75 million by 2032, at a CAGR of 11.6% during the forecast period. The Middle East accounts for a 2.3% share of the Global ASIC Emulation & Prototyping Systems Market, with notable traction in the UAE, Israel, and Saudi Arabia. It is witnessing growing adoption of ASIC verification platforms in national defense, satellite systems, and AI labs. Regional tech hubs are forming partnerships with global EDA vendors to expand access to advanced verification workflows. The emphasis is on building local semiconductor expertise and reducing reliance on imported IP. The shift toward smart infrastructure and sovereign chip design programs presents long-term growth opportunities. Cloud verification and digital twin technologies are supporting pilot deployments in research centers.

Africa

The Africa ASIC Emulation & Prototyping Systems Market size was valued at USD 3.39 million in 2018 to USD 7.78 million in 2024 and is anticipated to reach USD 18.24 million by 2032, at a CAGR of 10.2% during the forecast period. Africa represents 1.2% of the Global ASIC Emulation & Prototyping Systems Market and remains at a nascent stage. It is gaining momentum through academic research initiatives and international grants supporting digital infrastructure and chip education. Countries like South Africa, Kenya, and Nigeria are laying foundations for regional IC design capabilities. The demand is focused on low-cost prototyping systems integrated into university programs and innovation hubs. Partnerships with global semiconductor firms are gradually introducing scalable verification tools to the continent. Africa’s long-term opportunity lies in workforce development, education-led adoption, and regional semiconductor incubators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cadence Design Systems

- Synopsys

- Siemens EDA (Mentor Graphics)

- Xilinx (AMD)

- Aldec

- S2C (Aptiv)

- EVE

- Dini Group

- ProDesign

- Mentor Graphics (Siemens)

Competitive Analysis:

The Global ASIC Emulation & Prototyping Systems Market features a competitive landscape dominated by established EDA vendors and specialized hardware solution providers. Key players such as Synopsys, Cadence Design Systems, Siemens EDA (Mentor Graphics), and Aldec lead the market with comprehensive verification platforms and strong R&D capabilities. It sees continuous innovation in modular architecture, debugging tools, and cloud-based deployment models. These companies invest in product enhancements and strategic partnerships to expand their reach across end-use industries. Smaller firms and niche vendors focus on customizable and cost-effective solutions targeting emerging markets and academic institutions. The market experiences strong competition in terms of performance, scalability, toolchain integration, and customer support. As verification complexity increases, vendors that offer end-to-end workflows and cloud-native platforms gain a competitive edge. Global expansion strategies and localized technical support remain crucial for sustaining long-term market presence.

Recent Developments:

- In July 2025, Synopsys received regulatory approval in China to complete its landmark acquisition of Ansysfor $35 billion, a deal expected to close by mid-July. The merger brings together Synopsys’s leadership in chip design and IP solutions with Ansys’s broad simulation and analysis portfolio, aiming to provide customers with robust, AI-powered engineering solutions that span from silicon to entire systems.

- In June 2025, Siemens EDA introduced a suite of AI enhancements across its EDA portfolioat the Design Automation Conference. The new EDA AI system is designed to optimize both semiconductor and PCB design, bringing generative and agentic AI capabilities that accelerate innovation, improve productivity, and offer secure, customizable, and integrated workflows across the EDA industry.

- In May 2025, Cadence Design Systems unveiled the Millennium M2000 Supercomputer, a major addition to their enterprise platform that leverages NVIDIA Blackwell systems. This product launch is set to dramatically accelerate AI-accelerated simulation, delivering up to 80 times higher performance and 20 times lower power for electronic design automation (EDA), system design, and drug discovery applications.

Market Concentration & Characteristics:

The Global ASIC Emulation & Prototyping Systems Market demonstrates moderate-to-high market concentration, with a few dominant players holding significant market share due to their technological expertise and established customer base. It is characterized by high entry barriers, driven by the need for advanced R&D, capital investment, and long product development cycles. The market favors vendors offering integrated toolchains, cloud-enabled platforms, and scalable hardware solutions. It supports mission-critical applications in sectors such as automotive, telecommunications, and aerospace, where performance and verification accuracy are essential. Continuous innovation, long-term customer relationships, and technical support define vendor competitiveness. It also features a growing trend toward cloud-based services and remote accessibility, transforming traditional deployment models.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end-use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness strong expansion due to increasing design complexity in ASIC and SoC development.

- Growth will be supported by rising demand across AI, automotive, and telecommunications industries.

- Cloud-based verification platforms will see wider adoption for their scalability and remote collaboration benefits.

- Integration of AI and machine learning will enhance debugging accuracy and reduce verification cycles.

- Modular and reconfigurable hardware architectures will support flexible and cost-efficient deployment.

- Broader adoption among startups and academic institutions will emerge with accessible verification solutions.

- Strategic alliances between design tool vendors and semiconductor firms will strengthen innovation pipelines.

- Asia Pacific will lead in growth, driven by manufacturing expansion and regional semiconductor investments.

- Emphasis on low-power and energy-efficient systems will align with global sustainability priorities.

- Regulatory requirements in critical sectors like automotive and aerospace will influence future system capabilities.