Market Overview

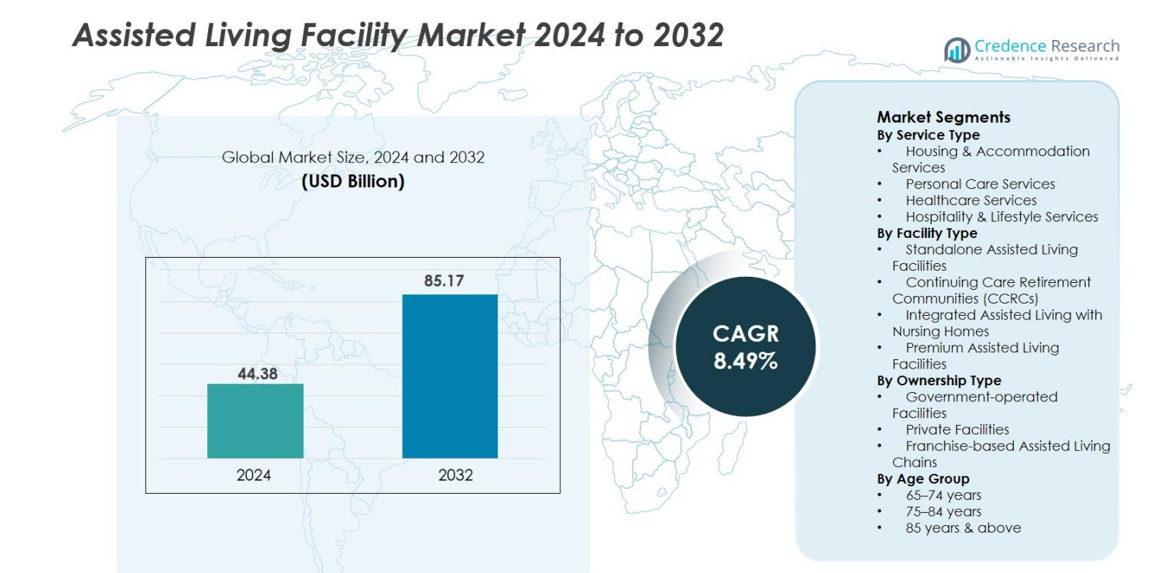

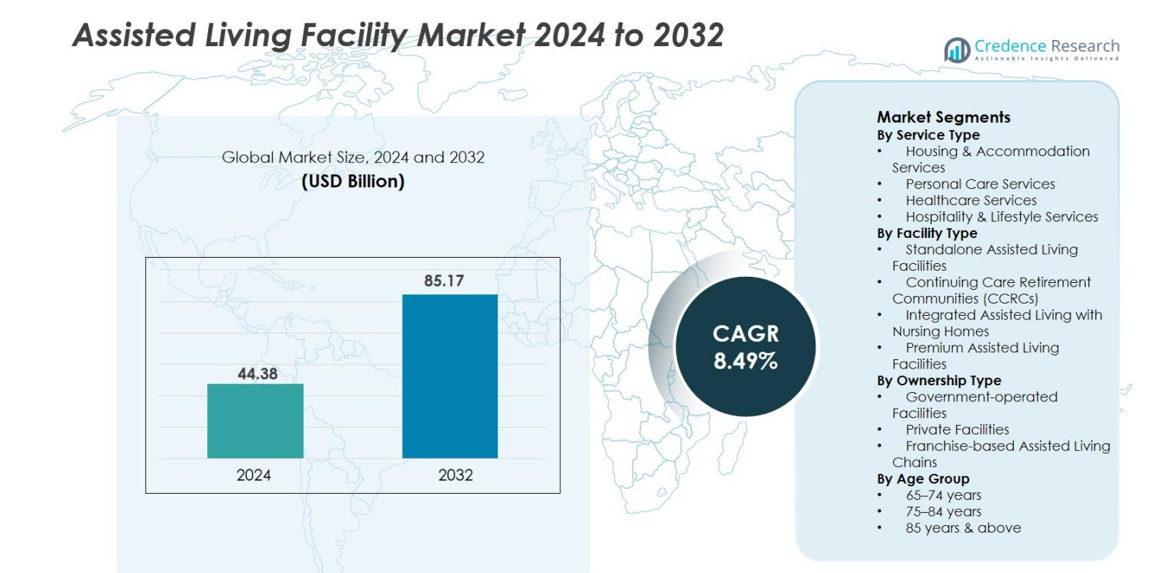

The Assisted Living Facility Market size was valued at USD 44.38 billion in 2024 and is anticipated to reach USD 85.17 billion by 2032, at a CAGR of 8.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Assisted Living Facility Market Size 2024 |

USD 44.38 billion |

| Assisted Living Facility Market, CAGR |

8.49% |

| Assisted Living Facility MarketSize 2032 |

USD 85.17 billion |

The Assisted Living Facility Market is primarily driven by key players such as Brookdale Senior Living Inc., Atria Management Company, Sunrise Senior Living, Life Care Services (LCS), and Sonida Senior Living. These companies are major contributors to the market’s growth through expansive networks, high-quality care services, and innovative senior living models. North America leads the market with a share of 36.24% in 2024, driven by a large aging population and advanced healthcare infrastructure. Europe holds a significant share of 20%, supported by increasing life expectancy and growing demand for senior care. Asia-Pacific is the fastest-growing region, capturing 15% of the market, with strong growth driven by urbanization and rising incomes in countries like China and India. The shift toward personalized care, technology integration, and premium offerings is expected to further shape the market dynamics in these regions.

Market Insights

- The Assisted Living Facility Market was valued at USD 44.38 billion in 2024 and is projected to grow at a CAGR of 8.49 % to reach USD 85.17 billion by 2032.

- The Housing & Accommodation Services segment held around 40 % of the market in 2024, while Standalone Assisted Living Facilities accounted for about 45 %.

- North America dominates the market with a 36.24 % share in 2024, Europe holds 20 %, Asia Pacific about 15 %, Latin America 7 %, and the Middle East & Africa around 5 %.

- Major drivers include ageing populations demanding long‑term support, rising healthcare costs pushing seniors toward assisted living solutions, and the adoption of smart‑home and telehealth technologies within facilities.

- Key restraints include stringent and varying regulatory compliance across regions that increase operational costs, and ongoing staffing shortages which limit facility expansion and care quality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Service Type

The Housing & Accommodation Services segment holds the largest share in the Assisted Living Facility Market, accounting for 40% of the market in 2024. This segment is driven by increasing demand for independent living arrangements with basic support services for seniors. Personal Care Services follow closely with a significant share, as aging populations seek assistance with daily activities. Healthcare Services, Hospitality & Lifestyle Services, and Specialized Services also play essential roles, but their contributions are relatively smaller compared to Housing & Accommodation, reflecting the shift towards more residential-focused care.

- For instance, Brookdale Senior Living operates over 650 communities across 41 U.S. states, offering various housing units, including assisted living, equipped with 24/7 emergency response systems and dedicated staff trained to support senior independence.

By Facility Type

Standalone Assisted Living Facilities dominate the market, holding 45% of the market share in 2024. These facilities provide dedicated residential services for seniors and are increasingly favored for their specialized care models. Continuing Care Retirement Communities (CCRCs) are also growing rapidly, driven by their integrated care model, while Integrated Assisted Living with Nursing Homes caters to more advanced needs. Premium Assisted Living Facilities cater to the affluent elderly population, while Affordable Assisted Living Facilities remain crucial in meeting the demand in lower-income segments.

- For instance, Life Care Services (LCS) manages over 140 Continuing Care Retirement Communities, accommodating more than 40,000 residents across independent living, assisted living, and skilled nursing units.

By Ownership Type

Private Facilities represent the largest portion of the Assisted Living Facility Market, with a share of 60% in 2024. These facilities are often seen as offering higher levels of care and more personalized services, driving their growth. Government-operated Facilities are crucial in providing affordable care for the broader population but occupy a smaller market share. Franchise-based Assisted Living Chains are also gaining popularity, especially for offering a standardized level of service across multiple locations, appealing to both operators and residents seeking consistent care.

Key Growth Drivers

Aging Population and Increased Demand for Senior Care

The rapidly growing aging population worldwide is one of the primary growth drivers for the Assisted Living Facility Market. As the global senior population continues to increase, particularly in developed nations, there is a rising need for long-term care options. The demand for assisted living facilities is further amplified by the preference for aging in place, where seniors seek supportive environments that allow them to maintain independence while receiving essential services. This demographic shift is expected to significantly fuel market expansion.

- For instance, Life Care Services (LCS) provides senior living accommodations to more than 40,000 residents across its managed communities, many of whom are above the age of 75.

Rising Healthcare Costs and Preference for Affordable Care Options

The rising costs of healthcare, combined with a growing awareness of long-term care expenses, are pushing more seniors toward assisted living facilities as an affordable alternative to nursing homes and hospitals. These facilities offer an attractive option with personalized care, lower costs, and the ability to provide various levels of support without the high financial burden of institutionalized healthcare. As a result, a larger segment of the population is opting for assisted living as a cost-effective solution to healthcare and personal care needs.

- For instance, Brookdale Senior Living structures its assisted living pricing between $2,160 and $14,300 monthly depending on location and care level, with individualized service plans where residents pay only for the support they actually need enabling cost optimization compared to institutional care models that charge fixed facility-wide rates.

Technological Advancements in Care Services

Technological innovations in healthcare and senior care services are transforming the Assisted Living Facility Market. From remote monitoring tools and telemedicine to advanced in-facility medical technologies, these innovations enable better management of residents’ health and improve their quality of life. Smart home technologies, in particular, are being integrated into facilities, allowing seniors to live more independently with enhanced safety and convenience. The growing adoption of technology in assisted living environments is increasing the appeal and efficiency of these facilities, driving further market growth.

Key Trends & Opportunities

Integration of Wellness Programs and Lifestyle Services

A growing trend in the Assisted Living Facility Market is the integration of wellness and lifestyle services into senior care offerings. These services go beyond basic medical and personal care, focusing on holistic well-being. Many facilities are incorporating fitness programs, recreational activities, and mental health support into their services, enhancing residents’ physical and emotional health. This trend is attractive to younger seniors who seek an active lifestyle, presenting an opportunity for facilities to expand their service offerings and cater to a broader demographic.

- For instance, Brookdale Senior Living operates its signature “B-Fit” program across more than 600 communities, offering structured exercise sessions designed for senior mobility.

Rise in Premium and Luxury Assisted Living Facilities

There is a rising demand for premium and luxury assisted living facilities as affluent seniors seek high-end, comfortable living environments with personalized services. These facilities offer upscale accommodations, gourmet dining, and specialized care services tailored to the individual needs of residents. This trend is not only driven by increased disposable income among older populations but also by the desire for enhanced quality of life in later years. The growing luxury segment presents a lucrative opportunity for service providers to capture a higher-paying market niche.

- For instance, Belmont Village Senior Living operates more than 30 premium communities, several of which feature luxury high-rise designs with 150–200 private units, on-site chefs, and licensed nurses available 24 hours a day.

Key Challenges

Regulatory and Compliance Challenges

One of the primary challenges in the Assisted Living Facility Market is navigating complex and evolving regulatory requirements. Governments impose stringent rules and standards for senior care facilities to ensure resident safety and well-being. Compliance with these regulations can be both time-consuming and costly for facility operators. Additionally, the regulatory landscape can vary by region, further complicating the expansion of facilities across different markets. These challenges may result in increased operational costs and slowdowns in market growth for some players.

Staffing Shortages and Workforce Management

The Assisted Living Facility Market is facing significant staffing shortages, with a high demand for qualified caregivers and healthcare professionals. The shortage of skilled labor, exacerbated by the COVID-19 pandemic and its lingering effects, has placed a strain on facility operations. Recruiting and retaining trained staff is a critical issue, as insufficient staffing can impact care quality and lead to higher turnover rates. The ongoing challenges in workforce management may hinder the growth and efficiency of assisted living facilities, limiting their ability to meet increasing demand.

Regional Analysis

North America

North America holds a market share of 36.24% in the assisted living facility market in 2024. The region benefits from a large and rapidly aging senior population, well-developed healthcare infrastructure, and supportive regulatory frameworks that enable private pay and government-funded senior care solutions. Providers leverage advanced care models and technology integration to improve service delivery. Strong consumer preference for independent and semi-independent living with support services continues to drive facility expansions. Competitive intensity remains high as operators pursue differentiation through wellness programs, memory-care offerings, and branded chain-managed communities.

Europe

In Europe, the assisted living facility market accounts for 20% of the global share. Demographic trends—such as increasing life expectancy and a growing population aged 65+ underpin rising demand for senior care services. Regulatory reforms and public-private partnerships in countries like Germany, the UK, and the Nordics are enhancing service standards and capacity. Operators are shifting toward holistic care models that combine accommodation with wellness and medical services. Investment in premium and specialized assisted living communities is increasing, offering opportunities despite slower growth compared to emerging regions.

Asia Pacific

The Asia Pacific region captures 15% of the global assisted living facility market share and is the fastest-growing region. Urbanization, rising disposable incomes, and a large and still-growing elderly demographic in countries such as Japan, China, and India are key growth drivers. Government initiatives and foreign investment are accelerating facility development, including hybrid models integrating senior housing with health services. The market presents significant opportunities for facility operators and care-service providers willing to adapt offerings to local cultural norms and multi-generational living preferences.

Middle East & Africa

The Middle East & Africa region currently holds 5% of the global assisted living facility market share. This region is witnessing growth due to the rising elderly population and increasing government support for senior care. Countries like the UAE and Saudi Arabia are investing heavily in healthcare infrastructure, including the development of assisted living communities that blend luxury accommodations with specialized healthcare services. While the market is still in its early stages compared to other regions, it offers significant potential for growth as regional governments seek to enhance eldercare options.

Latin America

Latin America holds a 7% share of the assisted living facility market, with countries like Brazil and Mexico seeing an increase in demand for senior living solutions. The market is supported by a growing elderly population and improved economic conditions, leading to higher demand for senior care services. In addition, urbanization and an expanding middle class are creating favorable conditions for the development of both affordable and premium assisted living communities. However, limited awareness and infrastructure challenges present barriers to growth, which could hinder the rapid expansion of the market in some countries.

Market Segmentations:

By Service Type

- Housing & Accommodation Services

- Personal Care Services

- Healthcare Services

- Hospitality & Lifestyle Services

By Facility Type

- Standalone Assisted Living Facilities

- Continuing Care Retirement Communities (CCRCs)

- Integrated Assisted Living with Nursing Homes

- Premium Assisted Living Facilities

By Ownership Type

- Government-operated Facilities

- Private Facilities

- Franchise-based Assisted Living Chains

By Age Group

- 65–74 years

- 75–84 years

- 85 years & above

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the assisted living facility market is characterised by a blend of large‑scale operators and regional specialists, with key players such as Brookdale Senior Living Inc., Atria Management Company, Sunrise Senior Living, Life Care Services (LCS) and Sonida Senior Living driving a significant share of global operations. These firms leverage expansive geographic networks, brand recognition, and economies of scale to compete effectively in a moderately fragmented market where the top five players account for around 32 % of total share. Consolidation through acquisitions and strategic partnerships underpins many providers’ growth strategies, while differentiation via service quality, technological integration (e.g., telehealth, remote monitoring), and premium‑amenity offerings becomes increasingly vital. Regional players also pose competition by targeting local demographic nuances and adapting culturally‑relevant service models. As the market evolves, competitive advantage will hinge on operational efficiency, care‑service innovation, regulatory compliance robustness, and the ability to scale while maintaining resident satisfaction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cassia

- Sonida Senior Living

- Presbyterian Homes and Services

- Evangelical Lutheran Good Samaritan Society

- Discovery Senior Living

- Atria Management Company

- Max Group

- Redwood Capital Investments LLC

- Brookdale Senior Living Inc.

- Life Care Services (LCS)

Recent Developments

- In September 2025, LTC Properties Inc. announced a US $40 million off-market acquisition of two assisted living and memory care communities in Kentucky (158 units total) from Charter Senior Living.

- In September 2025, Epoch Elder Care launched its “Monet House” assisted living and dementia care facility in Balewadi, Pune (10-floor, 33,000 sq ft, 56 rooms for ~70 residents) in India.

- In July 2025, CareAcademy and Wisconsin Assisted Living Association (WALA) announced a strategic partnership to advance assisted-living workforce development in Wisconsin.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Facility Type, Ownership Type, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained growth driven by the increasing global senior population and extended life expectancy.

- Providers will expand services tailored to higher‑acuity residents as chronic disease prevalence and cognitive impairment become more widespread.

- Facility operators will integrate advanced technology — including remote monitoring, tele‑health, and smart‑home systems — to improve resident care and operational efficiency.

- Premium and lifestyle‑oriented assisted living offerings will gain traction as affluent seniors seek upscale living combined with supportive care.

- Development of affordable assisted living models will accelerate to meet demand in emerging markets and lower‑income segments.

- Regionally, Asia‑Pacific and Latin America will grow more rapidly than mature markets, spurred by urbanisation, rising incomes, and government initiatives.

- Ownership structures will diversify, with private equity, public‑private partnerships and franchise‑based chains increasing their footprint in senior care.

- Operators will pursue consolidation, mergers and acquisitions to scale operations, leverage brand recognition and achieve cost efficiencies.

- Workforce shortages and rising labour costs will prompt greater use of automation, training programmes and new service staffing models.

- Regulatory reform and reimbursement innovation will influence market dynamics, with enhanced government support and alternative payment models shaping facility viability.