Market Overview:

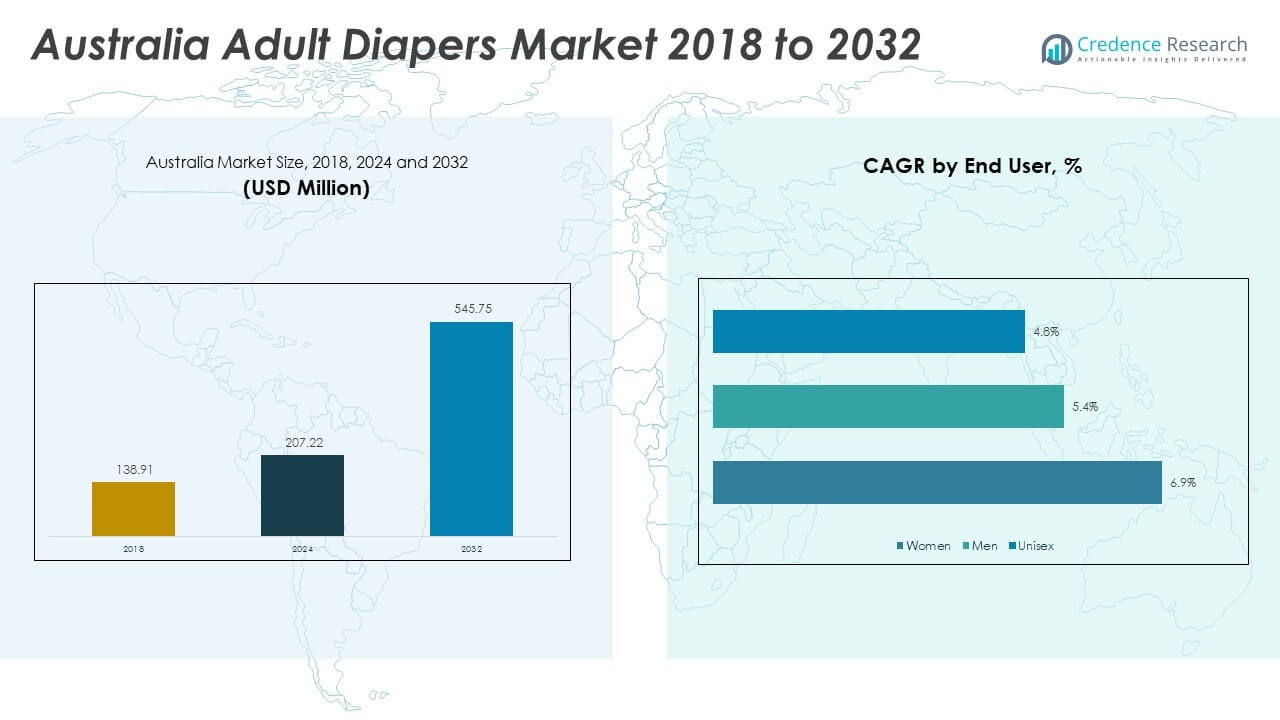

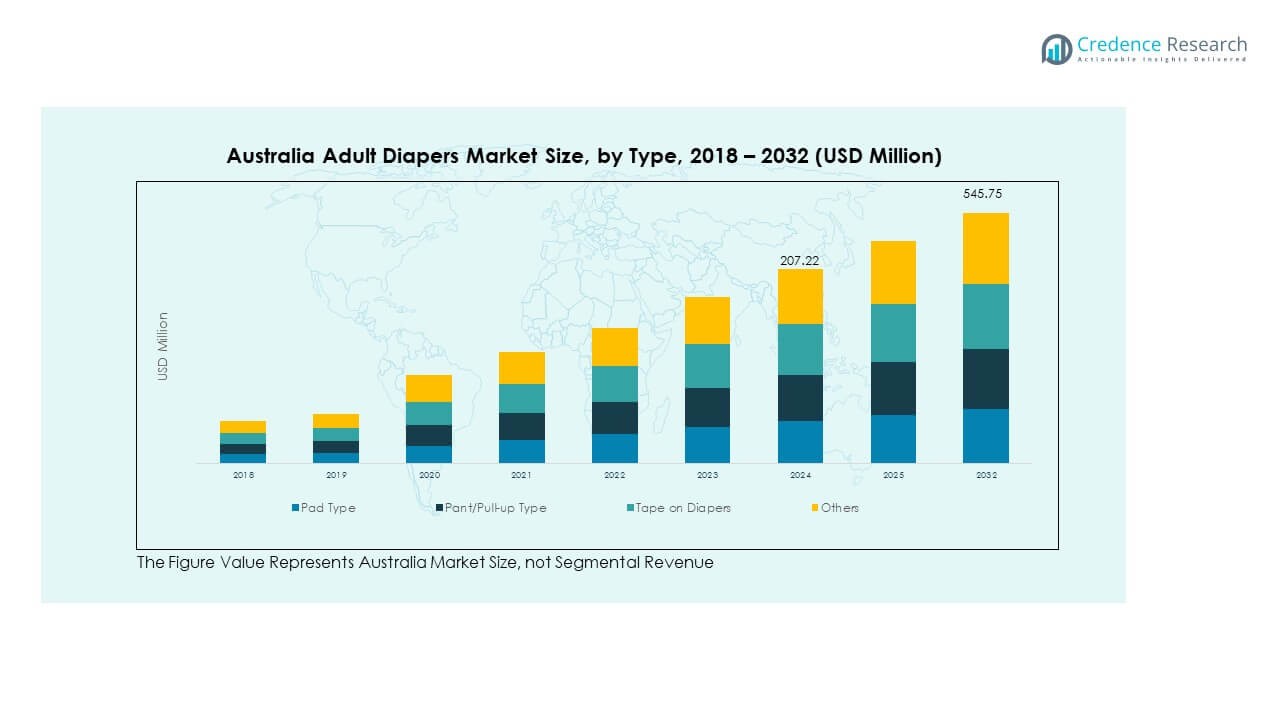

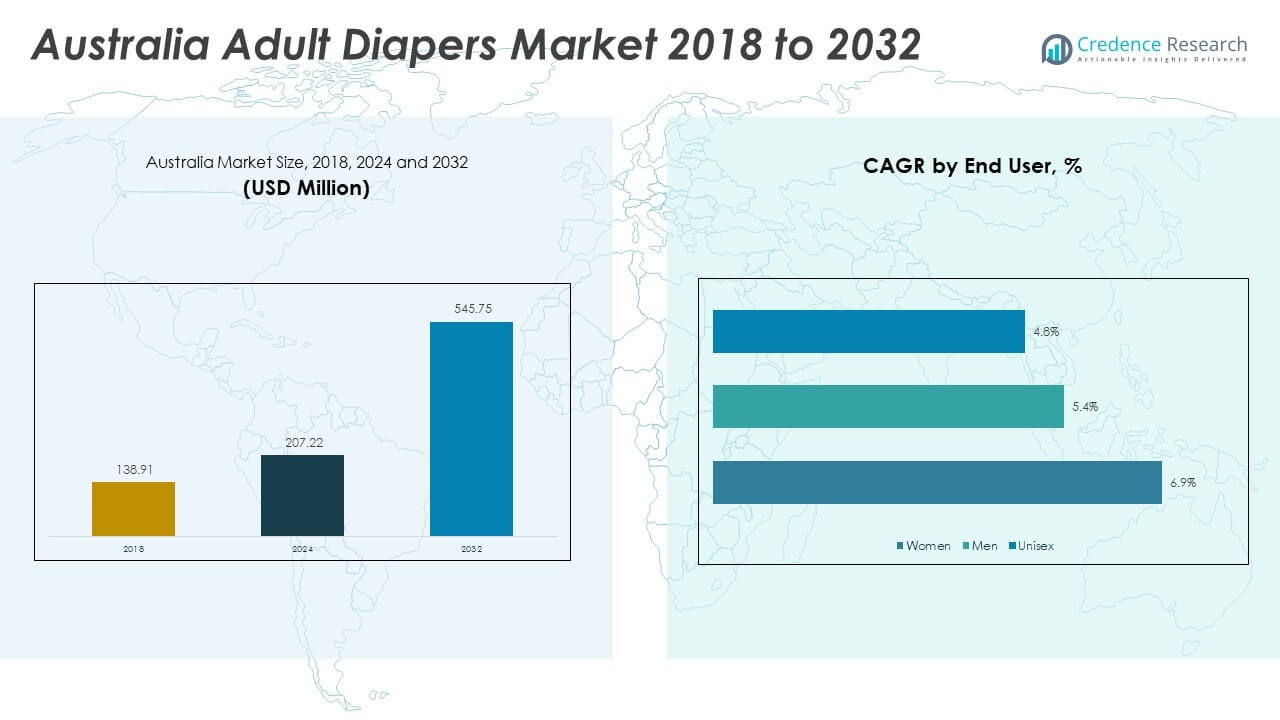

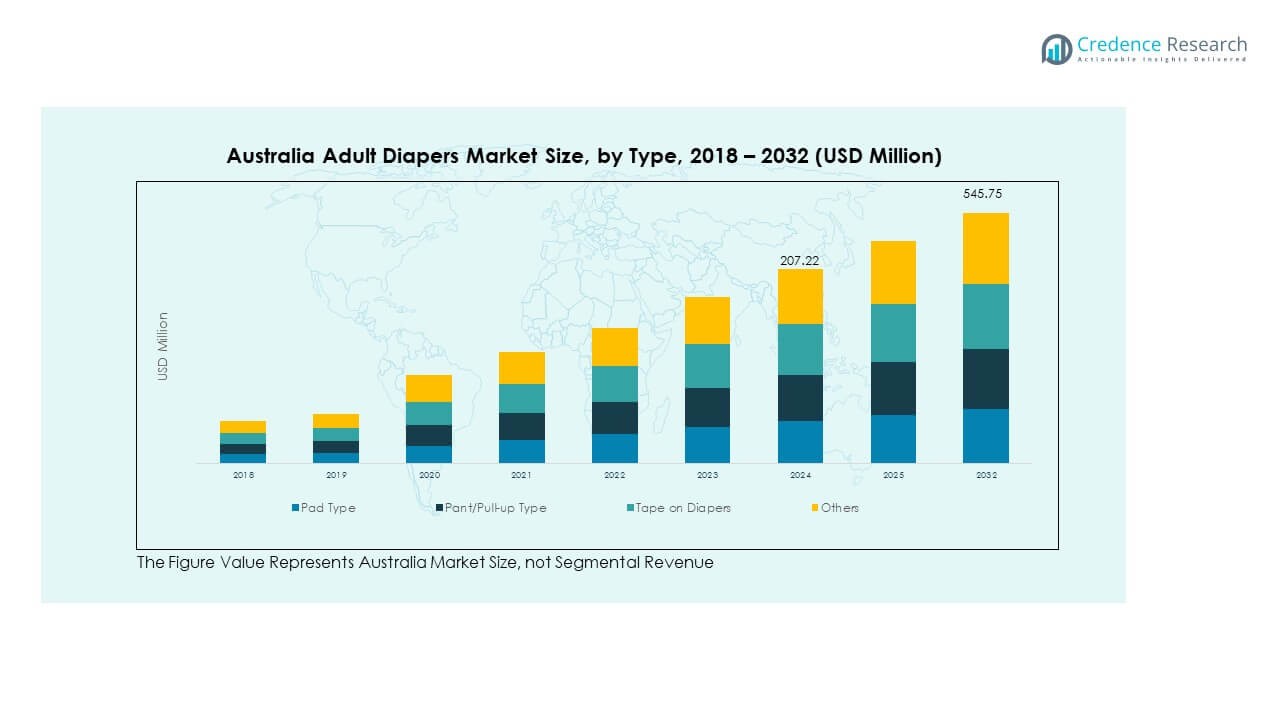

The Australia Adult Diapers Market size was valued at USD 138.91 million in 2018 to USD 207.22 million in 2024 and is anticipated to reach USD 545.75 million by 2032, at a CAGR of 12.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Adult Diapers Market Size 2024 |

USD 207.22 Million |

| Australia Adult Diapers Market, CAGR |

12.87% |

| Australia Adult Diapers Market Size 2032 |

USD 545.75 Million |

Growth in this market is driven by increasing aging population, rising awareness of personal hygiene, and greater acceptance of incontinence products among elderly consumers. Healthcare facilities, including hospitals and nursing homes, are adopting adult diapers widely to ensure patient comfort and prevent infections. Lifestyle changes, coupled with rising cases of chronic conditions leading to incontinence, further strengthen market demand. Growing product innovation, such as breathable materials and discreet designs, also fuels adoption across both institutional and personal use.

Regionally, demand is strong in urbanized and developed parts of Australia due to better healthcare infrastructure and higher awareness levels. Major metropolitan cities lead adoption, supported by strong retail presence and easy product availability. Rural regions are emerging steadily, driven by rising healthcare outreach and expanding distribution networks. Increasing government focus on elderly care services and community support programs also expands market penetration across diverse regions of the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Adult Diapers Market was valued at USD 138.91 million in 2018, reached USD 207.22 million in 2024, and is projected to hit USD 545.75 million by 2032, growing at a CAGR of 12.87%.

- Eastern Australia led with 40% share in 2024, driven by metropolitan hubs like Sydney and Melbourne, supported by strong healthcare infrastructure and advanced retail networks.

- Southern Australia held 30% share, while Western Australia accounted for 20%, both benefitting from healthcare programs, elderly care facilities, and expanding retail penetration.

- Northern Australia, with 10% share, is the fastest-growing region due to rising government elderly care initiatives, improved healthcare outreach, and the expansion of e-commerce in underserved areas.

- Among product types, Pant/Pull-up diapers held the largest share at 38%, followed by Pad type at 30%, reflecting consumer demand for convenience and affordability in daily use.

Market Drivers:

Rising Aging Population and Growing Incontinence Cases

The Australia Adult Diapers Market benefits from the increasing aging population that faces higher risks of incontinence. Longer life expectancy and advanced healthcare services contribute to a larger elderly base requiring hygienic support products. Rising cases of chronic conditions such as diabetes, mobility impairment, and urological disorders increase diaper demand. Healthcare professionals recommend disposable incontinence products for patient comfort and infection prevention. The growing number of aged care facilities and nursing homes expands institutional consumption. It continues to find strong acceptance among families seeking better elderly care. Urban households show higher adoption rates due to lifestyle changes and awareness. This dynamic positions adult diapers as essential care products rather than optional aids.

- For instance, the share of Australians aged 65 and over is projected to reach about 20.7% by 2066, driving increased demand for durable incontinence products in both aged care facilities and home care settings.

Rising Healthcare Infrastructure and Institutional Demand

Hospitals, clinics, and long-term care facilities play a significant role in driving consumption patterns. The Australia Adult Diapers Market benefits from rising government focus on elderly health and hygiene. Advanced healthcare infrastructure ensures consistent procurement of disposable hygiene solutions. Nursing homes rely on high-quality diapers to improve patient comfort and reduce caregiver workload. Strong demand in public and private healthcare systems supports market expansion. Bulk procurement by institutions further strengthens manufacturing and distribution networks. It continues to grow with consistent support from health campaigns promoting hygiene. Product quality and safety standards encourage higher trust among professional caregivers. These factors sustain the institutional pillar of the adult diaper market.

- For instance, healthcare institutions in Australia prioritize high-absorbency and leak-proof diapers to ensure hygiene during patients’ extended stays, supporting institutional bulk purchasing.

Rising Awareness and Shifting Consumer Perceptions

The market benefits from increasing awareness campaigns highlighting hygiene and dignity for elderly individuals. Families now view adult diapers as practical solutions rather than taboo products. The Australia Adult Diapers Market reflects growing acceptance in both urban and semi-urban regions. Companies focus on marketing strategies that normalize usage and highlight convenience. Product innovations such as discreet design, odor control, and breathable materials strengthen consumer confidence. Awareness through pharmacies, healthcare providers, and digital platforms promotes steady growth. It also ensures that adult diapers are adopted across wider demographics. Growing openness in conversations about hygiene contributes to sustainable long-term demand.

Product Innovation and Brand Strategies

Manufacturers are investing in innovations that improve comfort, absorption, and discretion. The Australia Adult Diapers Market shows steady growth from product launches with skin-friendly and eco-friendly materials. Rising focus on breathable fabrics reduces the risk of rashes and infections. Companies highlight gender-specific designs and tailored fits to enhance comfort. Strategic partnerships with retail chains and pharmacies improve visibility and availability. Digital advertising campaigns reinforce brand credibility and target tech-savvy caregivers. It benefits from strong brand competition that drives continuous innovation. These strategies collectively strengthen market positioning and long-term consumer trust.

Market Trends:

Sustainability and Eco-Friendly Product Development

Sustainability is shaping the future of the Australia Adult Diapers Market through innovation in biodegradable materials. Manufacturers are developing eco-friendly diapers that reduce environmental impact without compromising comfort. Growing consumer preference for sustainable solutions influences product design and packaging. Companies adopt recyclable and compostable materials to align with environmental goals. Regulations encourage brands to improve waste management practices across the hygiene sector. Rising eco-conscious consumer groups demand transparency in material sourcing. It creates pressure on industry players to balance sustainability with affordability. This trend positions green alternatives as a competitive advantage in the long term.

- For instance, while Drylock Technologies launched a compostable diaper in 2023 with 80–90% plant-based materials and aiming for higher, other companies like Popotine and Hiro Technologies have also developed similar compostable products, disputing Drylock’s “world’s first” claim. These products, including Drylock’s, are typically intended for institutional use, such as in hospitals and kindergartens, which can manage the specialized composting processes involved.

E-Commerce Expansion and Digital Retailing

The rise of online platforms is redefining distribution patterns for adult diapers. The Australia Adult Diapers Market experiences rapid growth in digital retail channels. E-commerce offers discreet purchasing options that appeal to consumers seeking privacy. Online subscriptions ensure continuous supply and strengthen customer loyalty. Marketplaces highlight wide product selections, discounts, and doorstep delivery convenience. Manufacturers collaborate with digital health platforms to promote hygiene solutions. It creates opportunities for direct engagement and feedback collection. The growing penetration of smartphones and digital payments accelerates online adoption.

- For instance, growing availability through online retailers and subscription models enhances convenience and privacy for consumers buying adult diapers in Australia.

Premiumization and Personalization of Products

Premium product lines are gaining traction among consumers who value comfort and convenience. The Australia Adult Diapers Market is witnessing strong adoption of high-absorbency and skin-friendly designs. Consumers prefer personalized solutions that cater to different body types and conditions. Brands introduce advanced features such as odor-lock, wetness indicators, and ultra-thin materials. Premiumization aligns with growing awareness of hygiene and dignity among elderly individuals. Healthcare professionals recommend premium ranges for patients requiring long-term care. It highlights the growing preference for quality over price among urban populations. This shift continues to redefine the competitive landscape of the industry.

Integration of Technology and Smart Features

Technological integration is creating innovative growth avenues for adult diapers. The Australia Adult Diapers Market explores smart diapers with sensors that track moisture levels. These innovations assist caregivers in monitoring patient comfort more effectively. Hospitals and nursing homes adopt smart solutions to reduce manual checks and enhance efficiency. Wearable health tech integration promotes better incontinence management in elderly care. Companies invest in R&D to combine healthcare data with hygiene solutions. It enhances product appeal for institutional buyers and modern caregivers. These advancements highlight the role of technology in reshaping the hygiene sector.

Market Challenges Analysis:

High Product Cost and Limited Accessibility in Remote Areas

The Australia Adult Diapers Market faces challenges related to affordability and access in remote regions. Premium products are often priced beyond the reach of lower-income households. Limited distribution infrastructure in rural areas restricts availability and awareness. Retail chains concentrate in urban areas, leaving gaps in rural penetration. Rising raw material costs further contribute to higher retail prices. It forces some households to reduce usage or depend on cheaper alternatives. Bulk purchases by institutions offset some of this challenge, but gaps remain. Bridging this divide requires strategic pricing and wider distribution networks.

Cultural Stigma and Consumer Reluctance

Social stigma around incontinence continues to limit adoption rates in certain segments. The Australia Adult Diapers Market must address cultural perceptions that associate diapers with shame. Families often hesitate to buy products due to social pressures. Awareness campaigns aim to normalize discussions around elderly hygiene. Marketing strategies focus on dignity, comfort, and convenience to shift perceptions. It requires consistent education efforts across urban and rural regions. Caregiver awareness programs also play a role in reducing reluctance. Addressing these challenges is crucial for long-term growth and acceptance.

Market Opportunities:

Expansion Through Elderly Care Programs and Healthcare Integration

The Australia Adult Diapers Market holds strong opportunities through government initiatives in elderly care. Expanding community healthcare services integrate adult diapers into standard care practices. Nursing homes and aged care centers continue to increase institutional procurement. Government funding for elderly health creates demand for cost-effective hygiene products. It also aligns with private sector investments in aged care infrastructure. Manufacturers partnering with healthcare providers strengthen product visibility. This opportunity ensures sustained demand from both public and private healthcare systems.

Innovation in Design and Growth of Discreet Product Lines

The market shows significant opportunity in discreet and comfort-oriented product innovations. The Australia Adult Diapers Market benefits from tailored designs meeting lifestyle needs. Gender-specific options and eco-friendly products open new consumer segments. Discreet packaging appeals to buyers seeking privacy in retail and online channels. It helps normalize adoption and expands acceptance across demographics. Growing R&D investments ensure a steady flow of innovative launches. These advancements create new revenue streams while addressing consumer comfort expectations.

Market Segmentation Analysis:

By Type

Pad type holds significant adoption due to ease of use and affordability. Pant or pull-up type leads in popularity among active users, offering convenience and discreet design. Tape-on diapers remain essential in healthcare and elderly care settings where caregivers manage hygiene. Others, including hybrid and specialty designs, address niche needs across specific age or health conditions. The Australia Adult Diapers Market benefits from this diversity, with demand shifting toward comfort-focused and high-absorbency categories. It continues to see growth driven by innovation in design and material technology.

- For instance, pant-type adult diapers are increasingly preferred by active elderly individuals in Australia due to discreet design and advanced absorbency features, supported by efforts from manufacturers to improve product comfort.

By End-User

Women represent a strong demand base due to higher prevalence of incontinence conditions and longevity. Men increasingly adopt products designed with tailored fits and improved comfort. Unisex offerings remain widely available, targeting institutional buyers and households seeking flexibility. Rising awareness programs expand adoption across demographics, encouraging normalization of usage. Healthcare providers also recommend gender-specific solutions to enhance effectiveness and dignity. The market reflects steady adoption across all groups, supported by product availability in multiple formats. It highlights shifting consumer attitudes toward hygiene solutions.

- For instance, in Australia, incontinence affects approximately one in four adults, with women showing higher adoption rates of gender-specific adult diapers, supported by healthcare awareness campaigns.

By Distribution Channel

E-commerce channels are rapidly expanding, driven by discreet purchasing preferences and subscription services. Online platforms highlight wide product choices, competitive pricing, and convenient delivery. Offline channels maintain dominance through pharmacies, supermarkets, and healthcare stores. Institutional buyers prefer offline suppliers for bulk procurement and assured quality. It benefits from strong retail presence across urban areas, ensuring access and brand visibility. Growth in e-commerce creates new opportunities for direct consumer engagement. The balance of both channels ensures broad product penetration across regions.

Segmentation:

- By Type

- Pad Type

- Pant/Pull-up Type

- Tape-on Diapers

- Others

- By End-User

- By Distribution Channel

- E-Commerce

- Offline Channel

Regional Analysis:

Eastern Australia – Leading Consumption Hub

Eastern Australia holds the largest share of the Australia Adult Diapers Market, accounting for nearly 40% in 2024. Major metropolitan cities such as Sydney, Melbourne, and Brisbane drive this dominance through advanced healthcare facilities and strong retail networks. The concentration of elderly populations in urban centers fuels consistent product demand. Institutional procurement from hospitals, aged care centers, and nursing homes further boosts adoption. It also benefits from high awareness levels, strong presence of global brands, and availability of premium products. Regional consumers show greater openness toward adopting hygiene solutions, creating sustained growth momentum.

Southern and Western Australia – Growing Adoption Across Communities

Southern Australia contributes nearly 30% share, supported by Adelaide and surrounding regions with strong healthcare infrastructure and elderly care programs. The market in Western Australia accounts for about 20% share, with Perth emerging as a key center for demand. Regional governments support elderly health initiatives, creating demand for affordable adult diapers. Expansion of retail and pharmacy chains ensures broader product availability across urban and semi-urban communities. It also benefits from growing healthcare awareness campaigns promoting hygiene among senior citizens. These regions highlight rising acceptance of both premium and mid-range products, reinforcing their growth prospects.

Northern Australia – Emerging Market Opportunities

Northern Australia captures nearly 10% share of the Australia Adult Diapers Market, reflecting its smaller population base and limited healthcare reach. Demand is concentrated in regional hubs where healthcare facilities and retail outlets are accessible. Rural and remote areas face challenges in product affordability and distribution, slowing wider adoption. It continues to show potential as awareness campaigns extend into community programs and healthcare outreach. Government support for elderly care in remote areas is expected to enhance accessibility. Expanding e-commerce channels also provide opportunities for discreet and reliable supply in underserved regions. This shift creates long-term prospects for growth in the north.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kimberly-Clark Corporation

- Procter & Gamble Co.

- Essity Aktiebolag (TENA)

- Abena A/S

- Paul Hartmann AG

- Ontex Group

- Unicharm Corporation

- First Quality Enterprises, Inc.

- Medline Industries, Inc.

- TZMO SA

Competitive Analysis:

The Australia Adult Diapers Market is highly competitive with strong participation from global and regional players. Kimberly-Clark, Procter & Gamble, Essity, and Unicharm dominate the landscape with established product portfolios and brand presence. Ontex, Abena, and Hartmann expand competitiveness through innovation, regional distribution, and healthcare partnerships. Companies compete on comfort, absorbency, and eco-friendly materials to meet evolving consumer demands. It shows growing emphasis on digital channels, ensuring wider reach and discreet purchasing options. Strategic collaborations with healthcare institutions further reinforce leadership. Continuous innovation and customer-centric strategies shape the long-term competitive advantage in this market.

Recent Developments:

- Kimberly-Clark Corporation: In December 2022, Kimberly-Clark launched “The Nappy Loop,” Australia’s first diaper recycling trial in South Australia. This innovation focuses on recycling used disposable nappies into compost and bioenergy, marking a significant step in sustainable adult diaper product management.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising elderly population will continue to drive steady demand.

- Healthcare institutions will expand bulk procurement to improve elderly care.

- Digital retail and e-commerce channels will grow in importance.

- Eco-friendly and biodegradable products will gain stronger acceptance.

- Product innovation will focus on comfort, breathability, and discretion.

- Gender-specific and premium ranges will see rising adoption.

- Awareness campaigns will normalize product usage across demographics.

- Regional penetration will expand through improved distribution networks.

- Partnerships between manufacturers and healthcare providers will strengthen supply chains.

- Competitive intensity will increase, supported by continuous product launches and brand strategies.