Market Overview:

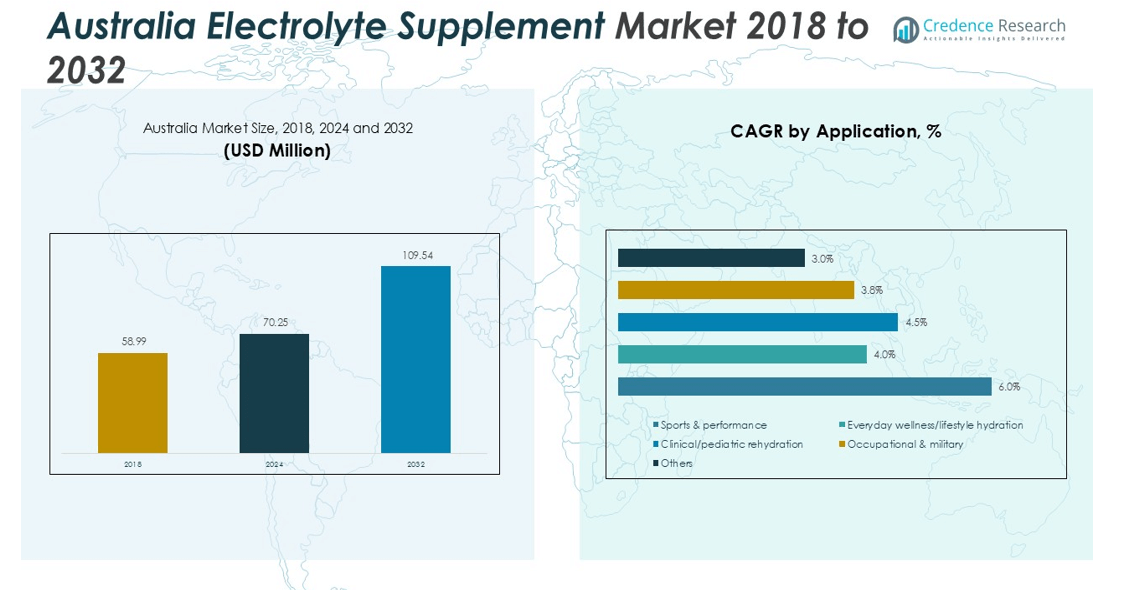

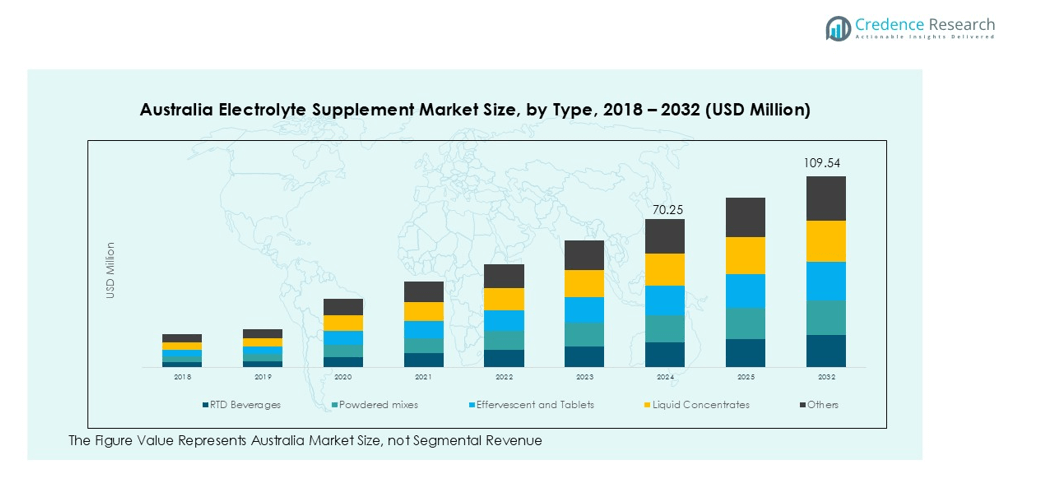

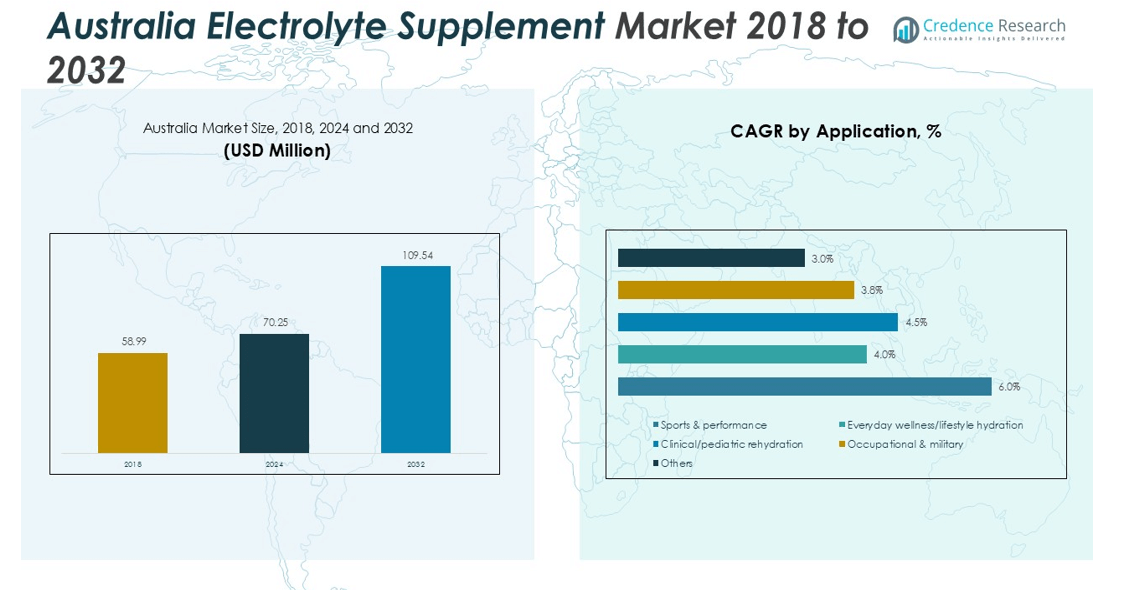

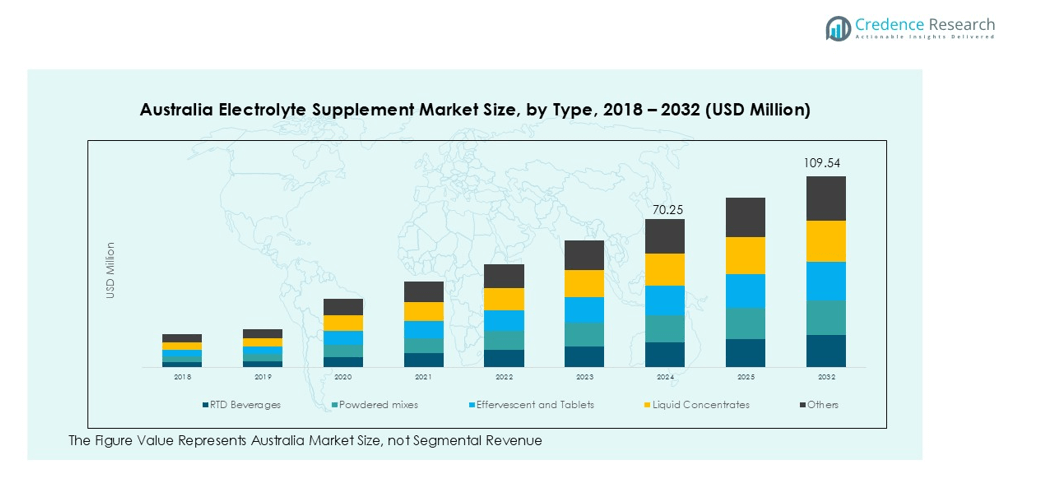

The Australia Electrolyte Supplement size was valued at USD 58.99 million in 2018 to USD 70.25 million in 2024 and is anticipated to reach USD 109.54 million by 2032, at a CAGR of 5.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Electrolyte Supplement Market Size 2024 |

USD 70.25 million |

| Australia Electrolyte Supplement Market, CAGR |

5.71% |

| Australia Electrolyte Supplement Market Size 2032 |

USD 109.54 million |

The key drivers of this market include the growing prevalence of dehydration-related issues, especially in warmer climates, and the increasing popularity of sports and fitness supplements. The rising consumer demand for products that aid in hydration, energy replenishment, and muscle recovery during physical exertion is a significant factor. Moreover, the availability of a wide variety of electrolyte supplements, including powders, drinks, and tablets, has fueled their adoption.

In terms of regional analysis, New South Wales and Victoria are the leading regions in terms of market share, driven by their large urban populations and high levels of sports and fitness participation. Additionally, the growing presence of major supplement manufacturers in these regions has enhanced the availability and accessibility of electrolyte supplements. As the market expands, other regions such as Queensland are expected to experience a surge in demand for these products.

Market Insights:

- The Australia Electrolyte Supplement Market was valued at USD 58.99 million in 2018, expected to grow to USD 70.25 million by 2024, and reach USD 109.54 million by 2032, at a CAGR of 5.71%.

- New South Wales and Victoria dominate the market, accounting for 50% of the total share, driven by urban populations and sports participation.

- Queensland holds a 25% market share, fueled by its warm climate and high levels of outdoor sports participation.

- The increasing awareness of hydration’s importance is driving demand for electrolyte supplements, especially in warmer regions like Queensland.

- The rising participation in fitness and sports activities, including gym memberships and outdoor events, is contributing to the growing demand for electrolyte supplements.

- Queensland’s health-conscious trends and active population further fuel the surge in demand, aligning with climate-related needs for hydration products.

- Technological advancements, such as sugar-free and organic options, are enhancing the accessibility and effectiveness of electrolyte supplements in meeting diverse consumer needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Awareness of Hydration and Wellness

The increasing focus on hydration and overall wellness is a major driver for the Australia Electrolyte Supplement Market. More consumers are recognizing the importance of maintaining proper hydration for optimal health and performance. This growing awareness is not only seen in athletes but also in the general population. The market sees higher demand for products that promote effective hydration, particularly in warmer regions where dehydration risks are higher. This trend reflects the broader shift towards health-conscious living in Australia.

Rising Participation in Sports and Fitness Activities

The growing interest in sports and fitness activities is a significant factor contributing to the demand for electrolyte supplements in Australia. Both professional athletes and fitness enthusiasts require supplements to maintain energy levels, enhance performance, and aid in recovery. The surge in gym memberships, outdoor sports, and marathon events increases the need for products that replenish electrolytes lost through sweat. This active lifestyle trend drives growth in the Australia Electrolyte Supplement Market, with an expanding consumer base looking for hydration solutions.

- For instance, in April 2024, Vitaco Health launched ATHENA Sports Nutrition, a range designed for the specific biological needs of female athletes and fortified with 4 key supplements including iron, collagen, calcium, and electrolytes.

Impact of Extreme Weather Conditions on Health

Australia’s hot climate exacerbates dehydration concerns, particularly during the summer months. High temperatures lead to increased sweating, which in turn depletes electrolytes necessary for bodily functions. Electrolyte supplements provide a convenient solution to restore these essential minerals, ensuring proper muscle function and reducing the risk of heat-related illnesses. The growing prevalence of heatwaves across the country drives higher demand for these products, particularly in areas like New South Wales and Queensland.

- For instance, Fixx Nutrition formulated its Fuel X Pro endurance drink mix to combat dehydration in warm climates by including 4 key electrolytes, with a single serving containing 468mg of sodium to replenish minerals lost through sweat.

Technological Advancements in Product Offerings

Ongoing innovation in electrolyte supplement formulations and delivery methods is another key driver of the market. Manufacturers are introducing new, more effective products that cater to various consumer needs, including sugar-free, organic, and vegan options. These advancements offer improved absorption and faster hydration, meeting the demands of health-conscious individuals. The expansion of retail and online channels also increases accessibility, further fueling growth in the Australia Electrolyte Supplement Market.

Market Trends:

Shift Towards Natural and Clean Label Products

A notable trend in the Australia Electrolyte Supplement Market is the growing consumer preference for natural and clean label products. Consumers are becoming more conscious about the ingredients in their supplements, demanding options that are free from artificial additives, preservatives, and excessive sugars. This shift is driven by the desire for healthier alternatives that align with the clean eating movement. Manufacturers are responding by developing products with organic, non-GMO, and plant-based ingredients. The market now features electrolyte supplements that cater to dietary restrictions, such as gluten-free, dairy-free, and vegan formulations. This trend not only meets consumer preferences but also boosts brand loyalty among health-conscious buyers.

- For instance, Australian brand Sodii has successfully developed a clean-label electrolyte powder that features salt sourced from an ancient 5-million-year-old lake in Western Australia, Each serving provides a precise dose of 1000mg of sodium, catering to health-conscious consumers seeking natural hydration.

Rise in Functional Beverages and On-the-Go Solutions

Functional beverages are increasingly popular in the Australia Electrolyte Supplement Market, particularly in the form of ready-to-drink (RTD) products and single-serving sachets. The convenience of portable, ready-to-consume electrolyte drinks aligns with the fast-paced lifestyle of Australian consumers. These products are marketed as quick hydration solutions that can be consumed during exercise or throughout the day. RTD beverages, such as electrolyte-infused waters and sports drinks, continue to grow in demand as they provide convenience without compromising on health benefits. The rise of these on-the-go solutions reflects the broader trend toward easy, functional products that support active and health-focused lifestyles in Australia.

- For instance, Dr. Hydrate has capitalized on this trend by offering single-serving sachets that are HASTA-certified, meaning each batch is tested for over 250 banned substances.

Market Challenges Analysis:

Competition from Alternative Hydration Solutions

The Australia Electrolyte Supplement Market faces significant competition from alternative hydration solutions, such as coconut water, fruit juices, and other natural beverages. These alternatives are often perceived as healthier or more natural, which appeals to a large segment of the population. Many consumers prefer these options due to their perceived nutritional benefits and minimal processing. This competition challenges the growth of electrolyte supplements, especially as these alternative solutions are marketed as providing similar hydration benefits without the added sugars or synthetic ingredients often found in commercial electrolyte products.

Price Sensitivity and Consumer Perception

Price sensitivity remains a challenge in the Australia Electrolyte Supplement Market. While many consumers seek premium hydration products, some may hesitate due to higher price points associated with high-quality or specialized formulations. The perception that electrolyte supplements are unnecessary for the average person further hinders market growth. For price-conscious consumers, the added cost of these supplements can be a barrier, especially when lower-cost alternatives are readily available. This dynamic complicates efforts to expand the market beyond fitness enthusiasts and athletes to a broader consumer base.

Market Opportunities:

Expansion of Product Variants for Diverse Consumer Needs

The Australia Electrolyte Supplement Market presents significant opportunities for manufacturers to expand their product range to cater to diverse consumer preferences. With an increasing demand for products free from artificial additives, there is a growing opportunity for clean-label, organic, and vegan electrolyte supplements. Introducing options tailored to specific health needs, such as low-sodium or sugar-free variants, can help manufacturers appeal to a broader audience. Customizing products for various lifestyles, including supplements aimed at seniors, athletes, or health-conscious individuals, can further drive market growth. Such diversification can position brands as leaders in addressing unique consumer demands for healthier, functional hydration.

Growth in E-commerce and Digital Platforms

The rise of e-commerce offers significant growth potential for the Australia Electrolyte Supplement Market. Online shopping provides convenient access to a wide variety of products, allowing consumers to easily compare and purchase electrolyte supplements. As more Australian consumers turn to digital platforms for their purchasing decisions, the market for online retail of health supplements is expanding. E-commerce platforms enable targeted marketing strategies and personalized offers, allowing brands to reach niche segments more effectively. This shift in consumer behavior towards online shopping presents a valuable opportunity for companies to enhance their digital presence and increase market share.

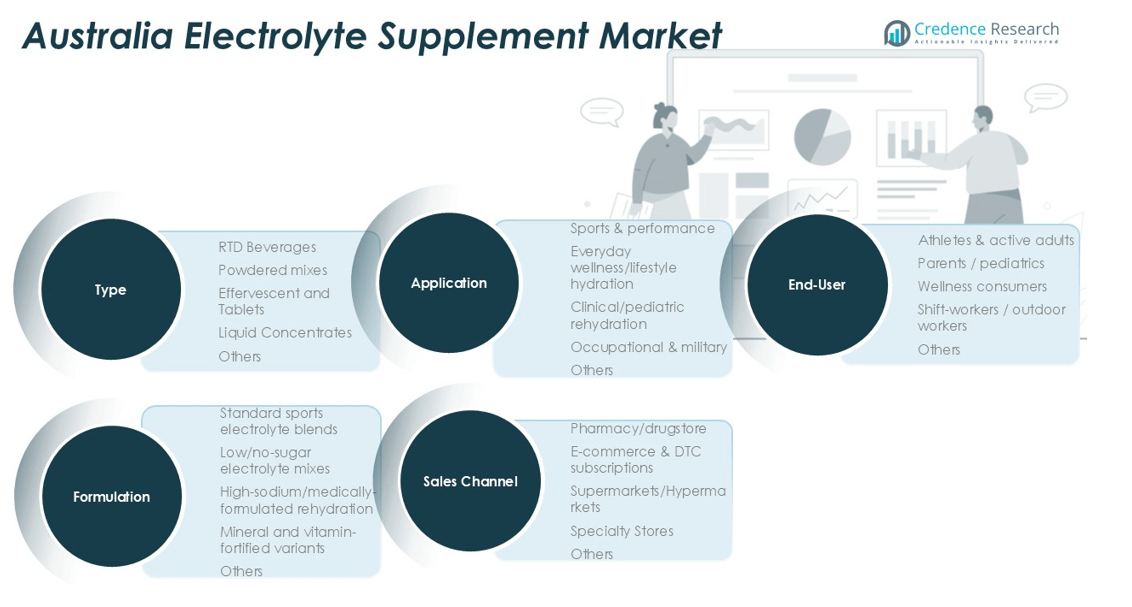

Market Segmentation Analysis:

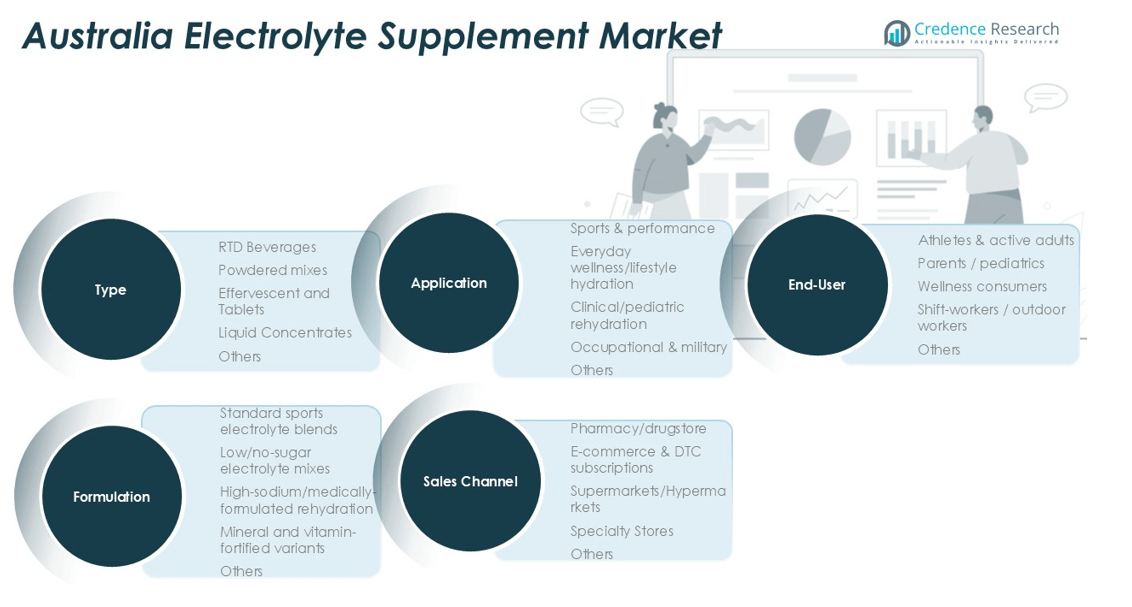

By Type

The Australia Electrolyte Supplement Market is segmented into RTD beverages, powdered mixes, effervescent tablets, liquid concentrates, and others. RTD beverages dominate the market due to their convenience and ease of use, particularly among athletes and active consumers. Powdered mixes and effervescent tablets are also gaining traction for their flexibility and portability. Liquid concentrates, while less popular, cater to niche markets that require concentrated hydration solutions. Each type of supplement is tailored to different consumer needs, from on-the-go hydration to more specialized formulations.

- For instance, the Emergen-C brand offers an effervescent powder drink mix that delivers key nutrients to the body. Each serving provides 1,000 mg of Vitamin C to support the immune system.

By Application

In the application segment, the Australia Electrolyte Supplement Market is divided into sports & performance, everyday wellness/lifestyle hydration, clinical/pediatric rehydration, and occupational & military. Sports & performance accounts for the largest share, driven by the increasing number of fitness enthusiasts and athletes. Everyday wellness and lifestyle hydration is also growing as more people prioritize hydration for general well-being. Clinical and pediatric rehydration supplements address specific health needs, while occupational & military applications cater to individuals in high-risk dehydration environments, such as outdoor workers and armed forces.

By End-User

The end-user segment includes athletes & active adults, parents/pediatrics, wellness consumers, and shift-workers/outdoor workers. Athletes & active adults are the primary consumers, driven by their need for enhanced performance and recovery. Wellness consumers focus on hydration for daily health maintenance. Parents/pediatrics require hydration solutions for children, particularly in hot climates. Shift-workers and outdoor workers benefit from electrolyte supplements to combat dehydration during long hours in physically demanding jobs. Each group has unique needs, fostering demand for targeted products.

- For instance, the Australian brand Hydralyte offers products specifically for pediatric use that are formulated to replace lost electrolytes and fluids. Their electrolyte powder contains 160mg of potassium per 200mL serving to aid in rehydration.

Segmentations:

By Type:

- RTD Beverages

- Powdered Mixes

- Effervescent and Tablets

- Liquid Concentrates

- Others

By Application:

- Sports & Performance

- Everyday Wellness/Lifestyle Hydration

- Clinical/Pediatric Rehydration

- Occupational & Military

- Others

By End-User:

- Athletes & Active Adults

- Parents/Pediatrics

- Wellness Consumers

- Shift-Workers/Outdoor Workers

- Others

By Formulation:

- Standard Sports Electrolyte Blends

- Low/No-Sugar Electrolyte Mixes

- High-Sodium/Medically-Formulated Rehydration

- Mineral and Vitamin-Fortified Variants

- Others

By Sales Channel:

- Pharmacy/Drugstore

- E-commerce & DTC Subscriptions

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis:

New South Wales and Victoria: Dominating the Electrolyte Supplement Market

New South Wales and Victoria account for 50% of the Australia Electrolyte Supplement Market, driven by large urban populations and high sports participation. Cities like Sydney and Melbourne contribute significantly to the demand for electrolyte supplements, with health-conscious individuals and fitness enthusiasts fueling market growth. These regions also host major sports events, boosting the need for hydration products. The prevalence of fitness culture and outdoor activities further strengthens the demand for electrolyte supplements, solidifying these areas as the primary markets for such products.

Queensland: Growing Demand Driven by Climate and Sports Engagement

Queensland holds a 25% share of the Australia Electrolyte Supplement Market, with its warm climate and high levels of sports engagement contributing to increased demand for hydration solutions. The state’s outdoor sports, such as surfing and rugby, significantly influence the need for electrolyte supplements to support performance and recovery. Queensland’s active population, coupled with the health-conscious trends, positions the state as a strong growth region. The climate-related demand for hydration products is expected to continue driving market expansion across the state.

Western Australia and South Australia: Emerging Markets with Potential

Western Australia and South Australia collectively account for 25% of the Australia Electrolyte Supplement Market. These regions, while smaller in population compared to the eastern states, are seeing a rise in health and fitness trends, which is driving the demand for electrolyte supplements. Western Australia’s active outdoor lifestyle, with hiking and cycling, supports the growth of the market, while South Australia’s increasing wellness focus offers additional opportunities for product growth. Both regions represent key areas for future expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis:

- PepsiCo

- The Coca-Cola Company

- Abbott Laboratories

- Nestlé S.A.

- Unilever PLC

- GlaxoSmithKline plc

- Otsuka Pharmaceutical Co., Ltd.

- GU Energy Labs

- Skratch Labs

- Ultima Health Products

- Hammer Nutrition

- SOS Hydration Inc.

Competitive Analysis:

The Australia Electrolyte Supplement Market is highly competitive, with both global giants and local players fighting for market share. Major multinational brands like PepsiCo’s Gatorade and Coca-Cola’s Powerade lead the market, benefiting from strong brand recognition and wide distribution networks. Local brands, such as Hydralyte and VOOST, are carving out niches by offering products tailored to Australian preferences, focusing on convenience and effectiveness. Emerging players like Unilever’s Liquid I.V. are gaining ground by targeting health-conscious consumers with clean-label and sugar-free options. Competition is driven by product innovation, digital marketing strategies, and a growing consumer demand for functional hydration solutions, with brands increasingly focusing on natural and low-sugar formulations to attract health-focused buyers. This dynamic market environment encourages continuous product development and strategic partnerships to enhance market positioning.

Recent Developments:

- In July 2025, PepsiCo launched its first-ever prebiotic cola, Pepsi Prebiotic Cola, which contains prebiotic fiber and comes in “Original Cola” and “Cherry Vanilla” flavors.

- In January 2025, The Coca-Cola Company announced its agreement to acquire Billson’s, an Australian brand of premium alcohol ready-to-drink products, with the acquisition expected to close by the end of the month.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User, Formulation, Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for electrolyte supplements in Australia will continue to grow as health-conscious consumers prioritize hydration for overall wellness.

- Sports and fitness activities will remain a key driver, with an increasing number of Australians engaging in outdoor and indoor sports.

- There will be a shift towards natural, organic, and sugar-free electrolyte products as consumers become more mindful of ingredient labels.

- The rise of e-commerce and direct-to-consumer (DTC) subscriptions will enhance product accessibility, especially in remote areas.

- The growing popularity of fitness influencers and online health communities will further fuel the demand for electrolyte supplements.

- Clinical and pediatric rehydration solutions will see growth due to heightened awareness of hydration in health management for children and vulnerable groups.

- Outdoor workers and shift workers will drive the need for targeted electrolyte products tailored to high-risk dehydration environments.

- Technological advancements in supplement formulations will offer more effective and quicker hydration, meeting diverse consumer preferences.

- Major brands will continue to expand their presence in Australia, with a focus on personalized hydration solutions for various consumer needs.

- Increased awareness of extreme weather conditions and their impact on hydration will continue to propel the market, especially in regions like Queensland.