Market Overview

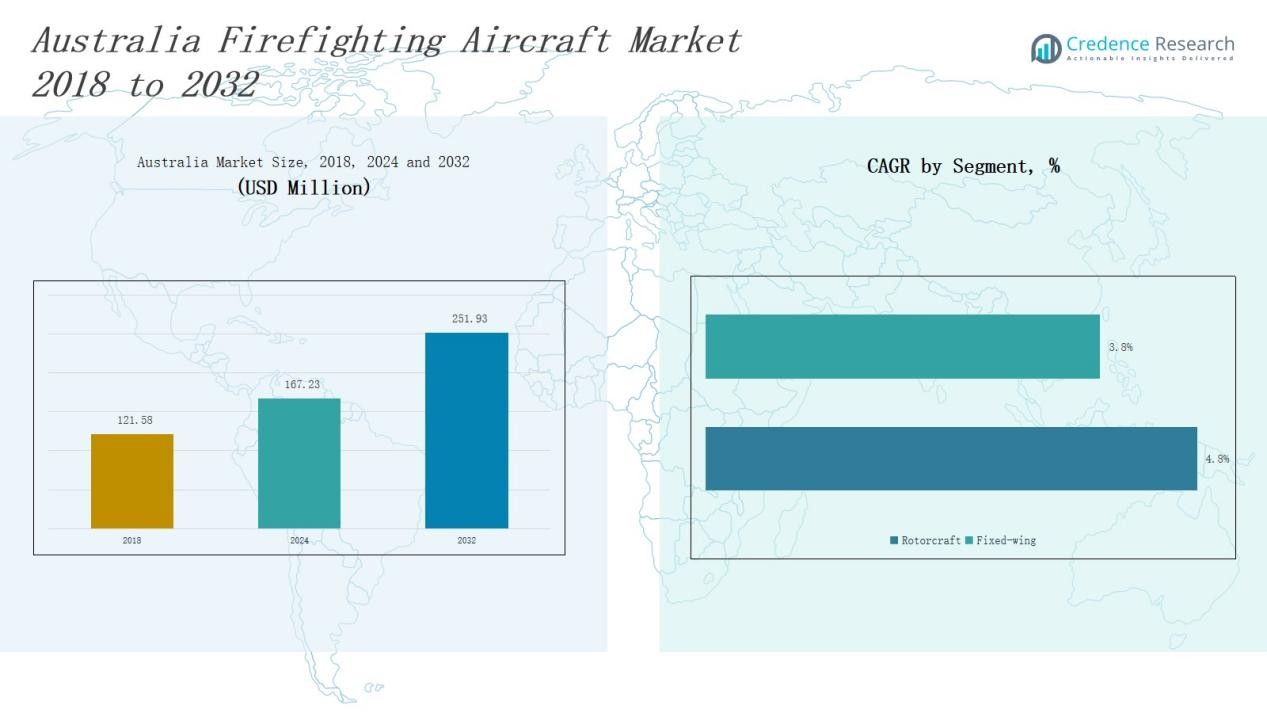

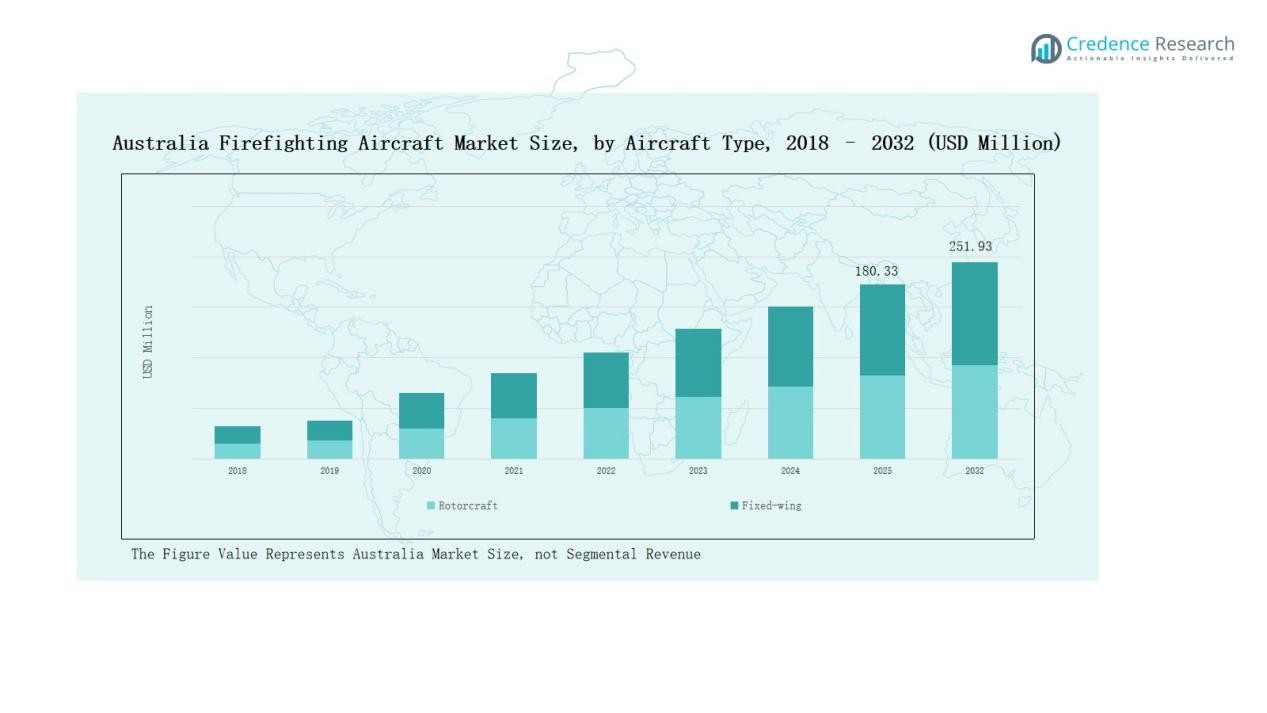

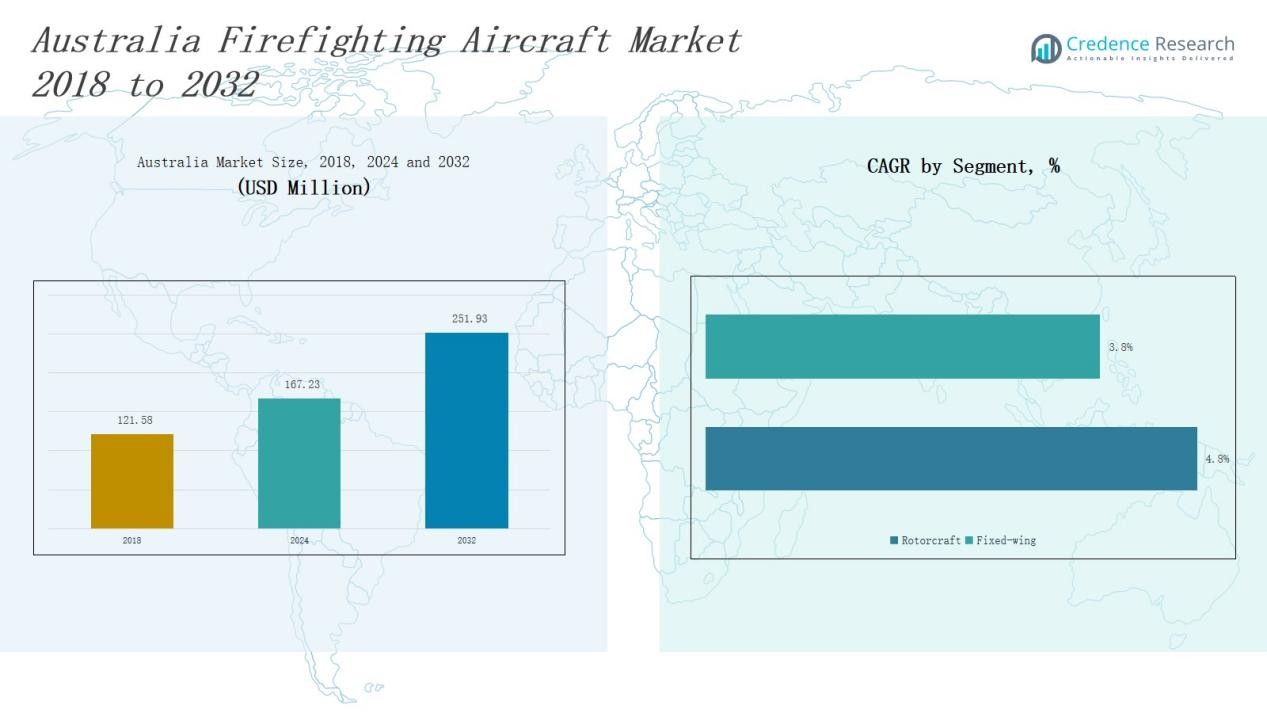

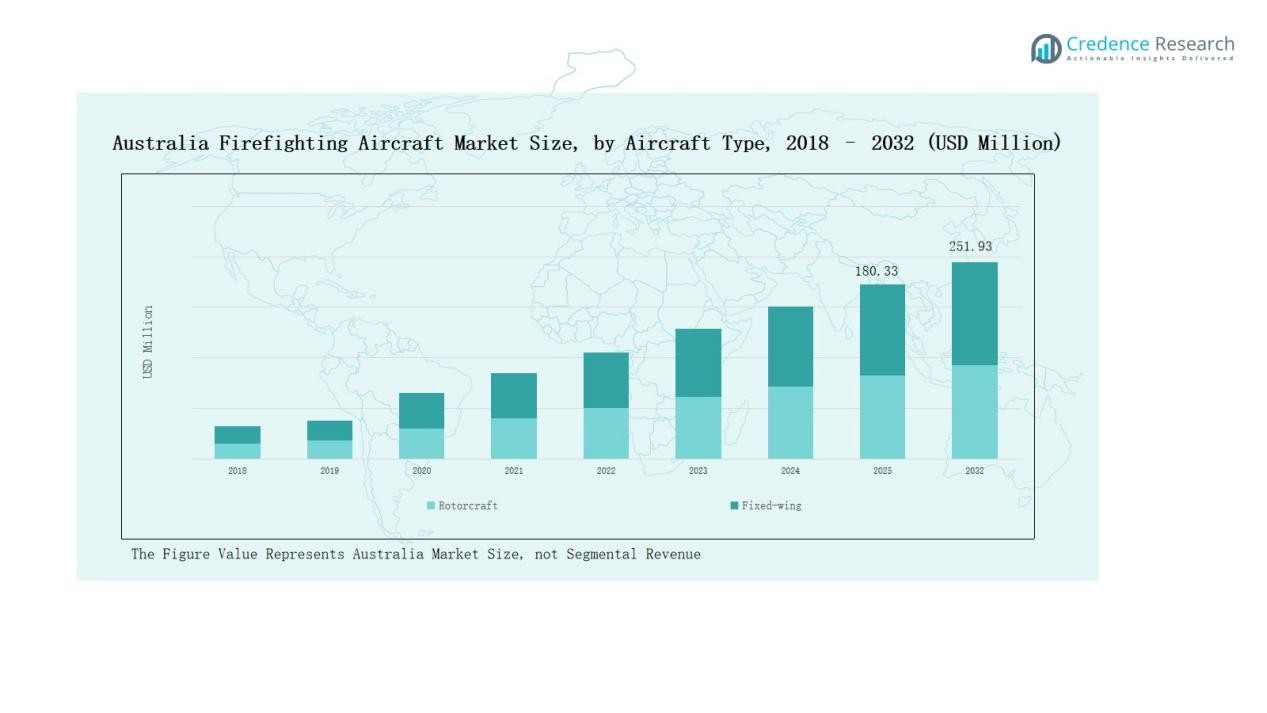

Australia Firefighting Aircraft Market size was valued at USD 121.58 million in 2018 to USD 167.23 million in 2024 and is anticipated to reach USD 251.93 million by 2032, at a CAGR of 4.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Firefighting Aircraft Market Size 2024 |

USD 167.23 Million |

| Australia Firefighting Aircraft Market, CAGR |

4.89% |

| Australia Firefighting Aircraft Market Size 2032 |

USD 251.93 Million |

The Australia Firefighting Aircraft Market is shaped by prominent players such as Coulson Aviation, BAE Systems Australia, Bristow Helicopters Australia, Aero-Flite Australia, Erickson Australia, Rossair Helicopters, and Heliwest Group. These companies compete through fleet modernization, technological integration, and long-term government contracts, with Coulson Aviation and Erickson standing out for their heavy-lift and large air tanker operations. BAE Systems leverages defense-grade expertise, while Bristow and Aero-Flite strengthen capabilities with leasing and rapid-response solutions. Smaller operators like Rossair and Heliwest provide regional agility and precision-based firefighting services. Regionally, New South Wales leads with 32% market share in 2024, driven by frequent bushfire exposure, substantial state investments, and well-established aerial firefighting infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Firefighting Aircraft Market grew from USD 121.58 million in 2018 to USD 167.23 million in 2024 and will reach USD 251.93 million by 2032.

- Fixed-wing aircraft dominate with 63% share in 2024, driven by higher payload capacity, long-range efficiency, and suitability for large-scale bushfire suppression compared to rotorcraft.

- Aircraft above 30,000 kg hold 58% share in 2024, favored for their ability to transport large water and retardant volumes essential for tackling intense wildfires.

- The 1,000 to 3,000 km range segment leads with 55% share, offering operational flexibility and fuel efficiency for both state-level and cross-regional aerial firefighting missions.

- New South Wales leads regionally with 32% market share in 2024, supported by high bushfire frequency, strong government investment, and advanced fixed-wing and rotorcraft deployment.

Market Segment Insights

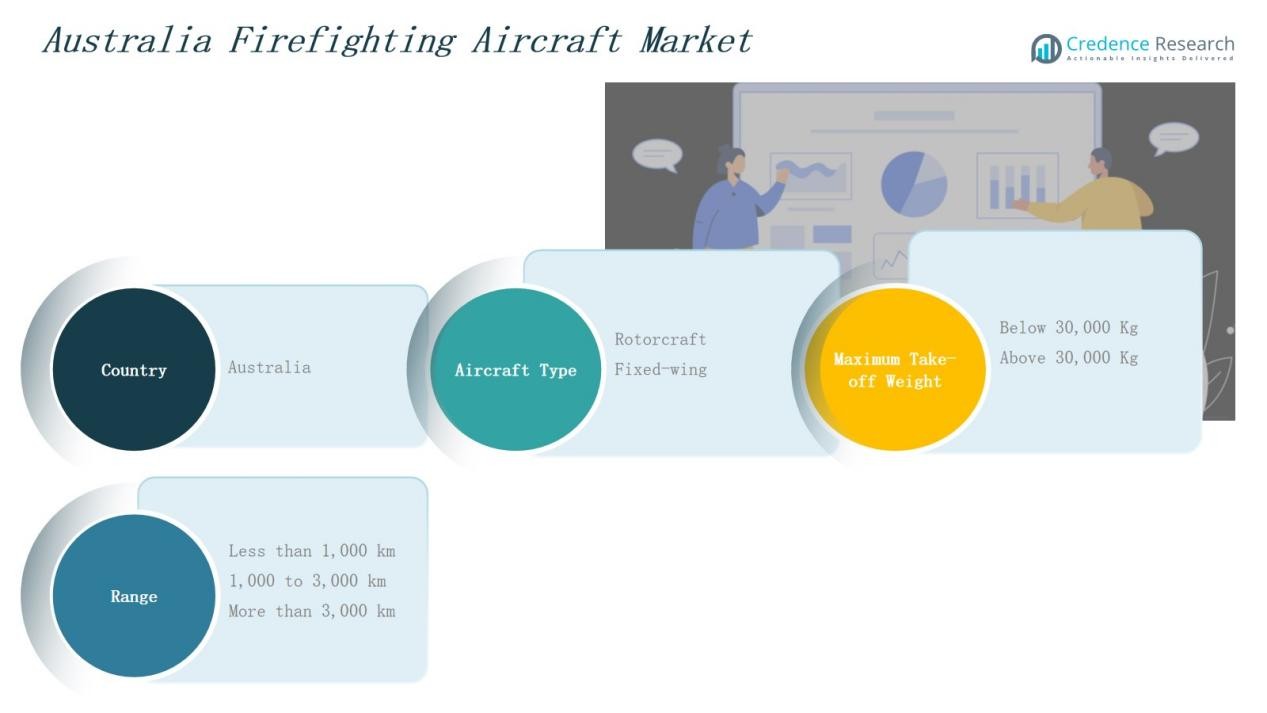

By Aircraft Type

Fixed-wing aircraft dominate the Australia Firefighting Aircraft Market, accounting for 63% share in 2024. Their higher water and retardant carrying capacity, extended range, and suitability for large-scale wildfire suppression make them the preferred choice. Fixed-wing platforms are widely deployed in Australia’s bushfire-prone regions due to their efficiency in covering long distances and executing rapid drop missions. Rotorcraft, with a 37% share, remain critical for precision drops, quick deployment in remote terrains, and flexible operations near urban boundaries.

- For instance, in December 2023, the National Emergency Management Agency (NEMA) announced the Australian Government’s national Boeing 737 Large Air Tanker (LAT). This Coulson Aviation Fireliner has a capacity of up to 15,000 litres of water or retardant, with a refill time of 10 minutes, making it suitable for rapid drops on large fires.

By Maximum Take-off Weight

Aircraft with above 30,000 kg maximum take-off weight lead the market with a 58% share in 2024, supported by their capability to transport large volumes of water and fire retardants in a single sortie. These heavy-duty aircraft are strategically vital for suppressing high-intensity bushfires across expansive landscapes. Meanwhile, the below 30,000 kg category holds 42% share, serving regional operations and providing agility in rugged terrains where larger aircraft face operational constraints.

- For instance, McDonnell Douglas DC-10 Air Tanker, with a maximum takeoff weight significantly over 30,000 kg, carries up to 12,000 US gallons of water or fire retardant in external belly tanks. It can create a retardant line 300 feet wide and one mile long, a drop equivalent to that of 12 smaller tankers.

By Range

The 1,000 to 3,000 km range segment holds the largest market share at 55% in 2024, driven by the need for flexible operational mobility and ability to cover wide geographic areas across fire-prone states. Aircraft in this category balance endurance with fuel efficiency, making them suitable for both state-based and cross-region deployment. The less than 1,000 km segment represents 28% share, mainly used for localized firefighting near dense forests and towns, while the more than 3,000 km range segment accounts for 17% share, supporting long-haul missions, interstate support, and aerial repositioning across Australia.

Key Growth Drivers

Rising Wildfire Frequency and Intensity

Australia faces increasingly severe bushfire seasons, with rising temperatures and prolonged drought conditions fueling the demand for advanced firefighting aircraft. The growing frequency of large-scale wildfires requires aircraft capable of delivering high water payloads and rapid aerial support. Government agencies are investing in fixed-wing and heavy-lift rotorcraft to improve response times. The need to strengthen national resilience and minimize economic and ecological damage makes aerial firefighting capabilities an essential component of Australia’s emergency preparedness strategy.

- For instance, Australia’s Defence Force received two additional CH-47F Chinooks that year to expand the Army’s heavy-lift capability for domestic and regional operations, such as flood relief in 2022

Government Investments and Fleet Modernization

Federal and state governments in Australia are prioritizing aerial firefighting modernization programs to enhance operational readiness. Funding is being directed toward upgrading existing fleets, acquiring heavy-duty aircraft, and establishing long-term leasing contracts with private operators. Modernization initiatives focus on improving payload capacity, avionics, and safety features. Additionally, partnerships with international OEMs and service providers ensure access to advanced technologies. This steady flow of public investment secures consistent demand for both fixed-wing and rotorcraft platforms in the market.

- For instance, in July 2025, Spanish OEM Vallfirest acquired Australian firm Aerial Fire Control, known for its Water Hog buckets and other aerial systems. The acquisition supports Vallfirest’s global expansion, ensuring advanced aerial suppression technology continues to be accessible in the region.

Technological Advancements in Aircraft Systems

Innovation in aerial firefighting systems is driving operational efficiency and market growth. The integration of advanced avionics, satellite connectivity, and thermal imaging allows precise fire monitoring and optimized water drop accuracy. Aircraft are being equipped with environmentally friendly retardant systems and automated refill mechanisms to improve turnaround times. These upgrades increase mission reliability and reduce operating costs over long-term deployments. The adoption of cutting-edge systems positions firefighting aircraft as vital assets in managing Australia’s growing wildfire risks.

Key Trends & Opportunities

Public-Private Partnerships and Leasing Models

Australia is witnessing a surge in public-private collaboration for aerial firefighting services. Leasing models with private operators enable state governments to access modern fleets without incurring full ownership costs. This trend is fostering opportunities for domestic and international aircraft operators to expand presence in Australia. It also ensures operational flexibility during peak fire seasons, supporting both national and regional agencies in scaling firefighting efforts efficiently.

- For instance, Erickson’s S-64s in Australia: Erickson has a long history of providing S-64 Air Crane helicopters for firefighting in Australia, including under contract with the NAFC. In fact, 2023 marked the 25th anniversary of Erickson’s support for Australian firefighting.

Growing Demand for Multi-Role Aircraft

There is rising demand for multi-role aircraft capable of performing firefighting, transport, and emergency medical evacuation. Operators are seeking platforms that deliver cost efficiency through year-round utilization. Multi-mission adaptability enhances aircraft value by enabling operators to generate revenue outside peak fire seasons. This trend provides opportunities for manufacturers to design versatile airframes that cater to firefighting while addressing broader emergency response needs in Australia.

- For instance,in October 2024, South Australia’s Country Fire Service added five multi-role aircraft to its fleet. These additions included two Black Hawk helicopters with a 4,500-liter water and foam capacity, which also serve transport roles, and a Eurocopter B3 Squirrel for aerial surveillance and crew transportation.

Key Challenges

High Acquisition and Operational Costs

The acquisition of advanced firefighting aircraft requires significant capital investment, often exceeding budgetary constraints for state agencies. Operational costs, including fuel, maintenance, and crew training, further strain resources. Leasing mitigates some burden, but long-term dependence increases overall expenditure. These financial challenges limit rapid expansion of firefighting fleets.

Limited Availability of Heavy-Lift Aircraft

The availability of large-capacity firefighting aircraft is limited due to global demand and complex procurement cycles. Australia often competes with other wildfire-prone regions like North America and Southern Europe for access to heavy-lift aircraft during overlapping fire seasons. This scarcity affects readiness and can delay deployment when urgent firefighting support is needed.

Environmental and Regulatory Constraints

Environmental regulations around chemical retardants and aircraft emissions pose operational challenges. Restrictions on specific retardants reduce flexibility in firefighting strategies. Additionally, stringent aviation regulations extend procurement and certification timelines, slowing market expansion. Compliance with evolving safety and environmental standards increases costs and complicates fleet management for operators in Australia.

Regional Analysis

New South Wales

New South Wales leads the Australia Firefighting Aircraft Market with 32% share in 2024, supported by high exposure to frequent bushfires. The state has invested in both fixed-wing aircraft and rotorcraft to enhance rapid response in forested and rural regions. It deploys large air tankers capable of covering vast fire lines and maintaining aerial surveillance during critical fire seasons. The strong presence of operational bases and government-backed contracts strengthens the state’s fleet reliability. It benefits from cross-border aircraft sharing, improving firefighting capacity during peak demand.

Victoria

Victoria accounts for 26% share and maintains a strong aerial firefighting infrastructure to combat seasonal bushfires. The state operates a mix of rotorcraft and fixed-wing platforms tailored to both precision drops and long-range missions. Investments in modern avionics and multi-role aircraft support flexible operations across dense forest areas. It is also supported by active collaborations with private operators, ensuring fleet availability during extended fire seasons. Growing urban-wildland interface risks further drive investments in aerial firefighting solutions.

Queensland

Queensland holds 18% share of the market, driven by its vast geographical spread and diverse terrain. The state uses rotorcraft for rapid deployment in regional and remote areas while also employing medium-range fixed-wing aircraft for large-scale fires. Government agencies focus on strengthening leasing agreements to meet seasonal demand. It leverages versatile aircraft for both firefighting and regional emergency response, adding efficiency to its fleet utilization. The rising number of high-temperature fire events increases demand for sustained aerial support.

Western Australia

Western Australia represents 14% share of the market and emphasizes aerial operations across expansive forest and grassland areas. It depends heavily on fixed-wing platforms with extended range to manage large-scale wildfires in remote regions. Investments in modern heavy-lift aircraft enhance operational capabilities for long-duration missions. The state also collaborates with federal authorities to access shared national fleets during critical events. It continues to upgrade regional airbases to improve aircraft turnaround efficiency.

South Australia and Others

South Australia, together with Tasmania and Northern Territory, contributes 10% share of the market. These regions operate smaller and more flexible aircraft fleets suited for localized fire events. Rotorcraft play a significant role in responding quickly to fires near settlements and forested areas. It benefits from seasonal fleet reinforcements sourced from national pools and private operators. Increasing fire risks in these regions are creating steady demand for improved aerial firefighting assets.

Market Segmentations:

By Aircraft Type

By Maximum Take-off Weight

- Below 30,000 Kg

- Above 30,000 Kg

By Range

- Less than 1,000 km

- 1,000 to 3,000 km

- More than 3,000 km

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The Australia Firefighting Aircraft Market features a moderately consolidated landscape, with key players including Coulson Aviation, Bristow Helicopters Australia, BAE Systems Australia, Aero-Flite Australia, Erickson Australia, Rossair Helicopters, and Heliwest Group. These companies compete on fleet capability, technological integration, and long-term government contracts. Coulson Aviation and Erickson Australia lead with strong expertise in large air tanker operations and specialized rotorcraft services, while BAE Systems Australia leverages advanced engineering support and defense-grade aircraft modifications. Bristow and Aero-Flite focus on providing versatile leasing solutions and rapid response capabilities. Smaller operators like Rossair Helicopters and Heliwest Group strengthen the market through regional deployment and precision-based firefighting. Strategic partnerships with federal and state governments, alongside public-private leasing models, remain central to sustaining market share. Competition is also influenced by seasonal demand peaks, cross-border fleet sharing, and technological upgrades in avionics, retardant systems, and mission efficiency. This dynamic environment drives continuous modernization and operational innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In July 2025, Vallfirest acquired Australia-based Aerial Fire Control (AFC) PTY LTD, a specialist in aerial firefighting buckets and helicopter mission systems. The deal expands Vallfirest’s global footprint and strengthens innovation in wildfire suppression technology.

- In June 2025, McDermott Aviation announced plans to add three Transall C-160 fixed-wing firefighting aircraft to its fleet. The new aircraft will enhance regional aerial firefighting capabilities and are expected to be operational for the 2025–26 fire season, pending CASA approval.

- In March 2025, Helitak advanced its global presence with its line of underbody helicopter tanks ranging from 1,000 to 11,000 liters.

Report Coverage

The research report offers an in-depth analysis based on Aircraft Type, Maximum Take-Off Weight, Range and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for large air tankers will rise to support long-duration firefighting missions.

- Rotorcraft use will expand for rapid response and precision operations in urban-wildland zones.

- Government agencies will strengthen long-term leasing contracts with private operators.

- Investment in multi-role aircraft will increase to maximize fleet utility across emergency services.

- Advanced avionics and thermal imaging will become standard in modern firefighting aircraft.

- Cross-border fleet sharing with international partners will gain importance during peak fire seasons.

- Heavy-lift aircraft deployment will grow to cover large-scale fires in remote regions.

- Public-private partnerships will expand to improve national aerial firefighting capacity.

- Operators will adopt environmentally safe retardant systems to meet regulatory requirements.

- Regional airbases will be upgraded to support faster aircraft turnaround and higher fleet readiness.