Market Overview

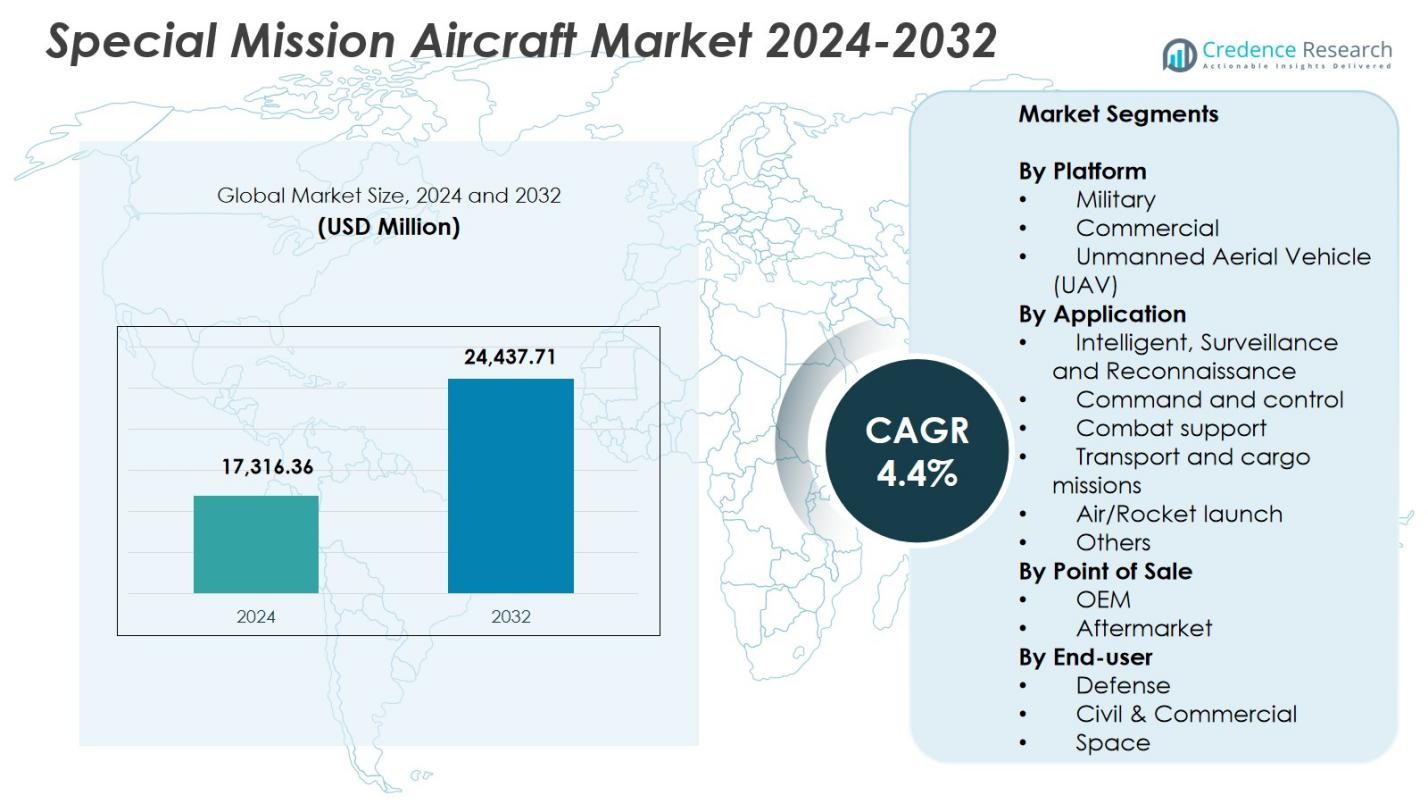

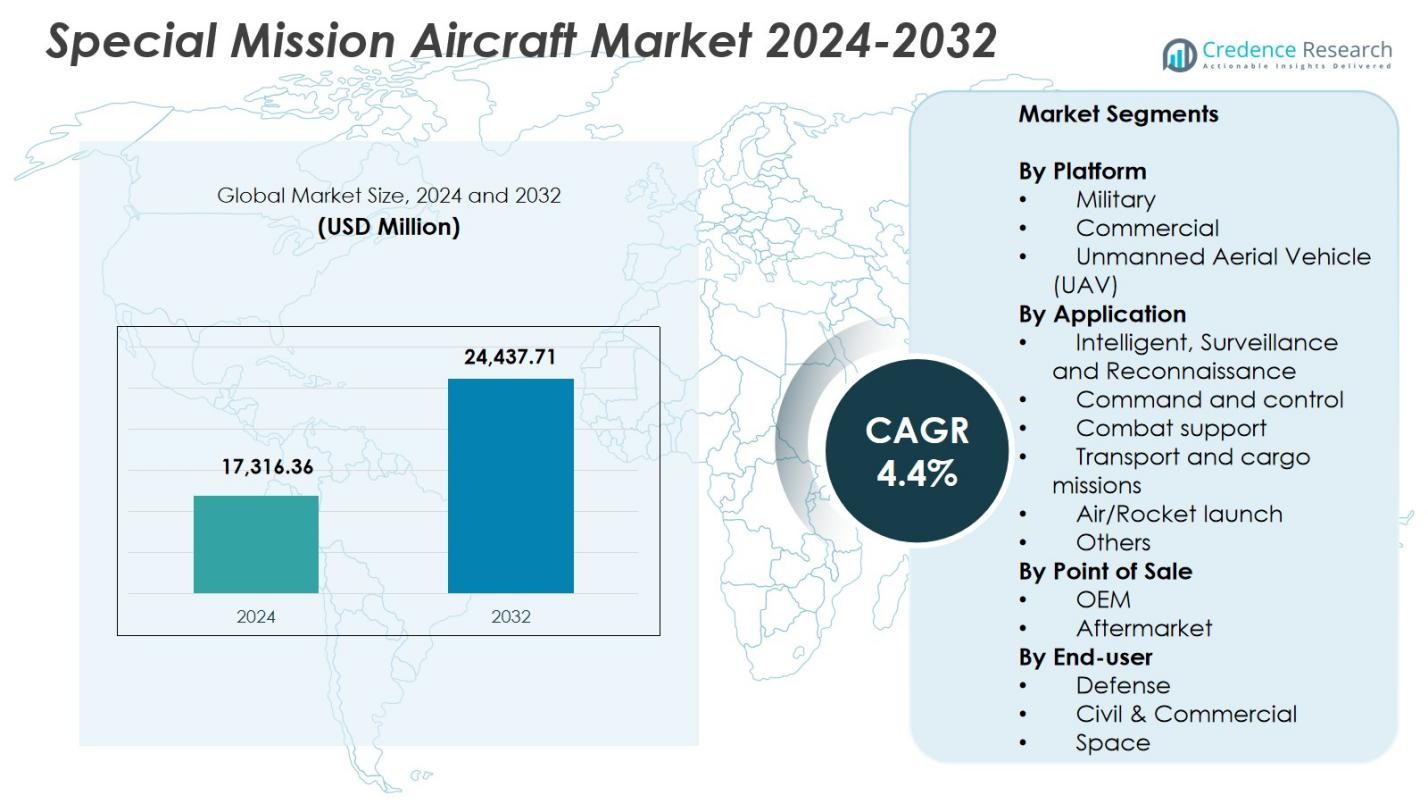

Special Mission Aircraft Market size was valued at USD 17,316.36 Million in 2024 and is anticipated to reach USD 24,437.71 Million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Special Mission Aircraft Market Size 2024 |

USD 17,316.36 Million |

| Special Mission Aircraft Market, CAGR |

4.4% |

| Special Mission Aircraft Market Size 2032 |

USD 24,437.71 Million |

Special Mission Aircraft Market is shaped by leading players such as Airbus SE, BAE Systems, Bombardier Inc., Elbit Systems Ltd., Israel Aerospace Industries Ltd., AeroVironment Inc., Kratos Defense & Security Solutions Inc., L3 Harris Technologies, Dassault Aviation SA, and General Atomics Aeronautical Systems Inc., each contributing advanced platforms and mission systems across ISR, maritime patrol, and defense operations. North America leads the market with a 42.6% share, supported by strong defense spending and increased modernization programs, while Europe follows with 27.4%, driven by growing investments in border security and ISR upgrades. Asia-Pacific holds 19.8%, reflecting rapid fleet expansion and rising regional surveillance needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Special Mission Aircraft Market reached USD 17,316.36 Million in 2024 and will grow at a CAGR of 4.4% through 2032.

- Rising defense modernization and a 62.4% share held by the military platform segment drive strong demand for ISR, maritime patrol, and multi-role aircraft.

- Key trends include expanding UAV adoption, modular mission configurations, and integration of AI-enabled surveillance and analytics.

- Major players such as Airbus SE, BAE Systems, Elbit Systems Ltd., and General Atomics focus on advanced sensors, multi-mission capabilities, and long-term fleet upgrade programs.

- North America leads with 42.6% share, followed by Europe at 27.4% and Asia-Pacific at 19.8%, reflecting strong ISR investments and expanding UAV deployments across these regions.

Market Segmentation Analysis:

By Platform

The Special Mission Aircraft Market by platform is dominated by the Military segment with a 62.4% share in 2024, driven by rising investments in defense modernization, border security, and electronic warfare capabilities. Nations are expanding fleets for intelligence, surveillance, and reconnaissance operations, fueling demand for retrofitted and newly built mission-ready aircraft. The Unmanned Aerial Vehicle (UAV) segment accounts for 23.1% as autonomous operations gain traction for high-risk missions, while the Commercial segment holds 14.5%, supported by applications in maritime patrol, environmental monitoring, and air ambulance services. Growing geopolitical tensions continue to reinforce military procurement.

- For instance, General Atomics MQ-9 Reaper conducts ISR with 30-hour endurance unarmed or 23 hours fully loaded, supporting ground troops via real-time imagery and signals intelligence.

By Application

The Intelligence, Surveillance, and Reconnaissance (ISR) segment leads with a 47.8% market share, supported by increased reliance on real-time situational awareness, advanced sensor suites, and multi-domain intelligence platforms. Demand for persistent monitoring across maritime, land, and air domains underpins strong adoption. Combat support represents 18.6%, driven by electronic attack, communication relay, and threat evaluation missions, while Command and Control accounts for 14.2%. Transport and cargo missions hold 10.9%, Air/Rocket launch contributes 4.1%, and Others collectively account for 4.4%, supported by specialized missions such as medical evacuation and calibration tasks.

- For instance, L3Harris’ AMORPHOUS software provides a single interface to control thousands of heterogeneous drones across domains, demonstrated in Army and Defense Innovation Unit tests for multi-asset missions.

By Point of Sale

The market by point of sale is dominated by the OEM segment with a 71.3% share, driven by rising procurement of next-generation mission aircraft equipped with integrated avionics, advanced radar payloads, and ISR technologies. OEMs benefit from large defense contracts and continuous platform upgrades aligned with evolving mission requirements. The Aftermarket segment holds 28.7%, supported by sustained demand for maintenance, repair, retrofitting, and lifecycle extension programs. Growth in mission-specific customization, sensor enhancements, and performance optimization initiatives strengthens aftermarket activity as operators aim to maximize fleet utility and operational readiness.

Key Growth Drivers

Rising Defense Modernization and Border Security Programs

Global defense forces are accelerating modernization programs to enhance multi-domain situational awareness, fueling strong demand for special mission aircraft equipped with advanced ISR, electronic intelligence, and maritime patrol capabilities. Heightened geopolitical tensions and increased emphasis on border surveillance promote procurement of both manned and unmanned platforms. Governments are investing in mission-specific aircraft to strengthen rapid response and threat detection, driving consistent market expansion. Additionally, aging fleets across several nations create replacement demand, further supporting long-term adoption of upgraded and technologically advanced mission aircraft.

- For instance, Bombardier Defense announced delivery of two Challenger 650 special mission aircraft to an Australian-based principal finance firm for ISR operations, scheduled for 2026 handover.

Expansion of UAV-Based Special Mission Operations

Unmanned Aerial Vehicles (UAVs) are transforming special mission operations due to their ability to conduct high-risk missions without endangering personnel. Growing adoption of medium-altitude long-endurance UAVs for reconnaissance, target acquisition, and persistent monitoring fuels market growth. Their cost-efficiency, extended endurance, and integration with AI-enabled analytics make UAVs a preferred choice for both military and homeland security agencies. Continuous advancements in autonomous navigation, payload miniaturization, and sensor fusion further enhance UAV capabilities, expanding their role in intelligence, environmental monitoring, and search-and-rescue missions.

- For instance, Israel’s IAI Heron UAV, with a service ceiling of 33,000 ft and endurance of 52 hours, supported Royal Australian Air Force missions in Afghanistan for surveillance, reconnaissance, security, and battle damage assessment

Technological Advancements in Sensors and Mission Systems

Rapid innovation in sensor technologies, including synthetic aperture radar, electro-optical systems, and signals intelligence payloads, significantly boosts the value proposition of special mission aircraft. Enhanced data processing, onboard analytics, and secure communication links enable real-time intelligence delivery, improving mission effectiveness. Adoption of open architecture systems allows easy integration of new payloads, reducing upgrade complexities. Furthermore, advancements in propulsion, avionics, and electronic warfare suites support multi-mission versatility, making these aircraft indispensable for defense, commercial, and scientific operations, thereby accelerating market expansion.

Key Trends & Opportunities

Growing Adoption of Multi-Role and Modular Mission Configurations

Operators are increasingly shifting toward modular mission configurations that allow rapid reconfiguration of aircraft for ISR, surveillance, maritime patrol, or cargo transport. This trend enables fleet optimization and cost efficiency as a single aircraft can support multiple mission profiles. Modular open-systems architectures also encourage incremental upgrades, allowing platforms to remain mission-relevant over longer lifecycles. This shift presents opportunities for OEMs and system integrators to develop plug-and-play payloads, sensor modules, and software-defined mission systems that meet evolving defense and commercial operational needs.

- For instance, Northrop Grumman’s MQ-4C Triton employs open architecture with modular payloads like the AN/ZPY-3 multi-function active sensor and electro-optical/infrared systems, delivering 24/7 maritime ISR with 80% effective time on station and a 51,000-hour airframe life.

Integration of AI, Cloud Analytics, and Digital Mission Management

Artificial intelligence, machine learning, and cloud-enabled analytics are creating new opportunities for enhanced mission planning and real-time decision-making. AI-driven threat recognition, predictive maintenance, autonomous navigation, and data fusion capabilities significantly elevate performance in ISR and surveillance missions. Cloud-based mission management platforms enable secure data sharing across command centers, improving collaborative operations. As defense agencies prioritize network-centric warfare and digital transformation, demand increases for aircraft capable of seamless digital integration, creating new opportunities for technology suppliers and avionics innovators.

- For instance, C3.ai’s predictive maintenance solution, transitioned to Air Force and Army aircraft like the F-35 Lightning II via the Defense Innovation Unit in 2020, reduced unscheduled maintenance by 40% on high-priority subsystems.

Key Challenges

High Procurement and Lifecycle Costs

Special mission aircraft require sophisticated sensors, communication suites, and mission-critical systems, resulting in high acquisition costs that limit adoption, especially among budget-constrained nations. Beyond procurement, operators face substantial lifecycle expenses related to maintenance, system upgrades, and regulatory compliance. Integrating advanced mission payloads into older aircraft can further increase costs due to structural and compatibility challenges. These financial barriers often delay fleet modernization programs and push operators to rely on legacy platforms longer, constraining market growth despite rising operational requirements.

Regulatory and Airspace Integration Constraints for UAVs

While UAV adoption continues to increase, regulatory challenges hinder their deployment for certain special mission operations. Restrictions related to beyond-visual-line-of-sight operations, cross-border surveillance, and integration into civilian airspaces limit their operational flexibility. Variability in certification standards and slow regulatory harmonization across regions further complicate procurement and deployment strategies for defense and commercial users. Ensuring safe coexistence of UAVs with manned aircraft requires advanced traffic management systems and extensive policy reforms, presenting a significant challenge to broader UAV-based mission expansion.

Regional Analysis

North America

North America leads the Special Mission Aircraft Market with a 42.6% share, driven by robust defense spending, large-scale ISR modernization programs, and strong adoption of both manned and unmanned mission platforms. The United States accelerates procurement of advanced surveillance aircraft, maritime patrol systems, and high-end UAVs to strengthen homeland security and global military operations. Continuous investments in AI-enabled mission systems, electronic warfare suites, and open-architecture avionics enhance the region’s technological edge. Additionally, the presence of leading OEMs and system integrators supports steady production, retrofit activities, and long-term fleet expansion.

Europe

Europe accounts for 27.4% of the market, supported by increasing emphasis on border security, counterterrorism operations, and maritime surveillance across NATO member states. Countries such as France, the U.K., and Germany invest in next-generation ISR aircraft and UAV platforms to bolster strategic intelligence capabilities. The region also benefits from strong collaboration programs, including multinational fleet-sharing initiatives and cross-border defense projects. Rising demand for maritime patrol aircraft in the Mediterranean and North Sea further strengthens market growth. Ongoing digitalization and sensor modernization programs also contribute to expanding adoption across major European fleets.

Asia-Pacific

Asia-Pacific holds a 19.8% share, driven by expanding defense budgets, territorial surveillance needs, and modernization of air and naval forces. China, India, Japan, and South Korea are significantly enhancing ISR and maritime patrol capabilities to respond to regional tensions and secure extensive coastlines. Increased procurement of UAVs and multi-role special mission aircraft supports rapid growth. The region’s investment in indigenous aircraft development and technology partnerships strengthens manufacturing capacity. Demand also rises for mission aircraft supporting disaster management, environmental monitoring, and search-and-rescue operations, making Asia-Pacific a rapidly advancing market.

Latin America

Latin America represents 6.1% of the market, supported by growing requirements for border surveillance, anti-smuggling operations, and environmental monitoring across large forested and coastal areas. Countries such as Brazil, Mexico, and Chile invest in mission-configured aircraft to enhance aerial patrol, maritime security, and emergency response capabilities. Budget constraints moderate procurement volumes, but ongoing efforts to modernize legacy fleets fuel retrofit and sensor-upgrade demand. The region increasingly adopts UAVs for monitoring illegal mining, deforestation, and drug trafficking routes, driving gradual expansion of mission aircraft utilization across governmental and security agencies.

Middle East & Africa

Middle East & Africa holds a 4.1% market share, driven by rising demand for ISR, border security, and counterinsurgency operations. Gulf nations invest heavily in advanced special mission aircraft equipped with sophisticated radar, SIGINT, and electronic warfare systems to enhance regional defense readiness. Africa’s demand is fueled by surveillance needs related to wildlife protection, maritime piracy control, and disaster management. Limited budgets in parts of the region slow large-scale procurement, but upgrades to existing fleets and growing interest in cost-efficient UAVs support sustained market participation, particularly among defense and homeland security agencies.

Market Segmentations:

By Platform

- Military

- Commercial

- Unmanned Aerial Vehicle (UAV)

By Application

- Intelligent, Surveillance and Reconnaissance

- Command and control

- Combat support

- Transport and cargo missions

- Air/Rocket launch

- Others

By Point of Sale

By End-user

- Defense

- Civil & Commercial

- Space

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Special Mission Aircraft Market features leading players such as Airbus SE, BAE Systems, Bombardier Inc., AeroVironment Inc., Elbit Systems Ltd., Israel Aerospace Industries Ltd., Kratos Defense & Security Solutions Inc., L3 Harris Technologies, Dassault Aviation SA, and General Atomics Aeronautical Systems Inc. The competitive landscape is characterized by continuous innovation in sensor technologies, mission systems, and multi-role platforms tailored for ISR, maritime patrol, command-and-control, and combat support missions. OEMs focus on expanding modular and open-architecture designs to enable rapid mission reconfiguration and cost-effective upgrades. Strategic partnerships between aircraft manufacturers, avionics suppliers, and defense agencies strengthen product portfolios and global market reach. Companies increasingly invest in unmanned systems, AI-driven analytics, and enhanced data processing capabilities to address growing demand for high-end mission performance. Additionally, acquisition-driven expansion and long-term defense contracts contribute to sustained competition, with players prioritizing fleet modernization and lifecycle support solutions across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Elbit Systems Ltd. secured a contract worth approximately USD 260 million to supply its J-MUSIC DIRCM self-protection systems for 23 Airbus A400M transport aircraft operated by the German Air Force.

- In October 2025, L3Harris Technologies won a USD 2.26 billion contract to supply four airborne early warning and control (AEW&C) aircraft based on its Global 6500 platform to the Republic of Korea Air Force.

- In December 2025, Airbus secured its first Australian order for the H160 multi-mission helicopter from Linfox for passenger transportation missions, following a successful demonstration tour covering over 2,000 kilometers across the country.

Report Coverage

The research report offers an in-depth analysis based on Platform, Application, Point Of Sale, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ISR-enabled aircraft will rise as nations prioritize real-time situational awareness and border security.

- UAV-based special mission platforms will expand rapidly with improved autonomy and long-endurance capabilities.

- Adoption of modular, multi-role configurations will increase to support flexible mission profiles and cost-efficient fleet utilization.

- Integration of AI, data fusion, and advanced analytics will strengthen mission effectiveness across defense and commercial operations.

- Investments in electronic warfare, SIGINT, and radar technologies will grow to counter emerging threats.

- Fleet modernization programs will accelerate as operators replace aging aircraft with next-generation mission platforms.

- Cross-border defense collaborations and joint procurement initiatives will shape future market partnerships.

- Demand for maritime patrol and anti-smuggling aircraft will increase due to rising coastal security requirements.

- Aftermarket services, including retrofits and sensor upgrades, will gain momentum to enhance lifecycle performance.

- Indigenous manufacturing and technology-transfer programs will expand in developing regions, driving localized production growth.