Market Overview:

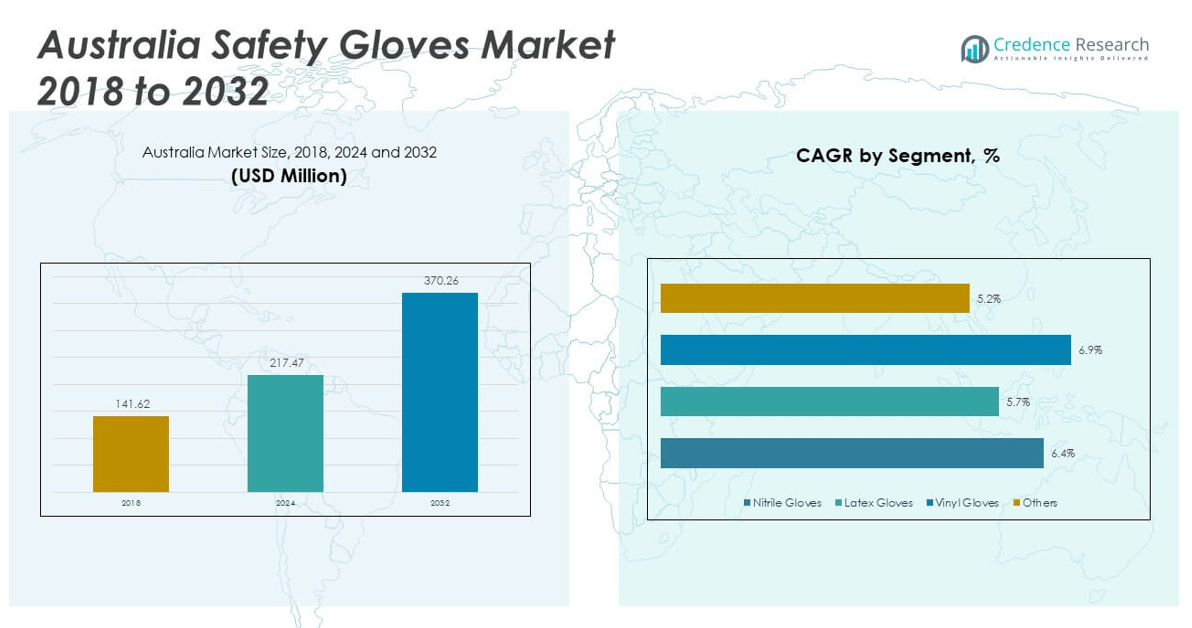

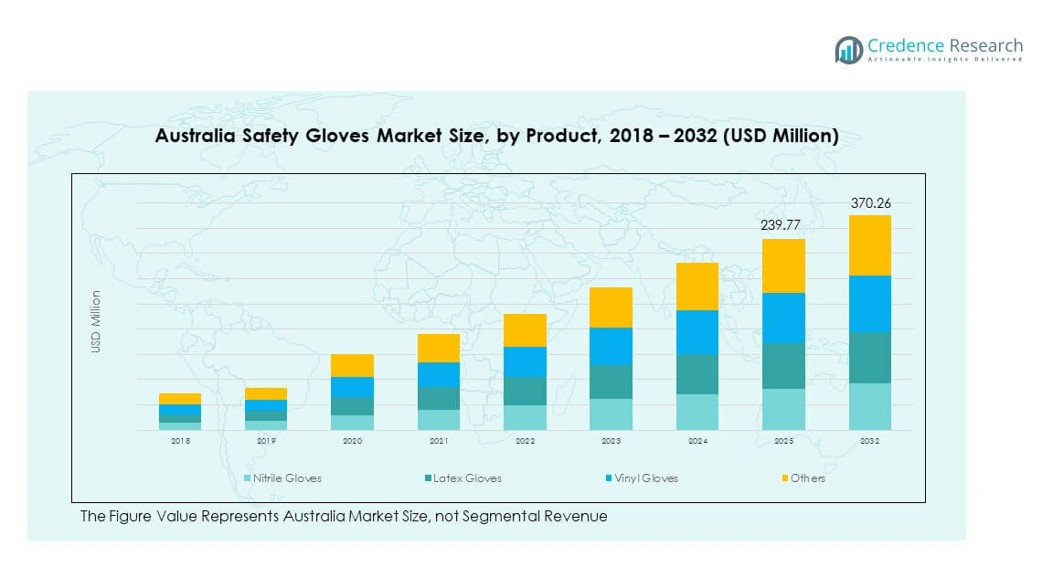

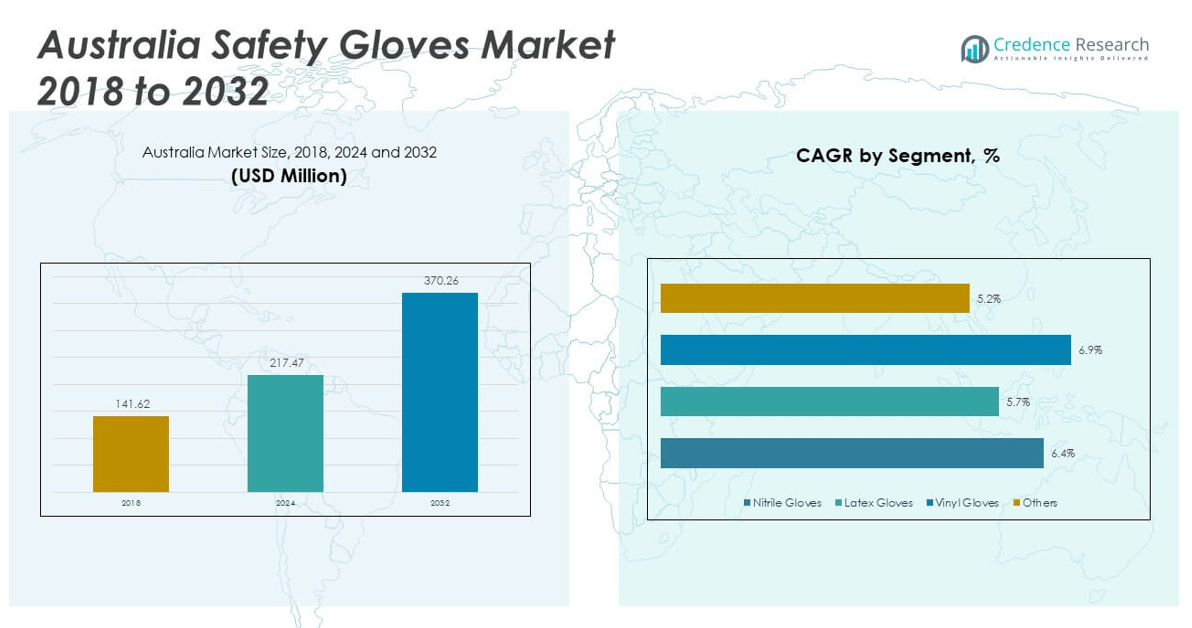

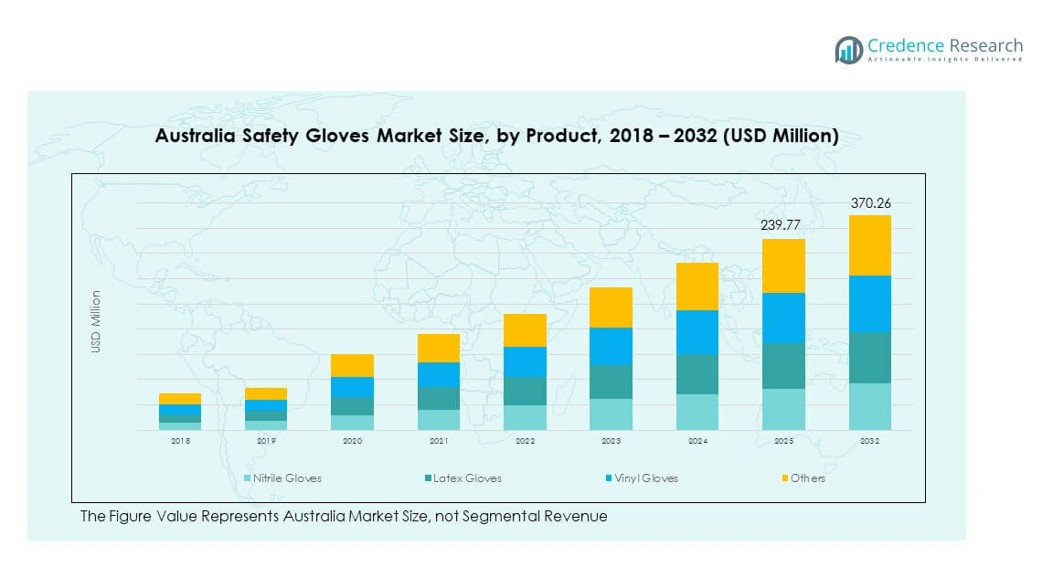

The Australia Safety Gloves Market size was valued at USD 141.62 million in 2018 to USD 217.47 million in 2024 and is anticipated to reach USD 370.26 million by 2032, at a CAGR of 6.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Safety Gloves Market Size 2024 |

USD 217.47 million |

| Australia Safety Gloves Market, CAGR |

6.40% |

| Australia Safety Gloves Market Size 2032 |

USD 370.26 million |

The market is witnessing growth due to increasing awareness of workplace safety regulations and rising industrialization. Demand is driven by industries such as construction, manufacturing, healthcare, and mining where protective gear is mandatory. Rising occupational hazards and stricter compliance policies encourage companies to invest in advanced gloves that provide durability, comfort, and enhanced protection. Additionally, technological improvements, including cut-resistant and chemical-resistant materials, are expanding adoption across diverse sectors. Growing emphasis on worker safety culture also plays a vital role in boosting consumption.

Regionally, urban and industrial hubs across Australia are leading the market due to high concentration of manufacturing, healthcare, and construction activities. Emerging demand is visible in rural and semi-urban areas where mining and agriculture dominate, creating opportunities for specialized protective gloves. The spread of multinational companies and local suppliers across these regions ensures availability and competitive pricing. Strong adoption in metropolitan areas and rising penetration in resource-driven sectors across the country highlight the balanced yet expanding growth trajectory of the safety gloves market.

Market Insights:

- The Australia Safety Gloves Market was valued at USD 141.62 million in 2018, reached USD 217.47 million in 2024, and is projected to grow to USD 370.26 million by 2032 at a CAGR of 6.40%.

- Eastern Australia led with a 38% share in 2024, driven by strong healthcare infrastructure, manufacturing, and construction activities. Western Australia followed with 26%, supported by mining and energy industries, while Northern and Southern regions together held 22% due to manufacturing and agriculture growth.

- Queensland, holding 14% share in 2024, is the fastest-growing region, supported by expanding construction projects and healthcare investment.

- Nitrile gloves dominate the product segment with nearly 45% share in 2024, supported by their chemical resistance and preference in healthcare and industrial use.

- Latex and vinyl gloves together account for around 40% share, serving cost-sensitive applications in healthcare, food handling, and general industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Industrialization and Expansion of Manufacturing Activities:

The Australia Safety Gloves Market is fueled by rapid industrial growth and a strong expansion of manufacturing operations. Increasing mechanization and automation require workers to handle heavy machinery, sharp tools, and chemical substances. Rising demand from construction, automotive, and metal fabrication sectors pushes adoption of protective gloves. Employers are focusing on reducing workplace accidents, which strengthens compliance with safety protocols. Growing investment in infrastructure development amplifies the use of durable gloves. High-risk jobs across energy and mining operations encourage procurement of advanced safety products. This environment drives a consistent demand trajectory for protective solutions.

- For instance, Ansell Limited has developed its INTERCEPT Technology yarns which offer cut protection ranging from European Standard EN levels 2 to 5 across eight glove models. These gloves demonstrate eight times more durability through proprietary FORTIX™ Abrasion Resistance coating and improved grip technology, which significantly reduces hand fatigue in automotive and manufacturing sectors.

Strengthening Workplace Safety Regulations and Compliance Standards:

Stricter enforcement of occupational health and safety rules creates consistent demand across industries. Government authorities and safety regulators impose strict compliance requirements on employers. The focus on worker protection reduces tolerance for unsafe working environments. Companies are compelled to adopt certified gloves to meet compliance standards. This approach improves worker confidence and supports organizational reputation. Public sector projects also follow strict guidelines, increasing demand for approved safety gear. The Australia Safety Gloves Market benefits from these frameworks by embedding safety culture at the organizational level.

- For instance, Honeywell launched the Perfect Fit 3.0 safety gloves featuring an 18-gauge construction that combines enhanced dexterity and an anti-static property, while offering touchscreen capability and breathability. These gloves meet OEKO-TEX 100 certification standards ensuring freedom from harmful substances and compliance with strict industrial safety guidelines, particularly in automotive finishing and electrical work.

Increasing Awareness of Occupational Hazards Among Employees:

Employees are more aware of risks associated with industrial and healthcare tasks. Growing exposure to educational programs and training sessions reinforces the need for protective gloves. The rising focus on employee well-being encourages industries to prioritize safety solutions. Healthcare professionals demand specialized gloves to reduce infection risks. Construction and mining workers push for products that ensure hand safety during challenging tasks. Employers provide protective equipment to reduce legal liability and improve workforce retention. The Australia Safety Gloves Market gains strength from this heightened awareness and proactive safety adoption.

Technological Innovations in Protective Materials and Designs:

Advanced materials improve glove durability, comfort, and protective efficiency. Companies focus on cut-resistant, puncture-resistant, and chemical-resistant designs to meet diverse industry needs. Lightweight materials enhance flexibility while maintaining strong protective qualities. Customization of gloves for specific industries drives higher adoption. The demand for ergonomic designs ensures comfort for extended use. Smart manufacturing processes help in producing consistent quality at scale. The Australia Safety Gloves Market leverages these technological innovations to support expansion across multiple industrial sectors.

Market Trends:

Adoption of Eco-Friendly and Sustainable Safety Glove Materials:

The market is witnessing rising preference for eco-friendly glove materials. Manufacturers are developing products using biodegradable or recyclable components. Demand for sustainable solutions reflects consumer expectations for environmentally responsible products. Companies prioritize reducing carbon footprints through innovative production techniques. The use of natural fibres and recyclable synthetics demonstrates this focus. Brands that highlight sustainability gain stronger acceptance among corporate buyers. The Australia Safety Gloves Market adapts to this trend by aligning production with sustainable practices.

- For instance, Safety Mate’s NXG glove range has been awarded the Oeko-Tex Made in Green label and its GreenTek gloves incorporate up to 50% recycled polyester yarn from plastic bottles, reflecting compliance with environmental and social responsibility standards while maintaining high performance in harsh mining environments.

Growing Demand for Specialized Gloves Across Diverse Industries:

The demand for industry-specific gloves is rising across mining, oil and gas, construction, and healthcare. Companies now request gloves tailored for chemical handling, electrical insulation, or biomedical applications. Increasing diversification of industries supports continuous innovation in glove design. Specialized gloves provide higher efficiency and worker safety in critical tasks. Industries prefer products engineered for their operational risks. This approach allows suppliers to target niche markets and build long-term relationships. The Australia Safety Gloves Market expands by delivering tailored solutions across these sectors.

- For instance, MCR Safety offers cut-resistant gloves with ANSI cut levels from A2 up to A9, made from advanced materials including DuPont™ Kevlar® and HyperMax® fibers, ensuring superior protection in high-risk environments involving heavy machinery and sharp materials while enabling dexterity and comfort.

Integration of Advanced Manufacturing Technologies in Production:

Automation and precision engineering are transforming the glove production process. Robotics and AI-driven systems ensure higher consistency and efficiency. 3D knitting and seamless glove designs are gaining prominence for comfort and durability. Advanced coatings improve grip and resistance to external hazards. Manufacturers invest in automated inspection systems to ensure product quality. Such improvements reduce defects and support global export potential. The Australia Safety Gloves Market strengthens its competitiveness by embracing these advanced technologies.

Expansion of Online Distribution and Digital Sales Channels:

Digital platforms are reshaping how safety gloves reach industrial and retail customers. E-commerce offers greater convenience for bulk procurement and direct purchases. Distributors expand their presence on specialized online platforms. Buyers access broader product portfolios with transparent specifications. This approach reduces procurement time and supports cost efficiency. Digital marketing campaigns raise awareness among smaller enterprises. The Australia Safety Gloves Market benefits from this expansion, as online channels connect suppliers with both large and emerging buyers.

Market Challenges Analysis:

High Cost of Advanced and Specialized Safety Gloves:

The Australia Safety Gloves Market faces challenges due to the high cost of advanced designs. Gloves that offer chemical resistance, electrical insulation, or ergonomic features require significant investment. Small and medium enterprises often struggle with procurement due to budget limitations. Employers may opt for cheaper alternatives, compromising on safety standards. This cost sensitivity affects widespread adoption across certain industries. Global raw material price fluctuations further impact production costs. Market players must balance affordability with quality to maintain growth.

Limited Awareness and Resistance to Change in Traditional Sectors:

Another challenge lies in limited awareness among small-scale enterprises and traditional industries. Many local operators underestimate the importance of certified safety gloves. Resistance to change delays the adoption of advanced solutions. Older sectors still rely on conventional low-cost options, which lack protective efficiency. Educational efforts and awareness campaigns are needed to address these issues. Limited enforcement in certain regions reduces pressure on businesses to comply. The Australia Safety Gloves Market needs consistent awareness-building to overcome these traditional barriers.

Market Opportunities:

Rising Investment in Healthcare and Medical Infrastructure:

Healthcare expansion creates strong opportunities for specialized safety gloves. Hospitals, laboratories, and clinics require gloves to prevent infections and ensure patient safety. Increased healthcare spending amplifies the need for high-quality products. Specialized medical gloves designed for surgical and examination purposes gain stronger traction. The Australia Safety Gloves Market benefits from this expansion, as suppliers target the healthcare industry with innovative products.

Growing Focus on Mining, Oil, and Gas Safety Standards:

Mining and energy sectors emphasize higher safety standards for employees. Rising investments in mining projects and oil exploration increase glove adoption. Workers demand products that protect against cuts, abrasions, and chemical exposure. Companies are willing to procure advanced gloves to ensure workforce protection. The Australia Safety Gloves Market finds opportunities by aligning product portfolios with the safety needs of these high-risk sectors.

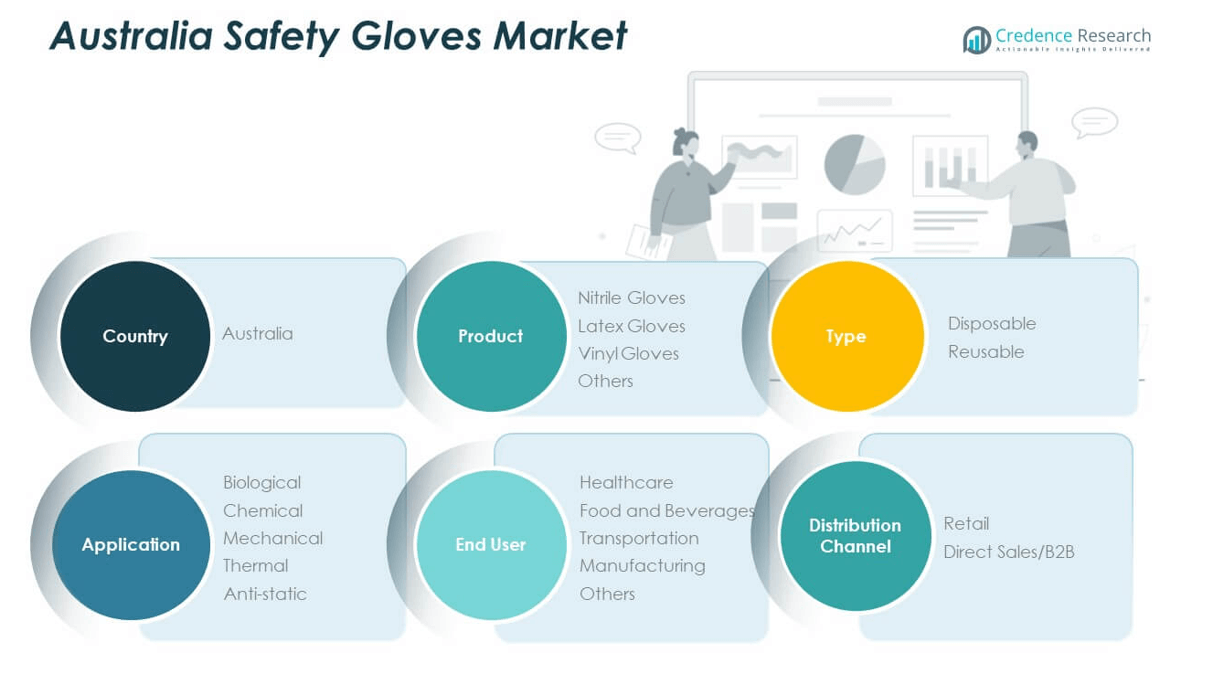

Market Segmentation Analysis:

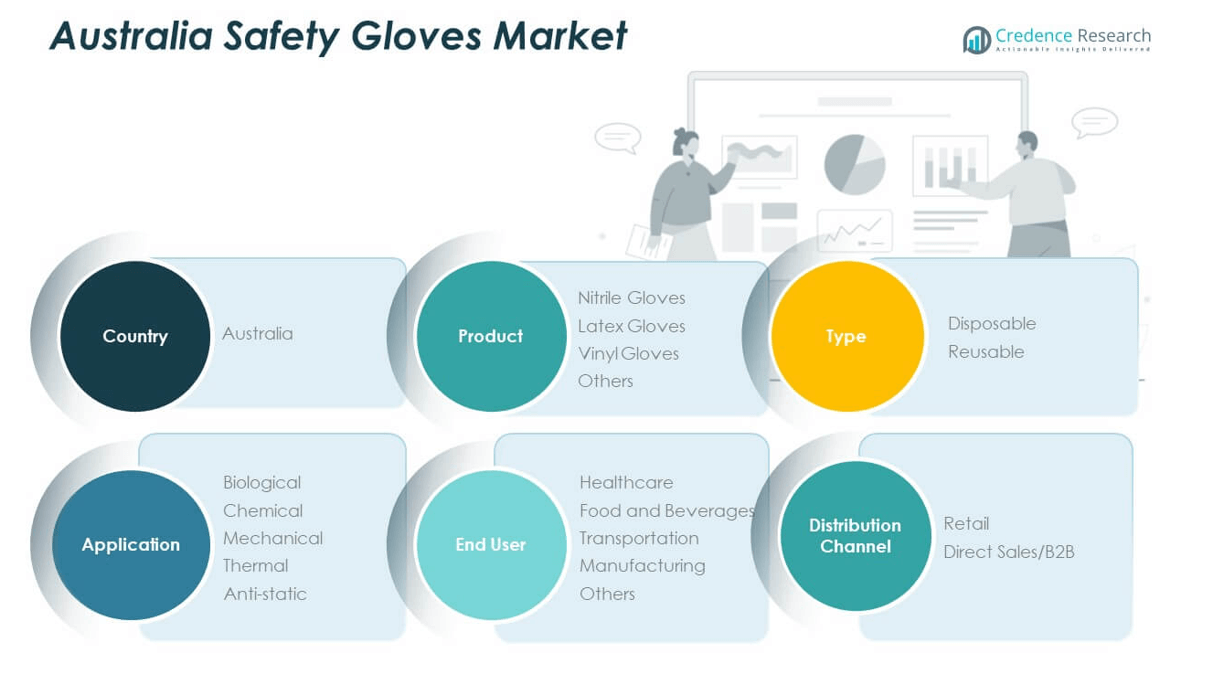

By Product

The Australia Safety Gloves Market is segmented into nitrile, latex, vinyl, and others. Nitrile gloves hold significant demand due to strong resistance against punctures and chemicals, making them a preferred choice across healthcare and industrial sectors. Latex gloves continue to serve in medical applications, though concerns over allergies drive a gradual shift toward alternatives. Vinyl gloves provide a cost-effective solution for low-risk tasks, particularly in food handling. Other specialty gloves address niche needs such as high durability and multi-material protection.

- For instance, The Glove Company pioneered the first black nitrile disposable mechanic’s glove in Australia, combining chemical resistance and enhanced durability suitable for automotive and industrial use.

By Type

Disposable gloves dominate usage in medical, food, and laboratory environments where hygiene and single-use standards are critical. Reusable gloves gain traction across industries such as mining, manufacturing, and construction where durability and long-term cost benefits matter. This balance ensures that both segments remain vital across Australia’s diverse industries.

- For instance, 3M Australia manufactures gloves with nitrile palm coating that delivers lightness, flexibility, abrasion resistance, and longevity, supported by nylon knit construction with stretch that enhances wearer dexterity and durability for robust use in manufacturing and industrial applications.

By Application

Biological applications rely on medical-grade gloves to reduce contamination risks in healthcare and laboratories. Chemical-resistant gloves secure demand across oil, gas, and industrial sectors. Mechanical applications emphasize gloves designed to protect against cuts, abrasions, and impacts. Thermal gloves remain important in manufacturing and energy industries. Anti-static gloves serve the electronics and technology sectors where precision and safety are essential.

By End User

Healthcare dominates end-user demand due to rising medical infrastructure and infection prevention standards. Food and beverages emphasize hygiene and contamination control. Transportation and manufacturing industries require gloves for worker safety during mechanical and operational tasks. Other industries, including agriculture, show steady but smaller-scale adoption.

By Distribution Channel

Retail channels cater to individuals and small enterprises, while direct sales and B2B supply dominate industrial and healthcare procurement. It ensures efficient coverage across professional and consumer demand points.

Segmentation:

- By Product

- Nitrile Gloves

- Latex Gloves

- Vinyl Gloves

- Others

- By Type

- By Application

- Biological

- Chemical

- Mechanical

- Thermal

- Anti-static

- By End User

- Healthcare

- Food and Beverages

- Transportation

- Manufacturing

- Others

- By Distribution Channel

- By Country (Australia Focused)

- Market Volume and Revenue segmented by:

- Product

- Type

- Application

- End User

- Distribution Channel

Regional Analysis:

Eastern Australia – Industrial and Healthcare Leadership

Eastern Australia, including New South Wales and Victoria, commands the largest share of the Australia Safety Gloves Market, accounting for around 38% of total demand. This dominance stems from its dense population, advanced healthcare infrastructure, and extensive manufacturing base. Hospitals, laboratories, and pharmaceutical companies in these states drive consistent adoption of disposable and nitrile gloves. Strong construction activity and mining-related support industries add to industrial demand. Employers in these regions prioritize certified gloves to comply with strict safety standards. The presence of leading distributors and suppliers ensures efficient product availability and stronger market penetration.

Western Australia – Mining and Energy-Centered Demand

Western Australia contributes nearly 26% of the Australia Safety Gloves Market, driven by its dominant mining, oil, and gas industries. Workers in these sectors require high-performance gloves that provide mechanical, chemical, and thermal resistance. Growth in mineral exports strengthens glove consumption for handling, drilling, and processing activities. The region’s dependence on resource industries creates steady demand for reusable and specialized gloves. Healthcare and food processing also contribute, though on a smaller scale compared to industrial applications. It maintains a solid position due to continuous investment in mining safety and operational efficiency.

Northern and Southern Australia – Emerging Growth Segments

Northern and Southern Australia collectively hold about 22% of the market, while Queensland accounts for the remaining 14%. The northern region benefits from agriculture and food processing industries, where gloves are essential for hygiene and worker protection. Southern Australia demonstrates demand from manufacturing and healthcare, though on a smaller base than eastern states. Queensland shows steady growth, supported by construction and healthcare expansion. These regions rely heavily on retail distribution channels and smaller-scale suppliers to serve diverse industries. The Australia Safety Gloves Market finds long-term potential here, as expanding industrial activity and healthcare investment continue to create new opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia Safety Gloves Market features strong competition among global brands and local manufacturers. Leading companies such as Ansell Limited, Honeywell, 3M Australia, and The Glove Company dominate with extensive product portfolios and advanced safety technologies. They focus on material innovation, ergonomic designs, and distribution expansion to secure market share. Local players like Safety Mate and regional distributors strengthen their presence through cost-effective solutions and customer proximity. The market benefits from strategic investments in protective features and compliance standards. It demonstrates balanced competition where international leaders and domestic firms both play crucial roles in shaping growth.

Recent Developments:

- In May 2025, Odyssey Investment Partners completed the $1.3 billion acquisition of Honeywell’s Personal Protective Equipment division, which included several well-known PPE brands like Fendall™, Howard Leight™, KCL™, Miller™, and Salisbury™. This acquisition expanded the product offerings and geographic reach significantly, enhancing safety solutions across industries globally.

- B. Industries acquired DECO Industrial Gloves, a respected Australian glove manufacturer, effective April 30, 2025. DECO has a long history of glove production, including pioneering electrical insulating gloves, and now joins G.B. Industries to strengthen their glove manufacturing footprint.

- In April 2024, Honeywell Industrial Automation opened an automated production line at its Clover, South Carolina facility to manufacture electrical safety gloves. The automation improved production efficiency and capacity, producing over 2,000 gloves per week with higher precision and speed, reflecting Honeywell’s commitment to worker safety amid growing electrification demands.

Report Coverage:

The research report offers an in-depth analysis based on product, type, application, end user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue expanding, supported by rising workplace safety compliance.

- Demand from healthcare will remain dominant, driven by infection prevention standards.

- Mining and energy sectors will drive strong adoption of reusable and durable gloves.

- Technological innovation in cut-resistant and chemical-resistant gloves will gain traction.

- Eco-friendly and biodegradable gloves will become a significant growth avenue.

- Retail channels will expand reach among small enterprises and individual buyers.

- Direct B2B channels will strengthen their dominance in industrial procurement.

- Local manufacturers will increase competitiveness through regional production strategies.

- Online distribution platforms will accelerate product availability across Australia.

- The Australia Safety Gloves Market will experience long-term growth with balanced opportunities across healthcare, industry, and consumer sectors.