| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Acoustic Engineering Service Market Size 2024 |

USD 6,706.47 Million |

| Automotive Acoustic Engineering Service Market, CAGR |

6.47% |

| Automotive Acoustic Engineering Service Market Size 2032 |

USD 11,477.96 Million |

Market Overview

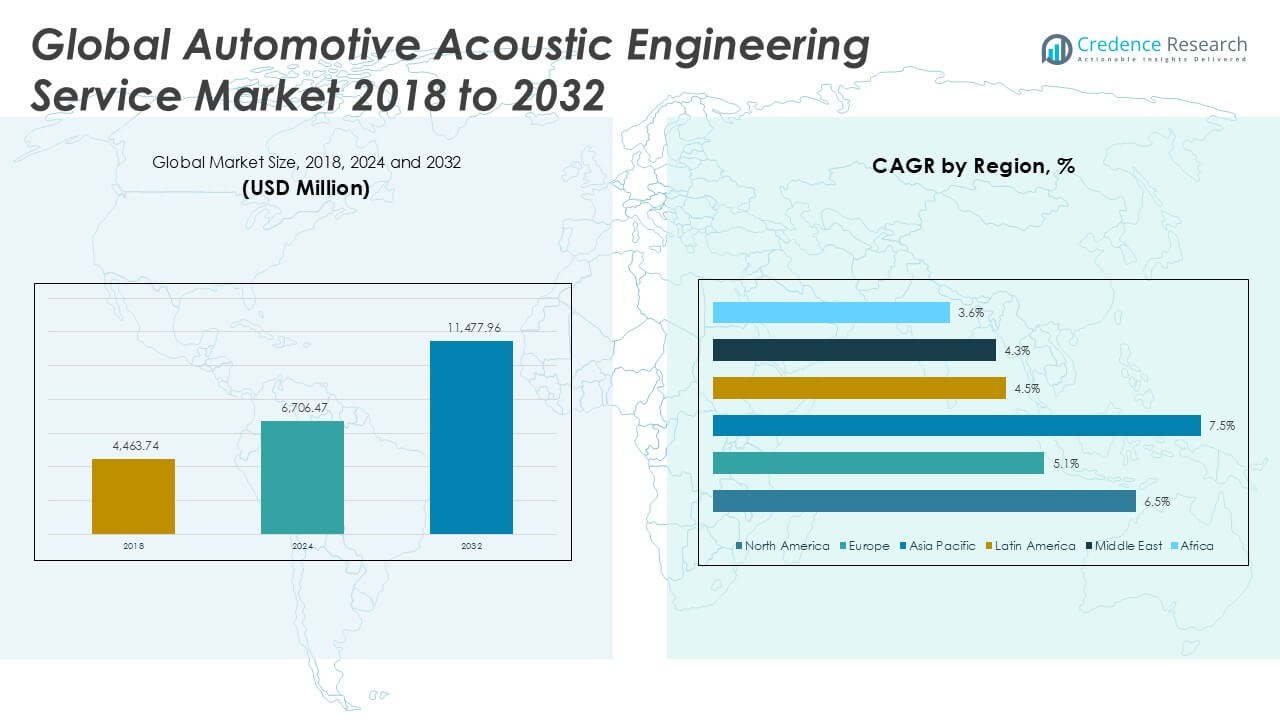

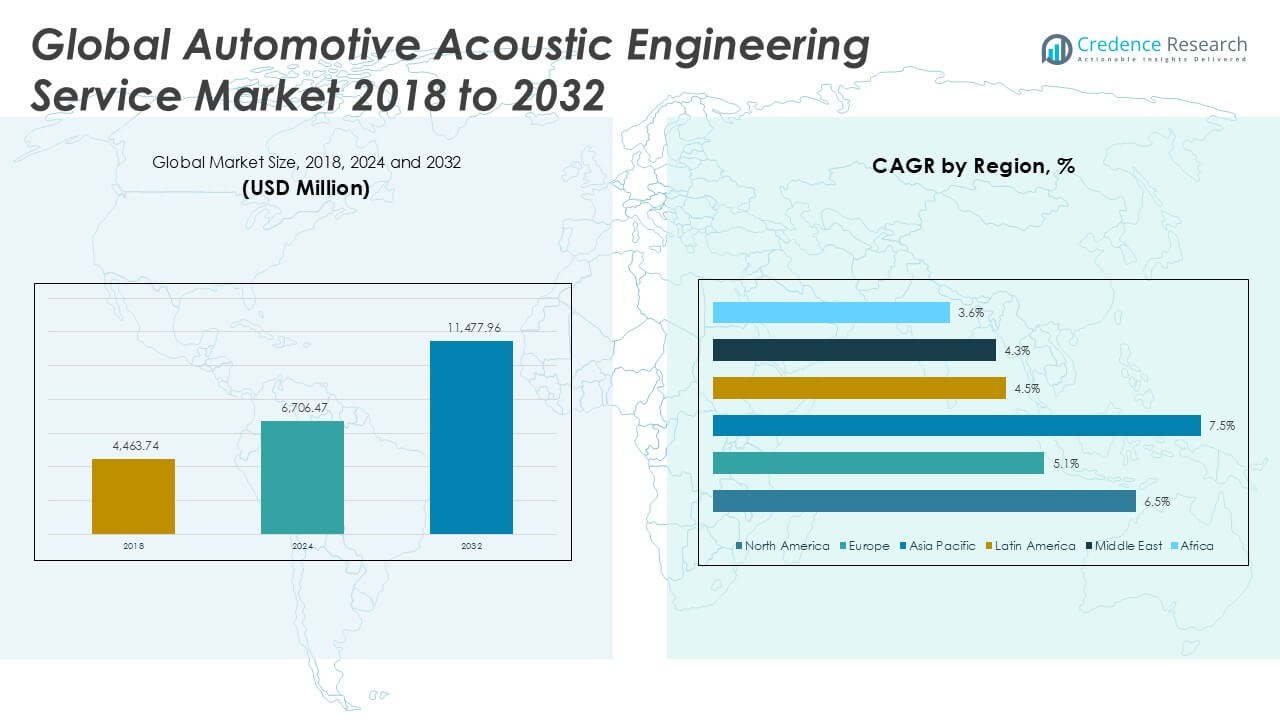

The Automotive Acoustic Engineering Service Market size was valued at USD 4,463.74 million in 2018, increased to USD 6,706.47 million in 2024, and is anticipated to reach USD 11,477.96 million by 2032, at a CAGR of 6.47% during the forecast period.

The Automotive Acoustic Engineering Service Market is driven by the rising demand for enhanced in-cabin comfort and noise reduction in modern vehicles, especially with the growing adoption of electric and hybrid models that alter traditional noise profiles. Stringent regulatory requirements regarding vehicle noise emissions further accelerate the need for advanced acoustic design and simulation. Automakers increasingly rely on engineering service providers to integrate NVH (Noise, Vibration, and Harshness) optimization early in the design process. Trends include the integration of AI and simulation technologies to model acoustic behavior more accurately, as well as the use of lightweight sound-damping materials to meet fuel efficiency goals without compromising acoustic performance. The shift toward connected and autonomous vehicles also contributes to the demand for low-noise environments that support voice recognition systems and occupant comfort. These developments collectively reinforce the importance of specialized acoustic engineering services across the automotive value chain.

The geographical landscape of the Automotive Acoustic Engineering Service Market spans key regions including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Asia Pacific leads due to strong vehicle production hubs in China, Japan, and South Korea, supported by increasing EV adoption and demand for NVH optimization. North America and Europe follow with well-established OEMs, stringent acoustic regulations, and advanced R&D facilities. Latin America, the Middle East, and Africa are gradually emerging with localized production and growing focus on in-cabin comfort. Key players in the market include Continental AG, known for its advanced NVH solutions integrated with intelligent vehicle systems; Robert Bosch GmbH, offering comprehensive acoustic testing and simulation services; Autoneum, a specialist in acoustic and thermal management for vehicle interiors; and EDAG Engineering GmbH, which provides full-spectrum engineering services including virtual acoustic modeling and validation for next-generation vehicles. These companies drive innovation through digital tools and global partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Acoustic Engineering Service Market was valued at USD 6,706.47 million in 2024 and is projected to reach USD 11,477.96 million by 2032, growing at a CAGR of 6.47%.

- Rising demand for enhanced in-cabin comfort, especially in electric and hybrid vehicles, is a key driver pushing manufacturers to adopt advanced NVH engineering services.

- Increasing integration of simulation tools, predictive acoustic modeling, and digital twin technology is transforming the service delivery landscape.

- Leading players such as Continental AG, Robert Bosch GmbH, Autoneum, and EDAG Engineering GmbH are investing in AI-enabled solutions and expanding their global engineering capabilities.

- High costs associated with sophisticated testing equipment and limited access to skilled professionals are major restraints impacting market expansion, particularly for small and mid-sized firms.

- Asia Pacific dominates the market due to strong manufacturing bases in China, Japan, and South Korea, while North America and Europe lead in regulatory compliance and R&D investment.

- The trend toward outsourcing acoustic engineering to specialized firms is gaining momentum, enabling automakers to reduce operational burdens and accelerate time-to-market.

Market Drivers

Increasing Demand for Noise Optimization in Electric and Hybrid Vehicles is Accelerating Market Growth

The shift toward electric and hybrid vehicles presents new challenges in noise profiling, prompting OEMs to invest in acoustic engineering solutions. Without traditional internal combustion engine sounds, secondary noises like tire friction and wind become more noticeable. The Automotive Acoustic Engineering Service Market responds to this by offering detailed simulation and testing services to enhance sound comfort. Automakers prioritize these services to ensure quiet cabin environments and meet consumer expectations for premium experiences. It supports the integration of advanced NVH solutions during vehicle design and prototyping stages. Growing global EV production volumes further expand demand for acoustic engineering capabilities.

- For instance, Continental AG’s Ac2ated Sound system reduces weight by over 10 kg compared to conventional speaker systems (14–15 kg down to 1 kg) and achieves acoustic performance above 90 dB(A) sound pressure level with 3D spatial audio.

Stringent Noise Emission Regulations Across Regions are Driving Engineering Requirements

Governments enforce strict vehicle noise standards to minimize environmental impact and urban noise pollution. These regulations require automakers to ensure compliance through precise acoustic testing and validation. The Automotive Acoustic Engineering Service Market enables manufacturers to meet these requirements efficiently by providing access to high-end test benches and predictive modeling tools. Engineering service providers support regulatory adherence at both vehicle and component levels. It helps manufacturers avoid penalties and enhance their sustainability credentials. Expanding global regulatory frameworks intensify the need for specialized acoustic consultancy.

- For instance, Bosch operates acoustic labs capable of recording and analyzing up to 480 data channels simultaneously, and calibrates vehicles to meet UN ECE R138 requirements mandating minimum sound thresholds of 56 dB(A) for electric vehicles at speeds below 20 km/h.

Integration of Advanced Simulation Technologies Enhances Service Capabilities and Efficiency

Technological advancements in simulation and computer-aided engineering are reshaping how acoustic challenges are addressed. Service providers leverage software tools to simulate sound propagation, vibration behavior, and structural responses under dynamic conditions. The Automotive Acoustic Engineering Service Market benefits from faster development cycles, reduced prototyping costs, and improved accuracy of sound prediction. It enables OEMs to optimize designs before physical production begins, lowering rework and material usage. Adoption of digital twin models and AI-driven analysis also improves sound quality tuning and fault detection.

Rising Focus on Passenger Comfort and In-Cabin Experience Supports Market Expansion

Consumers increasingly demand quieter, more refined vehicle cabins, especially in premium and mid-segment models. This trend pushes automakers to enhance acoustic insulation, vibration control, and sound quality. The Automotive Acoustic Engineering Service Market addresses these priorities through tailored solutions that target critical noise sources like engines, HVAC systems, and road interactions. It allows manufacturers to differentiate their vehicles and strengthen brand loyalty. Growth in autonomous and connected vehicle technologies further amplifies the need for quiet environments to support voice command systems and driver-assist features.

Market Trends

Growing Use of Predictive Acoustic Simulation Tools to Enhance Design Accuracy

Automakers increasingly adopt simulation-based approaches to address acoustic challenges early in the vehicle development cycle. Predictive acoustic tools enable accurate modeling of noise sources, material behavior, and structural dynamics. The Automotive Acoustic Engineering Service Market integrates these tools to improve design precision and reduce reliance on physical prototypes. It helps shorten development timelines and supports cost-effective engineering workflows. The ability to simulate real-world conditions before production enables OEMs to optimize NVH performance and meet stringent quality benchmarks. Demand for integrated digital modeling solutions continues to rise across both traditional and electric vehicle segments.

- For instance, Autoneum’s SimSound tool delivers simulation accuracy within ±2.5 dB(A) when compared to physical test data, and helps OEMs reduce development time by approximately 25% across multiple prototype cycles.

Rising Adoption of Lightweight Sound-Damping Materials in Vehicle Design

To meet fuel efficiency and emission goals, manufacturers prioritize lightweight construction while maintaining acoustic integrity. The trend has led to the use of advanced sound-damping materials that offer high noise absorption with minimal weight impact. The Automotive Acoustic Engineering Service Market adapts by offering material testing, validation, and implementation strategies tailored to each vehicle platform. It allows OEMs to balance weight reduction and passenger comfort without compromising regulatory compliance. Engineering firms assist with the integration of composite panels, foams, and laminates that meet dual objectives of performance and efficiency. This trend aligns with broader efforts toward sustainable vehicle architecture.

- For instance, Autoneum’s Ultra-Silent underbody technology achieves up to 8 dB(A) of exterior noise reduction and reduces component weight by up to 50%, from approximately 4.5 kg/m² to 2.2 kg/m², compared to conventional bitumen-based dampers.

Integration of Active Noise Control Technologies in Automotive Interiors

Active noise control (ANC) is gaining traction as a high-tech solution for managing in-cabin noise, especially in premium vehicles. Unlike passive materials, ANC systems use sensors and algorithms to counteract unwanted sound waves in real time. The Automotive Acoustic Engineering Service Market supports ANC development through calibration, software optimization, and integration consulting. It enables automakers to deliver customizable and adaptive sound environments. The trend reflects a shift toward smart acoustic systems that enhance user experience and support the evolution of infotainment and driver-assist features. Increased investment in electronic control units and signal processing is fueling adoption.

Increasing Importance of Acoustic Branding and Signature Sound Design

Automakers are using sound as a brand differentiator, creating signature acoustic experiences to convey identity and product quality. From engine start-up sounds to door-closing tones, sound design is now a core part of vehicle development. The Automotive Acoustic Engineering Service Market addresses this demand by offering specialized services in audio engineering and psychoacoustic analysis. It enables manufacturers to craft consistent sound profiles aligned with brand values. Consumer preference for immersive and pleasant cabin acoustics strengthens this trend. The practice also supports the marketing of electric vehicles, where synthetic sound signatures replace traditional engine noise.

Market Challenges Analysis

High Cost of Advanced Acoustic Testing and Simulation Tools Limits Adoption

The integration of sophisticated acoustic testing equipment and simulation software requires significant investment, posing a barrier for small and mid-sized automotive companies. Many firms lack the capital to acquire or maintain state-of-the-art testing facilities or license specialized software platforms. The Automotive Acoustic Engineering Service Market faces resistance in price-sensitive regions where cost control takes precedence over acoustic refinement. It restricts widespread access to high-end engineering solutions, especially among emerging market players. Budget constraints delay NVH optimization efforts and limit collaboration with external service providers. This cost-related challenge reduces the scalability of acoustic engineering services across the broader automotive industry.

Lack of Skilled Professionals and Technical Expertise Hampers Service Delivery

The demand for specialized knowledge in acoustics, material science, and simulation technology outpaces the available talent pool. Many organizations struggle to recruit and retain engineers with expertise in NVH modeling, signal processing, and psychoacoustics. The Automotive Acoustic Engineering Service Market experiences service delays and limited innovation due to these workforce gaps. It impacts the ability of firms to manage complex projects efficiently or respond quickly to changing OEM requirements. Insufficient training programs and low awareness about acoustic engineering as a discipline further contribute to this talent shortfall. Addressing this challenge requires long-term investment in education and professional development.

Market Opportunities

Growing Focus on Electric and Autonomous Vehicles Unlocks New Engineering Avenues

The rapid expansion of electric and autonomous vehicles creates a need for new acoustic design frameworks. These platforms require redefined NVH strategies due to the absence of engine noise and the presence of advanced electronic systems. The Automotive Acoustic Engineering Service Market gains opportunities by offering targeted solutions for cabin quietness, synthetic sound development, and component-level noise control. It supports the design of safer and more comfortable driving environments where sound plays a critical role in alert systems and user interaction. OEMs and Tier-1 suppliers seek service providers capable of managing unique acoustic challenges presented by battery packs, cooling systems, and electronic modules. This transformation enables the market to deliver specialized value beyond traditional vehicle segments.

Expansion of Outsourced Engineering Models Across OEMs and Tier-1 Suppliers

Vehicle manufacturers increasingly adopt outsourcing strategies to access niche expertise while reducing operational overhead. Acoustic engineering services are in demand as OEMs focus on core product development and delegate complex NVH tasks to specialized firms. The Automotive Acoustic Engineering Service Market benefits from this shift by offering end-to-end solutions, from simulation and material testing to validation and compliance support. It positions service providers as strategic partners in achieving design objectives within shorter timeframes. The rising complexity of vehicle architecture and the push for innovation drive demand for flexible and scalable engineering support. Outsourcing creates long-term growth opportunities in both mature and emerging automotive markets.

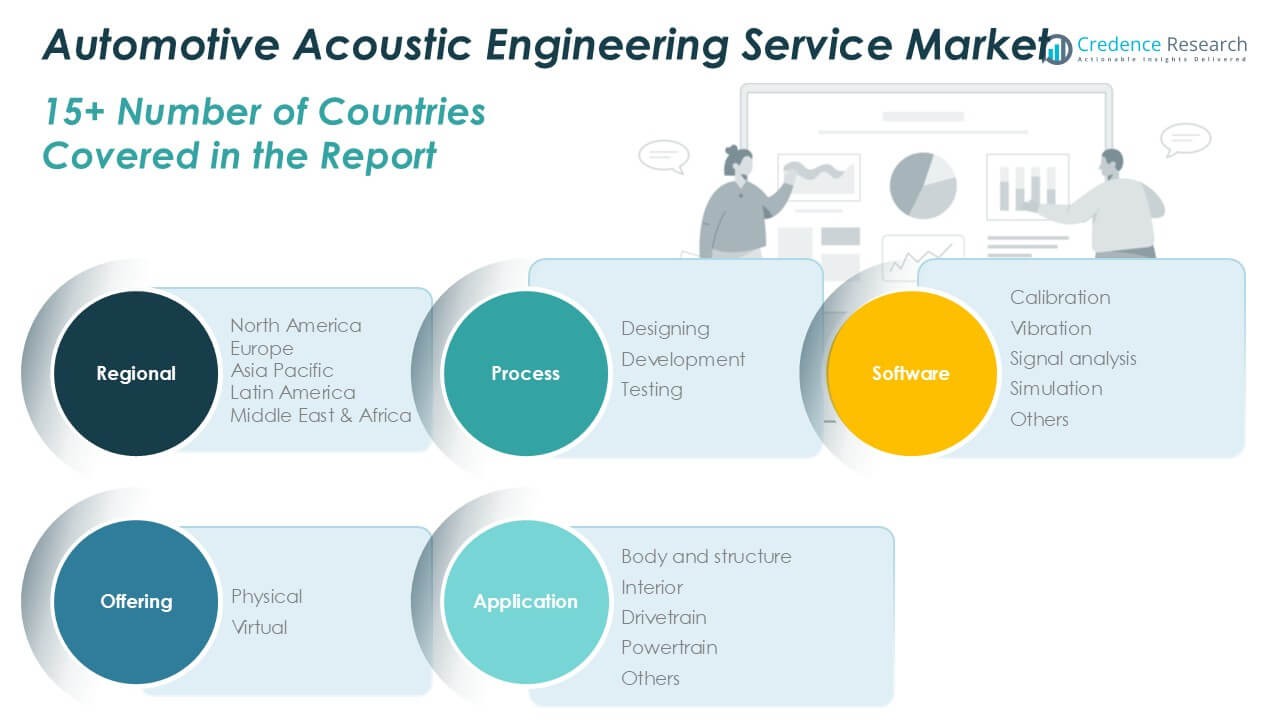

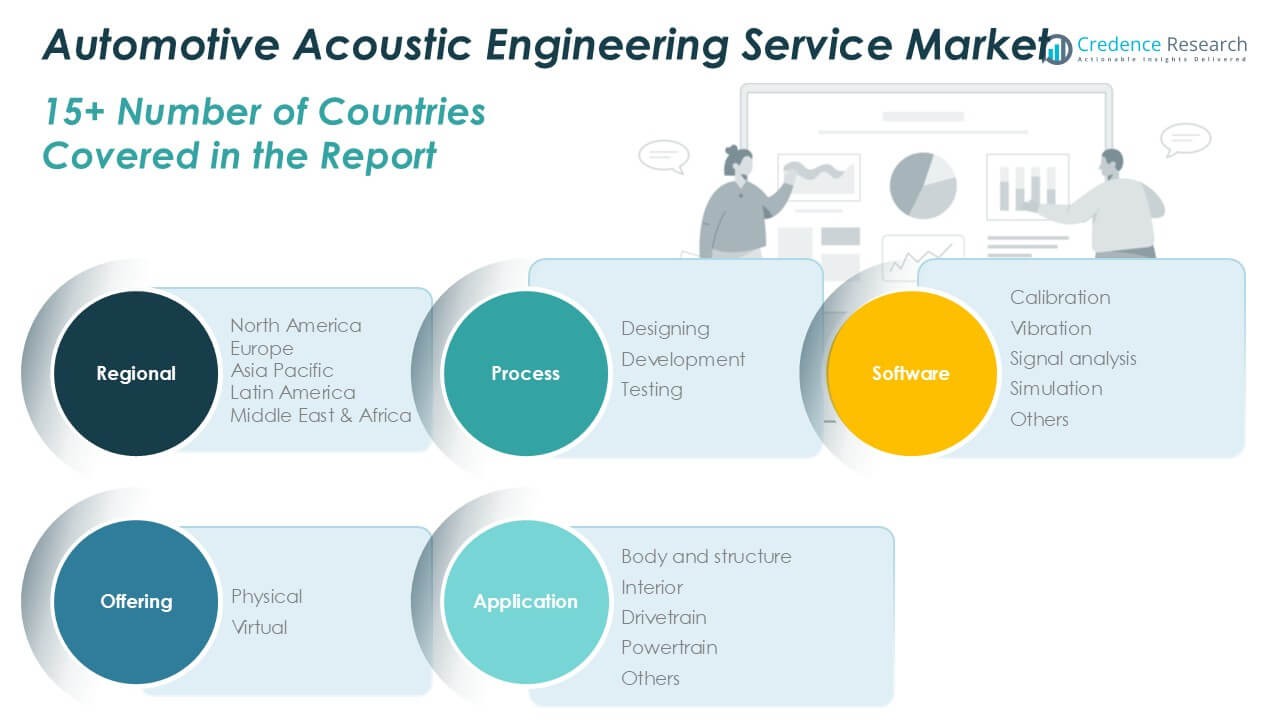

Market Segmentation Analysis:

By Process:

The Automotive Acoustic Engineering Service Market segments by process into designing, development, and testing. Designing plays a crucial role in defining the acoustic structure of vehicles at the concept level. It allows engineers to predict and address potential NVH (Noise, Vibration, and Harshness) issues early in the product lifecycle. Development follows by integrating acoustic solutions into vehicle systems and components. Testing validates acoustic performance under real-world and simulated conditions. It ensures compliance with regulatory standards and confirms comfort expectations before vehicles reach production. Each stage contributes to delivering optimized acoustic performance across different vehicle classes.

- For instance, EDAG Engineering GmbH conducts over 1,200 acoustic validation tests annually, including 350 virtual simulations and 180 full-vehicle acoustic measurements in acoustic chambers rated ISO 3745 class.

By Software:

Software tools used in acoustic engineering include calibration, vibration, signal analysis, simulation, and others. Calibration software ensures proper alignment of acoustic components for consistent performance. Vibration analysis tools detect and reduce structure-borne noise, which remains critical in lightweight and electric vehicle platforms. Signal analysis supports data interpretation and fault diagnosis across dynamic environments. Simulation tools enable virtual prototyping, helping reduce physical testing costs and accelerate product development timelines. The Automotive Acoustic Engineering Service Market utilizes these software applications to deliver accurate and efficient acoustic design solutions. It relies on advanced algorithms to provide real-time modeling and prediction capabilities.

- For instance, Head acoustics GmbH’s ArtemiS SUITE software supports up to 512 real-time analysis channels and includes over 270 acoustic processing modules, reducing acoustic diagnosis time by 35% compared to previous NVH workflows.

By Offering:

The market divides into physical and virtual offerings, both integral to vehicle acoustic development. Physical services involve on-site testing, acoustic chamber analysis, and component evaluation using hardware setups. It provides real-world data that strengthens simulation validation and supports final product approval. Virtual offerings include computer-aided engineering, digital twin modeling, and virtual NVH analysis. These services improve development efficiency and allow early error detection, helping manufacturers refine acoustics before building prototypes. The Automotive Acoustic Engineering Service Market balances both offerings to meet growing demands for faster turnaround, cost control, and engineering precision. It adapts to varying client needs through scalable, hybrid service models.

Segments:

Based on Process:

- Designing

- Development

- Testing

Based on Software:

- Calibration

- Vibration

- Signal analysis

- Simulation

- Others

Based on Offering:

Based on Application:

- Body and structure

- Interior

- Drivetrain

- Powertrain

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Automotive Acoustic Engineering Service Market

North America Automotive Acoustic Engineering Service Market grew from USD 1,849.51 million in 2018 to USD 2,748.34 million in 2024 and is projected to reach USD 4,717.50 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.5%. North America is holding a 24% market share. The region benefits from strong automotive R&D investments and early adoption of simulation technologies. The United States leads regional growth, supported by advanced OEMs and engineering service providers. Canada and Mexico also contribute through expanding EV production and cross-border component testing. The Automotive Acoustic Engineering Service Market in this region focuses on high-performance acoustic comfort and regulatory compliance for urban noise control.

Europe Automotive Acoustic Engineering Service Market

Europe Automotive Acoustic Engineering Service Market grew from USD 774.46 million in 2018 to USD 1,094.98 million in 2024 and is projected to reach USD 1,690.39 million by 2032, with a CAGR of 5.1%. Europe holds a 15% market share. Germany dominates due to its leadership in premium automotive manufacturing and NVH engineering expertise. France and the UK support regional demand through innovation in lightweight materials and electric vehicle acoustics. Strict noise regulations and strong sustainability targets drive adoption of advanced acoustic engineering services. The Automotive Acoustic Engineering Service Market in Europe emphasizes precision simulation and eco-compliant solutions.

Asia Pacific Automotive Acoustic Engineering Service Market

Asia Pacific Automotive Acoustic Engineering Service Market grew from USD 1,457.19 million in 2018 to USD 2,297.54 million in 2024 and is projected to reach USD 4,249.43 million by 2032, registering the highest CAGR of 7.5%. Asia Pacific accounts for 35% of the market share, the largest globally. China leads with significant electric vehicle production and investment in acoustic software platforms. Japan and South Korea offer robust support through innovation in powertrain NVH and active noise cancellation systems. India shows emerging demand tied to expanding mid-segment vehicle manufacturing. The Automotive Acoustic Engineering Service Market thrives on regional OEM expansion and localization strategies.

Latin America Automotive Acoustic Engineering Service Market

Latin America Automotive Acoustic Engineering Service Market grew from USD 176.59 million in 2018 to USD 261.37 million in 2024 and is projected to reach USD 385.81 million by 2032, with a CAGR of 4.5%. Latin America holds a 3% market share. Brazil is the key contributor, supported by a growing automotive base and demand for in-cabin sound optimization. Mexico and Argentina show moderate growth driven by increasing collaboration with North American OEMs. Budget constraints challenge widespread adoption of high-end acoustic services. The Automotive Acoustic Engineering Service Market in this region focuses on physical testing and cost-effective solutions.

Middle East Automotive Acoustic Engineering Service Market

Middle East Automotive Acoustic Engineering Service Market grew from USD 131.95 million in 2018 to USD 182.10 million in 2024 and is projected to reach USD 265.75 million by 2032, with a CAGR of 4.3%. The Middle East holds a 2% market share. The UAE and Saudi Arabia lead regional demand through luxury vehicle imports and customized acoustic services. Rising investment in EV assembly and infrastructure supports new opportunities for simulation-based NVH design. Local manufacturing activity remains limited, but partnerships with global service providers strengthen the ecosystem. The Automotive Acoustic Engineering Service Market in the Middle East is niche yet growing in premium segments.

Africa Automotive Acoustic Engineering Service Market

Africa Automotive Acoustic Engineering Service Market grew from USD 74.05 million in 2018 to USD 122.13 million in 2024 and is projected to reach USD 169.08 million by 2032, with a CAGR of 3.6%. Africa holds a 1% market share. South Africa is the leading market, with stable automotive production and growing interest in noise control solutions. Nigeria and Egypt are in early stages of market development, with limited application of simulation or virtual tools. Infrastructure gaps and cost sensitivity restrict service penetration. The Automotive Acoustic Engineering Service Market in Africa remains underdeveloped but shows potential in commercial vehicle applications and regional assembly hubs.

Key Player Analysis

- Continental AG

- Robert Bosch GmbH

- Schaeffler Engineering GmbH

- Autoneum

- Bertrandt

- Catalyst Acoustics

- Head acoustics GmbH

- EDAG Engineering GmbH

Competitive Analysis

The Automotive Acoustic Engineering Service Market is characterized by the presence of several established players offering specialized NVH solutions and simulation technologies. Key players include Continental AG, Robert Bosch GmbH, Schaeffler Engineering GmbH, Autoneum, Bertrandt, Catalyst Acoustics, Head acoustics GmbH, and EDAG Engineering GmbH. These companies compete on technological innovation, service integration, global reach, and domain expertise. Companies compete primarily on the basis of technological capabilities, breadth of service offerings, turnaround time, and integration of virtual simulation tools. Service providers focus on enhancing digital engineering capabilities through advanced modeling software, artificial intelligence, and real-time data analysis to meet evolving OEM requirements. Firms with established partnerships with automakers hold an advantage in securing long-term contracts and contributing to early-stage vehicle design. The growing complexity of electric and hybrid vehicle platforms increases demand for expertise in acoustic tuning, structural damping, and active noise control systems. Engineering service providers differentiate themselves by offering end-to-end support from component-level simulation to complete vehicle testing. The market also sees increasing competition from firms expanding their global footprint to serve emerging automotive hubs. To remain competitive, companies continue investing in innovation, workforce training, and regional presence.

Recent Developments

- In May 2024, Siemens AG introduced a next-generation acoustic simulation tool within its Simcenter platform, enabling real-time NVH analysis for electric vehicles and significantly reducing prototype testing cycles for global automakers.

- In April 2024, Continental AG unveiled an advanced Active Noise Cancellation (ANC) system at the Auto Shanghai Expo, designed specifically for EV platforms, helping reduce road and wind noise in premium segment vehicles.

- In March 2024, Bertrandt AG expanded its acoustic testing facility in Wolfsburg, Germany, adding new semi-anechoic chambers and laser vibrometry equipment to support rising demand for precise interior noise diagnostics from European OEMs.

- In February 2024, Schaeffler Engineering GmbH launched a vibration monitoring system for electric drivetrains, combining machine learning algorithms with NVH sensors to predict and prevent noise anomalies during vehicle operation.

- In January 2024, Autoneum Holding Ltd introduced a sustainable sound insulation solution made from 100% recycled PET fibers, which was adopted by multiple Asian and European automakers targeting lightweight and eco-friendly acoustic packaging.

- In December 2023, Catalyst Acoustics Group deployed a remote acoustic diagnostics platform for a North American EV manufacturer, allowing engineers to assess vehicle sound quality in real-time during road tests using cloud-based analytics.

- In November 2023, EDAG Engineering Group AG announced the launch of its Virtual Acoustics Lab (VAL), a digital NVH development environment that enables OEMs to simulate and tune vehicle sound signatures in the early design phase without physical models.

Market Concentration & Characteristics

The Automotive Acoustic Engineering Service Market exhibits moderate to high market concentration, with a limited number of specialized players dominating global operations. It is characterized by a strong presence of technically advanced firms offering integrated services across the design, development, and testing phases of acoustic performance. The market favors players with deep expertise in NVH simulation, digital modeling, and material science. It demands precision, regulatory awareness, and the ability to adapt solutions for both traditional and electric vehicles. Long-term partnerships with OEMs and Tier-1 suppliers form the backbone of service continuity, making relationship management a key success factor. The market is also defined by a growing reliance on software-driven engineering, where companies differentiate through proprietary platforms and AI-based analytics. While large firms lead in innovation and global reach, regional players contribute through localized testing capabilities and cost-effective service models. The Automotive Acoustic Engineering Service Market remains dynamic, influenced by the evolution of mobility, electrification, and demand for superior in-cabin experiences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Process, Software, Offering, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as electric vehicles require advanced acoustic solutions to manage noise, vibration, and harshness.

- Increasing consumer demand for quieter and more comfortable rides will drive the adoption of acoustic engineering services.

- Automotive OEMs will invest more in virtual acoustic simulation tools to reduce development time and cost.

- Stringent global regulations on vehicle noise emissions will push manufacturers to adopt acoustic optimization services.

- The integration of active noise control systems will create new opportunities for acoustic engineering providers.

- The rising popularity of luxury vehicles will increase the demand for premium acoustic performance solutions.

- The growth of autonomous vehicles will require specialized sound design for alerts and interior comfort.

- Collaboration between software developers and automotive engineers will accelerate innovation in simulation-based acoustic testing.

- The Asia Pacific region will witness significant growth due to expanding automotive production and R&D activities.

- Advancements in materials and acoustic sensors will enhance the precision and effectiveness of engineering services.