Market Overview

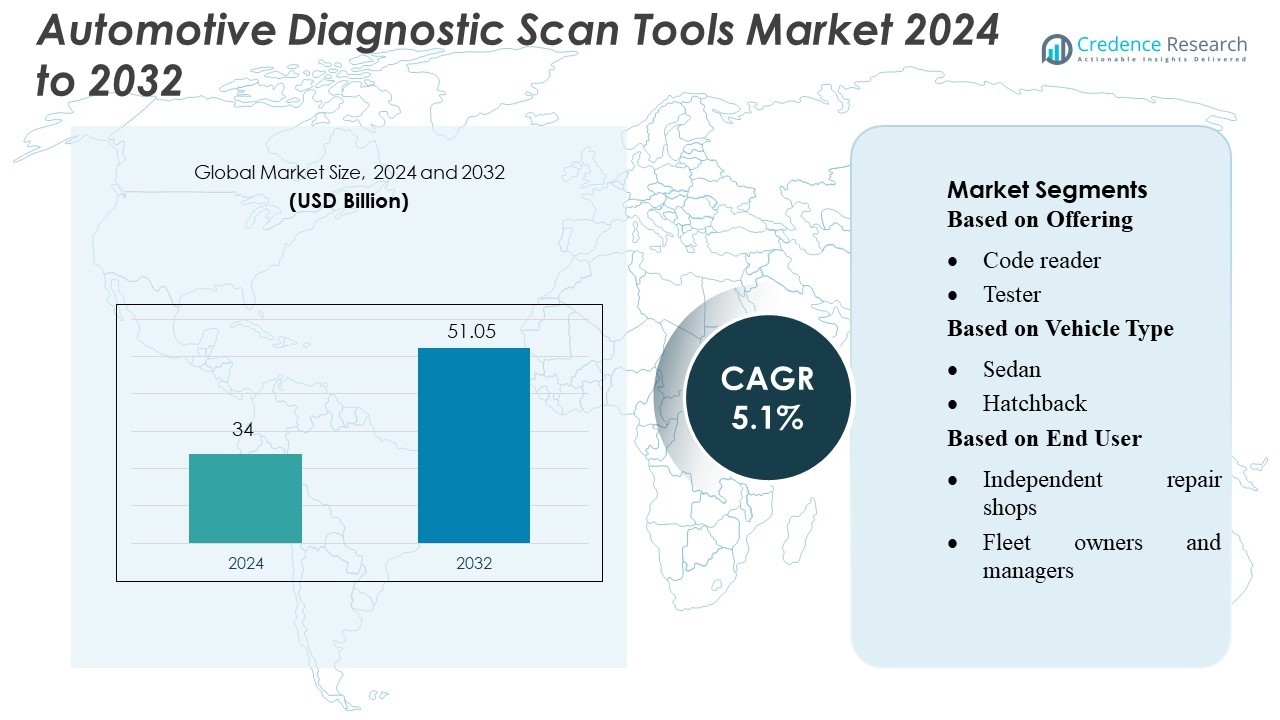

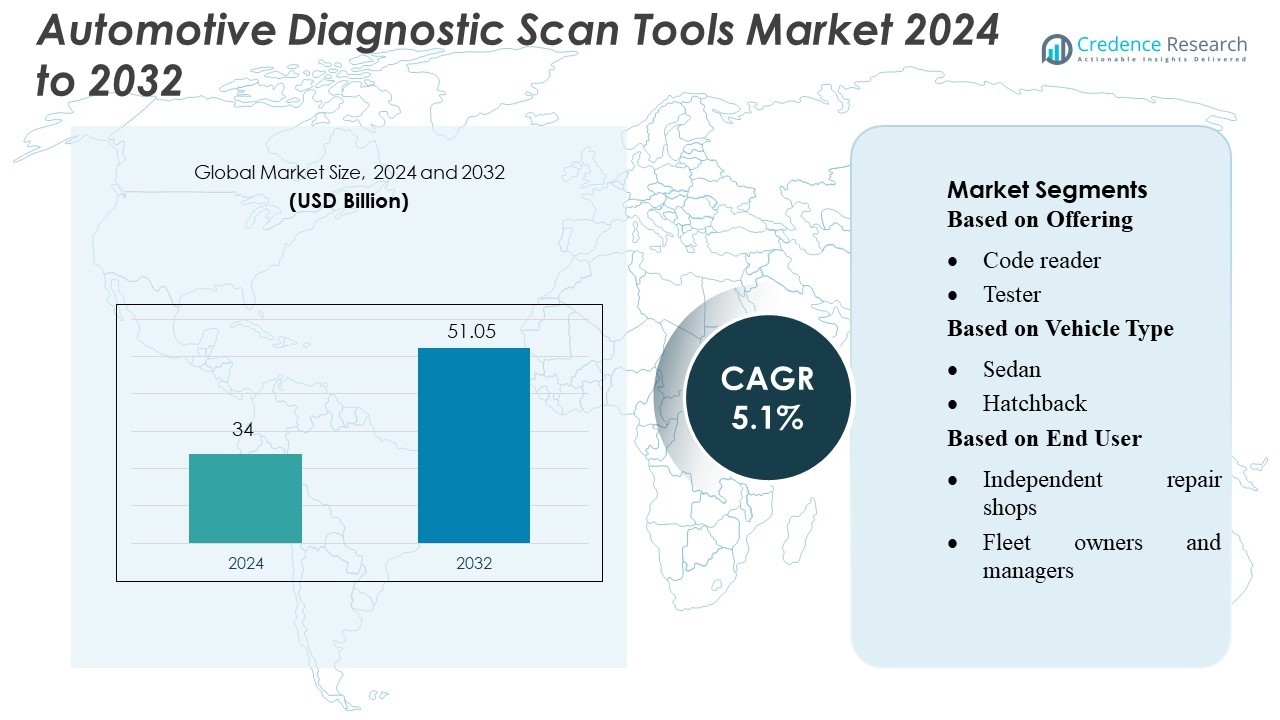

Automotive Diagnostic Scan Tools Market size was valued USD 34 billion in 2024 and is anticipated to reach USD 51.05 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Diagnostic Scan Tools Market Size 2024 |

USD 34 Billion |

| Automotive Diagnostic Scan Tools Market, CAGR |

5.1% |

| Automotive Diagnostic Scan Tools Market Size 2032 |

USD 51.05 Billion |

The Automotive Diagnostic Scan Tools Market through advanced platforms, strong service networks, and rapid adoption of digital testing systems. Major vendors focus on enhancing fault detection speed, improving software integration, and supporting multi-brand vehicle coverage to meet rising workshop needs. Strategic investments, product upgrades, and training programs help these companies expand their reach across repair shops and fleet service centers. North America holds the largest share at 38%, supported by high vehicle ownership, strong aftermarket demand, and early adoption of connected diagnostic technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Automotive Diagnostic Scan Tools Market reached USD 34 billion in 2024 and will hit USD 51.05 billion by 2032 at a CAGR of 5.1%.

- Growing need for faster fault detection drives higher demand for digital diagnostic platforms, with hardware tools holding the largest segment share due to strong usage in repair workshops.

- Rising use of connected and cloud-based diagnostics shapes key trends, supported by multi-brand compatibility and wider integration with vehicle electronics.

- Strong competition comes from global vendors expanding software upgrades and training programs, while high tool costs and limited technician skills act as major restraints.

- North America leads with a 38% share, supported by strong aftermarket activity, while passenger vehicles hold the dominant vehicle-type share due to higher service frequency and wider adoption of advanced onboard systems.

Market Segmentation Analysis:

By Offering

Diagnostic hardware remains the dominant category with a 54% market share, led by scanners that provide real-time fault detection and broad protocol compatibility. Scanners hold the largest hardware share due to strong use in independent garages and dealership networks. Code readers expand adoption through low-cost availability, while testers and analyzers support advanced electrical and sensor diagnostics. ECU diagnosis software grows quickly as vehicles integrate more electronic control units. Vehicle tracking and emission analysis platforms gain traction with rising regulatory checks. Diagnostic services, including maintenance support and custom training, help users manage complex repair workflows.

- For instance, ACTIA Group’s Multi-Diag device supports more than 1,000 vehicle models and enables fault detection in under 30 seconds. Code readers expand adoption through low-cost availability, while testers and analyzers support advanced electrical and sensor diagnostics.

By Vehicle Type

Passenger vehicles account for the largest share at 61%, driven by strong diagnostic demand across sedans, hatchbacks and SUVs. SUVs contribute most due to higher electronic system density and growing hybrid adoption. Light commercial vehicles follow as fleet operators rely on diagnostics to manage uptime and lower repair costs. Medium and heavy commercial vehicles show steady growth because long-haul operators use advanced tools for emission monitoring and drivetrain analysis. Rising electrification across vehicle classes increases the need for tools that support battery, thermal, and powertrain fault evaluation.

- For instance, Bosch’s eAxle for electrified vehicles achieves up to 96 % efficiency in the latest generation of compact powertrains. Bosch’s diagnostic software suite ESI[tronic] supports direct access to automakers’ documentation—including circuit diagrams—and is the only independent supplier.

By End User

Independent repair shops lead with a 48% market share, supported by high customer inflow and demand for multi-brand diagnostic capability. Fleet owners follow as they deploy tools for predictive maintenance, remote monitoring, and repair scheduling. Mobile repair services grow steadily because technicians use compact scanners and cloud-linked software for on-site diagnostics. Other users, including training institutes and service aggregators, adopt these tools to enhance skill development and improve service quality. Expanding connected vehicle technologies drives higher adoption across all user groups as systems require continuous fault analysis and software-based troubleshooting.

Key Growth Drivers

Rising Vehicle Complexity and ECU Integration

Modern vehicles now use many ECUs that support advanced safety, infotainment, and powertrain control. This rise in electronic complexity increases the need for accurate fault detection tools. Workshops and fleet operators rely on advanced scanners to reduce repair time and improve service quality. Automakers also integrate more sensors that require specialized diagnostics. This trend encourages faster adoption of high-performance scan tools in service workflows. Connected diagnostics strengthen this demand by enabling real-time insights. Growing ECU density makes advanced tools essential for efficient vehicle service.

- For instance, Continental’s Cross Domain Hub integrates more than 70 vehicle functions into a single high-performance computing unit and processes up to 50,000 signals per second, reducing diagnostic latency.

Expansion of Connected and Remote Diagnostics

Connected systems improve maintenance by enabling remote fault checks and predictive alerts. This shift reduces downtime for fleets and supports preventive repair models. Automakers and workshops use cloud-linked platforms to access live vehicle data. These platforms help technicians perform quick assessments and speed up decision-making. Remote diagnostics also support over-the-air updates, which cut manual intervention. The increased use of telematics in commercial fleets strengthens the need for reliable diagnostic hardware and software. Rising digital adoption pushes steady market growth.

- For instance, Softing’s VIN|ING 2000 vehicle communication interface supports over 100 diagnostic sequences in the cloud and enables parallel flashing of multiple ECUs during a single session.

Growth in Aftermarket Repair Demand

Growing vehicle ownership boosts demand for repair and maintenance services. Independent workshops depend on universal diagnostic tools that support multi-brand coverage. These tools help shops serve more customers without high equipment costs. Ageing vehicle fleets also require more frequent checks, raising the use of code readers, scanners, and testing tools. Fleet operators adopt robust diagnostic platforms to keep vehicles road-ready. Regular service requirements across passenger and commercial vehicles support strong aftermarket tool usage. This shift keeps demand consistent across regions.

Key Trends & Opportunities

Shift Toward Cloud-Based Diagnostic Platforms

Cloud integration enables real-time data access and scalable storage for large diagnostic logs. Workshops improve service quality by using shared databases and digital repair histories. Cloud tools also support subscription-based software upgrades. These upgrades ensure technicians always access updated vehicle protocols. Automakers adopt cloud ecosystems to strengthen remote monitoring. Cloud-linked tools also enhance collaboration across multi-location service centers. This creates strong opportunities for digital platforms and integrated diagnostic ecosystems.

- For instance, Snap-on’s “The Snap-on Cloud @Altusdrive” platform allows users to upload images or full vehicle system reports and share with up to 20 contacts per account. Workshops improve service quality by using shared databases and digital repair histories.

Adoption of AI-Powered Predictive Diagnostics

AI improves fault detection accuracy by learning from thousands of repair cases. Predictive models flag failures before they occur, helping reduce breakdowns. Technicians use AI-driven insights to shorten troubleshooting time. Fleet managers gain clear visibility into component health and plan maintenance cycles better. Automakers adopt AI in diagnostic software to support next-generation service models. This trend encourages tools that combine machine learning and connected systems. Strong demand for intelligent diagnostics continues to rise across all vehicle types.

- For instance, Delphi’s SiC (silicon carbide) inverter launched in 2019 is rated for up to 800 volts, delivering a design that is 40 % lighter and 30 % more compact than competitor inverters.

Growing Opportunity in EV Diagnostics

EV adoption increases the need for tools that diagnose high-voltage batteries, inverters, and electric drivetrains. EVs require deeper software-level analysis compared to ICE vehicles. Service centers now invest in specialized EV diagnostic platforms to meet rising demand. Battery health assessment and thermal management tests become common tasks. Automakers expand EV service networks, boosting the need for accurate diagnostic support. This trend offers major opportunities for vendors developing EV-focused hardware and software. Strong EV growth supports long-term market expansion.

Key Challenges

High Cost of Advanced Diagnostic Equipment

Advanced scanners and software platforms require high investment, which limits adoption among small workshops. Subscription fees for regular updates add to the financial burden. Many repair shops delay upgrades due to tight budgets. Complex vehicle protocols also demand specialized tools that increase overall costs. High-end diagnostic solutions can become difficult for small businesses to justify. This challenge slows market penetration in cost-sensitive regions. The price barrier affects adoption of cloud and AI-driven systems.

Lack of Skilled Technicians

Modern diagnostic tools require trained technicians who can interpret complex data. Many workshops struggle to hire staff with adequate technical skills. Rapid updates in vehicle electronics widen the skill gap. Technicians need frequent training to keep up with new protocols and EV systems. Limited training access in developing regions increases this challenge. Skill shortages reduce the effectiveness of diagnostic tools. This gap restricts the market’s ability to fully capture growing repair demand.

Regional Analysis

North America

North America holds a 34% market share, supported by a strong automotive service ecosystem and high adoption of advanced diagnostics. Workshops and fleets in the U.S. and Canada use connected tools to manage rising vehicle electronics and remote maintenance needs. Automakers also promote standardized diagnostic protocols that improve tool compatibility across brands. The region benefits from widespread telematics usage that strengthens real-time fault detection. Independent repair shops invest in multi-brand scanners to meet growing aftermarket service demand. EV sales growth further expands regional requirements for specialized diagnostic solutions.

Europe

Europe captures a 29% market share, driven by strict emission regulations and high vehicle electrification rates. Service providers adopt advanced diagnostics to comply with evolving repair standards. OEMs in Germany, France, and the U.K. promote digital service platforms that support remote and predictive diagnostics. Workshops also rely on multi-brand tools to serve diverse vehicle models across the region. Growing EV adoption increases the need for high-voltage system testing. Fleet operators strengthen maintenance efficiency with telematics-linked tools. Strong automotive manufacturing and regulatory pressure continue to shape the region’s diagnostic technology demands.

Asia-Pacific

Asia-Pacific commands a 27% market share, fueled by rising vehicle production and expanding aftermarket service networks. China, India, Japan, and South Korea lead investments in diagnostic platforms as vehicle complexity increases. Independent workshops adopt versatile scanners to manage multi-brand service demand. Rapid EV growth accelerates the need for advanced battery and powertrain diagnostics. Fleet expansion across logistics and ride-hailing further boosts tool usage. Automakers also promote cloud-linked diagnostic systems across their service chains. The region’s growing middle-class vehicle ownership keeps long-term demand steady for hardware, software, and service-based diagnostic solutions.

Latin America

Latin America holds an 6% market share, supported by a growing independent aftermarket and ageing vehicle fleet. Countries like Brazil and Mexico invest in diagnostic tools to improve repair accuracy and lower service costs. Workshops depend on affordable multi-brand scanners due to wide variation in vehicle models. Slow but steady telematics adoption supports early-stage connected diagnostics. Economic constraints limit premium tool uptake, yet rising used-car sales increase diagnostic needs. Automakers expand service networks, encouraging the use of standardized diagnostic platforms. Overall regional demand grows as maintenance quality gains importance across key markets.

Middle East & Africa

The Middle East & Africa account for a 4% market share, driven by rising service requirements across GCC countries and emerging markets. Workshops adopt diagnostic tools to handle imported vehicles with complex electronics. Fleets in logistics, oil and gas, and security operations rely on diagnostic equipment to reduce downtime. Growing digitalization encourages early adoption of connected service platforms. Limited technician availability and high tool costs restrict broader market penetration. Still, EV introductions in the UAE and South Africa create new diagnostic opportunities. Gradual infrastructure growth supports steady expansion across regional service networks.

Market Segmentations:

By Offering

By Vehicle Type

By End User

- Independent repair shops

- Fleet owners and managers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Diagnostic Scan Tools Market features strong competition among leading companies, including ACTIA Group, SPX Corporation, Robert Bosch GmbH, Continental AG, Softing AG, Snap-on Incorporated, Horiba Ltd, Delphi Technologies, Denso Corporation, and SGA SA. the Automotive Diagnostic Scan Tools Market continues to evolve as companies accelerate innovation to meet rising vehicle electronics and service complexity. Manufacturers focus on expanding diagnostic coverage, strengthening software accuracy, and integrating cloud-based platforms that enable real-time data access and remote troubleshooting. Many vendors enhance their tools with faster update cycles, intuitive interfaces, and deeper compatibility with advanced driver-assistance systems and EV components. The shift toward connected workshops encourages investment in predictive analytics, enabling technicians to identify faults earlier and reduce repair time. Subscription-based software models gain traction as service providers seek continuous access to updated protocols. Vendors also expand training programs to help technicians handle complex diagnostics across multi-brand vehicle fleets. As digitalization advances across the automotive ecosystem, competition intensifies around AI-driven diagnostics, cybersecurity safeguards, and scalable platforms designed to support both independent repair shops and large fleet networks, driving sustained product development and differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ACTIA Group

- SPX Corporation

- Robert Bosch GmbH

- Continental AG

- Softing AG

- Snap-on Incorporated

- Horiba Ltd

- Delphi Technologies

- Denso Corporation

- SGA SA

Recent Developments

- In May 2025, leagend launched its largest collection of OBD II scanners, which includes 12 new tools designed for professionals and DIYers. The lineup features integrated devices like 2-in-1 OBD II scanners with battery testers, Bluetooth-enabled code readers, memory savers, auto speedometers, and trip computers to address the evolving needs of modern vehicle diagnostics.

- In January 2025, Dealerslink OBD gives dealers critical diagnostic information on all used vehicles to include with their trade evaluations. On Board Diagnostic scanner, setting a new industry standard for vehicle diagnostic tools. OBD is the first product of its kind to be fully integrated with a best-in-class appraisal and inventory management platform, providing a seamless and intuitive diagnostic experience.

- In August 2024, Launch Tech USA partnered with the National Automotive Service Task Force (NASTF) to address critical issues in vehicle security and enhance the integrity of automotive repair services. This collaboration aims to tackle challenges such as car theft, the theft of diagnostic tools, and risks faced by locksmiths, while setting new industry standards for security protocols.

- In October 2024, Bosch and Tenstorrent announced a collaboration to create a standardized platform for automotive chip components using chiplets, aiming to reduce costs and accelerate innovation. By using standardized, modular chiplets, the partnership seeks to enable automakers to customize and build chips more efficiently than with traditional, off-the-shelf parts.

Report Coverage

The research report offers an in-depth analysis based on Offering, Vehicle Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as vehicles integrate more ECUs, sensors, and digital features.

- EV adoption will increase demand for high-voltage system and battery diagnostics.

- Cloud-based diagnostic platforms will grow as workshops shift toward connected service models.

- AI-driven predictive diagnostics will support faster fault detection and reduce repair time.

- Remote diagnostics and over-the-air update support will become standard across service networks.

- Independent workshops will adopt multi-brand tools to handle rising aftermarket service needs.

- Fleet operators will invest in diagnostics that enhance uptime and preventive maintenance.

- Subscription-based software models will gain traction for continuous protocol updates.

- Cybersecurity features will strengthen as diagnostic tools access more vehicle data.

- Training and digital skill development for technicians will grow to meet complex diagnostic demands.