Market Overview

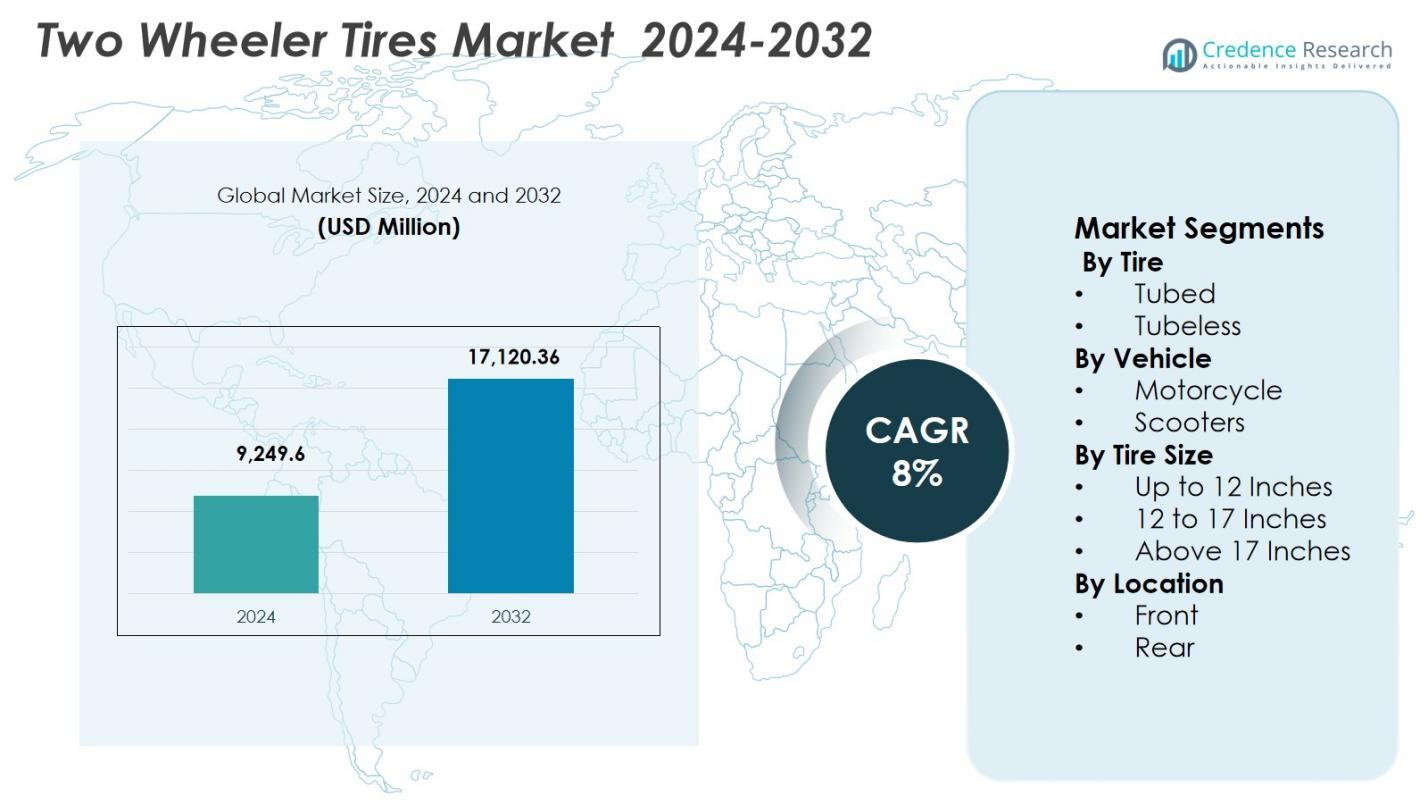

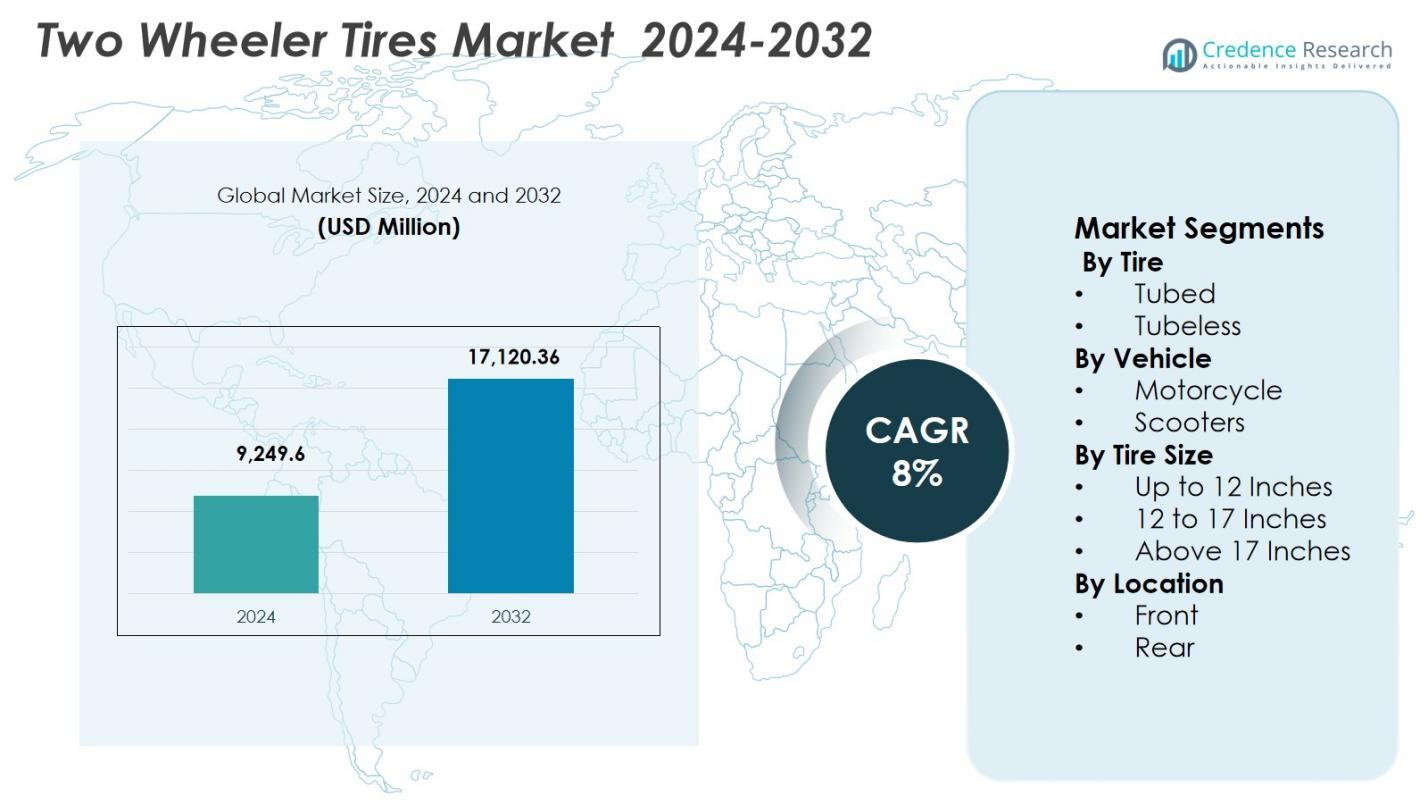

Two Wheeler Tires Market size was valued USD 9,249.6 million in 2024 and is anticipated to reach USD 17,120.36 million by 2032, growing at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Two Wheeler Tires Market Size 2024 |

USD 2745.8 Million |

| Two Wheeler Tires Market, CAGR |

8% |

| Two Wheeler Tires Market Size 2032 |

USD 9509.24 Million |

Two Wheeler Tires Market is shaped by the strong presence of established global and regional manufacturers including MRF, Michelin, Bridgestone, Apollo Tyres, CEAT, Continental, Pirelli, JK Tyre, Maxxis International, and TVS, which collectively drive product innovation, capacity expansion, and wide aftermarket reach. These players focus on advanced tread patterns, improved rubber compounds, and tubeless tire technologies to address evolving safety, durability, and performance requirements across motorcycles and scooters. Asia-Pacific leads the Two Wheeler Tires Market with a 58.6% market share, supported by high two-wheeler penetration, frequent replacement demand, and strong OEM production hubs. Europe and North America follow, driven by premium motorcycles, stringent safety norms, and rising demand for high-performance and specialty tire solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Two Wheeler Tires Market was valued at USD 9,249.6 million in 2024 and is projected to reach USD 17,120.36 million by 2032, growing at a CAGR of 8%.

- Rising two-wheeler parc, frequent tire replacement cycles, and expanding urban mobility strongly drive Two Wheeler Tires Market growth

- Increasing adoption of tubeless tires and EV-specific tire designs represents a key trend shaping the Two Wheeler Tires Market

- Price pressure from unorganized players and volatility in raw material costs restrain margin expansion in the Two Wheeler Tires Market

- Asia-Pacific leads with 58.6% market share, while tubeless tires dominate by type with 68.4% share and motorcycles lead vehicle segment with 72.1% share

Market Segmentation Analysis:

By Tire:

The Two Wheeler Tires Market by tire type is led by tubeless tires, which accounted for 68.4% market share in 2024. Tubeless tires dominate due to superior puncture resistance, improved riding safety, better heat dissipation, and reduced risk of sudden air loss. Growing adoption of alloy wheels, rising preference for low-maintenance tires, and increasing penetration of premium and mid-range two-wheelers strongly support tubeless tire demand. OEMs increasingly standardize tubeless configurations, while consumers favor longer tire life and fuel efficiency benefits, reinforcing the segment’s leadership across both urban and highway riding conditions.

- For instance, Royal Enfield introduced tubeless spoke wheels for its Himalayan 450 motorcycle in September 2024, available as a factory option for new buyers or an upgrade costing Rs 12,424 for existing owners, enhancing puncture repair convenience on adventure terrains.

By Vehicle:

Within the Two Wheeler Tires Market by vehicle type, motorcycles held the dominant position with a 72.1% market share in 2024. This leadership is driven by higher global motorcycle parc, frequent tire replacement cycles, and strong demand from commuter and performance motorcycle segments. Motorcycles experience higher mileage, load, and speed compared to scooters, accelerating tire wear and replacement demand. Expanding motorcycle ownership in emerging economies, growth of sport and premium bikes, and increasing use of motorcycles for daily commuting and logistics continue to drive sustained dominance of this segment.

By Tire Size:

The Two Wheeler Tires Market by tire size is dominated by the 12 to 17 inches segment, which captured 61.7% market share in 2024. This segment benefits from its broad applicability across standard motorcycles and scooters, offering an optimal balance of stability, handling, and ride comfort. Manufacturers prioritize this size range to meet mass-market vehicle specifications, while consumers favor it for durability and availability. Rising sales of commuter motorcycles, growth of mid-capacity bikes, and expanding OEM fitment requirements strongly support continued dominance of the 12 to 17 inches tire size segment.

- For instance, MRF supplies 90/90-17 front and 120/80-17 rear tires as OEM fitment for Bajaj Pulsar 150 models, supporting commuter stability on 17-inch rims.

Key Growth Drivers

Rising Two-Wheeler Parc and Urban Mobility Demand

The Two Wheeler Tires Market benefits strongly from the expanding global two-wheeler parc, particularly in emerging economies where motorcycles and scooters serve as primary modes of daily transportation. Rapid urbanization, traffic congestion, and rising fuel costs continue to push consumers toward cost-efficient two-wheelers. This directly increases OEM tire demand and creates a large replacement market due to frequent wear and tear. Growth in last-mile connectivity, ride-hailing services, and delivery fleets further accelerates tire replacement cycles, supporting sustained volume growth across urban and semi-urban regions.

- For instance, MRF supplies tires to key two-wheeler OEMs in India, including Honda Activa Electric, Bajaj Chetak, and Hero MotoCorp’s Vida electric scooters, supporting OEM volumes amid rising electric two-wheeler production.

Growth in Replacement Tire Demand

Replacement demand remains a core growth driver for the Two Wheeler Tires Market, supported by shorter tire lifespans compared to passenger vehicle tires. Frequent usage, varied road conditions, and exposure to extreme weather accelerate tread wear, leading to higher replacement frequency. Consumers increasingly prioritize safety, grip, and durability, driving steady aftermarket demand. Expansion of organized retail networks, dealer chains, and e-commerce platforms has improved product availability and brand visibility, further strengthening replacement sales across motorcycles and scooters in both developed and developing markets.

- For instance, food delivery and e-commerce fleets in India using two-wheelers like those from MRF or CEAT experience frequent tire replacements from 24/7 high-load operations on urban roads, prompting demand for durable options.

Increasing Focus on Performance and Safety

Rising consumer awareness regarding riding safety and performance significantly supports the Two Wheeler Tires Market. Riders increasingly seek tires offering superior grip, stability, braking efficiency, and wet-road performance. This shift is particularly strong among premium motorcycle owners and high-speed commuter segments. Manufacturers continue to introduce advanced tread designs, silica-based compounds, and reinforced structures to meet evolving performance expectations. Regulatory emphasis on road safety and quality standards further encourages adoption of higher-quality tires, supporting value growth alongside volume expansion.

Key Trends & Opportunities

Shift Toward Tubeless Tire Adoption

The Two Wheeler Tires Market is witnessing a clear shift toward tubeless tires, creating strong growth opportunities for manufacturers. Tubeless tires offer improved puncture resistance, better heat dissipation, enhanced fuel efficiency, and easier maintenance compared to tubed variants. OEMs increasingly standardize tubeless tires across new motorcycle and scooter models, accelerating penetration. This trend opens opportunities for premium pricing, technological differentiation, and higher-margin products, particularly in urban markets where consumers prioritize convenience, safety, and long-term cost efficiency.

- For instance, KTM’s latest 390 Adventure model uses 21-inch front (90/90-21) and 17-inch rear (130/80-17) tubeless spoked wheels with patented centrally-mounted spokes and rubber seals for airtight performance.

Expansion of Electric Two-Wheelers

The rapid adoption of electric two-wheelers presents a significant opportunity within the Two Wheeler Tires Market. Electric scooters and motorcycles require specialized tires designed for higher torque, lower noise, and enhanced durability. Manufacturers are investing in EV-specific tire designs to address unique performance requirements. Government incentives, urban electrification initiatives, and sustainability goals are accelerating EV penetration, creating a new demand pool. This trend supports innovation-led growth and allows tire makers to strengthen partnerships with emerging electric two-wheeler OEMs.

- For instance, TVS Eurogrip launched the ETorq tire, India’s first purpose-built for electric two-wheelers, featuring low rolling resistance to extend range while providing superior wet and dry grip to handle instant torque.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of key raw materials such as natural rubber, synthetic rubber, and crude oil derivatives pose a major challenge for the Two Wheeler Tires Market. Cost volatility directly impacts production expenses and profit margins, limiting pricing flexibility in highly competitive markets. Smaller manufacturers face greater pressure due to limited cost absorption capacity. Sustained raw material inflation can disrupt supply chains and force manufacturers to optimize formulations, renegotiate supplier contracts, or absorb costs, potentially affecting long-term profitability and operational stability.

Intense Price Competition and Counterfeit Products

The Two Wheeler Tires Market faces strong pricing pressure due to the presence of numerous regional and unorganized players offering low-cost alternatives. Intense competition limits margin expansion, particularly in price-sensitive markets. Additionally, the circulation of counterfeit and substandard tires undermines brand reputation and raises safety concerns. These products often attract cost-conscious consumers, impacting sales of established brands. Addressing this challenge requires stronger distribution control, consumer awareness initiatives, and continuous investment in brand differentiation and quality assurance.

Regional Analysis

Asia-Pacific

Asia-Pacific leads the Two Wheeler Tires Market with a 58.6% market share, supported by high two-wheeler penetration, large commuter populations, and strong domestic manufacturing bases. Countries such as India, China, Indonesia, and Vietnam drive volume demand due to daily mobility needs and rising disposable income. The region benefits from a strong replacement tire cycle, expanding road infrastructure, and growth in electric two-wheelers requiring specialized tires. Local manufacturers and global brands actively invest in capacity expansion, product localization, and cost-efficient distribution networks, reinforcing Asia-Pacific’s position as the largest and fastest-growing regional market.

Europe

Europe accounts for a 17.9% market share in the Two Wheeler Tires Market, driven by premium motorcycle ownership, stringent safety standards, and strong demand for high-performance and specialty tires. Countries such as Germany, Italy, France, and Spain support consistent demand through recreational motorcycling, touring culture, and urban mobility scooters. Regulatory emphasis on tire quality, wet grip performance, and sustainability accelerates adoption of advanced compounds and radial tubeless designs. Replacement demand dominates the market, while increasing adoption of electric scooters in urban centers further strengthens regional growth prospects.

North America

North America holds a 12.4% market share in the Two Wheeler Tires Market, supported by strong demand for heavyweight motorcycles, sports bikes, and recreational riding. The United States leads regional consumption due to a large base of premium motorcycle owners and frequent tire replacement driven by performance riding and long-distance touring. High consumer preference for branded, high-durability, and performance-oriented tires benefits premium manufacturers. Growth in urban scooters and electric two-wheelers in select cities also contributes to market diversification, while established aftermarket distribution channels ensure stable demand.

Latin America

Latin America represents a 7.1% market share in the Two Wheeler Tires Market, driven by affordable two-wheelers used for daily commuting and delivery services. Brazil, Mexico, Colombia, and Argentina are key contributors due to rising urban congestion and growing two-wheeler ownership among middle-income populations. The market is largely replacement-driven, with strong demand for durable, cost-effective tubeless tires suitable for mixed road conditions. Expanding e-commerce, food delivery platforms, and last-mile logistics continue to increase tire wear rates, supporting steady regional demand growth.

Middle East & Africa

The Middle East & Africa region accounts for a 3.9% market share in the Two Wheeler Tires Market, supported by growing two-wheeler adoption in Africa and selective premium motorcycle demand in the Middle East. In Africa, motorcycles are widely used for affordable transportation and commercial taxi services, driving high replacement tire demand. Countries such as Nigeria, Kenya, and Tanzania remain key volume markets. In the Middle East, recreational and performance motorcycles support demand for premium tire segments, while gradual infrastructure improvements and urban mobility initiatives aid market expansion.

Market Segmentations:

By Tire

By Vehicle

By Tire Size

- Up to 12 Inches

- 12 to 17 Inches

- Above 17 Inches

By Location

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Two Wheeler Tires Market highlights the strong presence of global and regional manufacturers such as MRF, Michelin, Bridgestone, Apollo Tyres, CEAT, Continental, Pirelli, JK Tyre, Maxxis International, and TVS. These companies focus on capacity expansion, product innovation, and strategic partnerships to strengthen market positioning. Leading players emphasize advanced tread designs, improved rubber compounds, and durability enhancements to meet evolving performance and safety expectations. Price competitiveness and extensive distribution networks remain critical differentiators, particularly in high-volume emerging markets. Manufacturers increasingly invest in R&D to develop tubeless, fuel-efficient, and high-grip tires aligned with electric two-wheeler adoption and regulatory standards. Regional players maintain strong domestic shares through brand loyalty and aftermarket reach, while global brands leverage technology leadership and premium offerings to capture higher-value segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pirelli

- JK Tyre

- Michelin

- TVS

- Maxxis International

- Apollo Tyres

- Continental

- MRF

- CEAT

- Bridgestone

Recent Developments

- In June 2025, Eurogrip Tyres announced a partnership with Honda Taiwan, integrating its motorcycle tyre range into Honda’s authorised service network across Taiwan to boost brand presence in Asia.

- In August 2025, Western Power Sports (WPS) entered a distribution partnership with Bridgestone Motorcycle Tires, adding Bridgestone’s street and off-road two-wheeler tyre lineup to its dealer network.

- In October 2023, Bridgestone launched its new sports motorcycle tire, the Battlax Hypersport S23. This next-generation tire is designed to enhance cornering grip and overall performance, particularly in wet conditions.

Report Coverage

The research report offers an in-depth analysis based on Tire, Vehicle, Tire Size, Location and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Two Wheeler Tires Market will continue to benefit from rising two-wheeler ownership driven by urban mobility needs and cost-efficient personal transportation.

- Growing demand for tubeless tires will strengthen as consumers prioritize safety, durability, and reduced maintenance requirements.

- Motorcycle tire demand will remain strong, supported by increasing premium and performance motorcycle sales globally.

- Expansion of electric two-wheelers will accelerate the need for low-rolling-resistance and high-durability tire solutions.

- Manufacturers will increasingly focus on advanced rubber compounds to enhance grip, mileage, and fuel efficiency.

- Aftermarket tire replacement demand will stay robust due to high wear rates and regular maintenance cycles.

- Sustainability initiatives will push adoption of eco-friendly materials and greener manufacturing processes.

- Asia Pacific will continue to shape volume growth due to high population density and daily commuting reliance.

- Digital retail channels and organized service networks will improve product accessibility and brand penetration.

- Ongoing investments in R&D will enable product differentiation and support long-term competitive positioning.