Market Overview

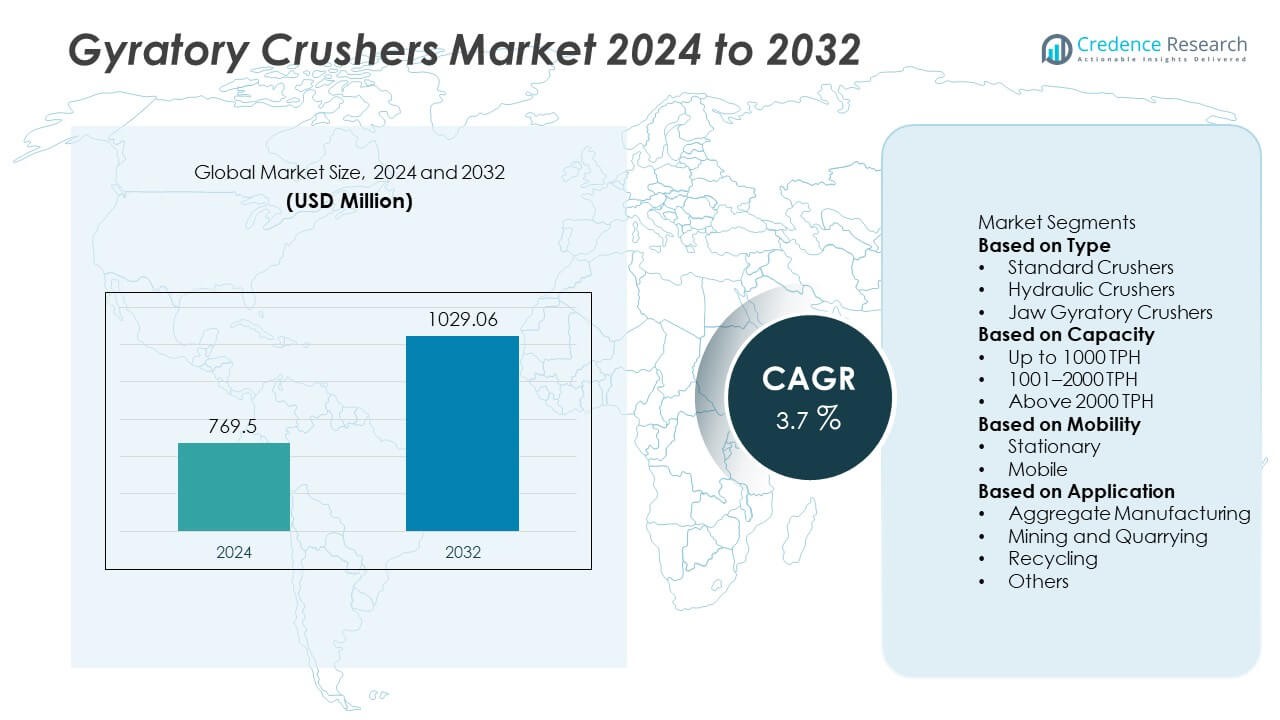

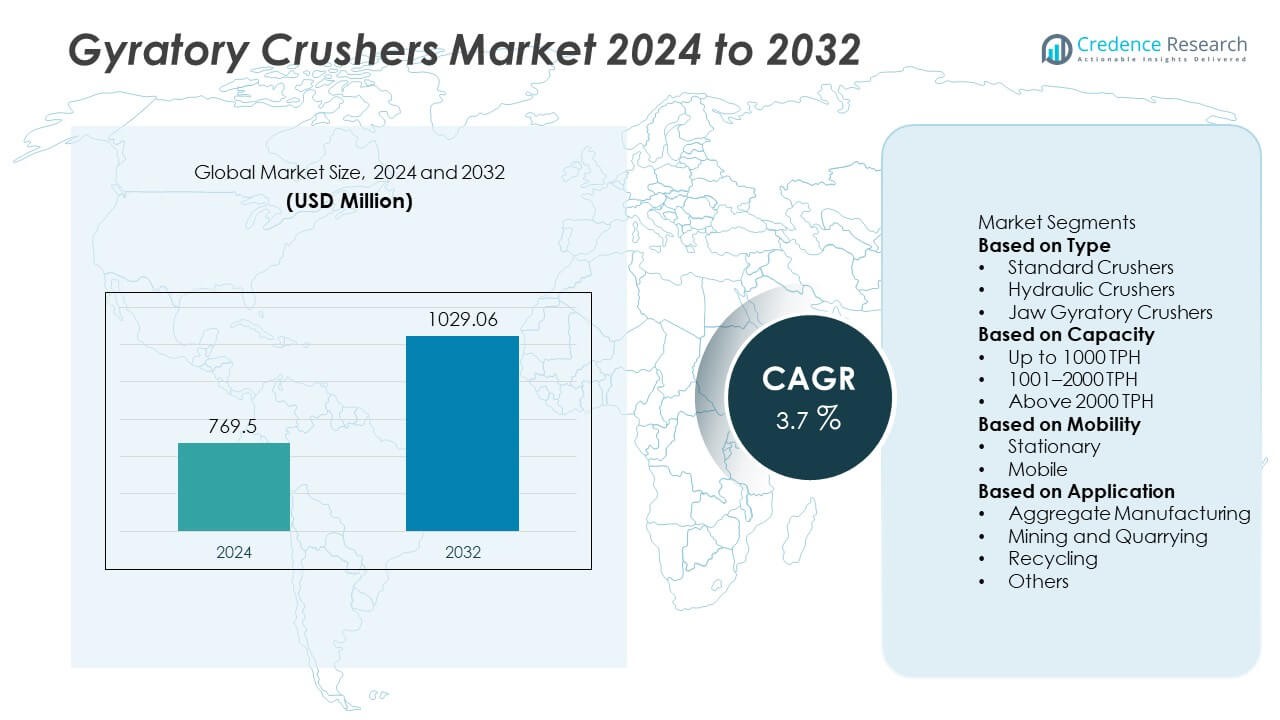

The Gyratory Crushers Market was valued at USD 769.5 million in 2024 and is projected to reach USD 1,029.06 million by 2032, registering a 3.7% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gyratory Crushers Market Size 2024 |

USD 769.5 Million |

| Gyratory Crushers Market, CAGR |

3.7% |

| Gyratory Crushers Market Size 2032 |

USD 1,029.06 Million |

Top players in the Gyratory Crushers market, including Shanghai SANME Mining Machinery Corp Ltd, CITIC Heavy Industries Co., Ltd., Sandvik AB, Metso Outotec, FLSmidth & Co. A/S, and TAKRAF GmbH, continue to strengthen their position through advanced crushing technologies, digital monitoring systems, and high-capacity designs. These companies focus on improving durability, energy efficiency, and automation to meet the needs of large mining and aggregate operations. Asia Pacific leads the market with a 30% share due to strong mining activity and infrastructure growth, followed by North America at 35% and Europe at 28%, driven by modernization of mineral processing facilities and rising demand for high-performance crushing equipment.

Market Insights

Market Insights

- The Gyratory Crushers market reached USD 769.5 million in 2024 and will grow at a 3.7% CAGR through 2032.

- Demand rises as large mining operations expand, with the 1001–2000 TPH capacity segment holding a 41% share due to high productivity needs in metal and mineral processing.

- Energy-efficient and automated systems shape market trends, while stationary crushers lead with a 68% share as mining sites prioritize long-term, high-volume crushing performance.

- Competition intensifies as major players focus on digital monitoring, wear-optimized chamber designs, and advanced hydraulic features, though high installation and maintenance costs remain key restraints.

- Asia Pacific holds a 30% share, North America 35%, and Europe 28%, supported by strong mining activity, infrastructure projects, and modernization of mineral processing plants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Standard crushers dominated the Gyratory Crushers market with a 46% share in 2024, driven by their reliable performance, durability, and suitability for large-scale primary crushing in mining and quarry operations. These crushers support heavy-duty applications and maintain consistent output, making them the preferred choice for high-capacity sites. Hydraulic crushers followed due to increasing demand for automated control, overload protection, and reduced downtime. Jaw gyratory crushers gained traction in underground mining projects for their compact design and strong crushing efficiency. Standard crushers held the lead because they deliver stable throughput and low maintenance requirements.

- For instance, the Metso Superior™ MKIII 70-89 primary gyratory crusher features a 70-inch feed opening and delivers up to 15,000 tons per hour. The design integrates advanced control systems, such as Metso’s MCP automation, with numerous automated functions.

By Capacity

The 1001–2000 TPH segment led the market with a 41% share in 2024, supported by rising adoption in medium-to-large mining operations requiring high productivity and continuous material flow. This capacity range balances performance, cost-efficiency, and operational flexibility across diverse mineral processing plants. The Up to 1000 TPH category followed due to its suitability for smaller quarries and construction aggregates, while the Above 2000 TPH segment catered to large-scale mines handling heavy-duty crushing. The 1001–2000 TPH range remained dominant as it meets throughput needs for most global mining projects.

- For instance, a CITIC Heavy Industries PXZ gyratory crusher (model PXZ1417) can deliver approximately 1,750 to 2,060 tons per hour with a maximum feed size of 1,200 mm (or 1,400 mm with a double-mouth spider).

By Mobility

Stationary gyratory crushers held a dominant 68% share in 2024, driven by their strong structural stability, high output capacity, and widespread use in fixed mining and mineral processing sites. These systems support long-term installations where consistent, large-volume crushing is essential. Mobile crushers experienced rising adoption due to greater operational flexibility, ease of relocation, and support for remote or short-term mining projects. However, stationary units maintained leadership because major mining companies invest in permanent crushing stations to maximize productivity, reduce operating costs, and ensure continuous material handling across large-scale operations.

Key Growth Drivers

Rising Demand from Large-Scale Mining Operations

Growth strengthens as mining companies expand metal and mineral extraction to meet rising industrial demand. Gyratory crushers support high-volume processing and handle hard ores with consistent performance, making them essential for both open-pit and underground mines. Increased investment across Asia Pacific, Latin America, and Africa accelerates adoption. Their ability to deliver continuous crushing, high capacity, and reduced downtime positions gyratory crushers as core equipment in mineral processing systems.

- For instance, FLSmidth has supplied its TSUV gyratory crusher for various projects, including an order for a South American copper mine where each crusher had a capacity of 2,500 TPH. The TSUV crusher line can handle capacities up to 15,000 TPH with motor power ratings up to 1,500 kW.

Technological Advancements in Automation and Control Systems

Automation drives efficiency by improving monitoring, reliability, and overall performance. Modern gyratory crushers integrate real-time wear detection, automated adjustments, and predictive maintenance that reduces manual handling. Smart controls help optimize chamber pressure, feed consistency, and energy use. As mining sites adopt digital workflows under Industry 4.0, automated crushers become vital for productivity and safety. These advancements increase machine lifespan and support steady market growth.

- For instance, Sandvik’s CG800i series uses the ACS 5 automation platform with over 250 sensor data points. The system provides remote monitoring, automatic setting regulation, and closed-loop performance tracking.

Infrastructure Expansion and Demand for Construction Aggregates

Global infrastructure projects boost aggregate consumption, generating strong demand for high-capacity crushing equipment. Gyratory crushers produce large volumes of high-quality crushed stone used in roads, bridges, and commercial developments. Rapid urbanization in emerging economies increases material requirements, prompting quarries to invest in durable crushers. Government-driven construction programs further support adoption. Reliable output, strong load handling, and reduced wear make gyratory crushers ideal for large aggregate production lines.

Key Trends & Opportunities

Growing Adoption of Energy-Efficient and Sustainable Crushing Solutions

Sustainability initiatives shape purchasing decisions across mining and aggregates. Manufacturers design gyratory crushers with improved energy efficiency, lower emissions, and optimized power use. These features help operators reduce operational costs and comply with environmental standards. Enhanced liner life and reduced waste generation further support adoption. As eco-friendly practices expand, demand for energy-efficient crushing technologies continues to grow, creating strong opportunities for next-generation systems.

- For instance, ThyssenKrupp Industrial Solutions introduced its ERC 25-25 system which achieves high throughputs of up to 3,000 tons per hour. The machine utilizes an innovative design with an integrated screen to reduce power consumption and minimize wear, featuring a roll diameter of 2,500 mm and motor power typically ranging from 450 to 600 kW.

Expansion of Digitally Integrated and Smart Crushing Plants

Digital transformation in mining drives interest in smart, connected gyratory crushers. Integration with sensor networks, cloud platforms, and real-time analytics improves operational visibility and decision-making. Remote monitoring and digital twins enable predictive maintenance and reduce unplanned downtime. Optimization of crusher settings enhances throughput and equipment longevity. As more mines adopt automated processing lines, digitally enabled gyratory crushers gain strong market traction.

- For instance, the ABB Ability™ Smart Sensor system is utilized for condition monitoring of various rotating equipment like motors, pumps, and fans. The sensors monitor parameters such as vibration, speed, and temperature.

Key Challenges

High Installation and Maintenance Costs

Gyratory crushers require substantial capital due to their size, heavy-duty components, and infrastructure needs. Installation involves skilled labor, specialized foundations, and extended setup times, increasing project expenses. Maintenance adds further cost through liner replacements and mechanical servicing. These financial constraints limit adoption among smaller mining firms and cost-sensitive regions. Despite strong performance benefits, high ownership costs remain a major barrier to wider market penetration.

Operational Complexity and Need for Skilled Workforce

Efficient operation of gyratory crushers demands trained technicians and proper maintenance routines. Inconsistent feeding, improper calibration, or lack of technical skills can reduce output and increase wear. Skill shortages in remote and developing mining regions create reliability challenges. Advanced automated systems require specialized knowledge that many sites lack. Ensuring safe, consistent operation remains difficult without continuous training and technical support, slowing adoption in some markets.

Regional Analysis

North America

North America held a 35% share of the Gyratory Crushers market in 2024, driven by strong mining activity, high metal consumption, and well-established mineral processing facilities. The United States leads regional adoption due to investments in copper, gold, and iron ore projects. Advanced automation, digital monitoring, and energy-efficient crushing systems support wider implementation across large mining sites. Growth in construction aggregates further boosts demand as infrastructure upgrades continue. The presence of major equipment manufacturers and strong focus on productivity optimization help North America maintain a leading position in the global market.

Europe

Europe accounted for a 28% share of the Gyratory Crushers market in 2024, supported by mining operations in countries such as Russia, Sweden, and Germany. The region benefits from strong technological capabilities, strict efficiency standards, and a shift toward sustainable mineral processing. Demand rises in metal recycling and quarrying applications as operators upgrade to energy-efficient crushers. European companies prioritize automated controls and high-capacity equipment to meet output requirements. Government-backed industrial expansion and modernization of mining infrastructure contribute to stable regional demand for high-performance gyratory crushing systems.

Asia Pacific

Asia Pacific captured a 30% share of the Gyratory Crushers market in 2024, driven by large-scale mining operations across China, India, Australia, and Indonesia. Rapid industrialization and rising demand for metals and construction aggregates fuel consistent equipment adoption. The region invests heavily in mining expansion projects and advanced crushing technologies to enhance efficiency and reduce downtime. Strong infrastructure development programs further support aggregate production. Growing emphasis on automation and digitized mining increases demand for high-capacity gyratory crushers. Asia Pacific remains the fastest-growing regional market due to expanding mineral extraction activities.

Latin America

Latin America held a 5% share of the Gyratory Crushers market in 2024, influenced by strong mining activity in Brazil, Chile, and Peru. Large reserves of copper, gold, and iron ore support steady demand for high-capacity crushing equipment. Mining operators in the region invest in durable crushers that handle hard ores and offer consistent throughput. While economic fluctuations impact short-term projects, long-term mineral demand drives equipment upgrades. Increasing private-sector investment and modernization of processing plants strengthen adoption. Improvements in transportation and export infrastructure also contribute to regional market growth.

Middle East & Africa

The Middle East & Africa region accounted for a 2% share of the Gyratory Crushers market in 2024, supported by growing mining potential across South Africa, Zambia, and the Gulf countries. Expanding extraction of diamonds, copper, and industrial minerals increases demand for large-capacity crushers. Infrastructure development and new mineral exploration projects contribute to steady adoption. However, limited technological readiness and high equipment costs slow widespread deployment. As governments prioritize mining diversification and attract foreign investment, the region sees rising interest in automated and energy-efficient crushing solutions, supporting gradual market growth.

Market Segmentations:

By Type

- Standard Crushers

- Hydraulic Crushers

- Jaw Gyratory Crushers

By Capacity

- Up to 1000 TPH

- 1001–2000 TPH

- Above 2000 TPH

By Mobility

By Application

- Aggregate Manufacturing

- Mining and Quarrying

- Recycling

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Gyratory Crushers market features major players such as Shanghai SANME Mining Machinery Corp Ltd, CITIC Heavy Industries Co., Ltd., Sandvik AB, Shunda Mining Group Co Ltd, Metso Outotec, TAKRAF GmbH, AGICO Cement Machinery Co Ltd, Propel Industries, FLSmidth & Co. A/S, and Earthtechnicia. These companies focus on developing high-capacity, energy-efficient, and automated gyratory crushers to support large-scale mining and aggregate production. Manufacturers invest in digital monitoring systems, advanced hydraulic designs, and wear-optimized crushing chambers to improve reliability and reduce downtime. Strategic collaborations with mining operators and technology providers strengthen product innovation and global distribution. Companies also expand service networks and offer predictive maintenance solutions to enhance machine lifespan. As demand grows for sustainable and high-throughput crushing equipment, leading players continue to upgrade designs, integrate smart controls, and expand manufacturing capabilities to maintain a strong competitive position.

Key Player Analysis

- CITIC Heavy Industries Co., Ltd.

- Sandvik AB

- Shunda Mining Group Co Ltd

- Metso Outotec

- TAKRAF GmbH

- AGICO Cement Machinery Co Ltd

- Propel Industries

- FLSmidth & Co. A/S

- Earthtechnicia

- Shanghai SANME Mining Machinery Corp Ltd

Recent Developments

- In January 2025, CITIC Heavy Industries Co., Ltd. successfully completed the commissioning of core equipment including a gyratory crusher for the M3.75 expansion project at the Marampa Mines in Sierra Leone.

- In June 2023, Metso Outotec was awarded orders (approx. EUR 20 million) for a primary gyratory crusher and an apron feeder package in the Americas, including its Superior™ MKIII crusher range.

- In January 2023, FLSmidth & Co. A/S announced an order to deliver the world’s largest gyratory crusher (capacity >12,000 t/h) and associated station to a South American copper mine.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Mobility, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as large mining operations expand extraction of metals and minerals.

- Automation adoption will increase as mines rely more on digital control and monitoring.

- Energy-efficient gyratory crushers will gain preference to meet sustainability targets.

- High-capacity models will see stronger demand as operators push for greater throughput.

- Smart maintenance tools will rise as sites shift toward predictive service planning.

- Underground mining growth will support adoption of compact jaw-gyratory designs.

- Modernization of mineral processing plants will drive upgrades to advanced crushers.

- Mobile gyratory units will gain traction in remote and short-term mining projects.

- Advanced wear materials and chamber designs will improve durability and reduce downtime.

- Emerging markets will adopt more high-performance crushers as mining infrastructure improves.

Market Insights

Market Insights