Market Overview

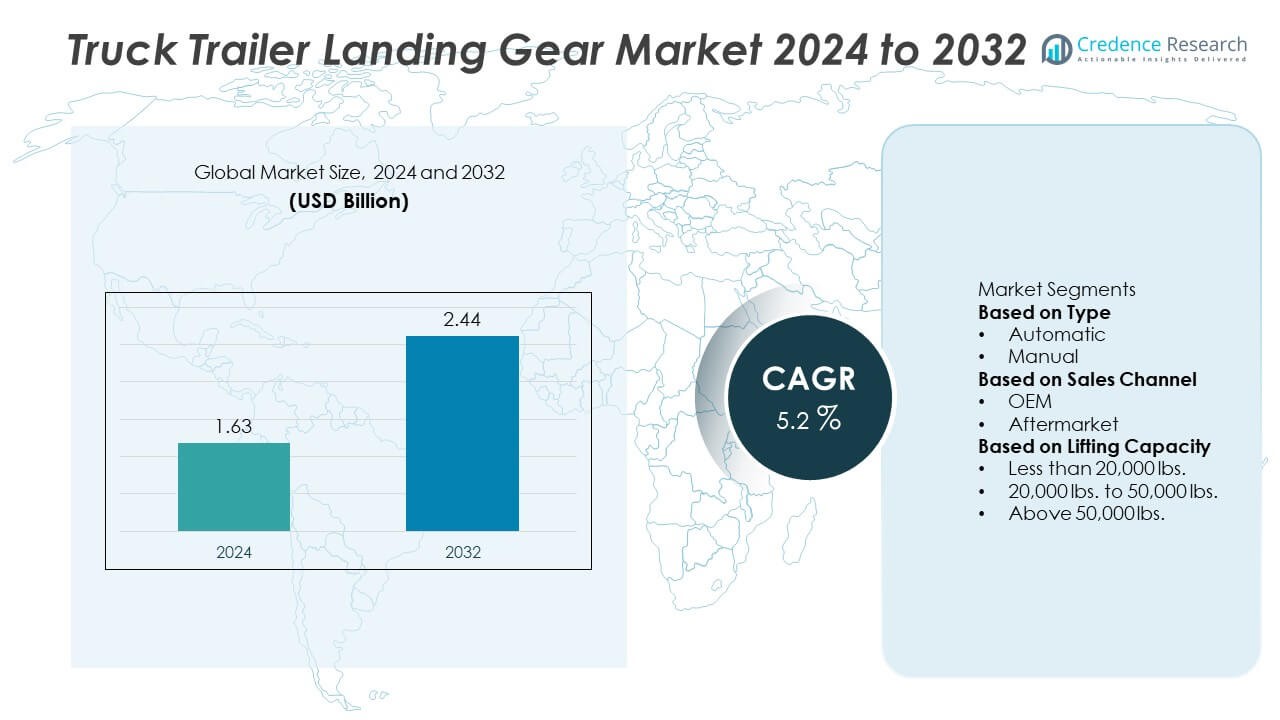

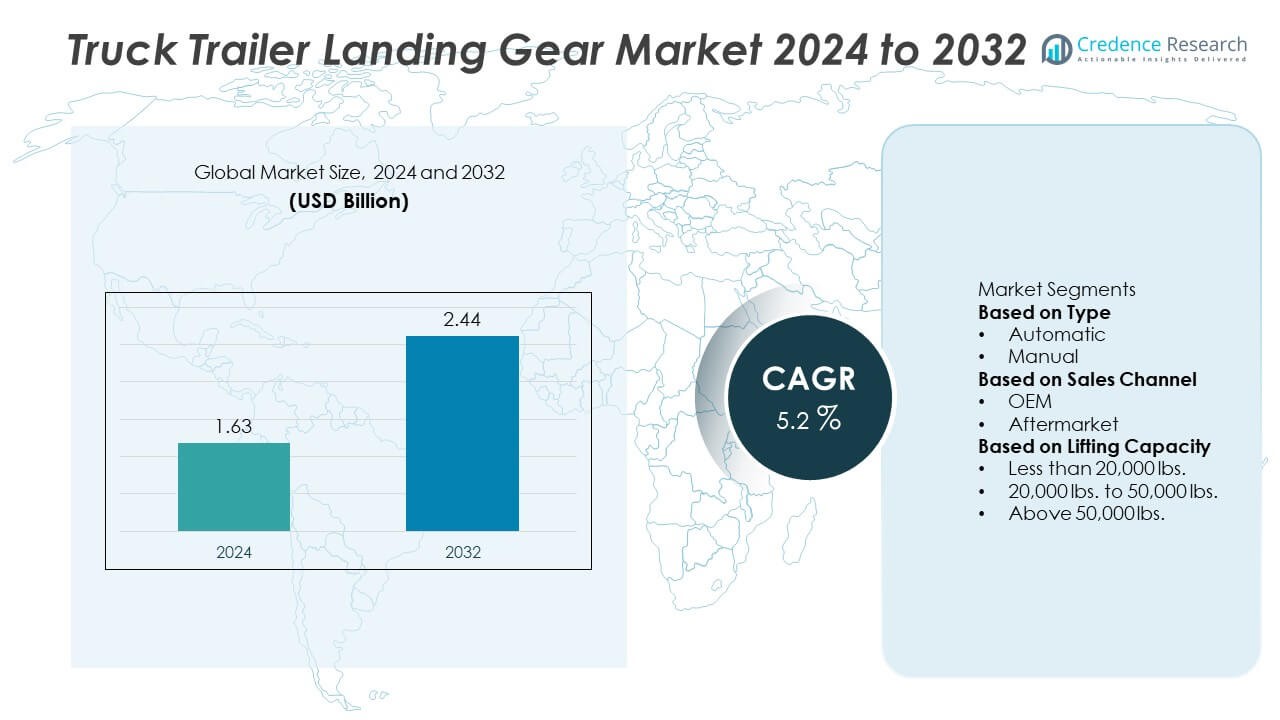

The Truck Trailer Landing Gear Market was valued at USD 1.63 billion in 2024 and is projected to reach USD 2.44 billion by 2032, growing at a 5.2% CAGR over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Truck Trailer Landing Gear Market Size 2024 |

USD 1.63 Billion |

| Truck Trailer Landing Gear Market, CAGR |

5.2% |

| Truck Trailer Landing Gear Market Size 2032 |

USD 2.44 Billion |

Top players in the Truck Trailer Landing Gear market include SAF-HOLLAND, JOST Werke AG, BPW Bergische Achsen KG, Fuwa Group, AXN Heavy Duty, haacon, H.D. Trailers Pvt. Ltd., Yangzhou Tongyi Machinery Co., Ltd., Sinotruck Howo Sales Co., Ltd., and Butler Products Corp. These companies strengthen their market positions by offering durable manual and automatic landing gear systems designed for high load stability, improved safety, and long service life. Their focus on advanced materials, precision lifting mechanisms, and OEM partnerships supports strong adoption across global freight fleets. North America leads the market with a 35% share, followed by Europe at 29%, driven by high trailer production, strict safety standards, and rapid fleet modernization.

Market Insights

Market Insights

- The Truck Trailer Landing Gear market reached USD 1.63 billion in 2024 and will grow at a 5.2% CAGR through the forecast period.

- Growth is driven by rising freight movement, expanding trailer fleets, and increasing adoption of landing gear systems that enhance stability, safety, and operational efficiency across logistics networks.

- Automatic landing gear adoption is accelerating, while manual landing gear remains dominant with a 58% share, supported by lower costs and strong usage across standard-duty trailers.

- Competition intensifies as key players invest in lightweight materials, corrosion-resistant designs, and powered lifting mechanisms, though fluctuating raw material costs and high maintenance needs continue to restrain market expansion.

- North America leads the global market with a 35% share, followed by Europe at 29% and Asia Pacific at 26%, driven by strong trailer production, fleet modernization, and growing demand for mid-capacity landing gear in long-haul and regional freight operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Manual landing gear holds the dominant share in the type segment with a market share of 58%, driven by its lower cost, simple design, and high reliability for standard freight operations. Fleet operators prefer manual systems for their ease of maintenance and reduced repair expenses. Automatic landing gear is gaining traction as logistics companies adopt automation to improve safety and reduce driver workload. Rising interest in smart fleets and fleet digitalization supports gradual growth of automatic systems, but manual landing gear continues to lead due to strong adoption across small and mid-size trailer operators.

- For instance, SAF-HOLLAND produces various two-speed manual landing gear models, such as the SAF HERCULES, which has a lift capacity of 24,000 kg and a static load capacity of 50,000 kg (which is 50 tonnes, or about 110,231 pounds) per set.

By Sales Channel

OEMs dominate the sales channel segment with a market share of 64%, supported by factory-installed landing gear systems that ensure compatibility, durability, and standardized performance across new trailers. Manufacturers integrate high-strength materials and enhanced lifting mechanisms to meet evolving trailer design requirements. The aftermarket segment grows steadily as aging fleets require replacement components and upgrades for improved operational safety. Increased trailer utilization and higher freight demand drive continuous OEM adoption, while the aftermarket benefits from maintenance cycles across large logistics and transportation fleets.

- For instance, JOST supplies landing gear modules to over 200 OEM trailer models worldwide, with each system rated up to 50,000 kg support load depending on configuration.

By Lifting Capacity

The 20,000 lbs. to 50,000 lbs. lifting capacity range leads the segment with a market share of 49%, as it suits most commercial trailers used in long-haul, regional, and heavy freight operations. This category offers the right balance of strength, stability, and operational efficiency for diverse load conditions. The less than 20,000 lbs. range serves lighter-duty trailers, while the above 50,000 lbs. segment addresses specialized heavy-haul and industrial transport. Rising demand for durable, mid-capacity landing gear across logistics networks supports continued dominance of the 20,000 lbs. to 50,000 lbs. category.

Key Growth Drivers

Expansion of Freight and Logistics Activities

Growing demand for road freight transport drives strong adoption of truck trailer landing gear across global logistics networks. Higher cargo volumes, rising e-commerce shipments, and expanding cross-border trade increase the need for durable and reliable trailer support systems. Fleet operators prioritize equipment that enhances load stability, reduces downtime, and supports safe coupling and uncoupling processes. As transportation companies expand fleets to meet rising delivery timelines, demand for high-strength landing gear systems continues to accelerate across OEM and aftermarket channels.

- For instance, BPW’s ECO series axles are designed and manufactured with a focus on durability, utilizing high-quality materials and undergo extensive function and load-capacity testing to ensure suitability for demanding logistics operations.

Increasing Focus on Driver Safety and Operational Efficiency

The industry experiences strong growth as fleet operators adopt landing gear systems that reduce manual effort and improve workplace safety. Automatic and assisted lifting mechanisms gain traction due to their ability to lower injury risks and ensure consistent lifting performance under heavy loads. Regulations promoting ergonomic equipment and safer handling procedures further support adoption. Companies invest in landing gear that improves operational speed, reduces physical strain on drivers, and enhances overall fleet productivity.

- For instance, BPW Bergische Achsen KG designed its modern ECO Air running gear system for an axle load of 9 tonnes (approximately 19,800 lbs) for on- and off-road applications, offering significant weight savings.

Rising Trailer Production and Fleet Modernization

Steady growth in trailer manufacturing and rising fleet replacement cycles fuel market expansion. Logistics firms upgrade older trailers with advanced landing gear to improve durability, load handling capacity, and maintenance efficiency. OEMs integrate improved materials, corrosion-resistant coatings, and optimized designs to support long-term performance. Growing use of heavy-duty trailers in construction, manufacturing, and retail distribution further boosts demand. Modernization initiatives among large fleet operators strengthen the market’s long-term growth prospects.

Key Trends & Opportunities

Shift Toward Automated and Smart Landing Gear Systems

A key trend shaping the market is the increasing adoption of automatic landing gear equipped with powered lifting, integrated sensors, and electronic controls. These systems improve lifting precision, reduce downtime, and enhance driver safety during loading and unloading. Smart connectivity features that monitor landing gear health and send maintenance alerts offer new opportunities for fleet optimization. As digital fleet management expands, demand for intelligent landing gear solutions is expected to rise across major logistics operators.

- For instance, the Airbus A380 has a highly engineered landing gear and braking system designed and manufactured by Safran Landing Systems (among other key suppliers) to manage its substantial weight and landing forces.

Development of Lightweight and High-Strength Materials

Manufacturers are increasingly incorporating advanced alloys, reinforced composites, and corrosion-resistant materials to reduce the weight of landing gear without compromising strength. Lightweight designs help improve fuel efficiency, increase payload capacity, and extend trailer life. These innovations create opportunities for premium landing gear products in markets that prioritize sustainability and total cost efficiency. Enhanced durability also helps fleets reduce maintenance downtime and improve long-term operational performance.

- For instance, the Fuwa Group produces landing gear for semi-trailers using high-quality and high-strength steel materials for durability and load capacity.

Growth in Aftermarket Services and Retrofit Opportunities

As fleets age, the aftermarket segment sees rising demand for replacement landing gear, upgrades, and performance-enhancing components. Retrofitting older trailers with automatic systems and reinforced lifting mechanisms presents strong revenue potential. Fleet operators seeking improved safety compliance and reduced repair frequency increasingly turn to aftermarket suppliers. This trend creates new opportunities for service providers offering installation, maintenance, and customized landing gear solutions.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatility in steel, aluminum, and composite material prices significantly impacts manufacturing costs. Supply chain disruptions and inconsistent availability of high-strength materials create production delays and increase procurement complexity for OEMs. These factors challenge manufacturers in maintaining stable pricing and meeting delivery schedules. Fleet operators facing budget limitations may delay trailer upgrades, affecting short-term market growth.

High Maintenance Requirements for Heavy-Duty Applications

Landing gear used in demanding environments such as construction, mining, and heavy freight logistics often faces rapid wear due to frequent loading stress, harsh climates, and rough terrain. High maintenance needs increase operational downtime and add to fleet ownership costs. Improper lubrication, misalignment, and overloading further shorten equipment lifespan. These challenges push manufacturers to focus on strengthened components, but maintenance demands remain a concern for long-haul and heavy-duty fleet operators.

Regional Analysis

North America

North America holds a market share of 35%, driven by strong trailer production, large freight networks, and high adoption of advanced logistics technologies. The region benefits from a well-established transportation sector that demands durable and efficient landing gear systems for long-haul operations. Growing investments in fleet modernization and increased use of heavy-duty trailers support market expansion. Rising emphasis on driver safety and operational efficiency accelerates the shift toward automatic landing gear. Strong OEM presence and significant aftermarket demand further reinforce North America’s leadership in the truck trailer landing gear market.

Europe

Europe accounts for a market share of 29%, supported by stringent safety regulations, advanced fleet standards, and strong adoption of ergonomically designed landing gear systems. The region’s logistics sector prioritizes equipment that improves operational safety, fuel efficiency, and load handling performance. Demand is driven by growth in cross-border freight movements and manufacturing activity. European OEMs increasingly integrate lightweight, corrosion-resistant materials into landing gear, supporting long-term reliability. The region’s focus on sustainability and equipment modernization strengthens its position in the global market.

Asia Pacific

Asia Pacific holds a market share of 26%, driven by expanding industrial activity, rising freight demand, and large-scale trailer manufacturing in China and India. Rapid growth in e-commerce, retail distribution, and construction transport increases adoption of mid- and heavy-capacity landing gear systems. Manufacturers in the region increasingly focus on cost-effective yet durable components to serve diverse load conditions. Fleet expansion among logistics companies and government investments in road infrastructure further fuel demand. Asia Pacific’s growing aftermarket sector also supports steady market penetration.

Latin America

Latin America captures a market share of 6%, supported by rising demand for commercial trailers across agriculture, mining, and long-haul freight operations. Countries with expanding logistics networks increasingly adopt durable landing gear to handle rough terrain and heavy loads. Economic development and fleet replacement cycles contribute to demand, while aftermarket sales grow due to frequent maintenance needs. Despite economic fluctuations, trailer production and cross-border trade within the region sustain steady market growth. Manufacturers focusing on cost-efficient and rugged landing gear solutions gain strong traction in this market.

Middle East & Africa

The Middle East & Africa region holds a market share of 4%, driven by increasing logistics activity, infrastructure development, and rising use of trailers in construction and industrial sectors. Fleet operators prioritize high-strength landing gear capable of operating in hot climates and challenging road conditions. Growth in mining, oil and gas transport, and regional trade enhances demand for reliable support systems. Although adoption of advanced automatic landing gear is gradual, steady investments in freight capacity and transport modernization support market expansion. The growing aftermarket segment also contributes to overall regional growth.

Market Segmentations:

By Type

By Sales Channel

By Lifting Capacity

- Less than 20,000 lbs.

- 20,000 lbs. to 50,000 lbs.

- Above 50,000 lbs.

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes leading companies such as SAF-HOLLAND, Yangzhou Tongyi Machinery Co., Ltd., AXN Heavy Duty, haacon, BPW Bergische Achsen KG, H.D. Trailers Pvt. Ltd., JOST Werke AG, Fuwa Group, Sinotruck Howo Sales Co., Ltd., and Butler Products Corp. These players compete by offering durable, high-strength landing gear systems designed to improve load stability, reduce driver effort, and support heavy-duty trailer operations. Manufacturers focus on enhancing product reliability through advanced materials, corrosion-resistant coatings, and precision-engineered lifting mechanisms. Automation is a key area of innovation, with several companies developing powered landing gear and sensor-assisted systems to support safer and faster trailer handling. Strategic initiatives include OEM partnerships, aftermarket expansion, and investments in lightweight designs to boost fuel efficiency. As global logistics networks grow, these companies strengthen their presence through global distribution networks and continuous product improvement to meet rising performance and safety standards.

Key Player Analysis

- SAF-HOLLAND

- Yangzhou Tongyi Machinery Co., Ltd.

- AXN Heavy Duty

- haacon

- BPW Bergische Achsen KG

- D. Trailers Pvt. Ltd.

- JOST Werke AG

- Fuwa Group

- Sinotruck Howo Sales Co., Ltd.

- Butler Products Corp.

Recent Developments

- In August 2025, SAF‑HOLLAND SE won a major order from a U.S. special-trailer manufacturer that includes delivery of landing gear alongside swivel-axle bogies.

- In January 2025, AXN Heavy Duty became part of Randon Corp. via acquisition, which could integrate its heavy-duty landing gear portfolio into a broader North American platform.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Sales Channel, Lifting Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automatic landing gear systems will grow as fleets prioritize safety and reduced manual effort.

- Lightweight and corrosion-resistant materials will gain adoption to improve durability and fuel efficiency.

- Smart landing gear with sensors and monitoring functions will expand across modern logistics fleets.

- OEM partnerships will strengthen as trailer manufacturers integrate advanced lifting technologies.

- Aftermarket upgrades will rise as operators replace aging manual units with higher-performance systems.

- Increased freight movement will drive higher demand for mid- and heavy-capacity landing gear solutions.

- Digital fleet management systems will influence adoption of connected landing gear components.

- Manufacturers will invest more in ergonomic designs to reduce driver injuries and improve operational safety.

- Emerging markets will adopt modern landing gear faster as trailer production and logistics activity expand.

- Sustainability goals will accelerate the shift toward long-life, low-maintenance landing gear systems.

Market Insights

Market Insights